“Turnaround On The Menu” Stock Market (And Sentiment Results)

Image Source: Unsplash

Papa John’s Update (PZZA)

(Click on image to enlarge)

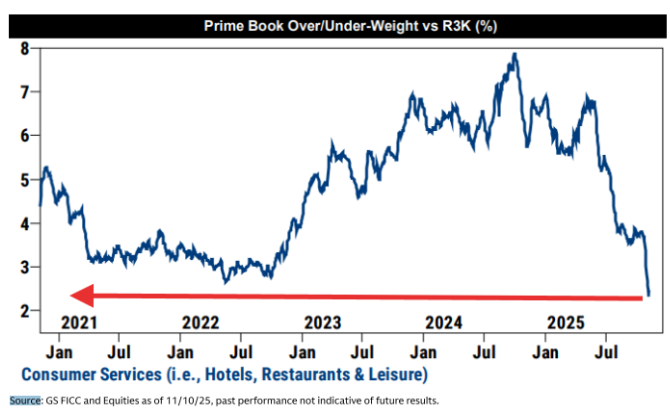

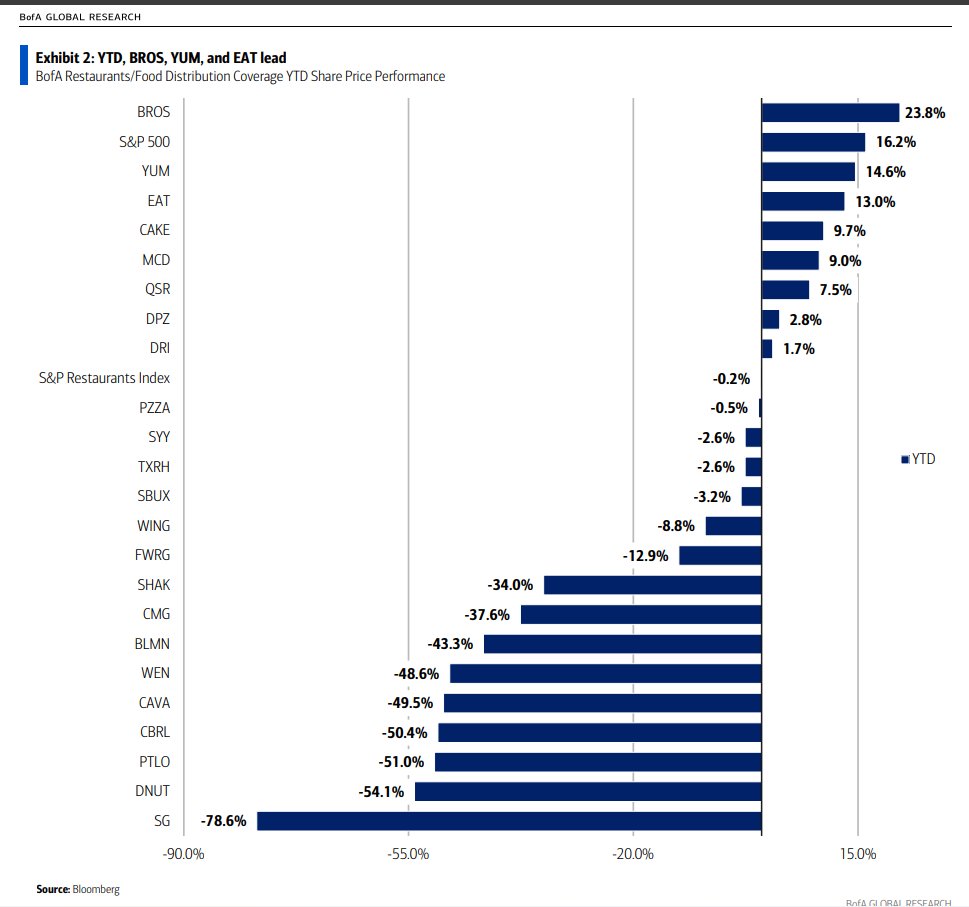

Papa John’s (PZZA) is a new position that gives us a fresh slice of exposure to the restaurant space, a corner of the market that has been taken out behind the woodshed all year.

(Click on image to enlarge)

We first went public with our Papa John’s thesis during a NYSE TV appearance on December 3, 2025 at the 5:50 mark:

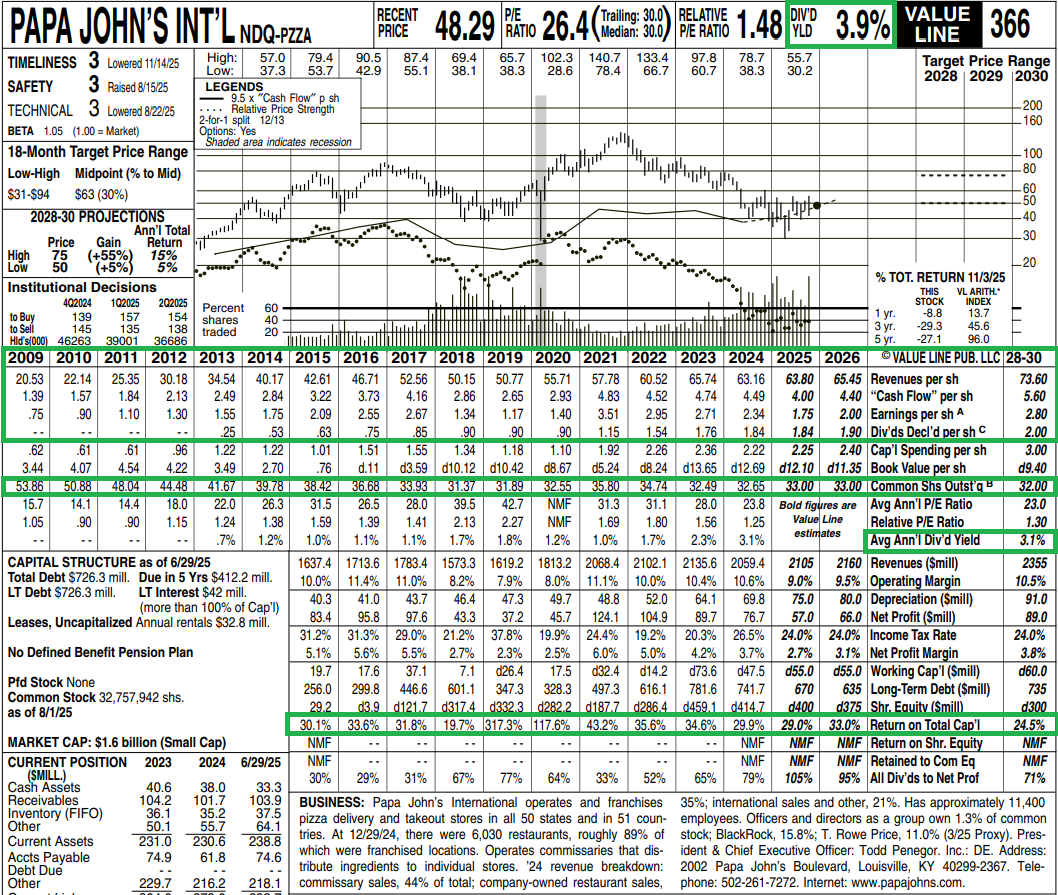

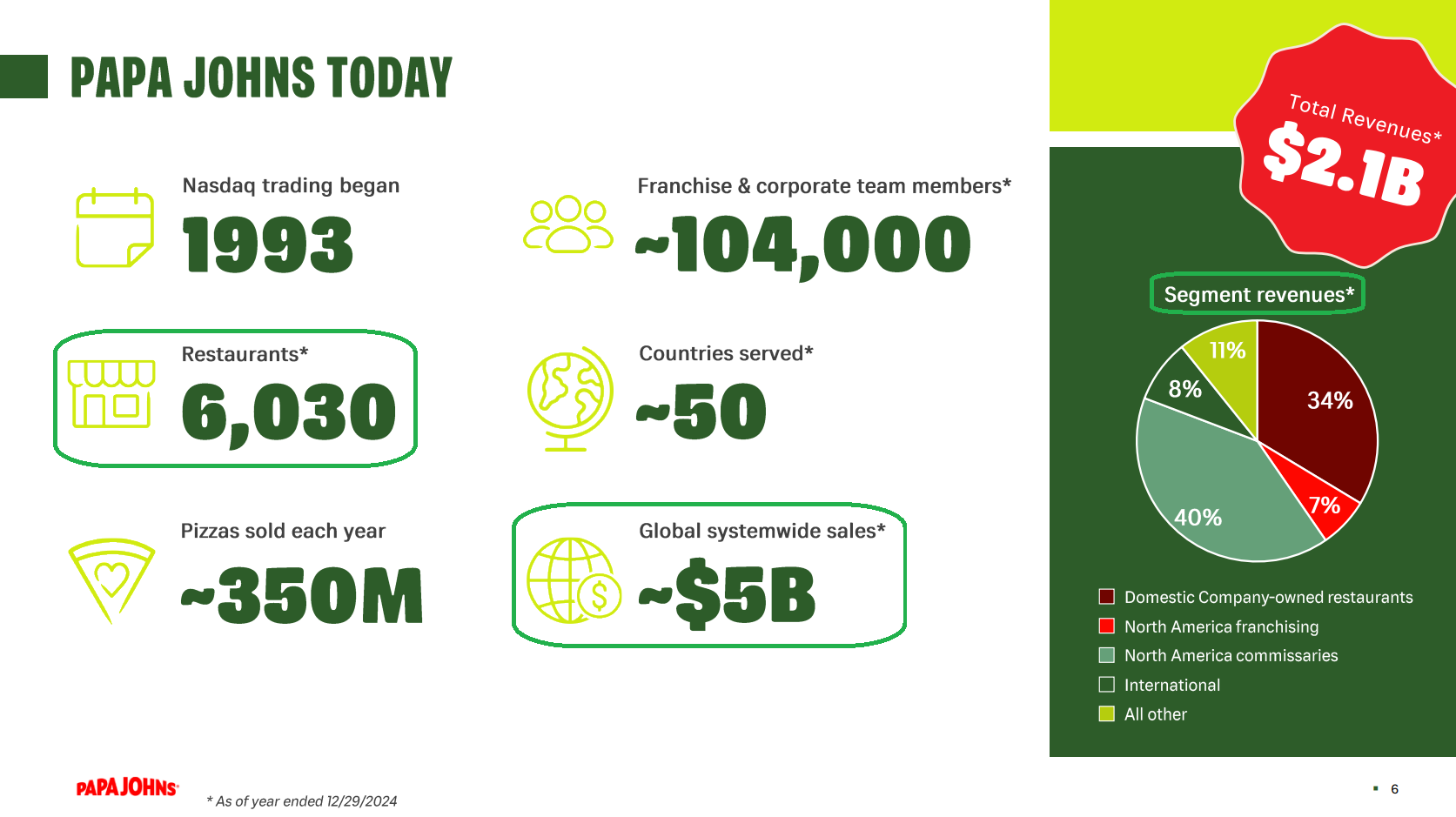

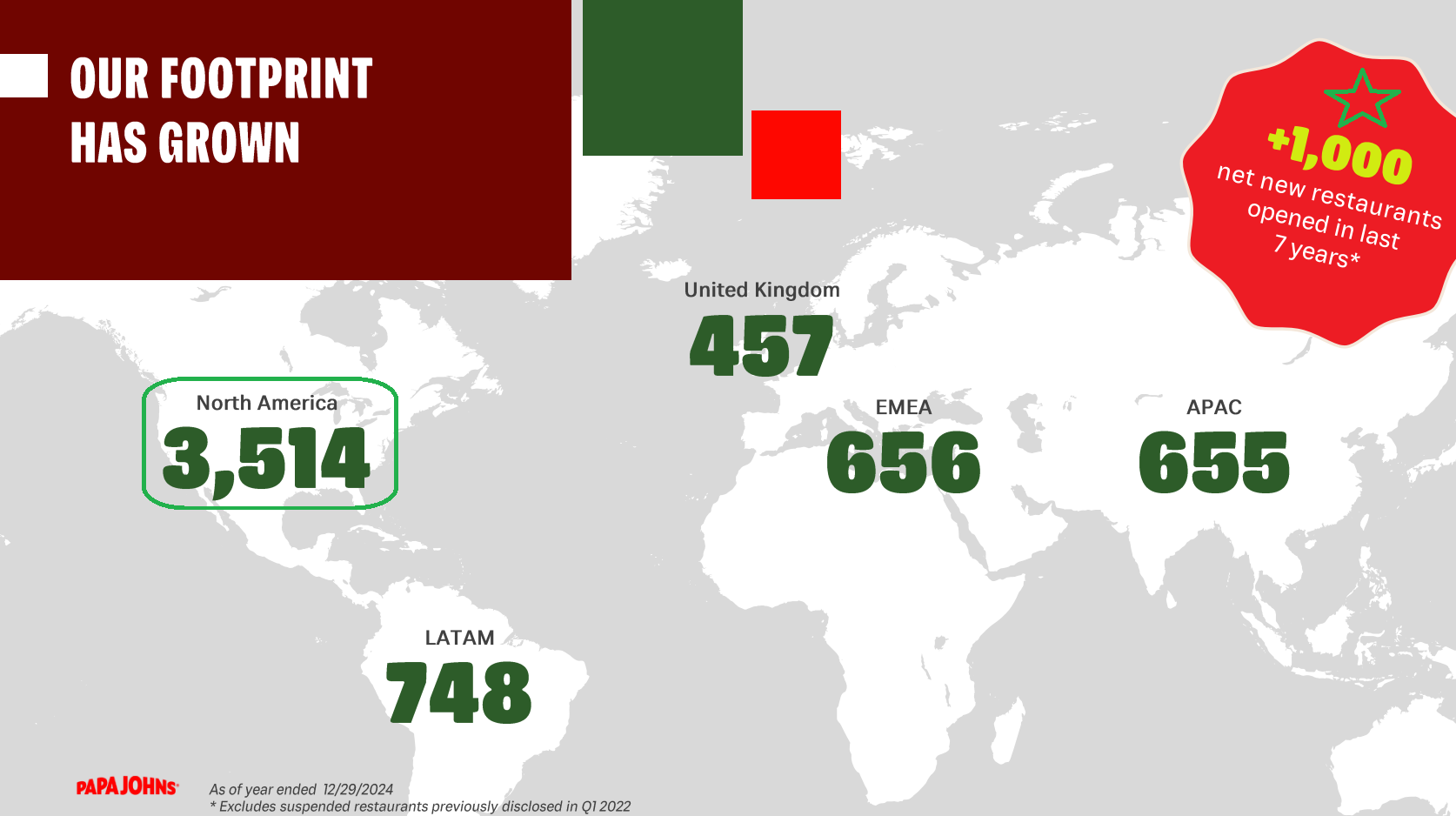

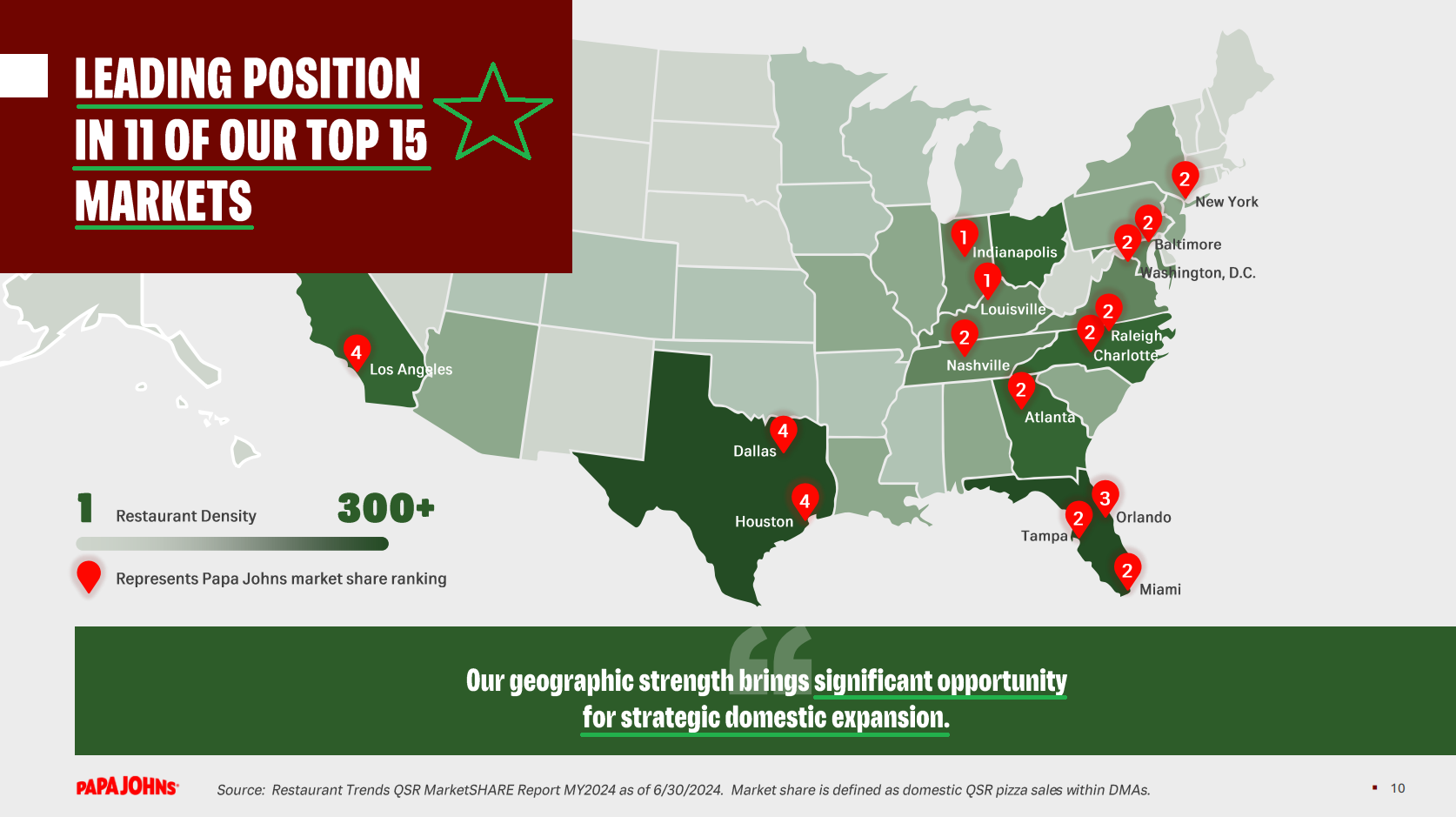

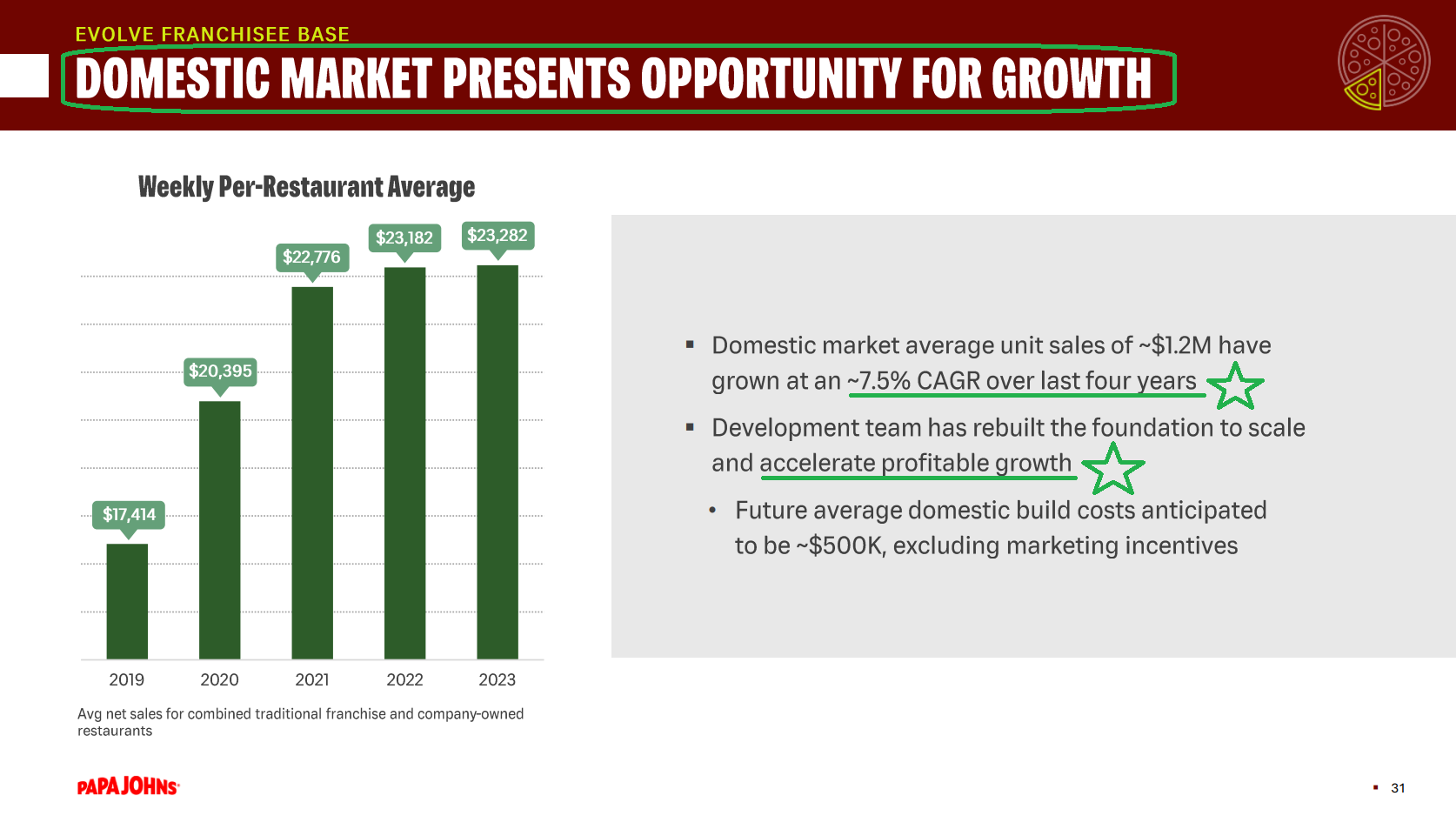

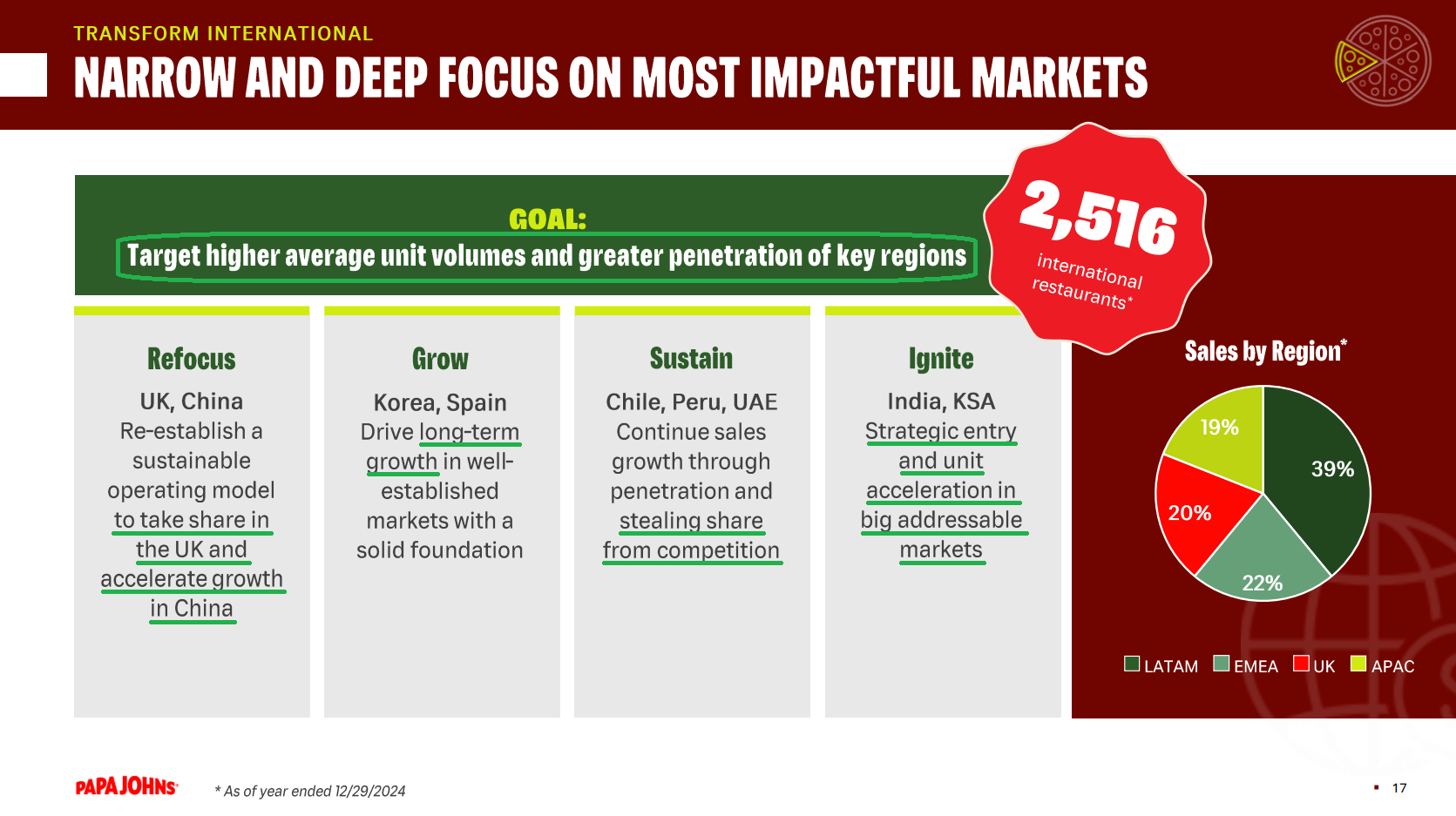

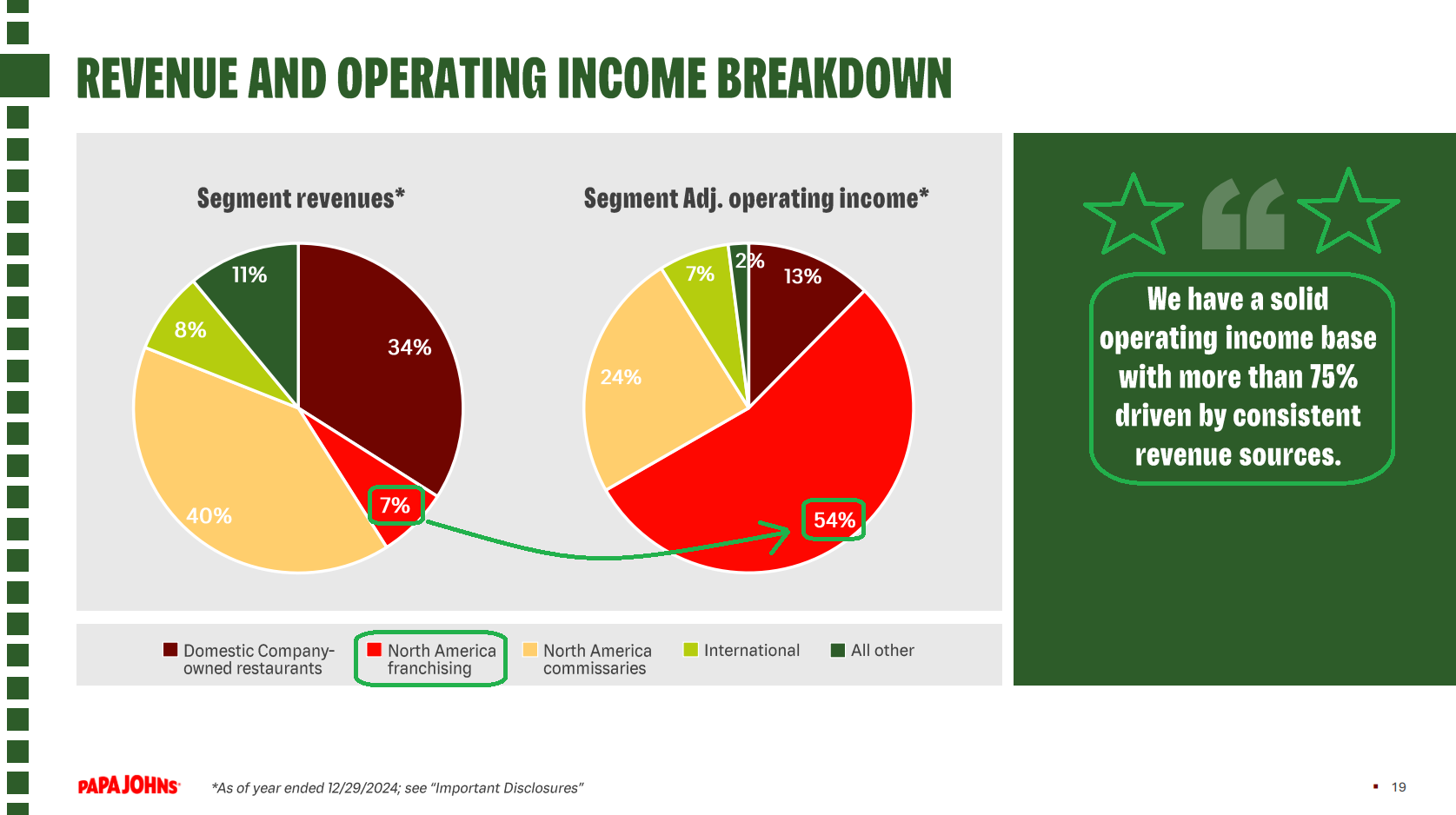

Founded in 1984, Papa John’s is a heavyweight in global quick service pizza with ~6,000 restaurants across 51 countries. It runs a highly asset-light, franchise-driven model (91% franchisee-operated) with a North America-concentrated footprint (~60% of units), where it commands leading share in 11 of its top 15 markets.

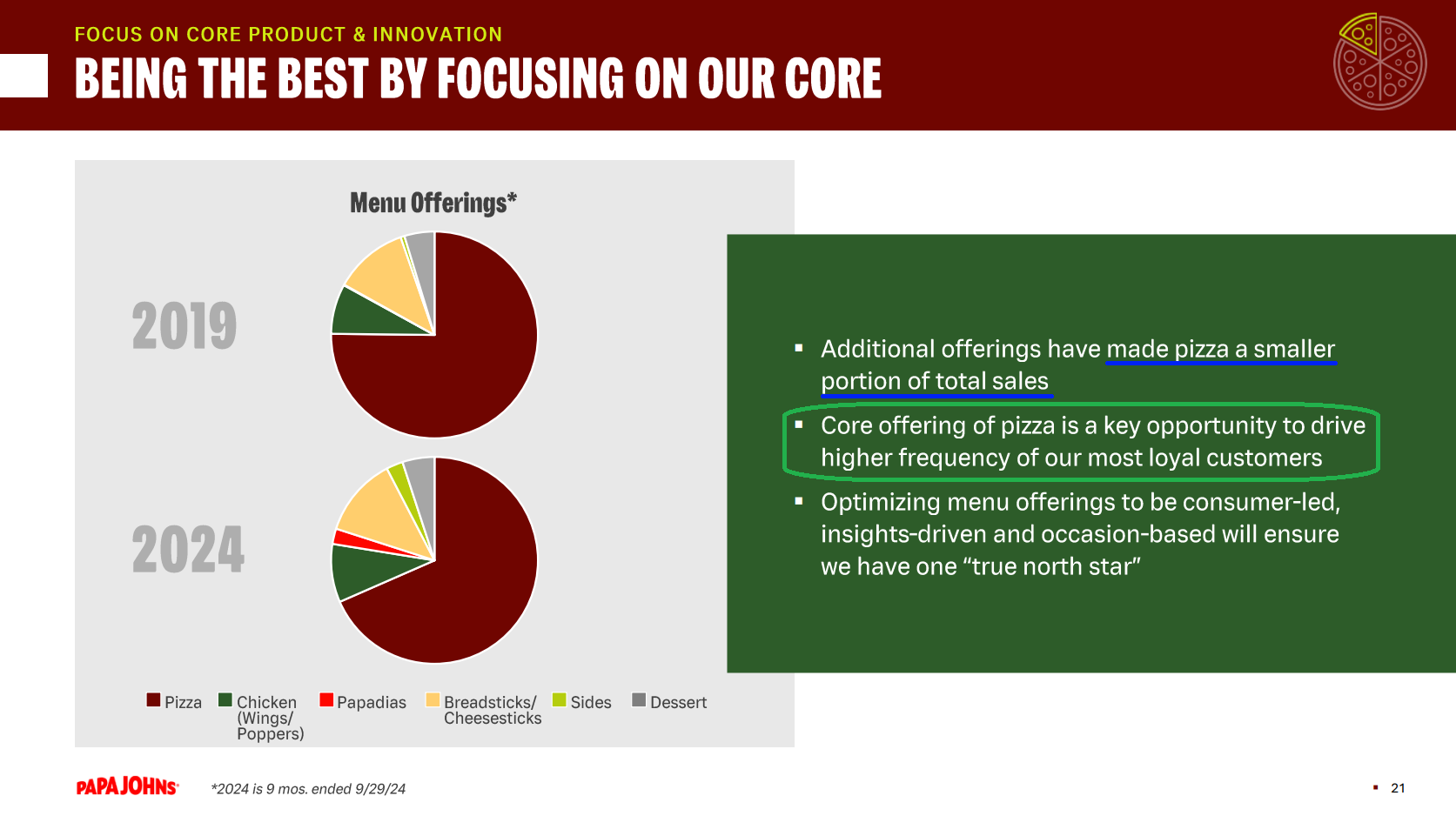

Lucky for us, the company spent the past few years tripping over its own feet. The 2017 founder controversy sparked a C-suite revolving door with four CEOs in seven years and no real executional stability. Missteps piled up, most notably a marketing pivot that scrapped the local co-ops that built the brand in favor of heavier national spending that failed to deliver, just as the CEO behind the change jumped ship for another job. At the same time, the menu ballooned with complexity