Zillow Warns Of "Deep Freeze" In Housing Market If US Defaults

Image Source: Unsplash

Lawmakers on Capitol Hill left this week with no deal on how to avert a default on the national debt. The US has never defaulted on its debt, and the probability remains low.

But, if Congress fails to pass legislation raising the statutory debt ceiling on the "X-date" – the date on which the Treasury can no longer meet its obligations (June 1) without raising debt in excess of the ceiling – then it would undoubtedly unleash economic turmoil and, more importantly, send the housing market into "a deep freeze," warned Zillow.

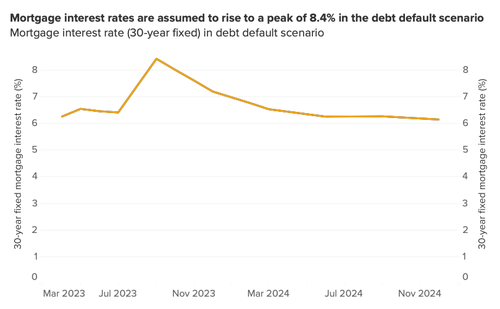

While a debt default seems unlikely, new scenario projections from Zillow show housing sales would crater and mortgage costs would soar in the worst-case scenario. Housing costs would jump by 22%, with the rate for 30-year, fixed-rate mortgages peaking around 8.4% in September. Securing a loan of $500,000 at an interest rate of 8.4% would result in a monthly payment of over $3,800, a significant increase from around $3,100 with rates at 6.3%.

Zillow explains the economic scenario below:

"A sharp increase in the unemployment rate starting this summer — jumping from the current level of 3.4% to a peak of 8.3% in October before gradually declining — and an increase in 30-year mortgage interest rates to a peak of 8.4% in September, before declining, as well.

"Those are in contrast to our baseline scenarios, in which we expect unemployment to only gradually increase very slightly from its present generational-low level of 3.4% over the next year and a half, and we expect mortgage rates to gradually fall somewhat over the same timeframe."

Jeff Tucker, a senior economist at Zillow, warned: "Home buyers and sellers finally have been adjusting to mortgage rates over 6% this spring, but a debt default could potentially raise borrowing costs even higher and send the market into a deep freeze."

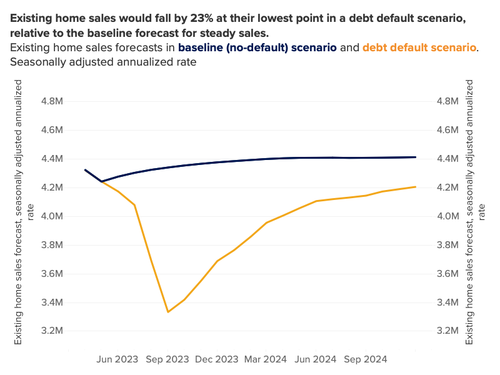

In another scenario, Zillow said 30-year mortgage interest rates above 8% would wipe out nearly a quarter of expected sales in the months ahead.

"We ran our forecast models for sales volume and price appreciation using the debt default scenario charted above, while holding other key input variables, such as demographics, the same as in our baseline forecasting scenario. [4]

"In the event of a debt default, existing home sales volume would fall from a projected seasonally adjusted annualized rate (SAAR) of 4.3 million this April to 3.3 million in September – a decline of 23% in housing market activity, both from the current pace of sales and the pace that we predict would prevail in the absence of a debt default crisis. Cumulatively, in the 18 months from July 2023 to December 2024, the decline in sales volume would be just over 700,000 existing homes sold – that is almost 12% of the 6 million sales in that 18-month span we would expect without a default."

Zillow pointed out, "It appears that home prices remain somewhat insulated from deeper declines due to today's very low inventory and the especially low flow of new listings so far this year."

It added, "Higher mortgage rates would likely further discourage homeowners from listing their homes, as they seek to avoid selling in an unfavorable market environment, much like the increase of mortgage rates in 2022 helped to depress new listings."

Zillow said it's only "if unemployment really rises by as much as assumed here, that could force many homeowners, unable to pay their mortgages, to sell, putting more downward pressure on home values than predicted here."

Even though Tucker acknowledges that default is "unlikely," the scenario he mapped out would be added downward pressure on shelter costs that have already peaked, as per the latest CPI report. We even pointed this out in early April. A real estate bear's dream would be for the US to default on its debt.

More By This Author:

Yellen: "We Have To Default On Something" If No Debt Ceiling Deal

UMich Inflation Expectations Haven't Been Higher Since 2008; Headline Sentiment Slumped In May

Fed Emergency Bank Loans Soared As Money Market Inflows Continue To Surge

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more