Weekly Market Pulse: Good News Is Good News Is Good News

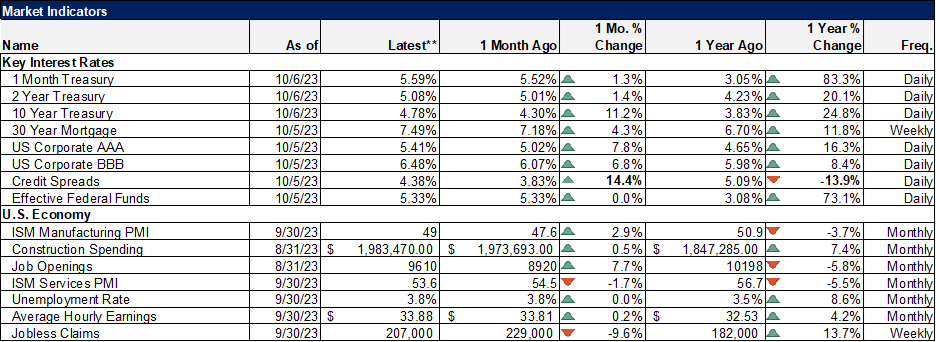

The employment report Friday seemed like a good one. The unemployment rate was unchanged as the economy added 336,000 jobs in September. The gains were widespread with additions in manufacturing, construction, wholesale trade, retail trade, transportation, warehousing, leisure and hospitality, healthcare and education and government. Average hourly earnings were up 0.2% for the month and 4.2% year over year.

It was good news, right? Well, maybe, but you wouldn’t know it from the initial reaction in the stock market which was decidedly negative. The S&P 500 traded down over 38 points – almost 1% – within minutes of the opening. The 10 year Treasury note yield spiked higher by 17 basis points and that was the trigger for traders who, for the last two months, have been selling stocks on every tick higher in yields. The obvious fear was that the strong report would push the Fed to hike rates more. And fear beat greed all to heck in the first half hour of trading.

But as I sit here at closing time on Friday, the S&P 500 has staged a pretty neat reversal, rising 2.5% from the low of the day to the high and closing 1.2% higher. Bond yields still closed up on the day but by just 7 basis points and below the closing high of the week which came on Tuesday at 4.8%. This is something I’ve been waiting to see, for good news to be taken as good news rather than as a warning that the Fed needs to inflict some more pain. Jerome Powell has made it clear that he believes the economy needs to soften, that more people need to lose their jobs to tame inflation.

Except, of course, that isn’t true because more people working isn’t what causes inflation. The fact is that the inflation rate has fallen pretty dramatically over the last year with no loss of jobs on net. Even if you think more people getting paid is reason to worry about inflation, there was nothing of concern in this report. Average hourly earnings were up just 0.2% which if inflation stays the same in September as it was in August would be an effective pay cut. Pardon me if I fail to see how a cut in real average hourly earnings is going to spur more inflation. Maybe the guy who ought to be shopping his resume – or finding a good retirement home – is Jerome Powell.

The employment report was pretty good but, as with most of these things, it needs to be taken with a grain of salt. As I’ve pointed out plenty of times over the years, I don’t spend much time on employment reports because they are subject to big revisions. While it looms large for the markets for some reason, it is way down the list of economic reports I think are important. I generally only pay attention to the sign, + or -, and I don’t even trust that because an initially positive report can be revised to negative and a negative one to positive. And sometimes both.

Over the last couple of months, those who are negative on the economy have been touting the fact that recent revisions have been negative, as if that were some kind of blinding insight about the true state of the economy. You won’t be hearing from them on that this month though since some of the previous negative revisions were revised again; July and August up by 119k jobs, wiping out the previous negative revisions. Economic data revisions are….well you know.