that slowed operations and distracted from what made Papa John’s great: making high-quality pizza consistently. These self-inflicted wounds were compounded by rising input costs, a soft consumer backdrop, and aggressive QSR discounting, driving a ~70% drawdown from the late-2021 highs and setting up what we view as an attractive turnaround hiding in plain sight.

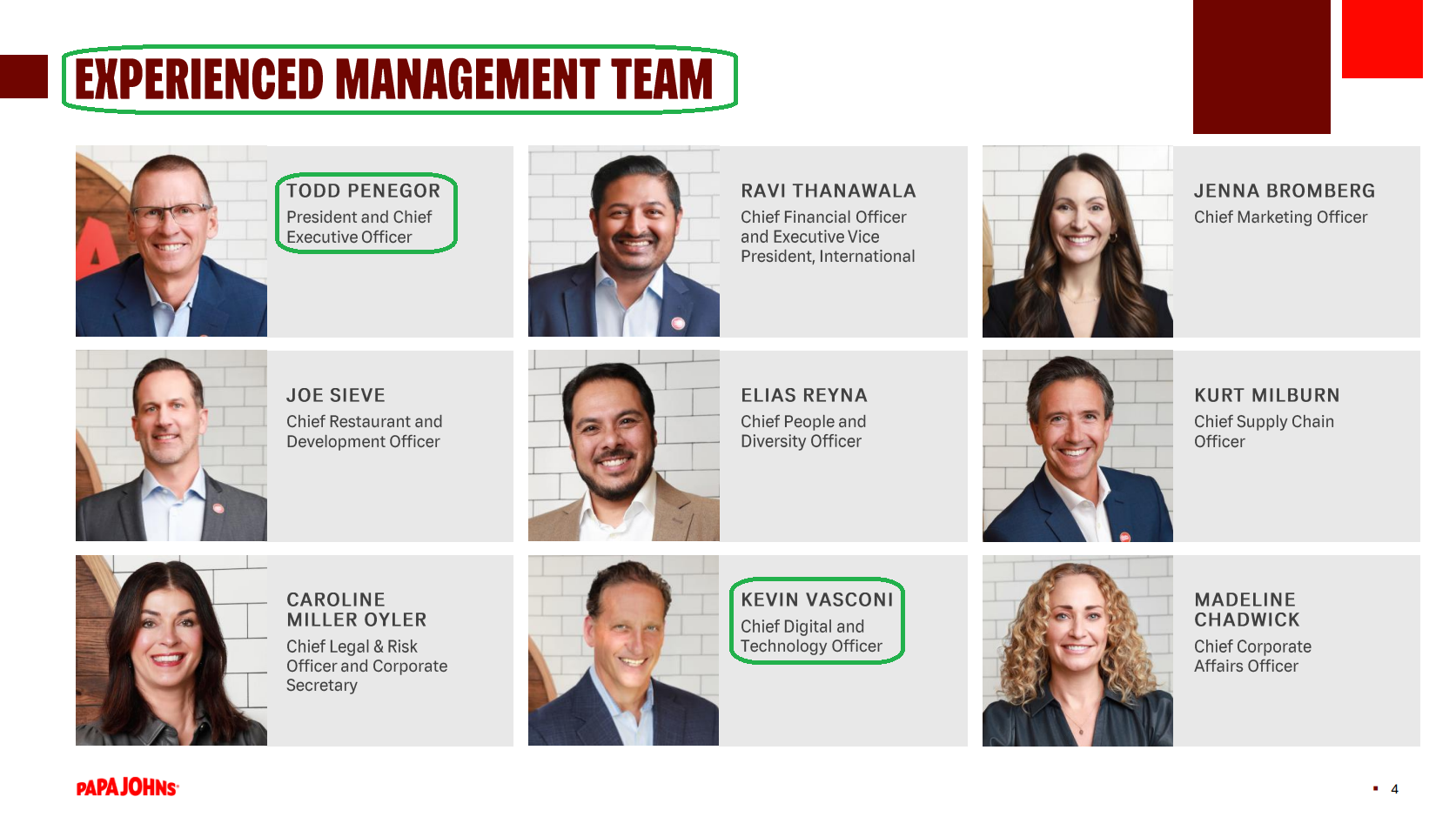

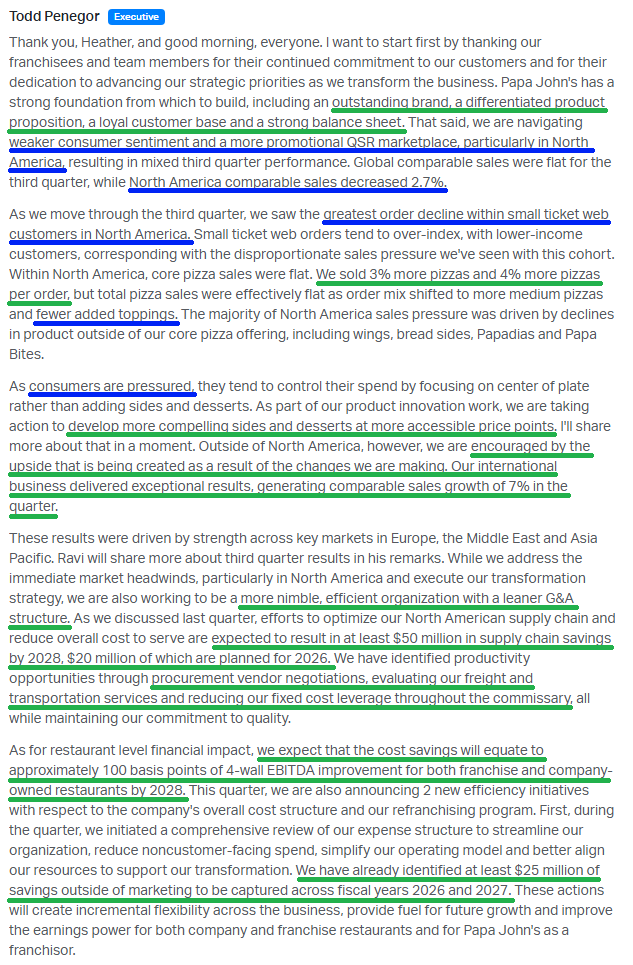

Our confidence in the turnaround starts with the right jockey now riding the horse. New CEO Todd Penegor is a proven winner in the restaurant space with more than 20 years of experience and QSR in his DNA, having grown up with a father who was a Wendy’s franchisee. Most recently, he served as CEO of Wendy’s from 2016 to 2024, where he led the turnaround by pushing digital, expanding internationally, and launching breakfast. Under his leadership, Wendy’s overtook Burger King as the #2 burger chain by sales and delivered the 12 straight year of same store sales growth, turning the stock into a 3-bagger and earning high praise from Nelson Peltz for his “tremendous contributions.”

