Where Do We Go From Here?

Image Source: Pexels

After a ferocious decline that pushed the S&P 500 down 10% in almost record time (the only other time in recent history where the market went down at this pace was the COVID Crash in 2020) the question of the day is, what's next? I.E. Where do we go from here?

As I wrote last time, we have seen this movie before. And the good news is the hero doesn't die in the end.

As I've been opining lately, what we are seeing is what is called a "bad news panic" that was accompanied by record levels of leverage in equities. In short, reports indicated that at the end of last year, hedge funds and other fast money/systematic trading types were nearly 3X more exposed to equities than normal. (Can you say, "crowded trade?")

But then the tariff tape bombs started. Which was followed almost immediately by the hand wringing, the fretting, and the abject fear about the economy, inflation, and earnings. Suddenly, every fast money manager had the same thought. Hey, we'd better get out of these ultra-levered positions now. As in right now! Because the economy might falter, inflation may linger, and earnings may not come in as planned. So, sell first and ask questions later became the modus operandi from February 20th through March 13th.

Since then, we've seen a bit of a rebound. Our take is the rebound occurred because the "unwind" of those levered positions had been completed. And, of course, some key technical levels were hit such as the Fibonacci retracement of the August through February rally and the sometimes magical -10% mark on the S&P. Both of which have been key turning points in past panic events.

The panic playbook suggests that once the bad news stops flowing, stocks tend to rebound - oftentimes violently to the upside. From there, the "battle" between the bulls and bears gets interesting. If the "thing" that caused the panic becomes resolved, then a "V Bottom" tends to happen and the bulls quickly regain control of the game.

However, if the flow of bad news resumes, then a "retest" of the lows (in this case 5500 on the S&P 500) becomes the order of the day. To review, a "retest" can take many forms. Technically, any movement "toward" the low can be considered a successful test. The market doesn't have to get close to the low. It can approach it or even exceed it. And as the saying goes, understanding these moves is often more art than science.

Given that the current market is based on the potential impact of tariffs on the economy, inflation, and earnings, as well as worries about growth rates, my best guess is that the "news" isn't likely to be resolved quickly and easily. For example, the next big, bad, deadline in the trade war is April 2nd. And even on that date, we are unlikely to get a "fix" to the situation as the White House likes to use threats and the imposition of tariffs as negotiation tactics.

As such, I'm currently in the "retest/basing period" camp in terms of what to expect next. In other words, I'm of the mind that the lows are very likely to be tested a time or two (or more). This would then be followed by a period of basing or back-and-forth as the market figures out what to expect on the big three issues (economy, inflation, and earnings).

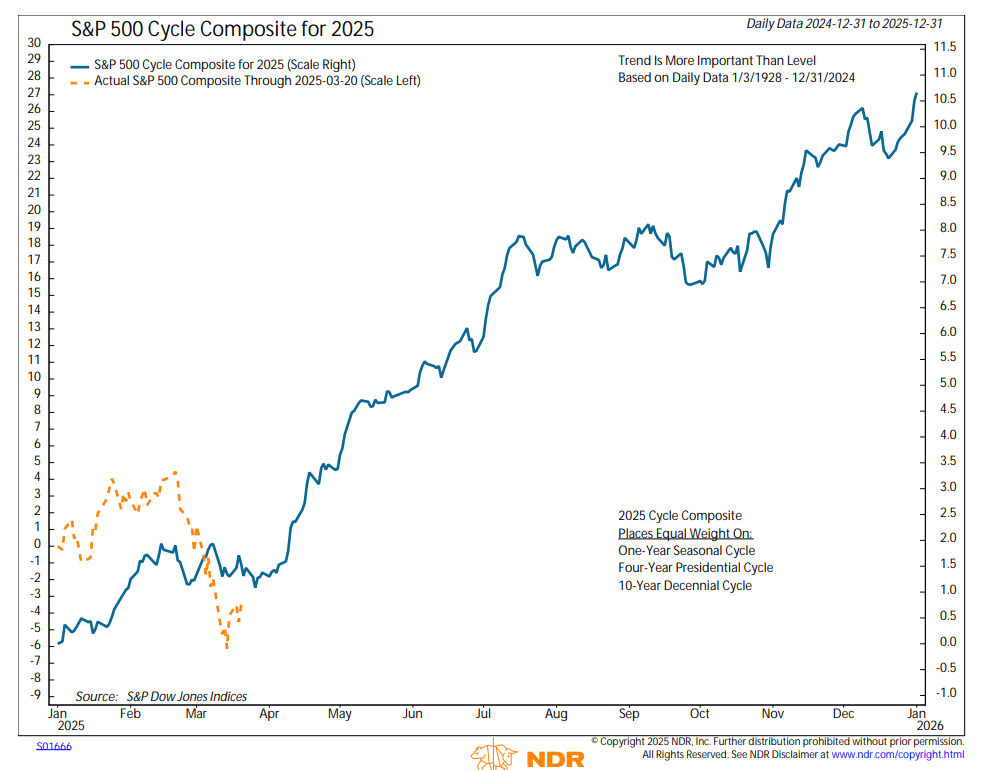

This idea also fits in rather nicely with what the historical cycles tell us to expect in the coming months. Long-time readers know that I employ the Cycle Composite developed by Ned Davis Research in my daily, weekly and monthly work. In case you aren't familiar, NDR's Cycle Composite is a mashup of all the 1-year seasonal, 4-year Presidential, and 10-year decennial cycles, and often provides a pretty solid framework for what to expect in the coming year.

Below is a chart from NDR showing the Cycle Composite (the blue line) and the actual movement of the S&P 500 in orange.

(Click on image to enlarge)

Copyright Ned Davis Research Group, All Rights Reserved

Clearly, the market has been a bit out of sync with the Composite's projection in the last couple of weeks. However, it was largely in sync prior to the unwind. And, as the Cycle Composite projects, a sideways period over the next few weeks would make sense - well, to yours truly, of course.

What is both interesting and encouraging is the projection of the Cycle Composite for the rest of the year. Cutting to the chase, history suggests the current scare is close to ending and that the Bulls are likely to regain possession of the ball in relatively short order.

This could certainly happen if the trade war cools quickly, and analysts can get comfy with what to expect for the rest of the year. Or not.

As I've said a time or twenty, there are times when the market is completely out of sync with history and the Composite's projection is nothing short of useless. However, the majority of the time, the market tends to follow along with its historical analogs. We shall see.

More By This Author:

Fear And Loathing (And, Of Course, Leverage)

My Take On The Action

Staying Seated On Bull Train For Now

NOT INDIVIDUAL INVESTMENT ADVICE. IMPORTANT FURTHER DISCLOSURES