US GDP Projection Q2, 2021

“The nearly $1.9 trillion relief package that passed Congress is projected to help propel the U.S. economy to its fastest annual growth in nearly four decades, reduce poverty and revive inflation. The legislation—following trillions of dollars in federal aid last year and arriving amid rising Covid-19 vaccination rates—prompted economists surveyed by The Wall Street Journal in recent days to boost their average forecast for 2021 economic growth to 5.95%, measured from the fourth quarter of last year to the same period this year. That was up from their 4.87% projection last month and would be the U.S. economy’s fastest since a 7.9% burst in 1983.” (WSJ, March 11, 2021)

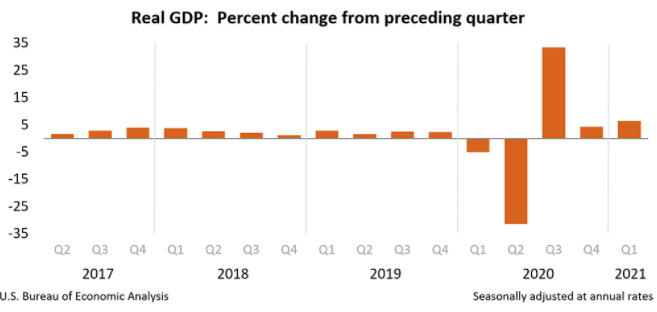

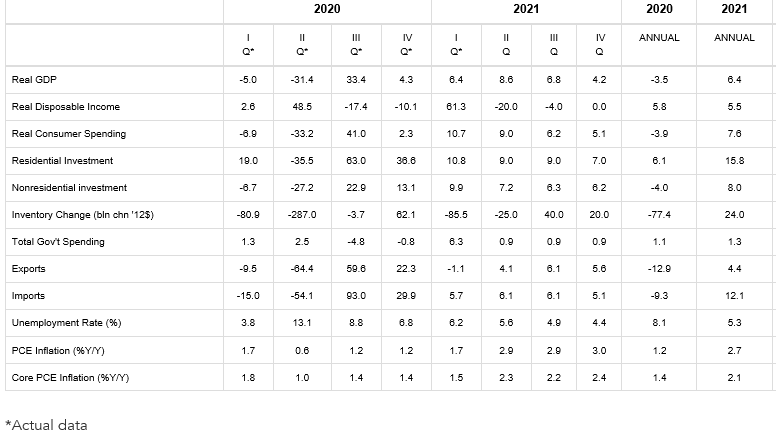

The US economy expanded at a 6.4% annual rate of growth in the first quarter of this year following a 4.3% expansion in the previous three-month period.

.

As the official data indicated, the economic expansion in the first quarter reflected substantial increases in personal consumption expenditures (PCE), nonresidential fixed investment, federal government spending, residential fixed investment, and state and local government spending.

Inventories and international trade were negative offsets to the strong first-quarter growth picture. What is particularly interesting is that American GDP is nearly back to pre-pandemic levels.

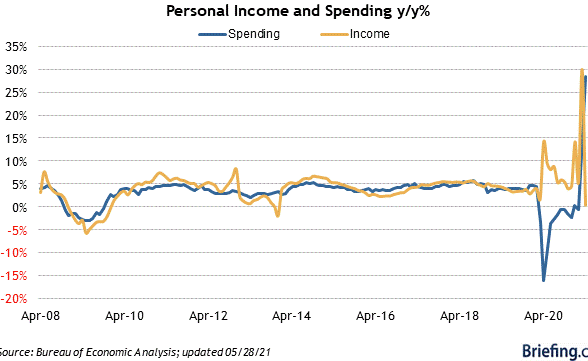

Clearly, government support payments drove strong consumer spending on goods in the first quarter, and the pent-up demand for household services will probably be the key to growth going forward.

This point is underscored in the following chart. Consumer spending soared to $15.1 trillion in the first quarter, an increase of 11.3% following a slim 2.3% gain in the fourth quarter of 2020. Ironically, US personal income declined sharply in Q1, though personal income was bolstered substantially by government relief payments in previous quarters. American consumers clearly are in a spending mood.

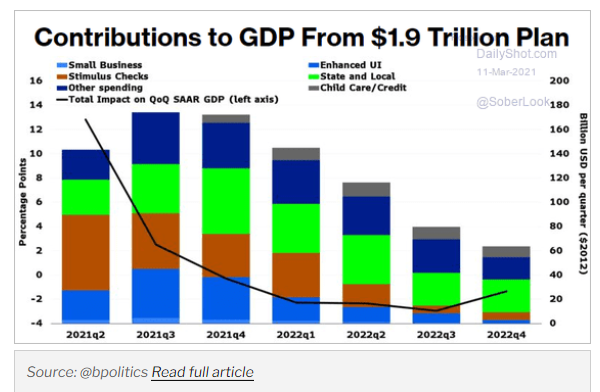

Analysts are also very upbeat about the second-quarter growth possibilities, given the accumulated fiscal supports as well as the fact that the US has been so successful in both vaccine rollouts and of course in terms of re-opening the economy. Then of course, there is the hefty impact of Biden’s major fiscal policy infusion into the economy to consider.

As the following chart indicates, the huge $1.9 trillion injection into the economy will have its largest spending impacts in the third and fourth quarters of this year and will still have diminishing but significant impacts right through to the end of 2022.

In comparison, the 2009 fiscal stimulus was only about 5.6% 2008 G.D.P. In contrast, the Rescue Plan this year is about 9.1% of last year’s G.D.P, so it is simply incredibly bigger.

The US economy’s underlying growth momentum can also be traced to robust corporate earnings, extremely low-interest rates, readily available credit, rising home values and strong equity prices.

As for the short-term outlook, the Conference Board, as most other forecasting agencies, recently elevated its projections for the US economy, and projected real GDP growth to rise at an even faster 8.6% annual rate in Q2, 2021, with continued strong economic growth also expected later in the year.

THE CONFERENCE BOARD BASE CASE ECONOMIC OUTLOOK

Percentage Change, Seasonally Adjusted Annual Rates

The intrinsic flaw of averages i that they hide the extremes, and that a few peak will hide the deep valley areas. So averages can lie by hiding the truth. The GNP may LOOK fine when a few stars do well, while others are not so well. Hidden truth hiding big pain for many.