“The Housing Power Play” Stock Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

On Wednesday, I joined Taylor Riggs, Brian Brenberg, Jackie DeAngelis, and Dagen McDowell on Fox Business’ The Big Money Show to discuss markets, the economy, news, and a lot more. Thanks to Taylor, Brian, Jackie, Dagen, and Madison Murtagh for having me on:

On Wednesday, I joined Diane King Hall on the Schwab Network to discuss markets, outlook, Pfizer, and Papa John’s. Thanks to Diane and Mya for having me on:

Watch in HD Directly on Schwab Network

On Wednesday, I joined Kristen Scholer on NYSE TV to discuss markets, outlook, Pfizer, and Papa John’s. Thanks to Kristen and Mel Montanez for having me on:

Watch in HD Directly on NYSE TV

MoneyShow

Earlier this week, I had the privilege to speak at the legendary 4 decade+ MoneyShow “Investment Masters Symposium” (for Accredited Investors) in Sarasota, FL. Thanks to Kim Githler, Debbie Osborne, Mike Larson and Aaron West for inviting me to speak:

Generac Update

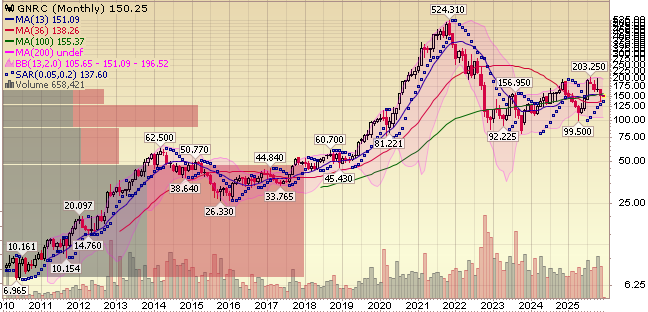

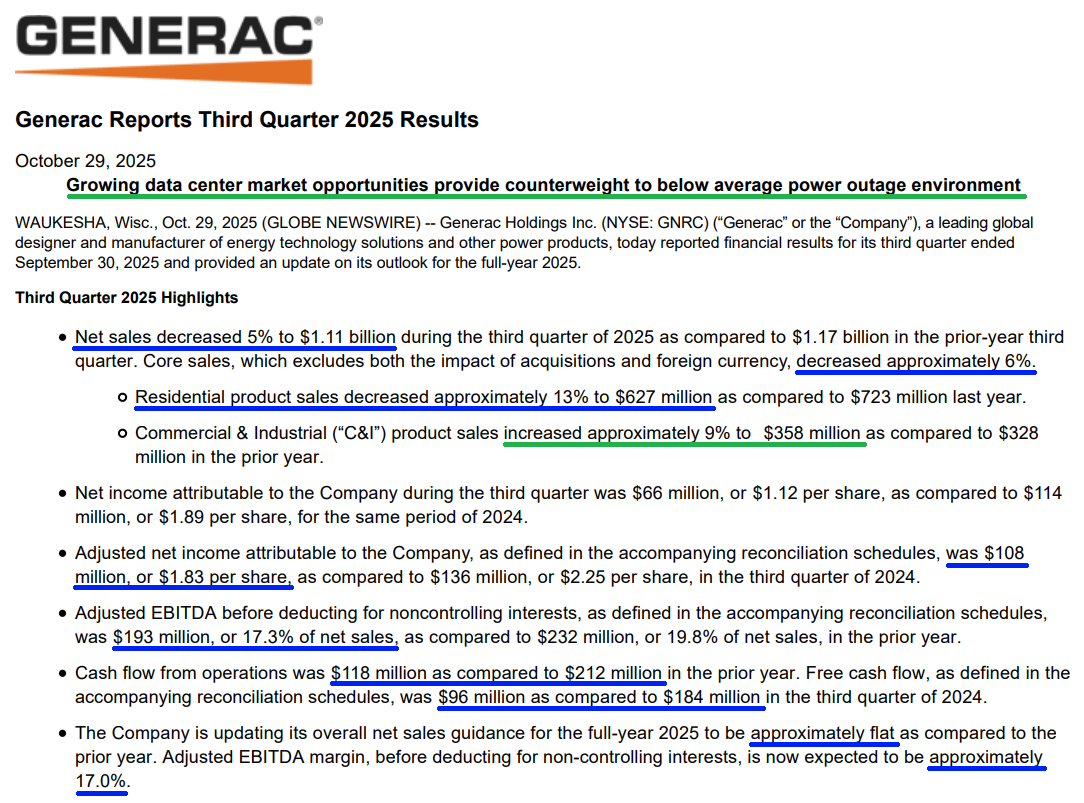

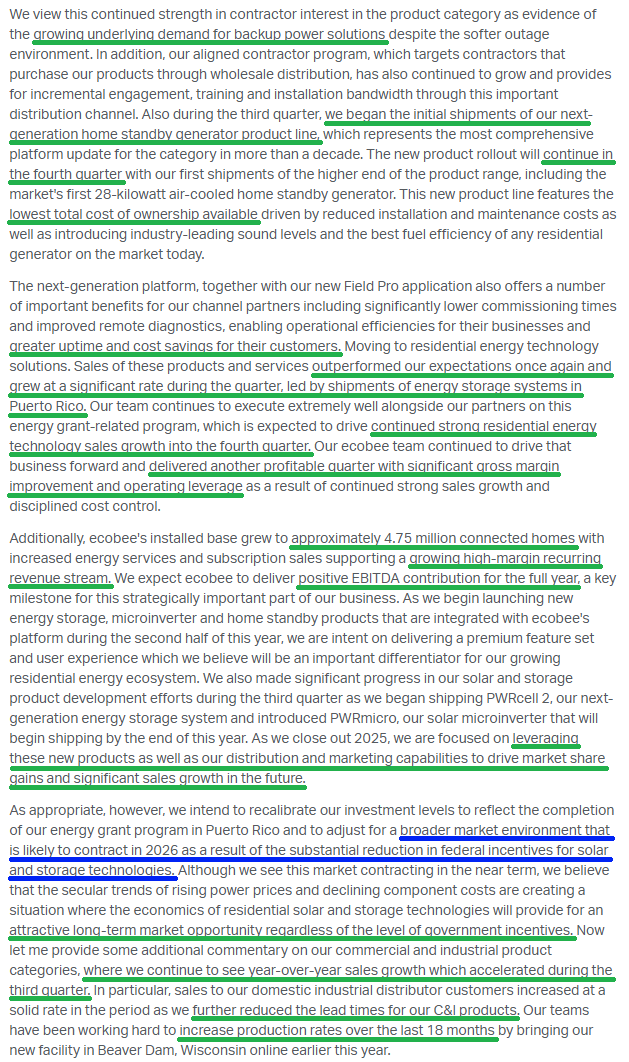

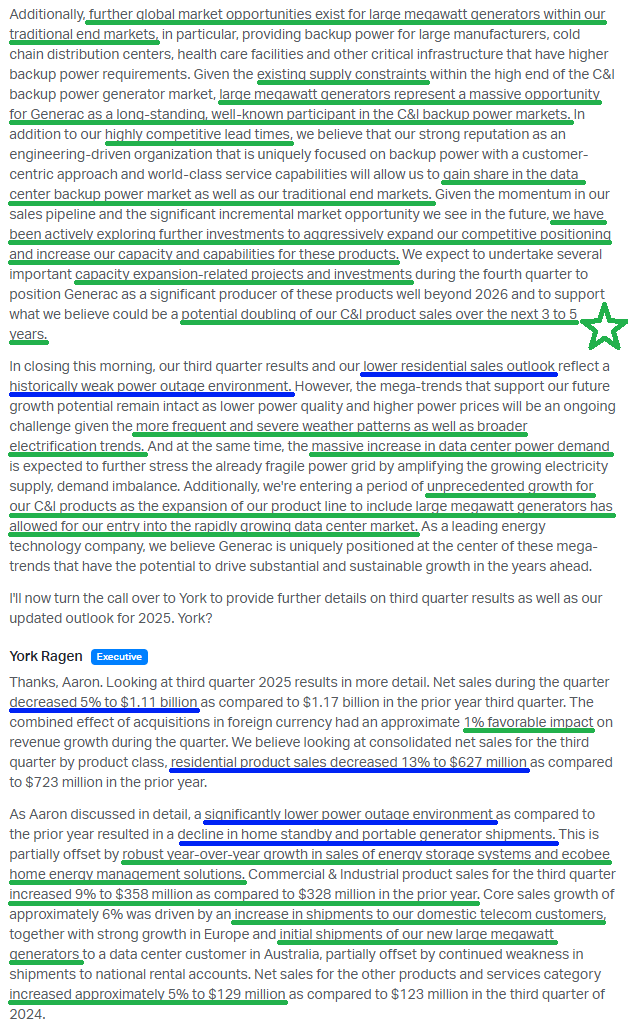

Generac (GNRC) delivered a softer-than-expected third quarter, with revenue of $1.11B (down 5% YoY) missing estimates by ~$79M and adjusted EPS of $1.83 (down 19% YoY) missing by $0.37.

