Using CoT To Analyze The Near Future

Following futures positions of non-commercials are as of November 5, 2024.

10-year note: Currently net short 818.3k, down 82.9k.

The fed funds rate was lowered by 25 basis points as expected. The benchmark rates are now down 75 basis points from the cycle-high range of 525 basis points to 550 basis points. The vote was unanimous, including Governor Michelle Bowman who was the lone dissenter in September – first “no” vote by a governor since 2005 – when the rates were slashed by a half percentage point.

Futures traders are betting with a 65 percent probability that the FOMC is on course for another 25-basis-point cut in December (17-18). At the post-meeting press conference Thursday, Chair Jerome Powell was noncommittal. Just when it looked like interest rates were on a sustained path lower, the outlook just got a little muddier.

President-elect Donald Trump’s win this week has the potential to turn the rates outlook on its head. Nowhere was this more evident than on the long end of the treasury yield curve, with the 10-year rallying 14 basis points on Wednesday. Yes, the rates have been rising since September when these notes yielded 3.6 percent, but Wednesday’s action had a little panicky look to it.

Long rates likely rallied expecting a whole host of things during Trump presidency – from rising odds of a soaring budget deficit to resurging inflation to higher economic growth to pure technicals.

On Wednesday, the 10-year rose as high as 4.48 percent, thereby kissing a falling trendline from October last year when it peaked at five percent. Thus far, the resistance has held and will probably continue to do so near term, notwithstanding what happens mid- to long-term as Trump’s policy begins to get reflected in the yield curve.

In the end, the noisy week ended lower, down six basis points to 4.31 percent, forming a weekly shooting star. This was the first down week in eight, with conditions way overbought. Yields are headed lower for now. Nearest support lies at 4.2s.

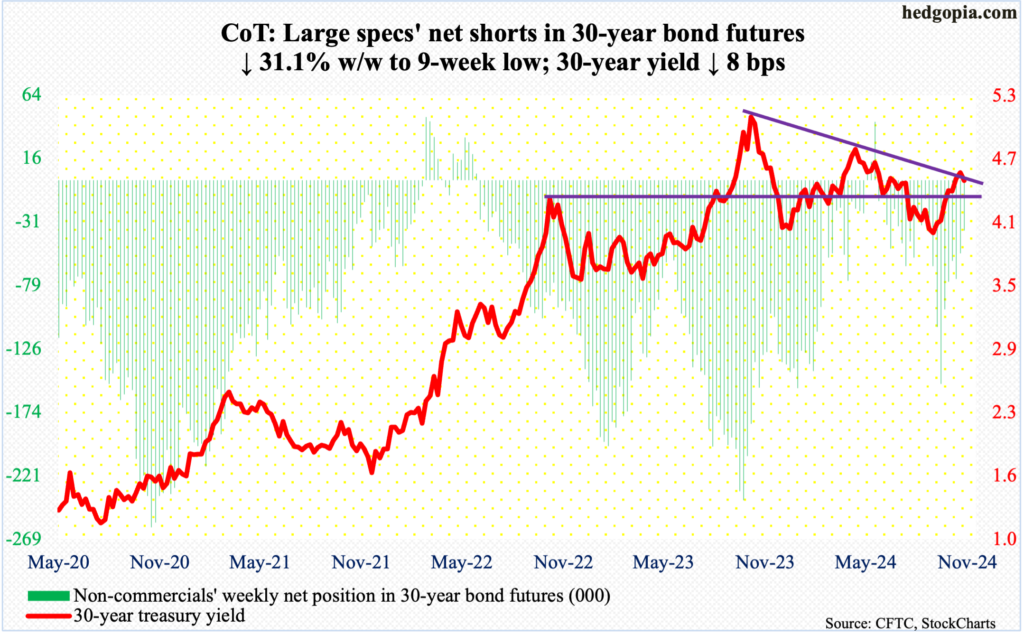

30-year bond: Currently net short 37.8k, down 17.1k.

Major US economic releases for next week are as follows.

The NFIB optimism index (October) is due out Tuesday. Small-business optimism grew three-tenths of a point month-over-month in September to 91.5 – a two-month high. March’s 88.5 was the lowest since December 2012.

