Weekly Market Pulse: The Cure For High Prices

There’s an old Wall Street maxim that the cure for high commodity prices is high commodity prices. As prices rise two things will generally limit the scope of the increase. Demand will wane as consumers just use less or find substitutes. Supply will also increase as the companies that extract these raw materials open new mines, grow more crops or drill new wells. The combination of those two will act to bring prices back down until the process reverses. As prices fall, demand rises and supply is constrained until prices start to rise again. We’ve seen this cycle many times throughout history so we know the sequence of events. What we don’t know is the time within which these things will occur. How high do prices have to go before we get demand destruction? How long does it take to bring a new mine into production and increase supply?

We can see the same supply/demand dynamic across the entire economy. Prices rise until, at some point we see a drop in demand, inventories build up and production has to be scaled back; we get a recession. We also face the same time issue across the entire economy as we do with the commodity markets. How high do prices have to rise before demand wanes? How much does demand have to drop before inventory build up requires producers to scale back production? How much will they have to scale back and how many people will have to be laid off in the process? The cycle this time around is more complicated than normal I suppose, by a pandemic and now a war, but I don’t have much doubt that the process will play out as it has in the past. But when? I don’t know obviously, but I do know that we are stress testing the economy with prices right now.

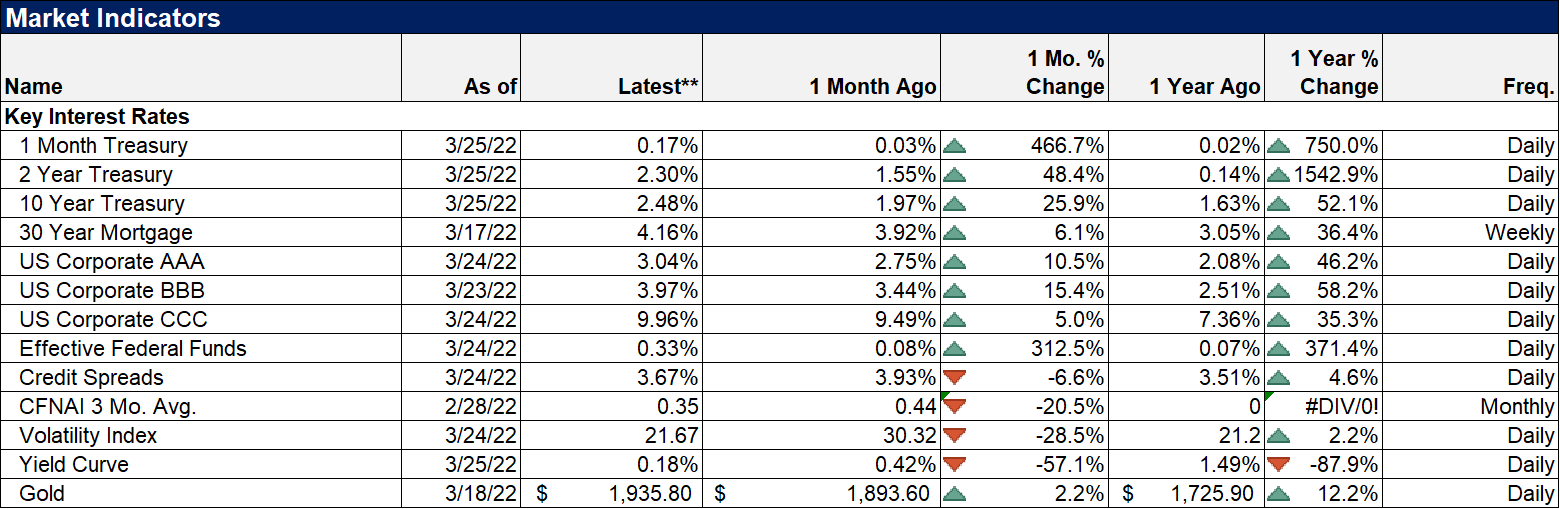

The economy right this minute is not in danger of recession, at least based on the indicators we follow. We have seen some early warnings such as the inversion of the 10/7 year Treasury yields but that is generally a very early warning of recession. Of course, at the rate prices and interest rates are rising recently, that may not prove true this time but we would still expect to see other indicators turn negative prior to the onset of recession. Other parts of the curve would still invert and credit spreads would still widen. And right before recession, the yield curve would probably steepen as short term rates fall rapidly; the market will not wait for the Fed to start lowering rates before rendering its own verdict on the economy.

