Weekly Macro Indicators, Through 10/28

Image Source: Pexels

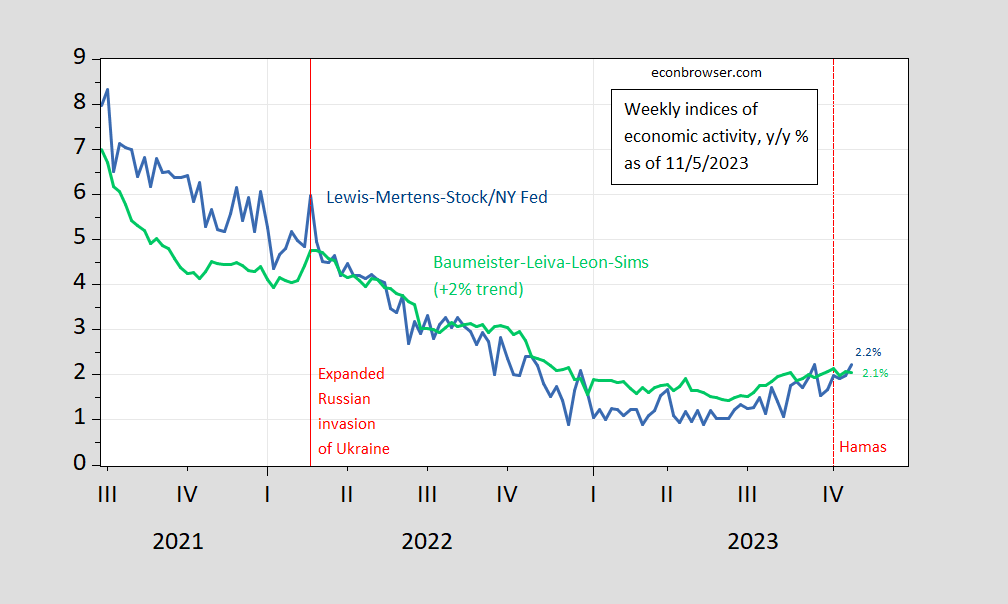

Year-on-year growth is accelerating modestly, according to the WEI.

(Click on image to enlarge)

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 11/5, and author’s calculations.

The WECI+2% thru 10/28 is (2.06%), while WEI reading is 2.23%. The latter is interpretable as a y/y quarter growth of 2.23% if the 2.23% reading were to persist for an entire quarter.The Baumeister et al. reading of +0.1% is interpreted as a 0.06% growth rate above the long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.06% growth rate for the year ending 10/28.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model.

More By This Author:

Risk And Uncertainty, Market And GeopoliticalInterest Rates Decline

Real Wage Growth – Mean And Median