Disney Tumbles Below $100 After Paying Subs Slide Following Sharp Price Increase

Image source: Unsplash

After Bud Light suffered a catastrophic corporate suicide after it tried to shove its tranny agenda into the mouths of its now former clients, is it now Disney's turn?

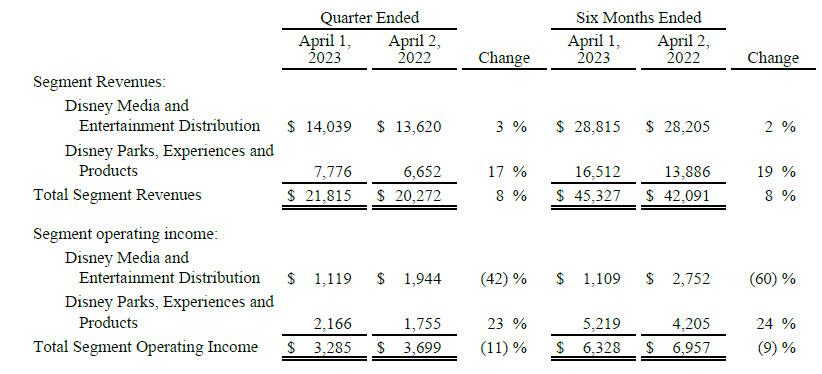

With Wall Street expecting the Mouse to report earnings of 93 and to grow subscribers to 163.1 million, reversing last quarter's slump, things did not quite work out as expected. Instead, moments ago Disney reported the following:

- Revenue $21.82 billion, +13% y/y, matching estimates of $21.82 billion

- Adjusted EPS 93c vs. $1.08 y/y, missing estimates of 94c

Broken down, revenue beat in parks but missed in medi:

- Media and entertainment distribution revenue $14.04 billion, +3.1% y/y, missing estimates of $14.16 billion

- Parks, experiences and products revenue $7.78 billion, +17% y/y, beating estimates of $7.67 billion

Despite the 13% increase in revenue, operating income declined 11% YoY, but was enough to beat median consensus expectations:

- Total segment operating income $3.29 billion, -11% y/y, estimate $3.18 billion

- Media and entertainment distribution operating income $1.12 billion, -42% y/y, beating estimates of $970.7 million

- Parks, experiences and products operating income $2.17 billion, +23% y/y, beating estimates of $2.14 billion

Profit at Disney’s traditional TV business, including the ESPN cable networks and ABC’s broadcasting business, fell 35% to $1.83 billion, the result of higher sports programming costs and lower advertising.

“The linear TV business is still in decline, there’s no two ways about that,” Bloomberg Intelligence analyst Geetha Ranganathan said.

