Weekly Market Pulse: Follow Buffett’s Rule

Image Source: Pexels

A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful. –

Warren Buffett, October 16, 2008, Buy American. I Am. , New York Times

That was a month after the bankruptcy filing of Lehman Brothers, in the teeth of the Great Financial Crisis. At the beginning of the article, he admits that things look rather bleak:

The financial world is a mess, both in the United States and abroad. Its problems, moreover, have been leaking into the general economy, and the leaks are now turning into a gusher. In the near term, unemployment will rise, business activity will falter and headlines will continue to be scary.

Then he says, he’s buying, not with Berkshire Hathaway’s money but his own:

So … I’ve been buying American stocks. This is my personal account I’m talking about, in which I previously owned nothing but United States government bonds.

Buffett goes through all the times in the past when things looked bleak but stocks rallied anyway, anticipating better days ahead. Why was he buying?

In short, bad news is an investor’s best friend. It lets you buy a slice of America’s future at a marked-down price.

The problems we face today, from wars to inflation to dysfunctional politics, are serious but they are no more serious than those we’ve faced in the past. We are not fighting a world war or trying to extract ourselves from a Great Depression. We are not in the midst of a financial crisis and there are no collapsing currencies (other than the perpetually collapsing Argentine Peso), certainly not the dollar as I’ve seen so many people warn of. As for the politicians, I expect them to be feckless, selfish, misguided, and injudicious, and they rarely disappoint in that regard.

Yes, inflation spiked during the post-COVID recovery but it peaked over a year ago and is coming down gradually. It would be nice if it were faster but it is going in the right direction. There may be more inflation waves to come, as there were in the 70s, but we don’t know that right now. We made a lot of mistakes back then and we don’t have to repeat them.

Yes, interest rates have gone up a lot from the lows but they are pretty average compared to history. Do we really think that this economy, this society is so far gone that it can’t function with “normal” interest rates? No, people can’t buy as much house as they could a couple of years ago when rates were much lower but markets adjust. The median sales price of a new home is down 16% since peaking a year ago while the average is down almost 12%. And if rates stay high, prices will probably come down more. Homebuilders had gross margins well over 20% last year – some over 30% – so I think they’ll be fine.

Yes, stocks have performed poorly but the underlying driver of stock prices – earnings – is doing just fine. Profit margins, at nearly 12%, are higher than they were pre-COVID and well above the long-term average. Higher interest rates mean that earnings multiples can and should contract, but with the yield on a BBB corporate bond at 6.5%, a P/E of 15 is certainly reasonable and in line with history. That means, to us at least, that the S&P 500 is probably modestly overvalued at about 17 times next year’s earnings that are expected to grow by 12% while mid and small cap stocks are quite cheap at around 12 times with expected earnings growth next year of 19% and 28% respectively (S&P 400 and S&P 600).

Yes, recession is, I know, right around the corner, exactly where it has been for the last 18 months. This has been the strangest of business cycles and everyone knows how it will end – in recession, which is where all business cycles end. But we don’t know when and we don’t know how severe any downturn might be. There is little sign of any impending contraction at present. Household balance sheets are in great shape – in aggregate – and most of the corporate sector is, too. There are exceptions in both spheres as there always are and after a decade of near zero interest rates, there are some bad habits that need breaking.

Banks mostly backed away from risky loans after 2008 and that gap was filled by private equity and private credit funds. There is a lot of junk debt coming due between now and 2028 that will have to be refinanced. Much of the CCC and lower credit coming due is for companies taken private when debt was cheap and if rates stay high, as the Fed seems to want, private equity funds will spend the next few years restructuring them. Luckily, PE funds are sitting on record “dry powder” of about $2.5 trillion and private debt funds are sitting on another $500 billion. And by the way, banks seem to be competing more for new debt deals to offset the low yielding Treasury paper sitting on their balance sheets. This is not 2008.