But the price hikes may be reaching a tipping point. The Chicago Fed tracks weekly credit and debit card activity, mobility (gas consumption and retail foot traffic) and consumer sentiment to project monthly retail sales ex-autos. The latest readings are showing a sizable drop off from February to March; their current projection is for March retail sales to fall over 3% and over 4% adjusted for inflation. I don’t think we should make too much of this yet since we knew that the previous pace of retail sales was not sustainable; retail sales were well above the pre-COVID trend. We also don’t know yet how much, if any, service spending has picked up although there are some indications that it has. This may be nothing more than a reallocation of spending rather than a big slowdown but it merits watching closely.

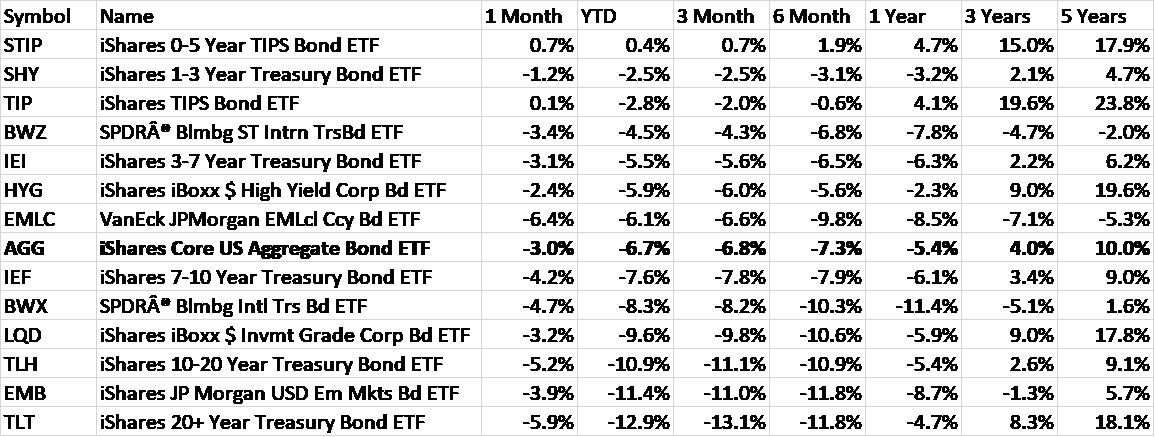

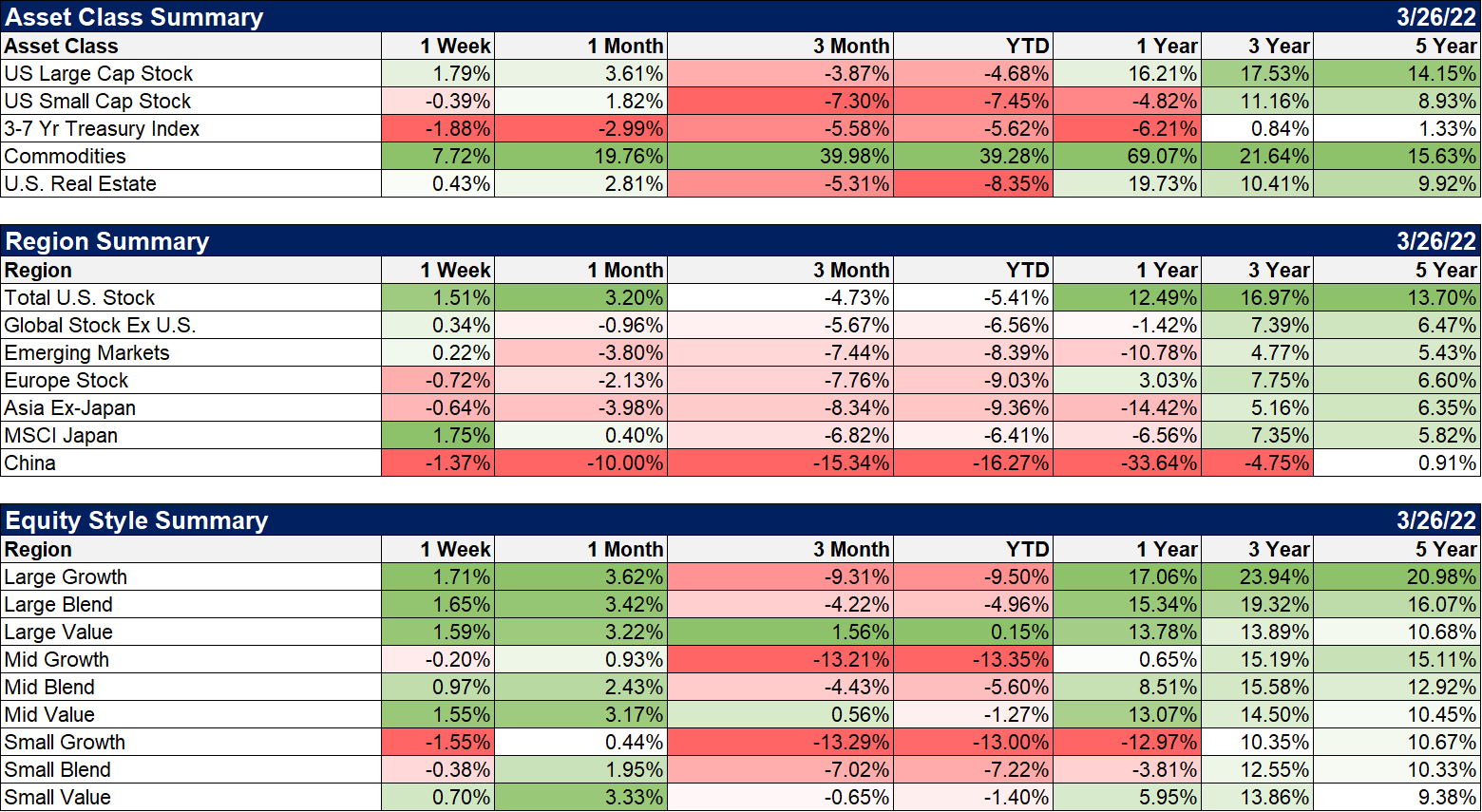

We certainly don’t see any indication that bond traders are concerned about recession yet. The 10 year Treasury yield rose 34 basis points last week to end right near 2.5% and the entire curve basically shifted up; the 10/2 year spread widened – a whole basis point – to 18. Bonds are now down more than stocks YTD, on pace for their worst quarter since 1980. The Aggregate bond ETF (AGG) is down nearly 7% this quarter.

(Click on image to enlarge)