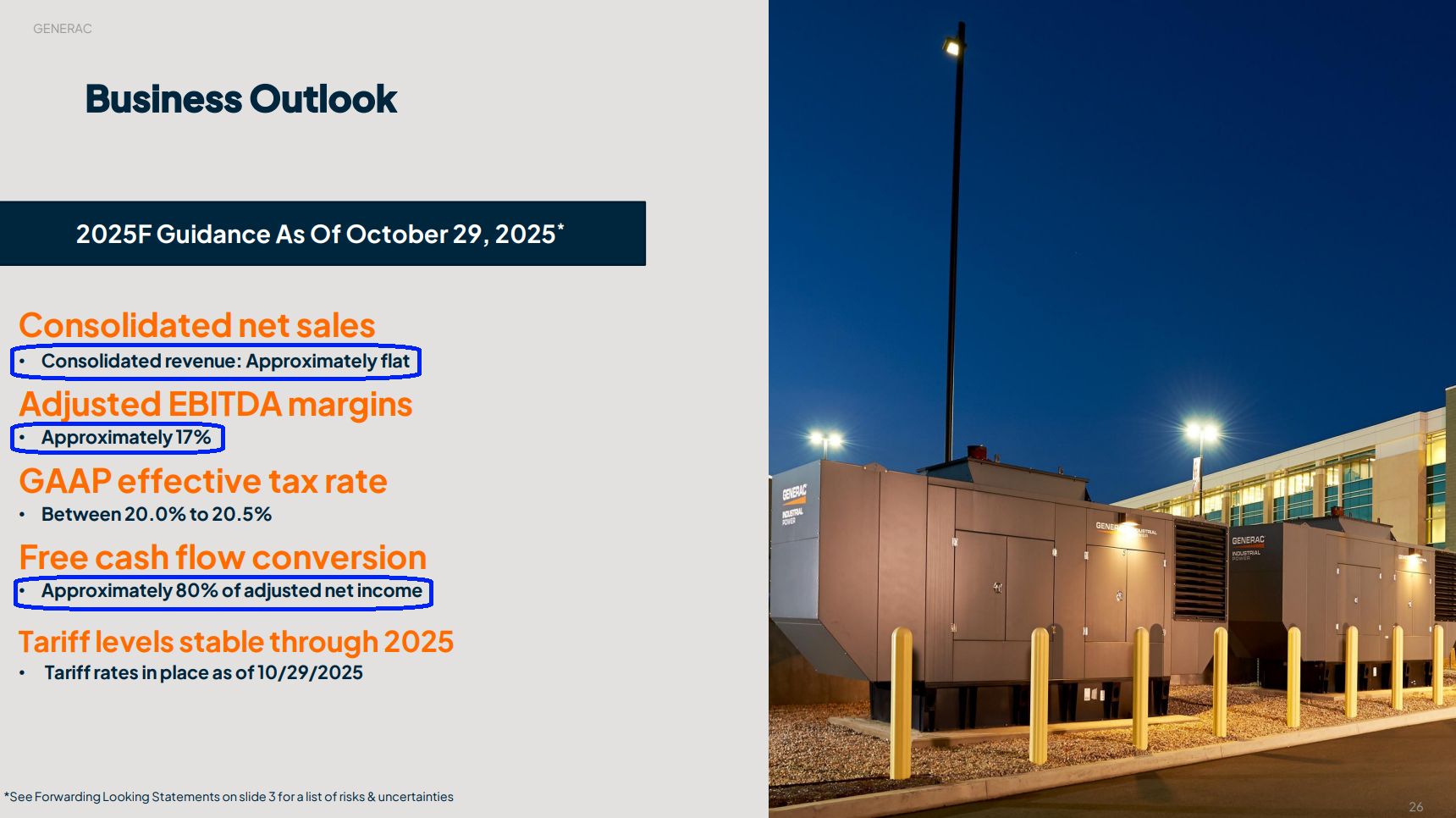

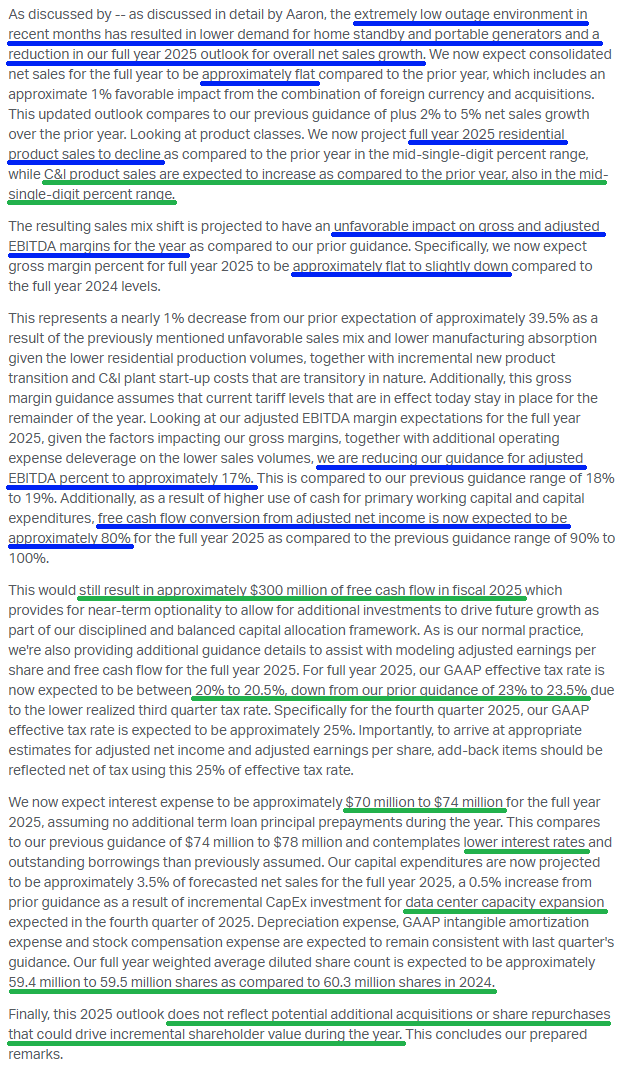

The miss forced management to lower full-year guidance: net sales now expected flat YoY (previously +2-5%) and adjusted EBITDA margins tracking to ~17% (previously 18-19%).

On the surface the numbers look ugly, but the story is far less dramatic than the headlines suggest. The entire shortfall was driven by an unusually quiet hurricane season that weighed heavily on Generac’s highest-margin, bread-and-butter Home Standby business.

