“Setting Up The Second Act” Stock Market (And Sentiment Results)…

Image Source: Unsplash

Pfizer Update

Each week we try to cover 1-2 companies we have discussed in previous podcast|videocast(s) and/or own for clients (including personally).

Pfizer is a name that has come across our desk many times over the years, and we recently pulled the trigger, building a nice-sized position on weakness.

We first laid out our Pfizer thesis publicly on Fox Business on December 4, 2025, along with several other media appearances that same week:

We expanded on the thesis at a more granular level at MoneyShow Sarasota, where we presented the full PFE investment case (see below, presentation from 23:57 to 33:00):

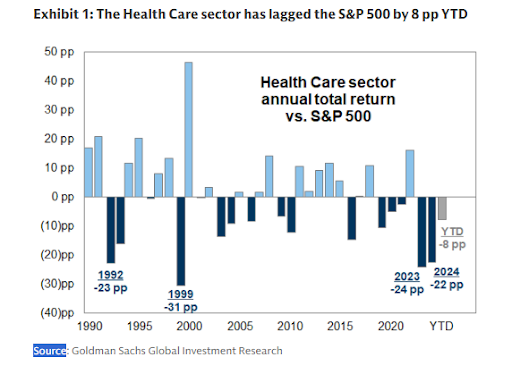

Healthcare has been an area of the market we have kept a close eye on and one where we have been looking to add additional exposure alongside our existing holding in Baxter International.

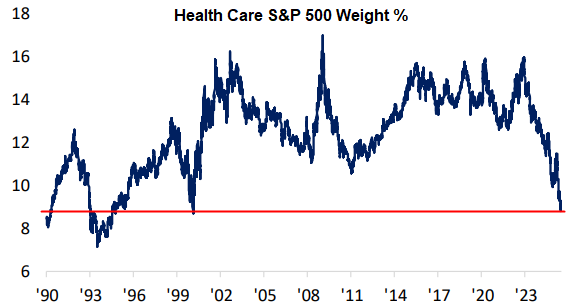

The sector has become one of the most dislocated corners of the market, battered by policy and regulatory headwinds and driven into three straight years of underperformance. This resulted in a 51-point cumulative lag behind the broader market, marking the worst stretch on record.

The ensuing forced selling and rush for the exits pushed the sector’s weighting to under 9%, a sharp retreat from over 15% in 2022 and reminiscent of levels not seen since the early 2000s — a setup that preceded a multi-year stretch of outperformance.

This shoot-first, ask-questions-later environment left a long list of high-quality Healthcare companies on the clearance rack. We quickly rolled up our sleeves and started digging through the rubble in search of a pony in the pile.

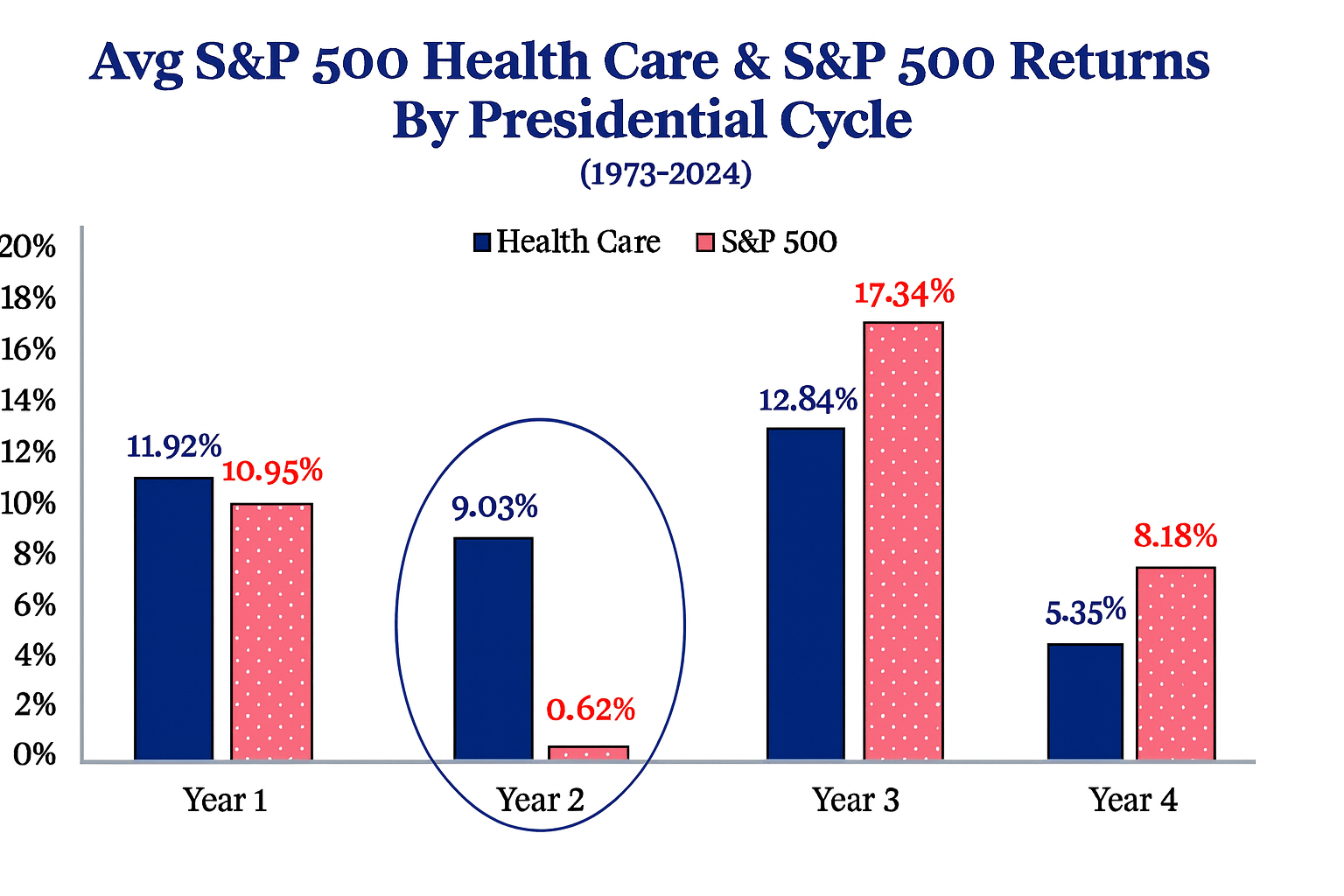

What made the setup even more compelling was the backdrop of a midterm election year, notorious for elevated volatility. Such conditions play directly into the strengths of resilient, durable-demand sectors like Healthcare, which has a consistent track record as a top performer in midterm cycles. In fact, the sector has outperformed in 11 of the last 13 midterm years, posting average annual returns of 9.03% and dwarfing the broader market’s modest 0.62%.

Source: Strategas

With that framework in mind and a willingness to lean against the prevailing narrative, we went hunting within the sector and eventually zeroed in on a name offering asymmetric upside while trading at life-support valuations.

That name was Pfizer.

Founded in 1849, Pfizer stands as one of the world’s largest pharmaceutical companies, with a broad portfolio spanning vaccines, oncology, and immunology. If you think this is the first time Pfizer has found itself in the gutter over its 176-year operating history, think again. Through wars, depressions, and countless cycles, this company has seen it all and consistently emerged stronger on the other side.

Today, Pfizer markets nine blockbuster products, led by Eliquis and the Prevnar family, and delivered the top-selling COVID vaccine (Comirnaty) and oral treatment (Paxlovid) during the pandemic.

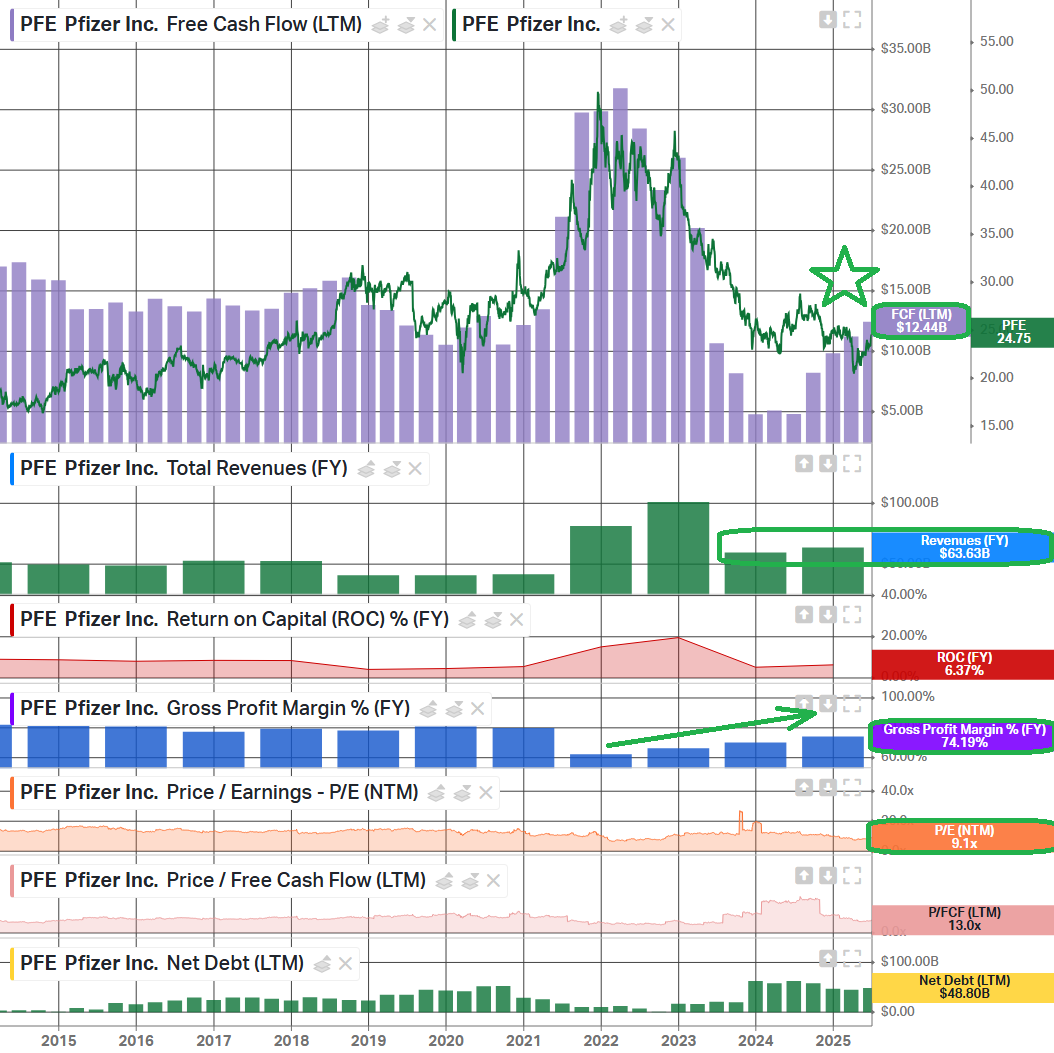

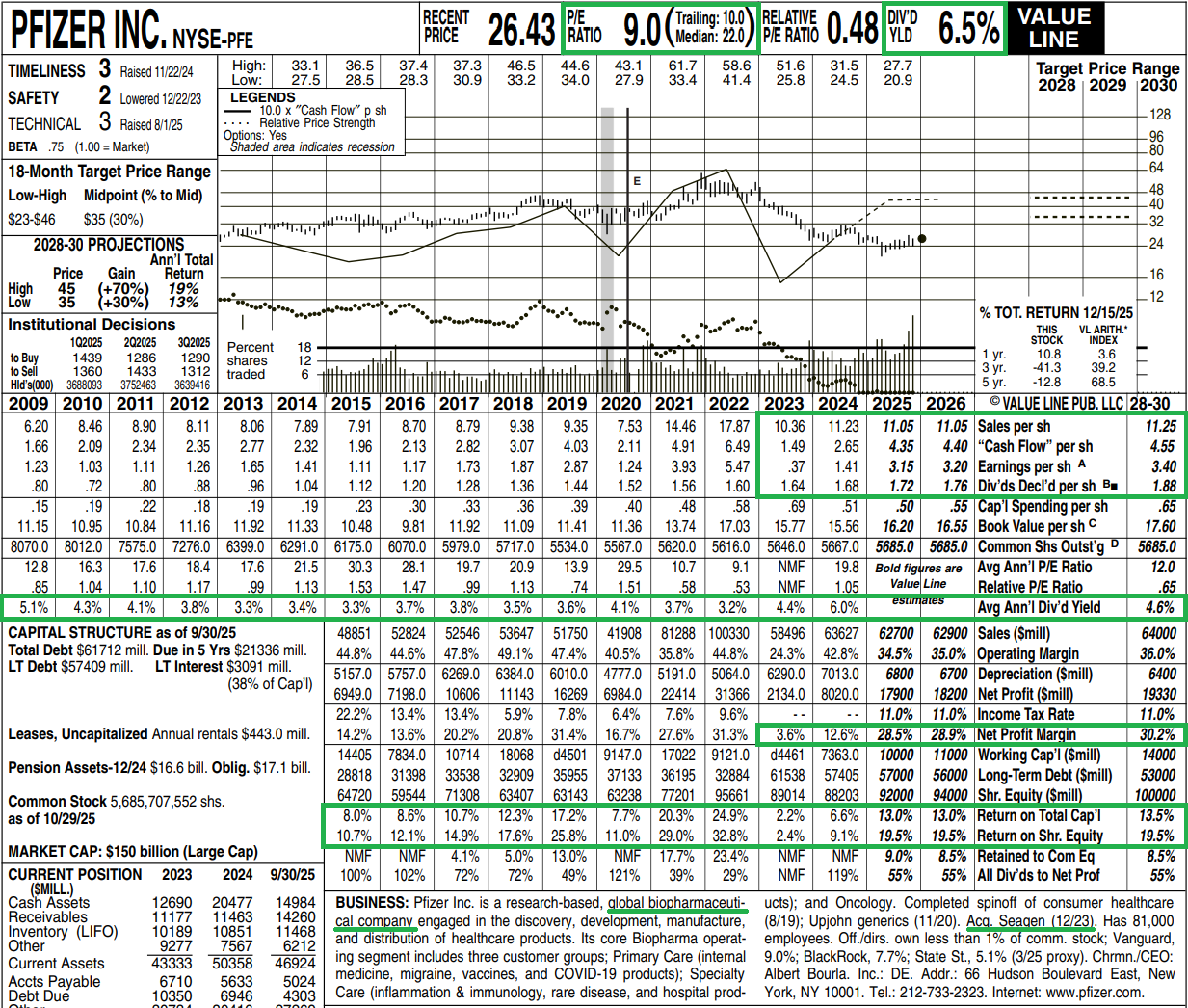

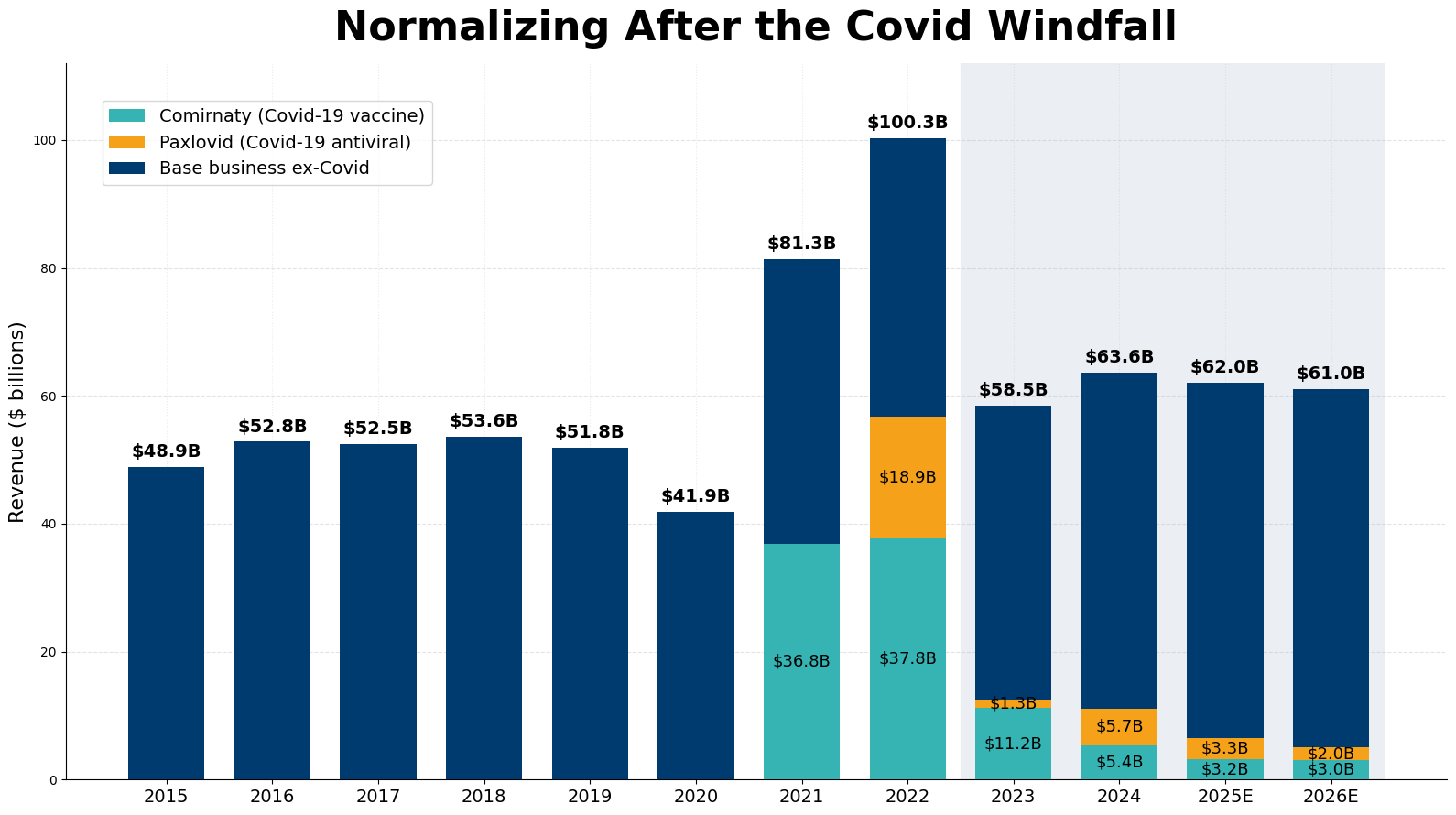

The stock remains down more than 60% from its COVID-era highs, when the company was effectively king of the world and its twin COVID franchise generated ~$90B in supplemental revenue and ~$40B in incremental free cash flow in 2021–2022 alone. That windfall faded much faster than management or the market anticipated. By 2023, revenues had fallen more than 40%, forcing large inventory and intangible write-downs and sending adjusted EPS down 72%.

