Key Events This Week: All Eyes On Payrolls

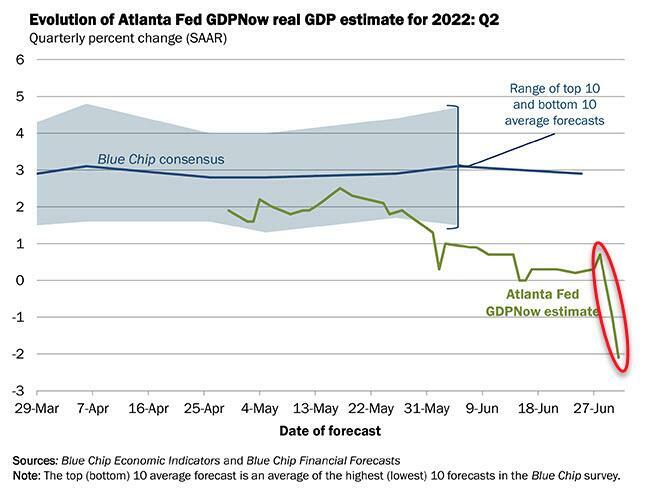

It was another rollercoaster week - the 11th drop in the past 13 - which however ended with a monster rally in bonds and stocks as markets priced in the coming Fed rate cuts, and although it'll likely be on the quieter side in markets today, we won't be able to escape the near-term recession risks for very long. As we noted last week, the Atlanta Fed Q2 tracker is now at -2.08% after slumping into negative territory at the end of last week, and if this is close to the mark that would mean two negative quarters and a technical recession.

The official definition is owned by the NBER and they will likely need more evidence (and a political green light or three) before they would declare it as they look at a broader range of indicators than just headline growth. However, we'll likely know we're in it before it's declared so it'll be crucial to work out if this is the start to a descent into bigger problems or if that's still some months away. Note, as Deutsche Bank's Jim Reid notes, it continues to be "when not if".

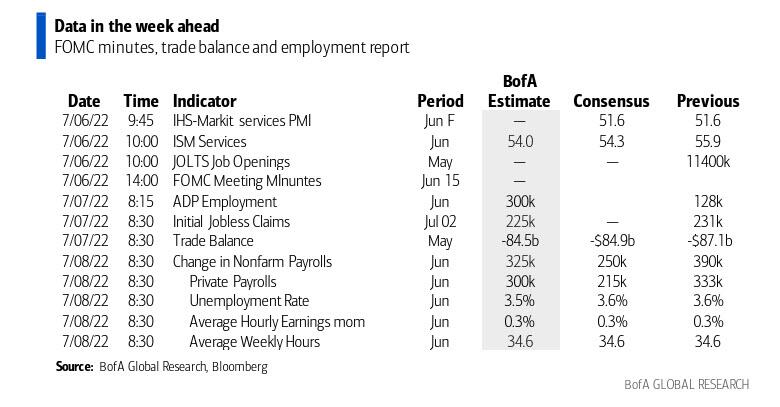

A big swing factor here could be employment and this week is jam-packed with US labor data. Payrolls (Friday) will be the headliner but JOLTS (Wednesday), ADP and claims (Thursday) will also be very important. As Jim Reid notes, labor markets remain strong around the world and although this is generally a lagging indicator, some kind of turn should occur before we can declare what is absolutely the inevitable dive into recession (there is an outside chance of a negative print as soon as this Friday).

For what it's worth, DB economists expect payrolls to slow (+225k forecast vs. +390k previously) but with unemployment falling a tenth to 3.5%. In many ways JOLTS (Wednesday) is the preferred employment measure although it has the disadvantage of being even more delayed as it is a month behind so we'll only get May's data this week. In the report, job openings have remained roughly 4.5mn above where they were prior to the pandemic so unless this dips there will still be a lot of demand for labor and the tightness will continue, leaving the Fed with a huge dilemma as growth slows. June's US services ISM on Wednesday will be watched for the headline growth implications and also the employment component which has been 'only' hovering around 50 in recent months.

It's worth noting, as DB's Reid does, that the increased growth pessimism towards the end of last week stabilized equities as a big rally in bonds and a more dovish repricing of the Fed kicked in. 10yr Treasuries rallied -25.0bps last week (-13.3bps Friday), their largest weekly decline since March 2020, and although the S&P 500 finished -2.21% lower, it did rally +1.06% on Friday on lower yields as Fed expectations kicked in.

Back to the week ahead and we'll see how central banks were thinking about this weak growth vs labor tightness dilemma in the minutes from the Fed's (Wednesday) and ECB's (Thursday) June meetings but this will be slightly dated in light of how rapidly the macro is evolving.