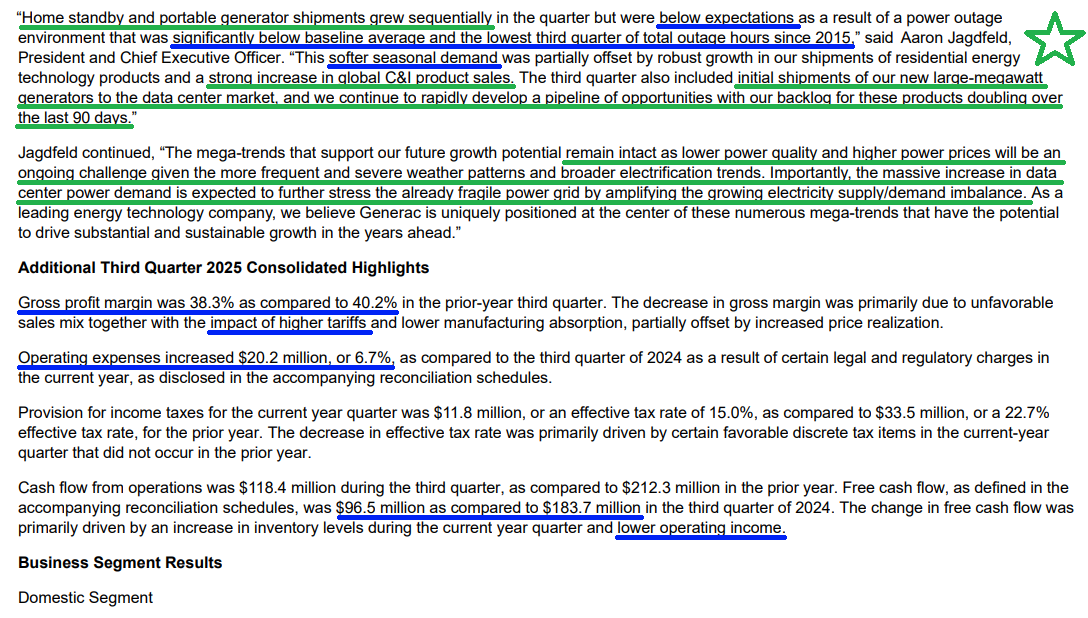

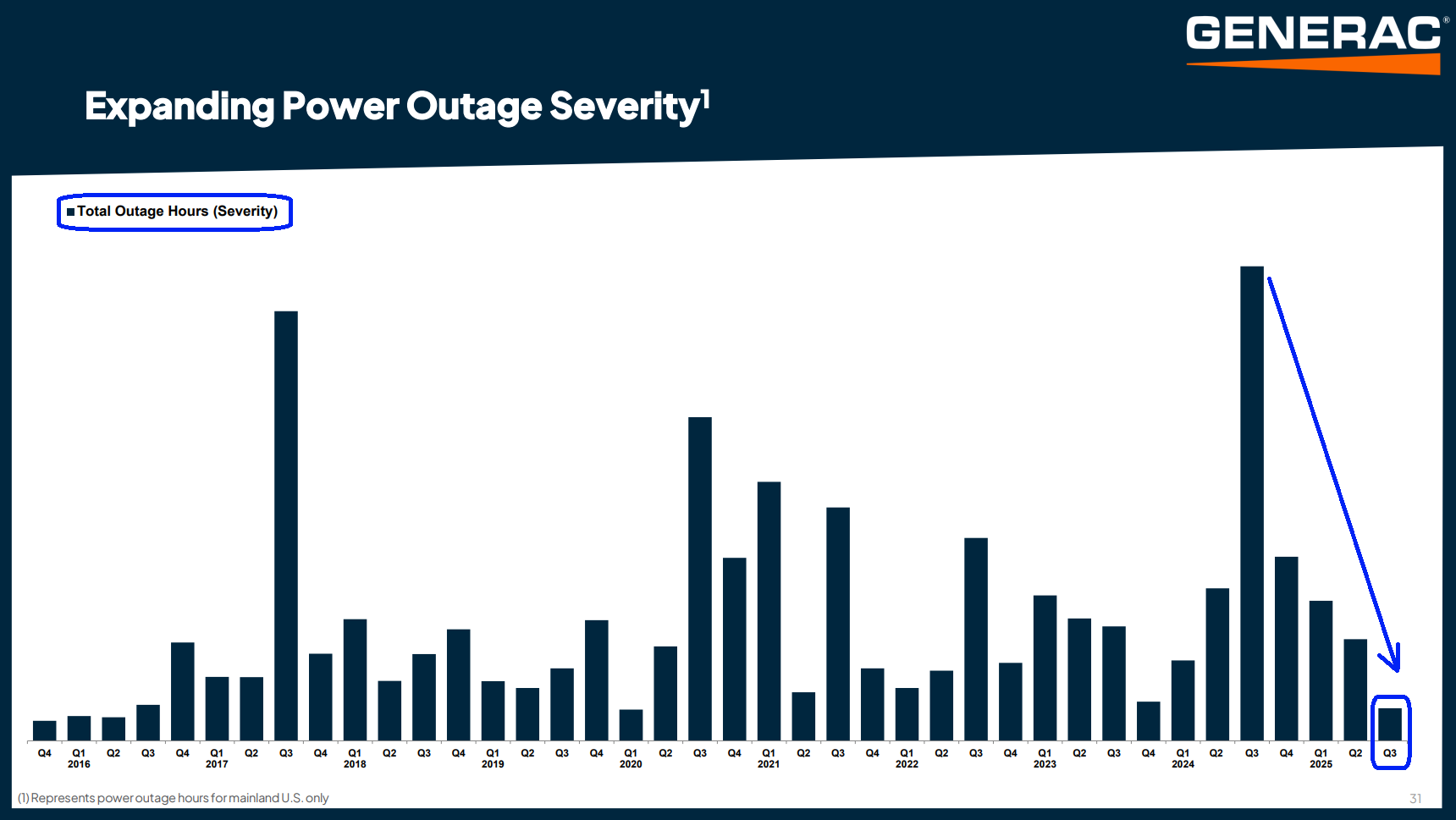

While great weather is a win for almost everyone, when your core product only sells when the lights go out, sunshine can be a gut punch to demand. Q3 delivered the lowest outage hours since 2015, running 75-80% below the long-term average, all against a tough comp from last year’s three major storms and the highest outage quarter since 2012. Tough setup, zero help from Mother Nature, entirely predictable outcome.

When Mother Nature is your business partner, these lumpy quarters are unavoidable. They cut both ways, have zero to do with management execution, and are simply table stakes in backup power. Always have been, always will be.

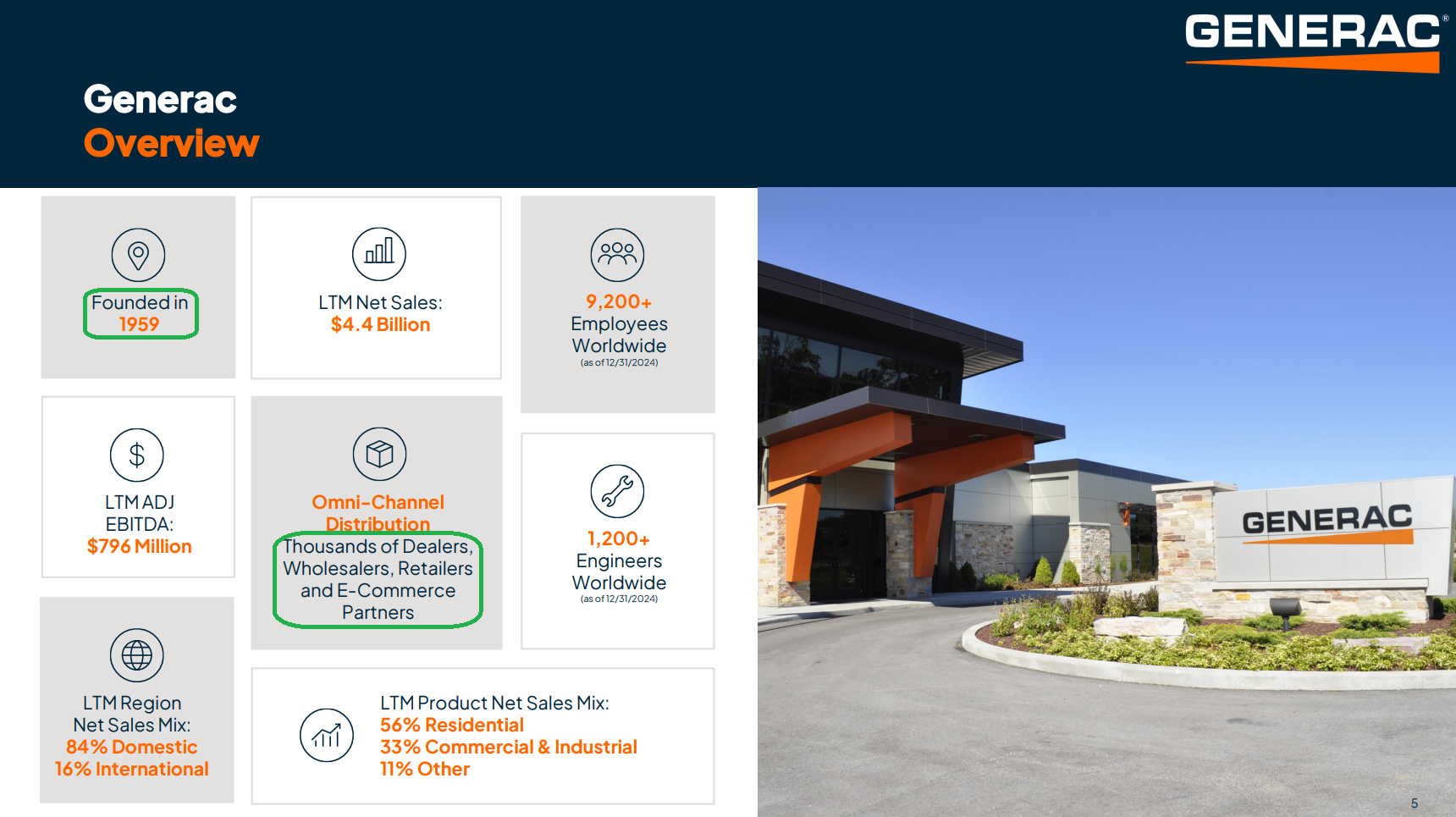

Zoom out and this “weak” quarter is pure noise. We didn’t buy Generac to play the weather-prediction business. We bought a high-quality secular compounder with 75%+ share in a market where U.S. household penetration is still only ~6.5%. Every additional point of penetration is a $4B opportunity waiting to be captured.

