Palo Alto Networks Inc. U.S. Stocks Elliott Wave Technical Analysis

Image Source: Pexels

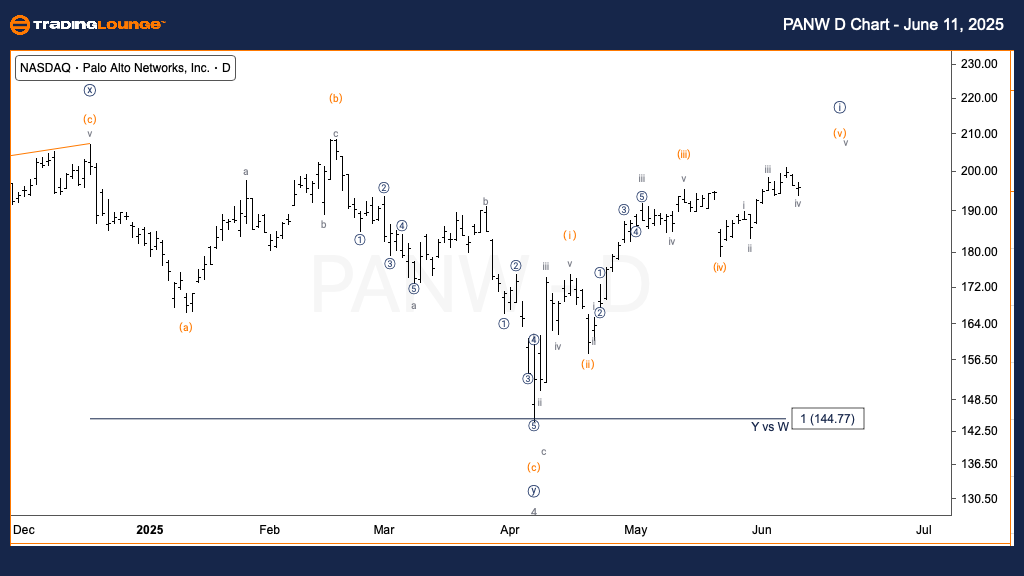

PANW Elliott Wave Analysis – TradingLounge Daily Chart,

Palo Alto Networks Inc. (PANW) – Daily Chart

PANW Elliott Wave Technical Analysis

- FUNCTION: Trend

- MODE: Motive

- STRUCTURE: Impulsive

- POSITION: Wave (v) of {i}

- DIRECTION: Upside into Wave (v)

- DETAILS: Price action is advancing into Wave (v), approaching a key resistance near Trading Level 2 at $200, a critical and sensitive price zone.

The daily chart for PANW shows continued upward momentum within an impulsive wave structure, targeting the completion of Wave (v) of Minor Wave {i}. The $200 level, corresponding to Trading Level 2, represents a potential resistance zone. A confirmed break above this level may trigger further bullish continuation.

(Click on image to enlarge)

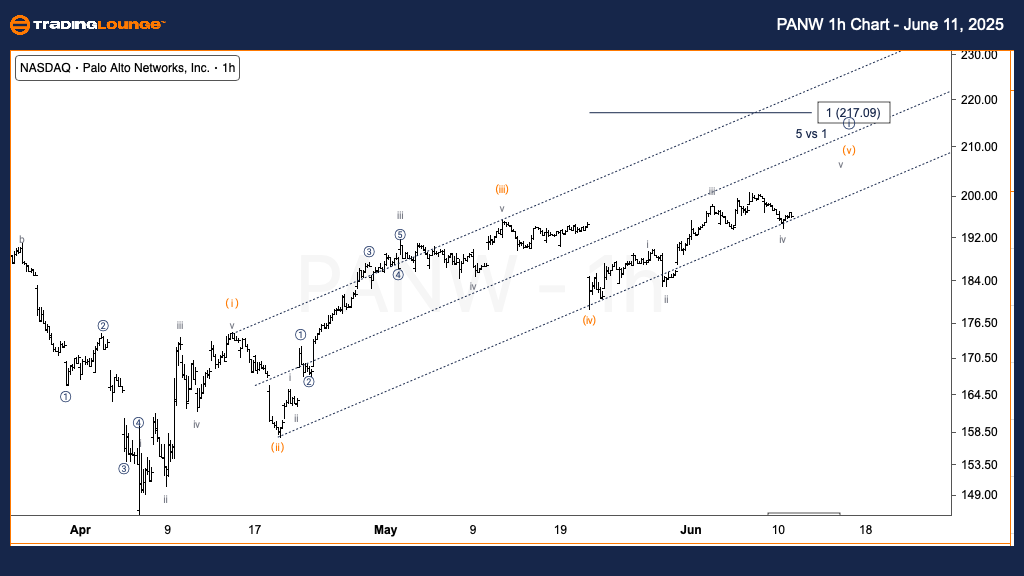

Palo Alto Networks Inc. (PANW) – 1 Hour Chart

PANW Elliott Wave Technical Analysis

- FUNCTION: Trend

- MODE: Motive

- STRUCTURE: Impulsive

- POSITION: Wave v of (v)

- DIRECTION: Upside in Wave v

- DETAILS: Price has found support atop the parallel channel from Wave (iv). We are now advancing in Wave v, with a minimum target of $200. The textbook target where Wave (v) = Wave (i) lies at $217.

The 1H chart confirms bullish structure continuation after a solid retest of the parallel channel support. With Wave (v) progressing, the short-term objective is $200, while $217 remains a logical extension if equality with Wave (i) plays out. Momentum supports a bullish near-term scenario.

(Click on image to enlarge)

More By This Author:

Ripple (XRPUSD) Elliott Wave Technical Analysis

Technical Analysis: Cocoa Commodity

Stock Analysis: Mineral Resources Limited

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more