Unconventional Wisdom

Conventional wisdom:

- US growth stocks continue to dominate the US stock market.

- Growth stocks have outperformed value stocks for a long time and the last year of AI driven gains shows that isn’t changing.

- US stocks have outperformed the rest of the world and that isn’t going to change because we have the best companies.

- The dollar is strong and for good reason – the US economy is better than the alternatives.

- You don’t need to own gold or commodities in your portfolio.

- Commercial real estate is in crisis so you shouldn’t own REITs right now.

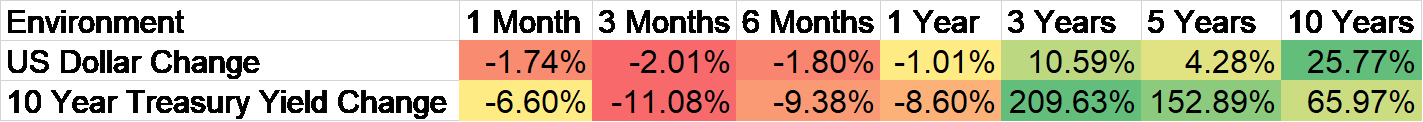

If you’re looking at the past decade, then most of this is an accurate depiction…of the past. But what if these trends are changing? How do you know when to call the end of one trend and the start of a new one? You certainly wouldn’t want to wait for the 10 year record to favor value before making a shift, adjusting your portfolio. And it appears to me that these items may already be in the process of being proved wrong – even if most people haven’t noticed. The economic environment, the one so many people have gotten wrong over the last few years, has changed. The post-COVID era is proving to be trickier than normal in some ways but the big drivers of future investment returns haven’t changed. Interest rates and the value of the dollar are still the most important prices in the world for investors and the movements of the last few years is mostly normal compared to history.