The resulting COVID volatility and uncertainty created a massive overhang on the stock, one we believe is now firmly in the rearview mirror. The core business has stabilized in the low $60B revenue range, with earnings power recovered to a solid $3+ baseline and COVID products representing just ~8% of sales, a fraction of the ~57% peak in 2022.

Despite this stabilization, the market continues to fixate on the lingering COVID shadow and the impending patent cliff, with key blockbusters (Ibrance, Eliquis, Xtandi, and Prevnar) facing loss of exclusivity between 2026 and 2028, putting ~$17B in annual revenue at risk.

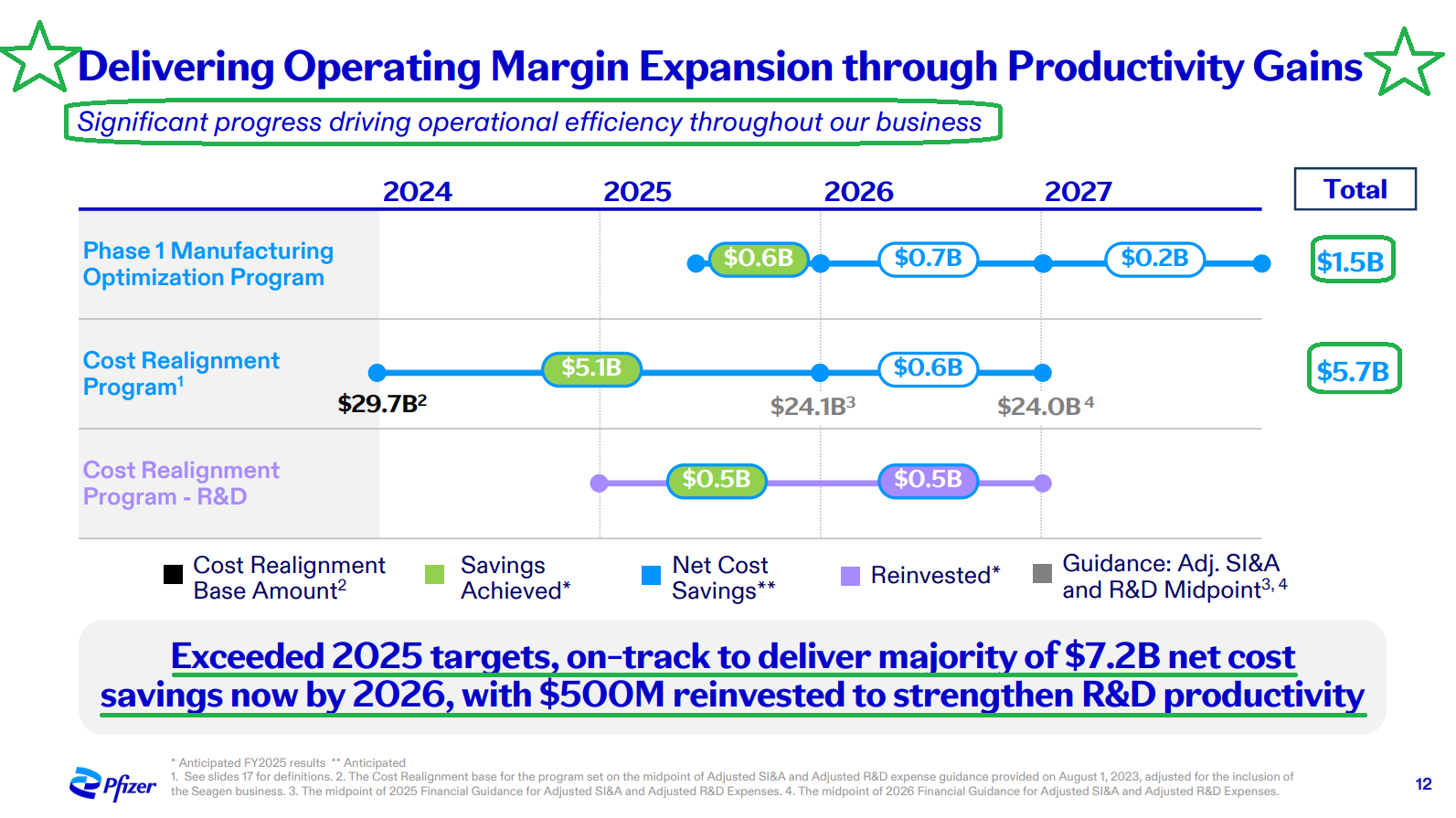

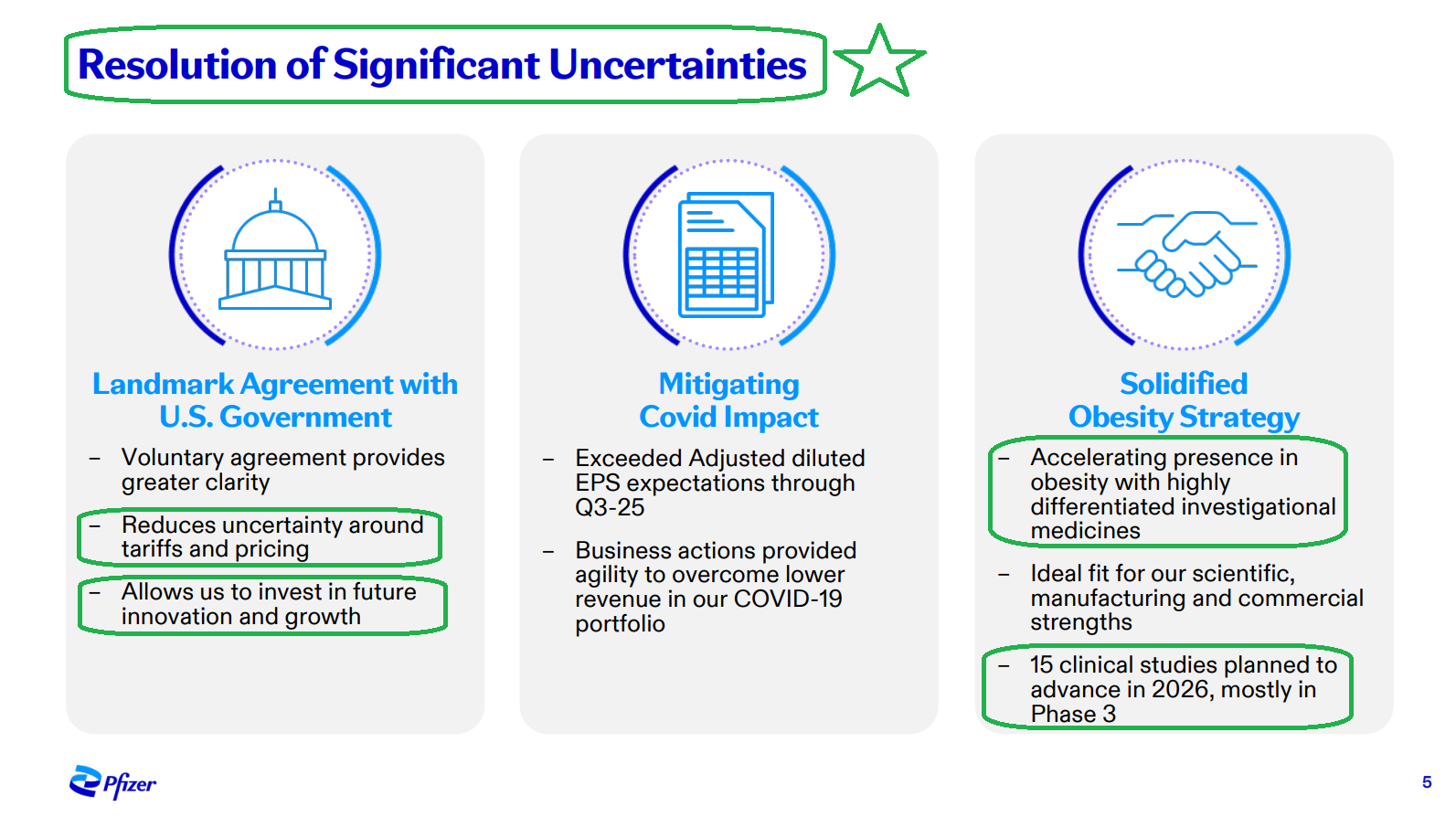

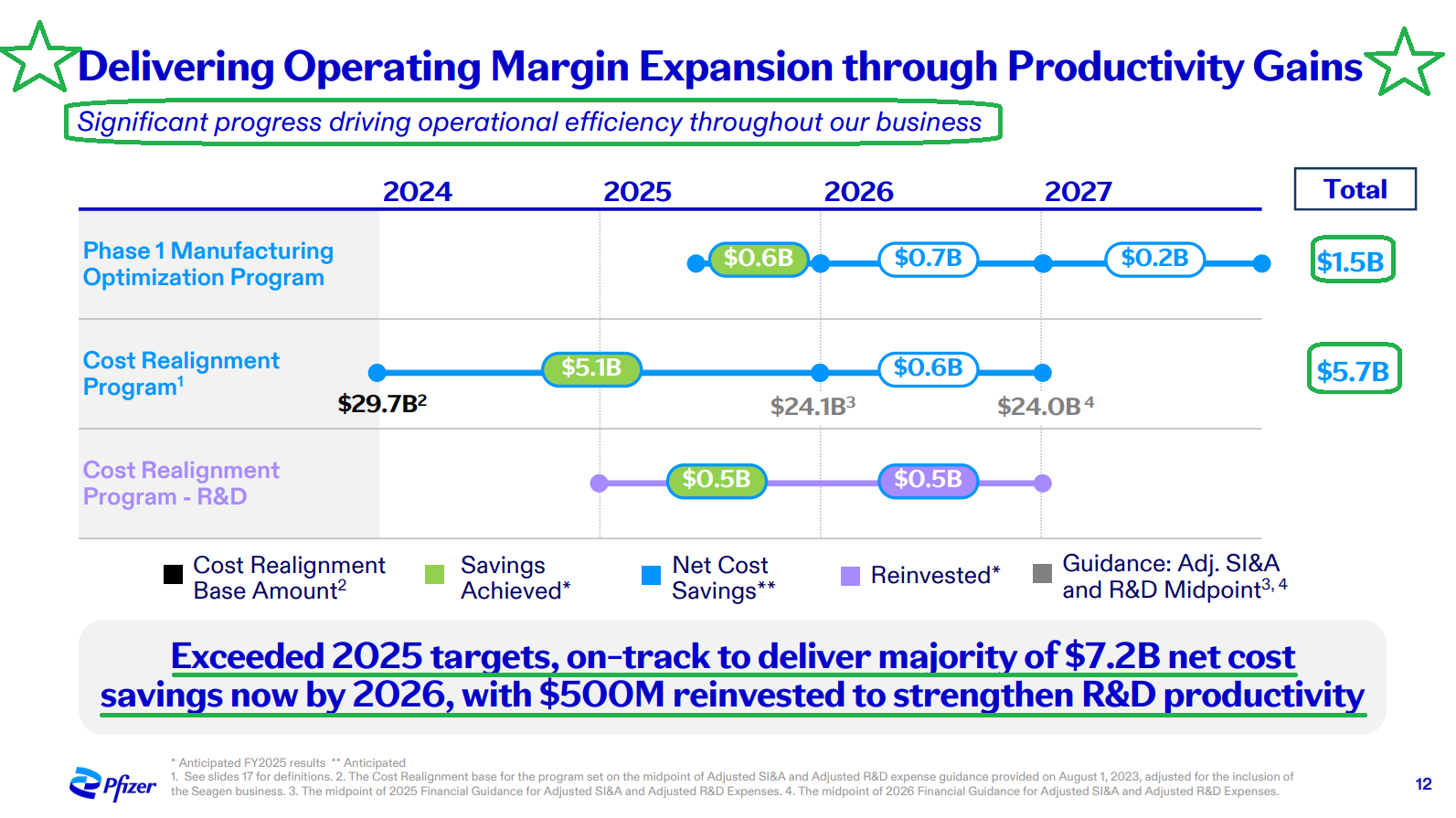

We believe this pessimism is far overdone and overlooks the heavy lifting management has already delivered to right-size the business and offset these headwinds. Pfizer launched a $7.2B cost-savings program aimed at restoring operating margins to pre-pandemic levels while reinvesting $500M to strengthen R&D productivity. Management has executed aggressively, already delivering $5.1B in savings and putting the company on track to achieve the full $7.2B by 2026, a full year ahead of schedule.

More telling, rather than relying solely on cost cuts to offset patent expirations, management went on offense with the COVID cash, going shopping for the next generation of growth drivers.

The $43B Seagen deal added four approved cancer drugs and a leading oncology pipeline that management expects to scale from ~$2B in revenue to more than $10B by 2030.

Most recently, and just when Pfizer appeared out of the GLP-1 race, the $10B Metsera acquisition puts the company back in the center of the $100B+ obesity market with a differentiated once-monthly platform targeting a 2028 launch and delivering $5B+ in peak annual sales potential.

Combined with earlier bolt-ons like Arena, Biohaven, GBT, and the licensing deal with 3SBio, Pfizer is well positioned to offset LOE pressures and return to growth later this decade, something we believe the market continues to materially under-appreciate.

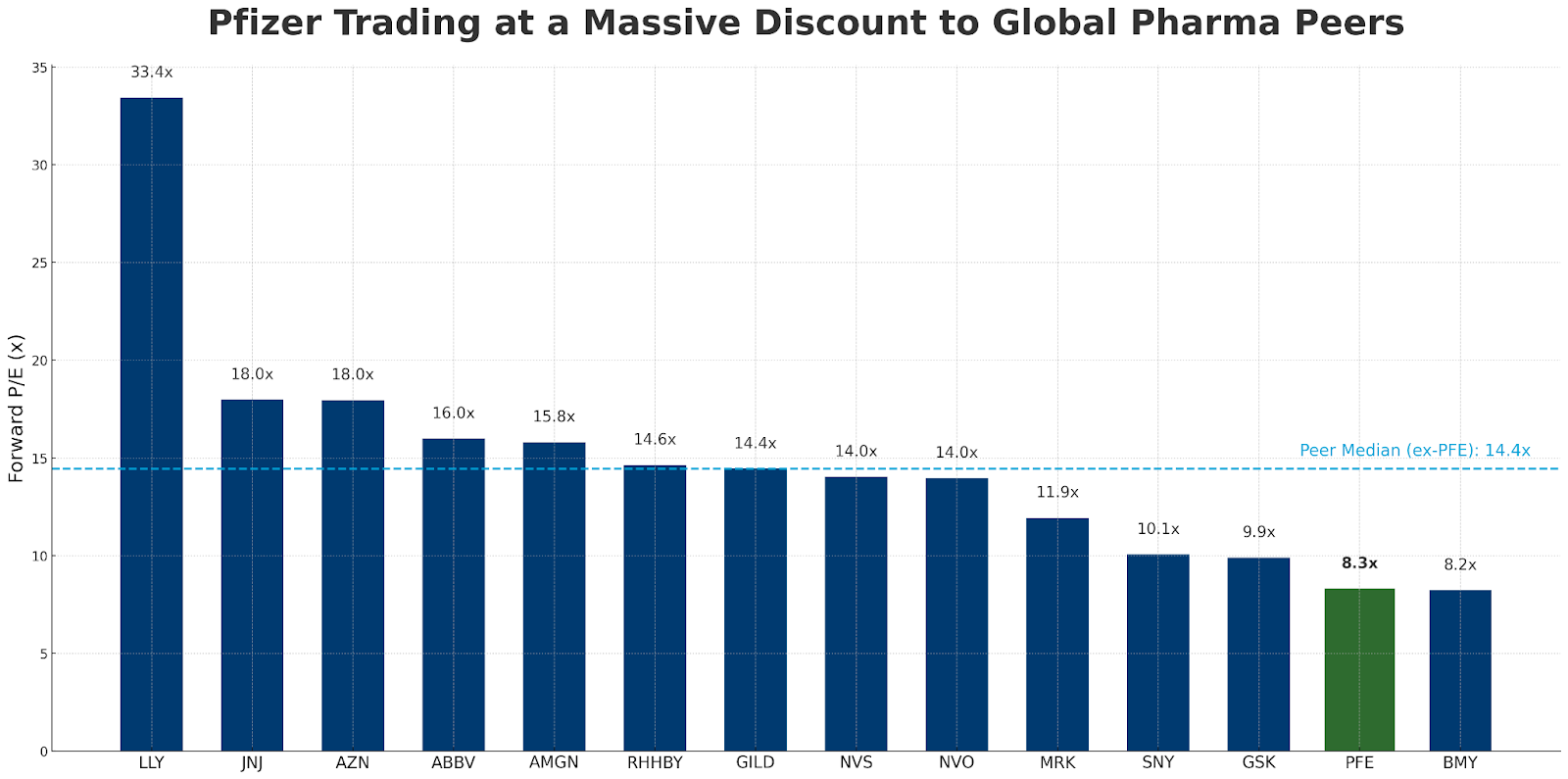

At just 8x earnings, the market is giving Pfizer zero credit for anything going right, making it one of the cheapest large-cap pharma names on offer. If management is even half right on the roadmap, we see a clear path to a double over the next few years. If the full vision plays out and Healthcare sentiment finds its way out of the doldrums, the upside is meaningfully higher.