I don’t know if we’ve reached peak pessimism – again – but the mood of the market is decidedly foul. Maybe not quite as foul as last year when I last wrote one of these “be greedy” pieces (see here). But everyone is rushing to the perceived safety of Tbills and while I can’t tell you how that will be wrong, it is way too popular, too easy, to yield a reasonable real return. As Buffett put it in that OpEd 15 years ago:

Equities will almost certainly outperform cash over the next decade, probably by a substantial degree. Those investors who cling now to cash are betting they can efficiently time their move away from it later. In waiting for the comfort of good news, they are ignoring Wayne Gretzky’s advice: “I skate to where the puck is going to be, not to where it has been.”

I understand the desire for safety. Most of us are not in the position of a Warren Buffett, with no concern for the short-term return on our investments. But concern shouldn’t turn into a wholesale shrinking from risk. It’s time to be a little greedy.

Environment

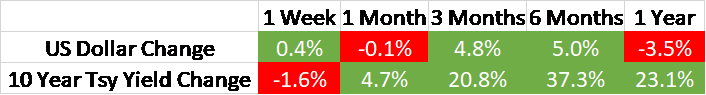

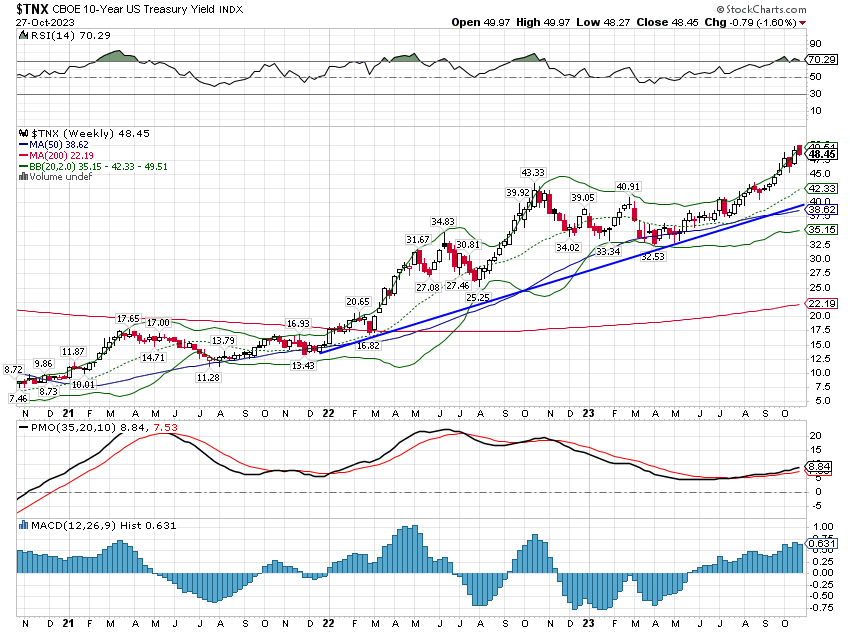

The dollar was up slightly last week but the short-term trend is still neutral, which it has been since early October. The intermediate-term trend is neutral to slightly positive while the long-term trend is still higher. I think the right question to ask right now is why the dollar isn’t higher. Considering the new outbreak of hostilities in the Middle East, the continued war in Ukraine, a Chinese economy with a big real estate/debt problem, an aggressive Federal Reserve, real interest rates at their highest level in 16 years and recession knocking on the door – again – why isn’t the dollar soaring?