The consumer price index (October) will be reported on Wednesday. In the 12 months to September, headline and core consumer prices rose 2.4 percent and 3.3 percent, in that order. In June and September 2022, they respectively peaked at four-decade highs of 9.1 percent and 6.6 percent. September’s headline reading is the lowest since that high, while the core was at a four-month high.

The producer price index (October) is on schedule for Thursday. September headline and core wholesale prices rose 1.8 percent and 2.8 percent respectively from a year ago.

Retail sales (October) and industrial production (October) are on deck for Friday.

In September, retail sales increased 0.4 percent m/m to a seasonally adjusted annual rate of $714.4 billion – a record.

Capacity utilization dropped 0.4 percent m/m in September to 77.5 percent, which was the lowest since January’s 33-month low of 77.2 percent.

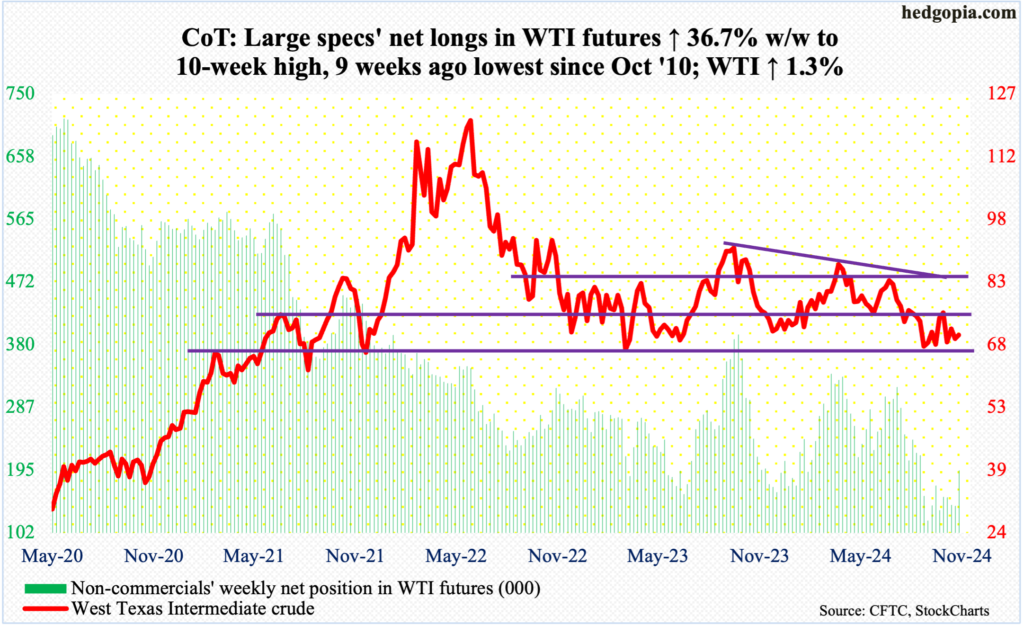

WTI crude oil: Currently net long 194.3k, up 52.2k.

On Sunday, OPEC+ member countries agreed to delay a planned December output increase by one month. West Texas Intermediate crude in that session rallied to reclaim the 50-day moving average ($70.57), which was then breached by Friday, albeit slightly. For the week, the crude rose 1.3 percent to $70.38/barrel; oil bulls nonetheless were unable to hang on to all the gains, as WTI ticked $72.88 intraday Thursday.

For months, WTI played ping pong between $71-$72 and $81-$82. The range support was lost early September. Since then, for the most part, the support-turned-resistance has held. Immediately ahead, risks have risen that WTI gravitates toward $66-$67, which has found buyers for the past couple of months, with the crude ticking $65.27 on September 10.

In the meantime, US crude production in the week to November 1 was unchanged for four consecutive weeks at 13.5 million barrels per day – a record. Crude imports increased 265,000 b/d to 6.2 mb/d. Stocks of crude, gasoline, and distillates all rose as well – respectively up 2.1 million barrels, 412,000 barrels and 2.9 million barrels to 427.7 million barrels, 211.3 million barrels and 115.8 million barrels. Refinery utilization firmed up 1.4 percentage points to 90.5 percent.