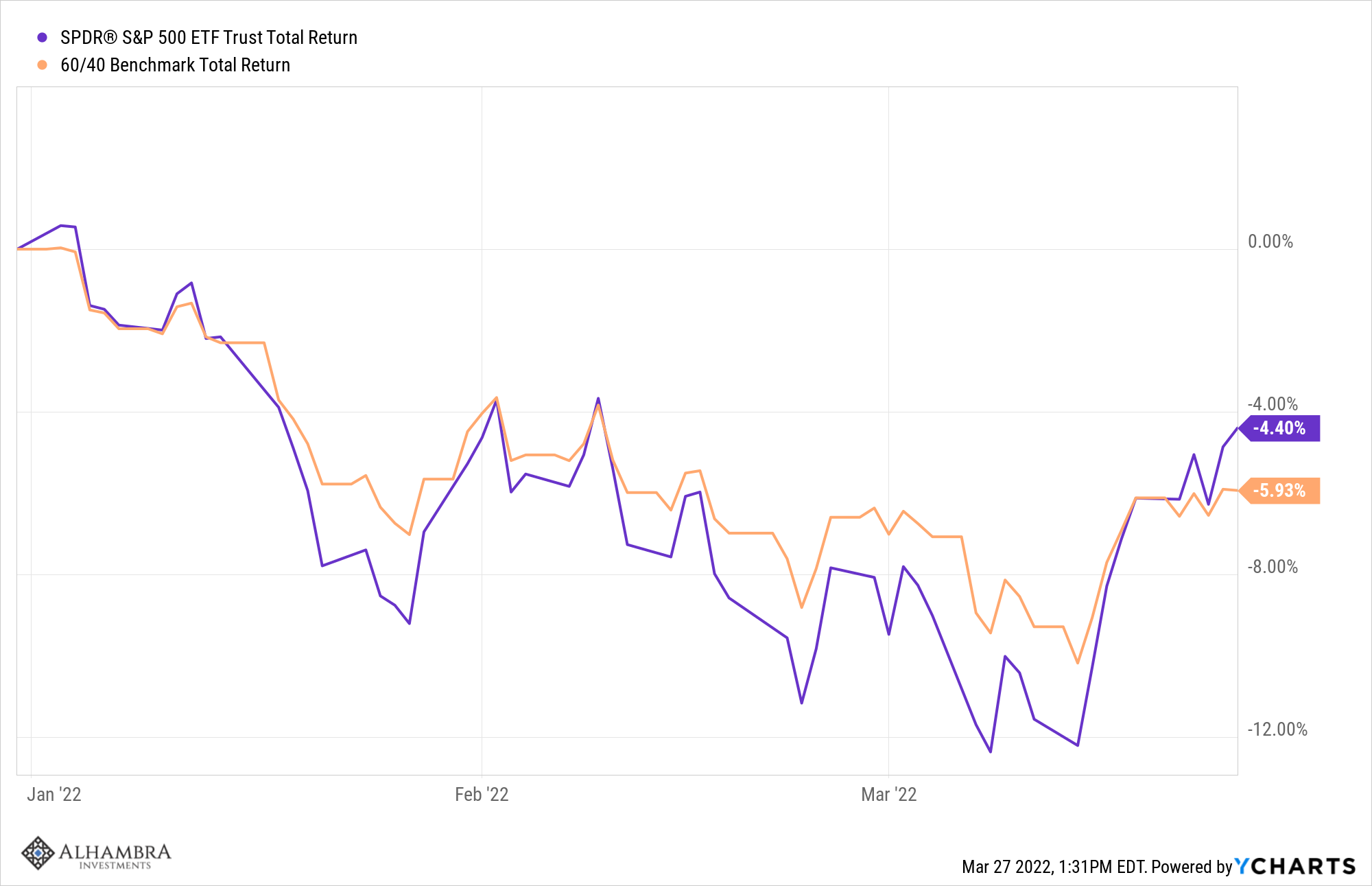

The S&P 500 is still down on the year too even after a decent – and confounding I might add – rally last week. But more interesting is that in a down year, the standard 60/40 allocation of stocks and bonds has done worse than just owning the S&P 500. Owning bonds as a diversifier, as a hedge against a bad stock market, has not worked out this year.

(Click on image to enlarge)