(Click on image to enlarge)

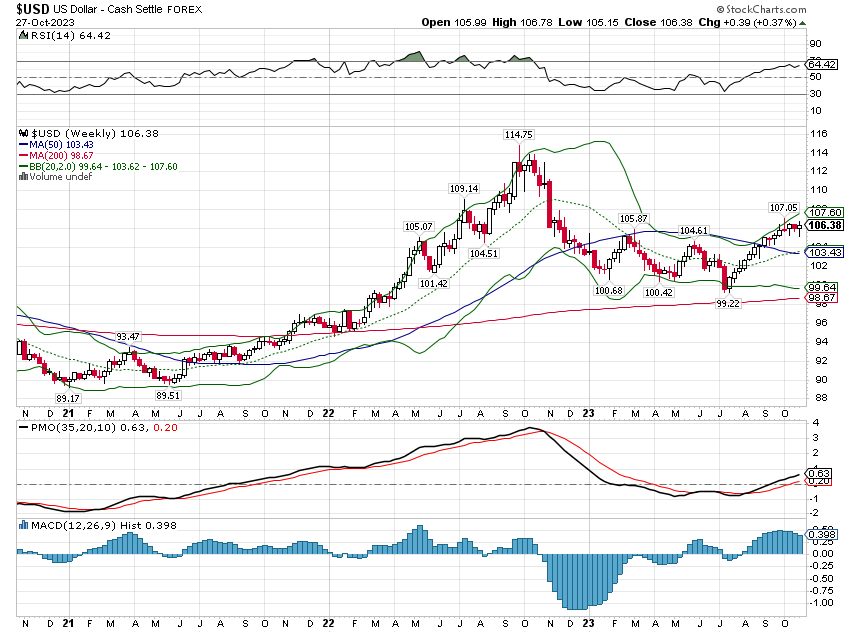

Anomalies like this are what should draw your attention. With US economic growth seemingly much better than the rest of the world and real interest rates up from negative 100 basis points to positive 250 basis points in the last 18 months, I’d expect the dollar to be soaring. I’d also expect gold to be tanking and that isn’t happening either. So, why not? That’s a question for which I don’t have a definitive answer but my guess is that people believe this is as good as it gets with the US economy. If growth and interest rates are peaking then so should the dollar and gold should be better bid the lower rates go.

(Click on image to enlarge)

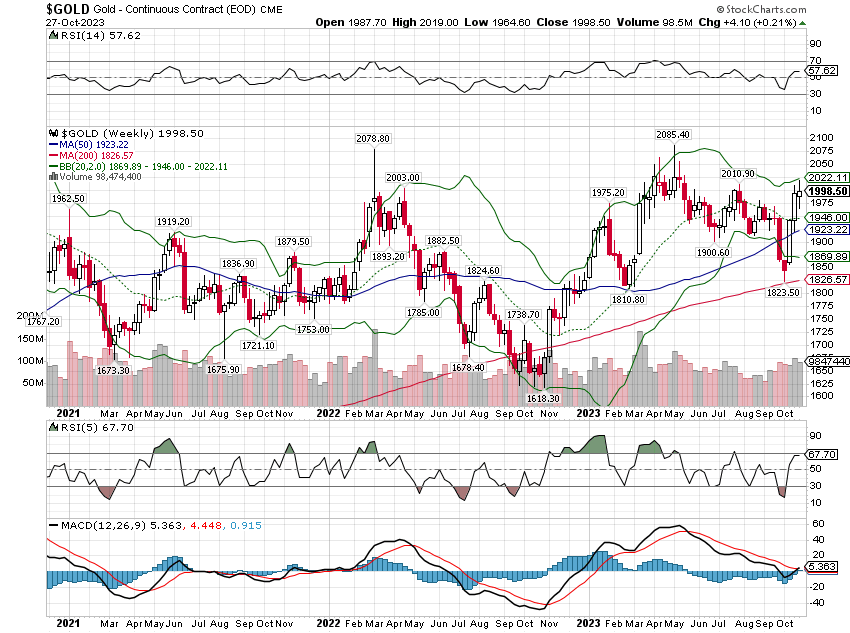

As for rates, the 10-year yield is looking toppy but the trend is still up. On the other hand we could get a sizable correction of the uptrend in rates without affecting the trend. And it wouldn’t surprise me in the least if that’s what we get right about now.

