Verdict Of The OpEx: Consolidation Ends Soon; We Sell Dow, Russell, And Gold If Bond Yields Fall Further

- The terminus of Wave 2 in the equity markets coincides with OpEx on Friday, leading to a moribund session, but provided exciting finish to the trading day and week.

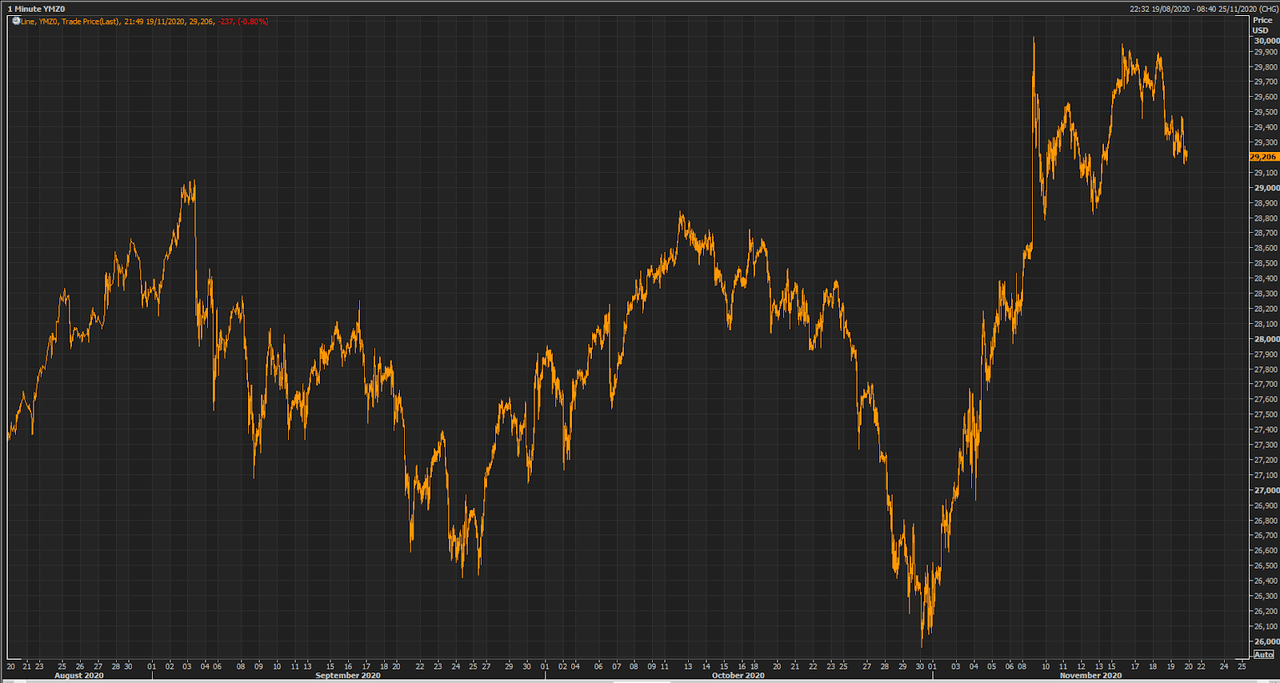

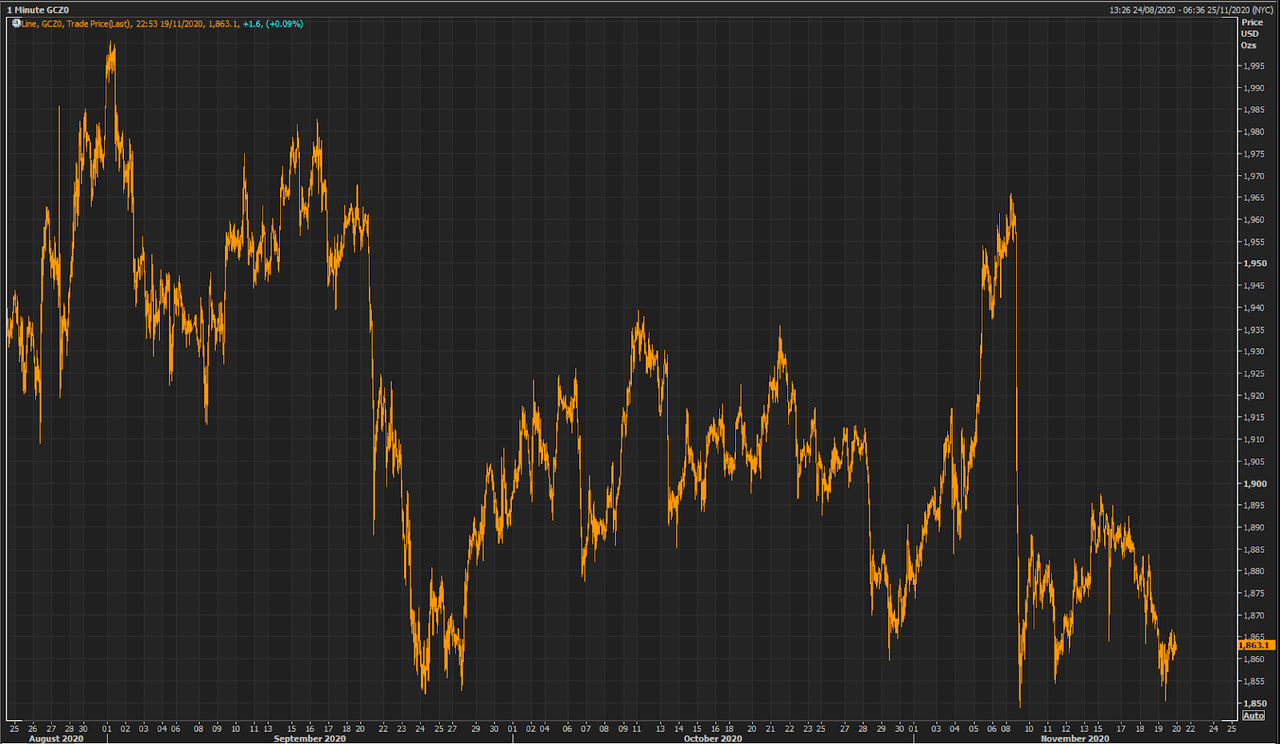

- We've been positioning for the onset of Wave 3 trend to the downside, more selling at breach lower of Wave 2 supports, with a specific focus on shorting Dow, Russell, Gold.

- It's clear that given recent declines in yields, there's a lot more lower adjustments in risk assets. It's also clear that the most vulnerable are Dow, Russell, and Gold.

- The bond market has always been the real indicator which we have learned to trust over the past 5 decades of being in the market. This is the market that is attuned the closest to the real fundamentals. And right now the bond market is telling us a readjustment will be happening soon in the stock markets, whether they like it or not, or even whether they know it or not.

- Russell remains elevated, simply because of the narrative that the Blue tsunami will rule uber alles and yields will have to inexorably shoot to the moon. But that is a story that is relevant in the medium-term, not in the near-term, when we still have the likelihood of a divided US Congress, a new brush with a recession in Q42020 - Q12021 time frame, and a new wave of COVID-19 emergency measures.

This article is a follow-through to the recent article we wrote on November 16, 2020: ("The Equity Market Outlook Until The First Half Of December 2020 Is Not A Pretty Sight, Liquidity Wise").