Until that math changes, we’re happy to hold the Kleenex of generators and leave the weather forecasting to someone else.

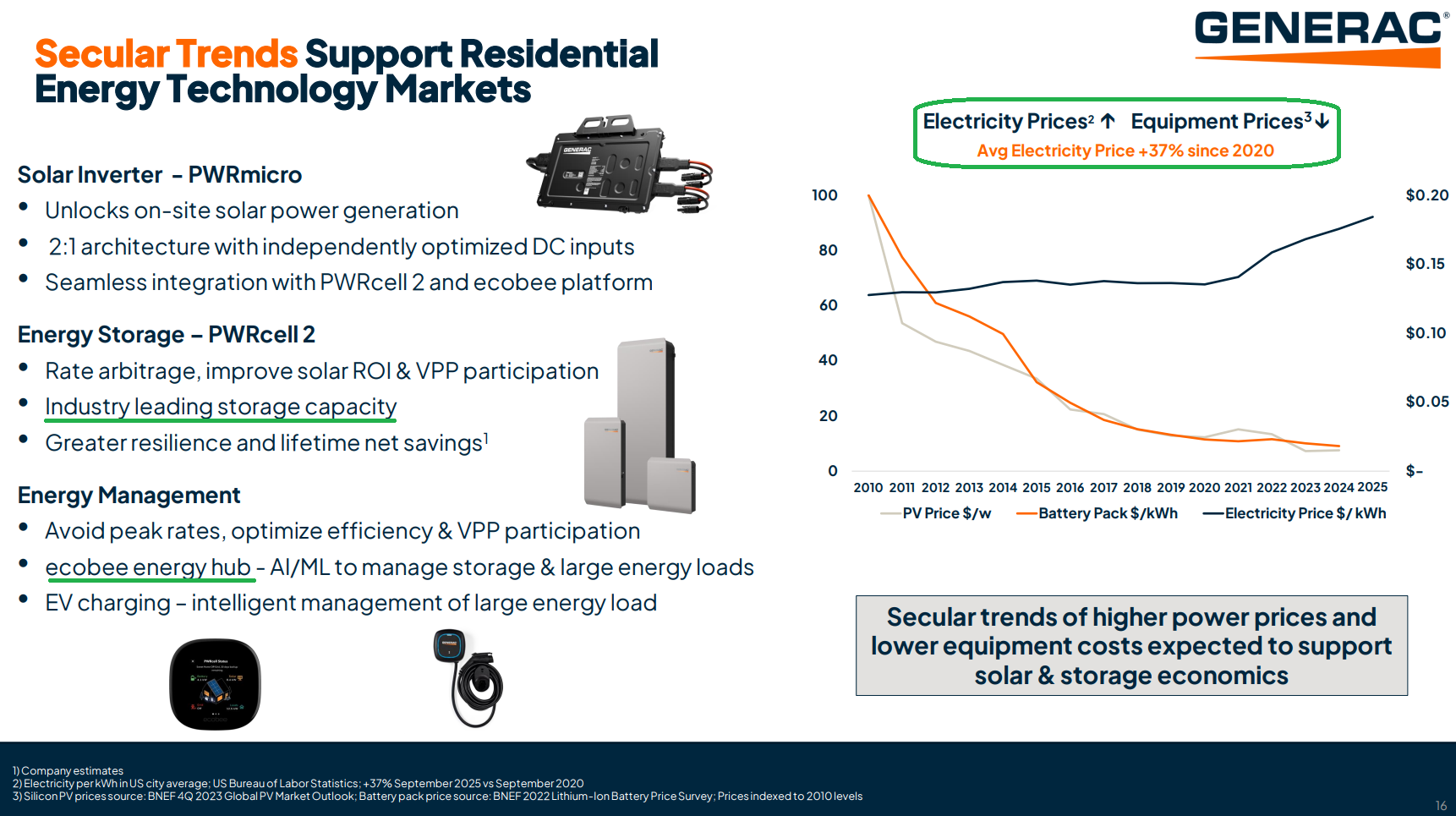

What we do care about, and what led the market to look past the soft hurricane season and shrug off the miss in about five minutes, is that investors are beginning to sniff out that Generac has quietly become a backdoor way to play the data-center buildout and the AI infrastructure arms race. Even better, it offers that exposure at a reasonable valuation.

The new large-megawatt generators, which management calls the biggest needle-moving opportunity in company history, began shipping in Q3, with the global backlog more than doubling to over $300M in the last 90 days.

These school-bus-sized units ($1.5M–$2M each) could drive what management views as a potential doubling of the C&I business (~$1.5B today) over the next three to five years. Generac is already preparing to ramp capacity from a ~$500M run-rate today to nearly $1B to capture what they believe is a structural $5B+ supply deficit.

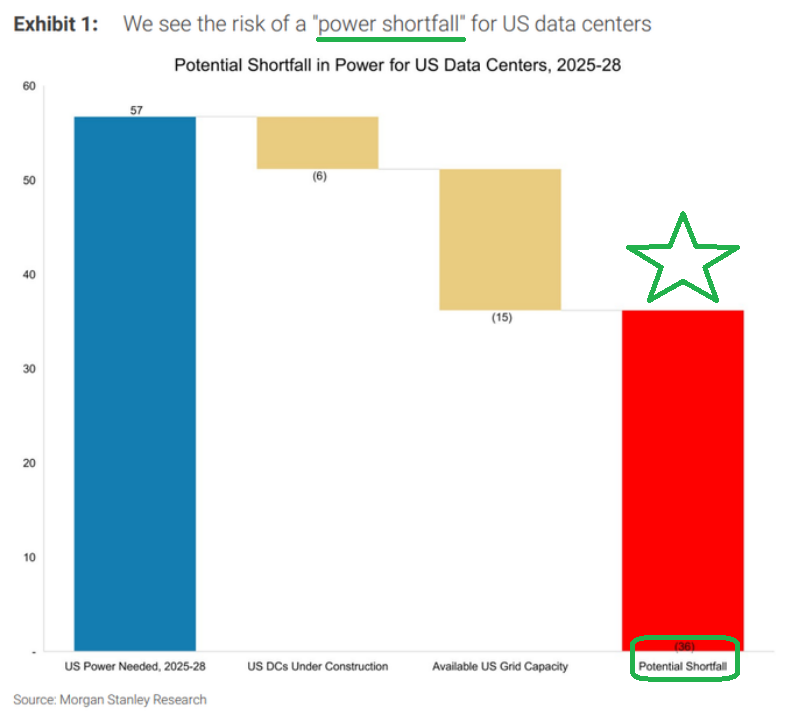

With data-center power demand exploding, even Uncle Sam is starting to take notice and exploring whether large-scale generators can bridge as much as 35 GW of the projected shortfall while the grid catches up.

With only a handful of credible players able to build these at scale, one phone call from the government would max out Generac’s production capacity overnight.

This is what happens when you own a great business at a reasonable price: upside surprises tend to show up along the way. Generac is a textbook example in real time, and our expectations for this high-quality secular grower continue to power higher.

Q3 Earnings Breakdown

10 Key Points

1) Residential product sales fell 13% to $627M as home standby shipments declined at a mid teens rate YoY and portable generators also moved lower. The softness came from a weak hurricane season, with outage activity running 75 to 80% below the baseline average and at its lowest level since Q3 2015, along with tough comps from last year when 3 major storms made landfall in the same period. Despite this, home consultations held their new higher baseline, with consultations relative to outage hours at the highest level since tracking began more than a decade ago and with close rates improving meaningfully.

