Warning: The Everything Bubble Is In Serious Trouble

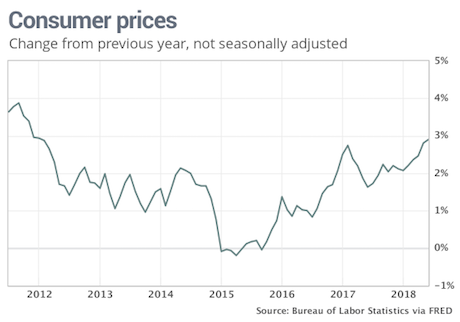

As we noted on Friday, the official inflation metric, called the Consumer Price Index (or CPI) is designed to HIDE inflation, not measure it.

Case in point, over the last two months, the CPI has relied on the collapse in prices of various non-essential items (airline tickets, hotel rooms, etc.) to “cover up” the increase in energy, housing, and the other items we all need.

And yet, even despite this “massaging” of the data, the CPI has hit 2.9%.

Put another way, inflation is running so hot right now that even with various gimmicks in place, the CPI is STILL closing in on 3%.

Why is this a big deal?

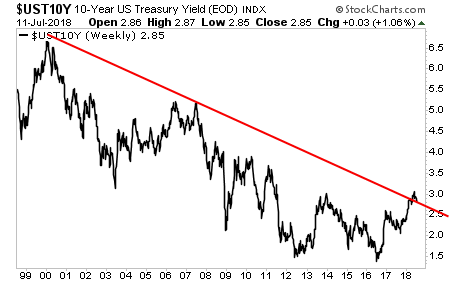

Because TREASURY bond yields trade based on inflation. If inflation is soaring higher, bond yields will also rise to accommodate this.

If bond yields RISE, bond prices DROP.

And if bond prices DROP enough, the Debt Bubble bursts.

With that in mind, consider that yields on Treasuries have broken their long-term 20-year trendline.

This is a MAJOR problem. The entire debt bubble requires interest rates to remain LOW in order for it to be maintained.

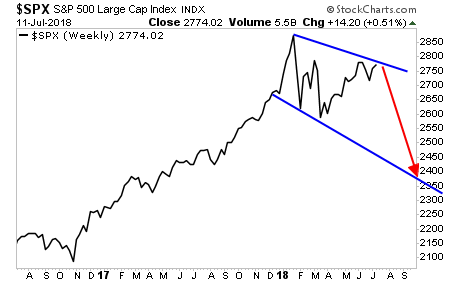

Inflation is screwing this up for the Fed… which now faces a NASTY choice… continue to support stocks or defend bonds… and unfortunately for stock investors, it’s going to have to choose bonds.

Put another way, I believe there is a significant chance the Fed will let the stock market collapse in order to drive capital BACK into the bond market to force bond yields down.

Yes, the Fed has screwed up with monetary policy. And it is doing so intentionally to try to sustain the Debt Bubble. Currently the downside target for the collapse is in the 2,300-2,450 range.

The time to prepare for this is NOW before the carnage hits.

We are already preparing our clients with a 21-page investment report that shows them FOUR investment strategies that will protect their capital when and if a stock market crash hits.

It’s ...

more

If one looks at the Consumer Prices chart it suggests that inflation over the period has probably averaged lees that 2%. I suspect a chart showing a longer period would show similar. In 2014 when energy prices hit their highest CPI remained low but now, at a time they have not reached that high, energy price increases are apparently a threat. I see no reason for the Fed to raise interest rates at all.

In terms of inflation, such conditions don't exist but for brief periods, very brief periods as proven across every inflationary metric. It's why the term reflation is more commonly being used in the modern era. The reason for more rates hikes is less about inflation given the history of inflationary data points and more about the Fed's desire to raise rates to be more on par with economic output as it aims to also give itself breathing room should they need to lower rates in the future. My opinions of course.

That seems like one reason but Kashkari said it was all about wage inflation and the workforce which has gotten the short end of the stick over time.

How can this be accurately viewed when accounting for wages, unemployment and the fact that even with yields rising, in kind with the pace of wages at this stage, we're still talking about a 10yr yield that will be nearly a full percentage point below the prior cycle's peak?

What is interesting to me Seth Golden, is that the Fed always says it ignores CPI and runs with PCE, but maybe 10 year bonds factor in CPI afterall. And even with massive demand for bonds, that trend broke. Prior cycles had less demand for bonds as collateral. So that point difference may not mean much in the new normal.

Thank you Gary, and with respect to your comment/reply there is historically depleting demand for bonds over time. This can be reviewed with a historic chart of the 10-yr yield?

I think bond demand is up except for this current period. The author is saying that if demand wains the Fed will force increased demand for bonds at the expense of stocks. That is not an unreasonable assumption IMO.

My point is bond yields only go in one direction long-term and as fundamental economic principle, also displayed but the historic chart of yields where they begin in the upper left hand corner and ultimately decline from there and to current, at least. The can only do so much, again as indicated in the history of supply and demand for debt and for very brief periods of time. Hard to believe that the Fed, at this stage of modern economics, would be able to fool the amount of investors and governments needed to inflate demand to any significant degree.

Ah, interesting point. But investors were fooled by mispriced risk in the housing bubble. Investors were fooled by the dot com bubble. Investors are fooled by the shale bubble. Investors are fooled by the stock market bubble. Investors still can fear, and that sets up well for bonds if necessary. After all, the Fed is in the business not mainly to buy bonds, which it does, but to sell bonds!

Investors for equities? Bonds? I think many in equities but the cyclical demand for bonds/yield back even then was significantly lower than the previous cycle. Demand peak for 2008 cycle that you might say started post 9-11 was right around 5% yields. The cycle leading up to dotcom crash was above 6.5%. So while we like to say the "Fed is responsible for this and that" debt tells a very constant and different story that ends with the inefficiency of the Fed rather than any causation from the Fed. Colloquialism are great for superficial rambling, but they mostly fail the sniff test.

Even George Selgin, hardly a conspiracy buff, almost comes out and agrees with my conspiratorial view that the Fed liquidates when it chooses. Truth is, IOER was a policy of tightening, not of loosening! Maybe that is why it will never adopt NGDP Level Targeting, lol. I was astonished at this Selgin article and happy he wrote it: www.alt-m.org/.../the-feds-recent-defense-of-interest-on-reserves/

I'm not sure where it's debatable that the Fed is the only authority with regards to its balance sheet and actions related to its holdings. Somewhat a red herring argument no and somewhat unrelated. Nonetheless, something I will certainly read as I'm speaking out our annual conference and appreciate a wide range of resources to include in my materials. Thank you kindly!