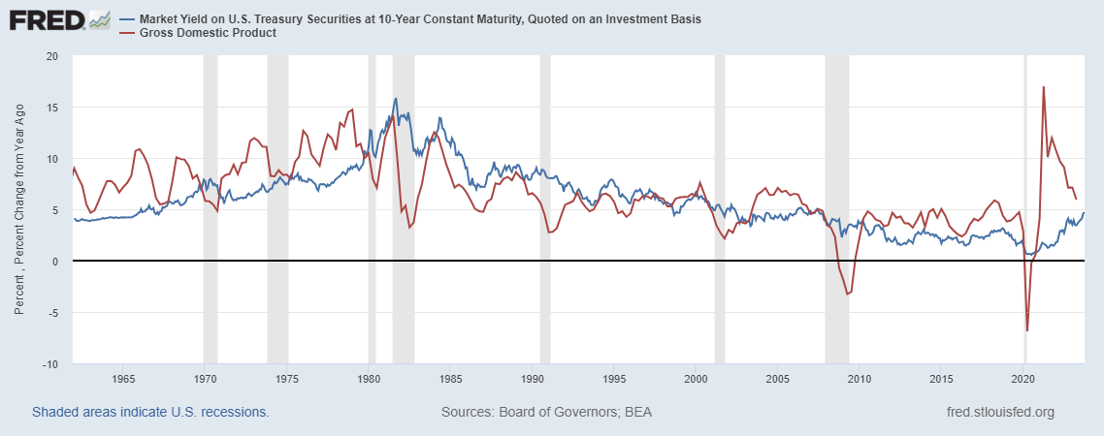

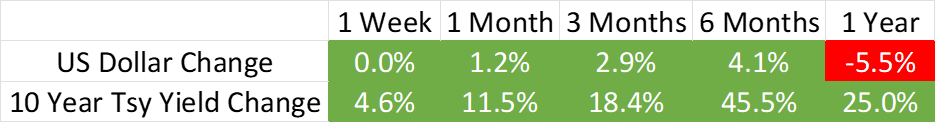

I have been waiting for good economic news to be taken positively – and I think this qualifies – because that would be an indication that interest rates are near a peak. I think we’ll be there soon or may be there now because while the 10 year rate has been climbing steadily for the last two years, the rate of change of nominal gross domestic product (NGDP, GDP not adjusted for inflation) has been falling since peaking at nearly 17% in Q2 2021.

Why is that important? Well, because the 10 year rate and the year over year change in NGDP track each other pretty closely over time and they are converging. The YOY change in NGDP last quarter was 5.9% and it will probably be lower again this quarter. If the change is the same as last quarter it would fall to just 5% which is close enough to the 10 year rate of 4.8% to satisfy me. (I did a video on this topic the other day which you can see here)

