Stock Analysis: Mineral Resources Limited

Image Source: Unsplash

ASX: MINERAL RESOURCES LIMITED - MIN

Elliott Wave Technical Analysis – TradingLounge

Market Update:

Today’s Elliott Wave analysis highlights the prospects of MINERAL RESOURCES LIMITED (ASX: MIN) on the Australian Stock Exchange. Our findings reveal strong upward momentum potential, following the completion of a major fourth wave correction. We now anticipate a fifth wave to be in progress, with detailed targets and invalidation levels laid out.

ASX: MINERAL RESOURCES LIMITED - MIN

Elliott Wave Technical Analysis

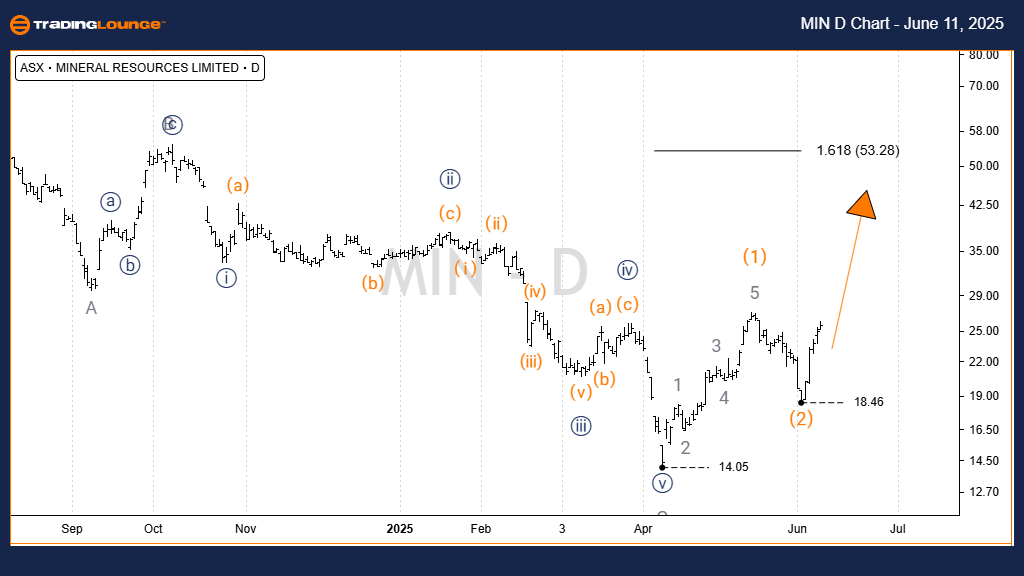

1D Chart (Semilog Scale) Analysis

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3) – orange of Wave 5)) – navy

Analysis Insight:

A substantial corrective wave concluded at the $14.05 low, which paves the way for a renewed Motive wave trend aiming higher. The price target is expected between $50.00 and $80.00, provided it remains above the $14.05 level. Dropping below this level would invalidate the bullish setup.

- Invalidation Point: $14.05

(Click on image to enlarge)

ASX: MINERAL RESOURCES LIMITED - MIN

Elliott Wave Technical Analysis – TradingLounge (4-Hour Chart)

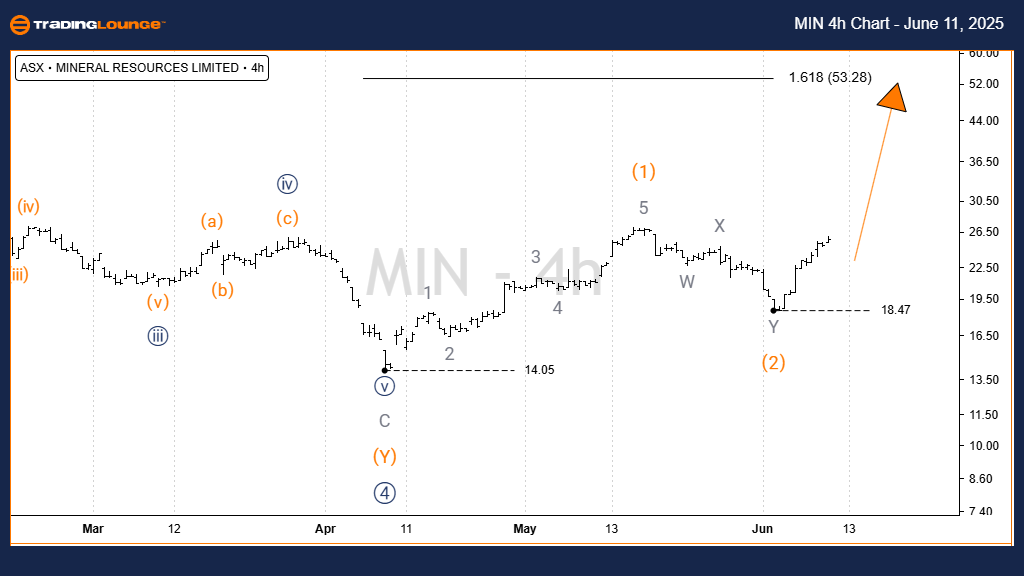

4-Hour Chart Analysis

- Function: Major trend (Intermediate degree, orange)

- Mode: Motive

- Structure: Impulse

- Position: Wave 3) – orange

Short-Term View:

Zooming into the 4-hour chart, wave 1) – orange completed as a five-wave pattern from the $14.05 base. Subsequently, wave 2) – orange wrapped up as a Double Zigzag correction at the $18.47 low. The new upward phase suggests wave 3) – orange is underway, with a near-term goal of testing the $53.28 high.

- Invalidation Point: $18.47 (Price must hold above this level to maintain the bullish view)

(Click on image to enlarge)

Conclusion:

Our technical analysis and forecasts offer a well-structured perspective on the ongoing trends in ASX: MINERAL RESOURCES LIMITED (MIN). We aim to equip readers with actionable insights and clearly defined support/resistance levels to assess the Elliott Wave structure effectively. This structured approach enhances trading decisions by providing clarity on market direction.

- Technical Analyst: Hua (Shane) Cuong, CEWA-M (Certified Elliott Wave Analyst – Master Level)

- Source: Visit TradingLounge.com for expert guidance.

More By This Author:

Unlocking ASX Trading Success: Northern Star Resources Ltd - Tuesday, June 10

Elliott Wave Technical Analysis: Hang Seng Index - Tuesday, June 10

Elliott Wave Technical Analysis: Euro/British Pound - Tuesday, June 10

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more