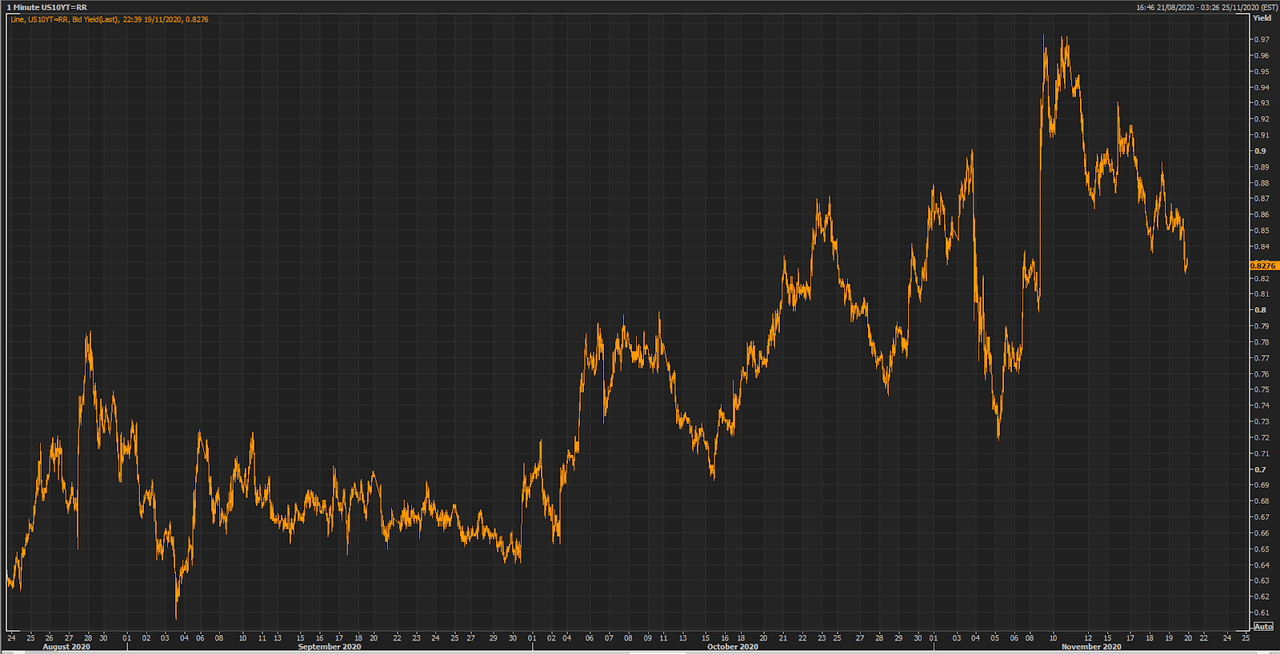

The variable response of risk assets to the recent fall in bond yields

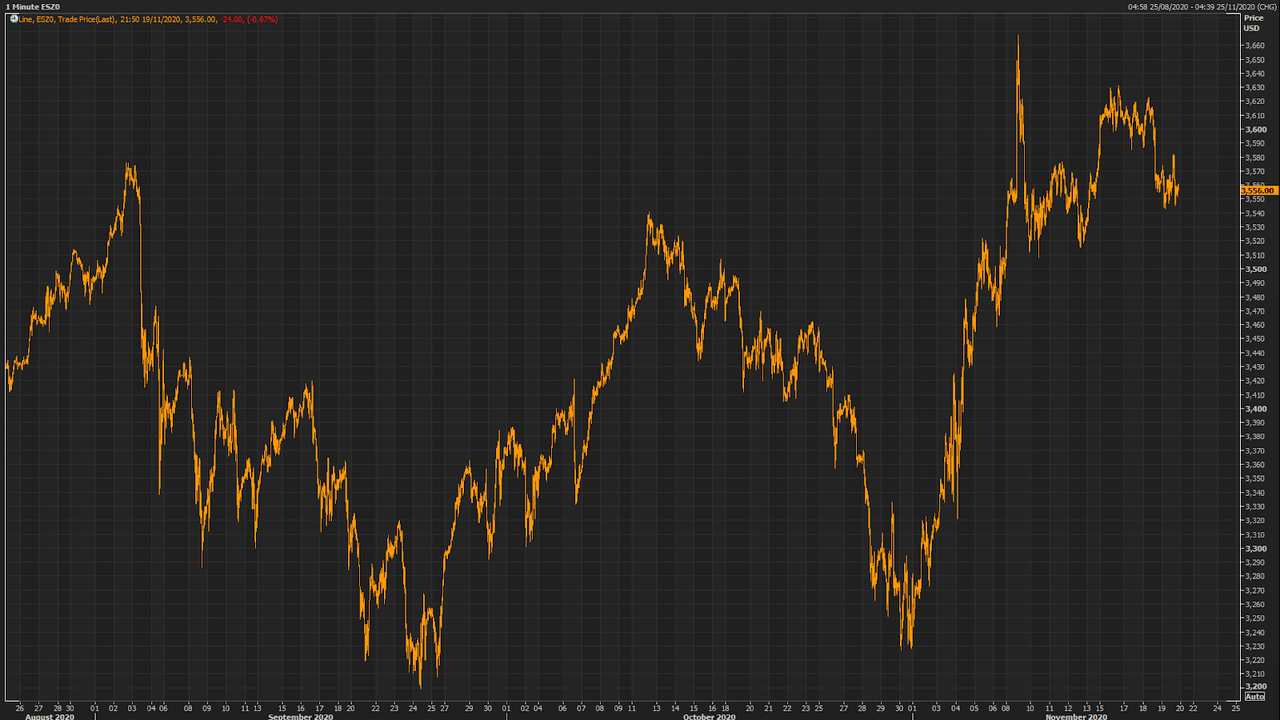

We were comparing the variable ways risk assets have responded to the recent decline in bond yields, the study done during the same market time frame. It was an eye-opener, and this comparative study has provided a basis for future expectations and market strategies.

We lined up the risk assets on the basis of which ones should make adjustments the most relative to the recent declines in the 10yr yield (chart below).

10yr yield

(Click on image to enlarge)

RTYZ0 (Russell 2000 December/20 futures)

(Click on image to enlarge)

YMZ0 (Dow Jones Ind. Ave December/20 futures)

(Click on image to enlarge)

GCZ0 ( (Gold December/20 futures)

(Click on image to enlarge)

ESZ0 (S&P 500 Index December/20 futures)

(Click on image to enlarge)

