“Don’t Let The Gloom Fool You” Stock Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

On Thursday, I joined my good friend Kenny Polcari on his show Trader Talk on Yahoo! Finance to discuss markets, AI, the Mag-7, and more. Thanks to Kenny for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 202 institutional managers with ~$550B AUM:

Here were the 5 key points:

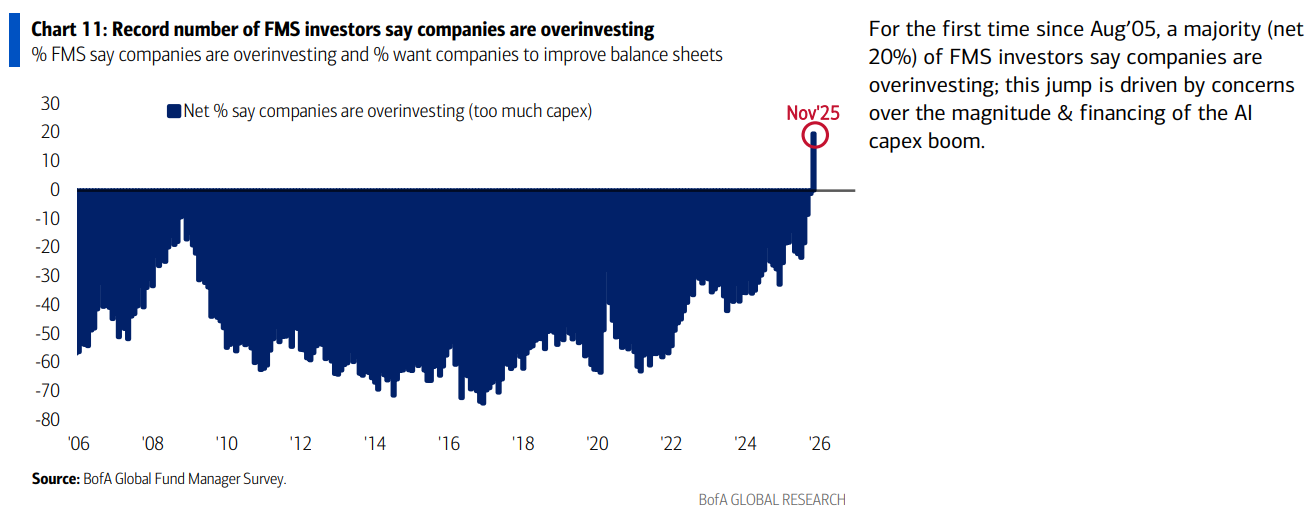

1) For the first time since the survey began in 2005, a majority of FMS investors with a net 20% now say companies are overinvesting in the AI capex boom. Until now, the market has been willing to give the hyperscalers time to show the “R” in ROIC. But with hyperscaler free cash flow set to drop by 43% through Q1 2026 and 60% of their operating cash flow going into capex, levels on par with big oil, investors are starting to say “Show me the money!”

(Click on image to enlarge)

