US Consumer Spending Remains Vulnerable To Credit Dynamics

Consumer credit grew more than expected in June, led by car loans, but credit card spending contracted as borrowing costs hit record highs. With banks increasingly reluctant to finance consumer credit and with consumer spending responsible for two-thirds of economic activity, consumption expenditure looks set to come under intensifying pressure.

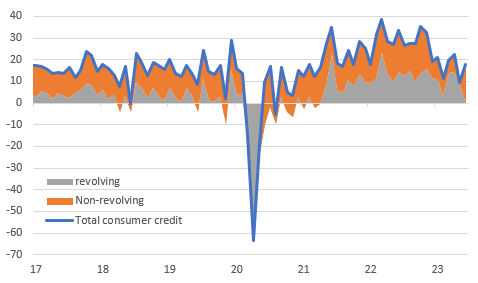

Consumer credit on a softening trend

The June US consumer credit data, published by the Federal Reserve, is stronger than expected, rising $17.8bn to stand at a total of $4.977tn. The consensus was looking for a $13bn increase while there was an upward revision to borrowing in May of around $2bn. Nonetheless, the trend is one of softening growth in consumer credit, particularly for revolving credit, which is predominantly credit card borrowing.

Monthly change in US consumer credit ($bn)

Macrobond, ING

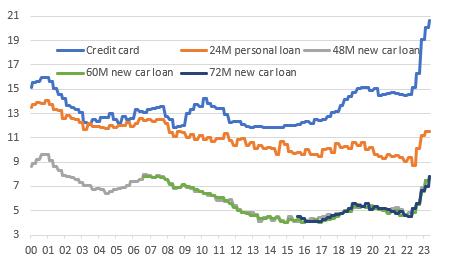

In fact, outstanding revolving credit fell $600mn to leave it at a $1.262tn. This is the first decline since April 2021 and likely reflects the sharp increase in interest rates charged for credit cards, which as of May was 20.68% – the highest since the Fed's data begins in 1972 and up from 14.51% in January 2022. News stories over the weekend suggest that the typical credit card borrowing rate you will be able to get in early August is around 3 percentage points higher than that.

Household borrowing costs (%)

Macrobond, ING

Non-revolving credit, such as personal loans and vehicle loans, rose $18.5bn to stand at $3.735tn. Here too there has been a slowdown over recent months, likely reflecting higher loan interest rates, but June was a good month for car sales, which helped support the numbers.

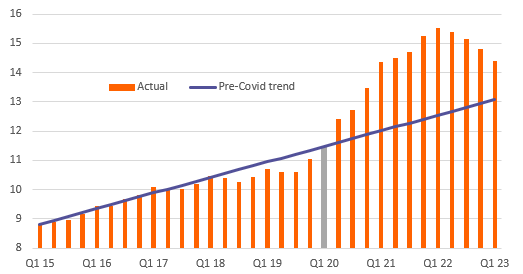

Savings and low borrowing costs have been supporting spending, but this might not last

A combination of easy borrowing conditions and the running down of savings accumulated during the pandemic has kept spending firm despite high inflation eroding household incomes. The stock of outstanding consumer credit has increased by $873bn since bottoming in May 2020, while the stock of outstanding household cash, checking and time savings deposits has fallen $1.1tn between the first quarter of 2022 and the first quarter of 2023 according the Fed’s flow of funds data. This combined $2tn has been a major contributor to the economy avoiding recession in the face of the Federal Reserve’s aggressive series of interest rate increases.

Pandemic excess savings are being run down – household cash, checking and time savings deposits versus pre-Covid trend (tn)

Macrobond, ING

While households are likely to continue to run down savings, the excess that was built up during the pandemic will be exhausted by the end of this year based on the trend seen in the past four quarters. Moreover, the latest Federal Reserve Senior Loan Officer Opinion survey showed banks increasingly unwilling to make consumer loans and as the chart below shows, there is a strong 12M lead for this survey in terms of predicting the path ahead for consumer credit.

Fed's SLOOS survey points to steep downturn in consumer credit

Macrobond, ING

Given consumer spending is two-thirds of economic activity in the US, this is a troubling signal. If consumer borrowing does turn negative and households exhaust their excess savings we will need to see rising real incomes to keep consumer spending positive. While this is possible, it highlights again that the risks for economic activity, particularly for the household sector, remain to the downside.

More By This Author:

Does Japan’s Higher Rate Cap Materially Hurt Treasuries?Monitoring Turkey: Inflation Fever

The Commodities Feed: Russia-Ukraine Tensions Add To Oil Supply Risks

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more