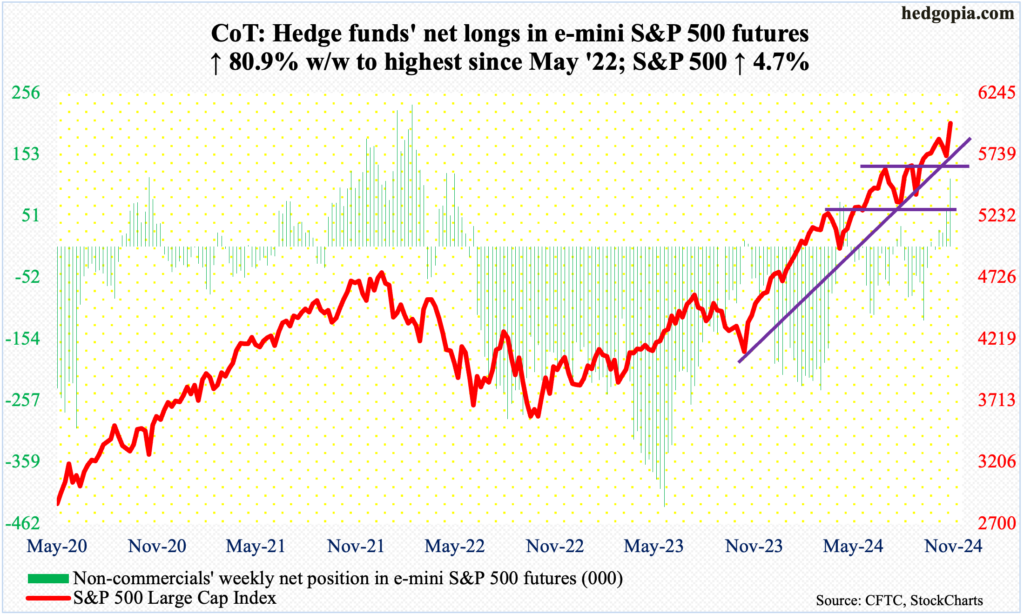

E-mini S&P 500: Currently net long 113.4k, up 50.7k.

Tuesday was the election day, and the S&P 500 had already voted with a jump of 70 points. Come Wednesday, the large cap index celebrated a Republican sweep by gapping up and breaking out of horizontal resistance at 5870s, with more rallies the next two sessions. When it was all said and done, it shot up 4.7 percent for the week.

Non-commercials rode this rally perfectly, as by Tuesday they were sitting on 113,440 net longs, up 80.9 percent week-over-week. These holdings are at a two-and-a-half-year high. As the cash continued to rally the next three sessions, it will be interesting to find out next week if these traders added more to their holdings or locked in profit.

Interestingly, even after this week’s rally, the daily and weekly RSI are still under 70 – 68.81 and 69.03 respectively. This metric – the weekly in particular – has been in divergence for weeks, although equity bulls would not mind that as the price has continued higher.

The daily will soon get overbought, even as the weekly has been in that territory for a while now. Nearest support lies at the breakout retest at 5870s, and after that Wednesday’s gap-fill at 5780s.

