Oil Crashes Below $100 As Recession Risk Roars, Dollar Soars

Oil prices are puking this morning, after some modest gains overnight, as recession risks roar higher around the world and the dollar's strength hits the energy complex with a double whammy.

“In the very near term the Dow & S&P will have a major factor on crude direction as recession fears remain,” said Dennis Kissler, senior vice president of trading at BOK Financial.

Fundamentally, there are concerns that fuel demand could “drop significantly now that the 4th of July holiday is behind us.”

WTI has broken below the $100 Maginot Line for the first time since May 11...

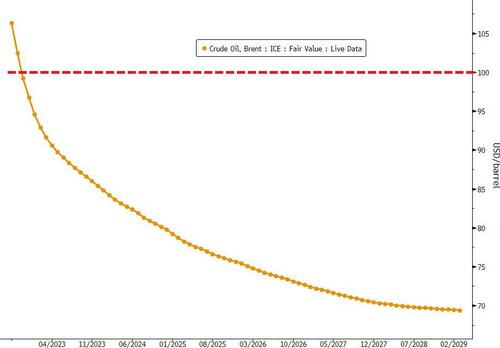

Brent Crude is trading below $100/bbl from November 2022 out...

The dollar's explosive surge higher (on the back of a weak euro) is also not helping as it reaches its highest since March 2020...

Interestingly, Citi said that crude could fall to $65 this year in the event of a recession, dramatically different from JPMorgan's most bullish $380 a barrel scenario.

Most notably, US retail gasoline prices have fallen for 21 straight days according to AAA.

Is President Biden hoping for a recession?

More By This Author:

White House Quiet As BBQ Inflation Roils Americans On July 4

Key Events This Week: All Eyes On Payrolls

Top German Trade Union Head Warns Entire Industries May Collapse Amid Worsening Energy Crisis

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more