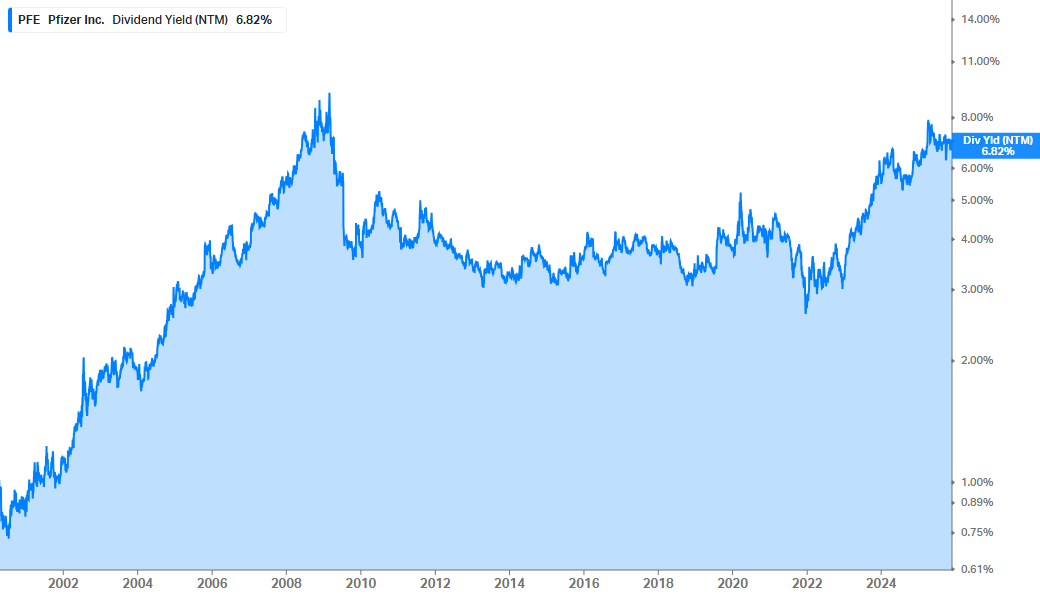

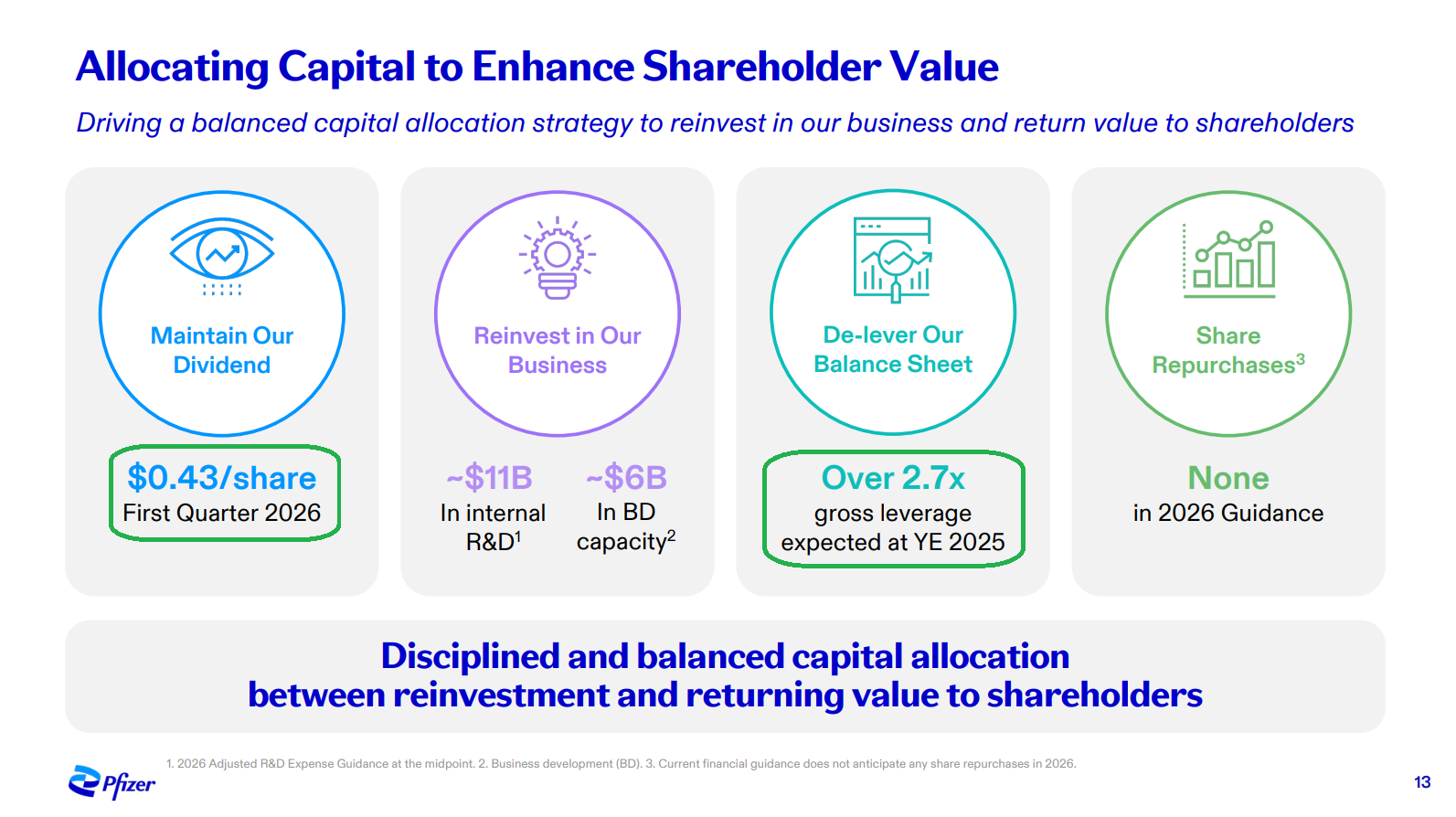

In the meantime, investors get paid a 6.82% dividend yield to wait, more than 4x the sector average and backed by an 86-year payment history. The dividend is supported by a strong balance sheet with ~$15B in cash and cash equivalents and more than $10B of annual free cash flow generation.

This life-support valuation, combined with an attractive dividend yield, sets a firm floor and offers meaningful downside protection. Meanwhile, the bar for positive surprises remains exceptionally low as the market prices in virtually no good news. As execution progresses and new growth engines begin to show through, we expect sentiment to turn, and quickly.

Until then, we are happy to sit tight, collect the dividend, and wait for this iconic American blue chip to reclaim its former glory.

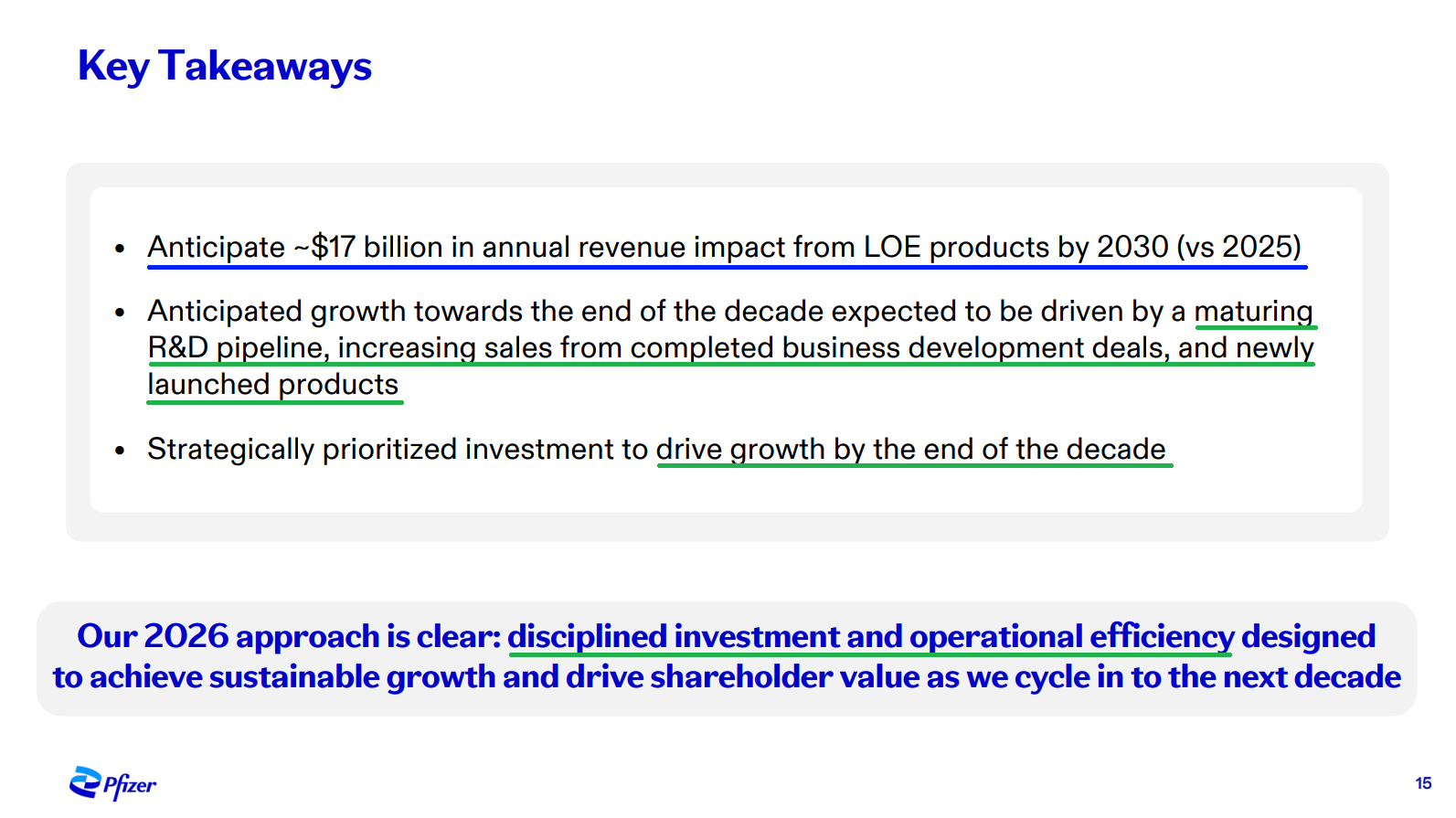

Earlier this month, management hosted an Analyst and Investor call to walk through 2026 guidance, recent acquisitions, and the long-term path back to growth. Below are the key takeaways:

10 Key Points

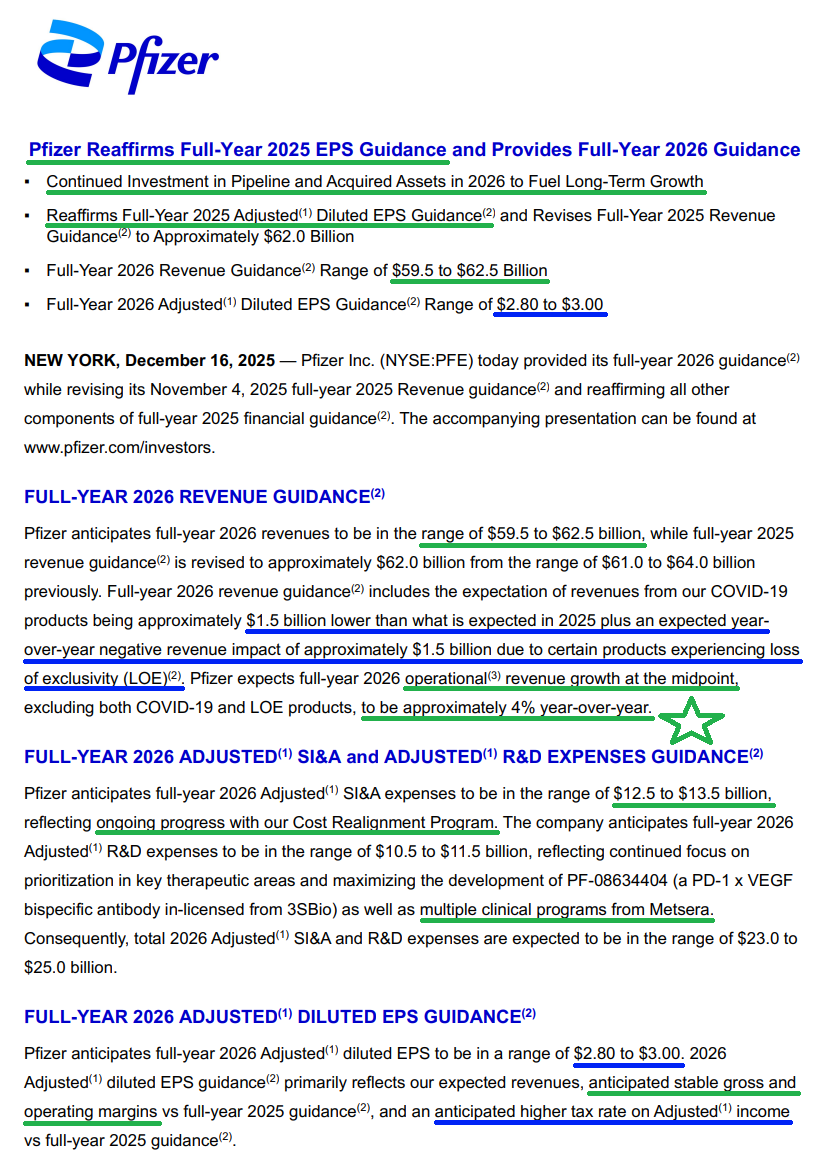

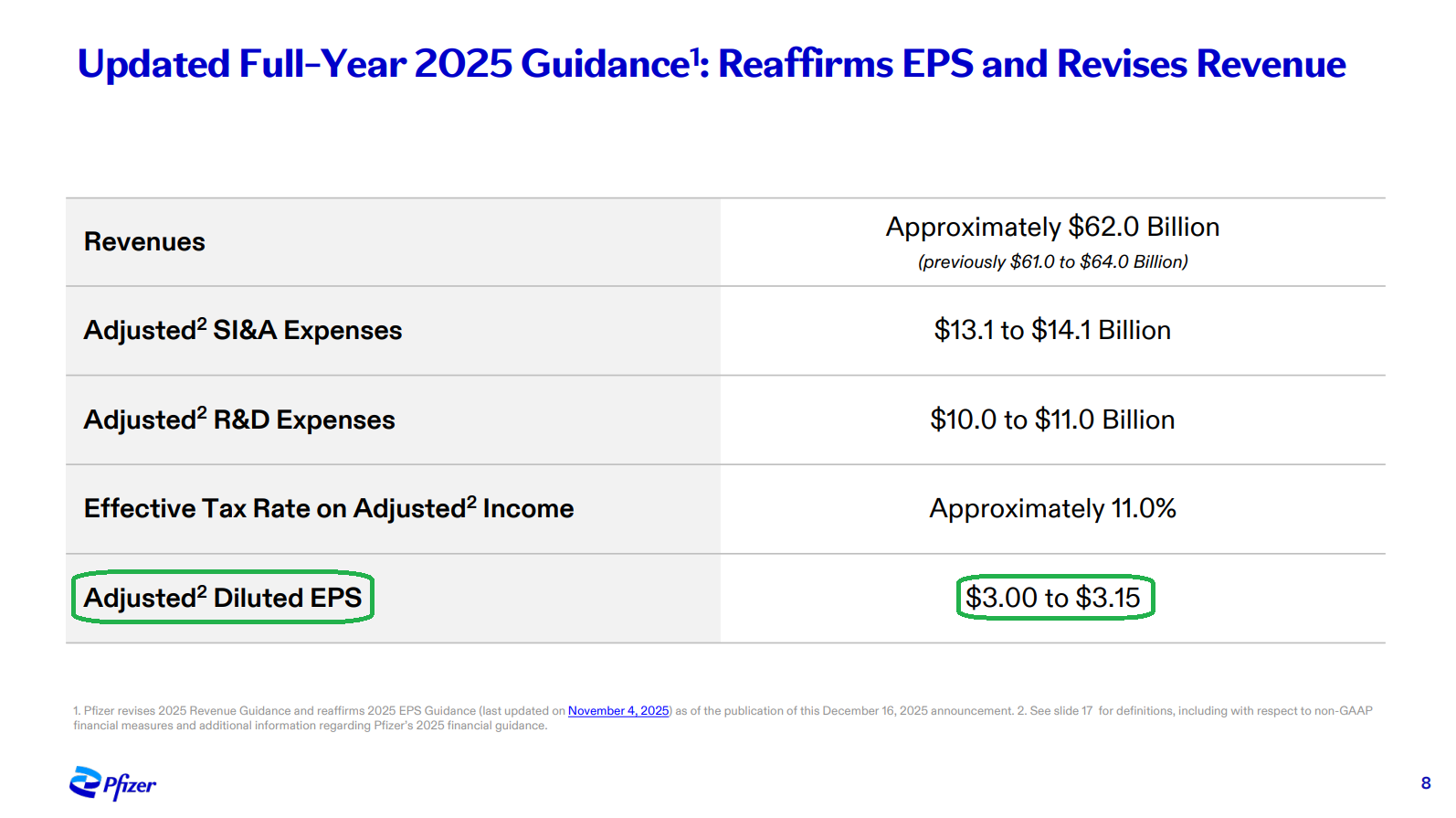

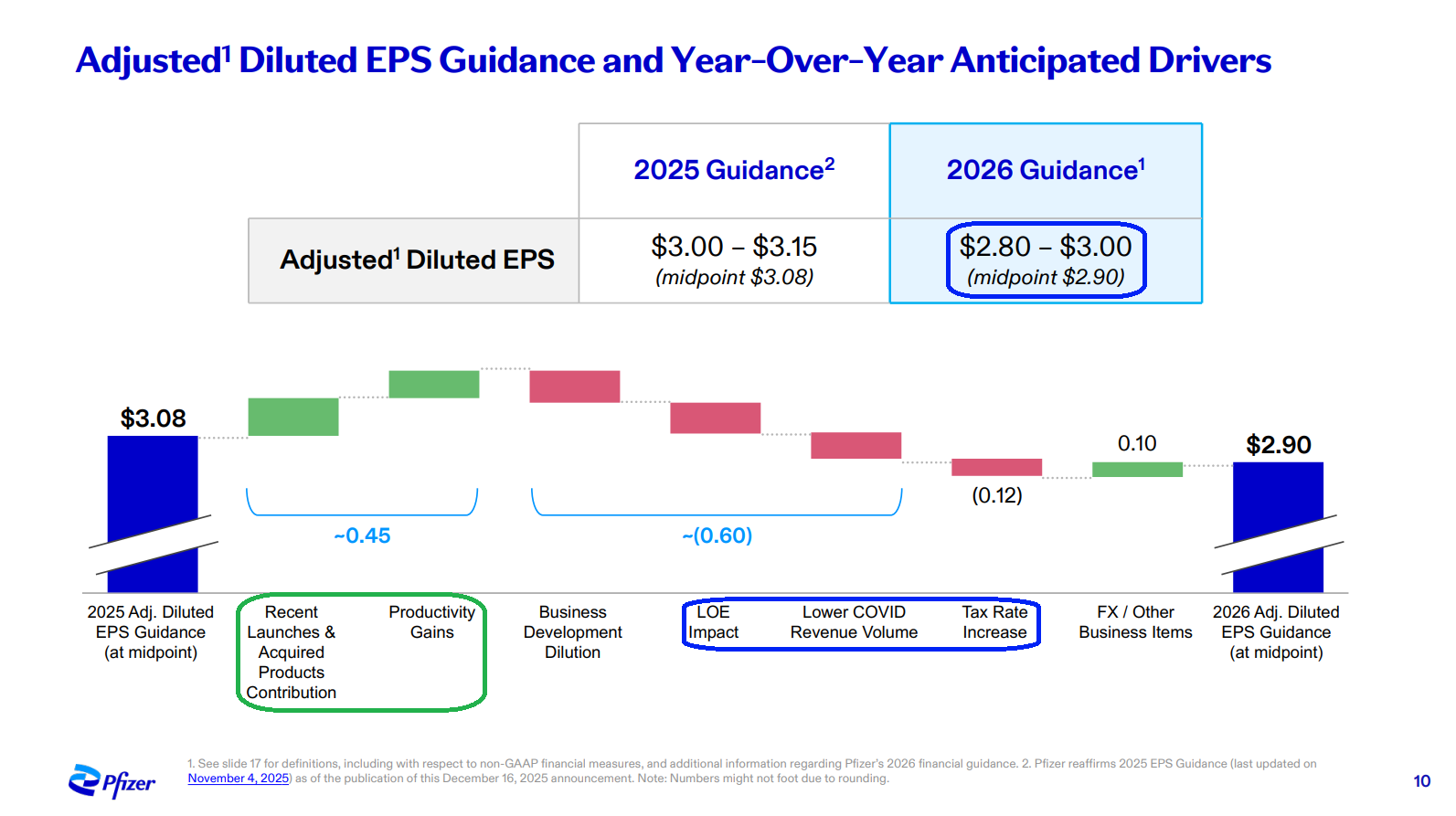

1) Management reaffirmed full year 2025 adjusted EPS guidance of $3.00 to $3.15 and noted results are currently tracking toward the top end of the range. Full year revenue guidance was narrowed to ~$62B, consistent with the prior $61B to $64B range.

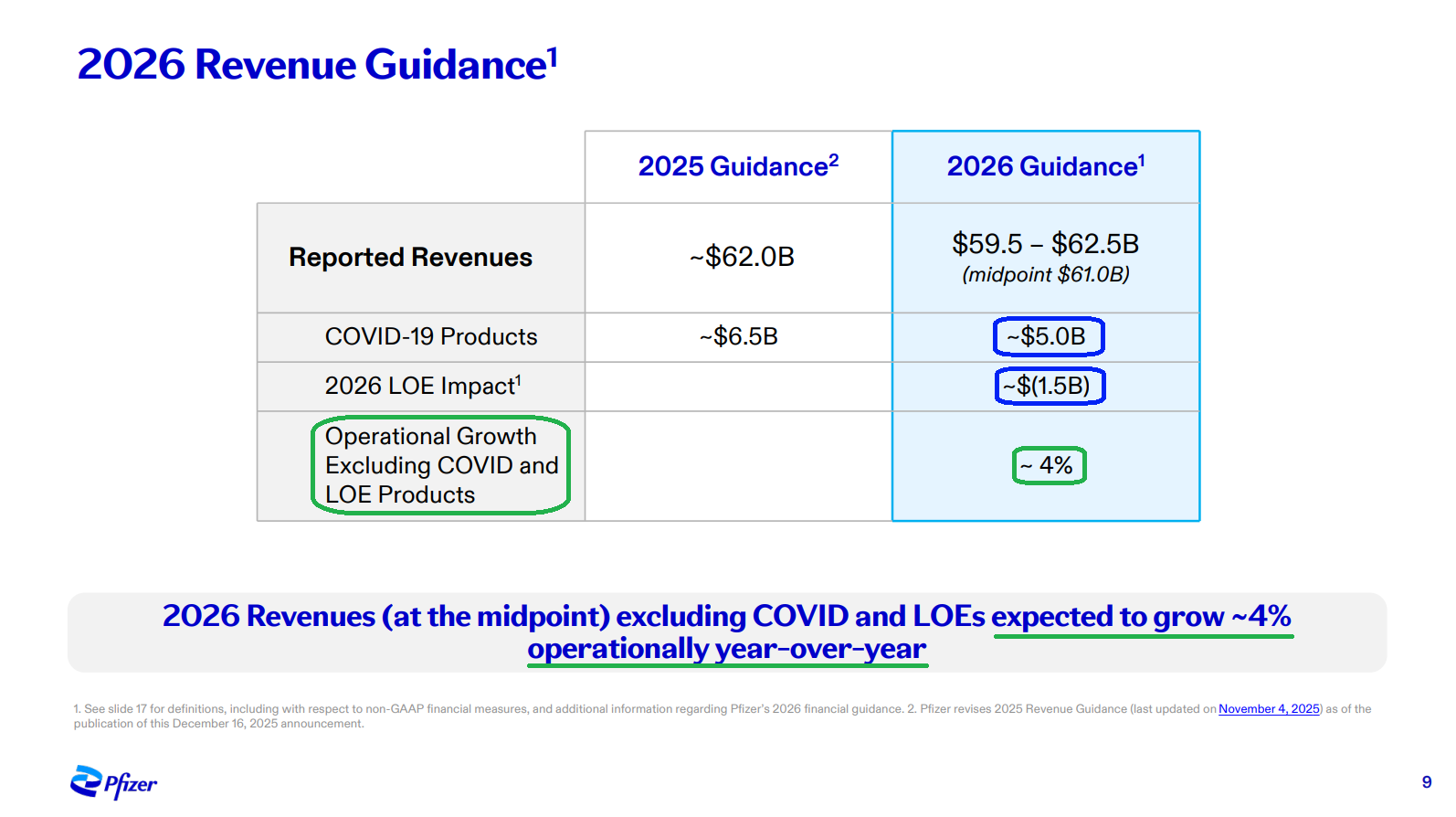

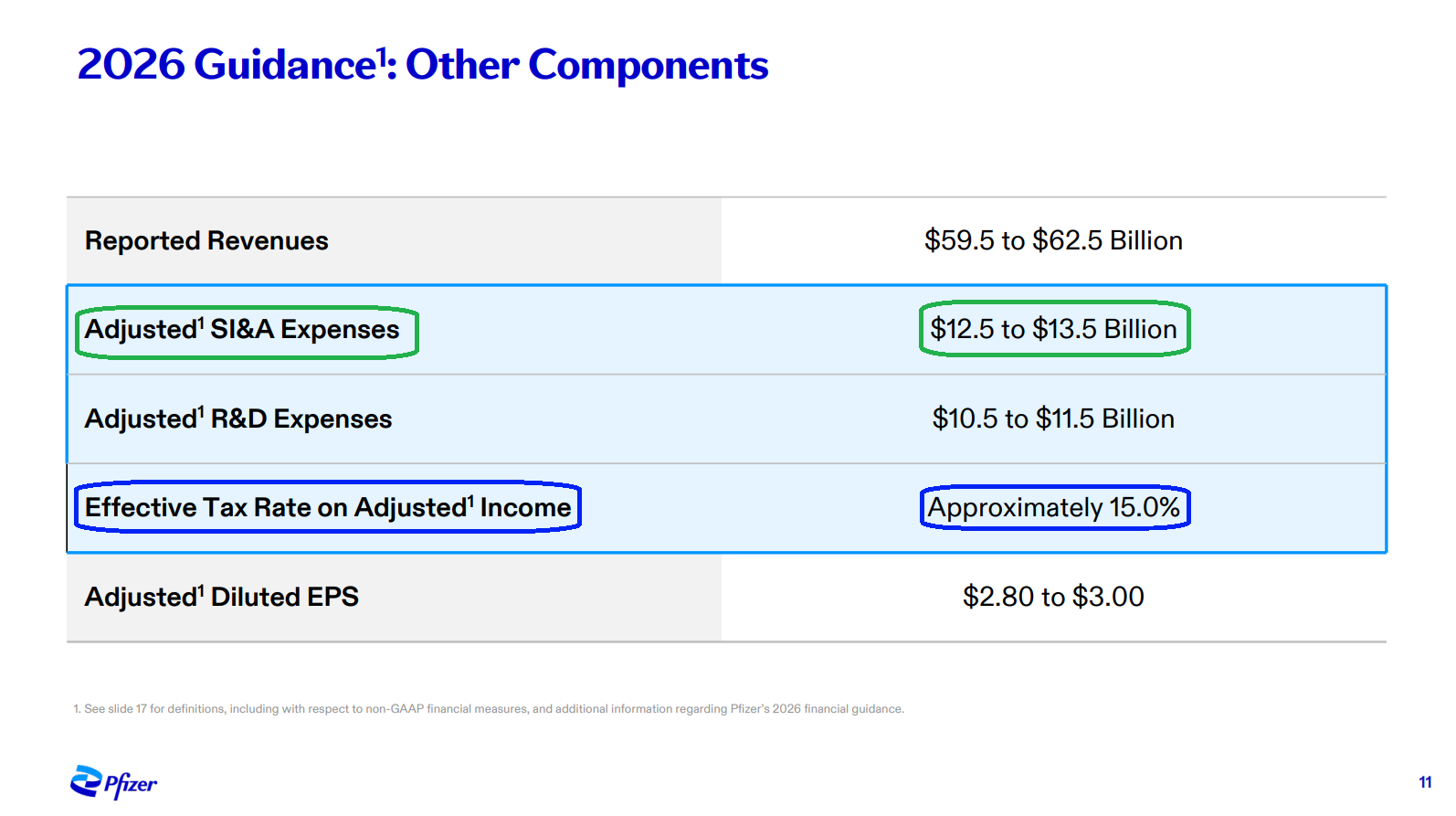

2) Looking ahead to 2026, management expects revenue of $59.5B to $62.5B, broadly in line with expectations, including ~4% operational growth at the midpoint excluding COVID and LOE. Adjusted EPS is guided to $2.80 to $3.00, modestly below Street estimates of ~$3.05, as several headwinds weigh on results. These include ~$0.22 of dilution from the 3SBio and Metsera deals, a $1.5B decline in COVID revenue representing a ~$0.18 EPS headwind, ~$1.5B of patent expirations, and a higher tax rate rising to 15% from 11%, a ~$0.12 headwind.

3) The Metsera acquisition is gaining traction, with management guiding to at least 15 obesity drug trials in 2026, the majority in Phase 3. The first Metsera product remains targeted for a 2028 launch, with meaningful contributions expected in the years that follow. Management also believes it now has the most advanced GIPR oral candidate in the industry, which it views as a significant opportunity to address the masses, with the key monthly dosing data expected in Q1.

4) Management cut 2025 COVID-19 sales expectations to $6.5B from ~$9B as global infection rates remain muted. COVID revenue is expected to decline further to $5B in 2026, representing just ~8.2% of total sales versus ~57% in 2022 as Pfizer continues to exit the COVID-driven era.

5) Pfizer expects ~$17B of annual revenue impact from loss of exclusivity by 2030 relative to 2025, with a $1.5B LOE headwind anticipated in 2026. Management remains confident that the internal pipeline, along with acquisitions of Biohaven, Seagen, and Metsera and the licensing agreement with 3SBio, positions the company well for 2029 and beyond to be strong growth years. By the end of 2025, the portfolio of recently launched and acquired products is expected to generate ~$10B in revenue growing at double-digit rates, with growth expected to accelerate into the latter part of the decade and help offset patent expiration headwinds.

6) The cost realignment program is now on track to deliver the majority of the $7.2B in total net cost savings by 2026, a full year ahead of prior expectations, with ~$500M reinvested to strengthen R&D productivity.

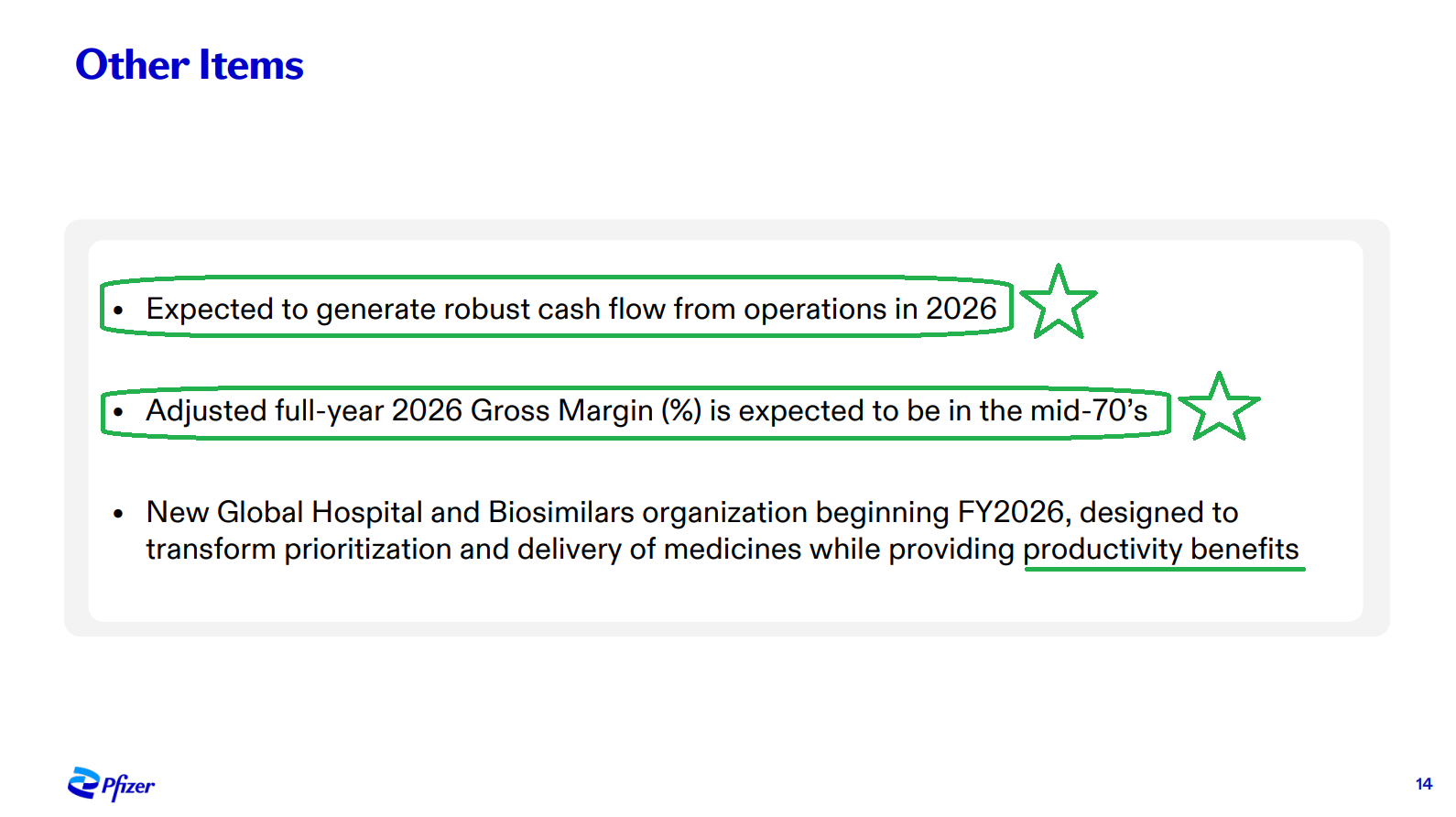

7) 2026 adjusted SI&A expenses are expected to be $12.5B to $13.5B, down from $13.1B to $14.1B in 2025, representing a ~4% YoY decline as cost savings continue to materialize. This is expected to support stable gross and operating margins for the year, with adjusted gross margins projected in the mid-70% range and management seeing a clear path to consistently returning to the mid to high-70% range over time.

8) Pfizer expects robust operating cash flow in 2026, with the bulk of cash restructuring payments now behind the company and the final $2.6B repatriation tax payment occurring in 2026. With capex expected to be slightly above $3B for the year, this sets up solid free cash flow generation on a go-forward basis.

9) Management reaffirmed its commitment to maintaining and growing the dividend over time, with the current quarterly dividend at $0.43 per share and the forward dividend yield now above 6.8%.

10) Management expects to exit the year with gross leverage slightly above 2.7x, which is expected to remain relatively stable through the LOE period. Entering 2026, Pfizer retains ~$6B of business development capacity.

Albemarle Update

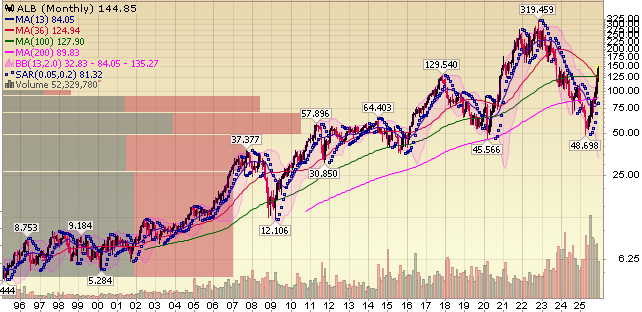

*We have taken profits on a portion of this position as it is now up 139% (~2.4x) off our blended basis (~$61.29) in a very short period of time (faster than we expected). It still remains a core position.