2) The new large megawatt generators began initial shipments during the quarter, and management expects strong sequential growth in data center demand in Q4. The global backlog for the product more than doubled to over $300M in just 90 days, with the vast majority slated to ship in 2026. Each unit sells for $1.5 to $2M, and with a structural supply shortage of roughly $5B, Generac’s highly competitive lead times are creating major opportunities across the sales pipeline. Current capacity is a little over $500M, and management is exploring investments to expand aggressively, potentially doubling capacity to $1B in annual sales. The margin profile on the megawatt generators is in line with domestic C&I, with a positive incremental impact on EBITDA margins.

3) The C&I business posted 9% revenue growth to $358M in the quarter, driven by the ongoing recovery in the National Telecom channel, which is growing at a strong pace. Mobile product shipments to national and independent rental customers also outperformed expectations and improved sequentially, signaling the early stages of a recovery in the segment. Management believes the new large megawatt generator opportunity in the data center market could potentially double the C&I business, currently ~$1.5B, over the next 3 to 5 years.

4) While none of the $300M+ global backlog for the new large megawatt generators comes from the Hyperscalers, management continues to have very productive conversations and is optimistic about being added to their approved vendor lists. With a trusted brand and more than 50 years in C&I, management sees no showstoppers in the process, with opportunities starting to open up in 2027 and beyond.

5) Ecobee delivered another profitable quarter with strong growth, meaningful gross margin improvement, and solid operating leverage. Management still expects the segment to contribute positive EBITDA for the full year, a major milestone. The installed base has now reached ~4.75M homes, driving more energy services and subscription sales and further building a high margin recurring revenue stream.

6) Free cash flow was $96.5M for the quarter, compared to $183.7M in the prior year, driven by higher inventory levels and lower operating income. Management now expects full year FCF conversion of ~80%, versus prior guidance of 90 to 100%, due to higher cash usage for working capital and capex. This still implies full year free cash flow of ~$300M.

7) Generac’s industry leading dealer count reached 9,400 in the quarter, up ~100 sequentially and nearly 300 year over year. Management sees this as a sign of healthy demand, with expanded retail presence a key opportunity for the business.

8) Gross margin came in at 38.3%, down from 40.2% in the prior year period, driven by lower home standby sales, Generac’s highest margin product, and higher tariff costs. This also contributed to weaker adjusted EBITDA margins of 17.3%, compared with 19.8% last year, with operating expense deleverage adding pressure.

9) Management expects the solar and storage market to contract by ~20 to 25% in 2026 because of a steep drop in federal incentives. Even so, they still see a solid long term opportunity for these products and are targeting breakeven by 2027 despite the expected pullback. That said, management has made it clear they will not stay in a money losing business forever, and continued investment will depend on the products gaining real traction.

10) Due to the softer hurricane season, management updated full year sales guidance to approximately flat, versus the prior outlook for 2 to 5% growth. Full year residential sales are now expected to decline YoY, while C&I should post mid single digit growth. Adjusted EBITDA margins are now expected to be ~17%, compared to prior guidance of 18 to 19%.

Earnings Call Highlights

Morningstar Analyst Note

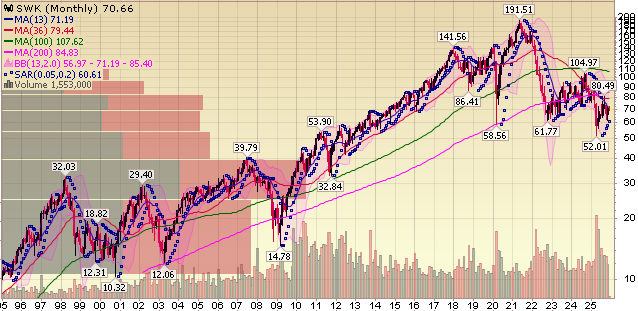

Stanley Black & Decker (SWK) Update

Q3 Earnings Breakdown

10 Key Points

1) SWK posted $3.8B in third quarter revenue, flat year over year and in line with expectations. Adjusted earnings came in at $1.43, up from $1.22 last year and ahead of consensus by $0.24, supported by a $0.25 tax benefit that had previously been expected to fall in the fourth quarter.

