Weekly Market Pulse: An Ego Driven Fed

Well, I finally got it. I’ve been fighting COVID for the last week and while most of my symptoms have improved, I am not 100% yet. My goal from the beginning of COVID was to avoid it, if at all possible, until it became endemic and less lethal. It seemed logical to me, a layman, that it would follow this path because it is the one that allows the virus to survive. And so, my wife and I were very careful, especially during the first year of the virus, and took every precaution we thought reasonable. And we succeeded in that neither of us had contracted COVID until last week, when we both got the latest strain.

This version is, obviously, less lethal than the original so we feel like we succeeded in our goal. But it is still a nasty bug. I’m in pretty good physical condition – 3 to 4 days a week at the gym, weekly horseback rides, lots of walking – and it still laid me out for a week. I can only imagine how bad it was in 2020.

All of that is a long way of saying that this won’t be my usual weekly commentary. I still watched the market last week and I have some observations but this week I’m just going to list them in bullet point format. Doug Terry covered the weekly economic reports and there are links below to those reports. Here are my thoughts on last week:

- I don’t pay as much attention to Jerome Powell and other Fed speakers as most people in this business. I don’t really care what they say; I just pay attention to the market reaction, how economic expectations are changing. But…I watched Powell’s talk at the NY Economic Club last week and the minute-by-minute changes in the markets based solely on what was coming out of his mouth. And the things coming out of his mouth were….I’m going to be polite here….devoid of intellectual rigor. It should not have moved the market because he talked for nearly an hour and said next to nothing of value. This quote from John Maynard Keynes kept running through my head:

“Practical men who believe themselves to be quite exempt from any intellectual influence, are usually the slaves of some defunct economist. Madmen in authority, who hear voices in the air, are distilling their frenzy from some academic scribbler of a few years back.”

- The Fed in general, and Powell more specifically, needs to shut up. They are creating volatility and disrupting markets for no reason other than to stroke their own egos. It is a disgusting display with potentially real economic consequences.

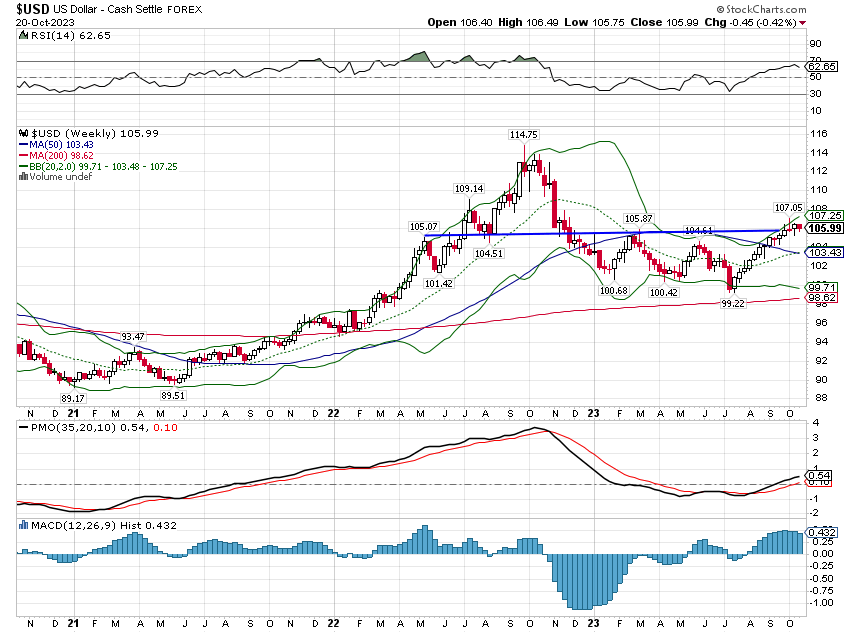

- Everything happening in markets right now is about interest rates. And the recent increase in volatility means, to me, that we are getting very close to the end of this rise in rates. You want to be a buyer of high volatility, not a seller.