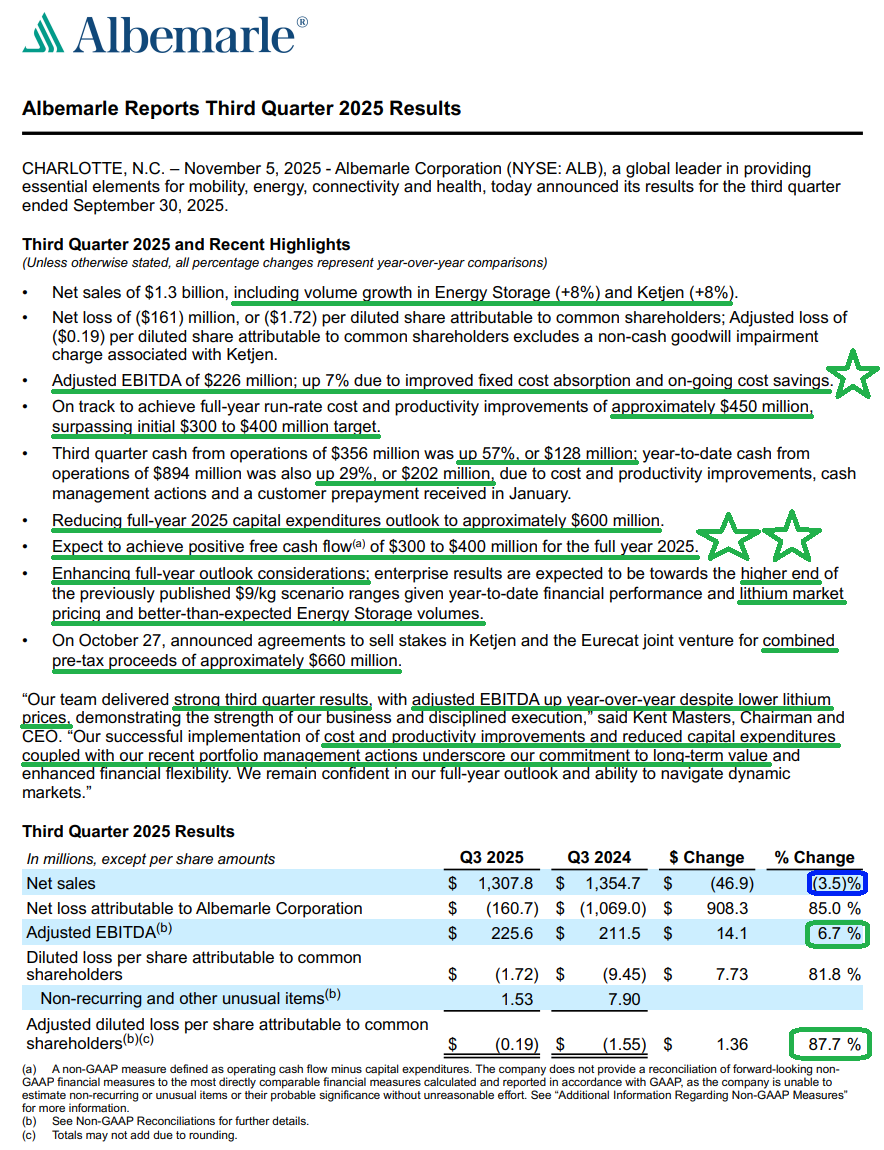

Q3 Earnings Breakdown

10 Key Points

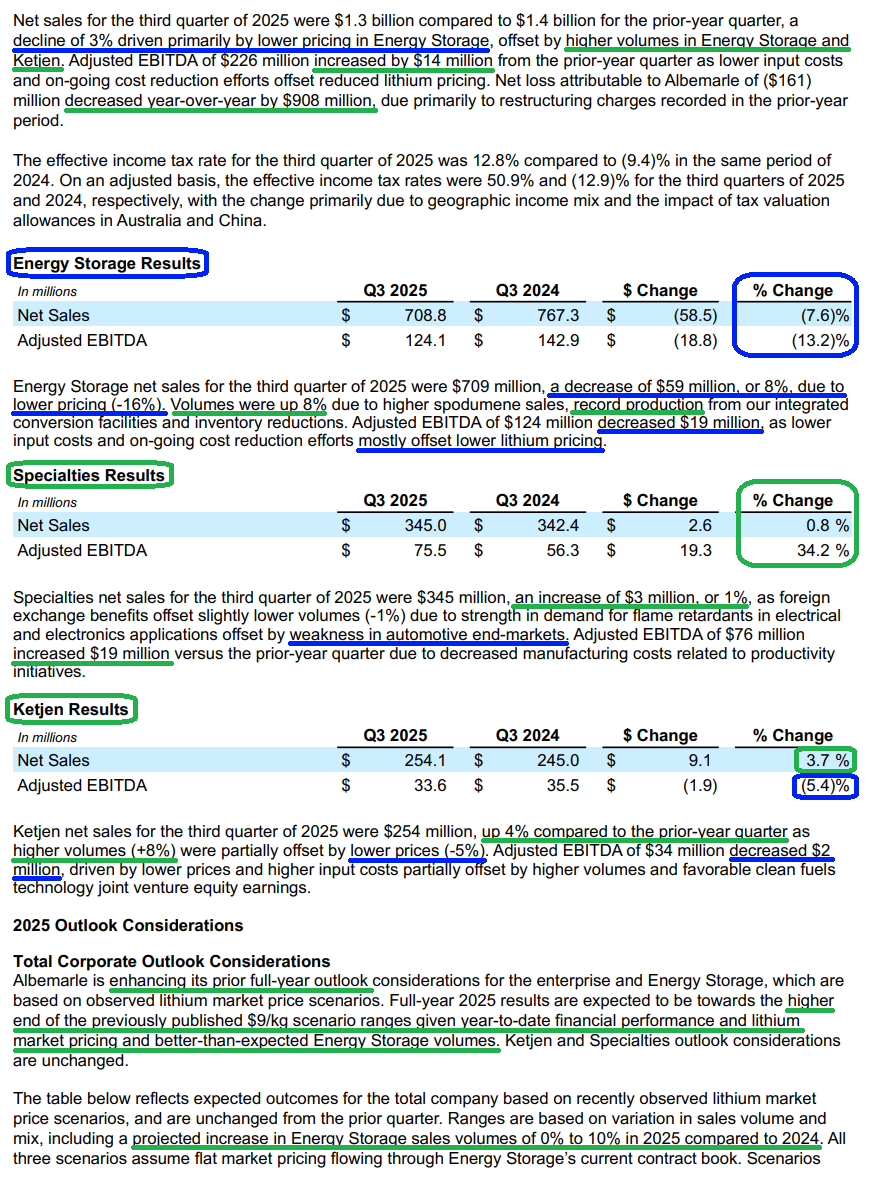

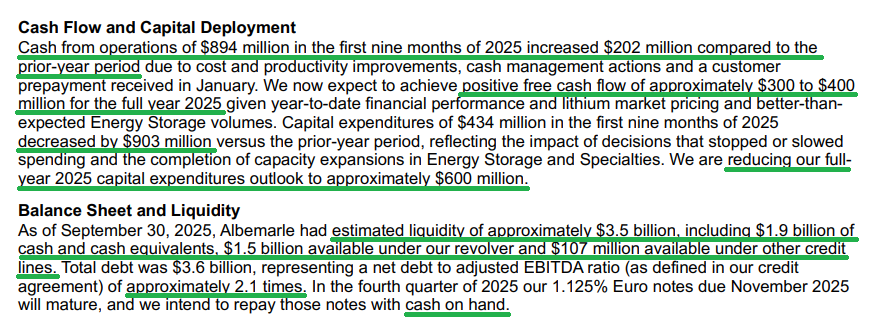

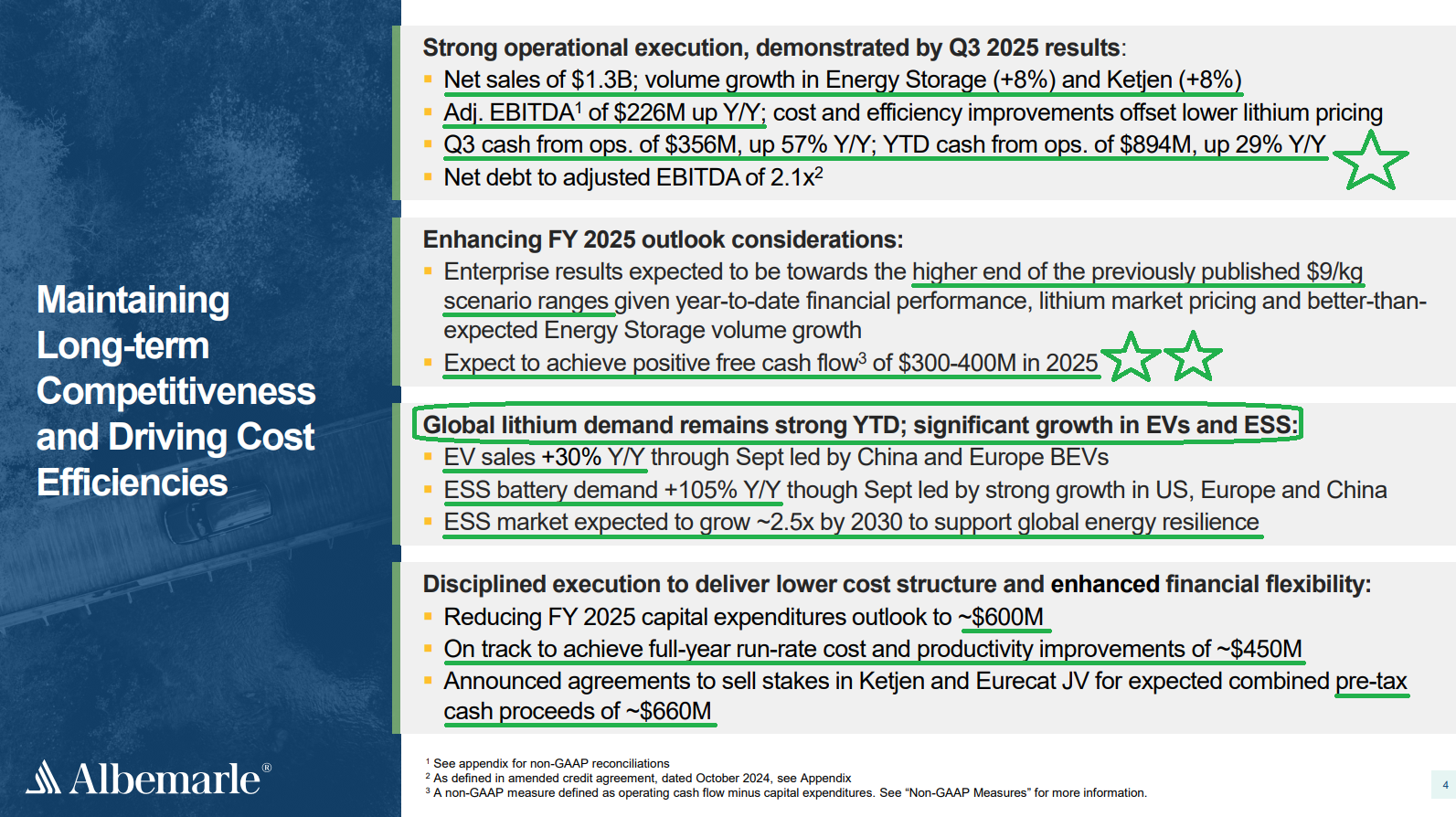

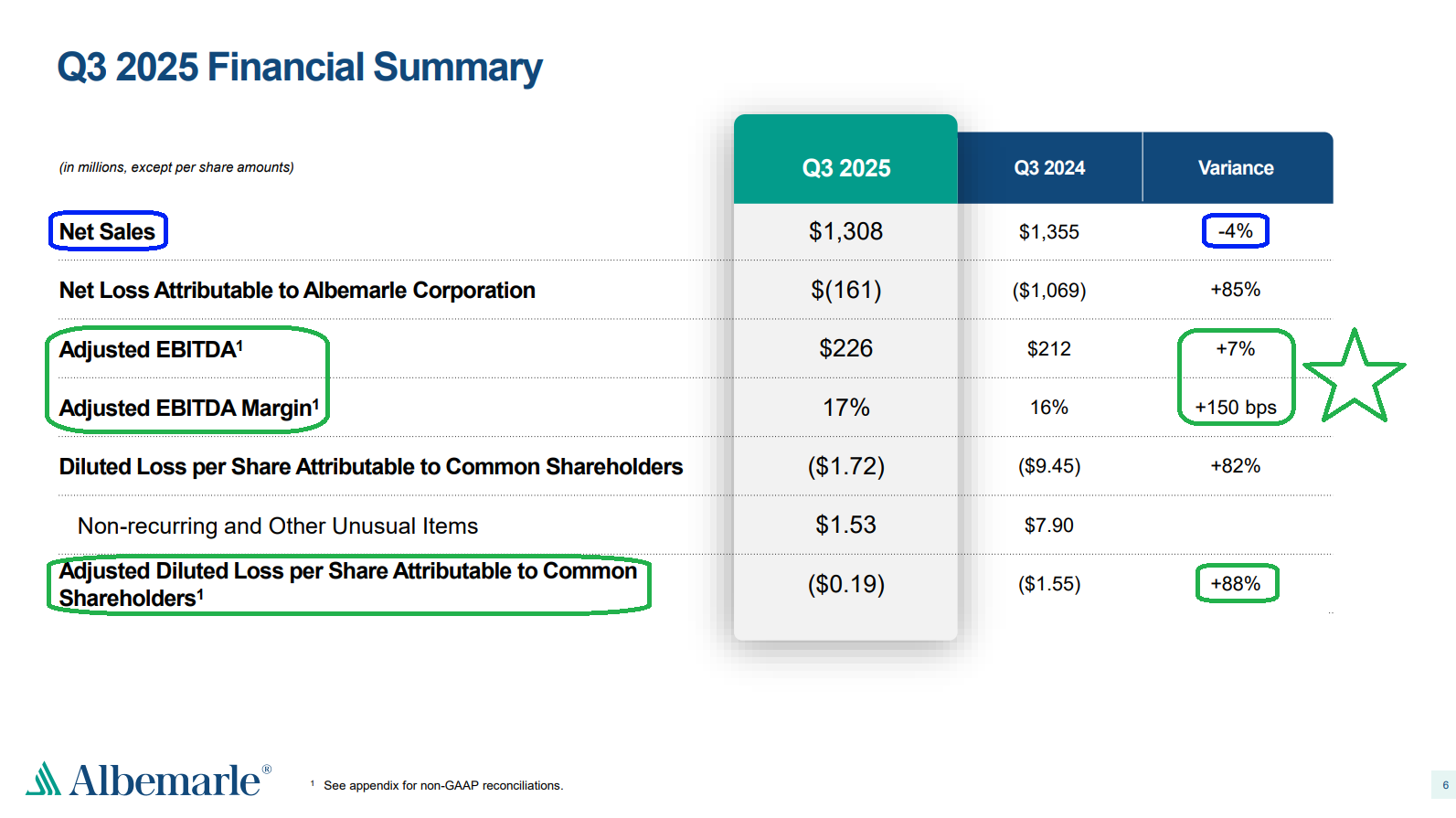

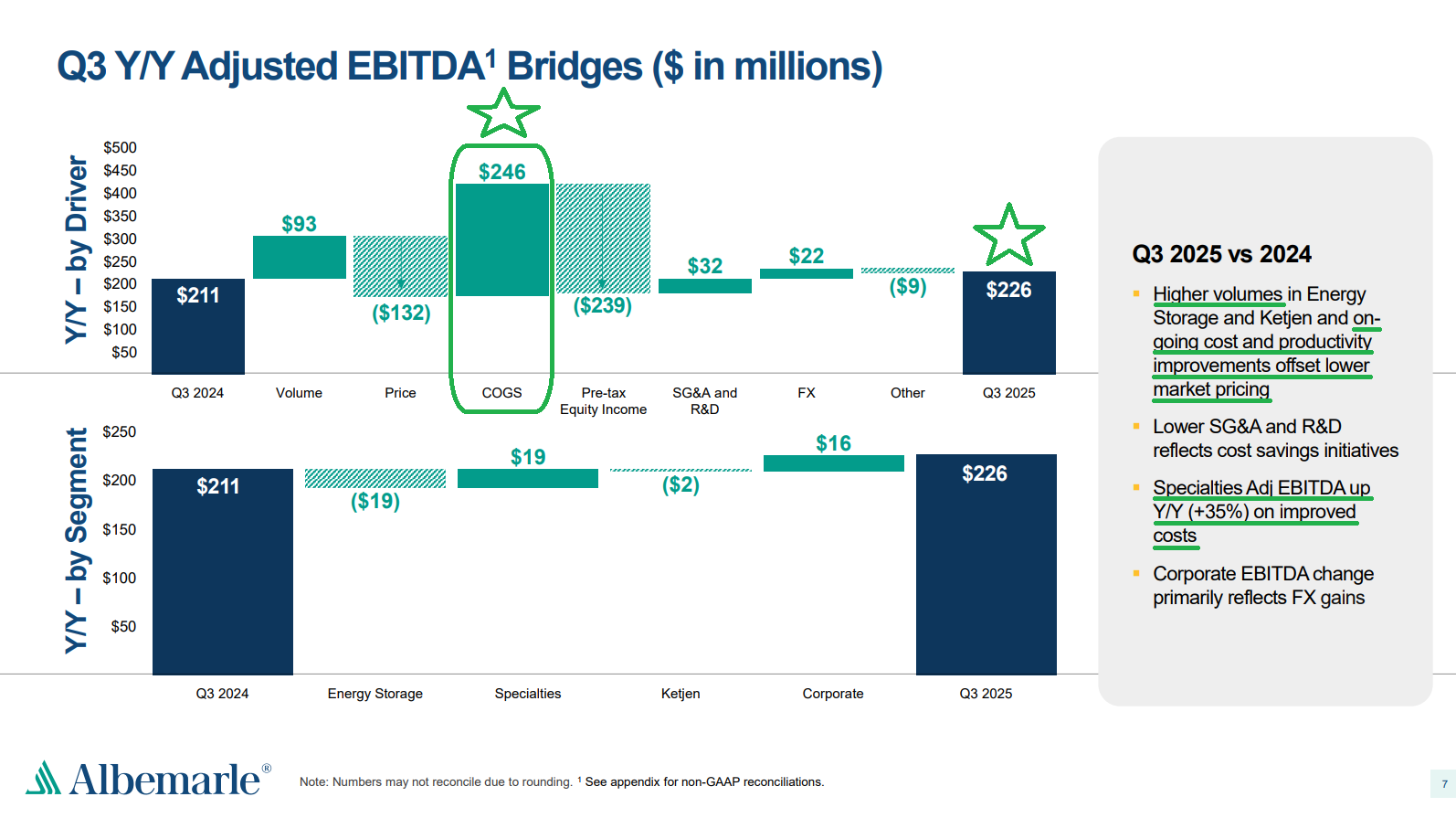

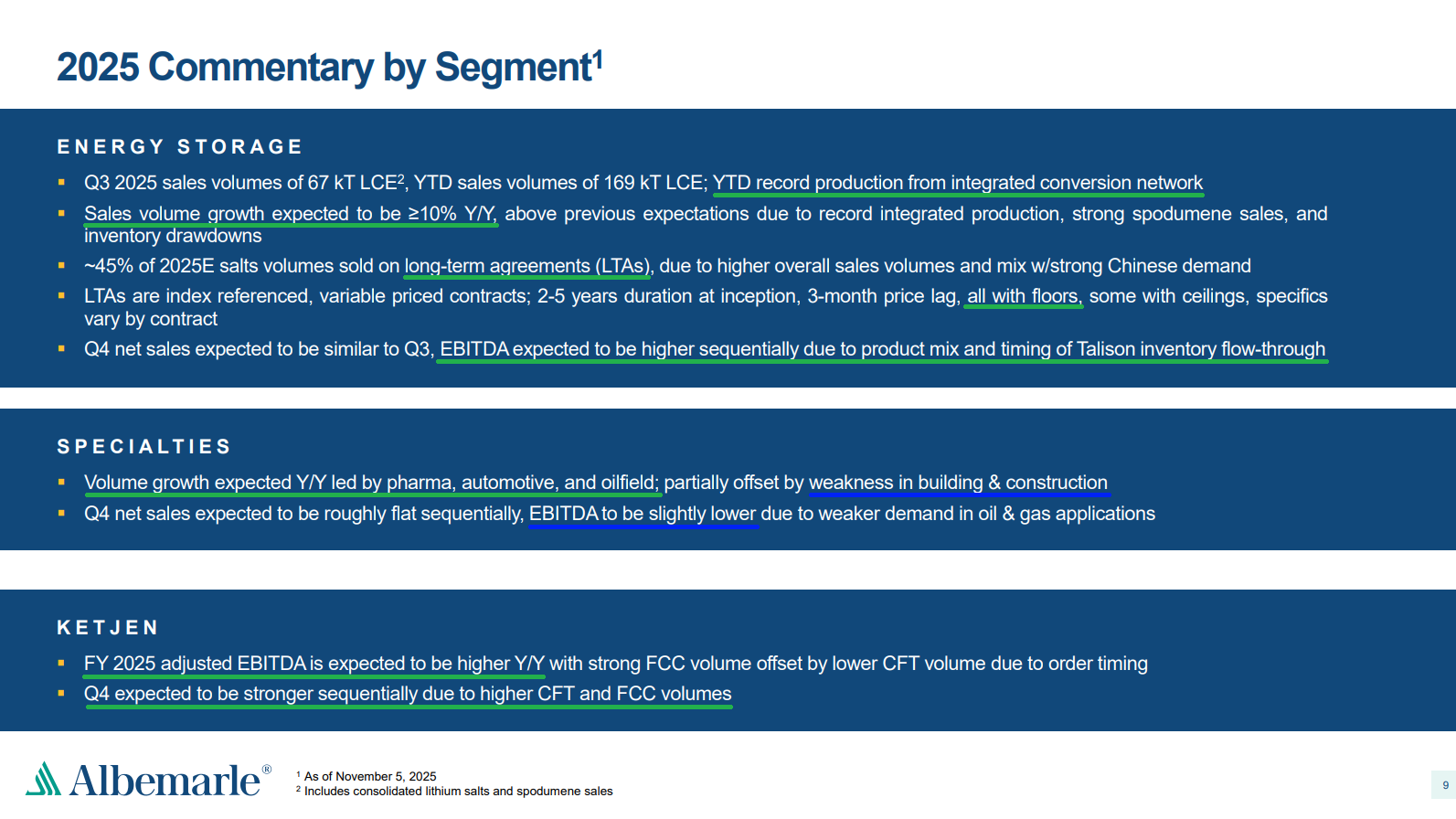

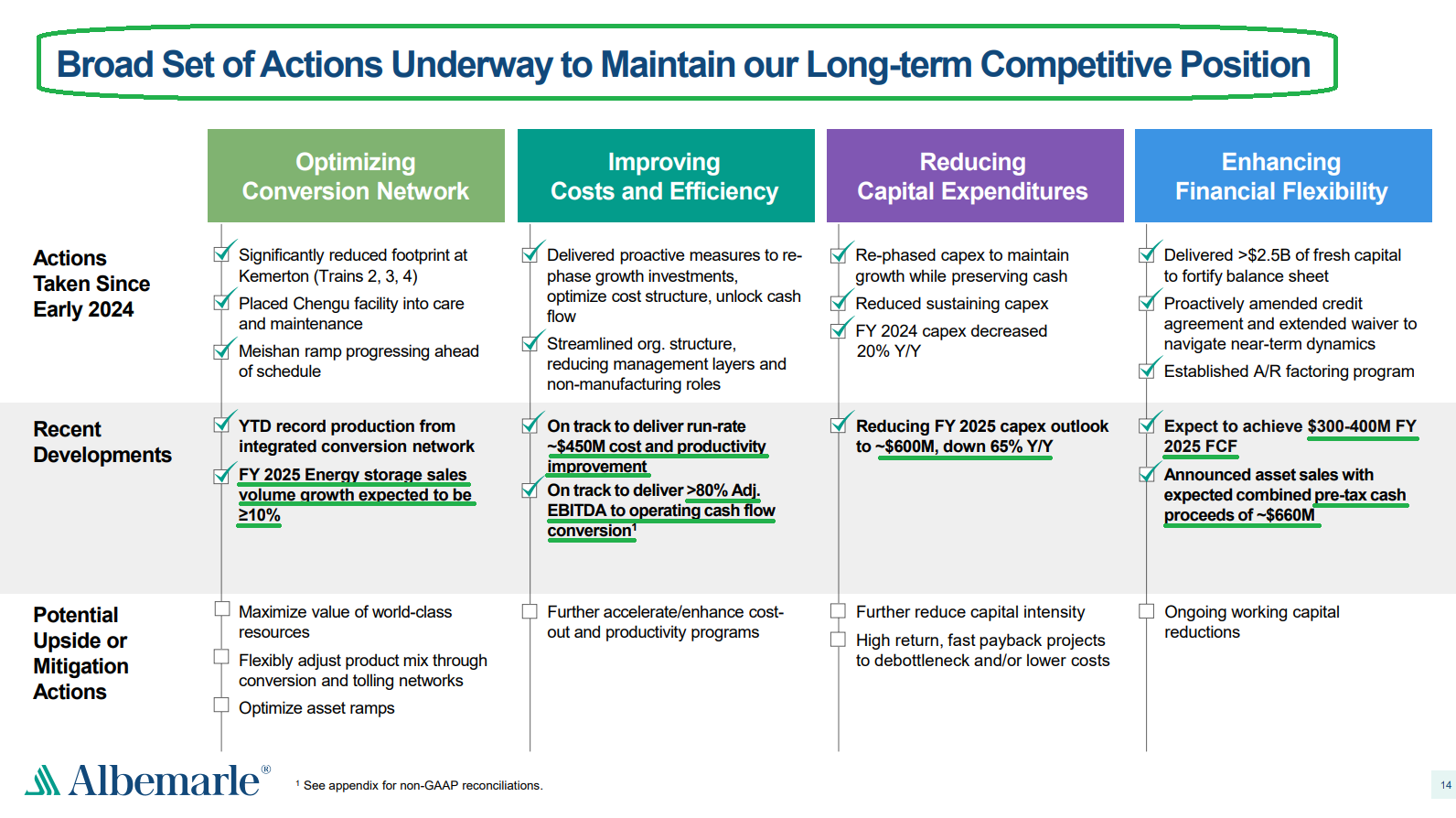

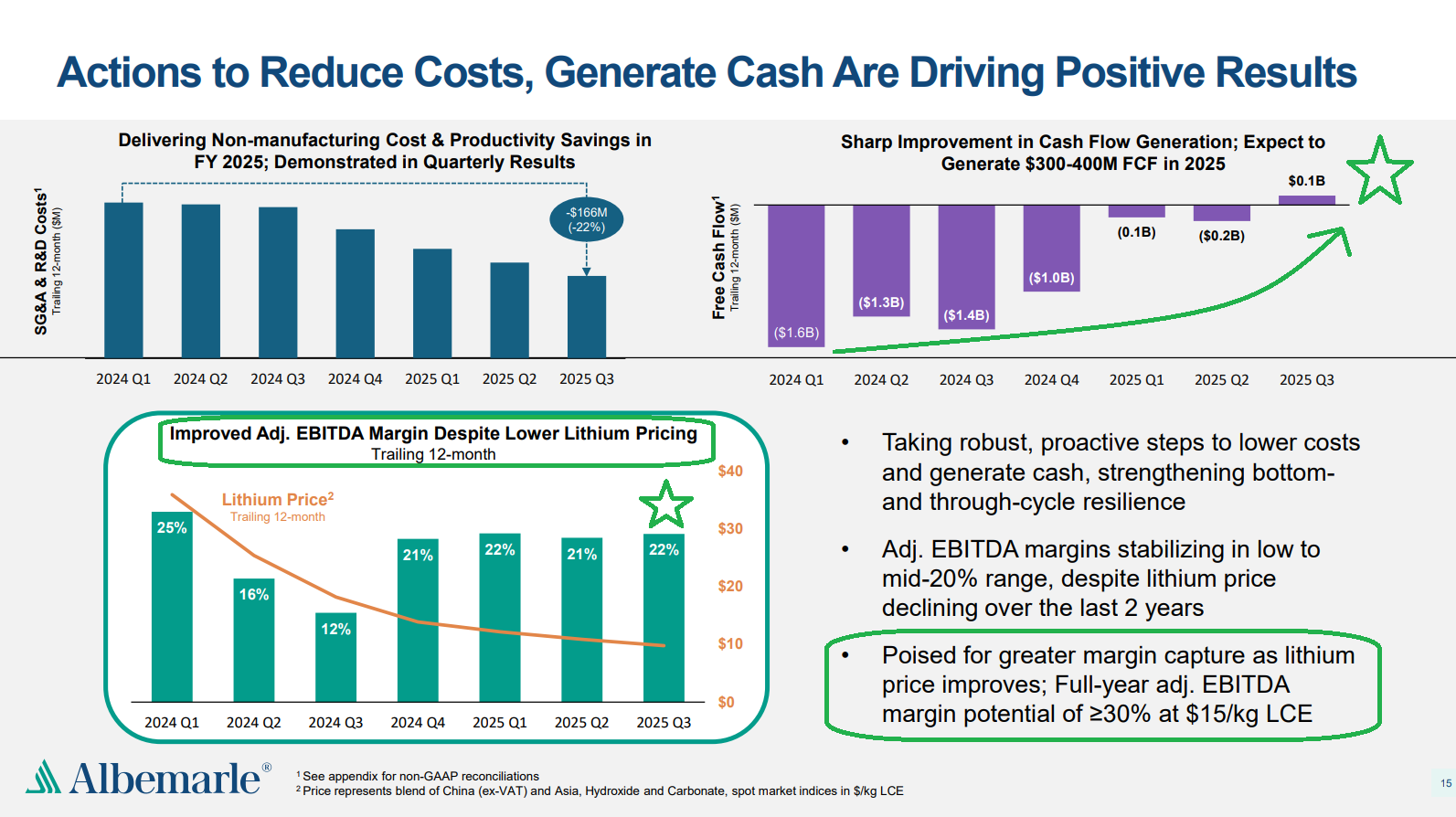