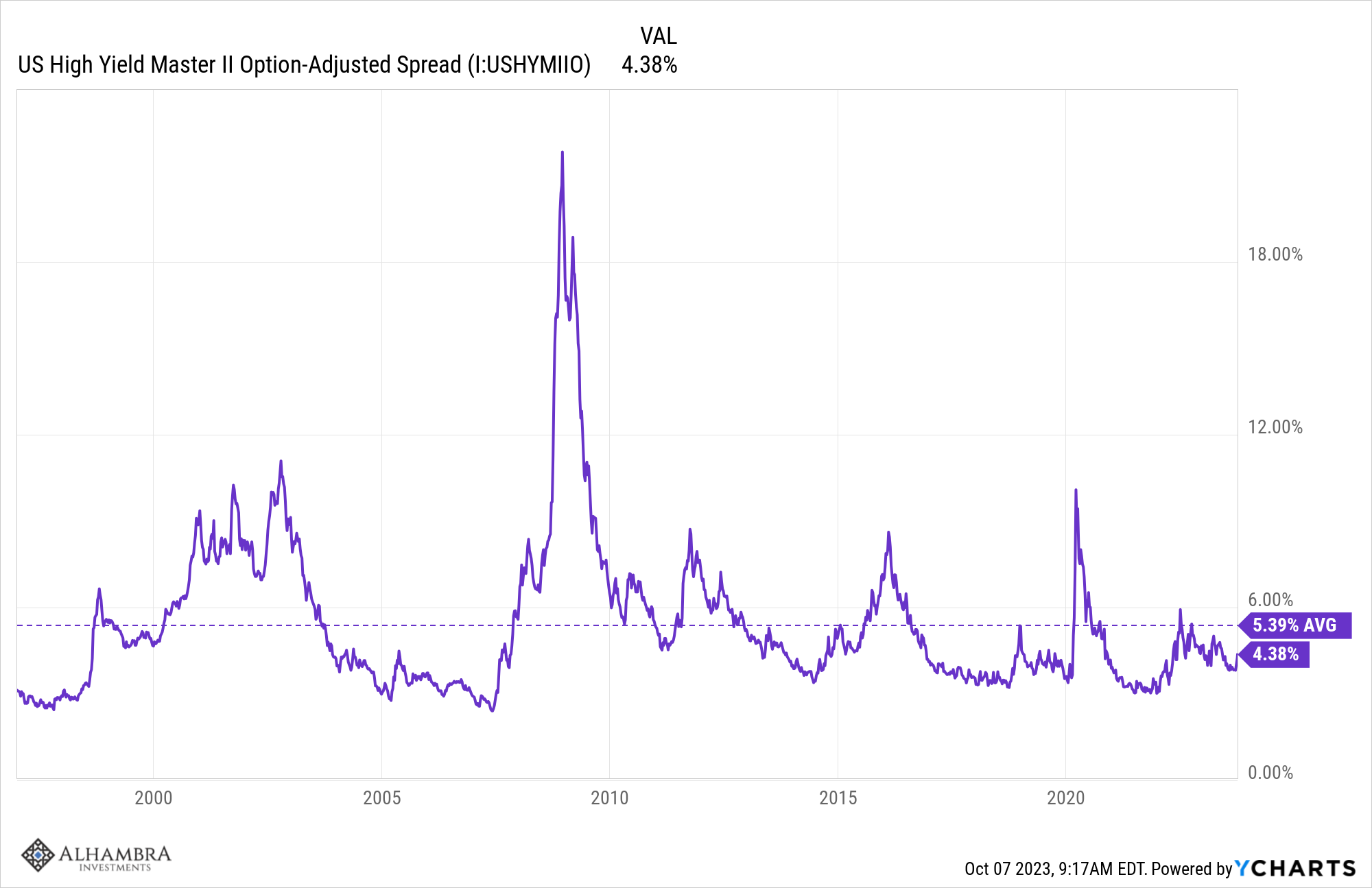

Another reason to think rates may be nearing a peak is that we’re starting to see some worrisome signs out of the credit markets. Not anything all that serious yet but credit spreads have been widening over the last couple of weeks; high yield credit spreads up 61 basis points since September 20th to 4.4%. What is concerning is not the level – which is still below the long term average – but rather the speed of the move. This doesn’t fall into the “time to panic” category but it definitely deserves watching more closely.