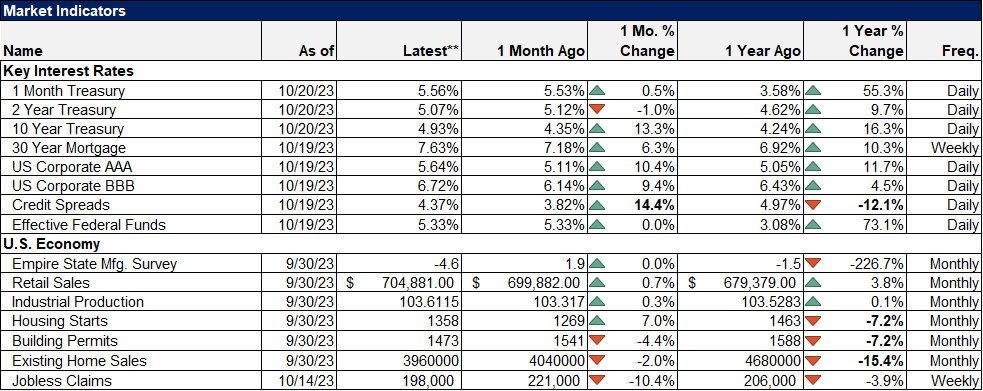

- About half the move in nominal rates last week was due to a rise in inflation expectations. Real rates were up too but not as much. 10-year inflation breakevens are up about 30 basis points since June but it looks like normal volatility to me.

- The SOFR (short-term rate futures that replaced LIBOR) futures curve has shifted significantly over the last 7 weeks. Since 8/31/23 expectations for SOFR in June 26 have risen from 3.55% to 4.4%. 6 months or so ago, expectations were for rates to fall into the 2s. That is “higher for longer” and while the market has taken it as a negative in the short term, think about what it says about expectations for the economy. Short-term rates are now expected to be 4.75% at the end of 2024, falling to 4.4% in 2025 and staying there until at least 2026. There is no recession in that forecast.

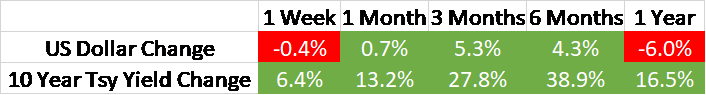

- With the 10-year rate rising 30 basis points in a week, I would have expected the dollar to rise; instead it fell. Maybe it will play catch up this week but that was really surprising. And, again, might be a sign that rates are nearing a peak.