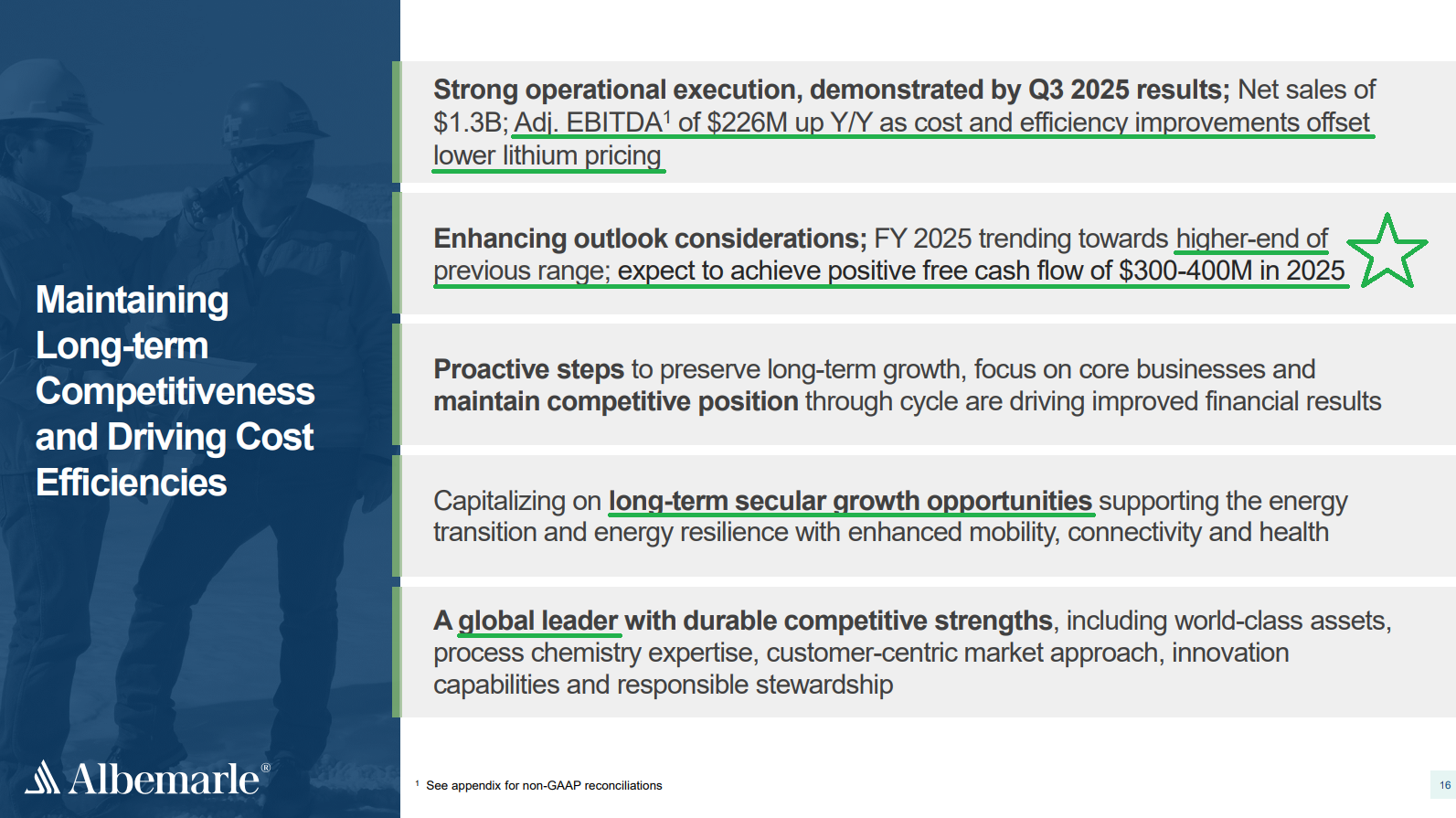

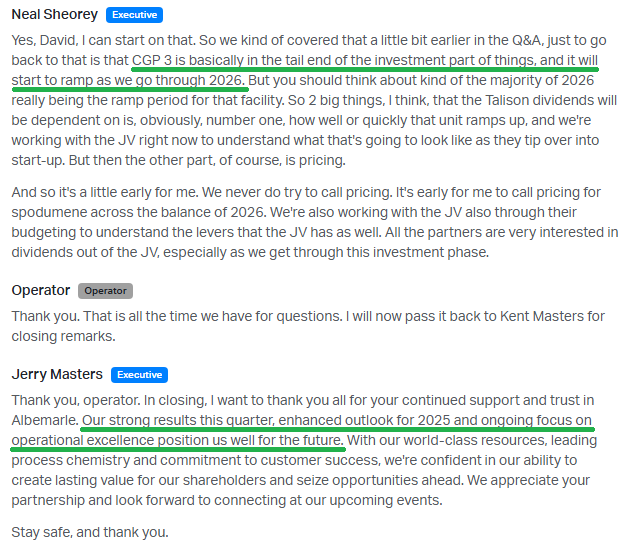

1) Revenue of $1.31B declined 3.5% YoY but beat consensus by ~$28M, as 8% volume growth in both Energy Storage and Ketjen was more than offset by price declines of 16% and 5%, respectively. Adjusted loss per share of $0.19 beat Street estimates by $0.69 and improved 88% from the $1.55 loss last year.