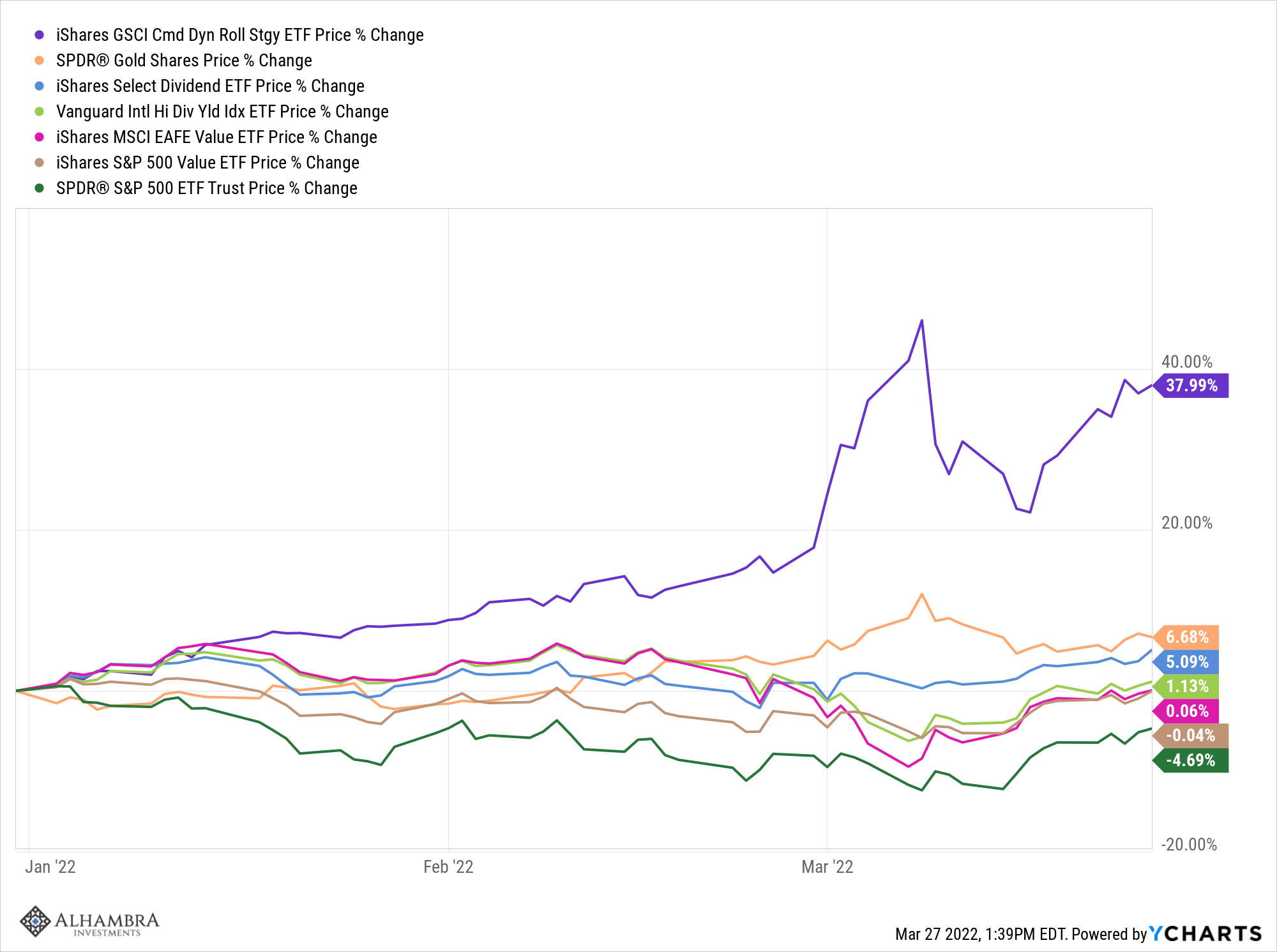

What has worked is owning commodities and gold, both of which are up on the year. What has also worked is to own value and dividend stocks; this has very much been a correction of growth stocks.

(Click on image to enlarge)

We have maintained a short duration bond portfolio this year because we expected rates to continue rising, if not quite this rapidly. But this bond bear market – and yes I think that is the appropriate term here – won’t last forever. Neither, by the way, will the bull market in commodities. At some point the demand destruction I talked about above will happen and we know generally what will happen when it does. Commodity prices will fall, the economy will slow and the bond market will start to price in fewer rates hikes. If it goes past some point, the bond market will start to price in rate cuts (which forward curves are already doing in late 2023). An investor is faced with two competing desires at this point. Let momentum work and keep our current allocations to commodities (which have risen due to gains) intact or rebalance to restore our bond allocations (which have fallen due to losses)? Considering investor sentiment regarding both assets, I’d suggest that rebalancing probably makes some sense right now. Investors seem too eager to buy commodities and too reluctant to buy bonds. If nothing else, it is the conservative choice.