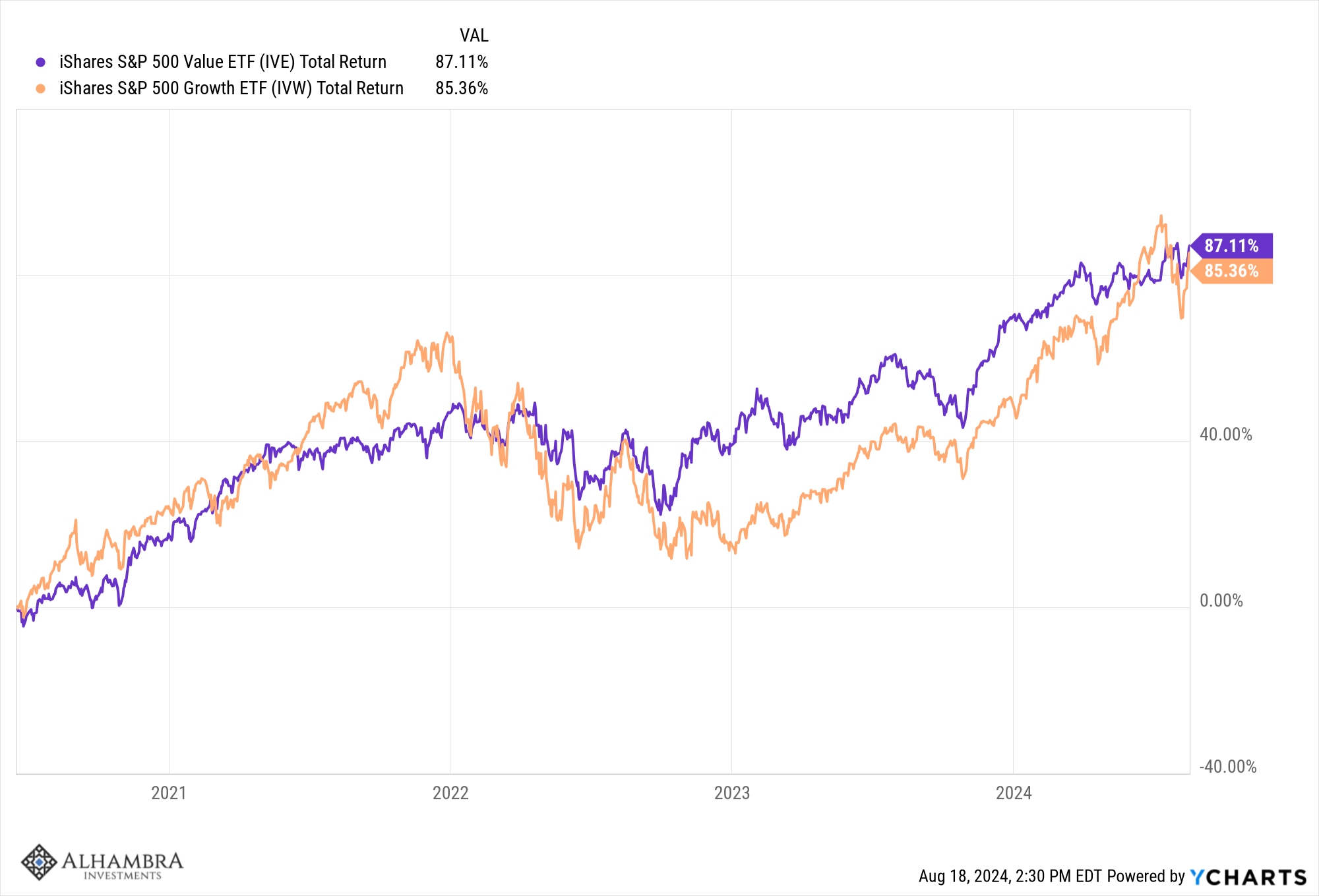

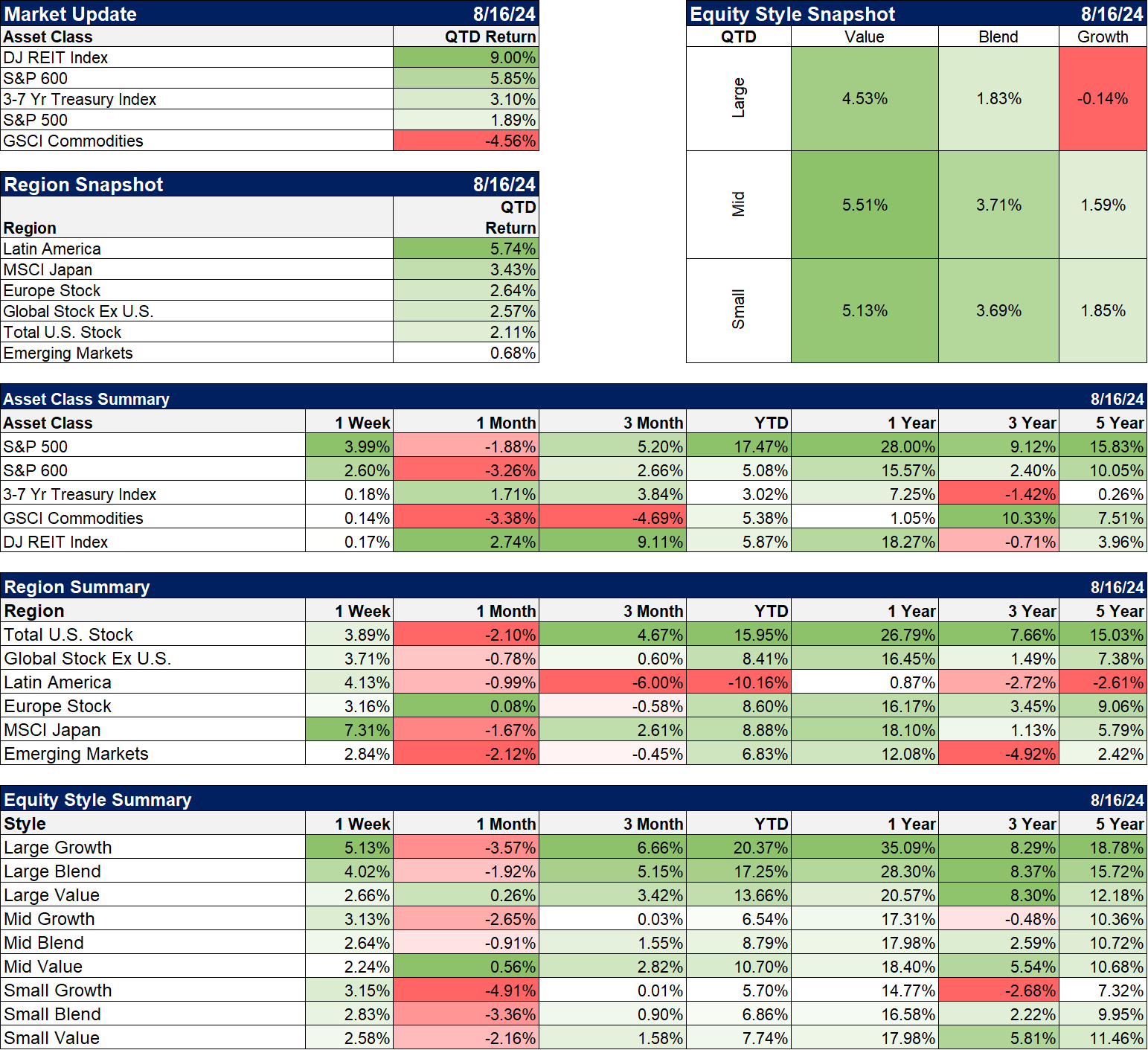

There is an ongoing rotation in markets that is happening so slowly I don’t think a lot of investors are even aware of it. Everyone is so focused on the recent performance of Large cap growth stocks – and especially the Magnificent 7/AI stocks – that the rotation to value stocks has escaped their notice. But it is happening across every market cap range and even in non-US stocks. It’s also been going on a lot longer than just the last couple of months when technology and other big growth stocks have taken a hit. The S&P 500 value index has outperformed the S&P 500 growth index over the last 4 years (since 6/17/20). As you can see, value has been in the lead for most of those four years, except for the surge in growth stocks at the end of 2021, right before the 2022 bear market and this year. The value index didn’t rise as much in 2021, but it didn’t fall as much in 2022 either. Sounds like a decent tradeoff to me. Is value outperformance a trend yet? Maybe, maybe not but one thing is undeniable; this isn’t the dominant narrative.

