What The Charts Say: S&P 500 Drops As Expected When Investors Shift Focus To 2023-Q1

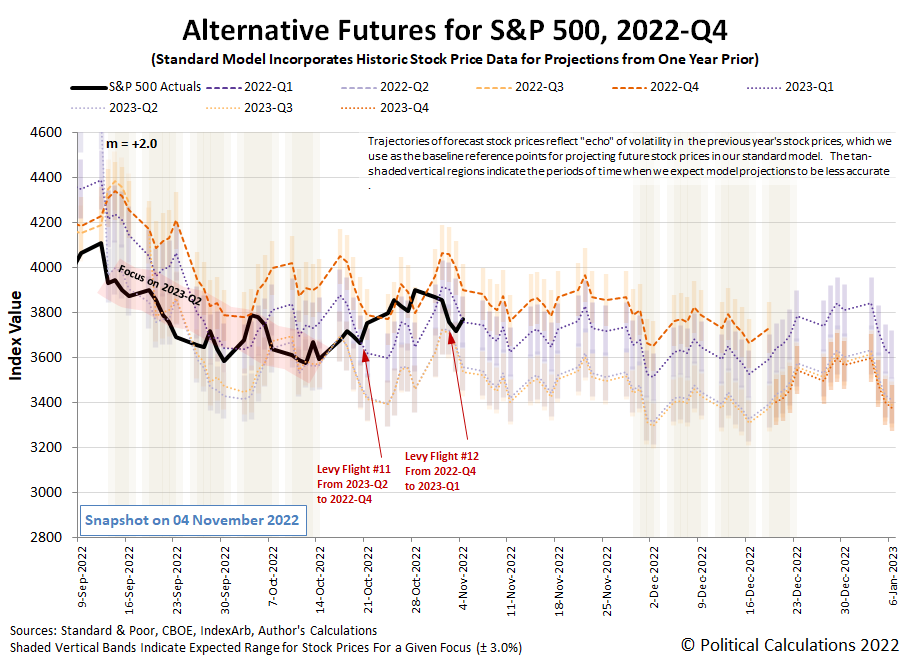

If it seems like it was just a week ago that we issued a cautionary note that the S&P 500 (SPX) would face a downward movement if investors shifted their attention to any point in the future other than 2022-Q4, that's because it was.

We said it would absolutely happen before the end of 2022-Q4. But we didn't have to wait very long at all, because it happened last week. The latest update to the dividend futures-based model's alternative futures chart shows it as the twelfth Lévy flight event of 2022, as investors refocused their attention on the first quarter of 2023.

The cause of the shift was easy to find in the week's newstream. It's directly tied to changing expectations for how the Federal Reserve's Federal Open Market Committee (FOMC) will be changing the Federal Funds Rate in upcoming months. The FOMC concluded a two day meeting on Wednesday, 2 November 2022, announcing it would immediately hike interest rates by three quarters of a percent, but it was Fed Chair Jerome Powell's press conference following the announcement that prompted investors to immediately shift their expectations for the future timing of when and how high the Fed's rate hikes will top out.

The CME Group's FedWatch Tool captured the associated change in expectations for the Fed's future rate hikes. After the announcement, it continued to project a half point rate hike on 14 December (2022-Q4). But in 2023, the FedWatch tool anticipates the Federal Funds Rate rising to a target range of 5.00-5.25% in 2023-Q1 and holding at that level until a quarter point rate cut might takes place in December (2023-Q4). As would be expected, the change for how high and, more importantly, when the Fed's series of rate hikes will peak in 2023-Q1 is behind the shift of investors' time horizon from 2022-Q4 to 2023-Q1. The trading week ended with investors having focused nearly all their forward-looking attention on the first quarter of 2023, fully accounting for the amount by which the S&P 500 dropped from the previous week.

Other stuff happened too during the week, which helps provide context for the environment in which these changes happened. Here's our summary of the week's market moving headlines:

Monday, 31 October 2022

- Signs and portents for the U.S. economy:

- Expectations setting in for Fed minions:

- Bigger trouble developing in China, Japan, Eurozone:

- Wall Street ends strong month on weaker note; focus on Fed meeting

Tuesday, 1 November 2022

- Signs and portents for the U.S. economy:

- U.S. manufacturing activity slowest in nearly 2-1/2 years in October -ISM

- U.S. construction spending unexpectedly rebounds in September

- U.S. labor market still tight, but some rays of hope in inflation fight

- Explainer-Several parts of the U.S. yield curve are inverted: what does it tell us?

- Oil up nearly 2% as weaker dollar offsets China concerns

- Bigger trouble developing in China, Japan, South Korea:

- ECB minions committing to keep raising interest rates, thinking about selling off its holdings of Eurozone government debt:

- Wall St slips as jobs data dents hopes for Fed rate deceleration

Wednesday, 2 November 2022

- Signs and portents for the U.S. economy:

- Fed minions deliver big rate hike, say they're going to slow down but rates will top out higher than they previously indicated and the coming recession won't be the soft kind:

- Bigger trouble developing in China:

- Bigger stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- BOJ minions exploring ways to keep never-ending stimulus alive:

- ECB minions looking forward to delivering more rate hikes:

- Wall Street drops as Powell signals Fed not close to done

Thursday, 3 November 2022

- Signs and portents for the U.S. economy:

- Fed minions expected to hike Federal Funds Rate above 5% in 2023-Q1:

- Bigger trouble developing in China:

- Central bankers continue rate hike mania:

- ECB minions claim they're more than halfway to last rate hike, won't copy Fed:

- Wall St down for fourth straight day on Fed rate hike worry

Friday, 4 November 2022

- Signs and portents for the U.S. economy:

- Fed minions say all's well with U.S. financial system, ready to slow down rate hikes as economy slows:

- Bigger trouble developing in the Eurozone, China, Japan:

- ECB minions focusing on inflation while Eurozone heads into winter recession:

- Wall St rallies to close out soft week after jobs report

The Atlanta Fed's GDPNow tool's projection for real GDP growth in 2022-Q4 is +3.6%, up from its estimate of +3.1% at the end of the previous trading week. There's a big gap between its current projection and the so-called "Blue Chip consensus", which anticipates near zero growth in 2022-Q4. We'll see how these economic growth projections evolve during the rest of the quarter.

More By This Author:

Affordability Of U.S. New Homes Reaches Record Low With Mortgage Rate HikesMedian Household Income In September 2022

The S&P 500 Rises With Investors Focusing On 2022-Q4

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more