(Click on image to enlarge)

Penegor has been in the Papa John’s kitchen for a little over a year now and before he even figured out where the coffee machine was, he started running the same proven playbook. He laid out the strategy and early progress recently on a podcast recapping his first year and the road ahead, which is well worth a listen:

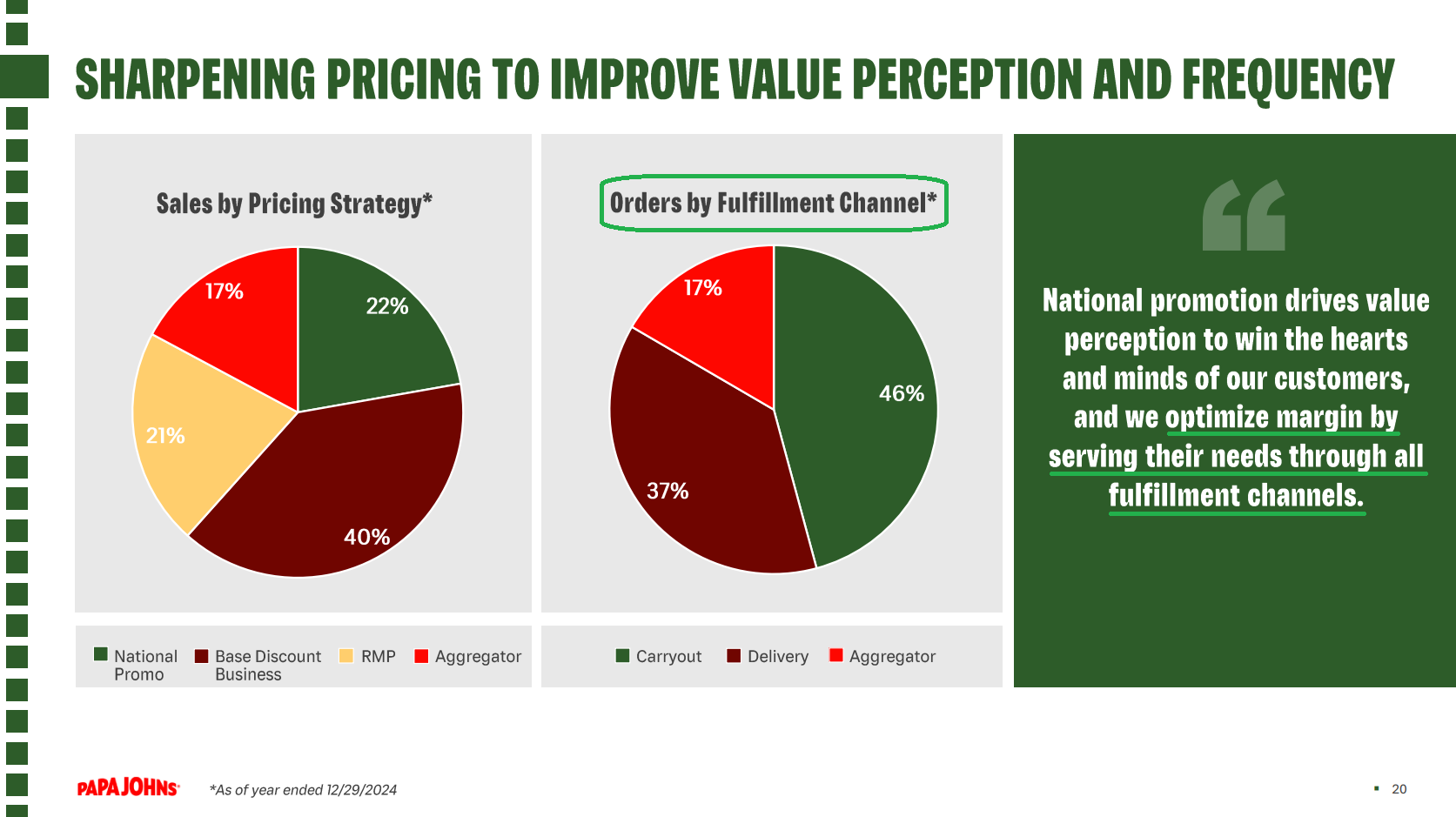

The Papa John’s turnaround isn’t rocket science. It’s back-to-basics blocking and tackling. Over the years, menu complexity layered far too many “rhythm breakers” that drove short-term sales but failed to drive the repeat frequency that wins in QSR pizza. Penegor is simplifying the menu around core products and it’s already paying off, with core pizza sales up 6% in Q2. Consistency had also slipped, so something as simple as oven calibration (making sure every pizza comes out at the same quality and temperature) kicked off in Q1 and is already improving quality and taste scores. When the product improves and execution gets simpler, volumes follow.

The digital pillar is just as important. With nearly 80% of orders coming through digital platforms, Papa John’s should be leading, not lagging. To close the gap, Penegor brought in Kevin Vasconi, an old Wendy’s ally who previously served as Domino’s CIO from 2012 to 2020 — a stretch when the stock turned into a more than 12x bagger as he built Domino’s into one of the largest e-commerce engines in the world at the time, behind only Apple and Amazon in transactions.

(Click on image to enlarge)

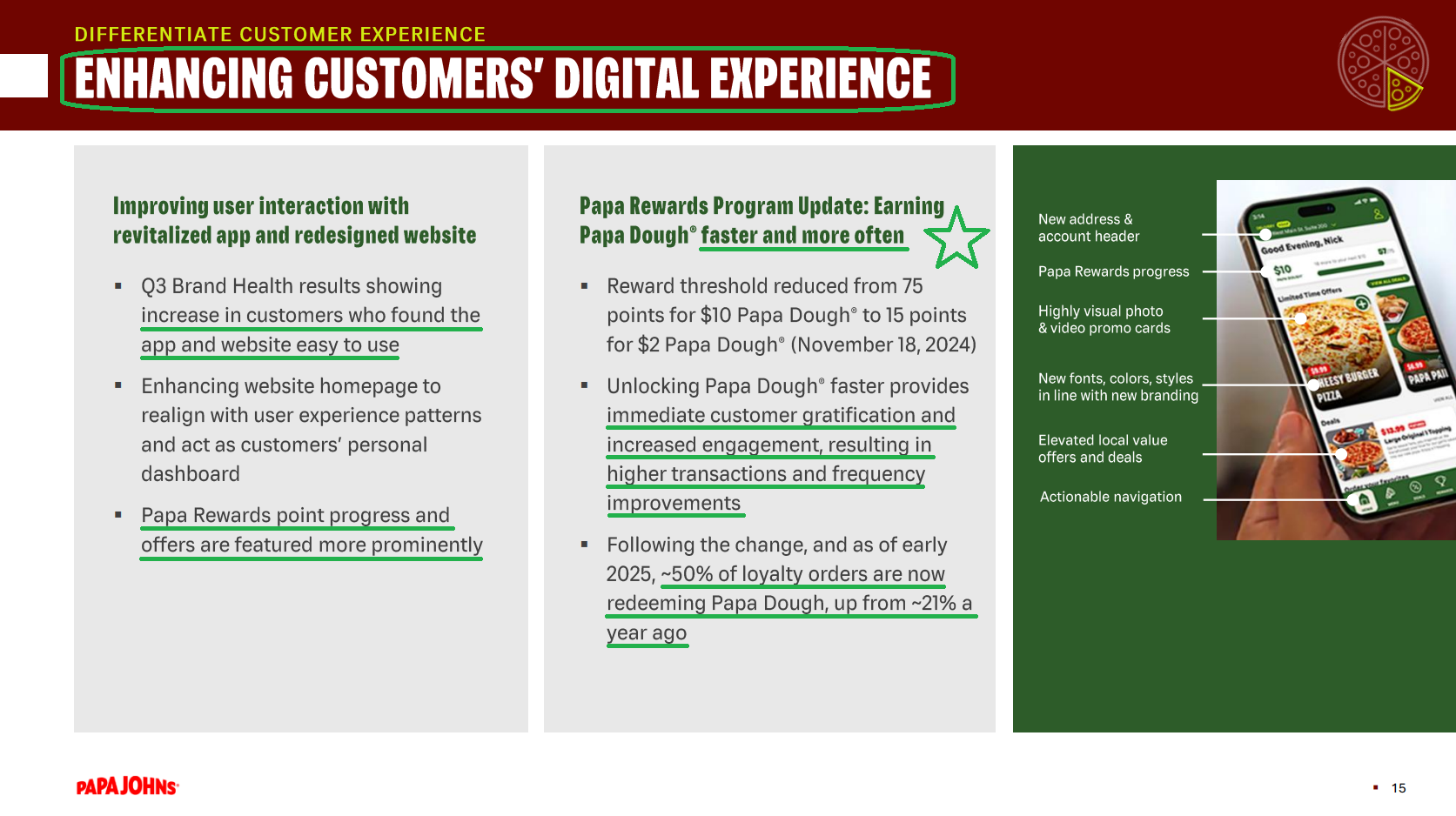

We are already seeing Vasconi’s fingerprints: a revamped app that cuts reorder time in half for favorite orders (~80% of volume), full delivery tracking rolling out system-wide (100% by Q1 2026), and a loyalty overhaul for ~40 million accounts that shifted from a clunky $75-spend-for-$10 reward to an easier $15-for-$2 structure driving frequency, repeat visits, and more than 50% higher conversion.