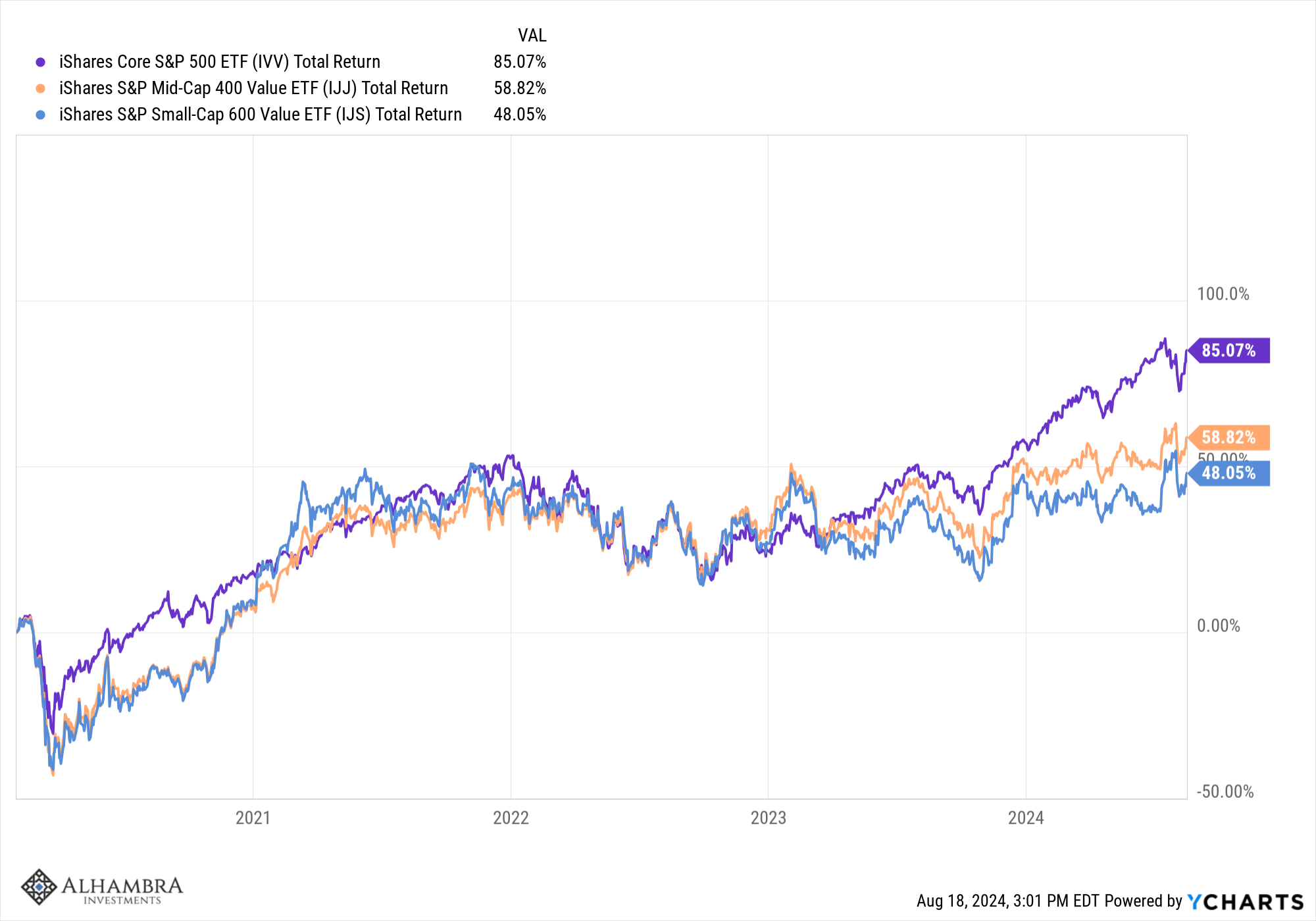

The outperformance of value extends to mid and small cap stocks as well and it’s actually a little longer than in large caps. The S&P 600 (small cap) and 400 (midcap) value indexes have outperformed S&P 600 and 400 growth since the onset of COVID (2/1/20).

Obviously, the returns from large cap stocks have continued to beat mid and small caps over that time so that trend hasn’t changed. On the other hand, the outperformance of large cap stocks since the onset of COVID has really been produced mostly since the beginning of this year during the AI boom. At the end of last year large cap was up but not by a lot. And smaller stocks also have outperformed since early June and especially this quarter to date (see below under the Markets heading).

