The S&P 500 Rises With Investors Focusing On 2022-Q4

The final full trading week of October 2022 saw the S&P 500 (Index: SPX) rise 148.31 points, or just shy of 4%, to end the week at 3,901.06. That's the highest close for the index since 14 September 2022, which puts it 895.50 points away from its record-high close of 4,796.56 on 3 January 2022.

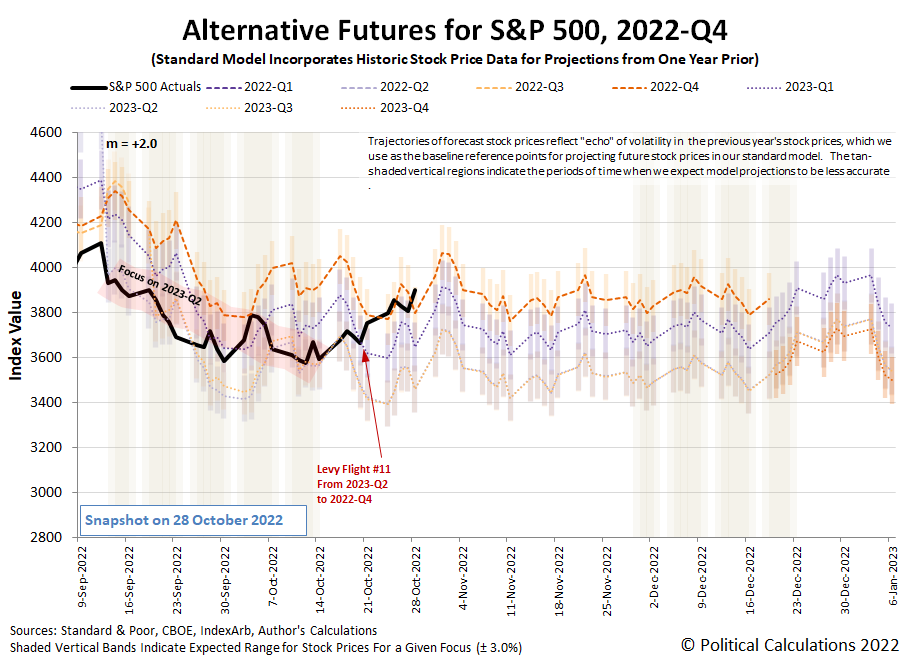

The S&P 500's trajectory during the week remains consistent with investors focusing on the current quarter of 2022-Q4 in setting current-day stock prices. The latest update to the alternative futures chart shows where that puts the S&P 500's trajectory with respect to the dividend futures-based model's projections of where the index would be if investors shifted their attention to more distant future quarters.

We're taking the trouble to point those alternative futures out because investors being focused on the current quarter means one thing with absolute surety. By the time this quarter ends, they will shift their forward-looking focus to one of these other points on the time horizon. That shift, regardless of which future quarter they might settle upon, will be accompanied by a downward movement in the level of the index. How much of a downward movement will be determined first by which quarter draws their gaze and second by how much the expectations for dividends for that quarter might change.

We've seen that phenomenon before. It happened most recently during the second half of the second quarter of 2022 as the level of the S&P 500 repeatedly see-sawed between the levels associated with investors looking at different points of time in the future. For us, it's exciting to watch these Lévy flight events play out in real-time. Depending on how you're invested, your entertainment factor while experiencing such high percentage changes in value may differ...

While the remainder of 2022-Q4 may not be quite as volatile as 2022-Q2 was, the one thing that can prompt investors to suddenly shift their time horizons is what they find in the random onset of new information. With that in mind, here are the market-moving headlines investors absorbed during the past week.

Monday, 24 October 2022

- Signs and portents for the U.S. economy:

- Poll of economists show their expectations of Fed minions:

- Some positive signs for China's economy:

- But bigger trouble still developing in China:

- Xi says China's economy has high resilience, room for manoeuvre

- China central bank head likely to step down amid reshuffle - sources

- China's Sept exports grow 5.7%, beat forecasts, imports weak

- China's Q3 pork output growth slows as farmers reduce breeding herds

- China's new home prices fall for second month on weak sentiment

- And more bigger trouble developing in the Eurozone:

- BOJ minions busy keeping yen from crashing, JapanGov minions to launch more stimulus:

- Wall St closes sharply higher on hopes of abating Fed

Tuesday, 25 October 2022

- Signs and portents for the U.S. economy:

- Fed minions claim to have multiple paths to get to same place, politicians plead with Fed chief to back off rate hikes:

- Bigger stimulus developing in China:

- Bigger trouble developing in China:

- Bigger trouble developing in the Eurozone:

- S&P 500 adds to mid-October rebound from bear market low

Wednesday, 26 October 2022

- Signs and portents for the U.S. economy:

- BOJ minions working to keep never-ending stimulus alive:

- Central bank rate hike mania hits Canada, IMF says it wants MOAR rate hikes:

- S&P 500 ends lower, snapping rally on mounting slowdown fears

Thursday, 27 October 2022

- Signs and portents for the U.S. economy:

- The Fed has "soothsayers":

- Bigger trouble developing in China, South Korea, Germany:

- JapanGov minions keeping upping their fiscal stimulus plans:

- BOJ minions determined to keep never-ending stimulus alive:

- ECB minions excited to deliver more rate hikes:

- S&P 500, Nasdaq slide, while Dow ends higher on mixed earnings picture

Friday, 28 October 2022

- Signs and portents for the U.S. economy:

- Fed minions losing money, may pay attention to Treasury yield curve inversion, not expected to stop hiking rates:

- Bigger trouble developing in the Eurozone:

- Looking backward, Taiwan Q3 GDP growth tied to China lifting zero-COVID lockdowns:

- JapanGov minion thinking about doing more to keep yen from crashing:

- ECB minions excited to deliver rate hikes as Eurozone recession develops:

- Wall Street surges to sharply higher close ahead of Fed week

The CME Group's FedWatch Tool continues to project a three-quarter point rate hike when the FOMC next meets on 2 November 2022 and a half-point rate hike on 14 December (2022-Q4). In 2023, the FedWatch tool projects another half-point rate hike in February (2023-Q1) but now anticipates a quarter-point rate hike in May (2023-Q2). That's followed by two quarter-point rate cuts, the first as early as June (2023-Q2) and the second in November (2023-Q4).

The Atlanta Fed's GDPNow tool's first projection for real GDP growth in 2022-Q4 is +3.1%. Meanwhile, to close the books on 2022-Q3, the Bureau of Economic Analysis's first estimate of real GDP for 2022-Q3 is 2.6%, slightly lower than the GDPNow tools' final forecast of 2.9% for the recently ended quarter.

More By This Author:

U.S. New Homes Market Cap Falls In September 2022

September 2022 Snapshot Of Who Owns The U.S. National Debt

The 2022 Return Of The Recession Probability Track

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more