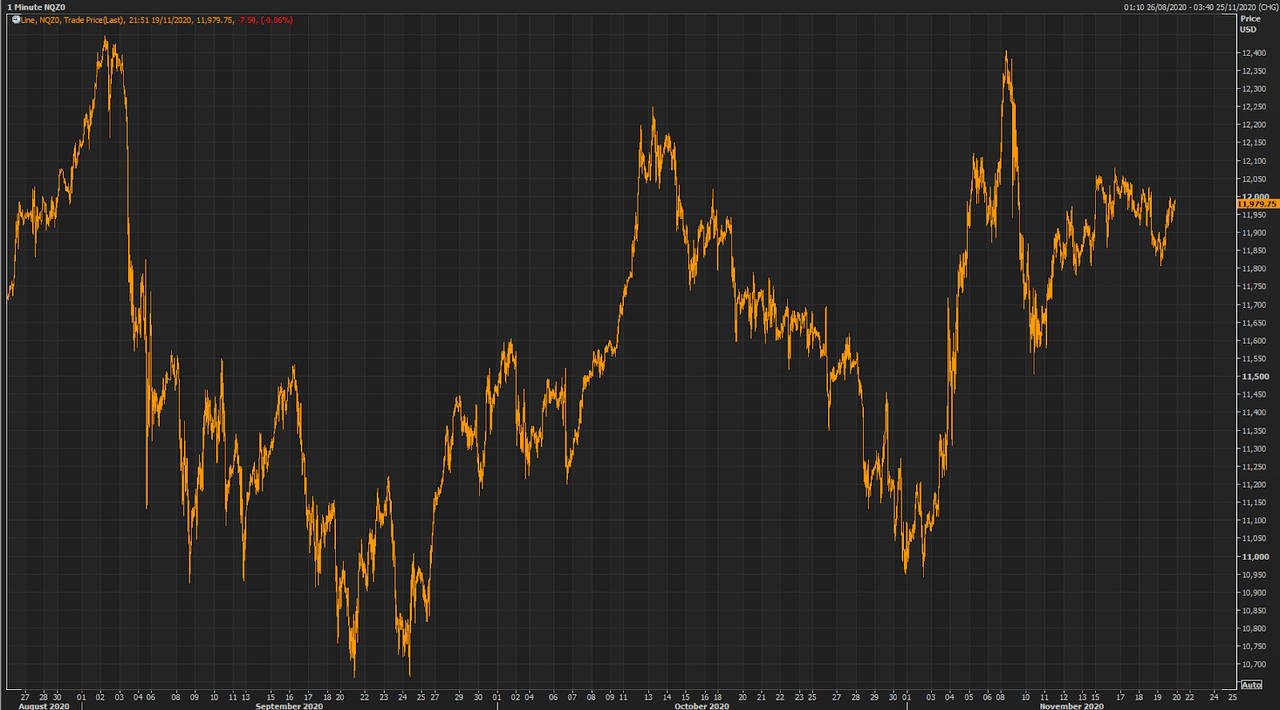

NQZ0 (Nasdaq 100 December/20 futures)

(Click on image to enlarge)

It's clear that given the recent declines in yields, there's a lot more adjustment that has to be done by these assets to the downside. It is also clear that the most vulnerable, based on this narrative, are Russell, Dow, and Gold. In fact, December 2020 gold futures fell below 1850 support and has been gravitating lower since then.

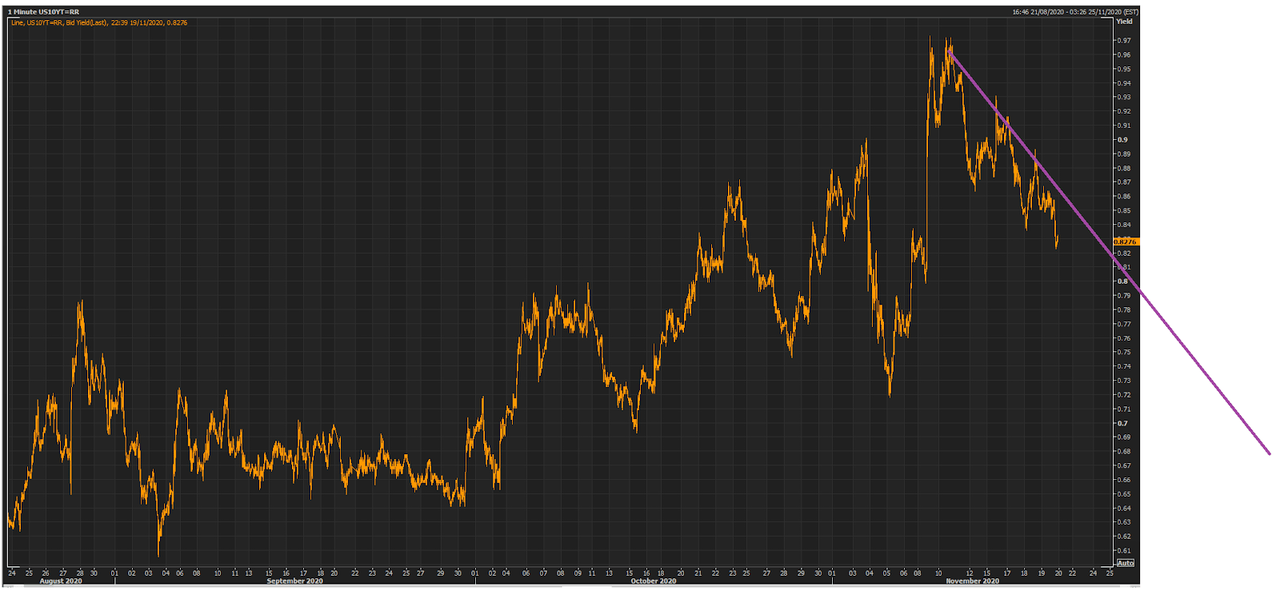