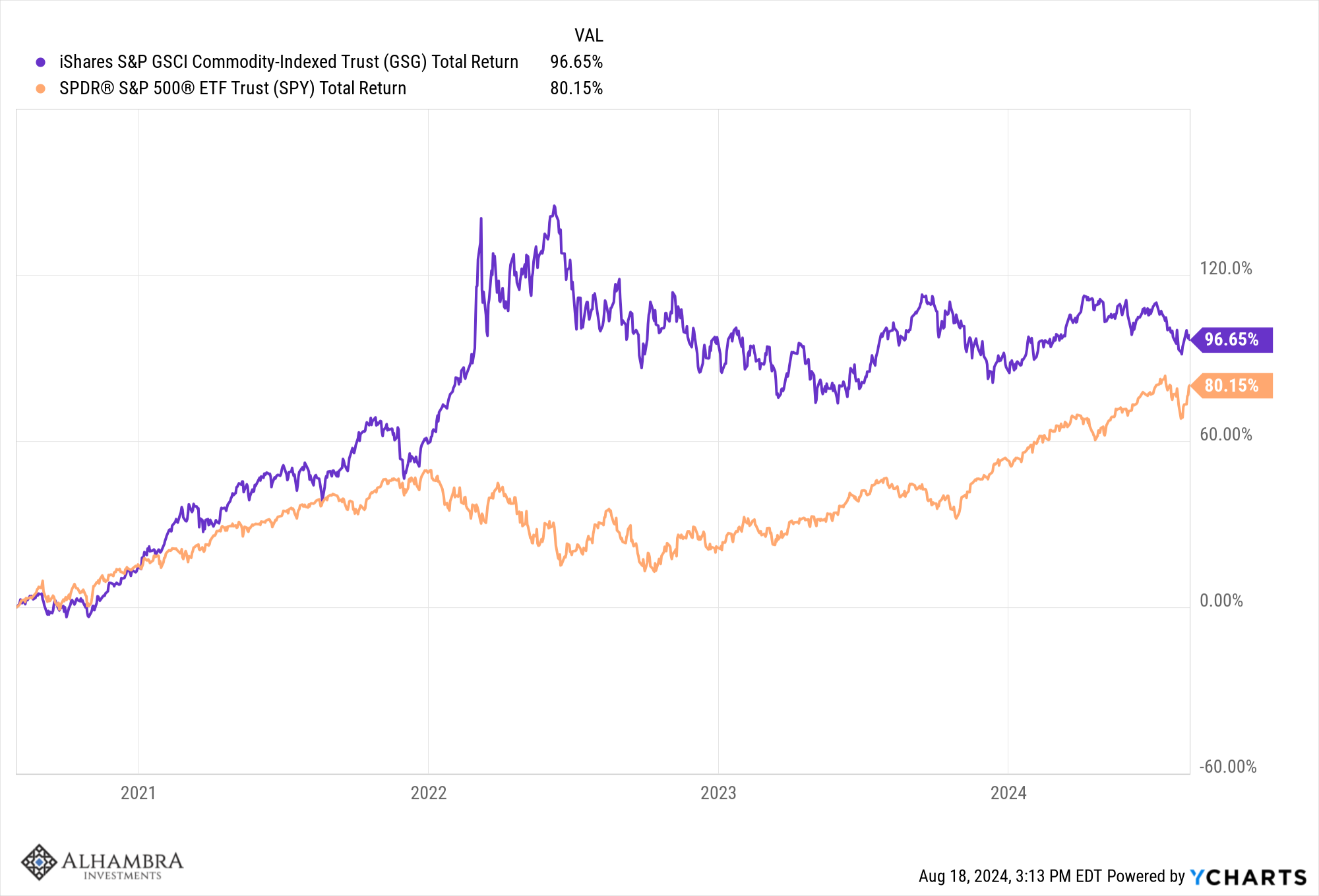

Why has value started to outperform? As I said above, the drivers of future returns are the interest rate and US dollar trends. When rates fell all the way to 0.5% in the summer of 2020, it was pretty easy to believe that rates had hit bottom. And I mean hit bottom in a secular kind of way, not just some short term blip. So, we’ve been in a rising rate environment since then and guess what? Value stocks have historically outperformed growth stocks in a rising rate environment. The average return of large value stocks in years when rates rise is 11.5% while large growth stocks manage an average of 9.4%. So, value outperformance is not surprising. Small value stocks also have a record of outperformance in rising rate environments. Commodities and gold also tend to outperform in rising rate environments although gold is more sensitive to the movements of the dollar. Commodities have outperformed the S&P 500 since rates started to rise in August of 2020:

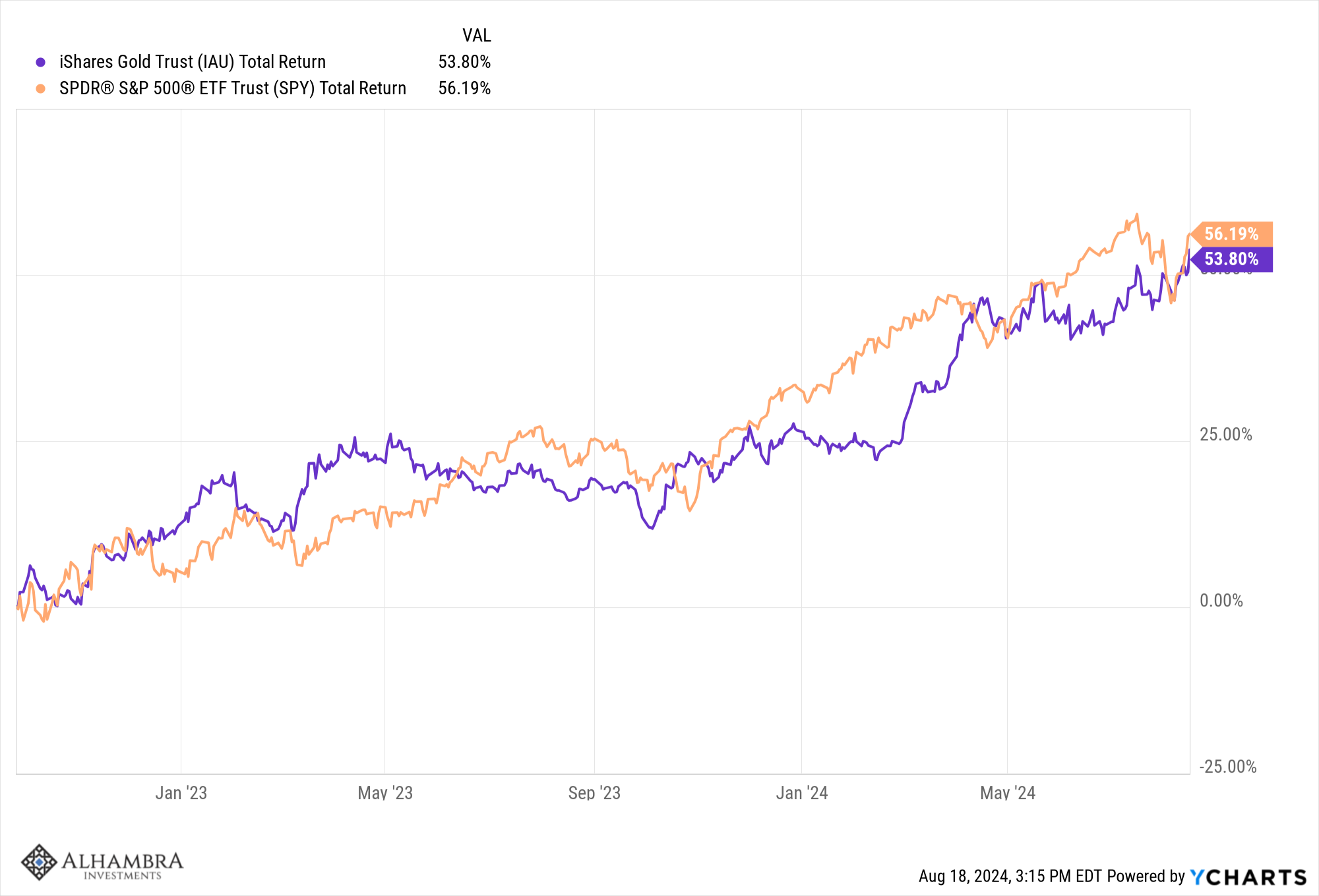

Despite the big run up in large cap growth stocks recently, gold has kept pace with the S&P 500 since the dollar peaked in September of 2022:

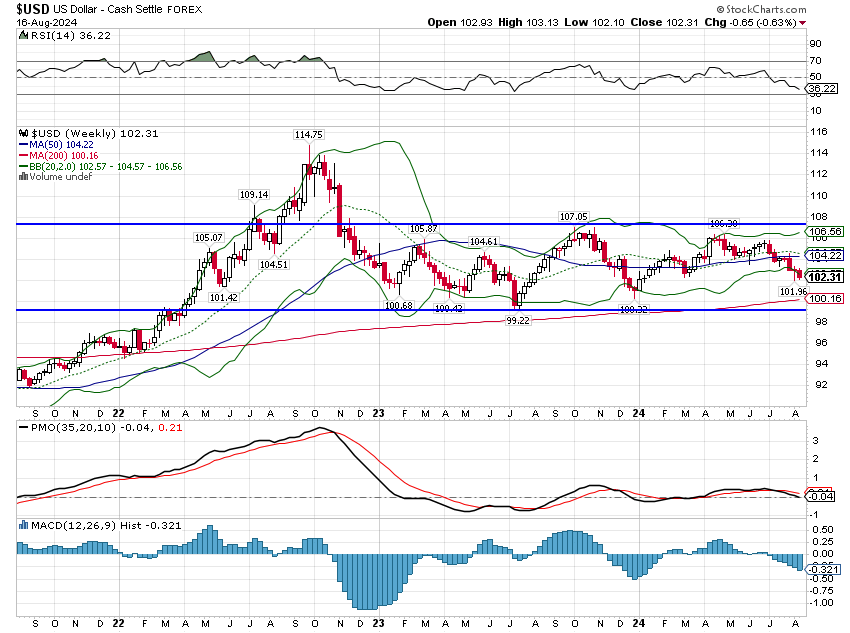

There hasn’t yet been much movement toward international stocks but that may be starting to change as well. The dollar is down over the last year which is flying a bit beneath the radar; everyone is still talking about a strong dollar. The drop over the last year is minimal but since the last week of September 2022, the dollar index is now down nearly 11%. International stocks tend to outperform when the dollar is falling and indeed the EAFE index has risen 51.4% over that time. Yes, the S&P 500 is up 56.2% but it took an AI boom to do it. You might also find it interesting – I certainly do – that European stocks, despite what is going on in Ukraine, have outperformed the S&P 500 over that time, up 64.1%.

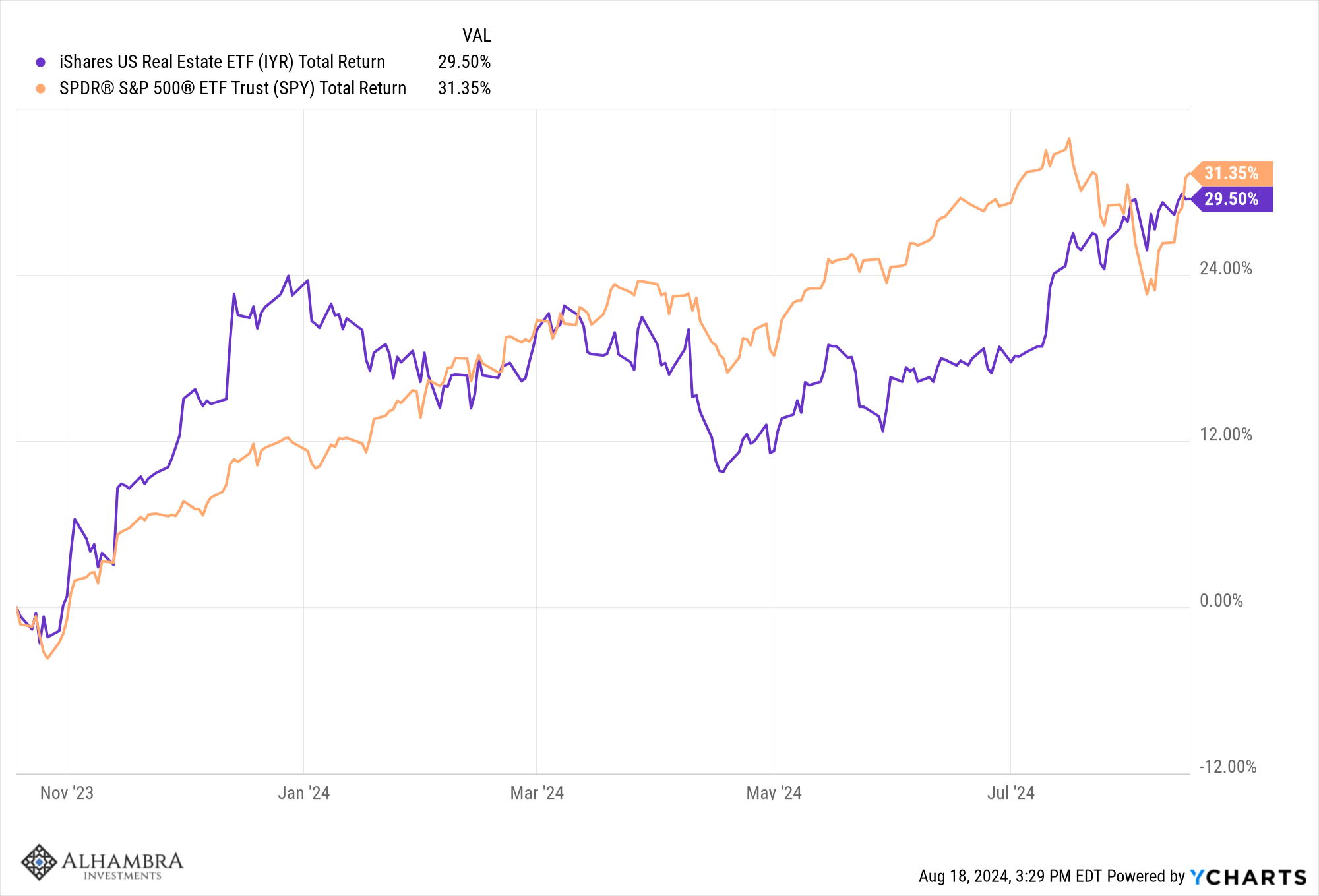

The performance of REITs recently should have also caught your attention. REITs have underperformed the S&P 500 for quite some time but since the 10 year rate peaked last October, REITs have returned almost the same as the S&P 500. REITs have historically performed very well in a falling rate environment and this one has been no different.

