US Homeowner Equity Drops For First Time Since 2012

Image Source: Unsplash

The housing bull market has peaked for now. Recent home price declines are leading to decreased tappable equity for homeowners.

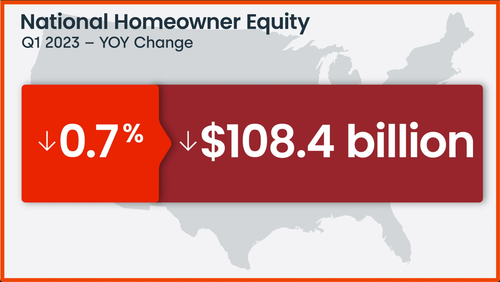

A new CoreLogic Homeowner Equity Insights report shows homeowners with mortgages (roughly 63% of all properties) saw their equity decrease by a total of $108.4 billion in the first quarter of 2023 versus the same period last year, a loss of 0.7% year-over-year (or about $5,400 per borrower). Even though it was a small loss of equity, it was the first loss since 2012.

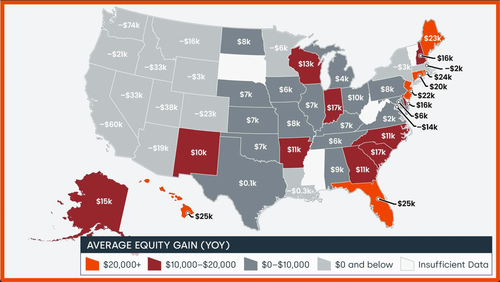

Home equity trends for the quarter show Hawaii, Florida, and Rhode Island had the most significant gains of $24,900, $24,500, and $23,700, respectively. Meanwhile, thirteen states and one district recorded annual equity losses: Arizona, California, Colorado, Idaho, Louisiana, Massachusetts, Minnesota, Montana, Nevada, New York, Oregon, Utah, Washington, and Washington, DC.

Despite the declines, the average US homeowner now has more than $274,000 in equity — up significantly from $182,000 before the pandemic. However, the trend is reversing.

In recent months, we've noted "US Home Price Growth Slowest In A Decade, San Francisco Crashes" and "US Home Prices Show Annual Decline For First Time Since 2012." The Federal Reserve has put a chill in the housing market with the most aggressive rate hikes in a generation to combat decades-high inflation.

Still, home prices have yet to crash, and that's a function of tight supply. Those chasing the real estate market during the COVID-19 boom in the western half of the US are experiencing the worst declines in equity and home prices.

More By This Author:

Growth/Value Trend Reverses On Week; VIX Dumps, Bonds & Gold Jump As Jobs Slump

S&P Futures Hit 4,300 After Entering Bull Market

Fed Emergency Bank Bailout Facility Usage Tops $100 Billion For First Time As Money-Market Inflows Soared Again