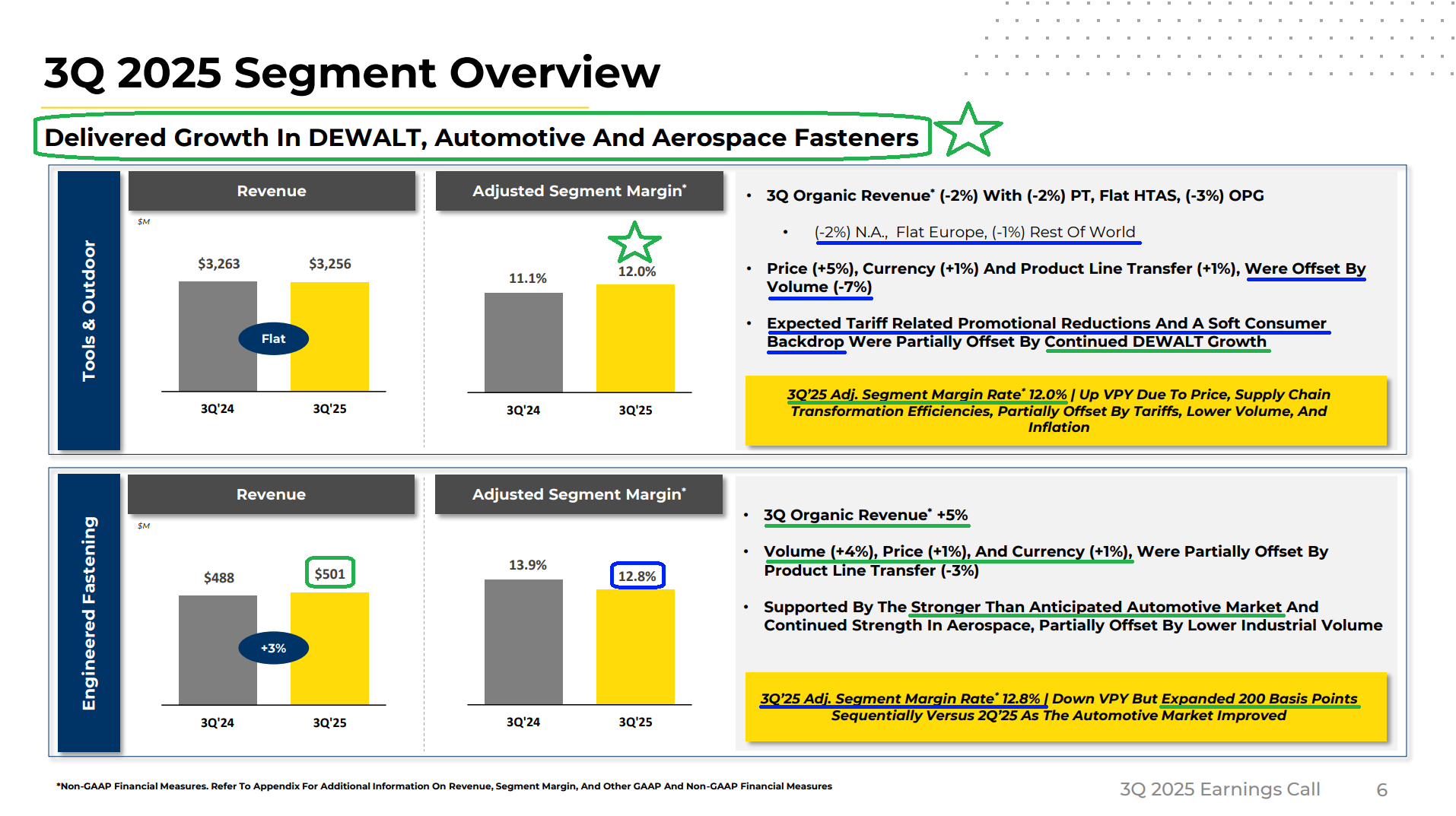

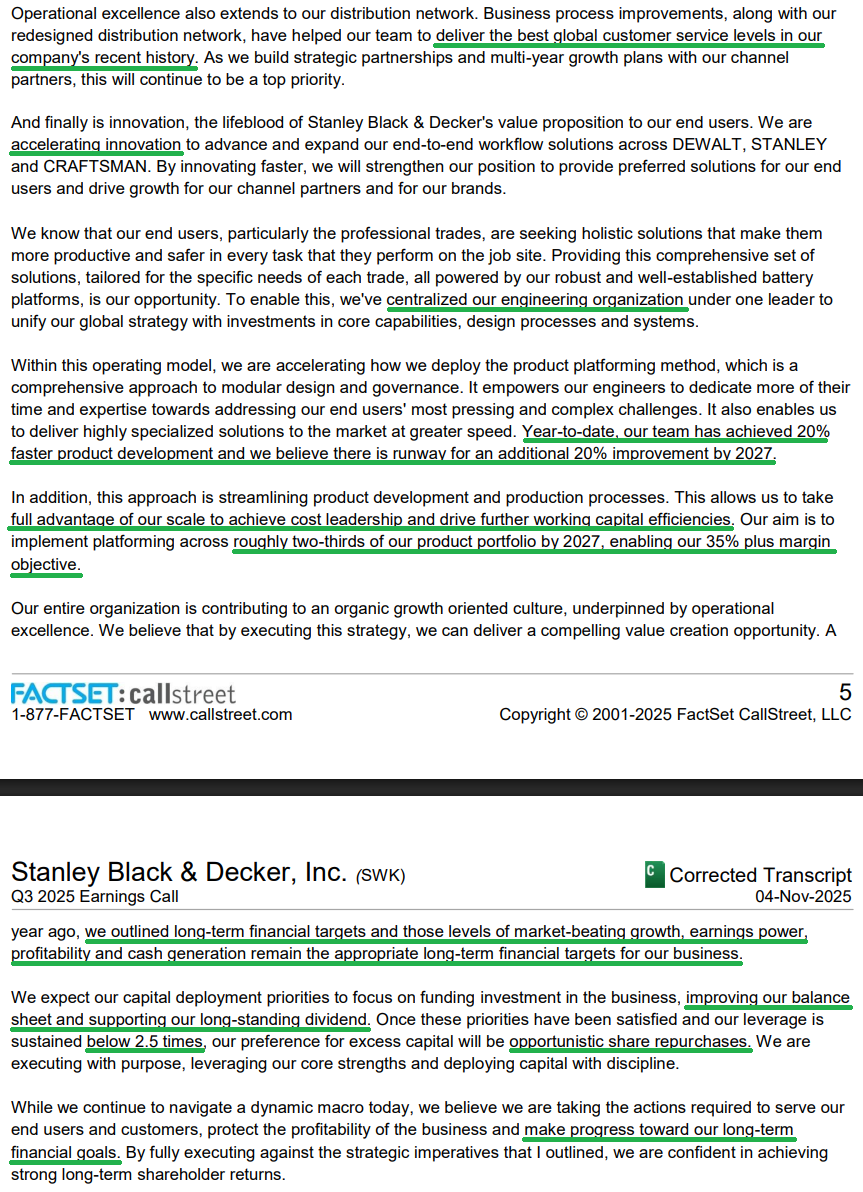

2) Adjusted gross margin, the key metric in the SWK turnaround, reached 31.6% in the quarter, up 110 bps YoY driven by pricing gains and supply chain transformation. Management expects further expansion in Q4, tracking near 33%, and believes the company is on pace to achieve or be very close to its long term 35% margin target by the end of 2026.

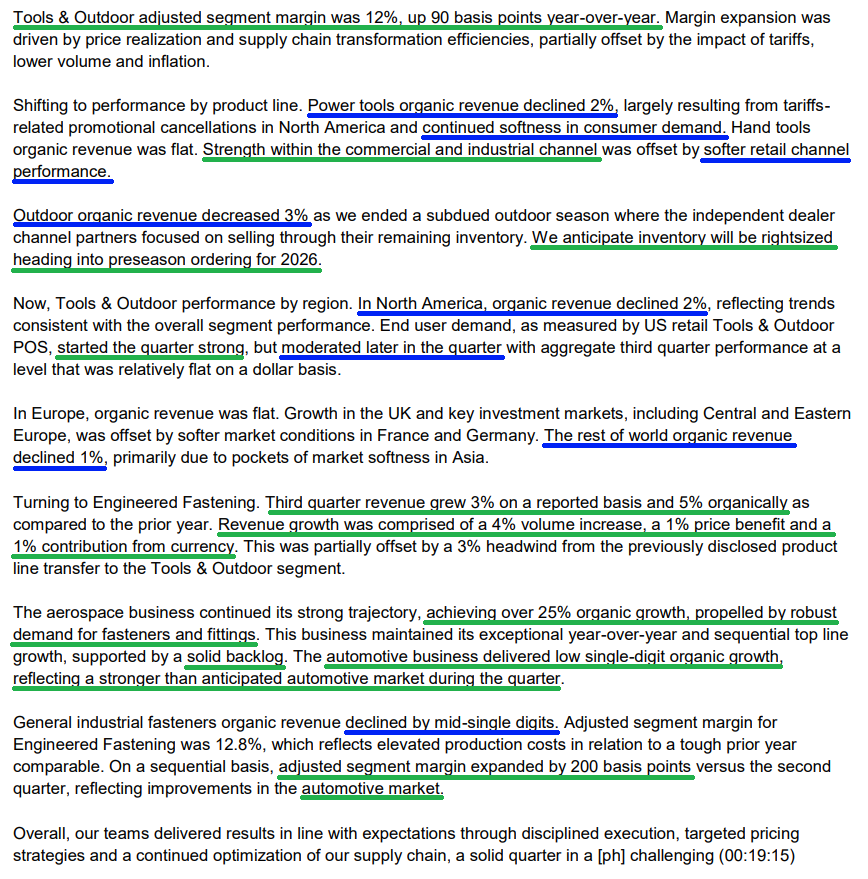

3) The Engineered Fastening segment posted net sales of $501M, up 3% YoY and 5% organically. Performance was driven by continued strength in Aerospace with more than 25% organic growth, and by better than expected results in Automotive, which delivered low single digit organic growth.

4) The Tools & Outdoor segment delivered $3.26B in sales, in line with last year’s third quarter as price (+5%), currency (+1%), and a product line transfer (+1%) were fully offset by lower volumes (-7%), resulting in a 2% organic decline. The business continues to operate in a subdued but relatively stable consumer DIY market, with another round of low single digit price increases going into effect in Q4.

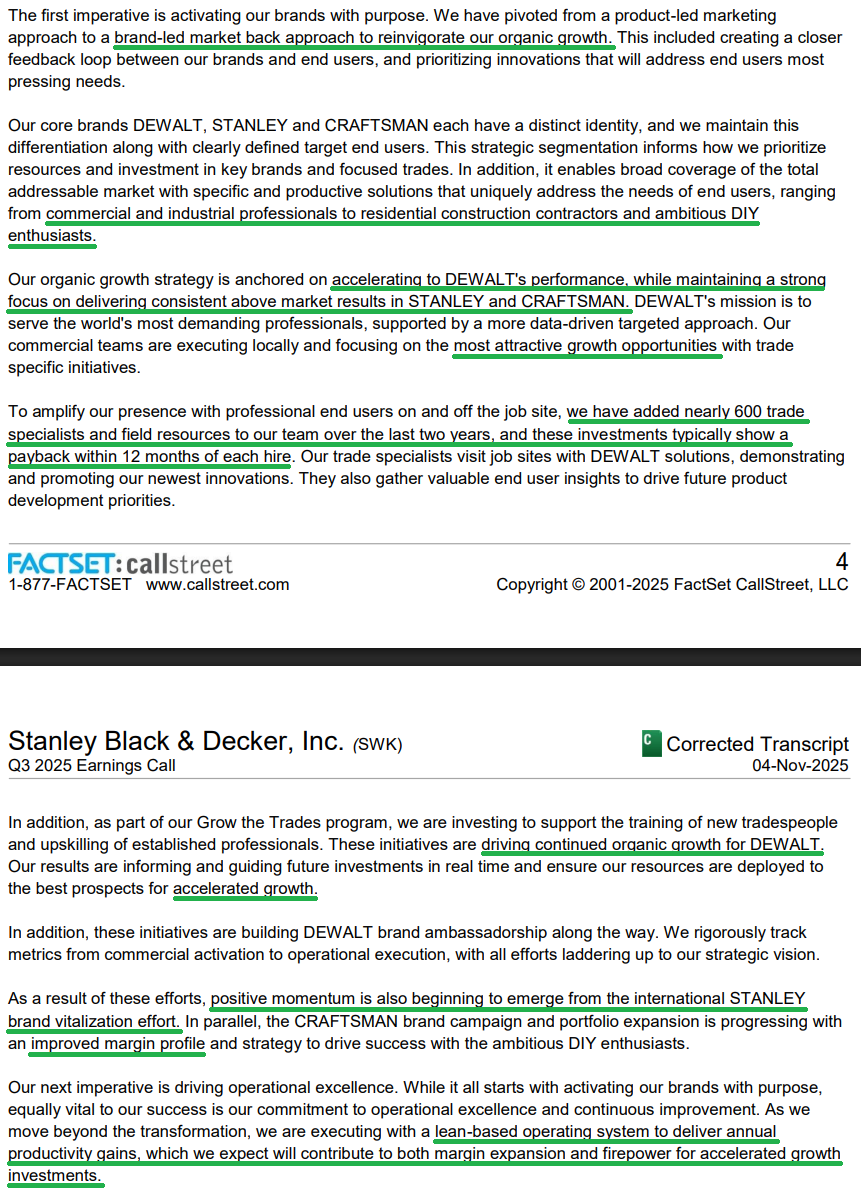

5) DEWALT, the ~$7B franchise brand focused on the pro market, delivered another strong quarter of organic growth, outpacing the broader marketplace on the back of resilient professional demand.