(Click on image to enlarge)

Markets

Stocks appear to have come slightly unmoored from the fear of higher rates. Investors seem to be selling now because other people are selling which is about as bad a reason to sell as I can think of. Sentiment on stocks is so negative that companies reporting better than expected earnings have seen their stock prices fall by 1%. In an average quarter, they rise by almost 1%. Companies that have missed estimates have seen their stock fall by over 5% versus the 5-year average of -2.3%.

Earnings overall for the S&P 500 have been quite good. If earnings come in as expected right now, the year-over-year change in full year earnings will be nearly 5%. If estimates for Q4 are accurate, full year 2023 earnings will rise nearly 11% from 2022. Year-over-year Q3 23 vs Q3 22 earnings are already looking up nearly 10%. 2024 earnings are expected to rise by another 12%.

By the way, most people are concentrating on the S&P 500 but the S&P 400 (midcap) and S&P 600 (small cap) both offer lower valuations and better expected earnings growth than the S&P 500. Midcap estimates put the earnings gain next year at 19% while small cap is expected to gain over 28%.

The point is that selling in stocks is not about earnings. And last week at least, it wasn’t about interest rates. I suppose that leaves fear of a wider war in the Middle East as the likely cause but that’s just a guess since I can’t know what other people are thinking. I loathe war and everything about it but I don’t see how anyone could make changes to their portfolio based on the latest news out of the Gaza strip.