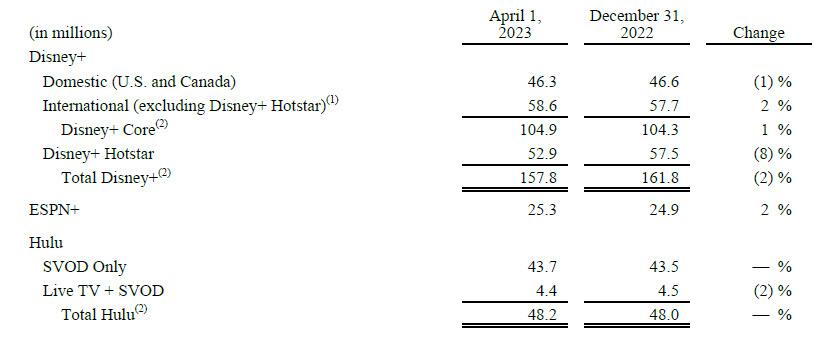

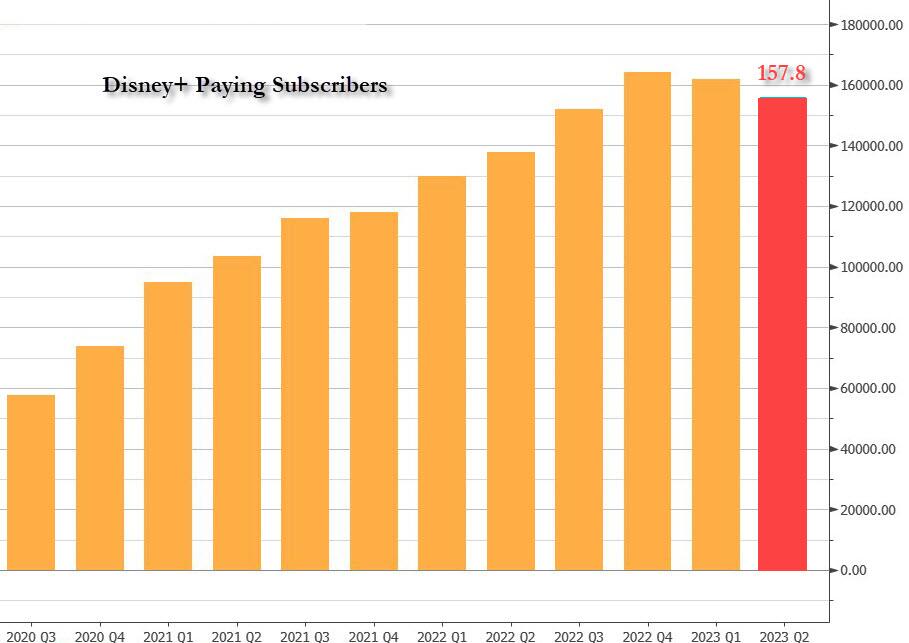

But while the company's financials were ok, if nothing spectacular for a company which is trading exactly at half its all time high price of 203 hit in March 2021, it was the number of subs that shocked markets: at only 157.8 million, this was not only a sharp, 2% drop from the 161.8 million last quarter (including a 1% drop in Domestic Disney + subs to 46.3 million)...

... but badly missed the consensus estimate of 163.1 million which would have reversed last quarter's decline. Instead, it only accelerated it.

The breakdown is as follows:

- ESPN+ subscribers 25.3 million, estimate 25.5 million

- Hulu & Live TV subscribers 4.40 million, estimate 4.50 million

- Total Hulu subscribers 48.2 million, estimate 48.6 million

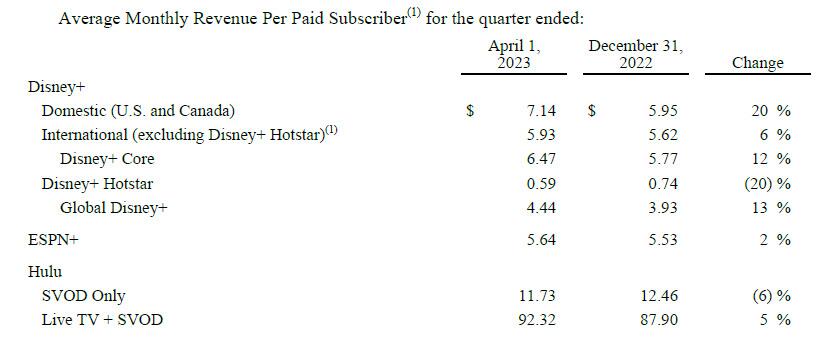

Why this unexpected drop? Simple: DIS is starting to charge way too much for its content: the good news is that ARPU rose notably, by 2some 20% domestically to $7.14 from 5.95, with most other verticals likewise raising prices.

Disney introduced a new ad-supported tier for Disney+ in December, hiking the cost of the ad-free version by 38% to $11 a month in the process.

The rise in ARPU was sufficient to push the Disney+ operating loss of $659 million, well below the $850.3 million analysts projected and less than half what it was just two quarters ago. The problem is that from this point on, any incremental price increases will lead to even more user declines. There is another problem: Disney+ Hotstar, which saw an 8% plunge in paying subs in the quarter, also saw its monthly revenue per paid subscriber decrease from $0.74 to $0.59 due to lower per-subscriber advertising revenue. In other words, the paying model has peaked, while the ad-supported model is in freefall.

CEO Bob Iger has been working to achieve profitability in streaming by 2024. As part of a wider plan to put Disney on a better financial footing, he’s cutting $5.5 billion in annual costs and culling 7,000 jobs from the entertainment giant’s workforce. The recent cost cutting led to the departure of streaming chief Michael Paull and most of the product and technology teams that supervised the rollout of Disney+ in 2019.

Commenting on the results, woke CEO Bob Iger said that he is "pleased with our accomplishments this quarter, including the improved financial performance of our streaming business, which reflect the strategic changes we’ve been making throughout the company to realign Disney for sustained growth and success.”

Judging by the plunge in the stock price, which slid below $100 after hours...

(Click on image to enlarge)

... and is now down more than 50% from its all time high...

(Click on image to enlarge)

we somehow doubt he is all that "pleased."

More By This Author:

10Y Auction Sees Solid Buyside Demand Despite Modest Tail

WTI Extends Losses After Biden Admin Drains SPR By Most Since December

WTI Holds Gains Despite API Reporting Biggest Crude Build Since Feb

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more