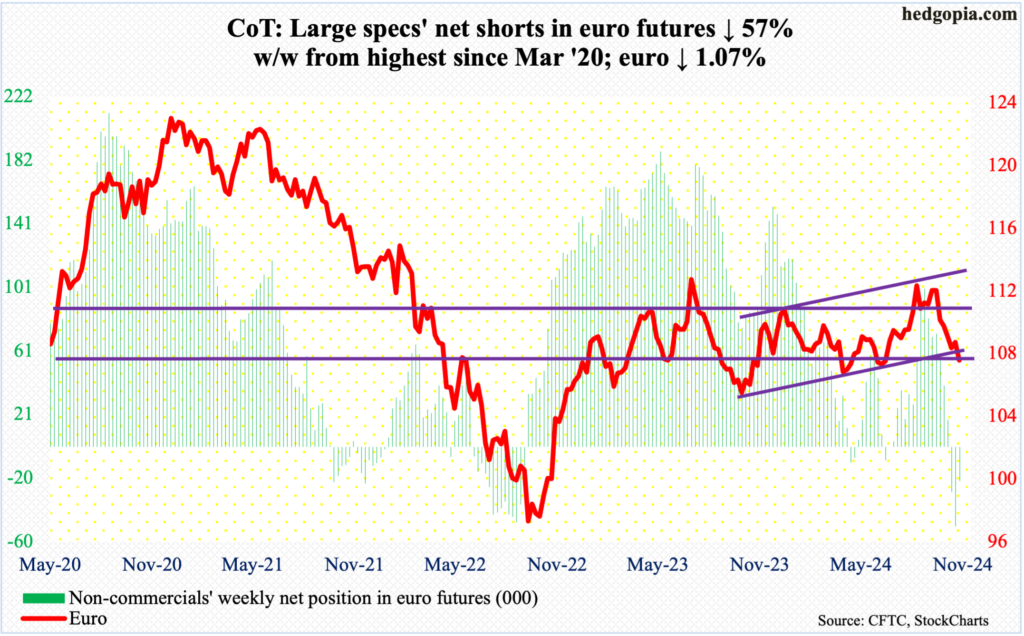

Euro: Currently net short 21.7k, down 28.7k.

Having defended a rising trendline from October last year for two successive weeks, euro bulls could no longer withstand this week’s Trump wave. The currency sliced through that support to drop 1.1 percent to $1.0718.

This was a fifth down week in six. On September 30, after facing rejection at $1.12 for six consecutive weeks, the euro sharply fell, proceeding to breach crucial lateral support at $1.10 by the 4th last month.

Wednesday’s intraday low of $1.0683 sort of tested $1.066, which was hit several times in June. A breach of this will open the door toward $1.05s, where horizontal support is solid.

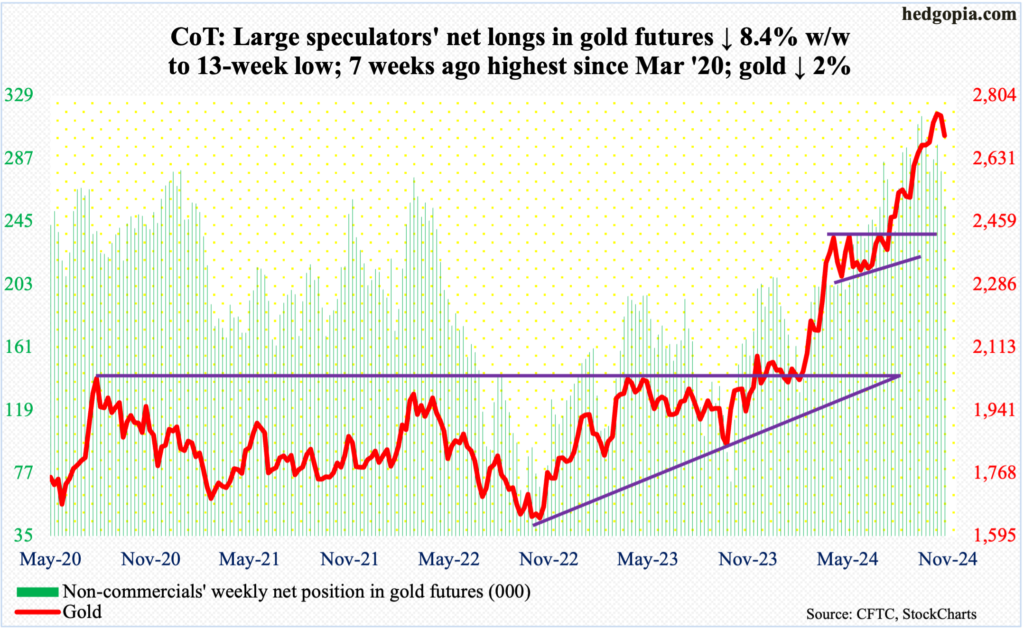

Gold: Currently net long 255.3k, down 23.3k.

