Growth/Value Trend Reverses On Week; VIX Dumps, Bonds & Gold Jump As Jobs Slump

Image source: Pixabay

Was this a week of reversals? The S&P 500 reversed into a new bull market (off the October lows) as jobless claims reversed to a 19-month high.

Source: Bloomberg

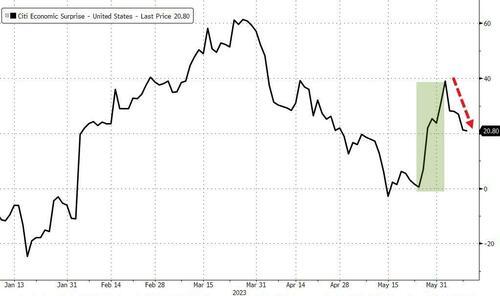

After a two-week rebound in macro-surprise data, US data disappointed this week -- most notably jobless claims.

Source: Bloomberg

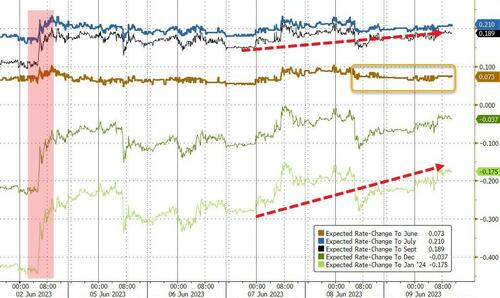

However, the market's expectations for Fed rate changes shifted modestly hawkishly, holding on to post-payrolls shifts, with June expected be a 'pause' but July pricing in almost a full rate-hike. At the same time, rate-cut expectations by year-end have shrunk significantly as soft-landing (not crash landing) hopes reshape the distribution of outcomes.

Source: Bloomberg

On the week, small-caps outperformed while the Nasdaq lagged (which served as another reversal) and the Dow and S&P struggled for gains.

The S&P 500 algos battled for a 4300 close but ultimately lost.

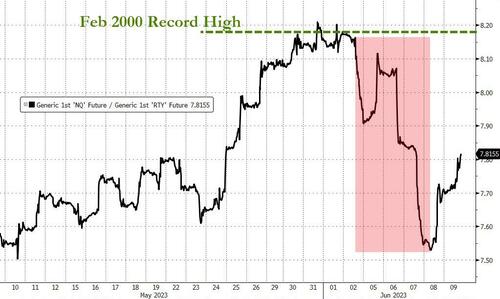

The trend of the Nasdaq outperforming the Russell 2000 ended abruptly this week after tagging its all-time high from the February 2000 peak of the dotcom bubble. But it did see some bouncing on Friday.

Source: Bloomberg

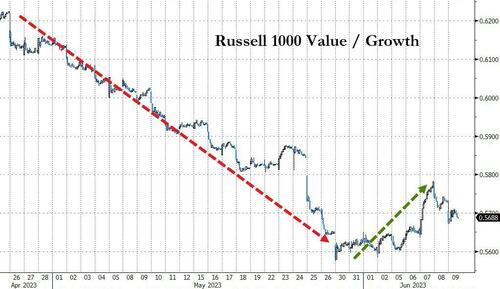

Following seven straight weeks of growth outperforming value, this week saw a notable reversal with value outperforming growth by the most since the first week of January.

Source: Bloomberg

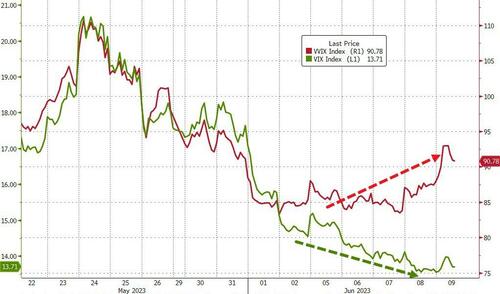

One thing that didn't change was the collapse in the VIX, which hit a 13 handle -- its lowest since February 2020 -- this week. However, VVIX started to decouple from VIX's demise, hinting at trouble ahead.

Source: Bloomberg

Regional bank shares rose for the fourth straight week, but stalled at resistance.

As far as the AI bubble, NVDA ended the week where exactly where it opened the morning after its blockbuster earnings; not exactly an exuberant follow-through.

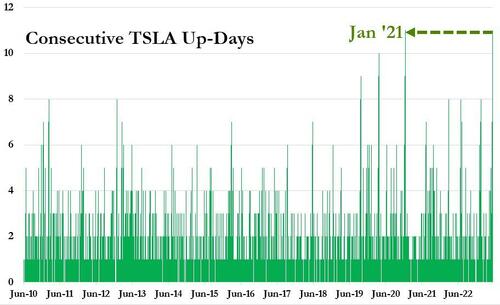

TSLA rose for the 11th straight day to its highest since October 2022.

This was in line with its record winning streak.

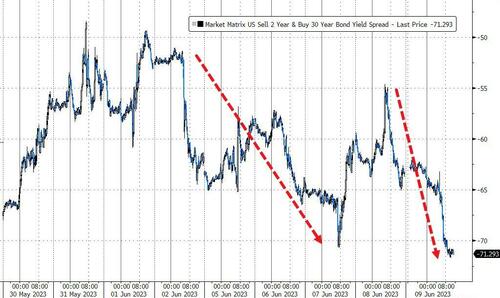

Treasuries were very mixed this week with some big jumpy swings seen intraday. By the close on Friday, the long-bond outperformed (-1 bps on the week) while the short-end was up around 9-10 bps.

Source: Bloomberg

The yield curve (2s30s) inverted deeper this week.

Source: Bloomberg

Meanwhile, the dollar fell for the second week in a row.

Source: Bloomberg

Crypto was mostly lower this week as the SEC sued Binance and Coinbase, prompting more fear, uncertainty, and doubt. Solana was hardest hit of the larger coins, with BTC and ETH each down around 3%.

Source: Bloomberg

Bitcoin clung to $26,500 after the Binance plummet and bounce.

Source: Bloomberg

Gold rallied for the second week in a row, but it had a very volatile dump-and-pump week.

Oil prices fell for the second straight week after the Saudi production cut news failed to impress (with WTI within a tick of a $68 handle at the week's lows, having touched $75 at the highs).

Finally, the "trilemma" continues to confuse many.

Source: Bloomberg

The dollar, tech stocks, and real rates are not supposed to act like this into a recession. Goldman believes that the dollar is right and equities aren't. Meanwhile, mega-cap tech continues to ignore the tightening of financial conditions.

Source: Bloomberg

How long before the Fed worries they have blown another bubble?

Source: Bloomberg

Six-month T-Bill yields are 50 bps higher than the S&P's current earnings yield -- the widest spread since January 2021.

More By This Author:

S&P Futures Hit 4,300 After Entering Bull MarketFed Emergency Bank Bailout Facility Usage Tops $100 Billion For First Time As Money-Market Inflows Soared Again

WTI Drops Below Pre-Saudi-Cut Levels After API Signals Big Product Builds