6) Management continues to advance tariff mitigation strategies, aiming to reduce the share of US supply sourced from China from 2024 levels of ~15% to less than 10% by mid 2026 and to less than 5% by year end. At the same time, they are rapidly increasing USMCA compliant production in Mexico and see no structural hurdles to reaching average USMCA compliance for industrial companies over the medium term. Taken together, management believes these efforts can remove $200–300M of tariff expense from the system in 2026.

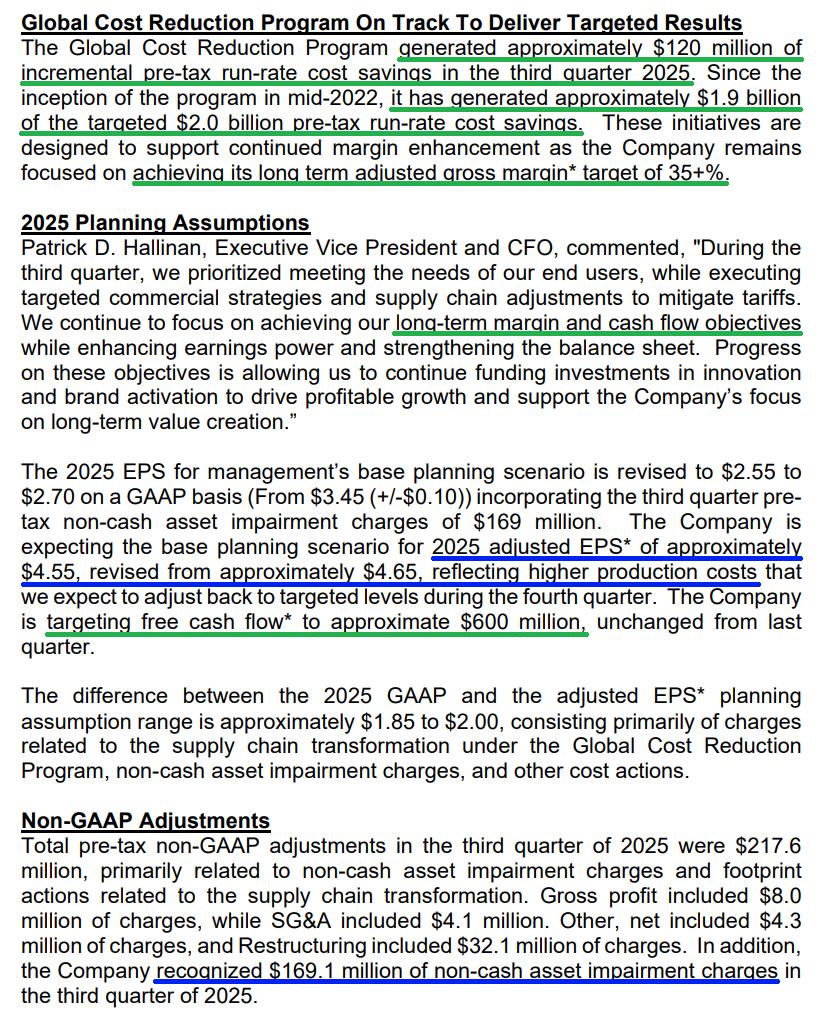

7) The global cost reduction program launched in 2022, targeting $2B in savings, remains on track for completion by the end of 2025. The quarter added another $120M of incremental pre tax run rate savings, bringing total savings to ~$1.9B. Spread across the ~155M shares outstanding, the program works out to just under $13 per share in savings by year end 2025.

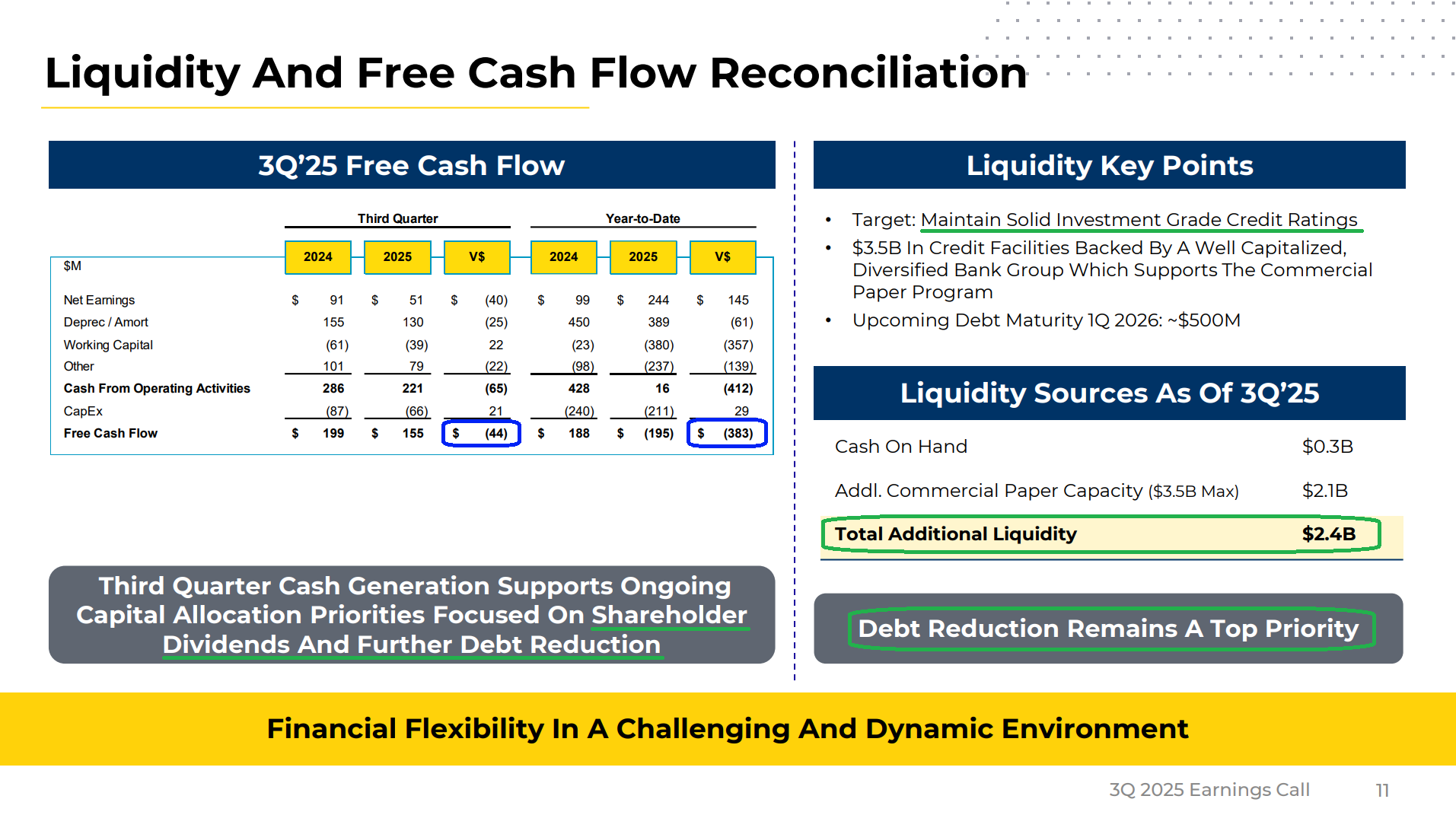

8) SWK generated $155M of free cash flow in the quarter, bringing YTD free cash flow to an outflow of $195M. Management still expects to generate ~$600M of free cash flow for the full year, unchanged from prior guidance, supported by more than $500M of working capital reductions in Q4. Looking ahead to 2026, they plan to reduce inventories by at least $200M, setting up another solid year of cash flow generation.