Last week, after rallying in six of seven weeks, a gravestone doji showed up on the weekly. It was a sign of exhaustion, and the metal gave back two percent this week to $2,695/ounce. From gold bugs’ perspective, the good thing is that Thursday’s low of $2,650 was bought, with the 50-day ($2,662) breached intraday but defended by close.

On the daily, it is possible gold rallies a bit more, but it remains way overbought on the weekly.

Before this week’s decline, the yellow metal rallied relentlessly from June when it ticked $2,305. Since then, there have been several breakouts – $2,610s seven weeks ago, $2,540s-50s eight weeks ago and $2,440s-50s in August. These are all potential supports now.

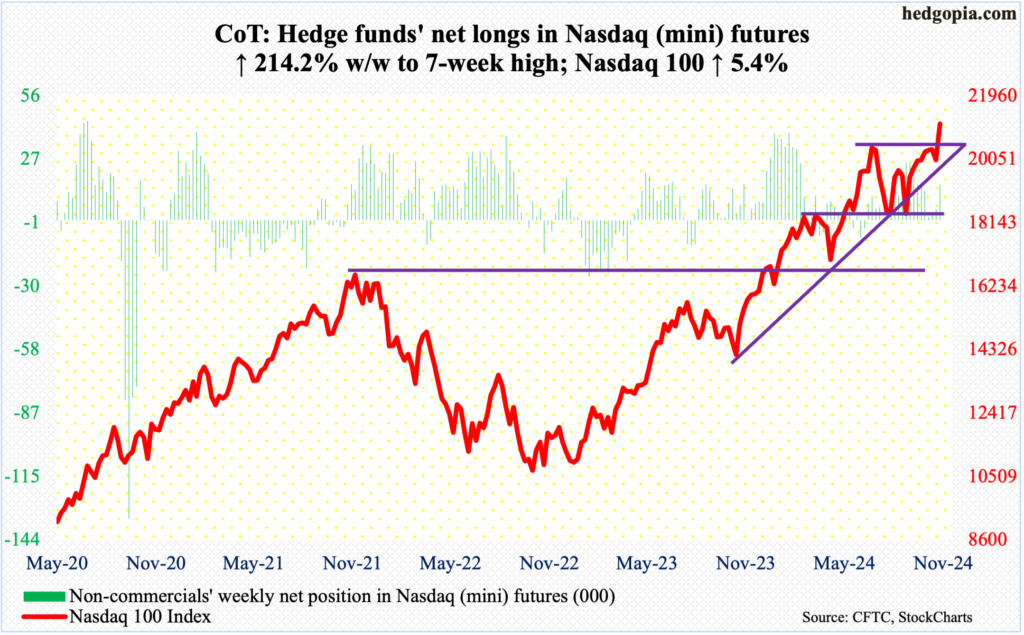

Nasdaq (mini): Currently net long 16.1k, up 11k.

After several weeks of failed attempts at July’s high, tech bulls finally pulled off a breakout. Four months ago, the Nasdaq 100 peaked at 20691. This week, the index added 5.4 percent to finally trump that high, closing at 21117.

As strong as the move was this week, if one were to nitpick, the RSI – both the daily and weekly – remain under 70, having closed at 67.30 and 66.13 respectively. This fact can be used by both bulls and bears to suit their own biases, with the former saying there is room for momentum to pick up steam and the latter arguing that momentum has diverged with the price. Time will be the arbiter of that.

For now, the threat of a double-top has been invalidated, and the bulls clearly hold the ball. If momentum fails to gain traction and the index heads lower, 20700 is the one to watch.