Elsewhere, trade and industrial data will be due from key economies globally. May trade data will be out for the US (Thursday), Germany (today), Japan and France (Friday). For the US, May factory orders will be released tomorrow, followed by June's ISM services index on Wednesday. In Europe, the Eurozone's PPI for May is due today, followed by May industrial production for Germany (Thursday) and France, June PMIs for Italy (Tuesday), and Germany's May factory orders (Wednesday).

In Asia, the highlight will perhaps be the Caixin services and composite PMIs for China and the RBA meeting taking place tomorrow. Our economists expect the central bank to hike by +50bp.

Courtesy of DB, here is the full week ahead calendar day-by-day

Monday, July 4

- Data: Japan June monetary base, Germany May trade balance, Eurozone May PPI, Canada June PMI

- Central banks: ECB's Nagel and Guindos speak, BoC's Business Outlook

Tuesday, July 5

- Data: US May factory orders, China June services and composite Caixin PMIs, Japan May labour cash earnings, France May industrial and manufacturing production, Italy June services and composite PMI, deficit to GDP Q1, UK June new car registrations, official reserves changes, Canada May building permits

- Central banks: BoE's financial stability report, BoE's Tenreyro speaks. RBA meeting.

Wednesday, July 6

- Data: US June ISM services index, May JOLTS report, China June foreign reserves, Germany May factory orders, June construction PMI, UK June construction PMI, Eurozone May retail sales

- Central banks: FOMC June meeting minutes, ECB's Rehn speaks, BoE's Pill and Cunliffe speak

Thursday, July 7

- Data: US May trade balance, June ADP employment change, initial jobless claims, Japan May leading and coincident index, Germany May industrial production, Canada May international merchandise trade

- Central banks: ECB's account of June meeting, Fed's Waller and Bullard speak, BoE's decision-maker survey, BoE's Mann speaks, ECB's Lane, Stournaras, Centeno, and Herodotou speak

Friday, July 8

- Data: US June nonfarm payrolls report, unemployment rate, participation rate, average hourly earnings, May wholesale trade sales, consumer credit, Japan June Economy Watcher survey, bank lending, bankruptcies, May household spending, trade balance, France May trade balance, Italy May industrial production, Canada June net change in employment, unemployment rate, hourly wage rate, participation rate

- Central banks: Fed's Williams speaks, ECB's Lagarde and Villeroy speak

* * *

Finally, looking at the US, Goldman notes that the key economic data releases this week are the JOLTS job openings and ISM services reports on Wednesday and the employment situation report on Friday. The minutes from the June FOMC meeting will be released on Wednesday and there are several speaking engagements from Fed officials, including Governor Waller and presidents Williams and Bullard.

Monday, July 4

- There are no major economic data releases scheduled.

Tuesday, July 5

- 10:00 AM Factory orders, May (GS +0.6%, consensus +0.5%, last +0.3%); Durable goods orders, May final (last +0.7%); Durable goods orders ex-transportation, May final (last +0.7%); Core capital goods orders, May final (last +0.5%); Core capital goods shipments, May final (last +0.8%): We estimate that factory orders increased 0.6% in May following a 0.3% increase in April. Durable goods orders increased 0.7% in the May advance report, and core capital goods orders increased 0.5%.

Wednesday, July 6

- 09:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make remarks at a virtual event on bank culture hosted by the New York Fed. On June 28, President Williams said, “In terms of our next meeting, I think 50 to 75 [basis points] is clearly going to be the debate. He added, “We’re far from where we need to be [regarding the federal funds rate]. My own baseline projection is we do need to get into somewhat restrictive territory next year given the high inflation...” He also indicated his growth forecast falls on the lower range among Fed officials: “I am expecting growth to slow this year, quite a bit, relative to what we had last year, and actually to slow to probably 1% to 1.5% GDP growth.”

- 09:45 AM S&P Global US services PMI, June final (consensus 51.6, last 51.6)

- 10:00 AM ISM services index, June (GS 54.4, consensus 54.0, last 55.9): We estimate that the ISM services index declined 1.5pt to 54.4 in June. Our forecast reflects sequential weakness in construction and real estate activity and the decline in our services tracker (-2.6pt to 53.9).

- 10:00 AM JOLTS job openings, May (consensus 11,000k, last 11,400k)

- 02:00 PM FOMC meeting minutes, June 14-15 meeting: The FOMC increased the federal funds rate target range by 75bp to 1.5%-1.75% at its June meeting. The median dot in the Summary of Economic Projections (SEP) showed a funds rate midpoint of 3.375% at end-2022. The statement dropped the expectation of a strong labor market, instead emphasizing that the Committee is “strongly committed” to returning inflation to target. The SEP showed a 0.5pp increase in the unemployment rate by end-2024 and below-potential GDP growth in 2022 and 2023.