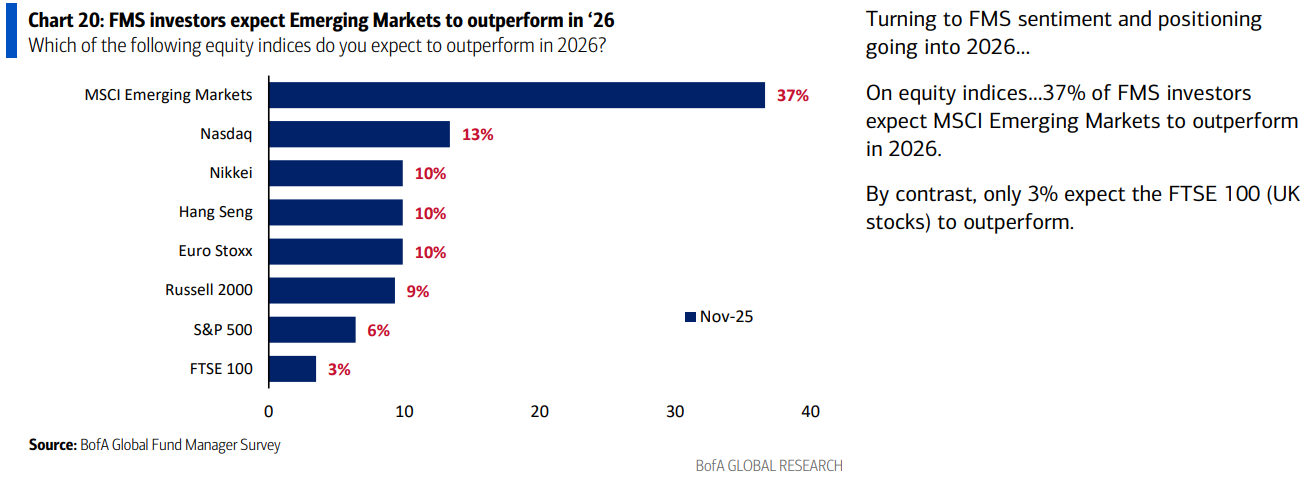

2) Opinion follows trend. Now that Emerging Markets are outperforming the US by more than 2 to 1, 37% of FMS investors now expect Emerging Markets to outperform in 2026, compared to just 6% who expect the S&P 500 to outperform.

(Click on image to enlarge)

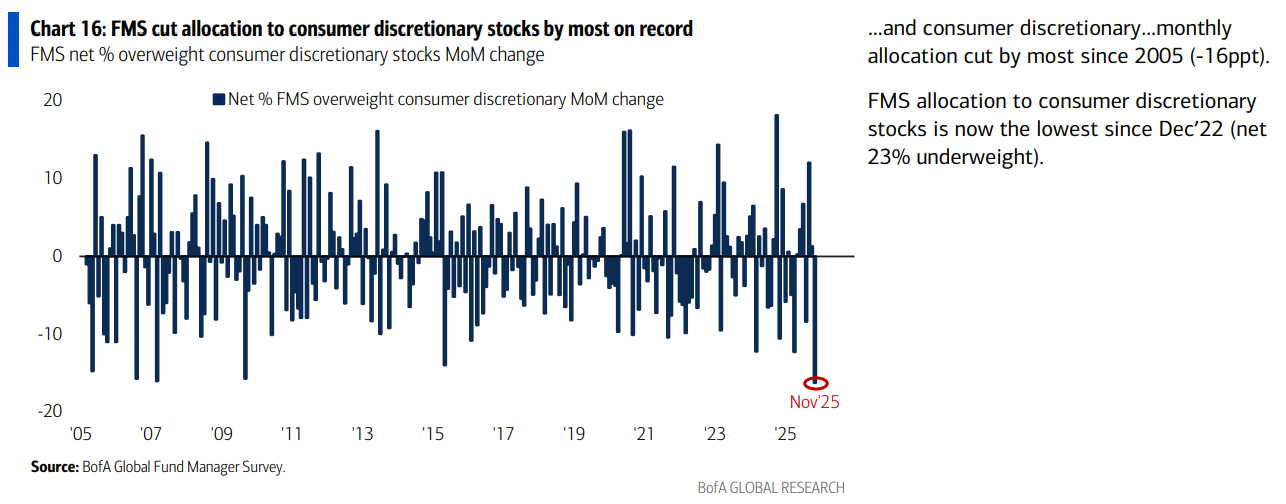

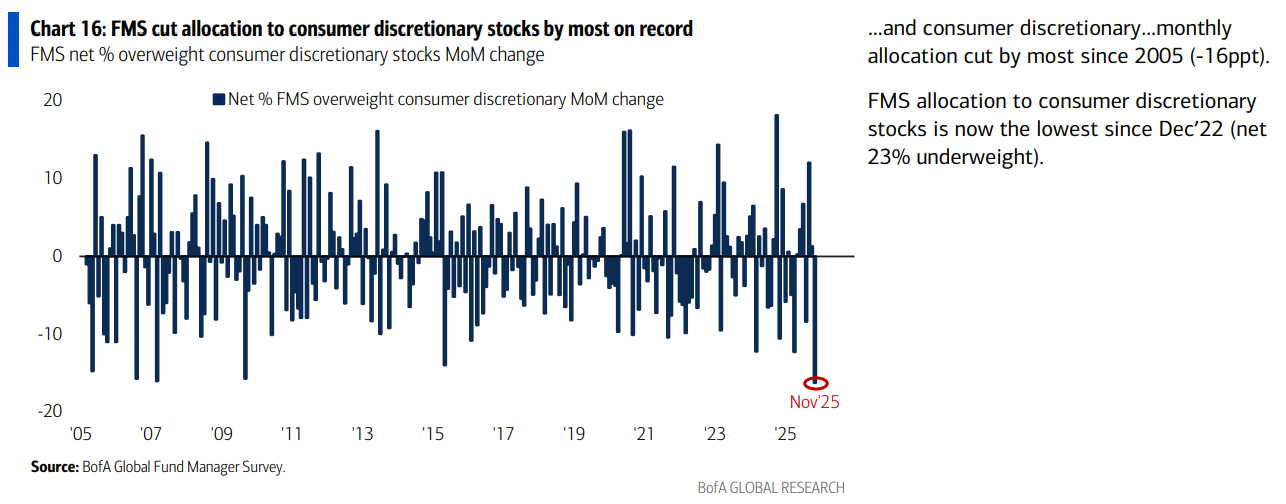

3) Fund managers cut their allocation to consumer discretionary stocks by the most on record, taking exposure down by 16 ppt and to the lowest level since December 2022. Betting against the US consumer when they have jobs rarely works out, and we’re happy to take the other side of this trade.

