US Services Surveys Signal "Bout Of Stagflation" Ahead, Employment Contracts Most Since COVID Collapse

With sentiment in freefall, and US macro data serially surprising to the downside - enough to prompt dramatic reductions in expectations for The Fed's rate-hike trajectory - analysts expected Services surveys to follow their Manufacturing brethren lower in June.

-

S&P Global US Services PMI printed 52.7 in June, up from the flash print of 51.6 but down from the May print of 53.4

-

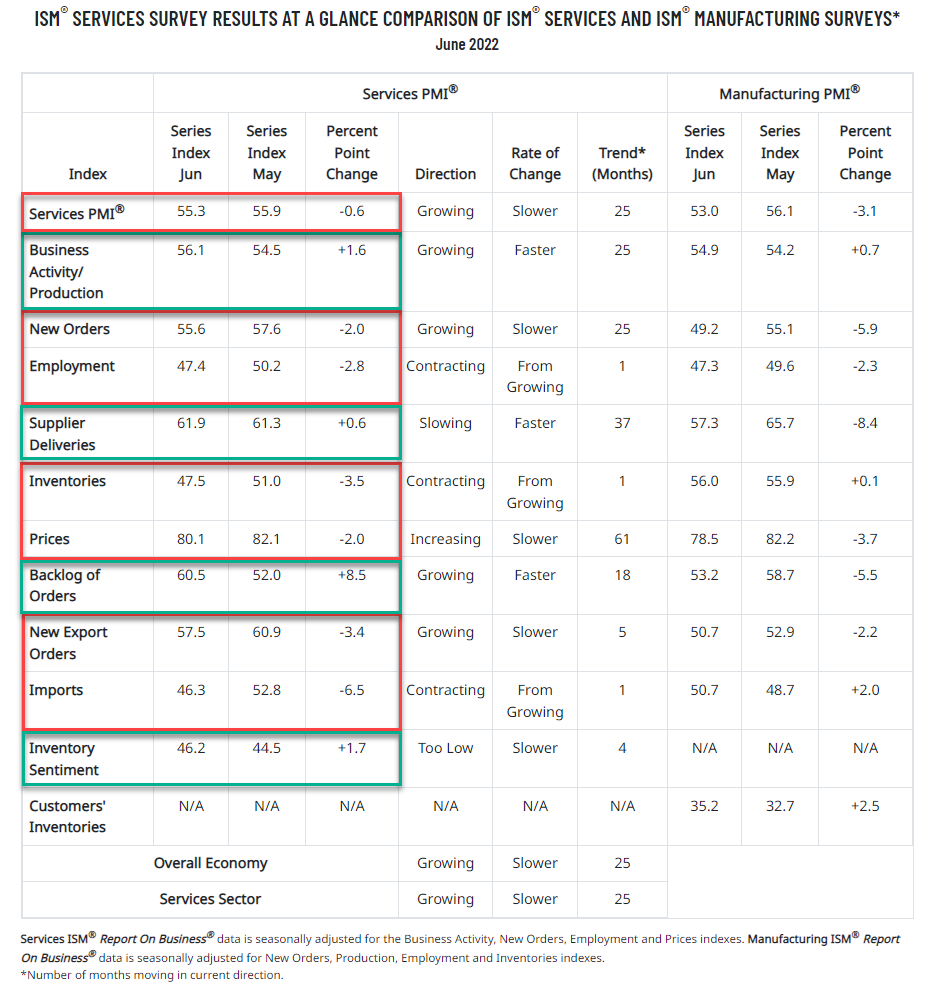

US ISM Services printed 55.3 in June, down from 55.9 in May, but better than the expected 54.0

Notably, S&P Global points out that US Composite New Orders fall for first time in almost two years.

The S&P Global US Composite PMI Output Index posted 52.3 in June, down from 53.6 in May. The latest rise extended the current sequence of expansion to two years, but was the softest since January. The slowdown in growth was broad based, with both manufacturing and services seeing weaker increases at the end of the second quarter. Business confidence also waned, dropping to the lowest since September 2020.

A weaker expansion in output reflected a renewed contraction in new orders, the first in almost two years. New business was down across both monitored sectors, with new export orders also falling. Rates of input cost and output price inflation remained sharp in June, but eased amid softer demand conditions.

Most notably, employment for both Services and Manufacturing contracted in June according to ISM...

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

"June saw signs of a broad-based weakening of the economy with demand now falling in both the manufacturing and service sectors. While the survey data point to a stalling of GDP at the end of the second quarter, a downshifting in the forward-looking new orders index and drop in companies' future output expectations hints at falling economic activity as we head through the summer.

"Demand for goods and services from households is showing signs of moderating substantially due to the rising cost of living. Meanwhile, tighter financial conditions are starting to hit, and it was notable that the service sector slowdown was led by a steep drop in financial services activity.

"Meanwhile there was welcome news in terms of a marked easing in upward price pressures, but it's clear that price growth remains elevated despite coming off recent peaks, all of which points to a bout of stagflation in the near term."

Not exactly the 'picture of health' The Fed keeps painting as being capable of withstanding multiple rate-hikes for the rest of the year.

More By This Author:

Norwegian Strikes Could Sever NatGas Supplies To UK

Oil Crashes Below $100 As Recession Risk Roars, Dollar Soars

White House Quiet As BBQ Inflation Roils Americans On July 4

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more