Impressive Demand In 30Y Auction As Foreign Buyer Demand Rises

Image Source: Pixabay

After a stellar 3Y auction, a solid 10Y moments ago we got the last refunding auction of the quarter when the treasury sold $21 billion in the 30-year paper, and it did so in an impressive fashion.

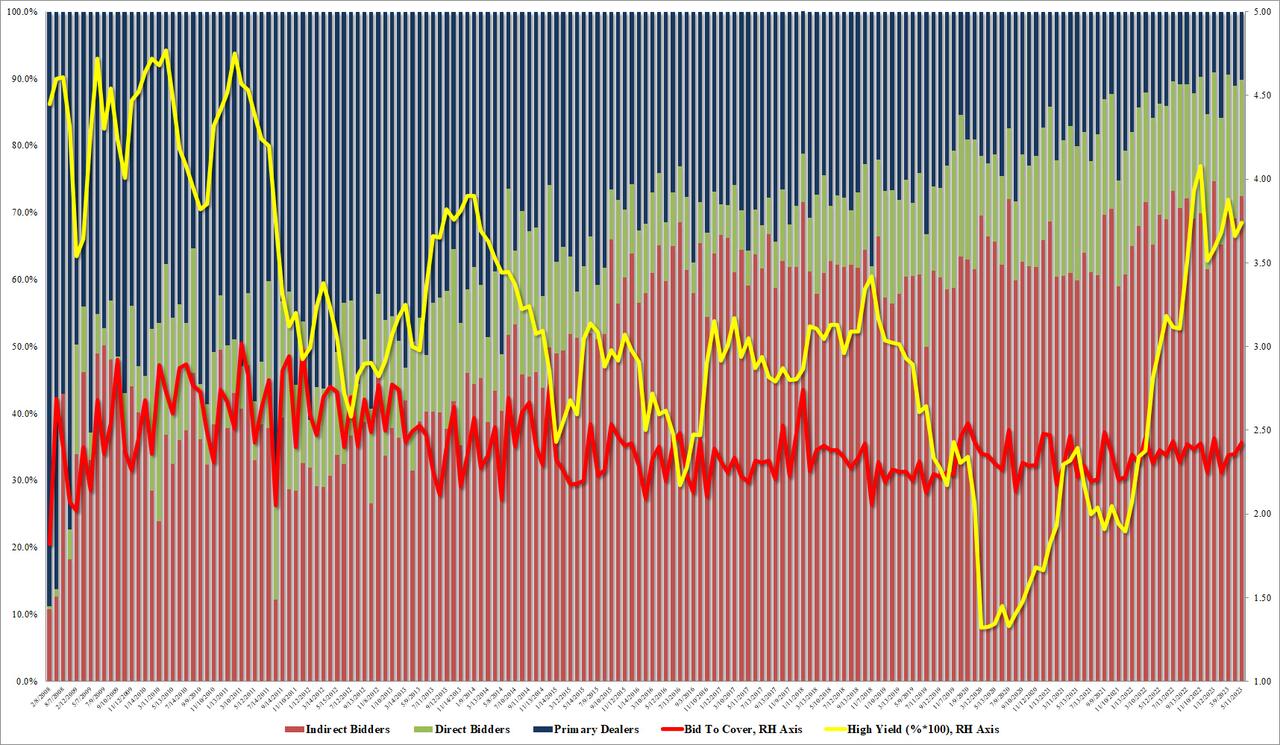

The high yield of 3.741% was just above last month's 3.661%. It also stopped through the When Issued 3.756% by 1.5bps, the biggest stop through since January's 2.4bps.

The Bid to Cover rose to 2.426, above April's 2.359, above the six-auction average 2.346 and the highest since January's 2.451.

The internals were also impressive with the Indirect award jumping to 72.44% from 69.12%, the strongest since - you guessed it - January. And with Directs taking down 17.4% (the lowest since, yup, January), dealers were left with 10.2% of the auction, modestly below the recent average of 11.7%.

(Click on image to enlarge)

Overall, this was another solid auction which managed an impressive stop through despite the sharp run up in bond prices (and drop in yields) into the 1Pm auction deadline amid growing recession fears.

More By This Author:

Disney Tumbles Below $100 After Paying Subs Slide Following Sharp Price Increase

10Y Auction Sees Solid Buyside Demand Despite Modest Tail

WTI Extends Losses After Biden Admin Drains SPR By Most Since December

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more