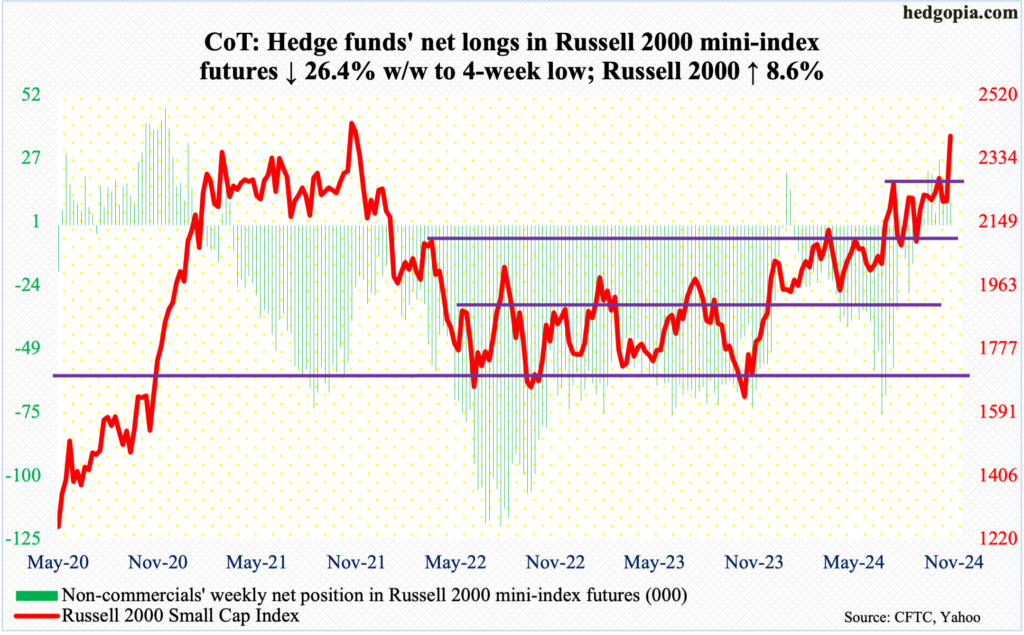

Russell 2000 mini-index: Currently net long 8.8k, down 3.2k.

The Russell 2000 is on the verge of making a round trip in four years. The small cap index peaked at 2459 in November 2021. For what it is worth, the Nasdaq 100 peaked in that very month, and it had to wait until last December to surpass that high. In small-caps’ case, the closest the Russell 2000 came was this July when it ticked 2300 on the 31st and retreated; from the middle of that month, it already faced resistance at 2260s, which fell like a rock this Wednesday when the Russell 2000 surged 5.8 percent. For the week, it added 8.6 percent to 2400, with an intraday high of 2402 on Thursday. The index is now within 2.5 percent of its high from four years ago.

As things stand, small-cap bulls deserve the benefit of the doubt to at least test the November 2021 high.

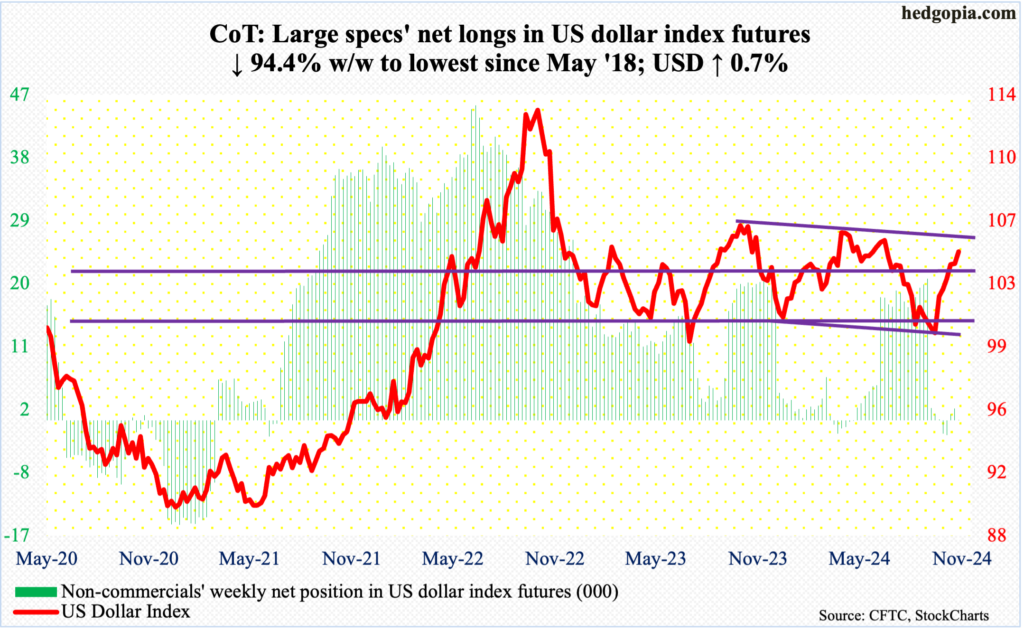

US Dollar Index: Currently net long 95, down 1.6k.