The commercial real estate market has been pounded by the Fed’s rate hikes but if the problems were mostly caused by higher rates, lower rates should solve them. On a cyclical basis, that’s exactly what we expect. I took some heat last year for holding REITs and I admit that I underestimated the rate impact on the sector. I thought rates would peak with the inflation rate in the summer/fall of 2022 and while that was close it wasn’t close enough. There was a subsequent, nominal, new high in rates in October of 2023 and REITs continued to underperform until that second peak.

Conventional wisdom is rarely wise, but is rather an excuse to not think, to just go along with the flow. Bucking conventional wisdom, being a contrarian is hard on the psyche because even when you are right, you can be wrong for periods that feel like forever. Growth stocks have outperformed a lot this year and over the last 20 months (since the beginning of 2023). But if you go back just a little further, you find that the switch to value stocks in the post-COVID era is well underway. Is it a shift that will last for years to come or is it already over? Is the recent shift to smaller stocks sustainable? Will the dollar continue its downtrend with non-US stocks, gold and commodities leading? I don’t know but those are the trends now no matter what you read and hear from most of the investment world.

Environment

Both the 10 year (SPTL) Treasury yield and the US dollar index are now down year over year. That hasn’t happened in quite a while so it feels significant but there’s no way to know how long it will last. At present, both are extended to the downside so a rebound wouldn’t be surprising.

Markets

The correction in stocks that started in mid-July is essentially over with the S&P 500 less than 2% from its July 16th high. Small and mid cap stocks are a little further away at 3-5% below their highs depending on which index you use (we do not use the Russell 2000 (IWM) because of its low quality). But other asset classes have picked up the slack from stocks – diversification works! Gold (GLD), REITs and intermediate term bonds are all higher over that time. Taking a little longer view, the third quarter has most asset classes higher and in a twist from last quarter, the S&P 500 (SPX) is the laggard. REITs in particular have performed quite well, up 9% so far in Q3 and the one year return is now the second best among the major asset classes we use in our portfolios, up over 18%.