We believe that by the time the 10yr yield is done falling by mid-December, the long yield could be back by the same levels we saw in mid-October (see chart below).

10Yr Yield

(Click on image to enlarge)

We discussed the reasons why we believe bond yields will fall further in our November 16 Seeking Alpha article. We do a brief reprise of the arguments in that article and added a few which will further sharpen the outlook.

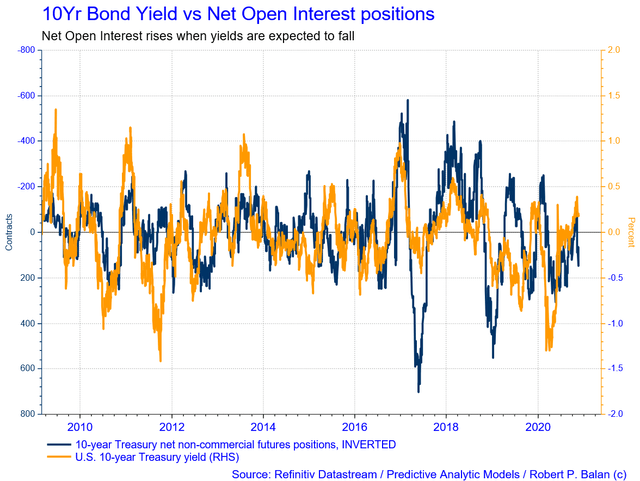

The latest investors' positioning in the bond market shows a preference for lower bond yields in the short term at least (see chart below).