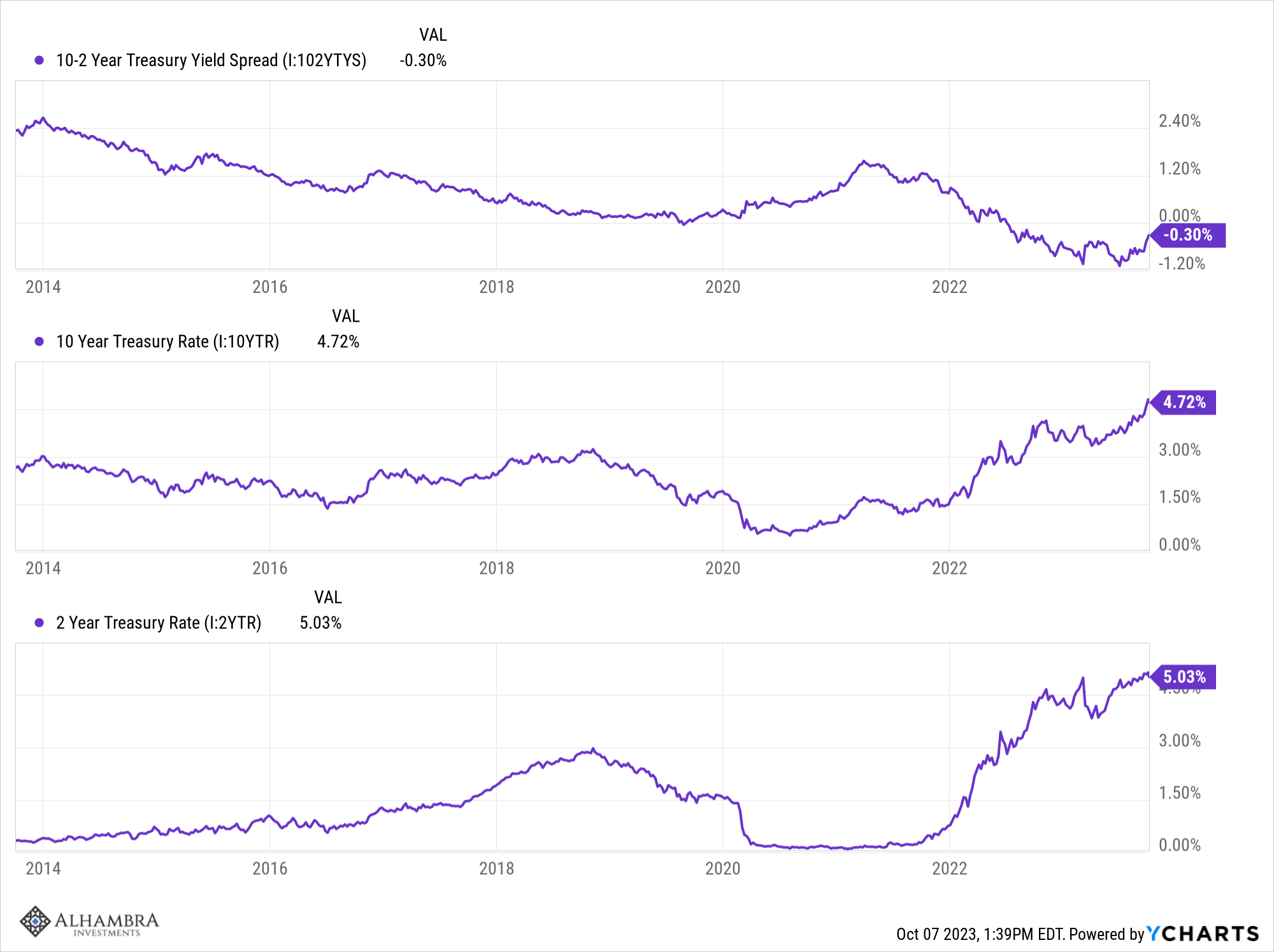

There’s also a lot of fretting out there about the yield curve steepening, which is also proceeding at a pretty rapid pace. But, as I’ve written recently, this is a bear steepening rather than the bull steepening we usually see just before recession, one more thing different about this cycle. If you look at past instances of bear steepenings, the implications are clear as mud. This is the ninth such steepening from an inversion since the 1960s. 6 of the previous episodes did end in recession with an average lead time of 9.3 months, but a range of 3 months to 21 months, which isn’t very helpful. They all also changed to bull steepenings after about 3 months and prior to recession.

The rise in the 10 year yield during this steepening is also extreme at about 90 basis points; the largest rise in the previous instances was 50 basis points and most of them quite a bit less. Based on what we’ve seen historically the warning would be if this shifts to a bull steepening, if rates peak and start to fall. And the faster rates fall the more urgent we should take the warning. But for now, I don’t think the steepening warrants any tactical change, especially given the current very negative sentiment in the market.

It is that negative sentiment that makes me think we’re at or very near the low of this recent correction. The correction was driven by higher rates but we don’t really know why there has been so much selling in the bond market. There are several prominent theories – too much debt issuance and QT, loss of confidence in the US because of our dysfunctional politics, inflation is still too high and won’t come down, the Chinese are dumping Treasuries – but I don’t find any of them very satisfying. This move higher in rates – selling of bonds – isn’t being driven by higher inflation expectations which is what I’d expect from all the potentially negative reasons. TIPS yields have risen in lock step with nominal yields which raises an obvious and interesting question. What if the rise in rates is not because of something negative but something positive?

As I said above, over time, the nominal 10 year Treasury rate tends to track the year over year change in Nominal GDP. Changes in the nominal 10 year rate today can be seen as changes in the expectations about future NGDP growth. We also know what drives Nominal GDP:

- Workforce growth

- Productivity growth

- Inflation

Workforce growth is currently expected to be around 0.5% over the next decade and absent a big change in immigration policy that’s probably a pretty good estimate. Current inflation expectations may end up being wrong – the historical evidence supports that – but they haven’t changed recently:

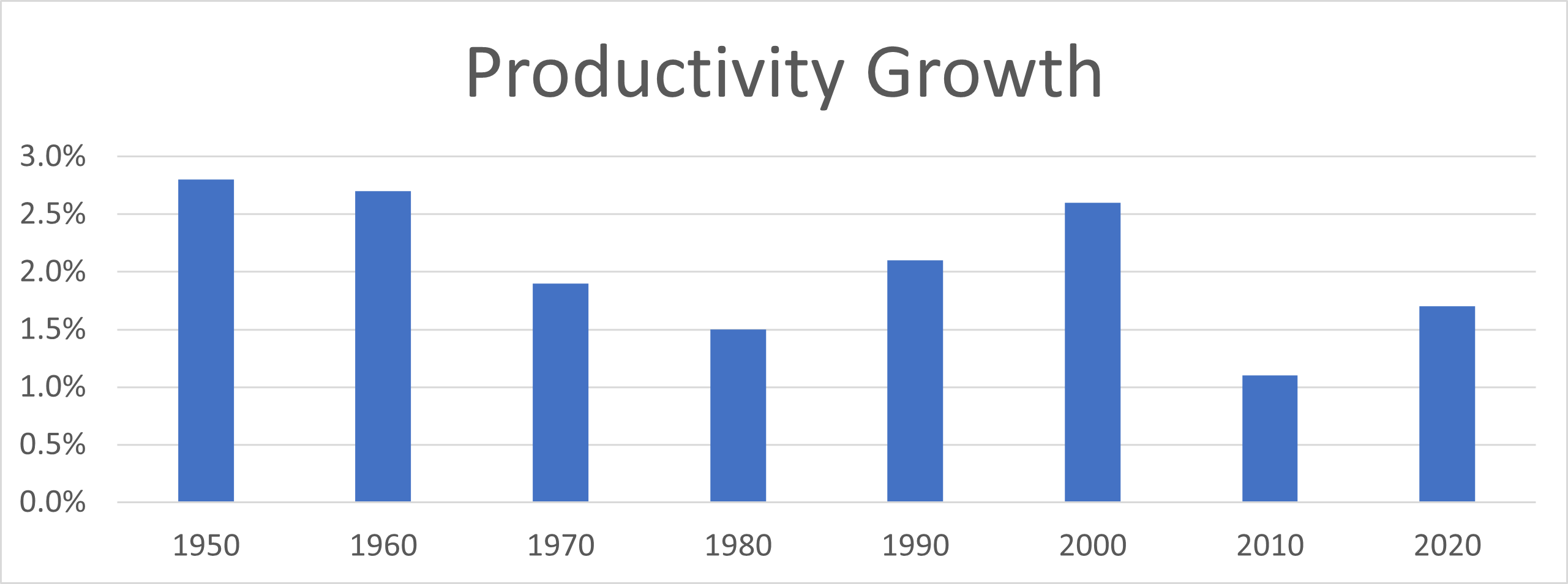

If we assume that the 10 year rate has been rising because NGDP growth expectations have been rising that only leaves one variable as the cause – productivity growth. Maybe the recent rise in interest rates and the recent surge in interest in artificial intelligence isn’t a coincidence. The decade of the 2010s had the slowest productivity growth of any decade in the post WWII era so an improvement doesn’t seem that far-fetched.

If we assume workforce growth and inflation expectations are correct and productivity growth reverts to the historical average of about 2.1%, NGDP growth should average about 5%. If we make the same assumptions and productivity growth reaches the levels of the 1950s and 1960s, NGDP growth could move up to about 5.5%. That provides us with a pretty solid explanation for the recent rise in the 10 year rate. It would also explain the bear steepening of the yield curve. An improvement in productivity growth would also keep inflation in check, keeping the Fed on hold. Long term rates rise because of rising growth expectations while short term rates stay the same because inflation is in check – bear steepening.

As I said above, I don’t know why other people are selling bonds. Maybe it is as simple as too many bonds being issued to pay for our politicians profligate ways. That certainly feels good since we all love to hate politicians – let’s blame it on those idiots! – but that only addresses the supply side of the equation. What about demand? Why aren’t there enough buyers? It doesn’t seem to be a fear of inflation – investors are selling TIPS which provide inflation protection – and since almost all bonds around the world are selling off too, it doesn’t seem to be about our credit rating. Artificial intelligence and how it might impact productivity, on the other hand, is a global phenomenon.

I could easily be wrong about why rates are rising but I think we need to at least consider the positive case. All I see in the press and from others in the investment business are all the potential negatives. Have we become so cynical, so negative about our future that a simple, positive explanation for rising interest rates just seems too far fetched to consider? I sure hope not.