9) Management’s top near term priority remains debt reduction to maintain its investment grade rating, with a ~$500M maturity coming up in Q1 2026. They are targeting an asset sale within the next 12 months to support additional deleveraging, and once leverage moves below 2.5x, excess capital will shift toward opportunistic buybacks.

10) Management lowered full year guidance, trimming 2025 adjusted EPS to $4.55 from $4.65 due to higher than expected production costs tied to tariffs and supply chain changes. They now expect total revenue to be flat to down 1% and are tracking toward the low end of that range. Most importantly, the long term targets laid out at the November 2024 capital markets day remain appropriate and achievable, though likely pushed out by one year to 2028 because of tariffs.

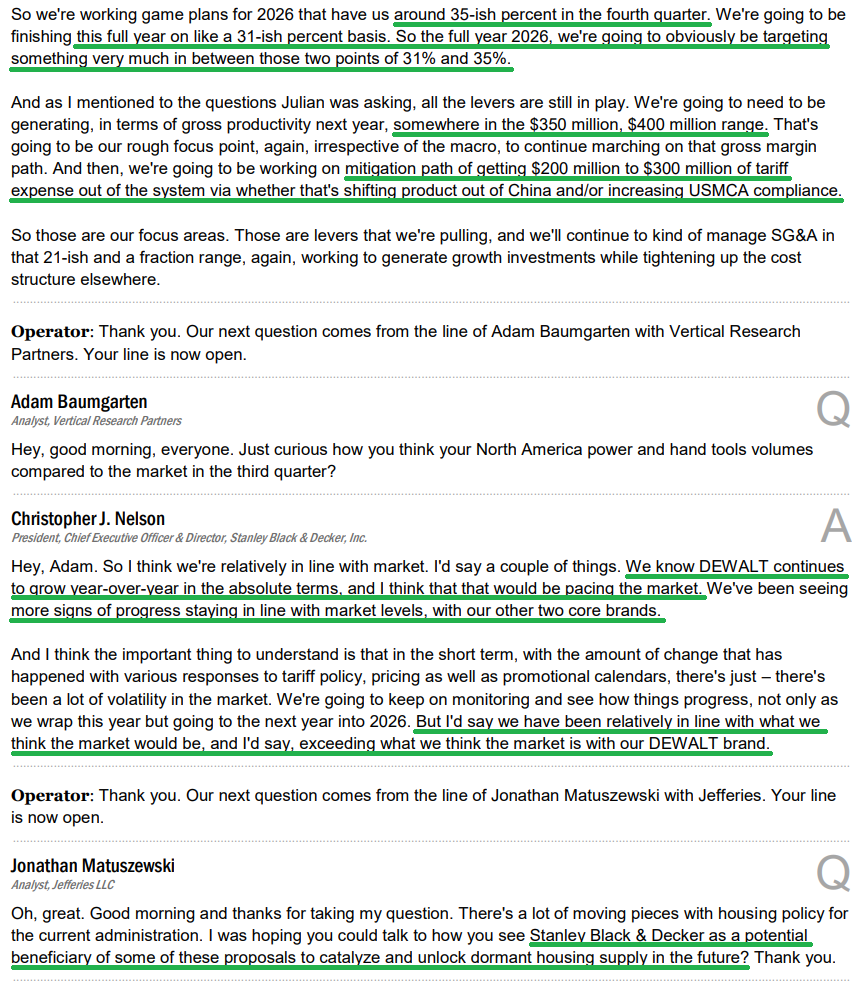

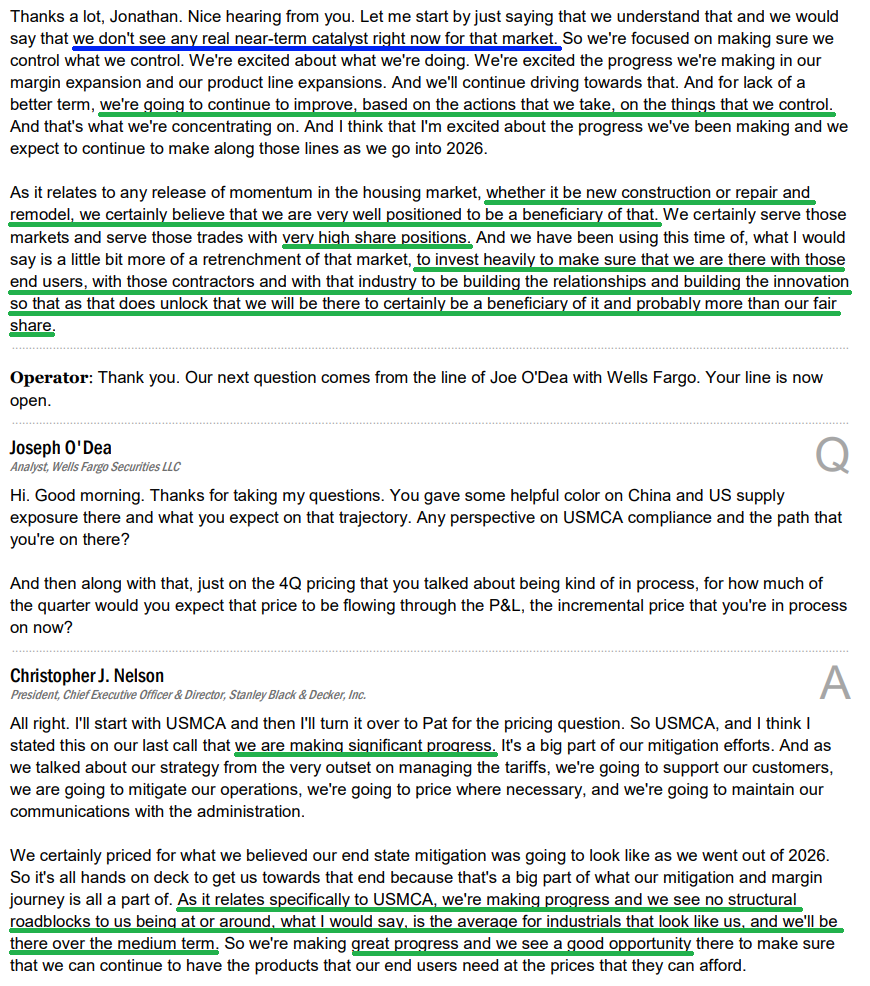

Earnings Call Highlights

General Market

The CNN “Fear and Greed Index” ticked up to 26 this week from 14 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

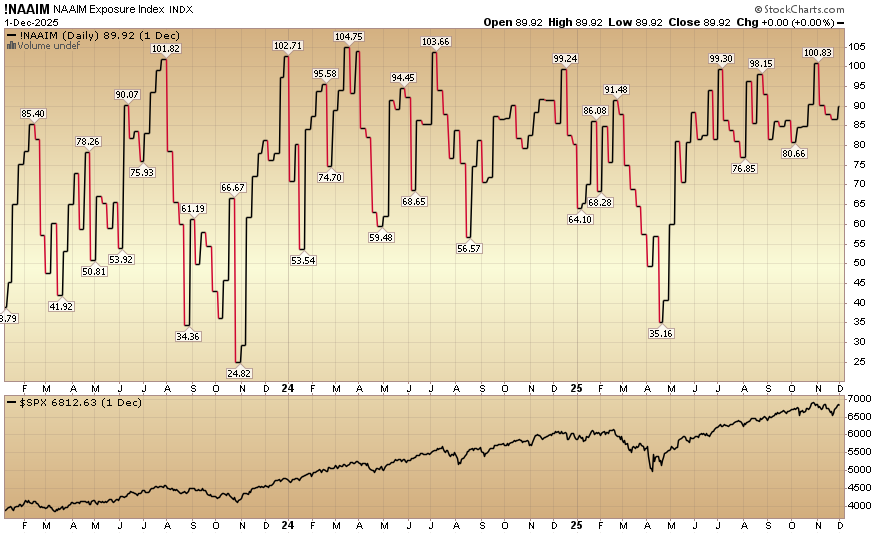

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 89.92% this week from 87.87% equity exposure last week.

More By This Author:

“Getting Their Groove Back” Stock Market (And Sentiment Results)

“Don’t Let The Gloom Fool You” Stock Market (And Sentiment Results)

“Boring Never Looked So Good” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more