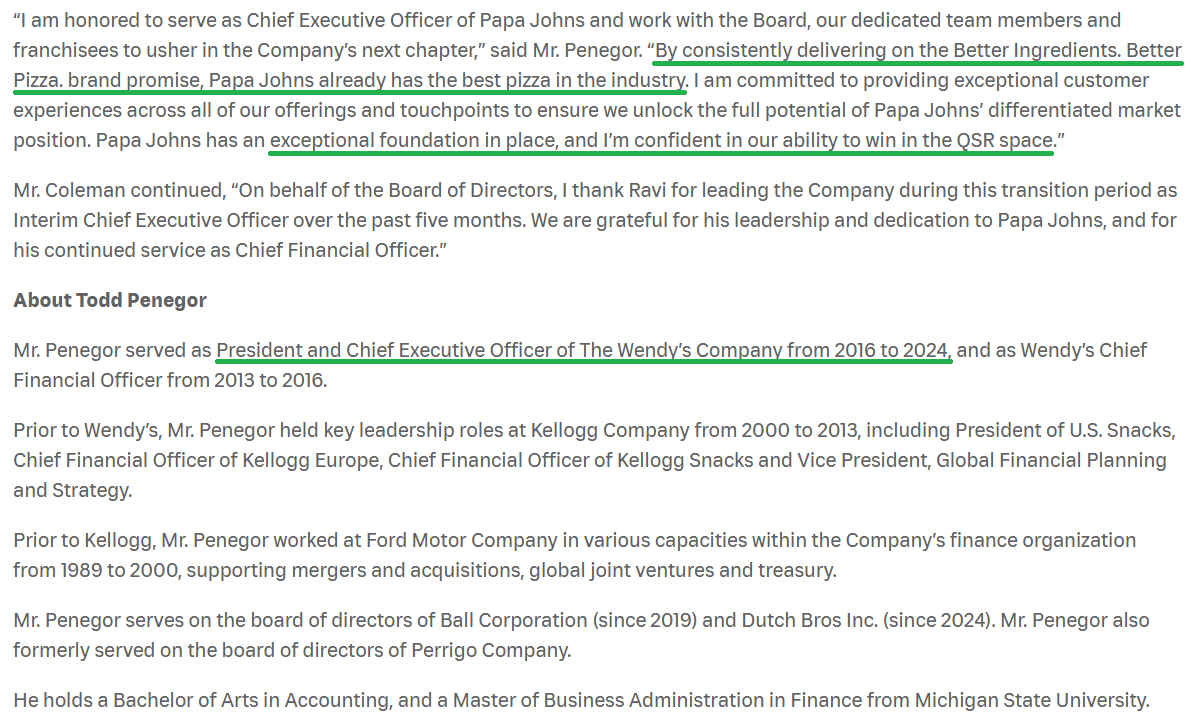

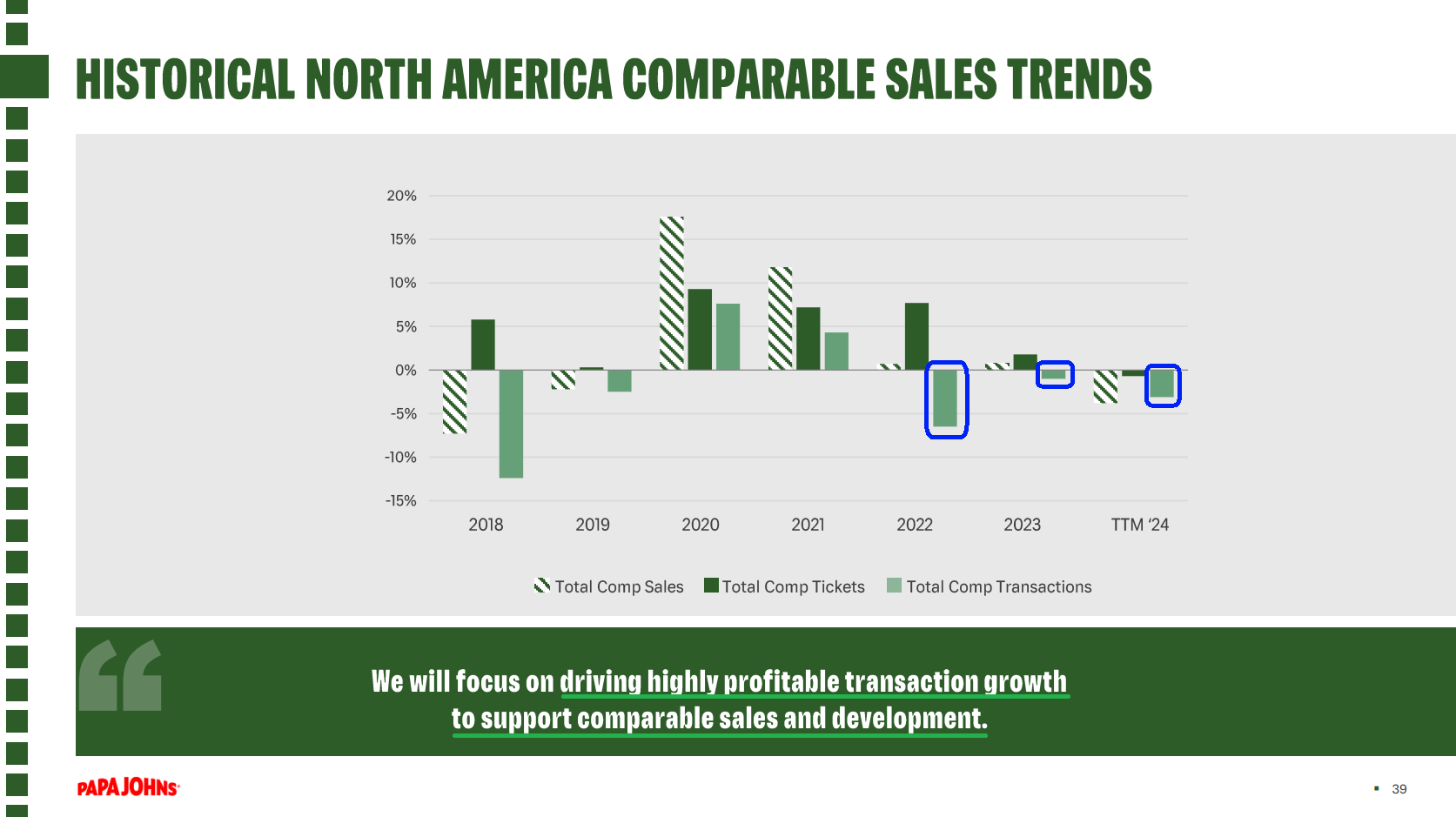

These early moves are starting to deliver encouraging signs, with international comp sales +7% in Q3 and the all-important North America comp sales beginning to stabilize and set for a recovery in 2026.

(Click on image to enlarge)