10Yr Bond Yield vs Net Open Interest positions

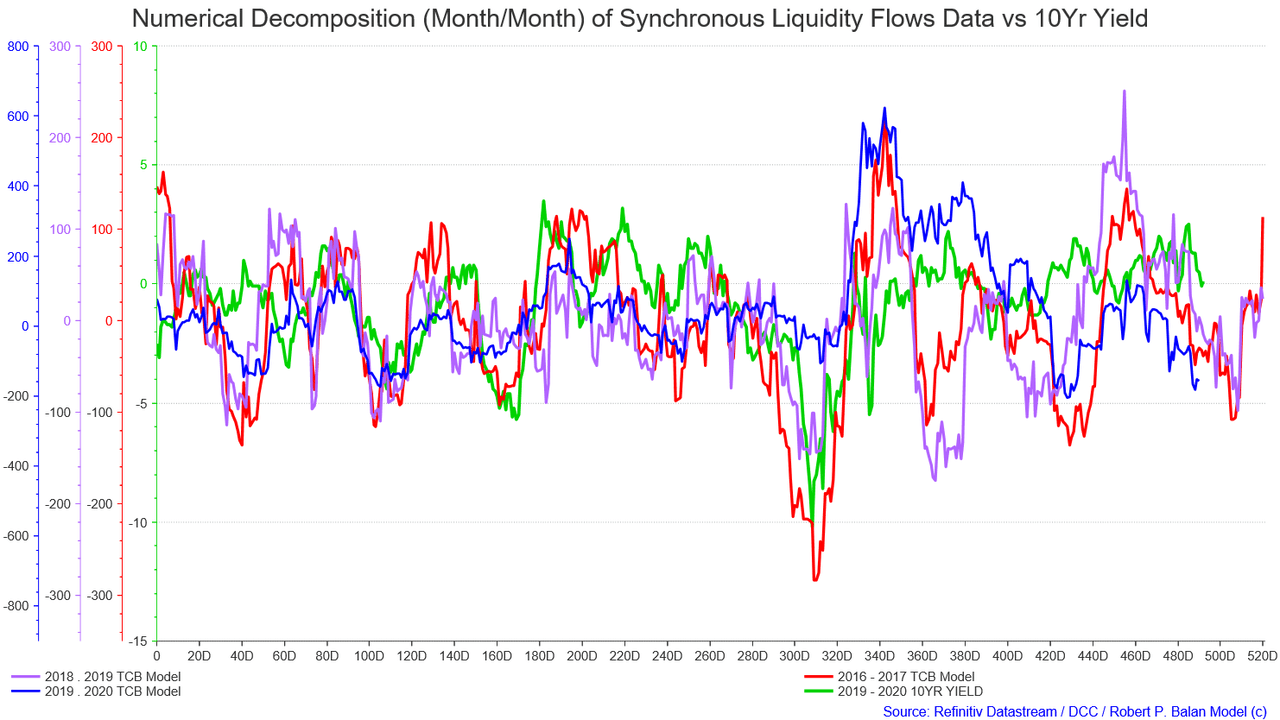

.The seasonality of systemic liquidity flows show that there is a mini-drought from Friday last week until mid-December, a period and circumstance which has given way to decline in bond yields (see chart below).

Synchronous Liquidity Flows vs 10Yr Yield

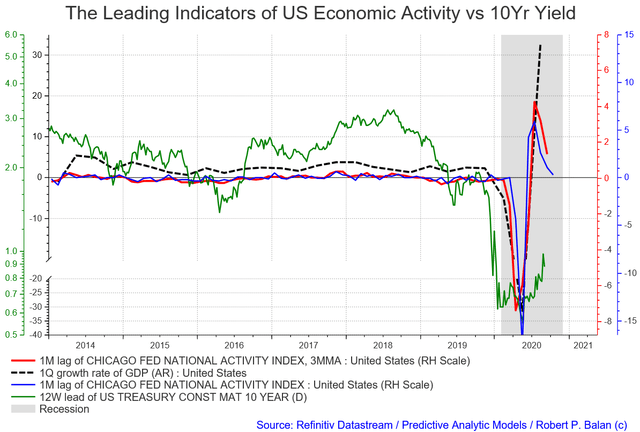

Deterioration of US economic activity and that clearly shows in the CFNAI -- another reason in the background which calls for lower yields. CFNAI is an economic activity mensuration which takes in 87 various leading indicators and aggregates, and distill all those in one succinct data point every month (see chart below). This indicator leads the US GDP by one quarter. The 10yr yield lags this leading indicator by circa 12 weeks.

