If Tech Bulls Do Not Stop Them In Time, Bears Have Chance Of Double-Top On Nasdaq 100

After seven consecutive up weeks, the Nasdaq 100 went negative last week. Bulls came so close but were denied a new high. This is occurring even as breadth is in divergence with the index.

Tech bears last week finally achieved what they were unable to pull off for seven consecutive weeks. For the first time in eight weeks, the Nasdaq 100 had a down week, dropping 1.6 percent to 20033.

At Tuesday’s intraday high of 20600, which kissed the daily upper Bollinger band, the tech-heavy index was less than 100 points from the all-time high 20691 posted on July 10. The subsequent bull-bear tussle went in bears’ favor, aided by Thursday’s gap-down, bearish marubozu session.

Last week’s reversal has the potential to be a major one, as this could be part of a double-top formation (Chart 1). Having rallied incessantly since August when it bottomed at 17435 – rising in 10 out of 12 weeks – the Nasdaq 100 was already losing momentum going into last week’s trading. When the index rose to a new high in July, the weekly RSI was in the mid-70s. In the week before, the metric hit low-60s before turning lower last week.

This week is crucial. The index sits so close to lateral support at 20000, a breach of which will open the door toward the 50-day at 19795; the index has remained above the average since September 12.

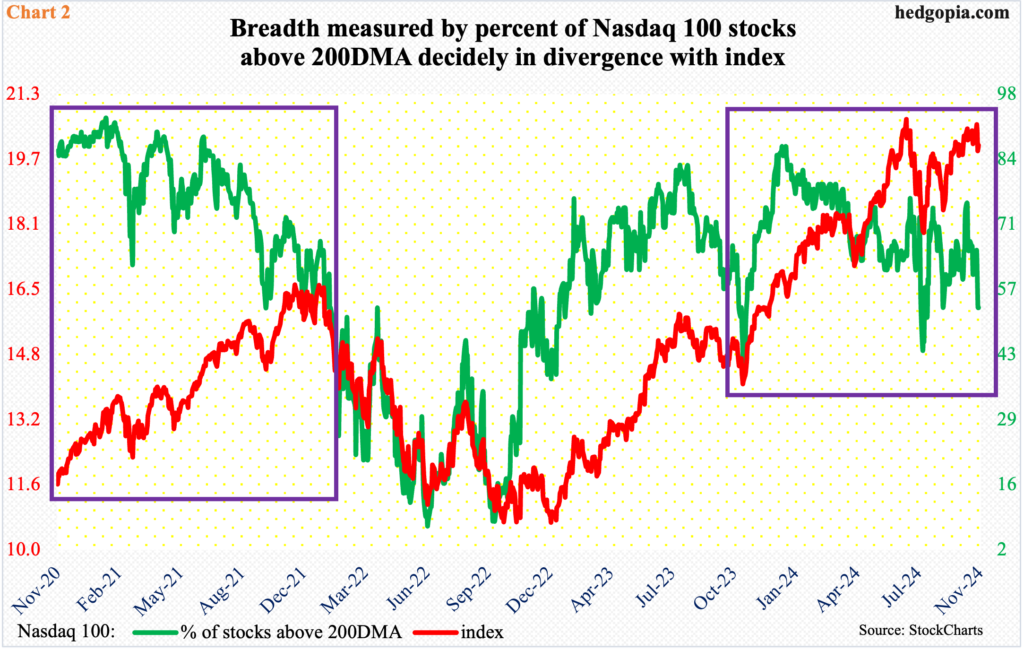

Besides the aforementioned RSI divergence, breadth measured by the percent of Nasdaq 100 stocks above the 200-day is showing weakness. Hence the significance of where the index is beginning to weaken.

Late December-early January, 87 percent of Nasdaq 100 stocks were above the 200-day. Last Friday, this closed at 53 percent, even as the index itself was a hair breadth away from its July high (box on the right side of Chart 2). This shows internal weakness and could portend further weakness in the index.

A similar divergence evolved leading up to the November 2021 high in the Nasdaq 100, with the green line in the chart persistently dropping and the red line rising (box on the left side). The index eventually caught up, tumbling nearly 38 percent between that high and a bottom next October.