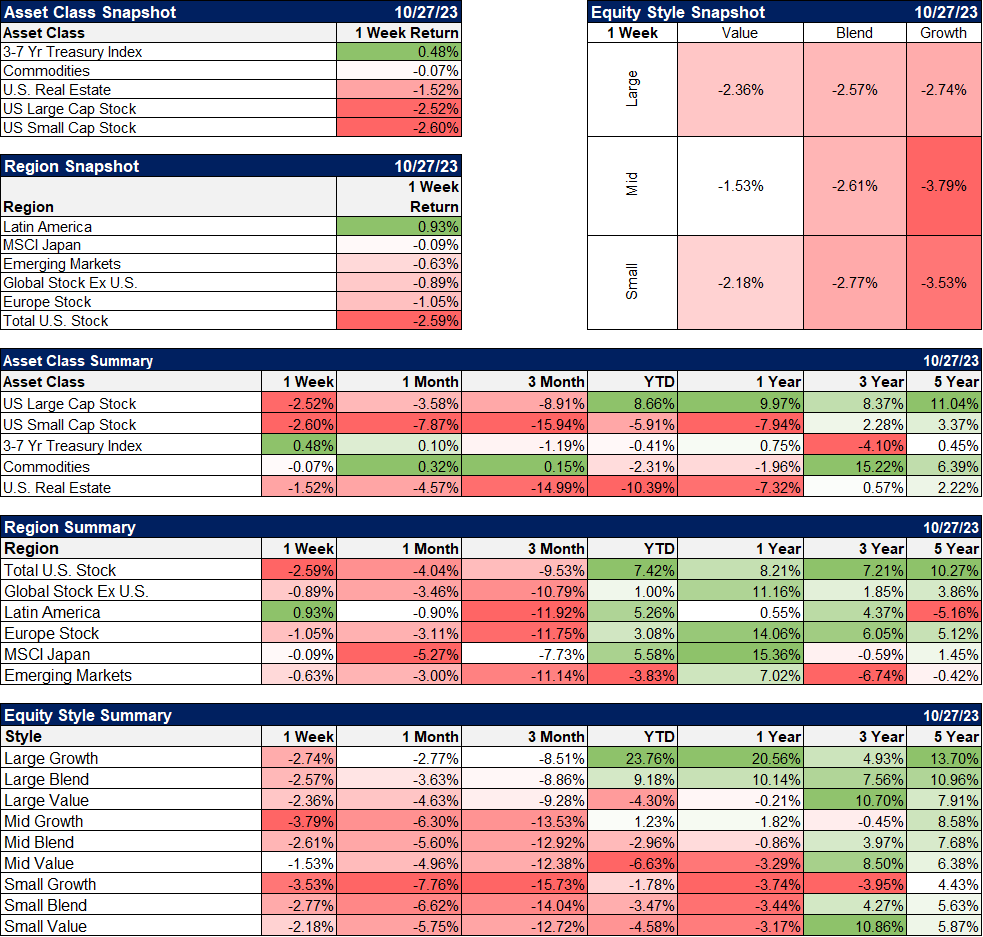

Bonds were up last week while stocks and real estate were down. Commodities were down slightly but continue to outperform stocks over the last 3 months during the stock correction. They also lead by a wide margin over the last 3 years.

The value indexes outperformed again last week but they haven’t offered any advantage during this correction when basically everything has been sold.

(Click on image to enlarge)

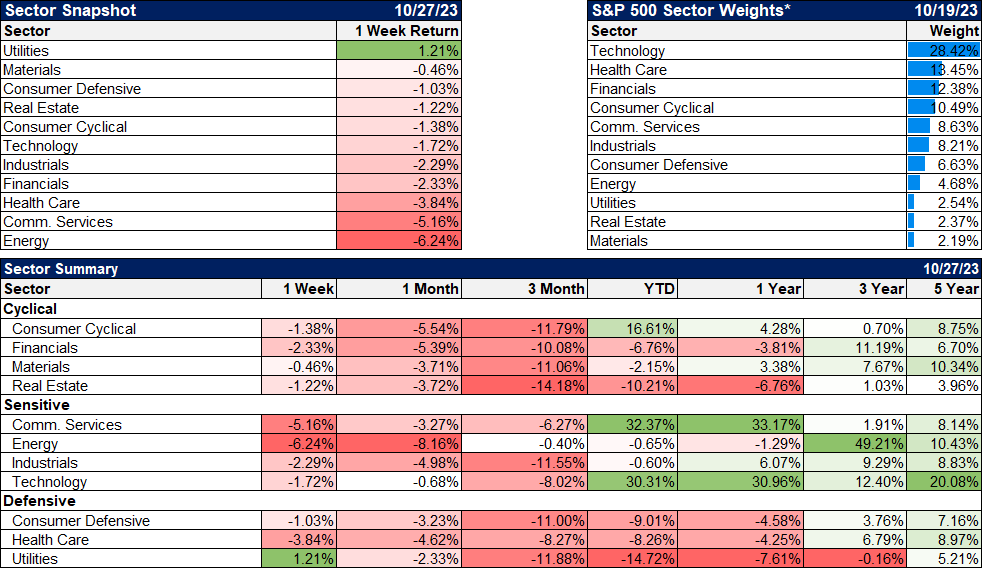

Utilities were the only sector higher last week while energy took a big hit on weak earnings from ExxonMobil XOM and Chevron CVX.

(Click on image to enlarge)