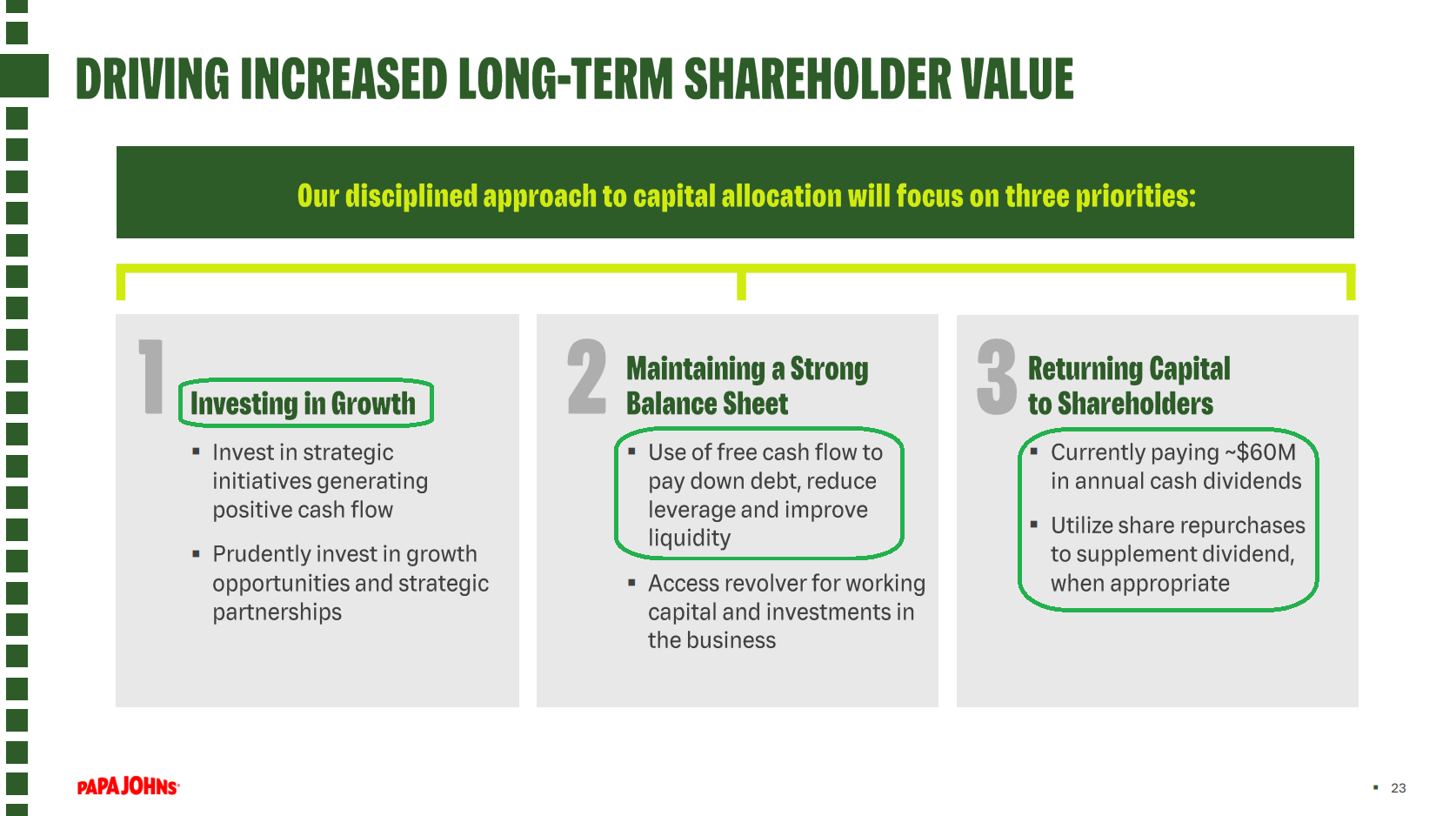

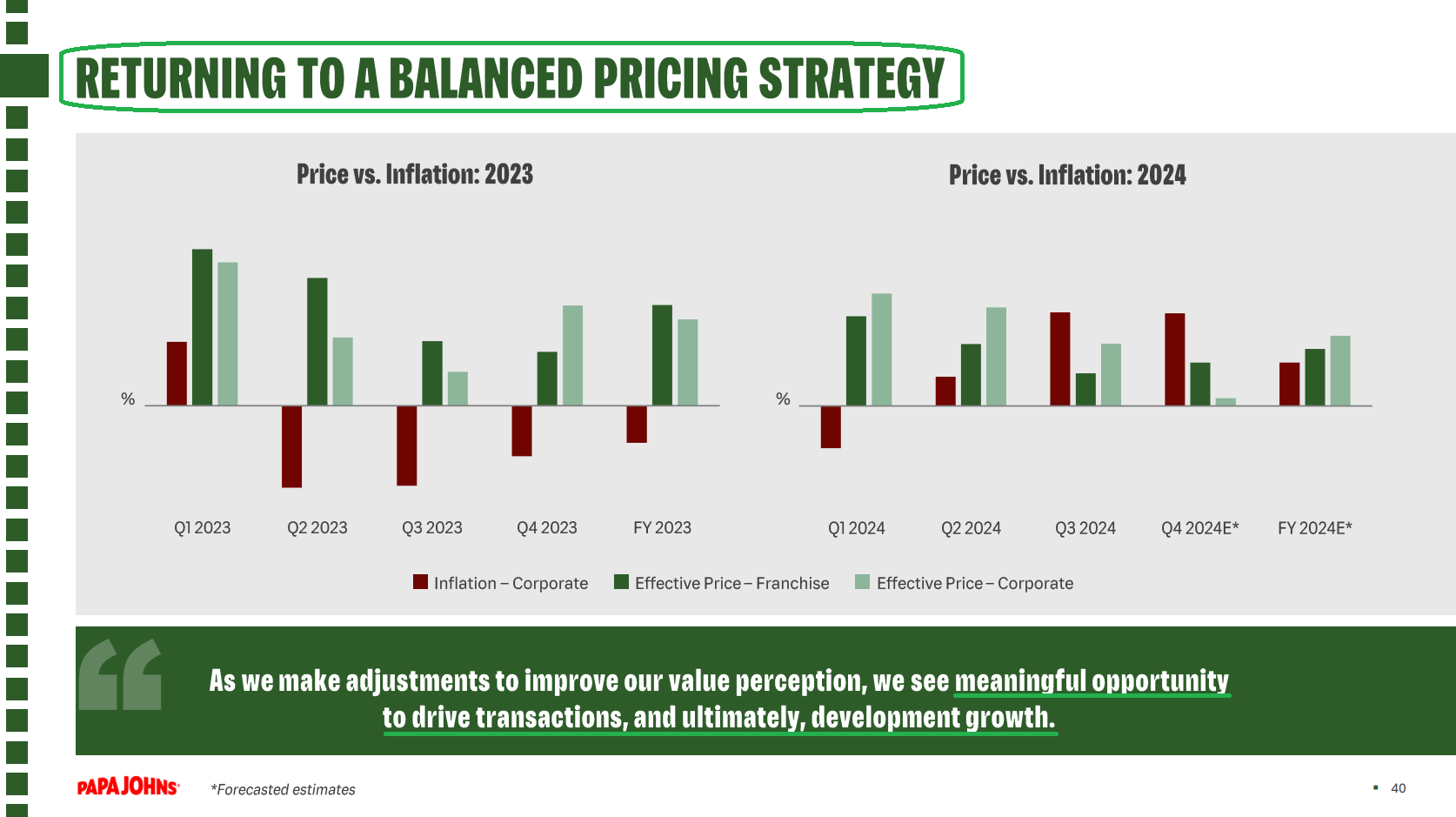

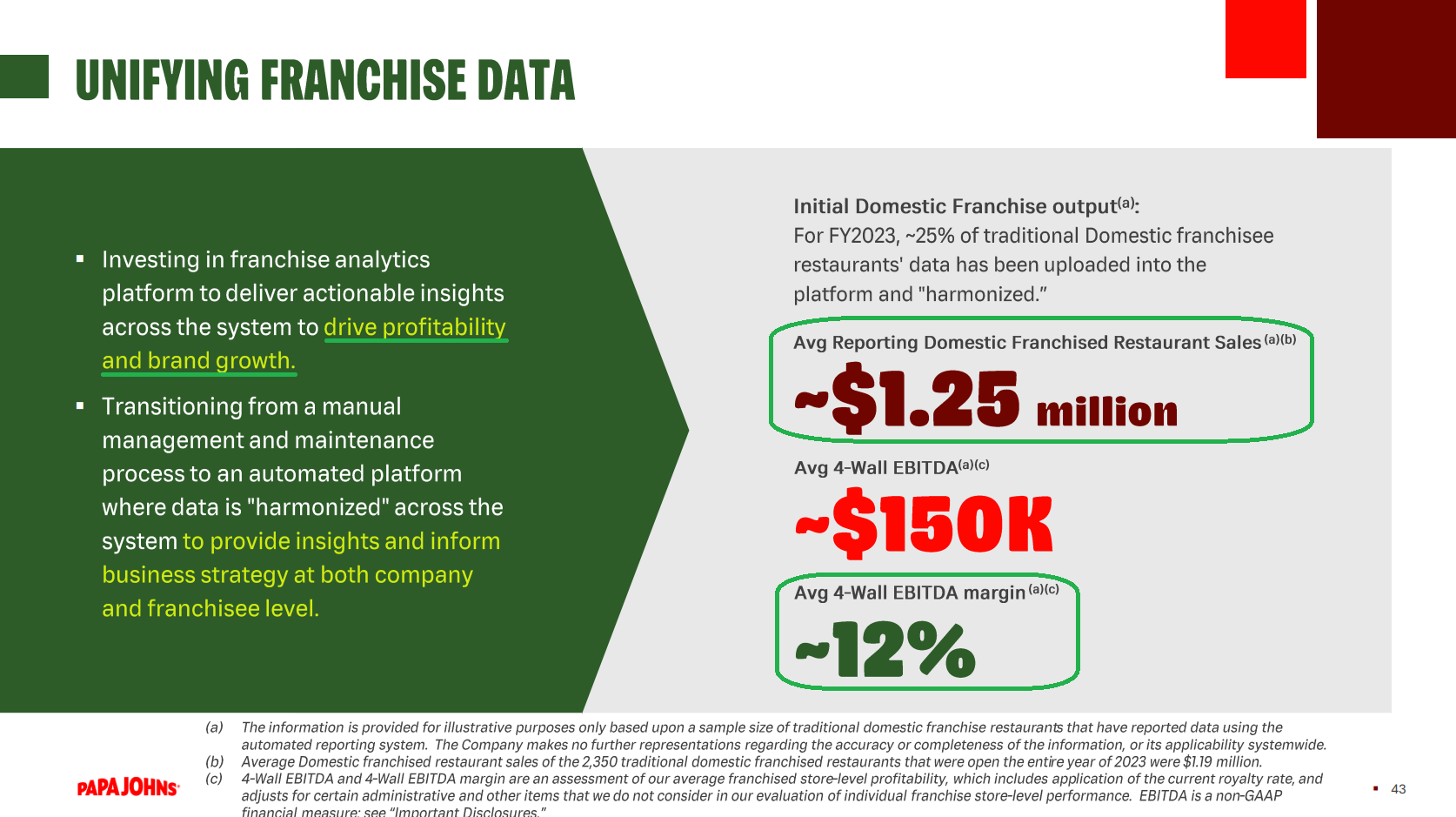

With product quality rebounding and comps stabilizing, margins become the next leg of the turnaround. Management has identified at least $50M in supply chain savings (with $20M hitting in 2026), plus another $25M of G&A savings, both fully phased by FY2028 and expected to deliver ~100 bps of 4-wall EBITDA margin expansion (from current ~12% levels). They’re also accelerating North America re-franchising toward a mid-single-digit company-owned target over the next two years — a capital-light pivot aimed at profitable growth, with an 85-restaurant deal already closed recently.

Put accelerating comps and margin expansion together and we see a clear path to normalized earnings power north of $3 per share and a potential double over the next few years.