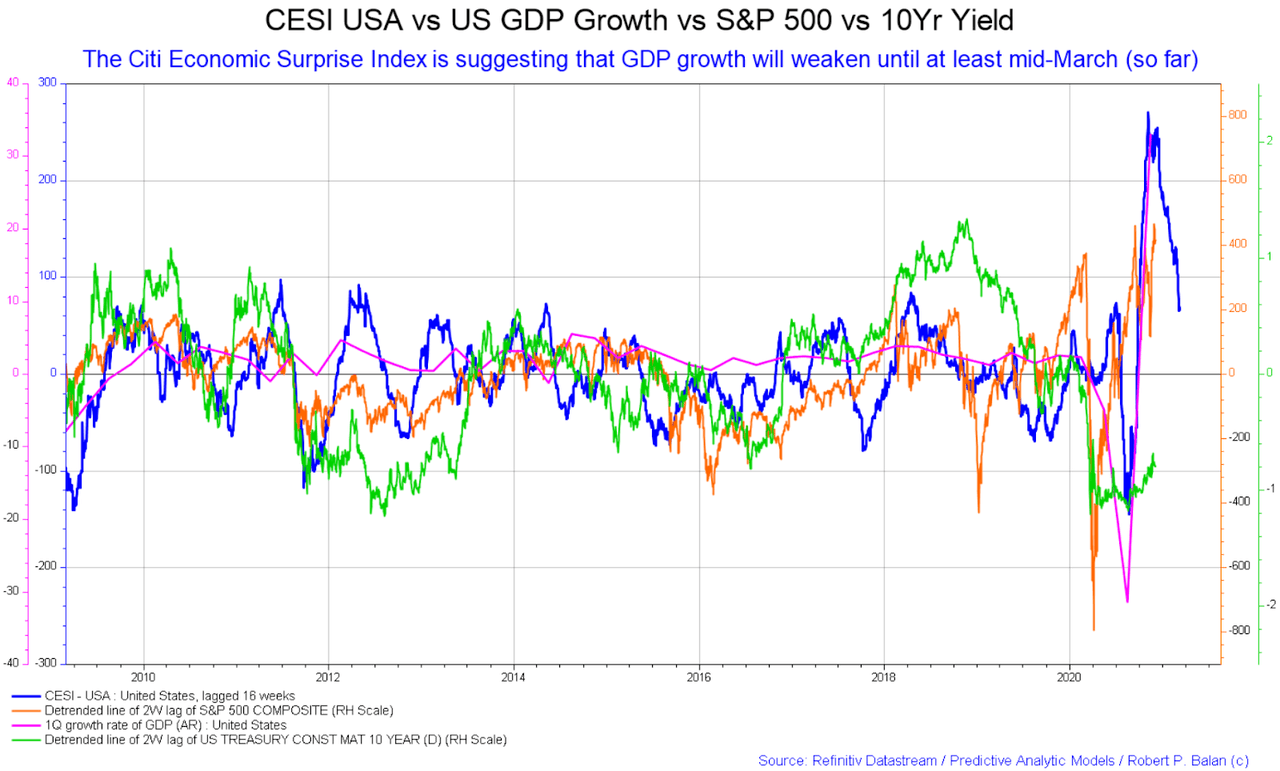

The Citi Economic Surprise Index is a powerful leading indicator of US economic performance. It leads to the stock market and bond yields, as well as the changes in US GDP (see chart below).

There has been very little discussion about GDP growth fading over the next 6 months in the popular media. But it is not only a possibility -- its certainty grows day by day.

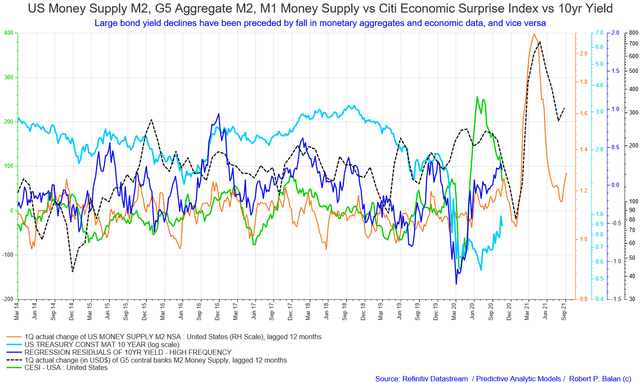

The G5 global central banks' aggregate balance sheets and money supply data also provides a clear leading indication of what to expect from equity and bond markets, with a very long lead (10 to 12 months, see chart below).

The evidence becomes even more telling with the addition of the US Citi Economic Surprise Index to the global monetary data. This aggregation of models suggests a decline in bond yields until late December - late January.

