What To Watch For In Friday’s US Jobs Report

US interest rate hike expectations have been flying all over the place in the past three weeks. The market has now settled on around a 25% chance of a 25bp hike on 14 June, but a strong jobs reading on Friday could easily swing things back in favour of a hike.

+195,000 Market expectation for payrolls in May

Markets think the Fed will "skip" June hike, but strong jobs could change that

When Federal Reserve Chair Jerome Powell opened the door to a potential Fed pause after the May FOMC meeting, financial markets swiftly priced a Fed peak with potentially 100bp of rate cuts by January 2024. However, strong jobs, sticky inflation and a raft of hawkish comments from some prominent regional Fed officials saw this completely reversed. As of last Friday a June hike has been seen as more likely than not, with perhaps just a couple of cuts priced by next January. This week though, comments from Fed Governor Philip Jefferson and Philadelphia Fed President Patrick Harker reignited the prospect of skipping a hike in June and a reassessment in July. There is clearly a core group at the Fed who think 500bp of rate hikes and tighter lending conditions may mean they have done enough.

We outlined our US rates view and the risks surrounding it in this report. It is that the Fed has peaked and we will get rate cuts from the fourth quarter onwards but we must acknowledge that if we get a strong jobs report and US CPI comes in hot on 13 June, the day ahead of the 14 June FOMC meeting, that could be enough to tip the balance in favour of another hike.

Some data points to strong gains

At the moment, the consensus is for the economy to add 195,000 jobs in tomorrow’s report, which is lower than the 253,000 outcome for April. In fact, none of the 69 organisations surveyed by Bloomberg expect payrolls to come in stronger than last month, which is a little surprising. In terms of the numbers we have seen, we know that job openings remain incredibly high and are in fact larger than the total number of Americans that regard themselves as unemployed. This means that a lack of people with the required skill sets continues to restrict hiring.

Yet today’s ADP jobs release reported private payrolls rose 278k versus the 170k consensus - it is a bit of a black box model that doesn’t have a great track record in predicting actual payrolls. Then we have the homebase data on hourly employed workers which was OK and the ISM manufacturing employment which pointed to modest growth. Then there are comments from St. Louis Fed economist Max Dvorkin, reported by MNI as saying that their real-time labour market index points to household employment (not the same as payrolls) rising 638k!

But other data is more cautious

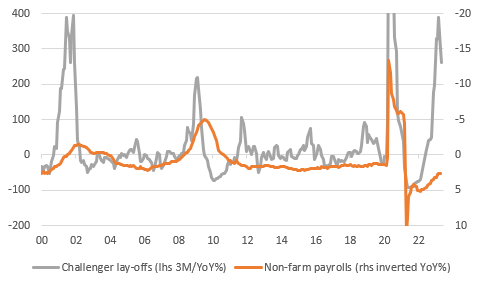

Nonetheless, we continue to see the number of job lay-off announcements climb. Indeed, today’s Challenger job lay-offs report for May showed 80,089 total for lay-offs, up 13,094 on April’s level, giving a 286.7% year-on-year change. Hiring announcements totalled just 7,885 versus 23,310 in April. This is the lowest hiring figure since November 2021 and before then, you have to go back to February 2016 to find a lower number than reported today. Yesterday, we had the Federal Reserve’s Beige Book which suggested that “Employment increased in most Districts, though at a slower pace than in previous reports”.

Rise in lay-offs points to shift in payrolls

(Click on image to enlarge)

Macrobond, ING

Watch for slowing wage growth despite record low unemployment

Putting it all together, we have some very contradictory signals, meaning we have little confidence in our own 200k forecasts and an acknowledgement that pretty much anything could happen. That said, the payrolls number isn’t the only figure to watch. Unemployment fell to 3.4% last month, however, it is wages that will probably get more attention given the Fed’s wariness that tight labour markets could keep service sector inflation higher for longer. Last month, it rose 0.5% month-on-month, but the market expects this to slow back to 0.3%.

Nela Richardson, chief economist at ADP, commented within their report that they saw the second month where there has been a “full percentage point decline in pay growth for job changers," before adding that "pay growth is slowing substantially, and wage-driven inflation may be less of a concern for the economy despite robust hiring."

Inflation could be the clincher

In terms of consensus expectations, the market is looking for 195k jobs with unemployment ticking up to 3.5% from 3.4% and average hourly earnings rising 0.3% MoM. If we get something similar to that we are likely to see the market remaining of the view that the Fed will not change policy at the June FOMC meeting, but leave the door open for a possible July rate hike.

However, if we get a 250k+ figure on jobs and wages rise 0.4% MoM or above and unemployment stays at 3.4%, we suspect it is likely to move in the direction of a 50:50 call for a hike. That would leave the outcome determined by the May CPI report, due out the day ahead of the Fed meeting. A 0.4% MoM core CPI print would put the decision on a knife edge and could give enough ammunition to push another hike over the line.

More By This Author:

Asia Rebound Could Be Weaker And LaterThe Commodities Feed: LME Zinc Inventories Surge

Eurozone Inflation Sharply Down To 6.1% In May

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more