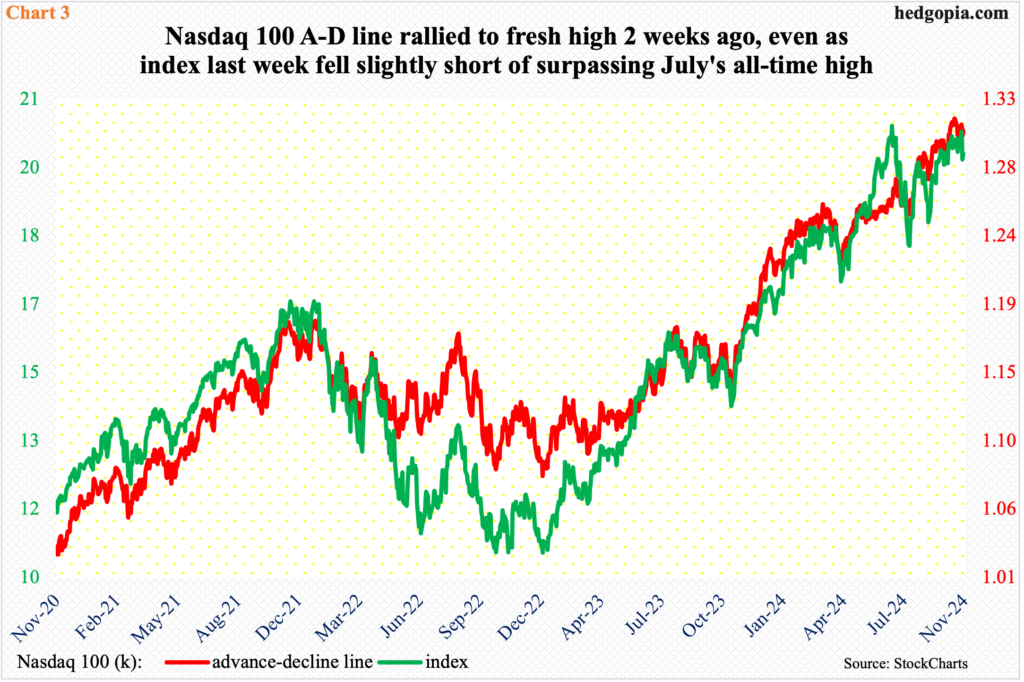

Breadth measured by the advance-decline line, however, is not as bearish.

The A-D line is calculated by subtracting the declining stocks from the advancing ones. It essentially measures the degree of participation in an advance or a decline. A rising AD line alongside a rising index is a bullish sign, and vice versa. Bullish or bearish divergences can telegraph an imminent reversal.

Currently, the A-D line and the index are in lockstep, except for the fact that the A-D line hit a new high on October 18 before weakening ever so slightly, while the index itself has failed to post a new high (Chart 3). Unless things change quickly, this can in due course develop into a divergence. Alternatively, they can both head lower.

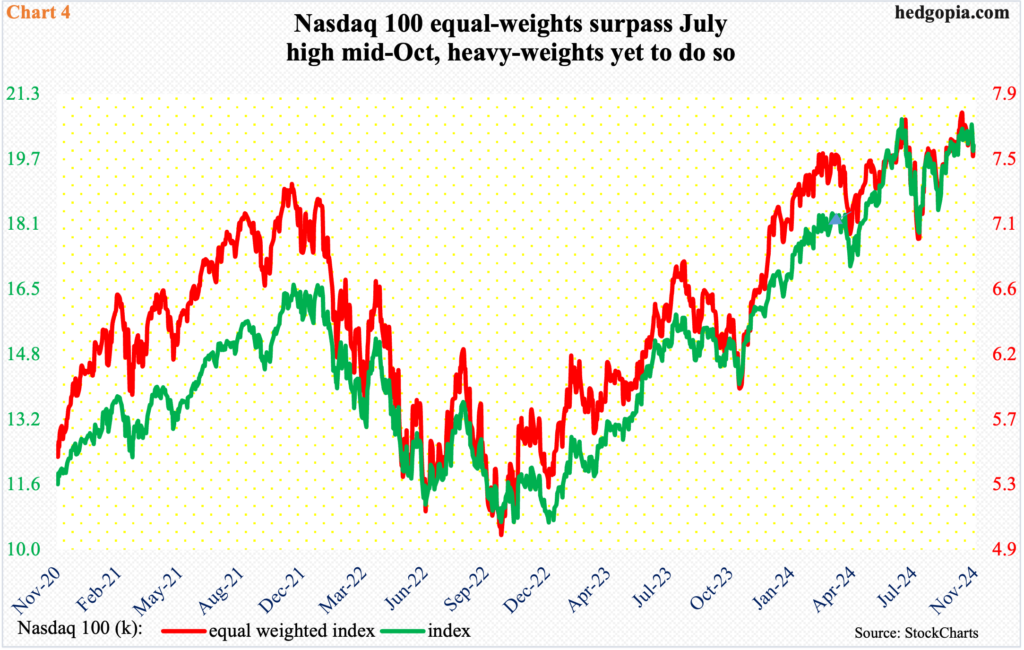

A similar relationship is brewing between the Nasdaq 100 and the Nasdaq 100 equal weighted index. The equal weights posted a new high on October 14 before coming under pressure. The heavy weights came under pressure last week alright, but they never managed to rally to a new high.

Ironically, it is the heavy-weights that matter for performance as being a market cap-weighted index the Nasdaq 100 is heavily influenced by the top names. There are seven names – Apple (AAPL), Nvidia (NVDA), Microsoft (MSFT), Broadcom (AVGO), Facebook parent Meta (META), Amazon (AMZN) and Google parent Alphabet (GOOG) – that each account for more than five percent for a cumulative total of just under 46 percent. This is why, as they go, so goes the index.

Last week’s action in the Nasdaq 100 has the potential to be a shot across the bows of bulls. This week is important.

More By This Author:

Per COT, Peek Into Future Through Futures, How Hedge Funds Are Positioned

Tech Heavyweights Set To Report 3Q Earnings This Week

Reading The Future: How To Interpret The Latest CoT Report

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more