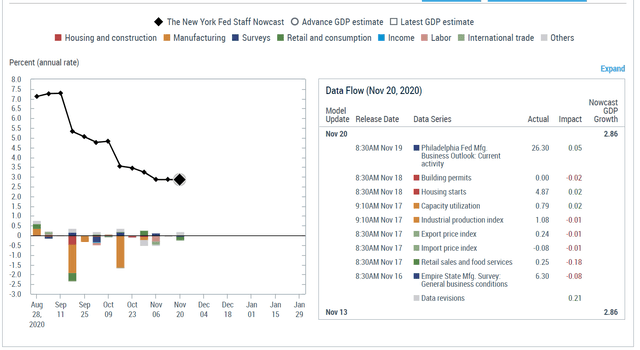

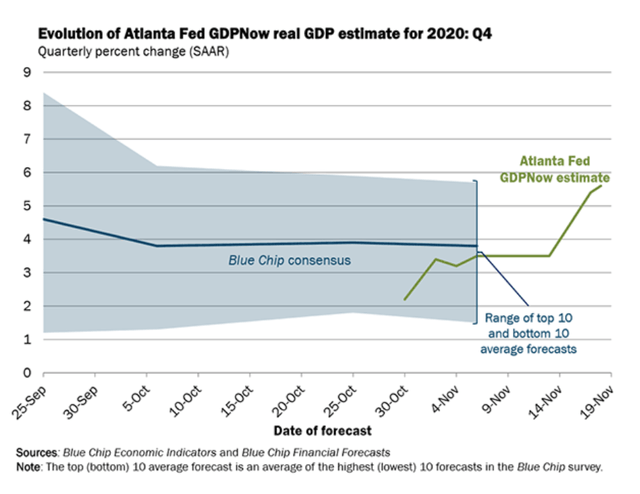

Deteriorating economic fundamentals are further documented by the severe decline in GDP outlook from both the NY Fed and the Atlanta Fed Nowcast GDP projections:

New York Fed: 2.86 % (as of Nov 20, 2020)

Atlanta Fed: 5.6 % (as of Nov 25, 2020)

Q4 2020 GDP is now estimated at 2.86% to 5.6% pct -- from 33.08 at end of September 2020. That is a massive delta from the Q3 GDP.

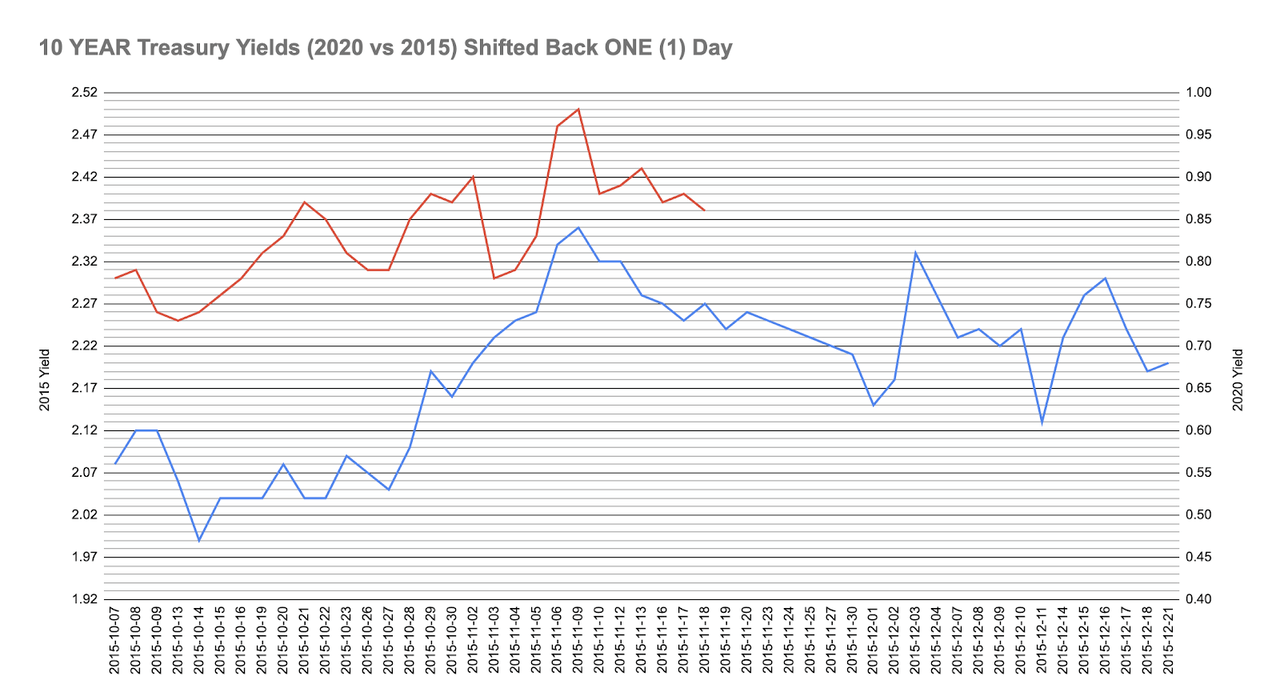

Meanwhile, PAM's resident bond market guru @Ippy04 said that the "tricky Masters of the Universe ( MOTUs) front-ran the monster auction last week (and this week) by 1 day... but the 10yr yield still tracking 2015 well." See the chart, below, which he has provided. This template is probably correct.

A PAM member rationalized the rationale behind this repetitive tendency: as the government bureaucracy (US Treasury) does the planning, budgeting, meetings, and auctions to buy/sell bonds routinely in almost the same way year over year, we can naturally expect patterns of previous years to emerge.

If bond yields fall further in a meaningful way, which asset will have to make the most adjustment lower?

The Russell 2000 Index, to us, will likely make the largest adjustments, valuation-wise.

Russell 2000 remains elevated, simply because of the narrative that the Blue tsunami will rule uber alles and yields will have to inexorably shoot to the moon. But that is a story that is relevant in the medium-term, not in the near-term. Meanwhile, we have a potentially divided US Congress, a new brush with the recession in Q42020 - Q12021 time frame, and a new wave of COVID-19 emergency measures.