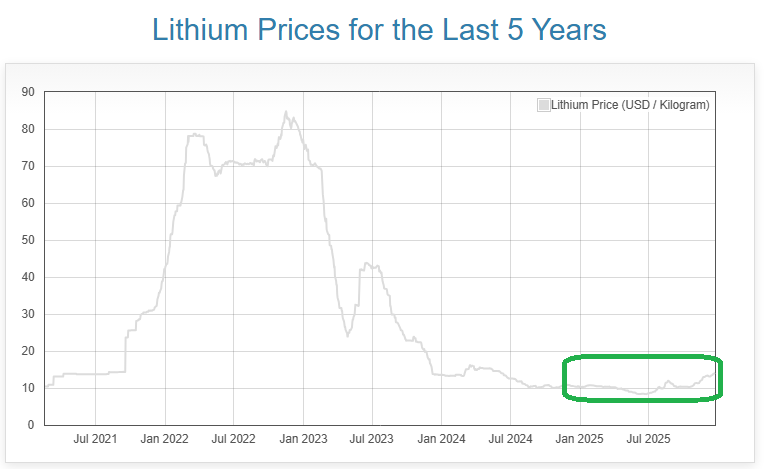

2) Despite lower lithium prices in Q3, management made meaningful progress on profitability, with adjusted EBITDA of $226M, up 7% YoY, and margins improving 170 bps to 17.3%. Based on costs removed from the business and recovering lithium prices, management expects operating leverage could eventually push adjusted EBITDA margins above 30% at $15/kg LCE. For context, lithium prices are now over $14/kg LCE, knocking on the door of management’s target.

Again – while this may seem like a big move from the summer lows, it pays to zoom out… These are still very early days.

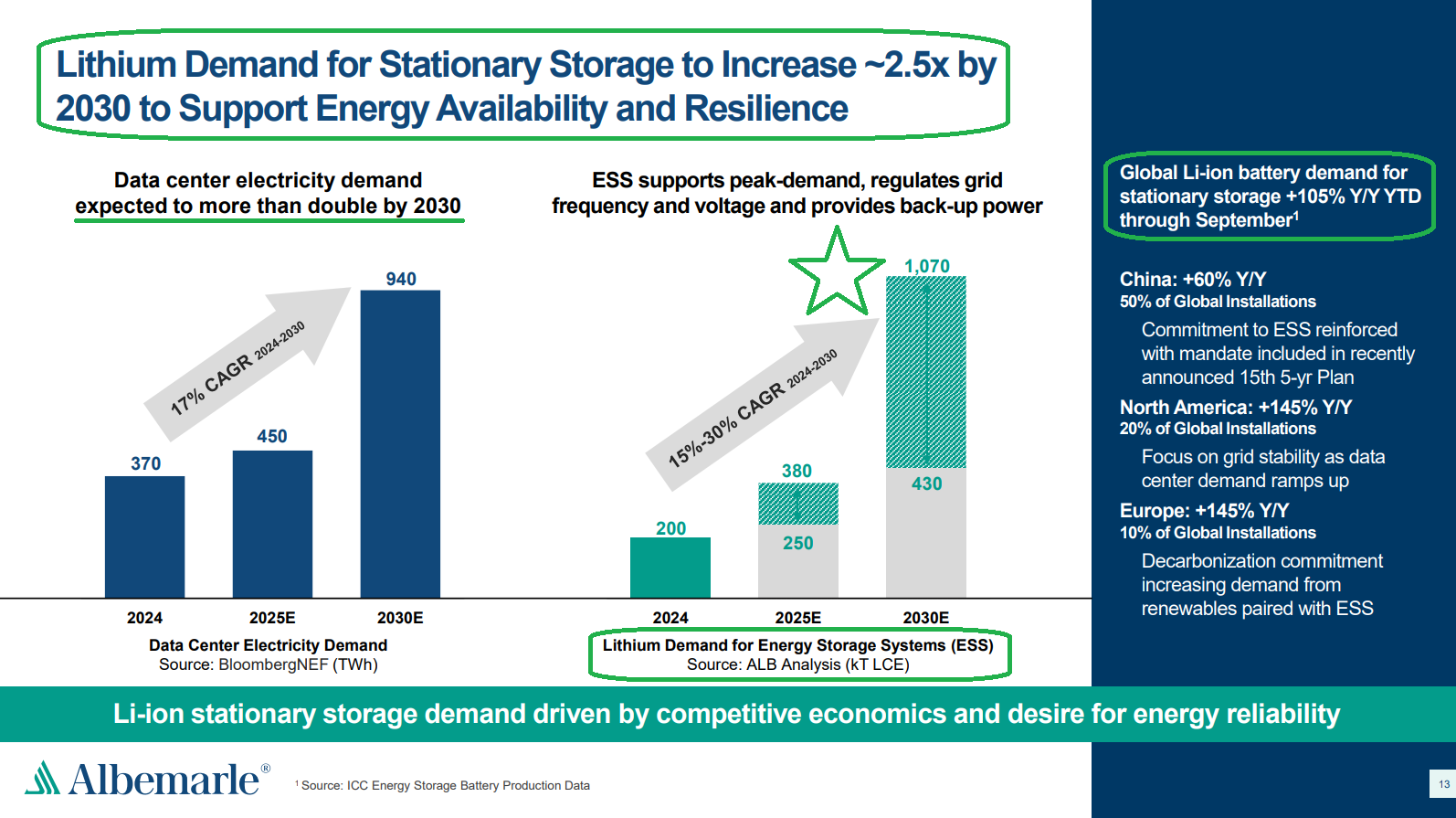

3) Global lithium-ion battery demand for stationary storage jumped 105% YTD, led by North America and Europe at 145% each, and China at 60%. The market has been a major upside surprise for management, with demand exceeding expectations and slower-than-expected supply growth tightening the market. Lithium demand for energy storage systems is now expected to increase more than ~2.5x, to a range of 430-1,070 kT LCE by 2030 from 200 kT in 2024, implying a 15-30% CAGR and potentially reaching half of total lithium demand.

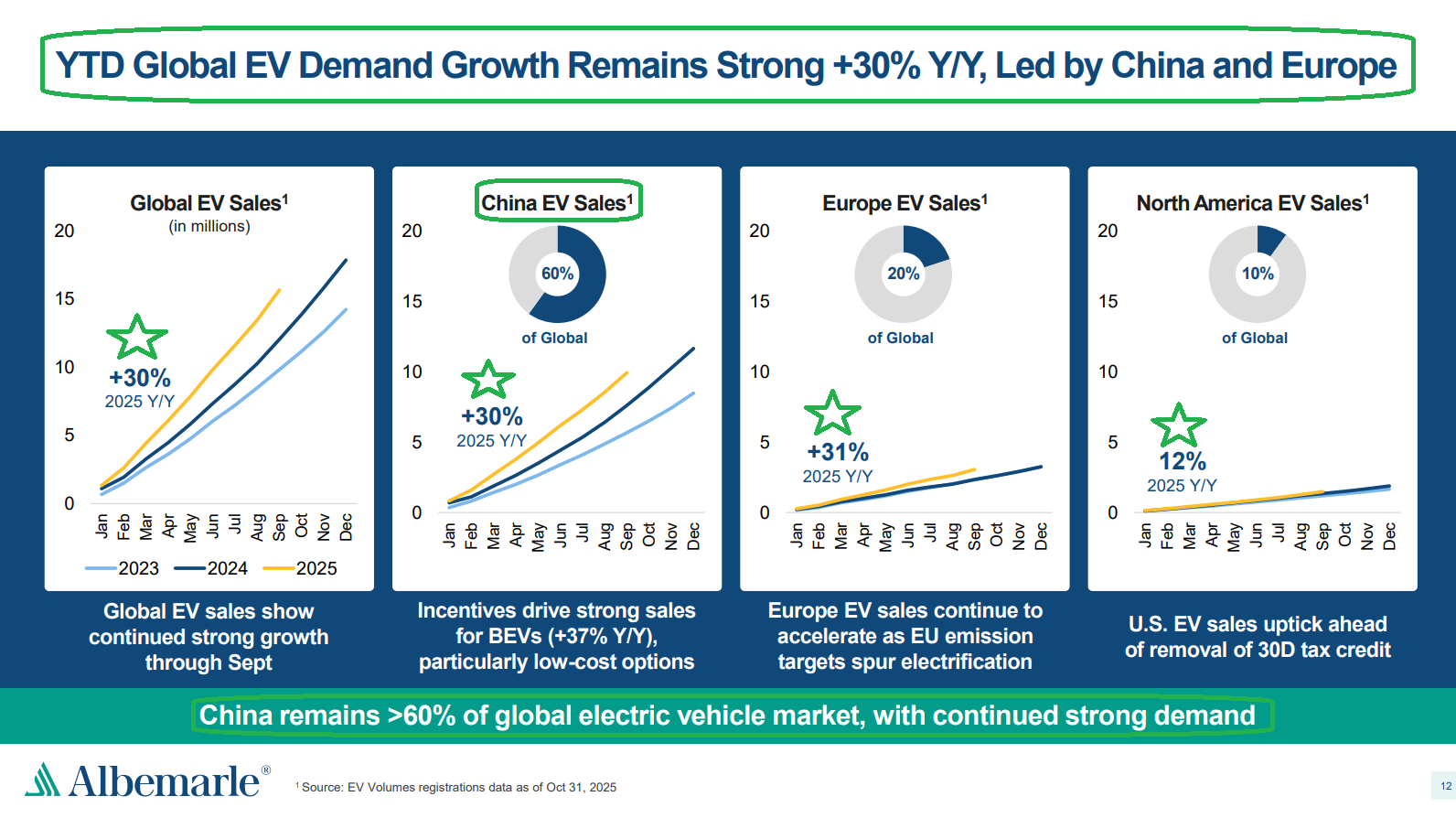

4) Despite the noise, global EV demand remains strong, growing 30% year to date. China continues to represent over 60% of the global EV market, maintaining strong demand even after surpassing 50% market penetration. Europe accounts for ~20% of the market with 31% growth, while the US makes up just 10% of the market with 12% growth. Global EV demand still drives over 70% of total lithium demand, and management expects the market to remain healthy with continued growth ahead.

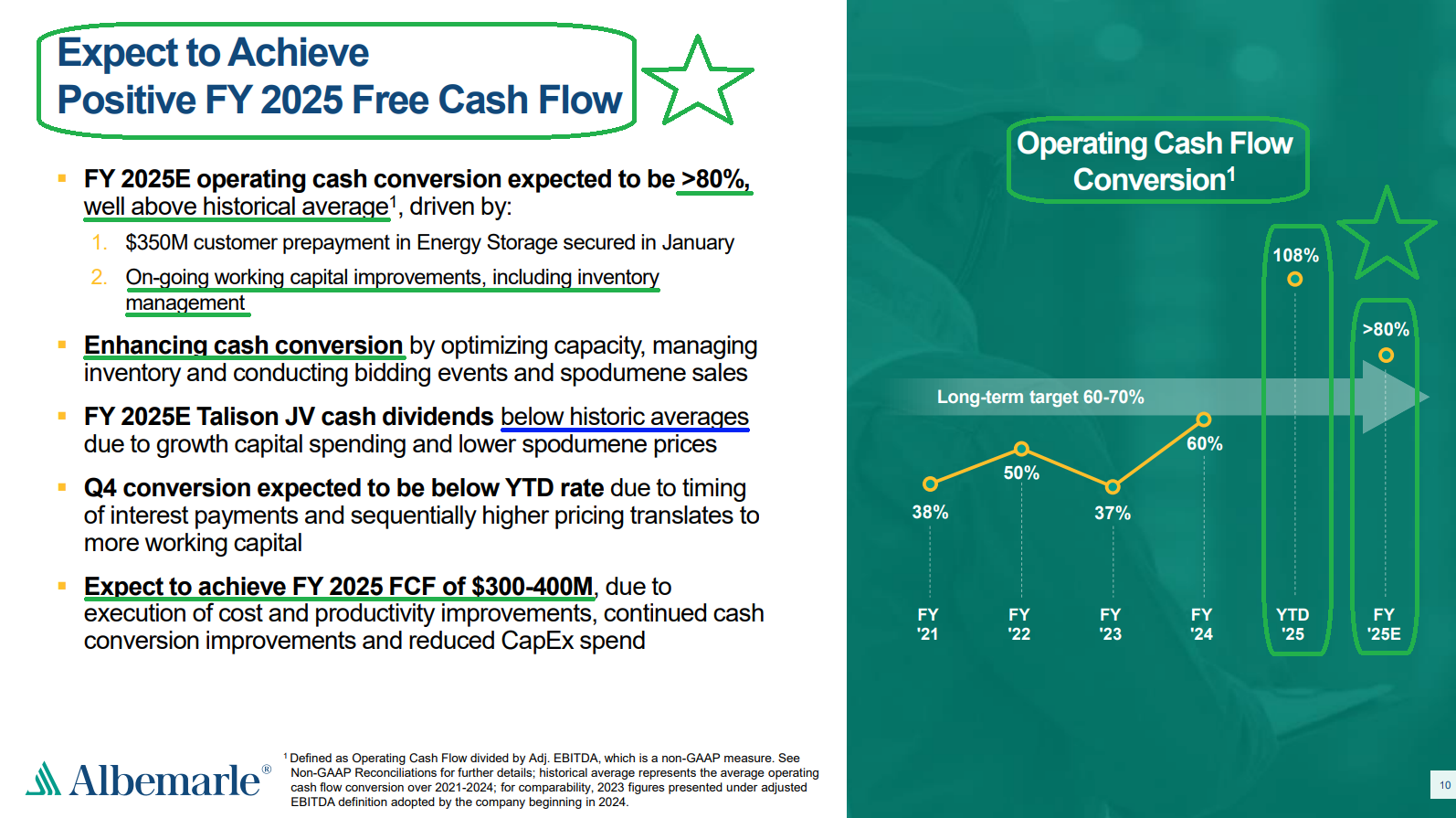

5) Operating cash flow came in at $356M in Q3, up 57% YoY, bringing YTD operating cash flow to $894M, up 29%. Management continues to expect full-year operating cash flow conversion above 80%, well above the long-term target of 60-70%, driven by the $350M customer prepayment earlier in the year and ongoing working capital improvements. Most importantly, management now expects to generate $300-$400M in free cash flow for the full year, compared to the year’s original expectation of breakeven and last quarter’s call for just positive.

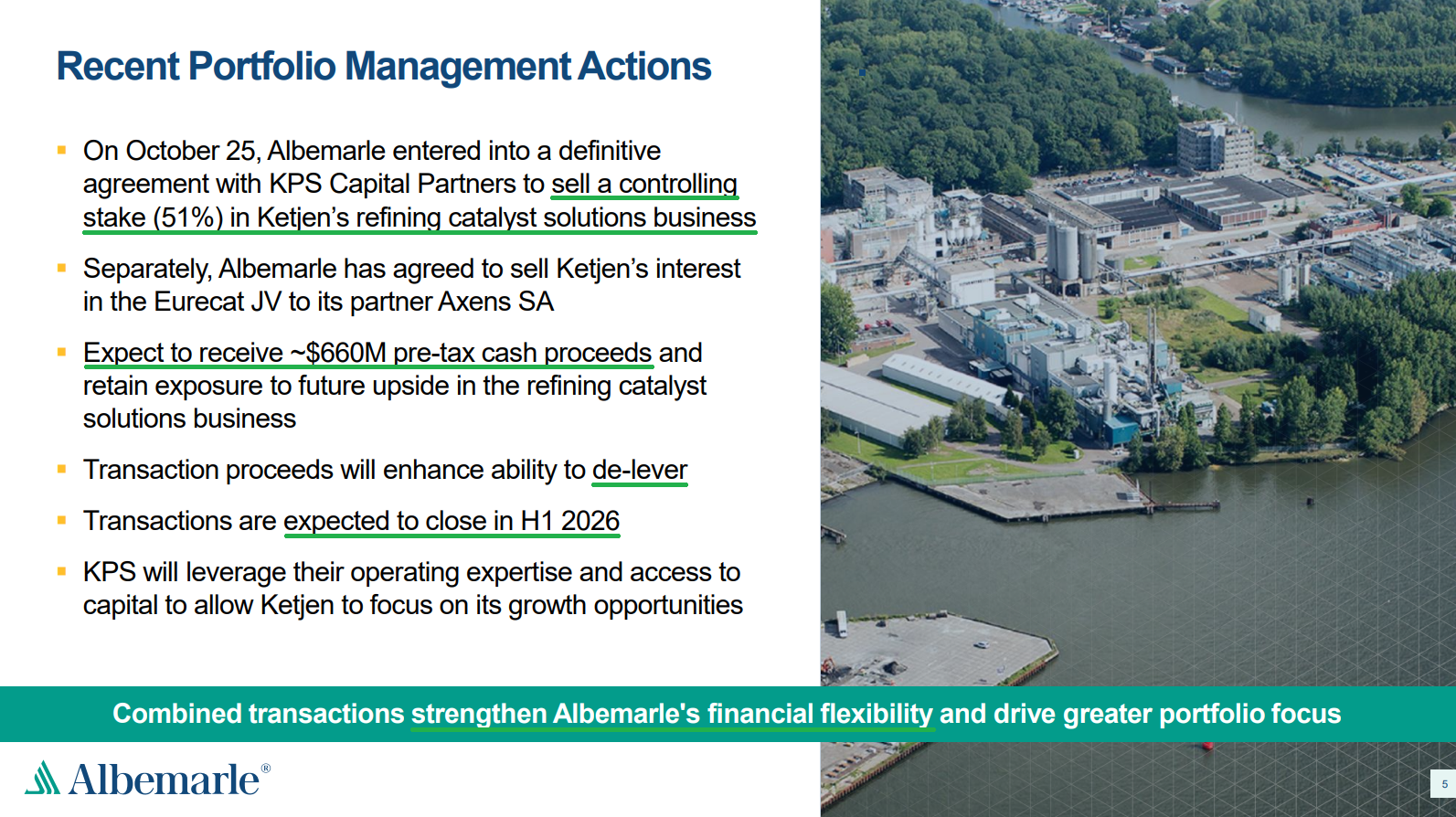

6) Management announced agreements to sell its controlling 51% stake in Ketjen’s refining catalyst solutions business and Ketjen’s interest in the Eurecat joint venture for combined pre-tax proceeds of ~$660M. Both transactions are expected to close in the first half of 2026, with proceeds supporting further balance sheet de-leveraging.