One more up week for the US dollar index! Up 0.7 percent this week to 104.89, this was the sixth up week in a row. The index began to reverse higher on September 30, after having gone sideways just under 100 for several sessions.

Earlier, the US dollar index had been under pressure since ticking 105.80 in June; this was preceded by highs of 106.38 in April and 107.05 in October last year, establishing a pattern of lower highs. Wednesday’s intraday high of 105.34 just about tested this trendline resistance, which remains intact. If dollar bulls succeed in taking this hurdle out, this would have come after having reclaimed 103-104, which goes back to December 2016. Else, they may have to defend 103-104 in the not-too-distant future.

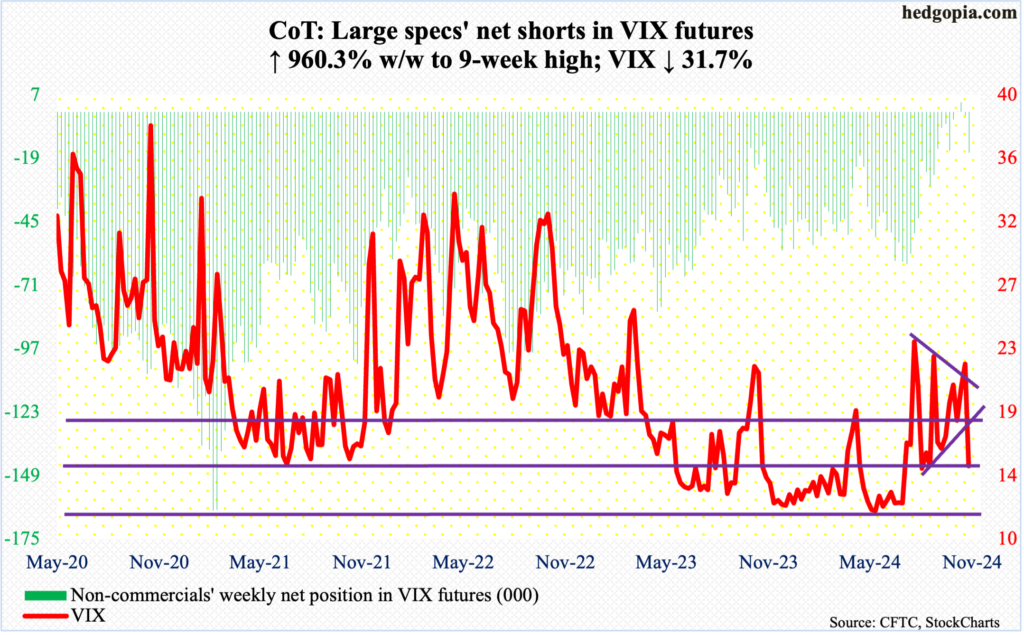

VIX: Currently net short 16.7k, up 15.1k.

Once again, it turns out non-commercials going long VIX futures was a reliable signal to go short the cash. Several times in the past, the volatility index peaked as these traders went long or got close to doing that.

In the week to October 15, non-commercials switched to net long after having remained net short since January 2019. In the subsequent week, these traders remained net long, switching back to net short in the week to October 29. On the 31st, VIX tagged 23.42 and headed lower, unable to take out two-month resistance north of 23. This week, VIX tumbled 6.94 points to 14.94. This is a support zone, although the 200-day at 15.81 has been compromised. If the index does not stabilize soon, volatility bears will be eyeing 12, or thereabouts.

Thanks for reading!

More By This Author:

If Tech Bulls Do Not Stop Them In Time, Bears Have Chance Of Double-Top On Nasdaq 100

Per COT, Peek Into Future Through Futures, How Hedge Funds Are Positioned

Tech Heavyweights Set To Report 3Q Earnings This Week

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more