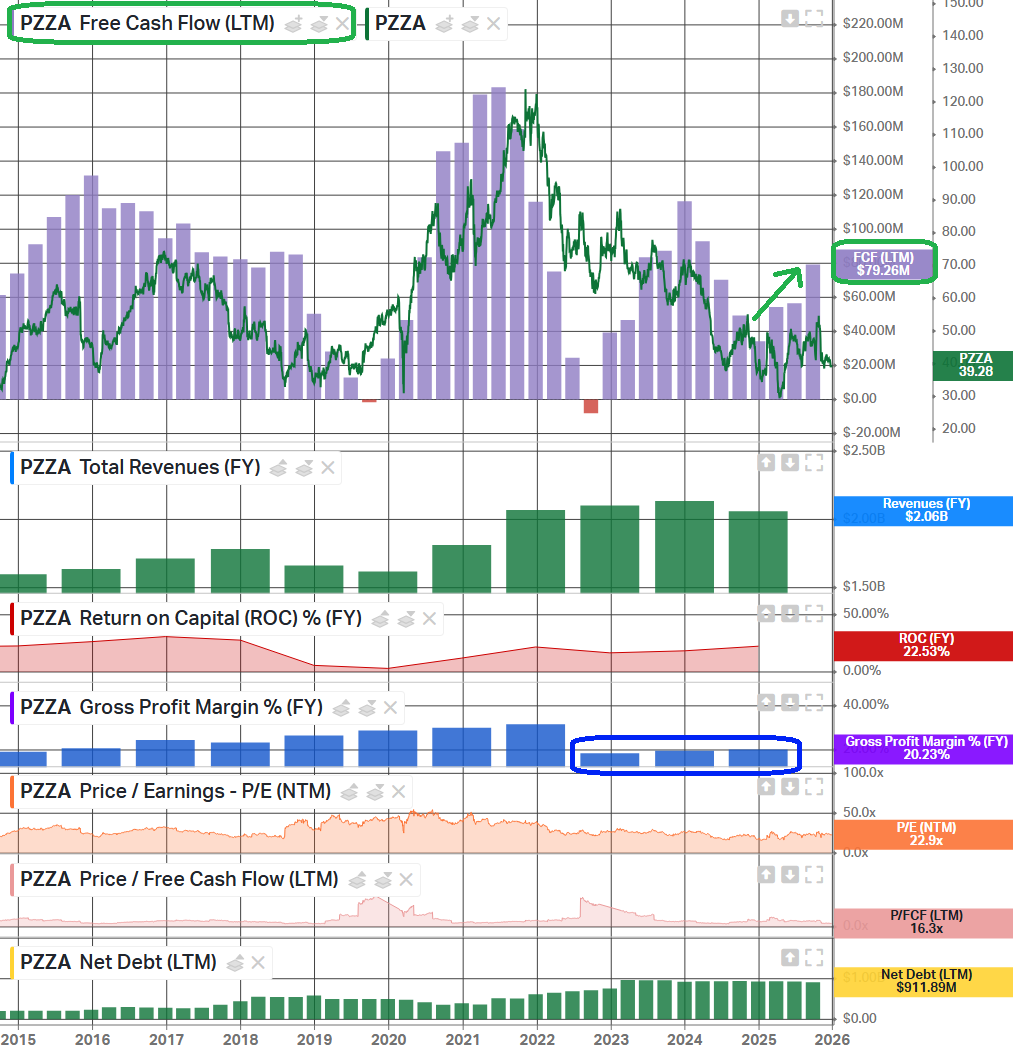

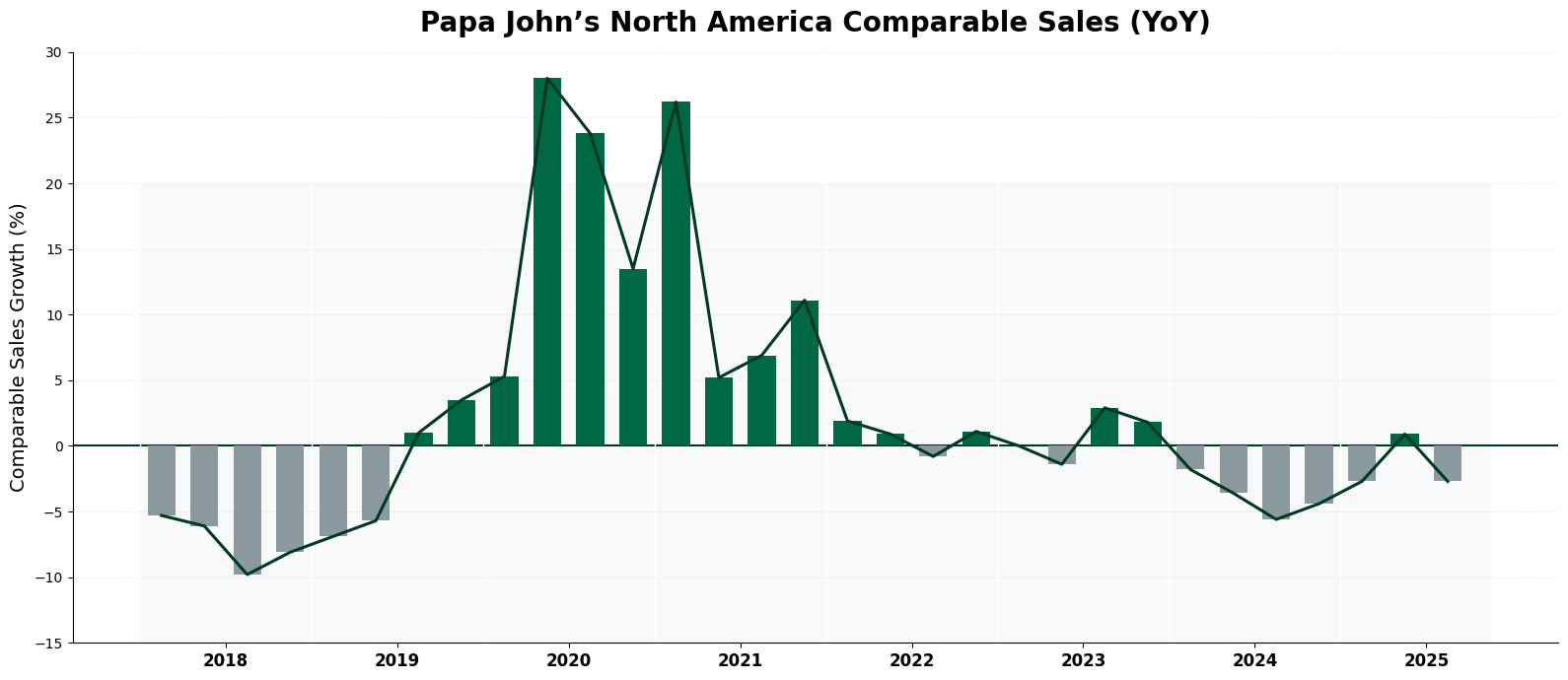

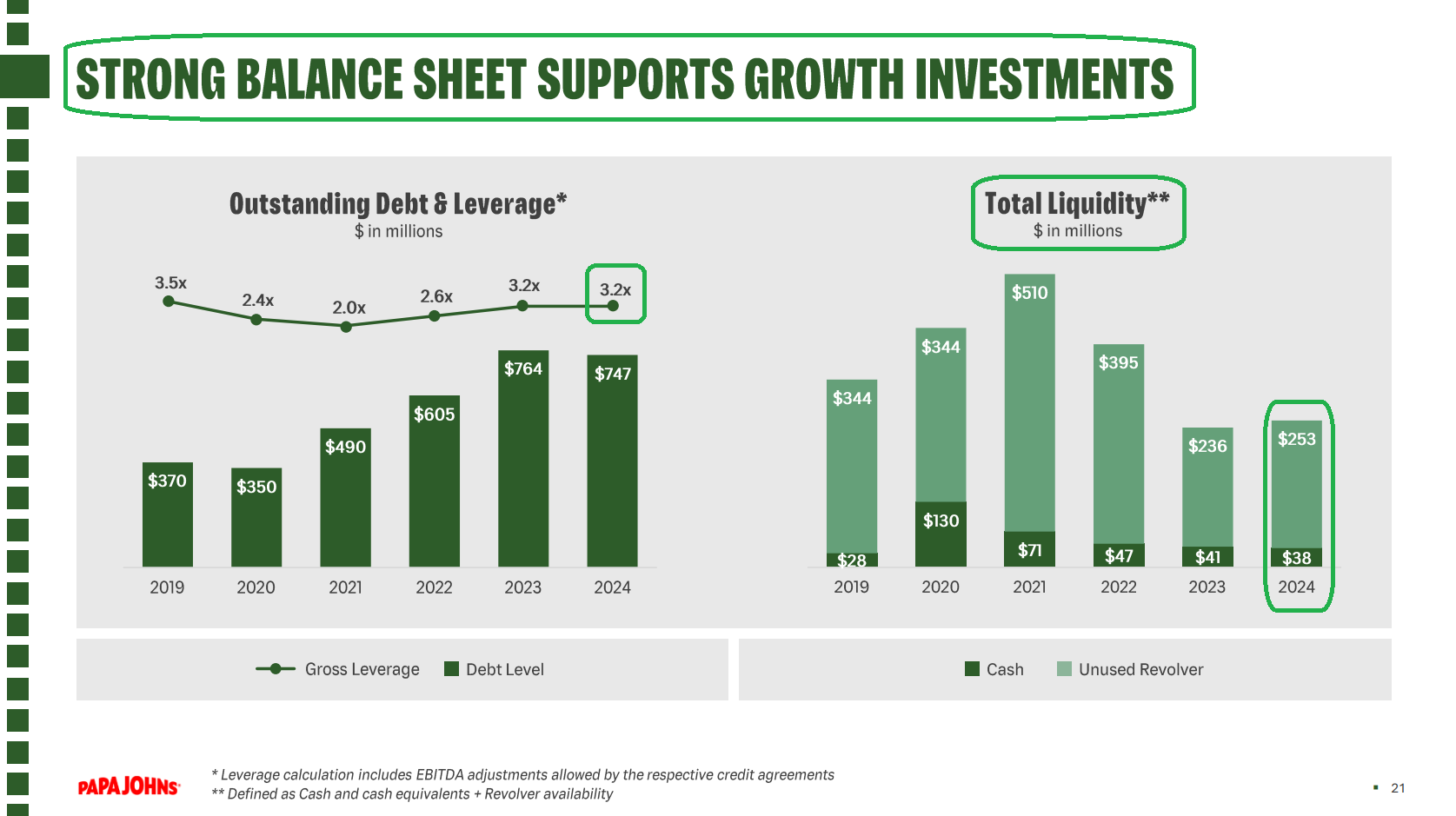

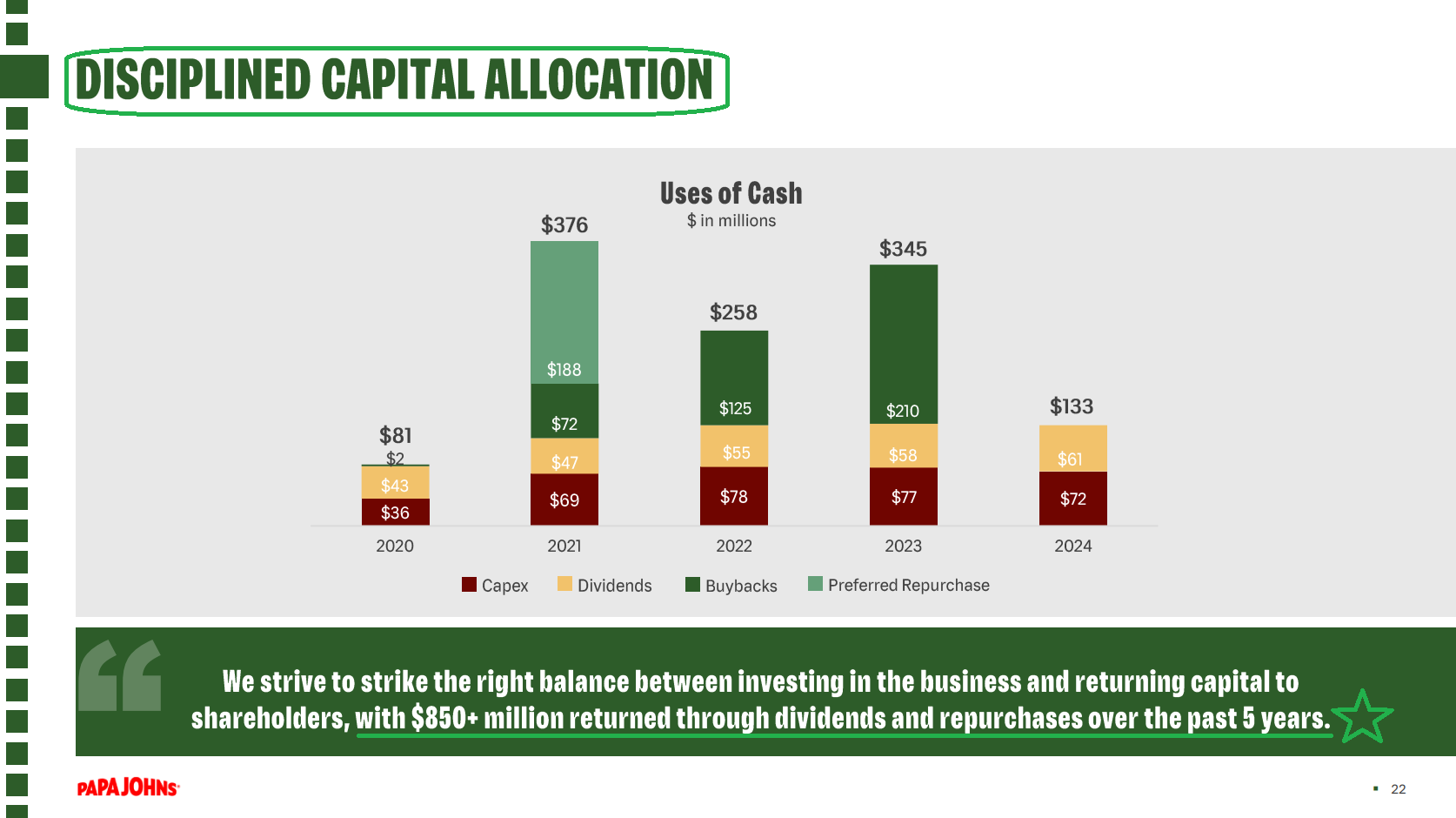

And while we wait for the turnaround to play out, we collect a ~5% dividend yield, the exact type of yield we expect to be in high demand as cash moves off the sidelines in the easing cycle. The dividend is backstopped by recovering free cash flow ($60M YTD) and a solid balance sheet with ~3.4x gross leverage (well below 5.25x covenants) and no major maturities until 2029-2030.

(Click on image to enlarge)

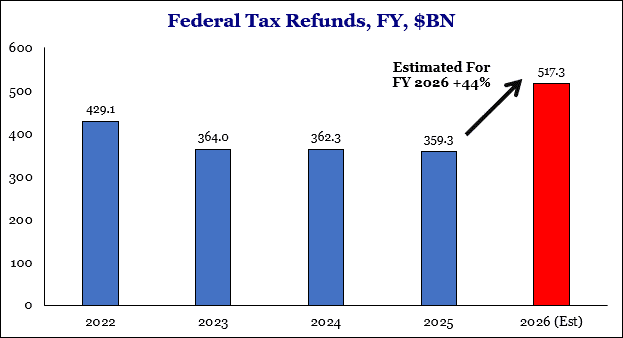

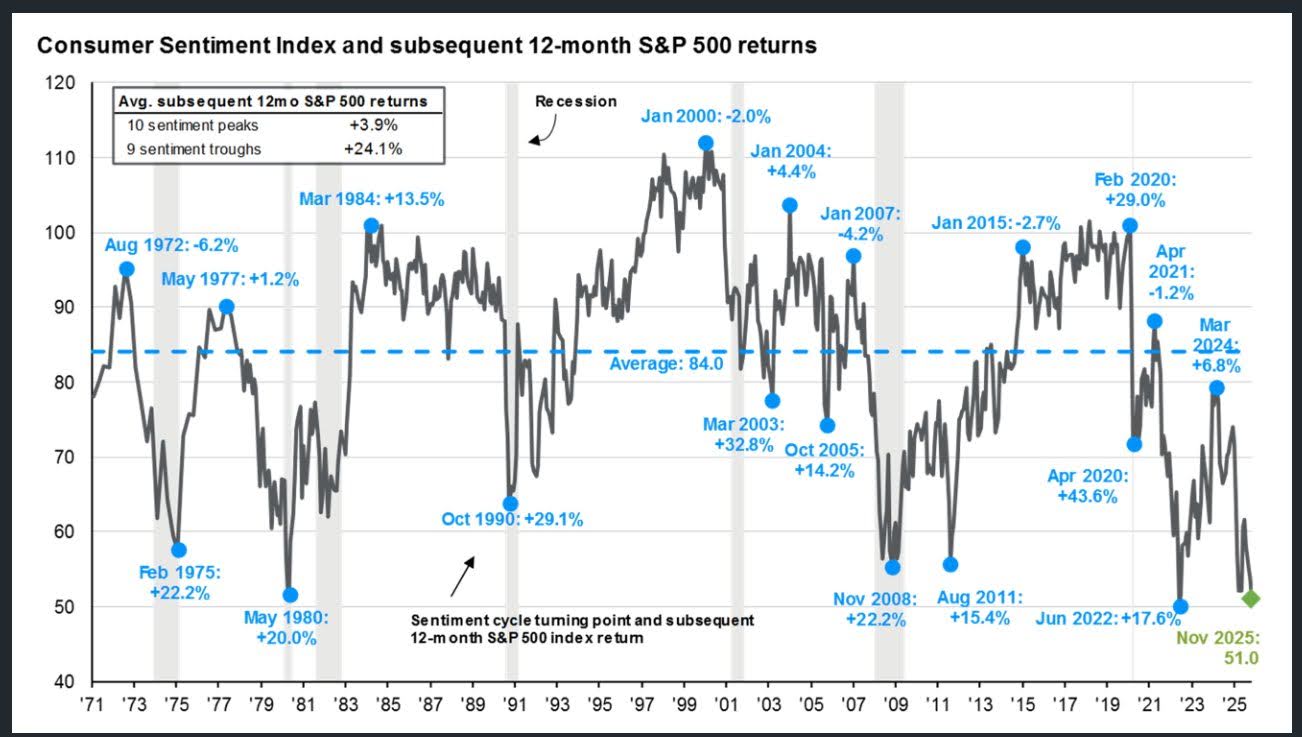

Not to mention, we expect a company like Papa John’s to be a key beneficiary of a better consumer backdrop in 2026 — something the market is giving zero credit for. There are plenty of arrows in the quiver to support that view, whether it’s the easing cycle with more rate cuts and QE, federal tax refunds up 44% YoY to $517B with households seeing $1-2k boosts, or the cherry on top being the potential $2,000 tariff dividend checks. If those make it over the line, Papa John’s will have a line out the door and ovens running overtime just to keep up. Despite all that discretionary firepower, consumer sentiment sits at rock-bottom levels worse than COVID and the GFC, setting a bar as low as they come for upside surprises.

Strategas

(Click on image to enlarge)

Bottom line: this is a classic story of a strong brand that lost its way, now led by a proven operator restoring the basics. The asset-light model prints cash when run properly and the right pieces are finally in place. We’re happy to own the turnaround, collect the dividend, and let the rest of the market rediscover Papa John’s at much higher prices.

Here’s a more detailed look at the business and turnaround strategy from this year’s Investor Day:

(Click on image to enlarge)