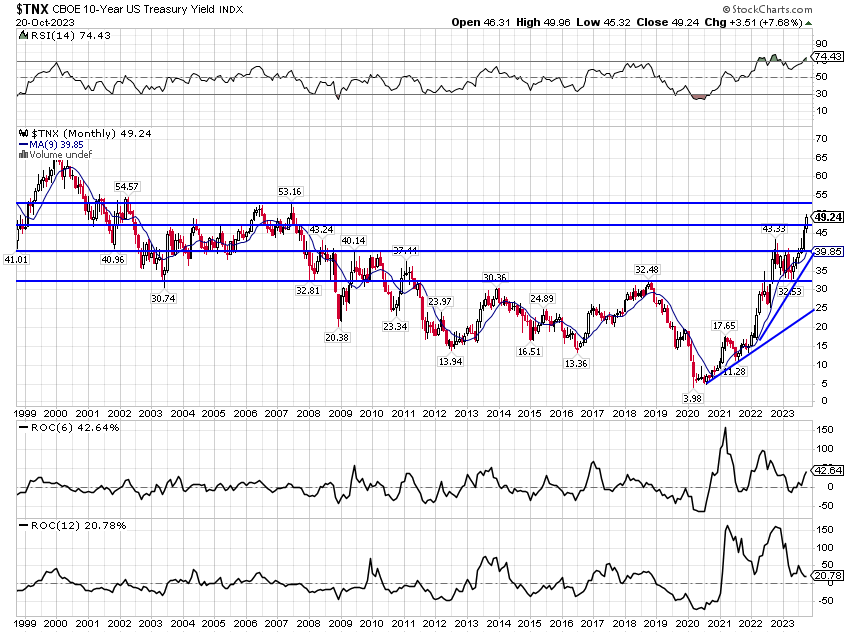

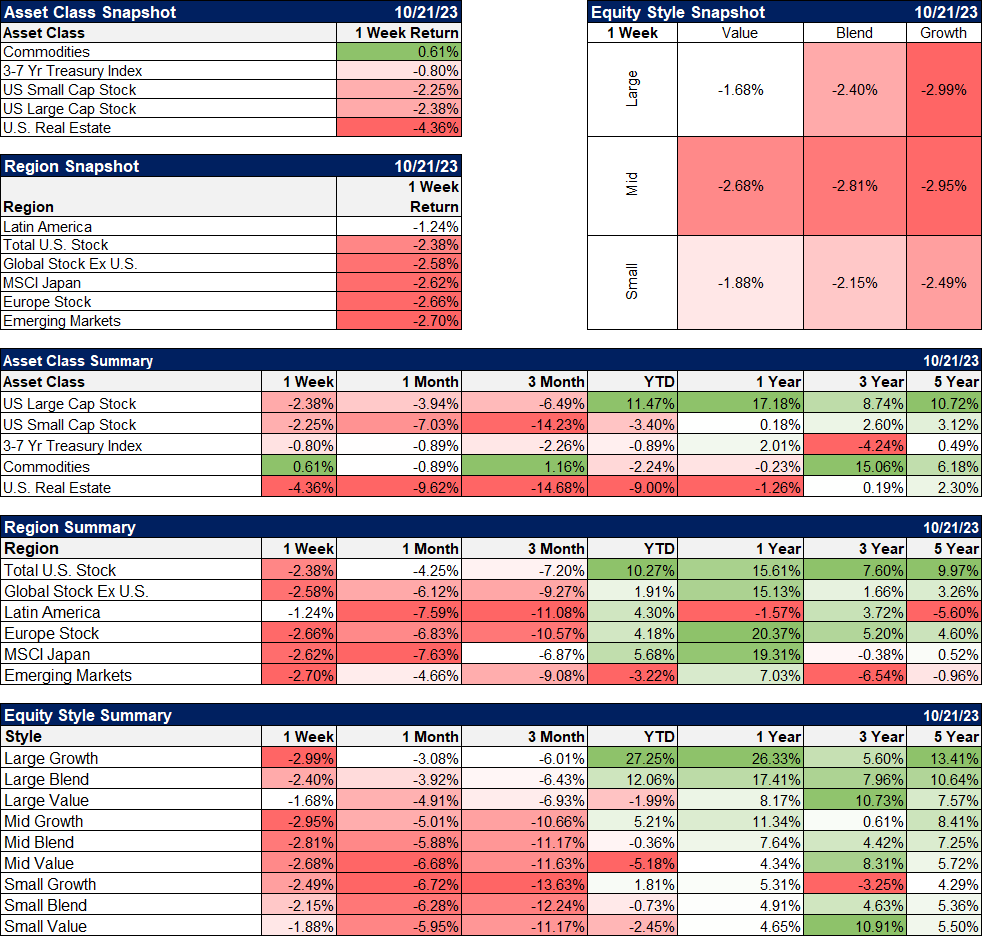

- Commodities were up again last week and are on a multi-year outperformance streak, nearly doubling the performance of the S&P 500 since the COVID market recovery started on 4/1/20. The GSCI outperformed in 2021 (38.8% vs 28.7%), 2022 (24.1% vs -18.1%) and while it lags the S&P 500 this year, it has risen during this stock market correction (+7.1% vs -3.8% since August 16th). The last big outperformance cycle for commodities lasted 10 years (1999 to 2008) and the ratio of GSCI to S&P 500 rose from 1.47 to 8.6. The low in 2020 was 0.41 and today it is 0.88. If this cycle is like the last one, it has a long, long way to go.

- Sentiment about stocks and other risk assets is very, very negative right now, even as market expectations about the economy continue to improve.

