What Did Other Term Spreads Do? What Does The US Spread Mean For Foreign Economic Activity?

As noted in the post by Rashad Ahmad, foreign yield curve developments helped predict US growth. What did those spreads do? And, turning the question on its head, what does the US spread mean for those economies’ recession prospects?

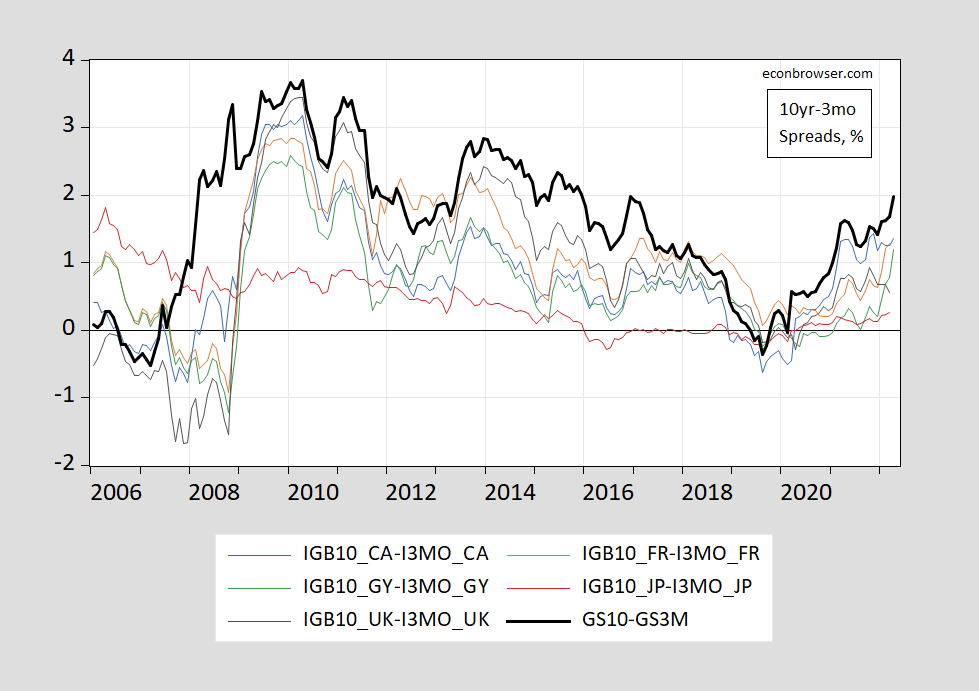

Figure 1 depicts 10yr-3m sovereign spreads over time — so before the 2007 recession and during the run-up to the 2020 pandemic.

Figure 1: 10yr-3mo Treasury spread (bold black), 10yr-3mo government bond – 3 month interbank spread for Canada (blue), for France (brown), for Germany (green), for Japan (red), for UK (dark gray). Source: Treasury via FRED, OECD Main Economic Indicators via FRED, and author’s calculations.

A cleaner measure for the foreign countries would’ve used sovereign yields for the short rate, to make comparable to the US spread (and to control for default risk), but I couldn’t get that easily.

While Chinn and Kucko (2015) examined cross-country evidence for own 10yr-3mo term spreads predicting recessions, we did not examine whether US term spreads had predictive power for foreign recessions. Mehl (2009) examined the usefulness of US spreads for predicting other-country economic activity and inflation rates — but using the 5yr-3mo spread. See the (brief) review of predicting recessions cross-country in this post.

A quick and dirty look at the data shows that the US term spread does not help much in adding to the 12 month predictive power of own-term spread for recessions during the 1970-2022M05 period for the countries shown above (recession peak-to-trough dates from ECRI). The probit regression involves the local economy recession indicator on the LHS, and the local term spread on the RHS, alone and augmented with the US term spread, along with a constant. (Of course, results might change with the addition of other covariates like oil price, equity prices and some measure of financial conditions).

Note that I only examined recessions; I didn’t examine growth or inflation. More for later.

Disclosure: None.