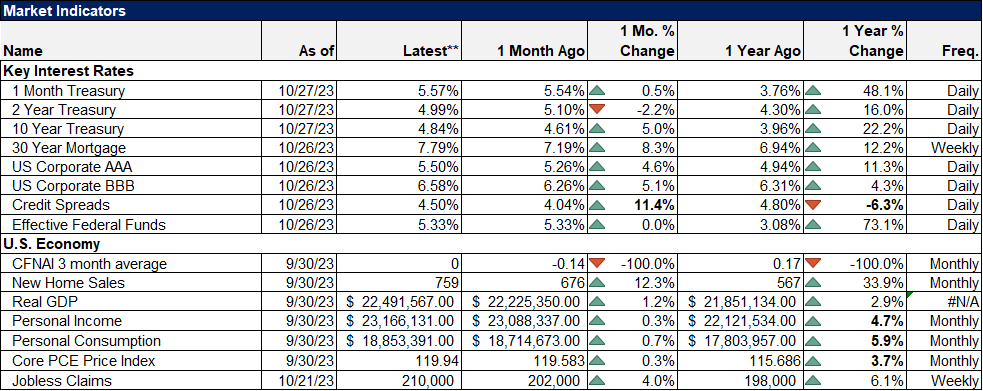

In contrast to the hot GDP report, the CFNAI released last week showed the 3-month average at 0, indicating an economy growing at trend. And I think that’s about right. Q3 was better than Q2 but the underlying growth rate was just a little over 3% (real final sales). One quarter doesn’t a trend make. We know there will be quarters above trend and some below trend. We shouldn’t get too excited about either.

Doug did short posts on the weekly data releases:

Inflation: PCE and GDP Deflator

The economy is growing right now but a lot of that is due to government spending, directly or induced through policy. That certainly isn’t my preference and I have serious doubts as to the investing acumen of the Biden administration – or any other group of politicians/wonks for that matter. Poor results from government directed investment is not a function of the party doing the investing. Crony capitalism is great…for cronies and their politicians. The rest of us get to foot the bill.

For now, the government-directed investing will raise GDP because it is creating activity. In the long run though, economic growth is about productivity growth which is driven by efficient investment. Will today’s government-directed investments – in semiconductors and electrification, for instance – pay off? Will the investments of the private sector raise productivity enough to overcome the drag of politics? Those are questions that will only be answered with time but we remain fairly optimistic about the private sector.

(Click on image to enlarge)

I don’t believe the conditions today even approach those that prevailed during 2008 or any of the other financial crises that have periodically beset our nation. I doubt I will ever experience anything like 2008 again; it was truly once in a lifetime. But fear often grips the market and offers opportunities to investors, as I think it does today. It takes an optimist to look past the current problems and see a better future but those who have done so in the past have always been rewarded. Pessimists abound these days, in all walks of life, and maybe they’re right that this time is different, that America has finally run out of good days.

But I don’t think so. The communications revolution of the last few decades has given the worst among us a larger stage, one they use to appeal to our lowest, basest instincts. They use scare tactics to sell their message of political or economic doom. All you have to do, they say, is vote for my party or buy my research or subscribe to my TikTok and you too will be part of the club, an insider with special knowledge that no outsiders have.

Here’s what Buffett had to say about market timing:

Let me be clear on one point: I can’t predict the short-term movements of the stock market. I haven’t the faintest idea as to whether stocks will be higher or lower a month or a year from now. What is likely, however, is that the market will move higher, perhaps substantially so, well before either sentiment or the economy turns up. So if you wait for the robins, spring will be over.

This is the greatest investor of our age telling you that he can’t do what that guy on Twitter keeps telling you he can. Are you really going to side with the guy on Twitter? I think I’ll stick with Buffett.

I think America’s and the world’s best days are still ahead of us. Throughout history we have always found the leader we need at the right time, from Lincoln to Roosevelt (Teddy) to FDR to JFK and Ronald Reagan. Innovators from Deere to Carnegie to Rockefeller to Noyce and Moore to Andreessen and Bezos have always found a way to move our economy forward. We’ll find the right leader and entrepreneurs will find ways to make us more productive.

Buffet’s article, by the way, did not mark the bottom of that bad 2008 bear market. In fact, the S&P 500 fell another 27% from that day to the low, but if you bought the S&P 500 the day Buffett said to Buy American, a year later you were sitting on a 19% gain. I don’t know if this is THE bottom of this bear market that has dragged on for two years. But I am sure that the prevailing mood today is much more fear than greed. Follow Buffett’s rule.

More By This Author:

Weekly Market Pulse: An Ego Driven Fed

Weekly Market Pulse: Prophets Of Doom

Is The Stock Market Overvalued?

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more