UMich Inflation Expectations Haven't Been Higher Since 2008; Headline Sentiment Slumped In May

After last month's massive jump in 12-month inflation expectations, analysts are hoping the this morning's preliminary May data from UMich's consumer sentiment survey shows some pullback in that fear. While inflation expectations for the next year dipped very modestly, expectations for the next 5-10 years jumped to +3.2% - it hasn't been higher since 2008 (tied for its highest since 2011)...

Source: Bloomberg

A necessary component of returning inflation to the Fed’s 2% target is keeping long-term inflation expectations anchored at a low level. While the pickup is concerning, Hsu noted that there were few signs consumers were buying in advance to avoid future price increases.

That suggests “the rise in long-run inflation expectations did not reflect the growing influence of inflationary psychology or increased risk of a wage-price spiral,” Hsu said.

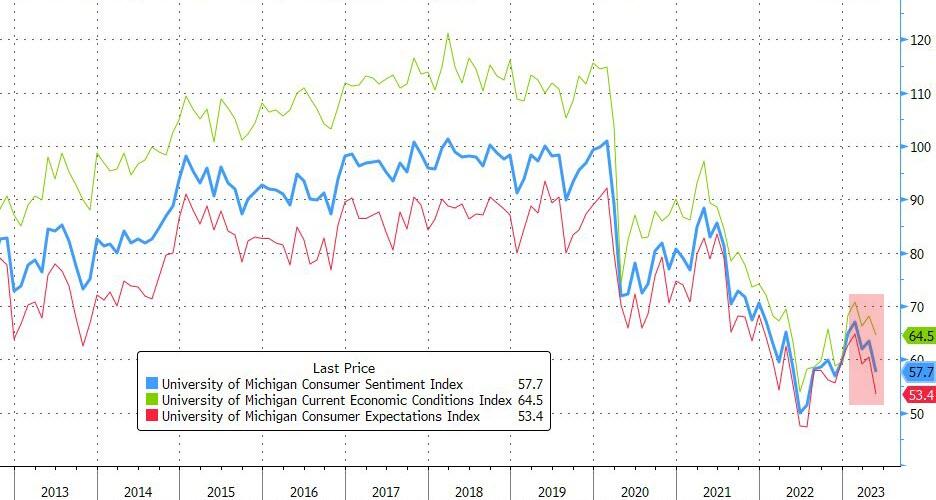

Back to the headline sentiment data, that was very ugly with the recent bounce having eroded significantly with the consumer sentiment index slid to 57.7, the lowest since November and weaker than all forecasts, from 63.5 last month. The university’s overall measure of expectations fell to a 10-month low of 53.4. The current conditions gauge also decreased.

Source: Bloomberg

Buying conditions for durable goods declined to a five-month low in early May, with about 42% of respondents blaming high prices for eroding their living standards.

“While current incoming macroeconomic data show no sign of recession, consumers’ worries about the economy escalated in May alongside the proliferation of negative news about the economy, including the debt crisis standoff,” Joanne Hsu, director of the survey, said in a statement.

Throughout the current inflationary episode, consumers have shown resilience under strong labor markets, but their anticipation of a recession will lead them to pull back when signs of weakness emerge.

If policymakers fail to resolve the debt ceiling crisis, these dismal views over the economy will exacerbate the dire economic consequences of default.

Consumer confidence also dropped sharply during the 2011 debt-ceiling crisis but snapped back after its resolution.

More By This Author:

Fed Emergency Bank Loans Soared As Money Market Inflows Continue To Surge

Impressive Demand In 30Y Auction As Foreign Buyer Demand Rises

Disney Tumbles Below $100 After Paying Subs Slide Following Sharp Price Increase

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more