To us, this Russell dominance is misguided. If we have growth issues very soon (and we mean very soon), the Fed will likely do another QE, and that will flatten yields even further.

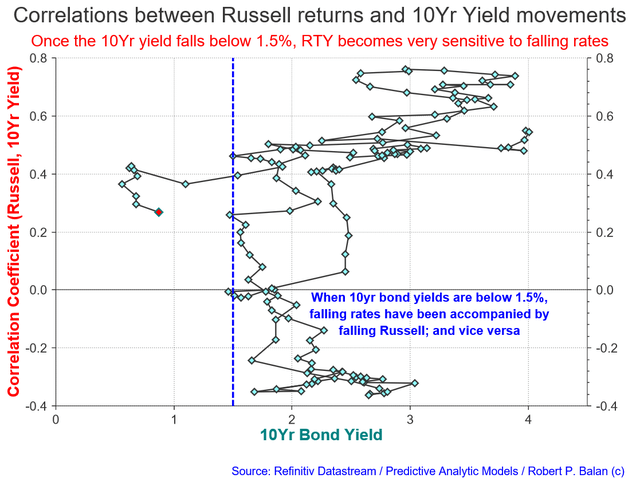

We did a study on the sensitivity of the Russell 200 to the changes in long bond yields (10Yr yield). This is what we got:

Post Quantitative Easing (QE) Era (November 2008 to present)

Correlation between Russell returns and the 10Yr yield shows a distiinctively sharp delineation: when 10yr bond yields are below 1.5%, falling rates have been accompanied by falling Russell; and vice versa.

This study above covers the period from November 2008, when the Fed's Quantitative Easing programs became institutionalized. It is important to make that distinction because the super-abundance of systemic liquidity has skewed many of the traditional correlations between market data, and even assets. The last data is November 2020.

This correlation coefficient study is telling us that when the 10Yr yield starts falling below 1.5%, the Russell 2000 Index becomes very sensitive to falling rates and its valuation begins to suffer and weaken.

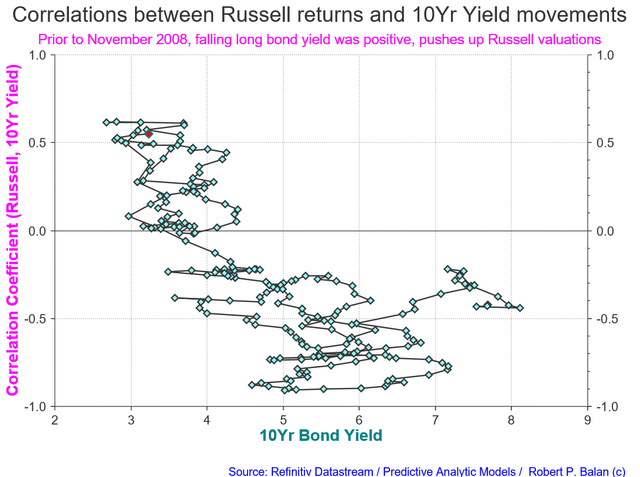

Pre-Quantitative Easing (QE) Era (November 1990 to present)

It was different during the era prior to November 2008, when QE became institutionalized. Before that, falling yields were positive to Russell index valuations (see chart below). But that environment of course did not include periods when the 10yr yield was less than 1.5%.

The paradigm broke when yields fell below 1.5% -- the environment became extremely deflationary, and there was a high risk that low growth/low inflation will become institutionalized as well.

One PAM member also explained that inflation expectations rise when the economy is doing well, and so does the 10Y yield. So when we have a troubled economy like today with suppressed 10Y rates, Russell becomes more sensitive to the 10 Year yield and therefore sensitive to inflation as well.

Another member added that Russell's sensitivity is not merely tied to inflation. Russell is a growth proxy -- small caps outperform in periods of good GDP growth, which is why they tend to outperform early in new bull markets after recessions end. He added, however, that if we double dip on a recession, Russell will lose the most value comparative to other indexes.

I added that we will likely see a double-dip recession in Q1 2021. And it is not just us. Some professional economists say that the market is not paying much attention to that possibility: The Economic Outlook – WSJ November Survey | Econbrowser

Large investments banks are also starting to warn their customers about that growth decline as well: J.P. Morgan is now forecasting a negative Q1 GDP, revising its earlier forecast

And Wall Street's investment bank analysts are starting to get skittish about the current equity market rally. Why Wall Street's "Most Accurate Analyst" Expects Another Market Correction Before Year-End

Conclusion:

Last Friday's OpEx (Options Expiration) provided market guidance -- and the outlook was conducive for lower equity prices and lower bond yields. In effect, OpEx suggested that Wave 2 (in Elliott Wave Principle parlance) was just about done, and we will soon have a phase transition into a Wave 3 that should bring equities and equities significantly lower. We add that by the time a new trend for lower is done (at the end of Wave 5) -- we could be seeing levels in bond yields and equity prices which we saw in mid-October.

During the first TEN months of 2020, PAM delivered phenomenal real-dollar trading performance, the best at Seeking Alpha:

PAM's flagship more