Weekly Forex Forecast - Sunday, Sept. 8

Image Source: Unsplash

Fundamental Analysis & Market Sentiment

I previously wrote on Sunday, Sept. 1 that the best trade opportunities for that week were likely to be:

- Long of the EUR/USD currency pair following a bullish daily close above $1.1057. This set up on Wednesday, but it ended the week only at break-even.

- Long of gold in US dollar terms following a daily close above $2,525. This did not set up.

- Long of the S&P 500 Index following a daily close above 5,668. This did not set up.

Last week’s key takeaways were as follows:

- US Non-Farm Payrolls data came in notably lower than expected, with only 142,000 net new jobs created last month, compared to the expected figure of 164,000. This was dovish for the US dollar and the Fed's monetary policy outlook. However, average hourly earnings data released simultaneously showed a month-on-month increase of 0.4% when only 0.3% was expected, which slightly tempered the dovish effect. The overall result of the data was to push the US dollar and US treasury yields lower. Markets now expect the Fed to cut rates by a full 1%, at least by the end of 2024.

- The Bank of Canada cut its interest rate by 0.25% for the third consecutive meeting, from 4.50 to 4.25. The cut was widely expected, and the Bank held out the prospect of further reductions if inflation continued to look tame.

- The only other significantly notable data release was Swiss CPI (inflation), which showed no change month-on-month, while an increase of 0.1% was expected. This continues the trend of most G20 nations, showing inflation falling faster than expected, which globally is a dovish trend for monetary policy.

- Commodity currencies such as the Australian and New Zealand dollars and commodities in general (especially soft commodities) experienced a tough week as chilly risk-off winds breezed through markets. The week's big winner was the Japanese yen, followed by the Swiss franc, another traditional safe haven. The US dollar ended the week softer following weaker-than-expected NFP data.

- Stock markets saw strong losses, especially technology stocks.

The Week Ahead: Sept. 9-13, 2024

It will be a slightly slower week ahead, but it includes more important data, with the most significant items this coming week expected to be:

- US CPI data – this event is currently the most important monthly data release in the Forex market

- US PPI

- European Central Bank Main Refinancing Rate and Monetary Policy Statement – the ECB is expected to cut its Official Rate from 4.25% to 3.65%

- UK GDP

- US Unemployment Claims

- UK Unemployment Claims (Claimant Count Change)

Monthly Forecast for September 2024

(Click on image to enlarge)

I forecasted that the EUR/USD currency pair would rise in value during September. The performance of my forecast so far is as follows:

Weekly Forecast for Sunday, Sept. 8, 2024

Last week, I made no weekly forecast, as there were no currency crosses with unusually large directional movement, which is the basis of my weekly trading strategy.

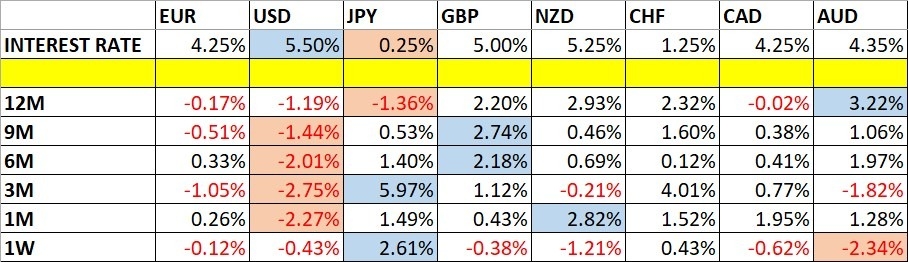

This week, I again give no weekly forecast, as although 6 currency crosses fluctuated in value by more than 2%, I only like to trade when at least 7 have done so. The odds of profitable reversals are better when many crosses have abnormally large price movements. The volatility is now seen in the Japanese yen alone.

Directional volatility in the Forex market rose last week, as 56% of the most important currency pairs and crosses fluctuated by more than 1%.

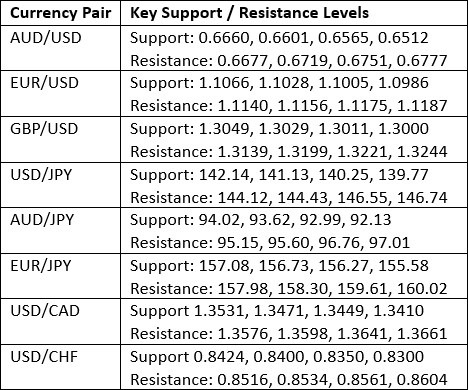

Key Support/Resistance Levels for Popular Pairs

Technical Analysis - US Dollar Index

The US Dollar Index printed a bearish candlestick last week, albeit with a significantly lower wick, suggesting the bearish momentum may not be strong. The price is below its levels of three and six months ago, suggesting a long-term bearish trend in the greenback. Recently, the price broke down below the long-term consolidating triangle pattern, which was a significant bearish sign.

The overall picture is bearish, but the price is likely to consolidate until next Wednesday’s release of US CPI (inflation) data. Data from last week suggested that the US economy is a little weaker than expected, and it is now expected that the US Federal Reserve will cut rates by a full 1% before the start of 2025.