Investors can also start to consider some tactical choices. Once rates have hit a peak (so easy to write, so hard to see), an investor who has held short and intermediate term bonds can start to extend maturities in anticipation of a declining rate environment. Way back when this recovery started I looked at the long term trends and decided that somewhere around 2.5% would be the top in the 10 year Treasury rate for this cycle. That was based on nothing more than extrapolating the long term trend and assuming that the long term downtrend in rates would stay intact. It is far from scientific but I think it helps to have an idea of where the long term trends are headed. Anyway, the pace of rising rates has surprised me so we’ve arrived at my target before I expected. And I don’t know for sure that the long term rate downtrend will stay intact. But if it does, the time for extending duration and positioning for capital gains in bonds is probably near.

Once recession looks inevitable, there will be an opportunity for another tactical change. As we near recession, as those other indicators start to send warnings, an investor could decide to make a short term change in their strategic allocation. If your strategic allocation is to hold 30% in bonds, you might choose to shift to a 40% bond allocation or if you have a lot of conviction, 50% bonds. Changes to your strategic allocation should be rare though because they tend to be hard to reverse. If you shift to a more conservative allocation and there is no recession, you should shift back to your original strategic allocation. But that is very hard to do; we humans aren’t great at admitting our mistakes.

One last thing to consider is that this doesn’t have to unfold this way. Commodity prices and inflation more generally, could fall before demand destruction sets in. The rise in prices has been driven by multiple factors, some of them on the supply side, some on the demand side. The Ukraine war has added an element of uncertainty that could be relieved – to some degree – by a sudden resolution. The anticipated drop in goods demand may not precipitate an inventory correction; inventory to sales ratios remain quite low. The future of high prices inducing demand destruction and a recession fairly soon is just one potential future. Unfortunately, our crystal balls are all cracked so we’ll just have to wait and see how things unfold.

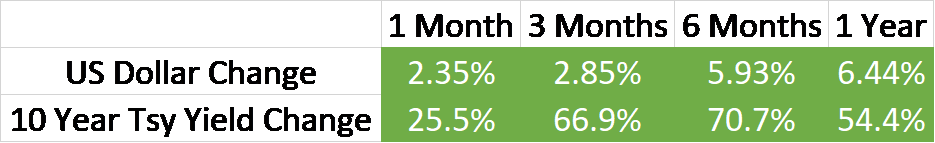

Environment

The environment continues to be marked by a rising dollar and rising rates. The dollar remains in its long term range and isn’t worrisome right now. Rates, on the other hand, are rising rapidly and seem likely to have an impact on the housing market, where mortgage rates have risen dramatically recently. I saw 30 year mortgages being quoted at 5% last week, up from an average of 3.3% a year ago. And rates were under 3% at one point in this cycle. Some home buyers are going to have to shift to a lower price point. Still, housing inventory is quite low and a lot of buyers – especially new home buyers – have locked in lower rates so this might take some time to have a big impact. And for those with existing mortgages, we seem to have learned our lesson about variable rates; over 95% of outstanding mortgages are fixed rate.

(Click on image to enlarge)

Markets Review

Commodities resumed their run last week after a brief pause. That was driven mainly by energy with natural gas and crude oil up 15.4% and 10.5% respectively. Natural gas prices rose on news that the US agreed to supply an additional 15 billion cubic feet of LNG to Europe this year. Nat gas prices have been on the rise for some time but I don’t think this deal changes the overall supply/demand picture. We have a finite amount of LNG capacity and we’re using it all right now so any shift to Europe will just be a reallocation of what we were sending to Asia. Not bad news for producers maybe since they’ll likely get a better price but the amount of gas being exported isn’t going to change much.