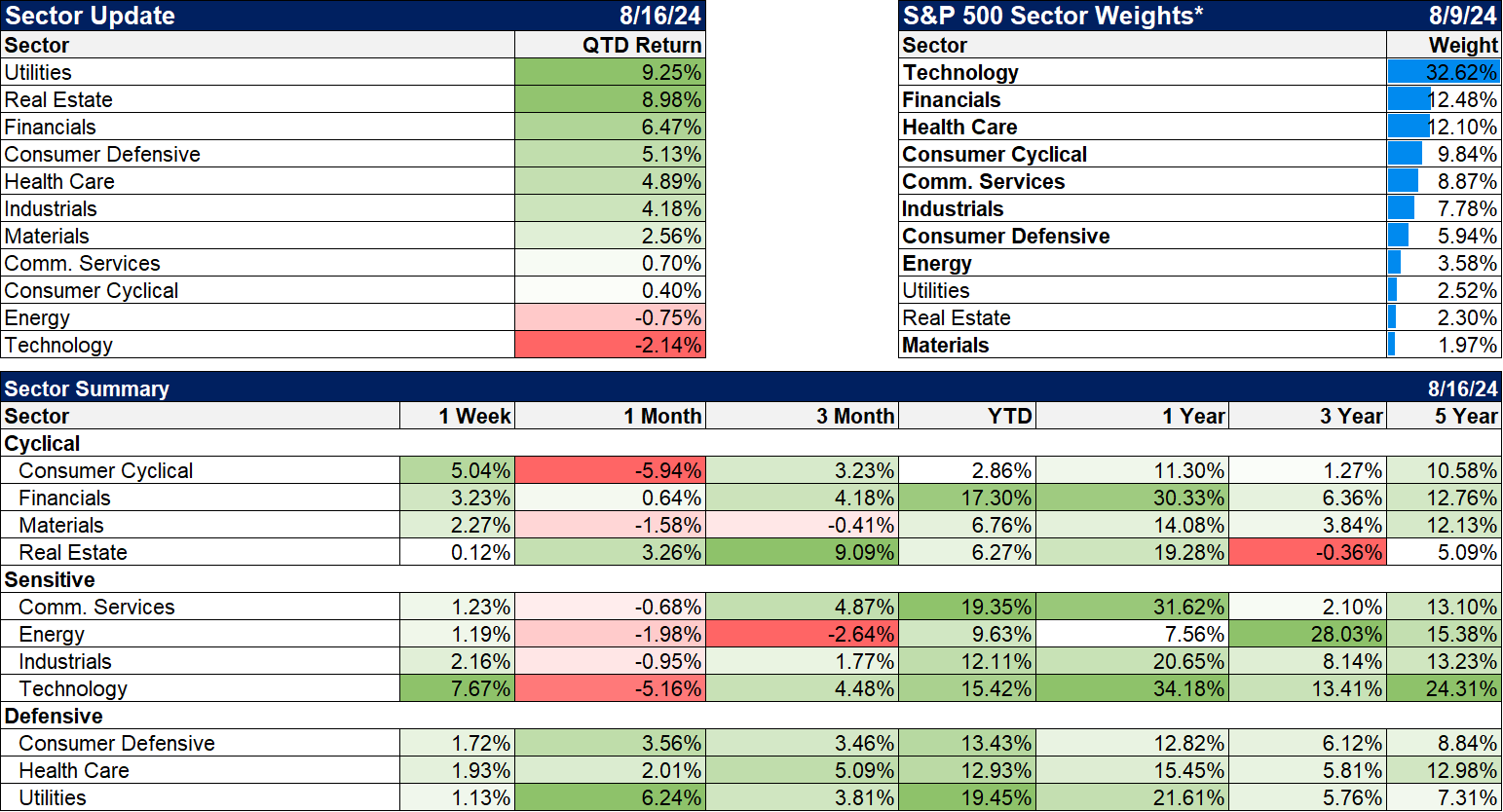

Sectors

This quarter, so far, has been led by interest sensitive sectors – utilities, REITs and financials. It isn’t surprising then to see defensive sectors like health care next on the list.

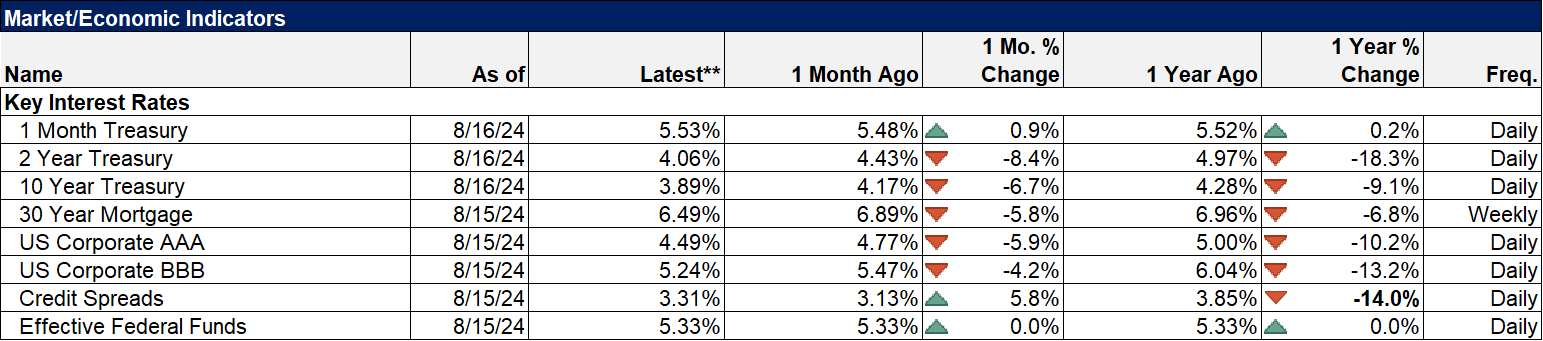

Market/Economic Indicators

The inflation reports last week were slightly better than expected and the markets took that as a signal the Fed would go ahead with a rate cut in September. For now that looks like a good bet but probably for just a quarter point.

Mortgage applications have been rising lately as rates come down and that will ultimately have a positive impact on real estate of all types. But rates aren’t falling fast – and we should be thankful for that because if they were it would mean the economy is doing poorly – so it may take a while.

Retail sales were better than expected but some of that may have been auto purchases getting completed late after last month’s software glitch. But retail sales ex-autos also showed a nice gain, up 0.4% which is better than the recent trend.

Two regional Fed surveys – NY and Philly – produced mixed results with NY improving and Philly falling back a bit. I think this is still consistent with an eventual improvement in goods production but we’re still coming out of the trough progress is slow.

Jobless claims, which spooked everyone a couple of weeks ago by spiking up to 250k fell back to 227k. There’s no there there.

Housing starts and building permits both fell as the new home market is still having some inventory issues.

Credit spreads narrowed last week after a brief spike over the last couple of weeks. Spreads are still pretty tight although off the lows of the cycle.

More By This Author:

Weekly Recap & DARP Update

What? I Can’t Hear You For All The Noise!

Wall Street Casino Craziness

Disclosure: This material has been distributed for informational purposes only. It is the opinion of the author and should not be considered as investment advice or a recommendation of any ...

more