(Click on image to enlarge)

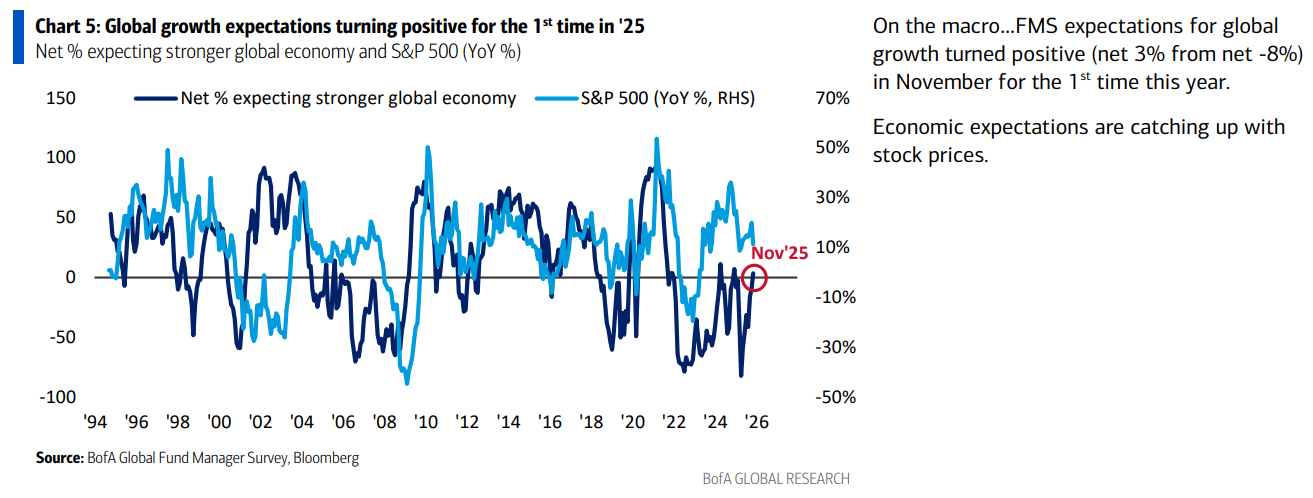

4) Fund managers’ expectations for global growth turned positive to a net 3% for the first time this year, as economic expectations continue to catch up to stock prices. With sentiment still essentially neutral, there is plenty of room for expectations to move higher.

(Click on image to enlarge)

5) Fund managers’ average cash level dropped to only 3.7%, the lowest in ~15 years. There have been 20 instances of cash levels at 3.7% or lower since 2002, and in every case stocks delivered negative returns while treasuries outperformed over the following 1 to 3 months.

(Click on image to enlarge)

Consumer Gloom? Not So Fast

Back in September, right after the Fed finally acknowledged the dual mandate and delivered the first rate cut, investors began tripping over themselves to pile into the obvious trades: discretionary, small caps, and rate sensitives, all catching a bid after being left for dead. The market quickly convinced itself that this was now an all-or-nothing regime as the pendulum swung risk on, leaving the boring, defensive corners of the market completely forgotten.

We pushed back on that idea. Our view then, and now, is that the current environment is one where both trades can work. When the rubber band gets stretched to one extreme and everyone crowds to one side of the boat, reversion to the mean becomes inevitable. Or as we like to say in plain English, the market tends to inflict the most pain on the most people at any point in time. With that in mind, we went hunting in the ignored defensive areas of the market, whether it was healthcare, staples, or energy, topping off existing positions and picking up new names from the clearance rack.

Fast forward to today and the pendulum has swung all the way back. As tech has started to wobble and the air has leaked out of the shiny objects and the AI trade, exactly the type of rotation you would expect has started to happen. The unloved dividend payers and defensive corners of the market that we have been pounding the table on are starting to catch a bid.

But just like September, the market has overreacted once again. Investors have crowded into one side and thrown the baby out with the bathwater. This time, it just so happens to be consumer discretionary.

(Click on image to enlarge)

Fund managers have cut exposure to discretionary by the most on record. The new consensus is simple: the consumer is dead.