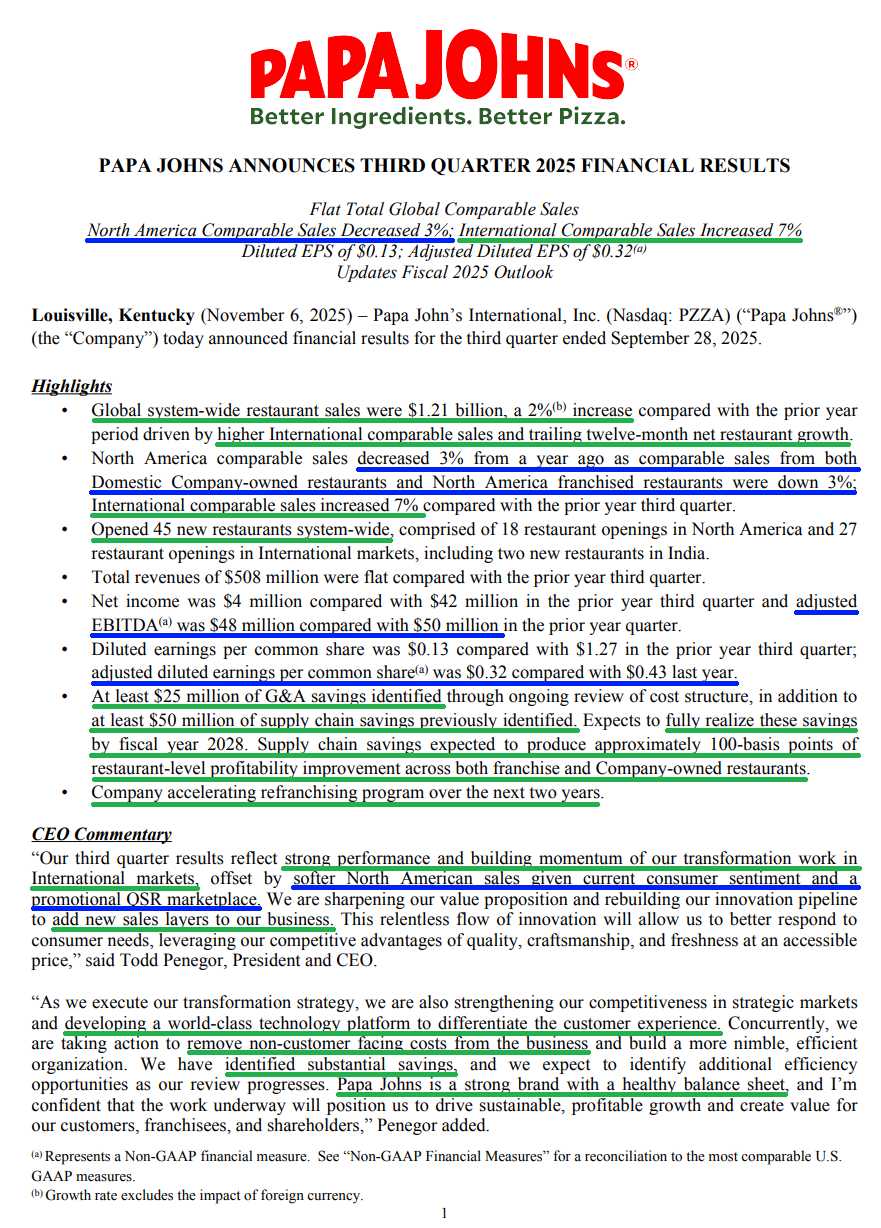

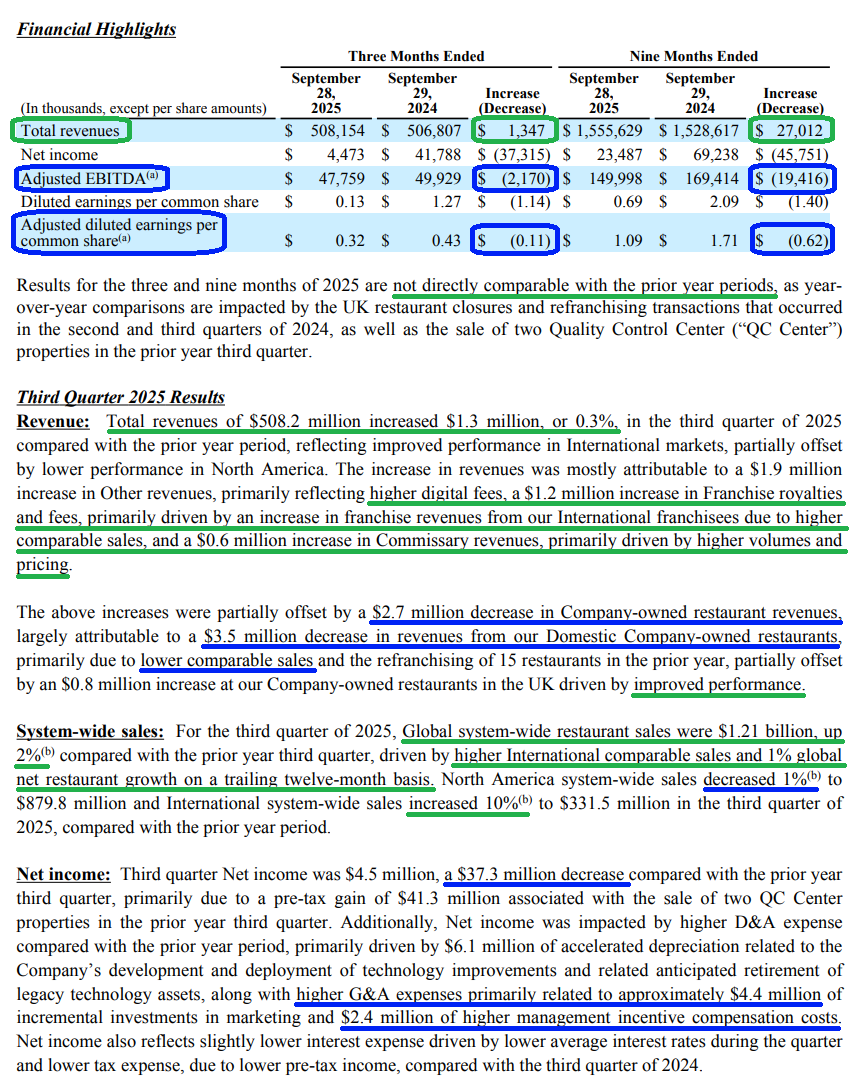

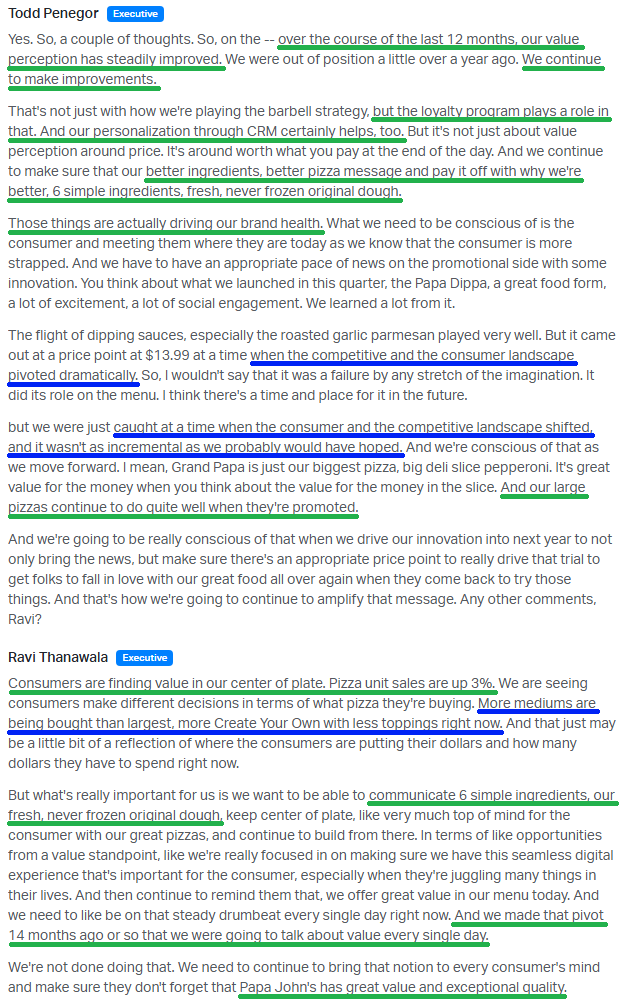

Q3 Earnings Breakdown

(Click on image to enlarge)

10 Key Points

1) North America systemwide sales decreased 1.1% to $879.8M, with total comp sales down 2.7%. Management noted the greatest order decline came from small-ticket web customers, and the majority of the comp pressure was driven by weakness in sides as soft consumer sentiment and a promotional QSR backdrop weighed on results. Core pizza sales were solid with units up 3% and pizzas per order up 4%, although the negative mix shift left overall pizza sales roughly flat.

2) The international business continues its recovery, with systemwide sales up 10.3% to $331.5M and comp sales up 7.1%, marking the fourth straight quarter of positive comps with sequential improvement each quarter. Management remains encouraged by what they are seeing in Q4 and the long runway for expansion ahead. A key driver of recent growth has been the expanded Croissant Pizza offering into three additional markets, generating significant media buzz and activation.

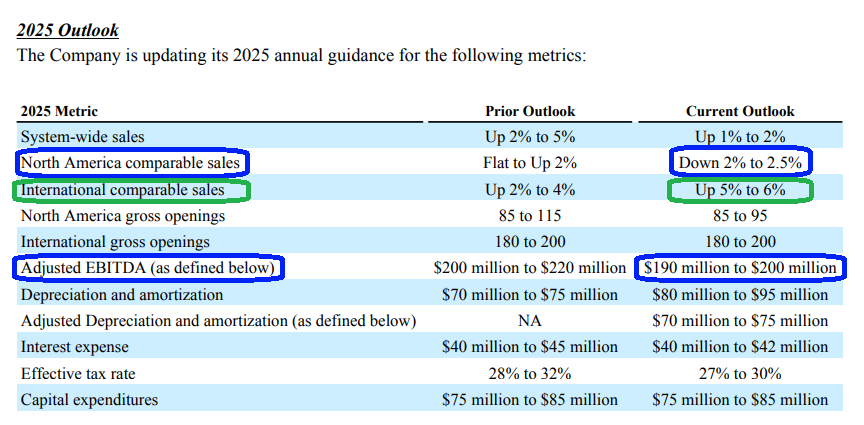

3) Management has identified at least $25M of G&A savings through the ongoing review of the cost structure, with at least half expected to be realized in 2026 and further efficiency opportunities likely ahead. These savings are in addition to the previously announced ~$50M of supply chain savings driven by procurement vendor negotiations, freight and transportation improvements, and reduced fixed cost leverage throughout the commissary network. Together, management expects these initiatives to be fully realized by FY2028 and to deliver ~100 bps of restaurant-level profitability improvement across both franchise and company-owned restaurants.

4) Papa John’s is accelerating the re-franchising program over the next two years with the goal of reducing company-owned restaurants to a mid-single-digit percentage of the North America system, which is expected to strengthen local markets and increase operational efficiency. Management noted they already have a strong pipeline in place with existing buyers at attractive multiples, and the sale of the ownership stake in a JV operating 85 restaurants closed in Q4. The transaction is expected to reduce consolidated revenues by ~$60M but have negligible impact on net income.

5) During Q3, Papa John’s opened 45 restaurants systemwide, consisting of 18 openings in North America and 27 in international markets, bringing the total restaurant count to 5,994. For the full year, management expects 85–95 gross new openings in North America and 180–200 gross new openings across international markets.

6) Management addressed the M&A speculation during earnings (reports of a $64 per share takeout bid from Apollo), noting they remain focused on maximizing shareholder value and are open-minded about the path to achieve it. At the time, they stated that “the opportunity before the company to drive the greatest value creation is through the execution of the transformation strategy.” We agree. We didn’t get involved in this stock for a 50% takeout and are pleased to see management staying focused on long-term value.

7) Management continues to make progress on the digital front, with the revamped loyalty program now accounting for nearly half of total sales and driving increased redemptions and higher order frequency. Total loyalty accounts have reached 40M, up 1M sequentially. The delivery tracking service is expected to be fully rolled out by Q1 2026 and is already live in ~60% of U.S. restaurants.

8) Net cash provided by operating activities increased to $106M year-to-date, with free cash flow of $59.2M through Q3 compared to just $9M in the same period last year. The increase in cash flow has been driven by the timing of cash payments into the national marketing fund, favorable changes in working capital, lower cash taxes, and reduced spending related to international transformation initiatives.

9) Management revised the full year 2025 outlook, now expecting systemwide sales growth of +1% to +2%, down from the prior +2% to +5% range, driven by a softer consumer backdrop and a more promotional QSR environment that is expected to persist into the start of 2026. North America comp sales are now expected to be down 2% to 2.5% versus the prior outlook of flat to +2%. Offsetting some of the weakness, international comp sales guidance was raised to +5% to +6% from the prior +2% to +4%.

10) The balance sheet remains in a healthy place, with total available liquidity of $502M in cash and borrowings available under credit facilities, and gross leverage of 3.4x well within the permissible limit of 5.25x.

Earnings Call Highlights

General Market

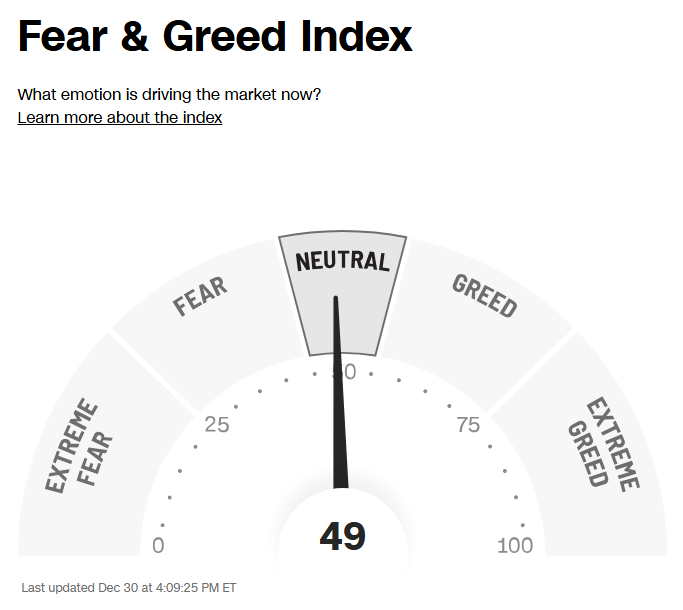

The CNN “Fear and Greed Index” ticked down to 49 this week from 55 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

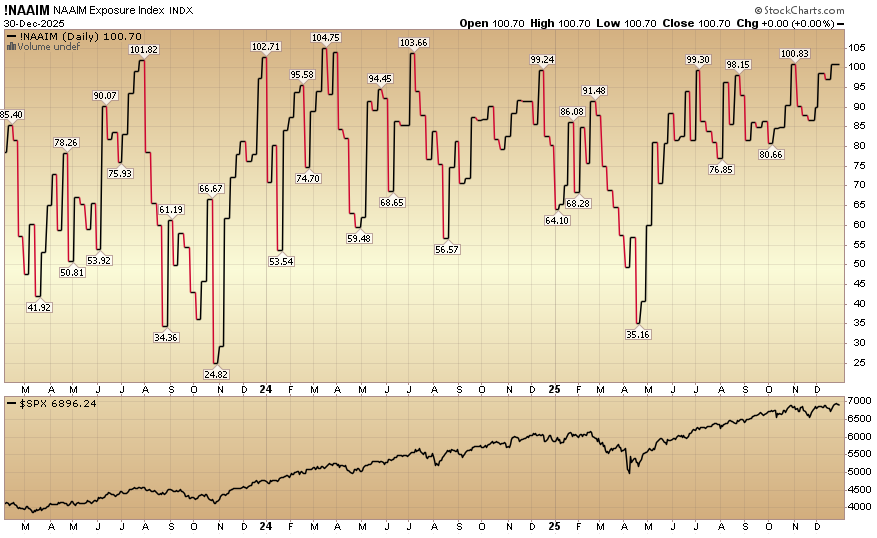

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) held steady at 100.70% equity exposure this week, unchanged from last week.

(Click on image to enlarge)

More By This Author:

“Setting Up The Second Act” Stock Market (And Sentiment Results)…

“Lifting Off And Looking Good” Stock Market (And Sentiment Results)

“Holiday Carts And Auto Parts” Stock Market (And Sentiment Results)…

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more