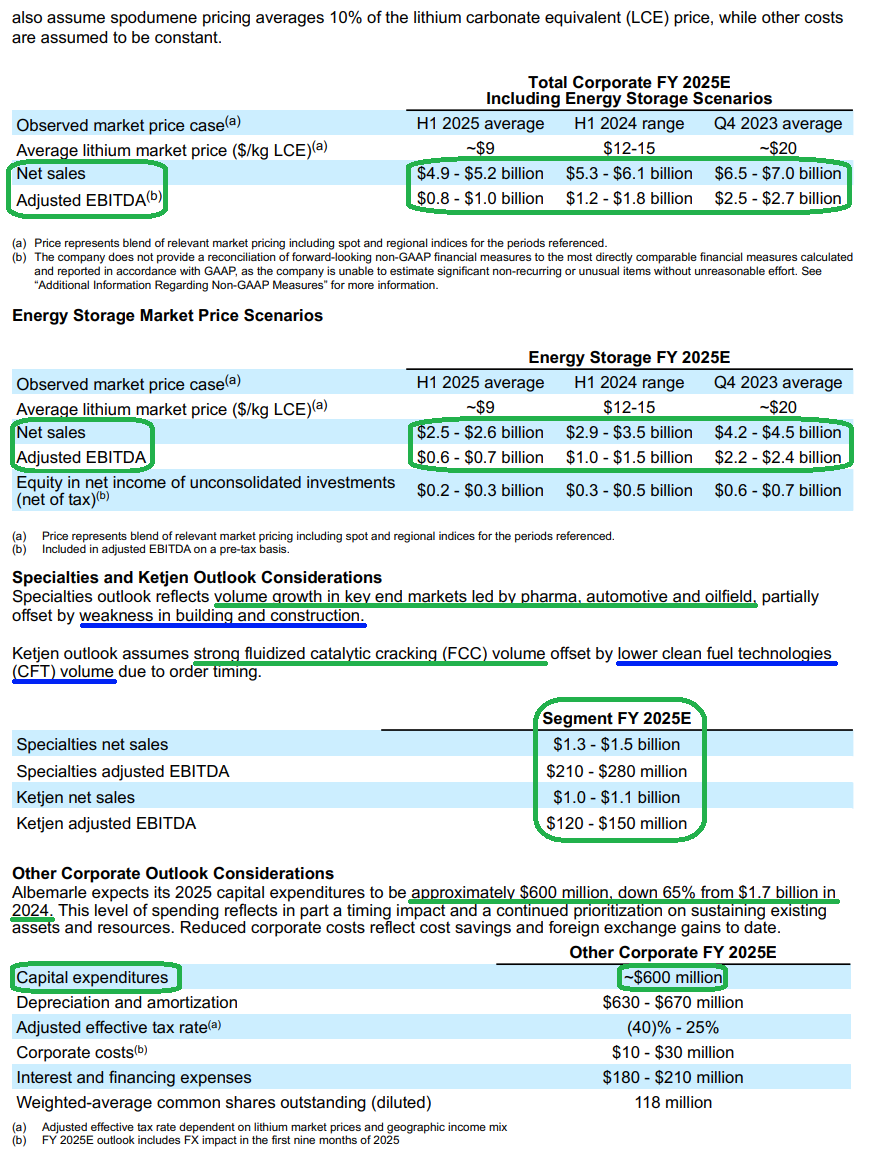

7) Albemarle further lowered full-year capex expectations to ~$600M, a 65% decline from last year’s $1.7B and exceeding the original plan for a 50% reduction, as management focuses on projects with the highest returns and fastest paybacks. Looking to 2026, management sees a further 10% decline as reasonable, emphasizing that current capex maintains assets and reflects efficiency gains rather than underinvestment.

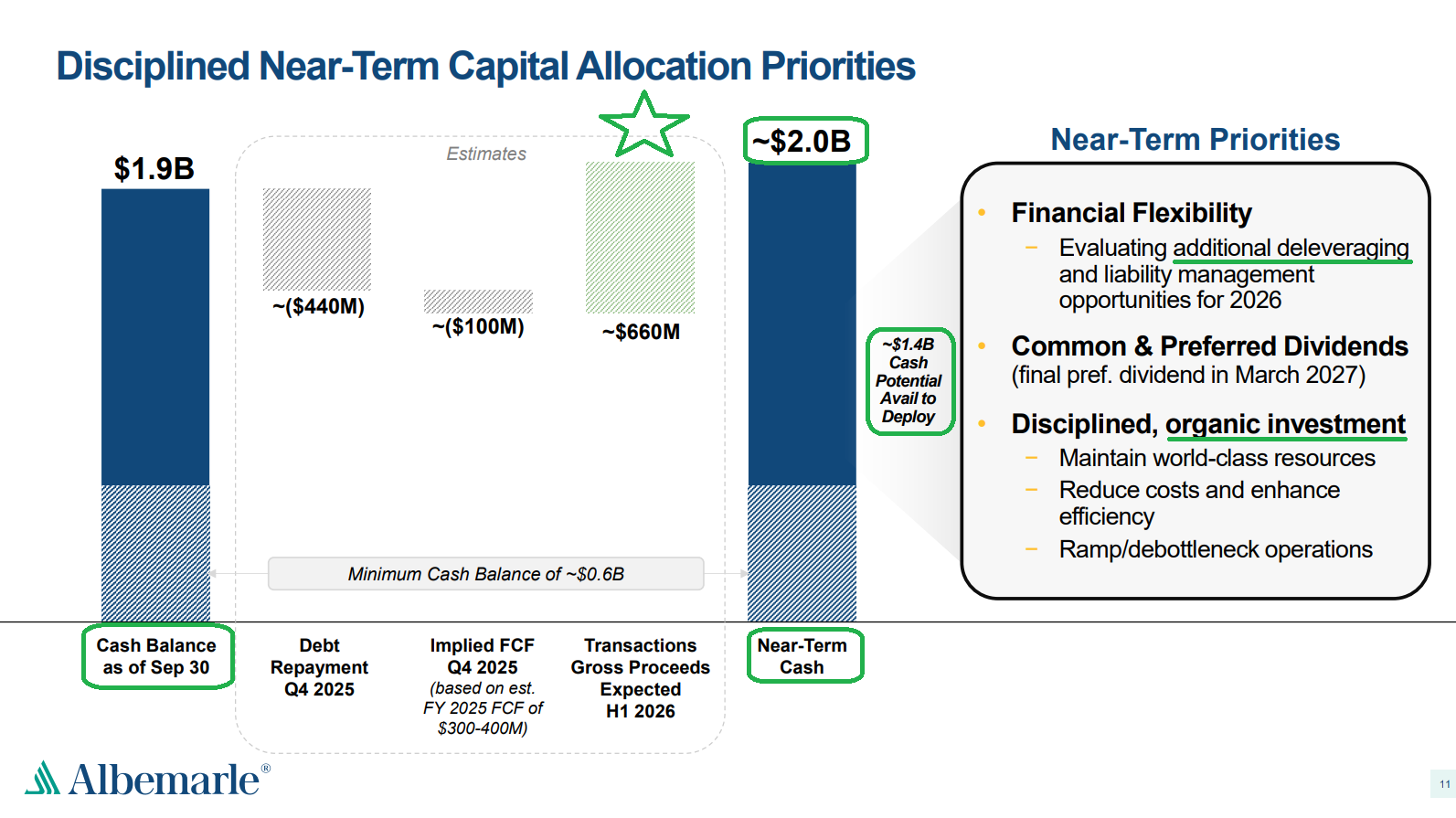

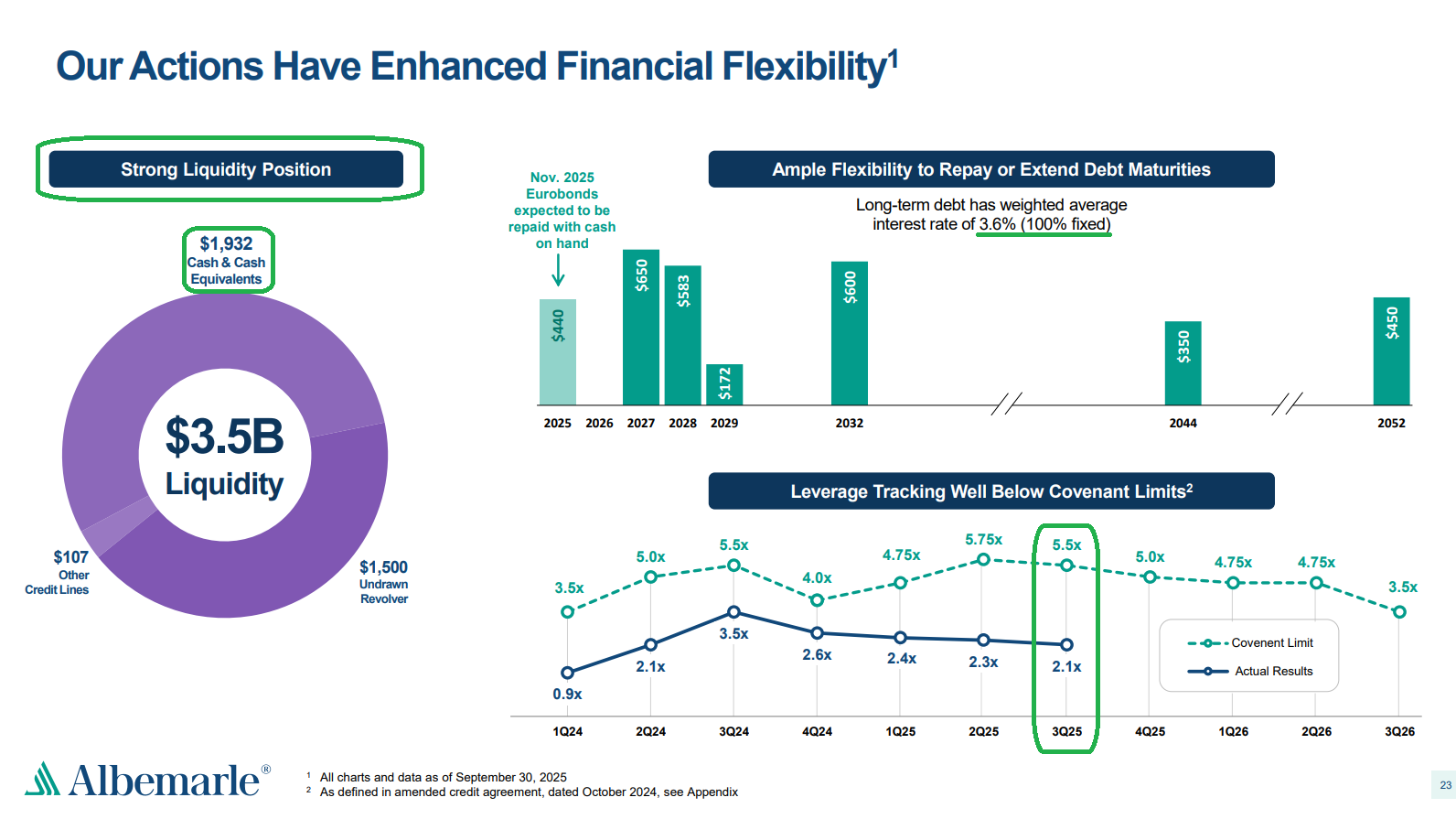

8) Management continues to strengthen the balance sheet, with $1.9B in cash and cash equivalents and total liquidity of ~$3.5B. Total debt stood at $3.6B, fully fixed at a weighted average rate of 3.6%, resulting in net debt to adjusted EBITDA of just 2.1x. Following the Ketjen transactions and the Q4 debt repayment of $440M, near-term cash is expected to reach ~$2B.

9) Management is now on track to deliver full-year run-rate cost and productivity improvements of ~$450M, above the initial target of $300-$400M, with sales, administrative, and R&D expenses down $166M, or 22% YTD.

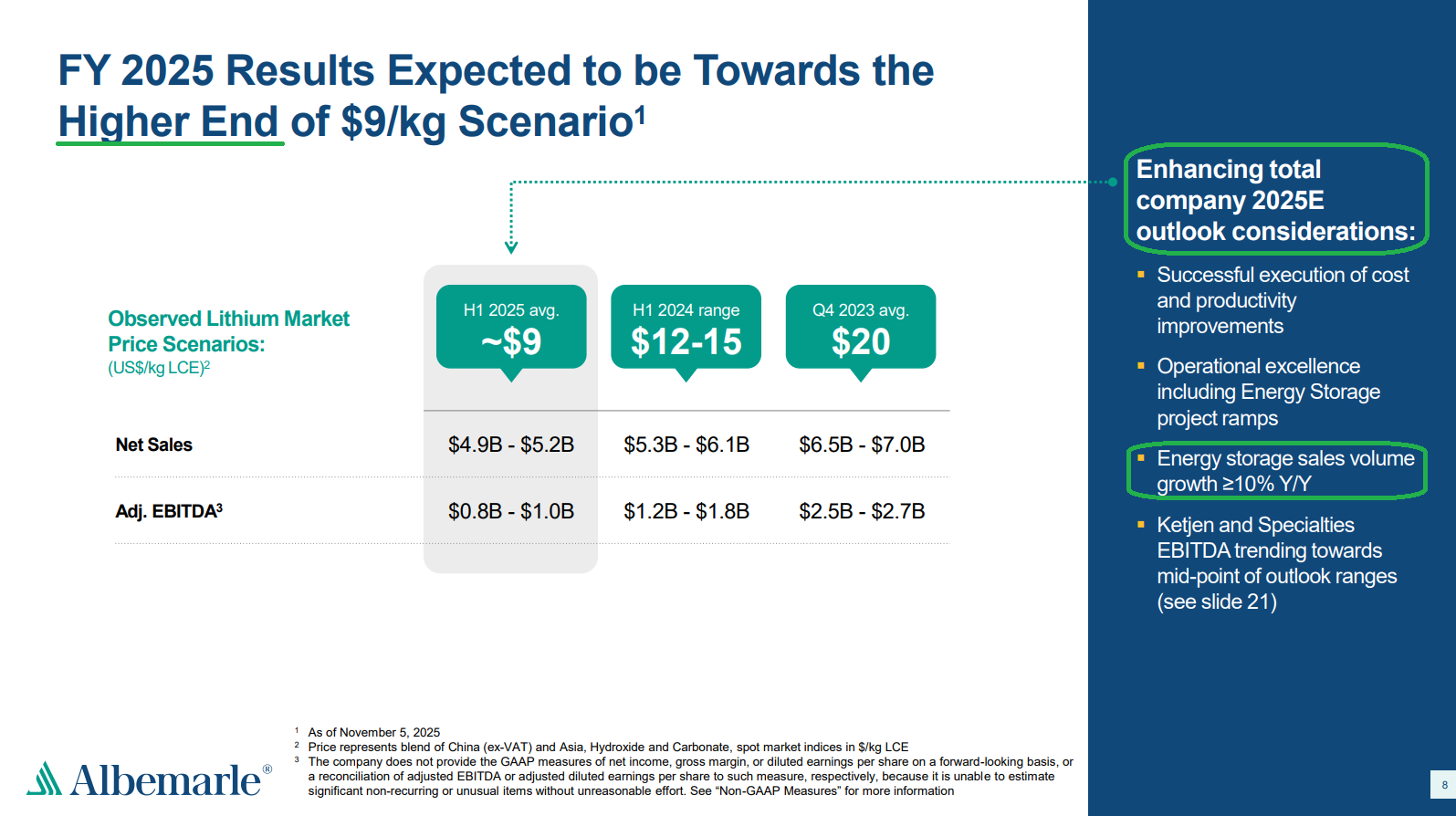

10) Management now expects the full-year outlook to land at the higher end of the previously published $9/kg scenario, which called for sales of $4.9-$5.2B and adjusted EBITDA of $0.8-$1B, driven by stronger lithium pricing and full-year volumes expected to exceed 10%. Keep in mind, this guidance was issued in early November when prices were still below $11.5/kg, suggesting meaningful upside to those numbers based on today’s prices.

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked up to 55 this week from 51 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

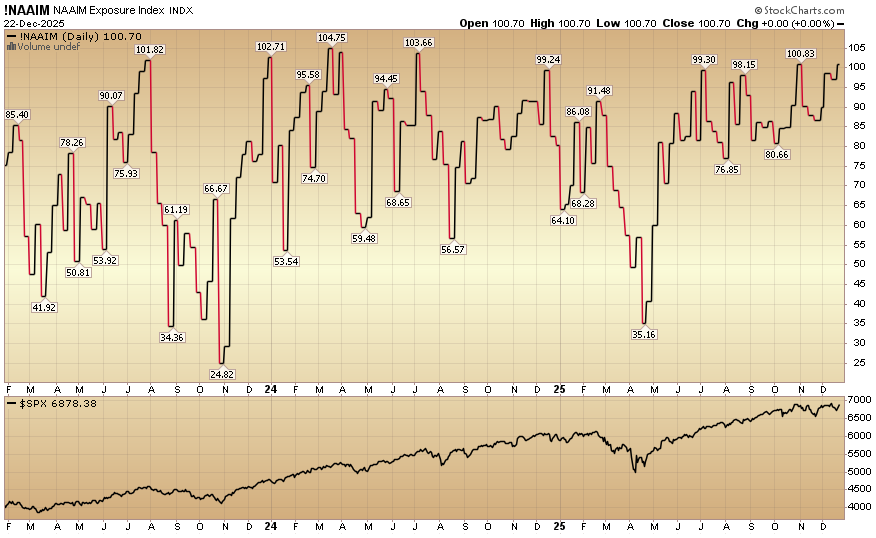

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 100.70% this week from 97.13% equity exposure last week.

Our podcast|videocast will be out sometime today. We have a lot of great data to cover this week. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form here.

More By This Author:

“Lifting Off And Looking Good” Stock Market (And Sentiment Results)

“Holiday Carts And Auto Parts” Stock Market (And Sentiment Results)…

“The Housing Power Play” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more