We think that’s a mistake, with some of these names priced at panic levels as if consumers will never spend again.

In fact, sentiment around the consumer is as washed out as we have seen in decades, at levels unheard of outside major recessions. Yet nearly every data point and earnings call tells the same story. The consumer may complain, but they keep spending. Or as Bracken Darrell likes to call them, the “stubbornly positive consumer”. Consumers may say the world is ending, but the next day they go out and buy a car, shop for the holidays, or take the family to Disney.

Pay attention to what they DO, not what they SAY.

If there is one thing we have learned time and time again, never bet against the US consumer when they have jobs.

And here is the kicker. Discretionary is being left for dead exactly as we enter a Fed easing cycle. What has historically outperformed in the 12 months following the start of Fed cuts? Exactly what investors have abandoned. Discretionary has been the top-performing sector, outperforming 75% of the time and by ~300 bps annually across past easing cycles.

The whipped cream and cherry on top would be if the proposed $2,000 “tariff dividend checks” make it over the finish line. If that happens, investors will be tripping over themselves to get exposure back into the sector, at which point we will be happy to help them out.

Whether that happens or not is anyone’s guess. But until then, we are more than happy to stand pat and take the doomsday crowd up on their offer of a second-bite-at-the-apple opportunity in some of our favorite names.

VF Corp Update

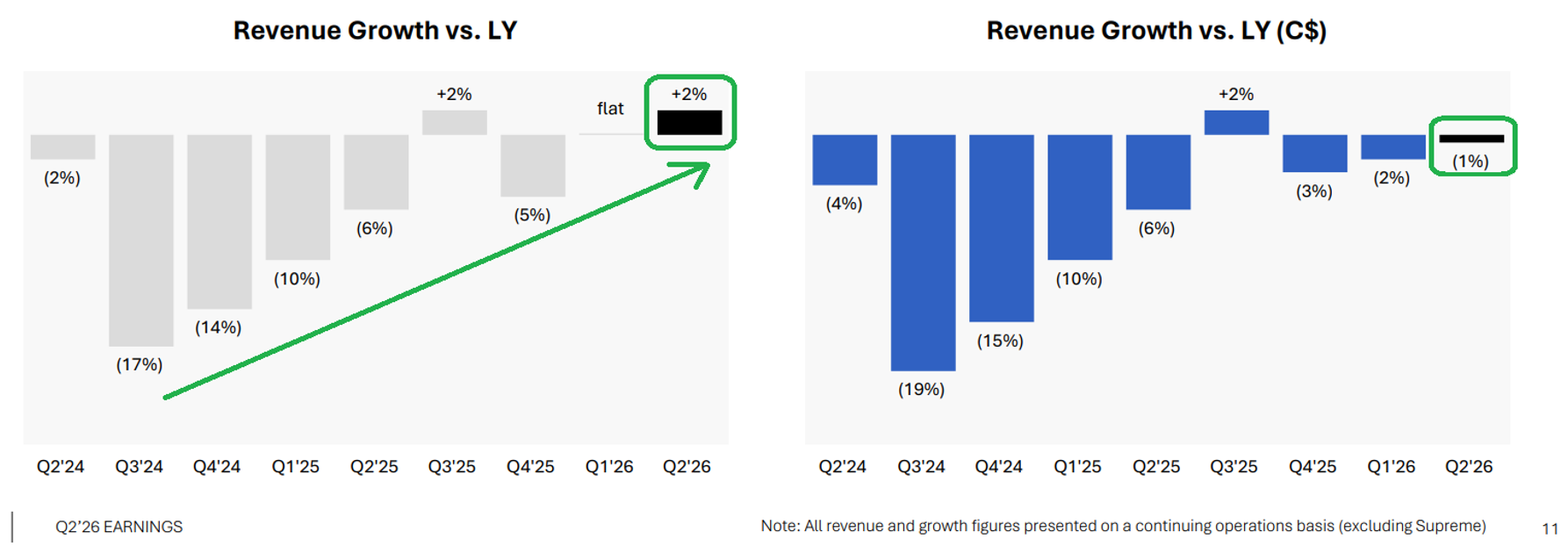

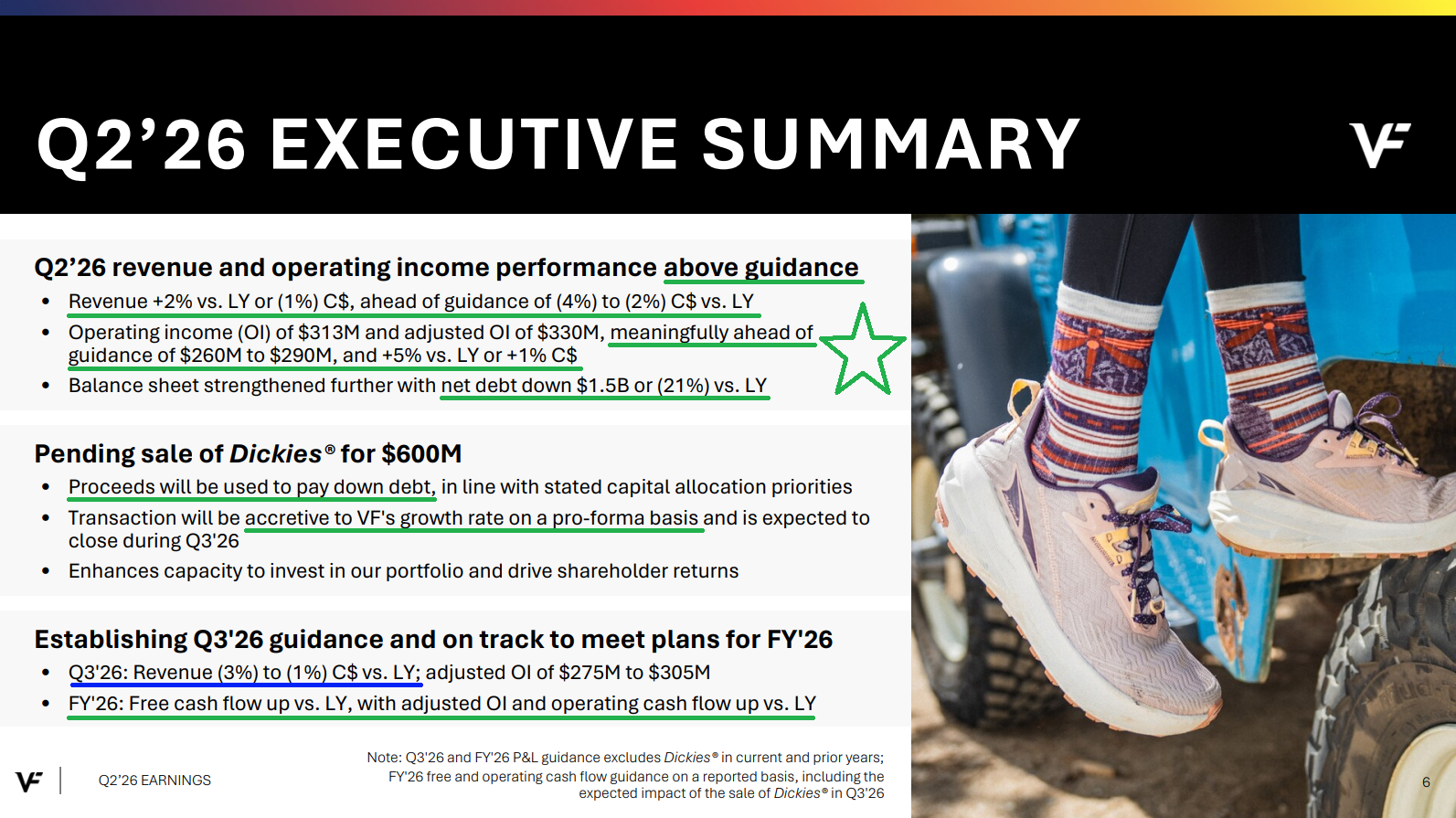

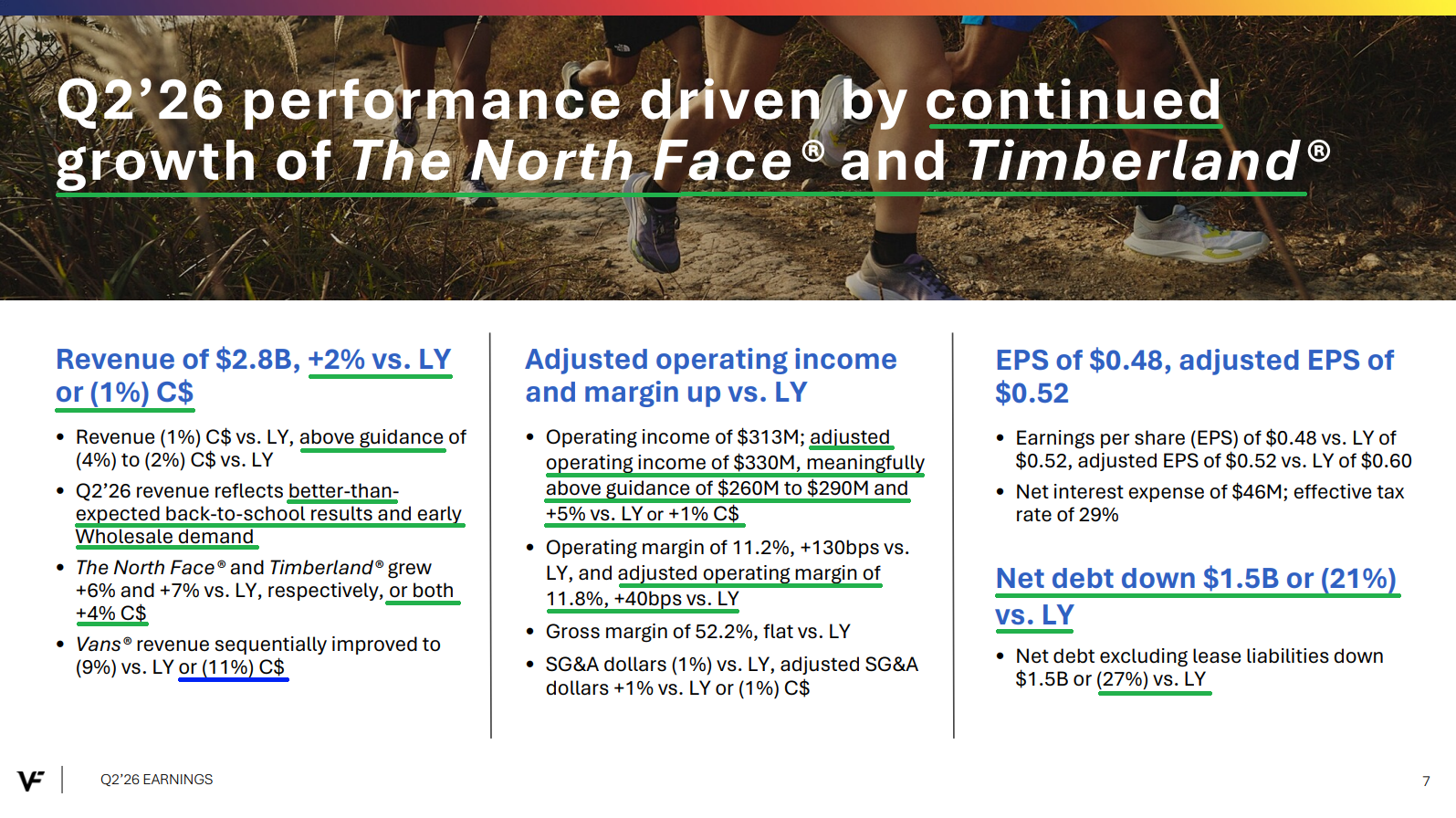

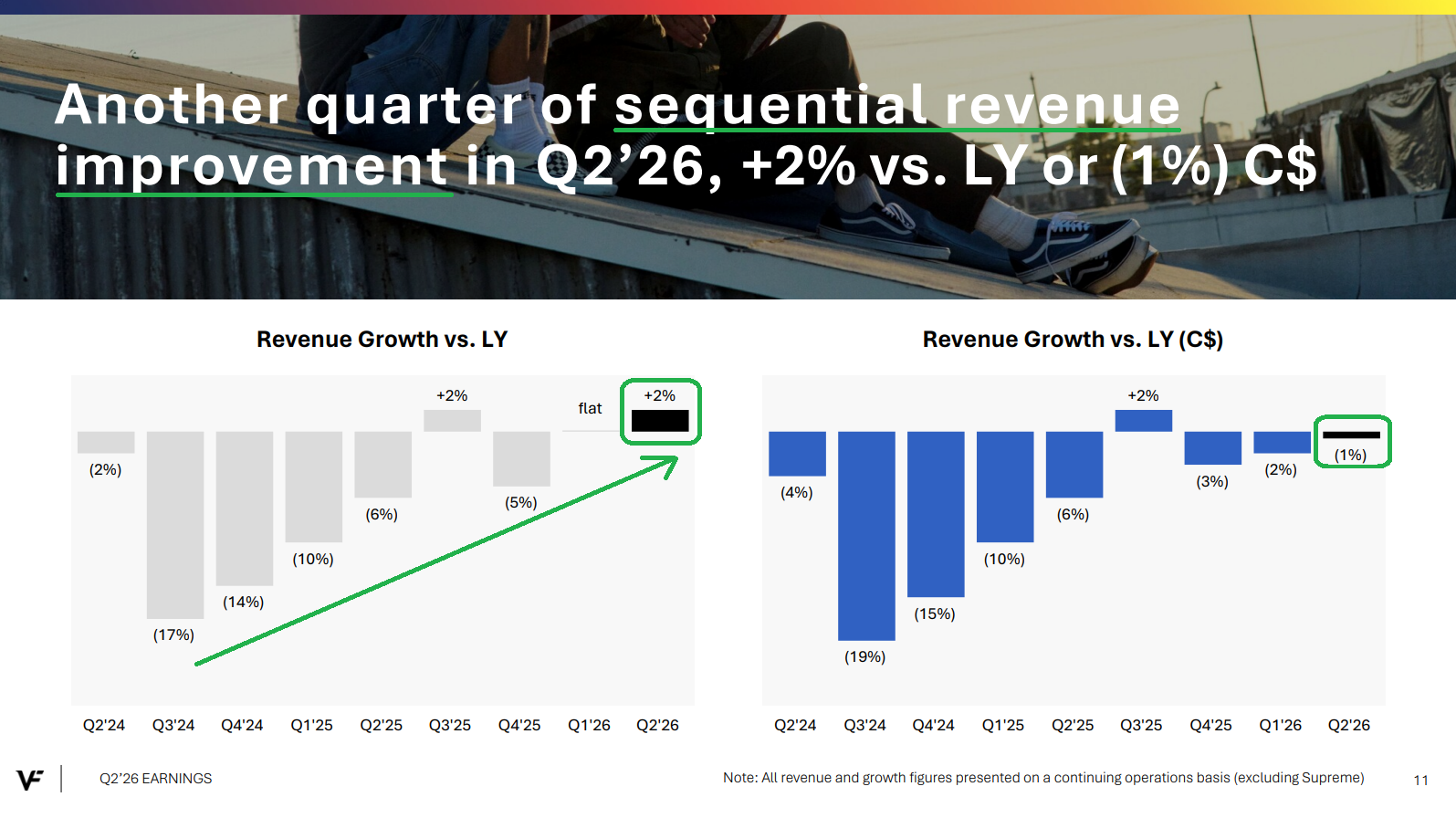

VFC delivered another solid quarter as the turnaround continues to take shape. Revenues of $2.80 billion, up 2% YoY or down 1% C$, came in ahead of expectations and prior guidance. Nearly 70% of the portfolio is now back to top line growth compared to just ~10% at this point last year. Adjusted operating margins, the single most important metric in the turnaround, expanded by 40 bps YoY to 11.8%. Net debt is down $1.5 billion or 21% YoY. Inventories are cleaner. Free cash flow is still on track to grow this year.