- On June 22, Chair Powell reiterated that the Fed will make “continued expeditious progress toward higher rates,” and noted “financial conditions have already priced in additional rate increases, but we need to go ahead and have them.” Chair Powell also noted that the Fed would not engage in active sales of mortgage-backed securities anytime soon. He emphasized that while the FOMC is “not trying to provoke and do not think we will need to provoke a recession,” it remained “absolutely essential” for the Fed to restore price stability, and noted that it would be “very challenging” for the Fed to achieve a soft landing.

Thursday, July 7

- 08:30 AM Trade Balance, May (GS -$84.7bn, consensus -$84.9bn, last -$87.1bn): We estimate that the trade deficit decreased by $2.4bn to -$84.7bn in May, reflecting an increase in exports in the advanced goods report.

- 08:30 AM Initial jobless claims, the week ended July 2 (GS 225k, consensus 230k, last 231k); Continuing jobless claims, the week ended June 25 (consensus 1,330k, last 1,328k); We estimate initial jobless claims ticked down to 225k in the week ended July 2:

- 01:00 PM Fed Governor Waller (FOMC voter) speaks: Fed Governor Christopher Waller will participate in an interview during a virtual National Association for Business Economics (NABE) event. A moderated Q&A is expected. On June 18, Governor Waller said, “This week, the FOMC took another significant step toward achieving our inflation objective by raising the Federal Funds rate target by 75 basis points. In my view, and I speak only for myself if the data comes in as I expect I will support a similar-sized move at our July meeting.” He added, “The Fed is ‘all in’ on re-establishing price stability.”

- 01:00 PM St. Louis Fed President Bullard (FOMC voter) speaks: St. Louis Fed President James Bullard will discuss the economic outlook and monetary policy at an event hosted by the Little Rock Regional Chamber. A Q&A with media and audience is expected. When discussing the US economy on June 24, President Bullard said, “I actually think we will be fine. It is a little early to have this debate about recession probabilities in the US” and reiterated his call for “front-loading” rate hikes. He noted, “this is in the early stages of the US recovery – or US expansion, we are beyond recovery. It would be unusual to go back into recession at this stage. Interest-rate increases will slow down the economy, but will probably slow down to more of a trend pace of growth as opposed to going below trend. I don’t think this is a huge slowing. I think it is a moderate slowing in the economy.” On June 28, he published an essay on lessons from the 1974 and 1983 US policy responses to inflation.

Friday, July 8

- 08:30 AM Nonfarm payroll employment, June (GS +250k, consensus +273k, last +390k); Private payroll employment, June (GS +200k, consensus +240k, last +333k); Average hourly earnings (mom), June (GS +0.3%, consensus +0.3%, last +0.3%); Average hourly earnings (yoy), June (GS +5.0%, consensus +5.0%, last +5.2%); Unemployment rate, June (GS 3.6%, consensus 3.6%, last 3.6%): We estimate nonfarm payrolls rose by 250k in June (mom sa), a slowdown from the +390k pace in May. Job growth tends to be strong in June when the labor market is tight as firms aggressively hire youth summer workers. However, the June seasonal factors have evolved significantly more restrictive—perhaps overfitting to the reopening-related job surges in June 2020 and June 2021—and represent a headwind of roughly 200k in our view. Additionally, Big Data employment indicators were generally weaker in the month, consistent with a possible drag from tighter financial conditions and modestly higher layoffs in the retail and tech sectors. We estimate an unchanged unemployment rate at 3.6%, reflecting a solid rise in household employment offset by a 0.1pp rise in labor force participation to 62.4%. We estimate a 0.3% rise in average hourly earnings (mom sa) that lowers the year-on-year rate by two-tenths to 5.0%. The arrival of the youth labor force may have eased some of the upward pressure on wages, but we see scope for supervisory earnings to rebound after two weak months (we assume neutral calendar effects).

- 10:00 AM Wholesale inventories, May final (consensus +2.0%, last +2.0%)

- 11:00 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will make remarks at an event hosted by the University of Puerto Rico. A Q&A with media and audience is expected.

Source: DB, BofA, Goldman Sachs

More By This Author:

Top German Trade Union Head Warns Entire Industries May Collapse Amid Worsening Energy CrisisHome Price Cuts, Rising Inventories Are Ominous Signs Of Top

Russia Now Demands Rubles For Grain As World's Largest Wheat Exporter

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more