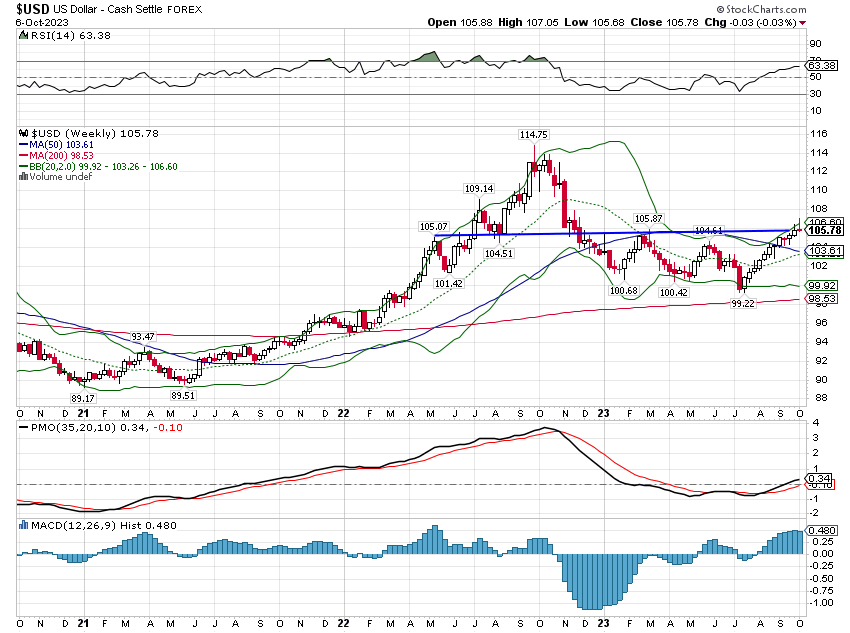

Environment

The 10 year yield is, obviously, still in an uptrend after last week’s surge higher. As I said above though I do think we’re getting close to a peak. The reversal on Friday may well have marked the top but we will only know that with the benefit of hindsight. What I can say is that the technicals favor a pullback in rates. But everything seems to get taken to the extreme these days so maybe it goes higher first.

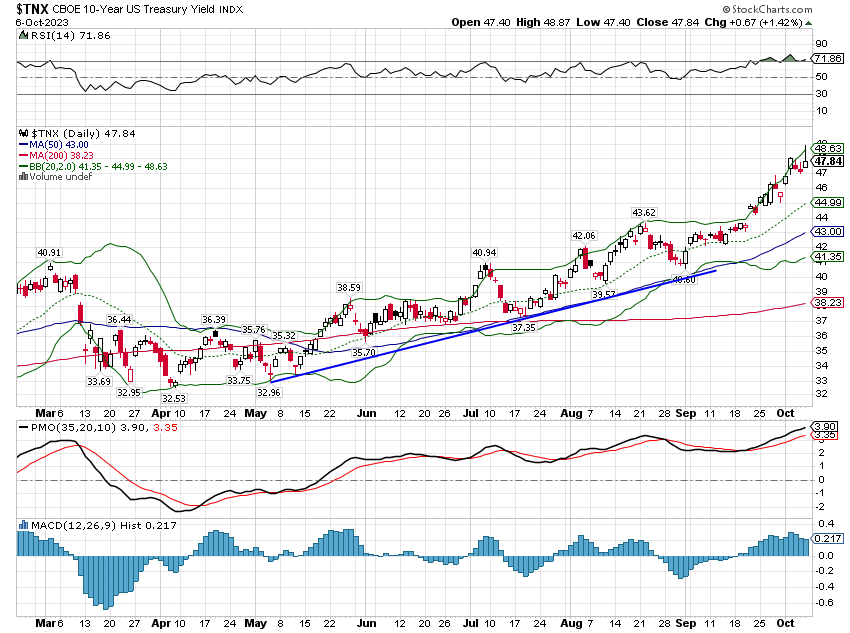

The 2 year rate continues to stick around the 5% level while the 10 year keeps rising.