This week, I am cautiously bearish on the US dollar due to the overall bearish trend.

(Click on image to enlarge)

EUR/USD

The EUR/USD currency pair ended the week by printing a higher candlestick, but looking at the price chart below, it is hard to say it looks bullish – but for this currency pair, which is prone to deep retracements, it still might be. That large upper wick is daunting for bulls, though.

The price remains within a valid long-term bullish trend. Just like last week, I think a long trade here could still be a good possibility, provided that the nearest support level at $1.1066 survives.

Much will depend on US CPI data, the policy statement, and the likely rate cut from the European Central Bank, which is due later this week. These events will likely cause some volatility here, as both currencies in the pair are directly affected.

(Click on image to enlarge)

USD/JPY

The USD/JPY currency pair continues to be at the heart of the modern Forex market, and it is still showing a high level of range volatility. There are two good reasons for the volatile status of the Japanese yen:

- There is increasing fear in the market of recession, especially in the US, which has caused a run to safe havens. As the US dollar is seeing increasingly dovish tilts in its monetary policy, the number one choice for a safe currency is now the Japanese yen (the Swiss franc is also strong for the same reason).

- The Bank of Japan has decisively shifted away from its former ultra-loose monetary policy after years of negative interest rates, which has prompted a belief that the yen will continue to advance.

Last week's candlestick was very bearish—it was relatively large, and the price closed very near the low of its range. It was the lowest weekly close seen in more than eight months, and the price is very near a full eight-month low. I see this currency pair as a sell.

(Click on image to enlarge)

USD/CAD

I expected the USD/CAD currency pair to have potential support at the $1.3471 level.

The H1 price chart below shows how the price action rejected this support level with a very large and very bullish hourly pin bar, marked by the upward arrow. This rejection occurred just at the start of the overlap of the London/New York sessions, which can often be a great time for reversals such as these in the US dollar. The trade made a profit so far of slightly less than 2 to 1.

All the commodity currencies are weak, and the Canadian dollar is no exception, although it remains notably stronger than the Australian and New Zealand dollars. The bearishness in crude oil helped drag the Loonie lower, as oil reached a new one-year low price last week.

(Click on image to enlarge)

XAU/USD

Gold in US dollar terms has been grinding higher for weeks in a choppy, long-term bullish trend. Over the last few weeks, it has rejected the blue sky above the big, round number of $2,500 at least five times. This is a bearish sign, despite the long-term bullish trend and recent record highs.

Last week, the price briefly touched a new all-time high, but looking at the weekly price chart below, we can see that last week's candlestick was the third indecisive candlestick in a row and the second doji structure within that three-candlestick formation. This indicates indecision in the market.

The bearish retracement from the record high is still shallow, so it could be too soon to go short, especially if the price keeps finding support at the $2,494 level.

Something to watch for is if the price turns strongly bullish again and decisively takes out the record high. This could be a decisive bullish sign after the five rejections, suggesting that a new long trade entry could be an excellent trade. I see gold as a buy if we get a daily close this week above the $2,525 mark.

(Click on image to enlarge)

Nasdaq 100 Index

The Nasdaq 100 Index fell strongly last week, in what was one of its worst-performing weeks in recent times. The large size of the bearish candlestick, as well as the fact that it closed right on the low of its range, are bearish signs.

Markets are firmly in risk-off mode and will likely remain that way until there is more clarity on the prospects of a soft landing for the US economy. US CPI data due this week will likely provide a clue on this or prompt the Fed to give more clarity on its intentions.

The price is still not very far from its record high, but it looks like the bullish stock market, especially in the technology sector, might be over. However, I think it is too early to take a short trade here—shorting is a risky undertaking in stock markets.

The price is sitting on two key support levels and has not broken the levels of a recent bullish pin bar. Therefore, bears should probably not open any new short trades here.

(Click on image to enlarge)

US 2-Year Treasury Yield

Some CFD brokers offer trading in US Treasury yields, and traders with larger bankrolls can access this asset through the CME micro futures market. Treasury yields can be great for trend traders as they have historically tended to trend very reliably.

The continuing slowdown in the US economy, lower inflation, and increasing fears of a recession in the US have all combined to push expectations of the Federal Reserve in an increasingly dovish direction. This has pushed short-term (2-year) treasury yields lower and lower.

The daily price chart below shows that the yield fell strongly last Friday following lower-than-expected US non-farm payrolls data. It made the lowest daily close in one year and also traded at a new six-month low.

As all trend traders should be, I am interested in being in a short trade here as it aligns with the direction the Fed is getting pushed in.

(Click on image to enlarge)

Bottom Line

I see the best trading opportunities this week as:

- Long of the EUR/USD currency pair following a bullish bounce off $1.1066.

- Long of gold in US dollar terms following a daily close above $2,525.

- Short of the USD/JPY currency pair.

- Short of the 2-Year US Treasury yield.

More By This Author:

BTC/USD Forex Signal: First Signs Of Support After Selloff

GBP/USD Forex Signal: Bearish Consolidation Below $1.3154

AUD/USD Forex Signal: Supported At $0.6750

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more