But none of that progress mattered to the short-term voting machine. Instead of focusing on the clearly improving fundamentals, the stock sold off on quarter to quarter macro noise around tariffs and the final stages of cleanup actions that weighed on a conservatively guided Q3. Investors wanted an overnight return to growth and when they didn’t get it, they lost patience and threw in the towel.

For us, this is silly season and a reminder of the advantage that comes from zooming out. Good operators don’t chase short-term revenue to “beat the next quarter.” They build a foundation that creates durable earnings power for years to come. That is exactly what Bracken Darrell is doing. And if anyone had doubts, he spelled it out plainly on the call:

“We’re really trying to think in terms of driving growth longer term, not just what we can do this holiday and in Q4. That’s our mindset for the entire business. I hope you’re starting to get a feel for that. We’re going to execute in the key commercial moments, but our real game plan is longer term than that. We’re going to systematically put the building blocks in place that are going to deliver for years to come.”

When you step back and burden yourself with the facts, the story becomes obvious. Cleanup actions are nearly lapped. The product pipeline is ramping. Brand heat is building. Most importantly, the medium term targets of 55% gross margins and 10% operating margins remain firmly on track. And here is what the market continues to overlook: those targets assume zero top line growth through FY2028. Let me repeat. The path to 10% operating margins is driven entirely by cost savings, not revenue growth.

That is about as low a bar as you will find for a business already showing signs of inflection. When VF does return to growth, operating leverage kicks in and each $1 billion in incremental revenue lifts operating margins by 1.5% to 2%. It doesn’t take a genius to look at the chart below and see how close that inflection really is.

(Click on image to enlarge)

The market continues to ignore this, with consensus still modeling a little over 8% operating margins for FY2028. If there is one thing we have learned, it is that you do not want to bet against Bracken Darrell.

Until then, we will sit on our hands, stay patient, and let turnaround Bracken, or growth Bracken as he prefers, do what he does best.