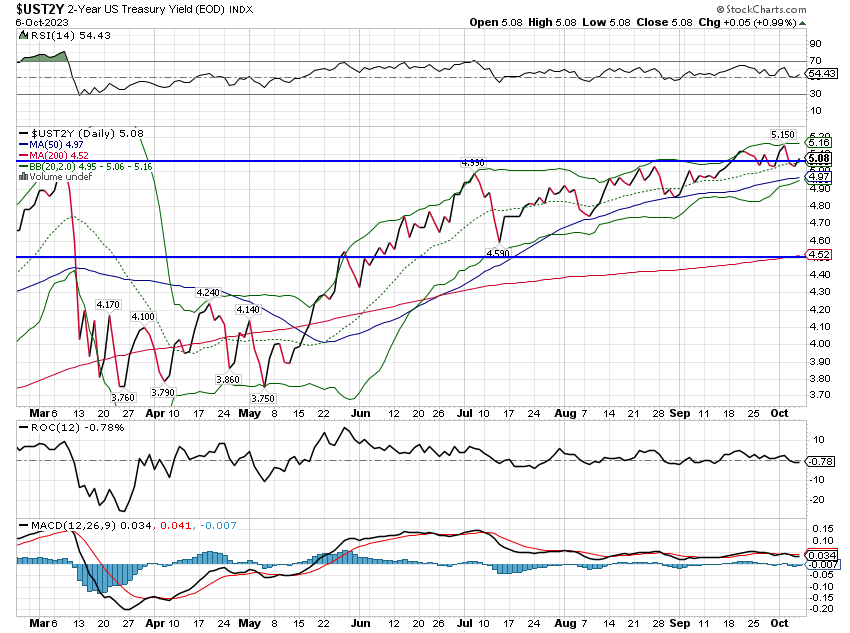

The action in the dollar continues to surprise me, not because of its strength but rather its lack thereof. With rates rising as they have, why isn’t the dollar soaring? I don’t know but things that don’t fit always bother me. Still, the short and long term trends remain up.

Markets

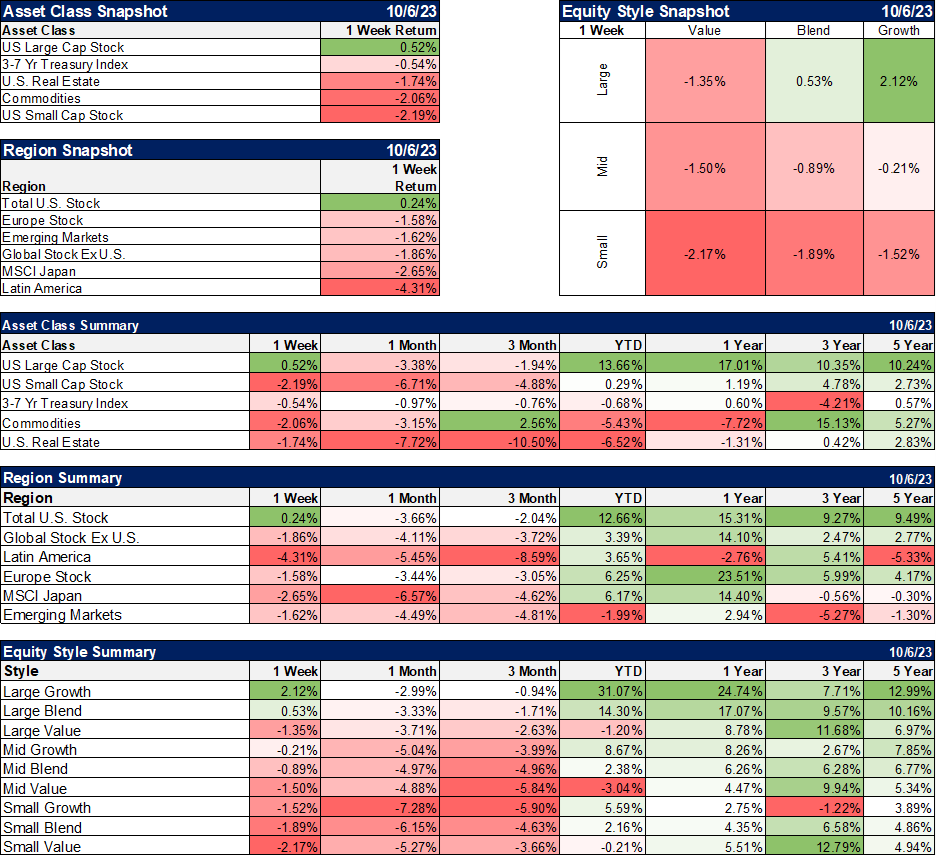

Large cap growth stocks had a good week but most everything else was down. That rise in large cap growth looks tempting, up 24.74% over the last year so let me just remind you that it is still down 5.5% over the last two years while large cap value is up 7.7%. Value continues to lead over the three year period as well.