Agricultural commodities have also risen strongly this year. That isn’t just due to the potential disruption of supply from Russian and Ukraine but also due to problems with fertilizer supply. The problem there has as much to do with high natural gas as the war. Russia is an exporter of fertilizer but the US is a larger producer. US farmers are seeing higher fertilizer bills but the impact will be felt much more acutely in other countries. To add one more element of uncertainty, there is also a shortage of glycophosate, a widely used week killer. It’s tough being a farmer these days. Okay, it’s always been tough to be a farmer but this year is turning out to be a special kind of tough.

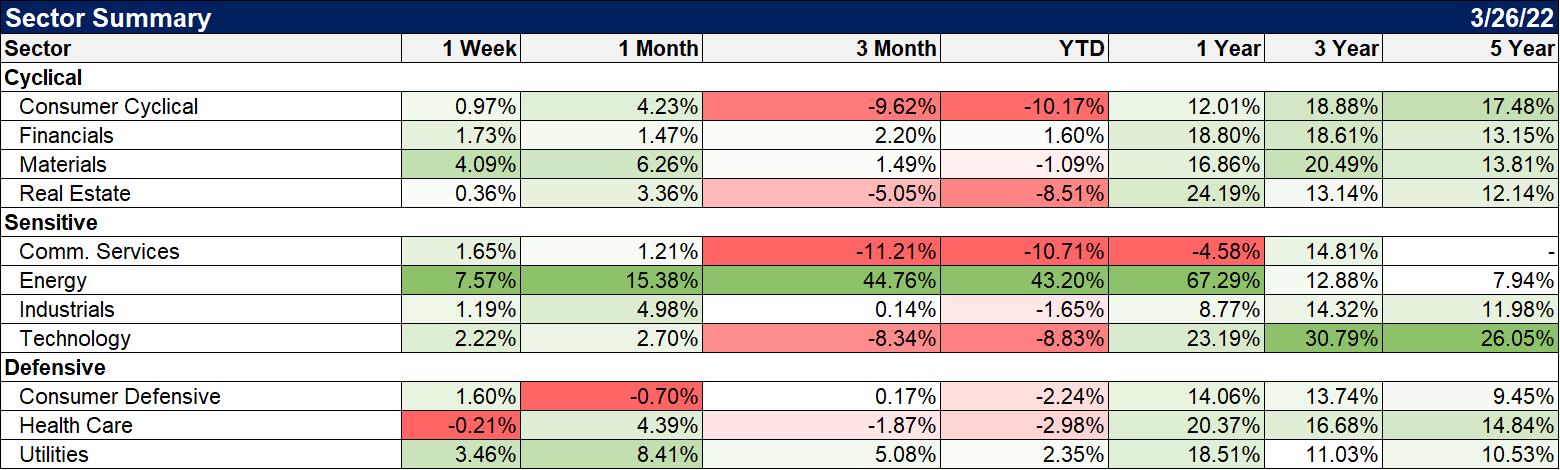

There wasn’t much difference in returns for large cap growth and value last week but value continued to lead in small and mid-cap.

(Click on image to enlarge)

Energy and materials were the big winners last week but most sectors were up last week, healthcare the exception.

(Click on image to enlarge)

Credit spreads have narrowed over the last two weeks and the volatility index has fallen to the low 20s. The volatility index is in an uptrend that started in November. After falling from the high 30s, it may be ready for another run higher. I still don’t think sentiment got negative enough at the recent low to make this a reliable bottom. We may need to revisit the lows before we can put this correction behind us and that would likely push the VIX higher again.

(Click on image to enlarge)

We can’t know how the future will unfold but we should know history and basic economics. Real commodity prices have been falling for decades through a series of booms and busts. We are obviously in one of those boom periods right now but how long it will last is something we can’t know in advance. But we know that the bust will come, it is only a matter of time. We can also look at historical bond returns and know that down periods like we’re in now are inevitably followed by up periods. Seems like a great time to rebalance your portfolio back to its strategic, long term allocation. It may not be the top for commodities or the bottom for bonds but we’re a lot closer now than we were just at the beginning of this year.

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more