- Short-term interest rates rose only by a few basis points last week so the yield curve continued to steepen. The 10/2 curve is now inverted by just 14 basis points. Because long rates are rising, this steepening reflects the improved NGDP growth expectations (steeper curves are associated with higher future growth). And since inflation expectations have risen more modestly, the change is more about growth than inflation, although it reflects a rise in both. If it shifts to a bull steepener with rates falling instead of rising, then recession will likely be imminent. We aren’t there yet but this is our number one worry right now.

- We would also expect to see widening credit spreads if we are approaching recession and while they’ve risen some recently they are still below the long-term average. IG spreads are unchanged over the last month. Even low-rated credit spreads, CCC and lower, are still below the long-term average.

Environment

The dollar was down last week and is still hanging around the 106 level. The inability to rally with yields rising would worry me a lot if I was a dollar bull. I’ll still call the short-term trend up but as I said last week the trend is faltering. The long-term trend is still up and intermediate is neutral.

The 10-year yield was up a lot last week but I don’t think there is much left in this move. There is the possibility that rates spike over 5% for a brief time but I don’t think that would last very long. We’ve come a long way but we’re nearing the end of this move:

Markets

Commodities were the only asset class up last week. This time it wasn’t crude oil or natural gas leading but rather gasoline. But it was a pretty broad-based rally with coffee, gasoline, silver, gold, platinum, and wheat all up over 1%.

Value stocks outperformed last week but growth stocks are the only thing still positive for the year.

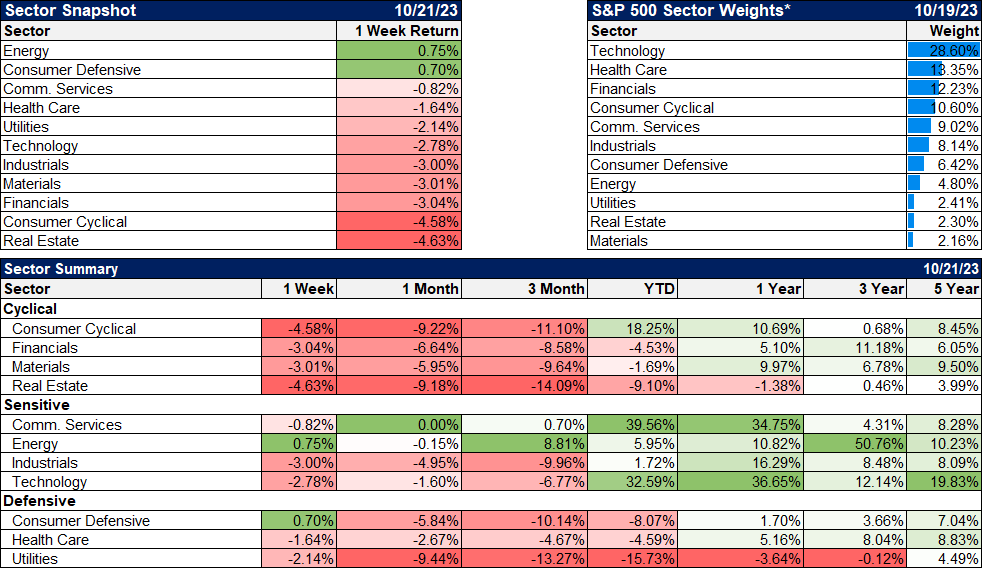

Sectors

Energy and defensive stocks were the only sectors in the green. REITs continue to get beat up even as some positive news leaks through. Return to office looks real this time as companies are finally pushing employees harder. And employees are likely a tad less secure than they were a year ago. Remember what Warren Buffett says: Be greedy when everyone else is fearful and fearful when everyone else is greedy. I can’t think of an asset more hated than commercial real estate right now.

Economics/Market Indicators

Doug covered the reports for the week:

Empire State Manufacturing Survey

New York Business Leaders Survey

Philly Fed Manufacturing Survey

More By This Author:

Weekly Market Pulse: Prophets Of DoomIs The Stock Market Overvalued?

Weekly Market Pulse: Good News Is Good News Is Good News

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more