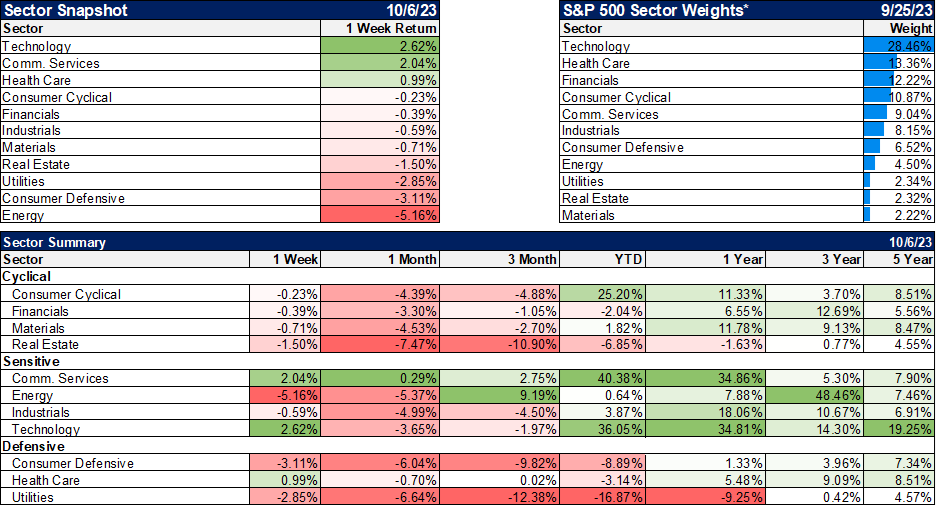

The news in sectors was more about the ones that were down rather than the ones that were up. Energy had a bad week, down over 5%, but still maintains a healthy lead over the last 3 months. Crude oil got whacked by nearly 9% last week although you’d be hard pressed to find a good reason other than profit taking. There was some talk during the week about gasoline demand being at a 25 year low but that was extrapolated from someone’s nether regions in my opinion. I suspect the explanation will ultimately come from low crude oil inventories at Cushing and the annual refinery shutdowns and maybe even some revisions. And if you really think gasoline demand suddenly dropped to a 25 year low over the last month, you need to go find your common sense because that doesn’t pass the smell test.

Defensive shares were also on the, um, defensive. Utilities have been hammered recently as the 10 year rate now exceeds their dividend yield. Utilities tend to use a lot of debt too so financing costs are a concern. If rates have peaked though, this is the cheapest they’ve been since 2008. Probably time to start looking through the debris and find the babies that were thrown out with the bathwater.

Economics/Market Indicators

As I said above, the widening of credit spreads recently is a bit concerning but they are still well below their levels of a year ago and the long term average.

Job openings jumped again but I don’t pay a lot of attention to this one either although someone must because this report is the one that precipitated the bond selloff last week.

The ISM manufacturing PMI continued to improve and the services version was pretty steady. The ISM manufacturing index appears to have bottomed at 46 in June. This was always just a correction of COVID inventory mistakes and with goods consumption rising again, I would expect this to get back over the 50 level that marks expansion pretty soon.

I think it says a lot about how we feel about the economy today that no one even considers the potential for a positive outcome. In fact, it seems that most people go for the most negative interpretation. It’s October so I must have seen 10 charts in the last two weeks comparing today’s stock market to 1987. Everybody is expecting a recession because of the inverted yield curve and its recent steepening but the recession they’re expecting is a re-run of 2008 or 2020 or the Great Depression. Or they find a way to combine worst case scenarios; recession is on the way but inflation hasn’t been beaten so we must be headed for stagflation like the 1970s.

Everyone is searching so hard for a left tail outcome that they have completely dismissed the possibility of a right tail. Maybe so many people got burned by the last next big thing – crypto – that they’ve become too gloomy, so jaded that they’ll miss the real deal when it really does come along. Or maybe it’s just that doom and gloom sells newsletter subscriptions.

I don’t know what the future will look like and I don’t know a lot about artificial intelligence. But technological leaps to higher productivity do happen, evidence of which can be found in the device you’re using to read this. Is it really so crazy to think we might be on the verge of another?

More By This Author:

When Will Interest Rates Peak?Weekly Market Pulse: Patience Is A Virtue

Weekly Market Pulse: Higher For Longer

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more