VeChain Crypto Price News Today - Thursday, June 12

VeChain (VETUSD) Elliott Wave Technical Analysis

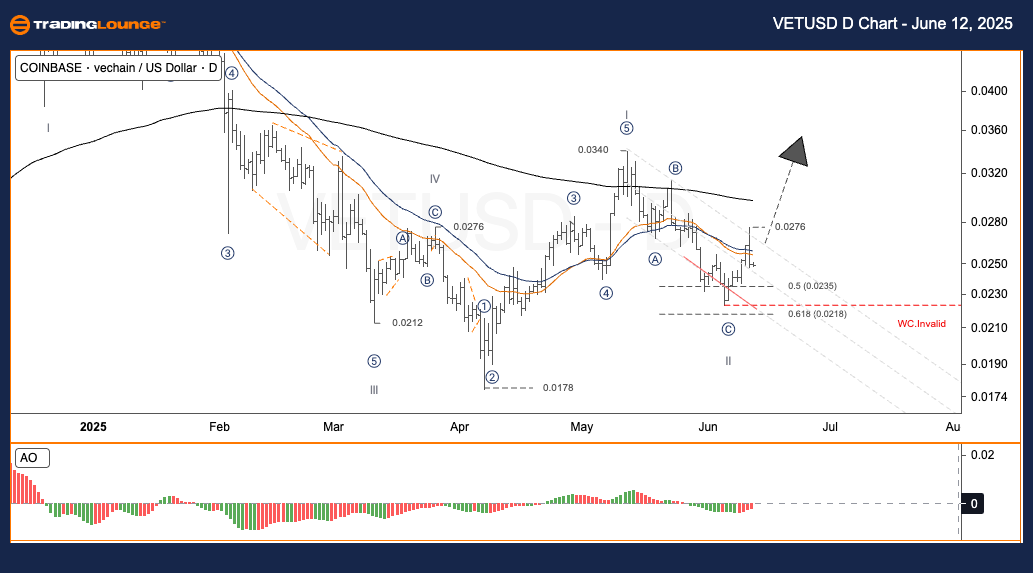

Daily Chart Analysis – TradingLounge

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Wave Position: Wave II

- Wave Cancel (Invalidation) Level: Not specified

Market Overview:

Following a completed corrective pattern labeled ABC, VETUSD entered a strong upward phase, finishing wave (1). The price is now likely to enter wave (2), typically seen as an ABC retracement. This phase can serve as a consolidation before the next bullish trend begins.

Trading Strategy – VETUSD

- Short-Term Approach (Swing Trade):

-

- Wait for price movement into the wave (2) zone.

- Look for a valid entry signal or pattern before buying.

- Risk Management:

-

- Stop-loss should be set below $0.02220 to manage risk effectively.

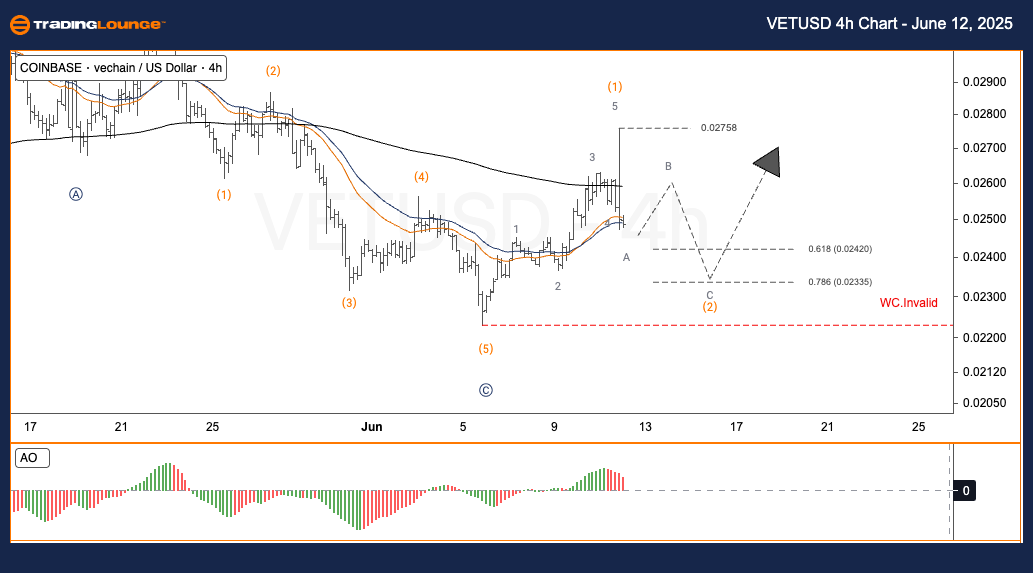

4-Hour Chart Analysis – TradingLounge

- Function: Follow Trend

- Mode: Motive

- Structure: Impulse

- Wave Position: Wave II

- Wave Cancel (Invalidation) Level: Not specified

Short-Term View:

The recent market activity reflects the same wave progression seen in the daily chart. Wave (1) has completed, and wave (2) is forming. Traders should be cautious and wait for a pullback confirmation before entering a position.

Trading Strategy – 4H Chart

- Swing Trade Setup:

-

- Watch for a corrective pullback into the wave (2) region.

- Enter trades only after validation through price structure.

- Risk Strategy:

-

- Suggested stop-loss level: below $0.02220

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Palo Alto Networks Inc. U.S. Stocks Elliott Wave Technical Analysis

S&P BSE Sensex Next 50 Index Wave Technical Analysis

Technical Analysis: Euro/U.S. Dollar

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more