Q2 Earnings Breakdown

10 Key Points

1) Q2 revenues were $2.80 billion, up 2% YoY or down 1% in constant currency, beating estimates by $70 million and coming in ahead of management’s guidance for a 4% to 2% decline in constant currency. The upside was driven by better than expected back-to-school performance and early wholesale demand. Adjusted EPS of $0.52 beat consensus by $0.10.

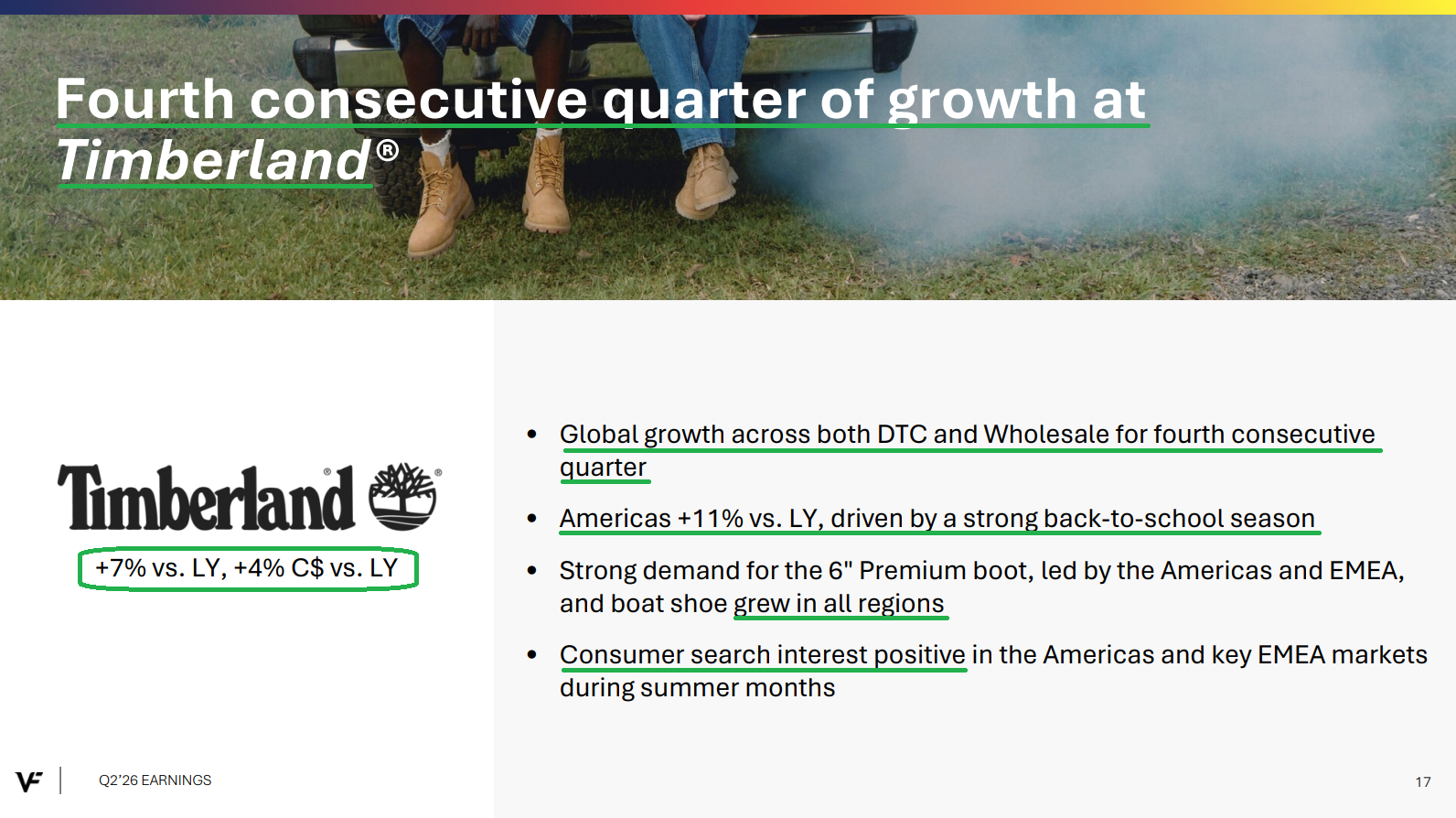

2) Timberland delivered its fourth consecutive quarter of global growth across both DTC and Wholesale, posting 7% growth, or 4% C$, driven by continued strength in the Americas. The region grew 11% YoY, supported by a strong back-to-school season and remains a major opportunity for the brand. Management noted that Timberland is still “terribly under-distributed” in the US with only six full-price stores. The plan is to expand DTC deliberately, beginning in Q3 and continuing into Q4, rather than aggressively expanding into the wholesale channel.

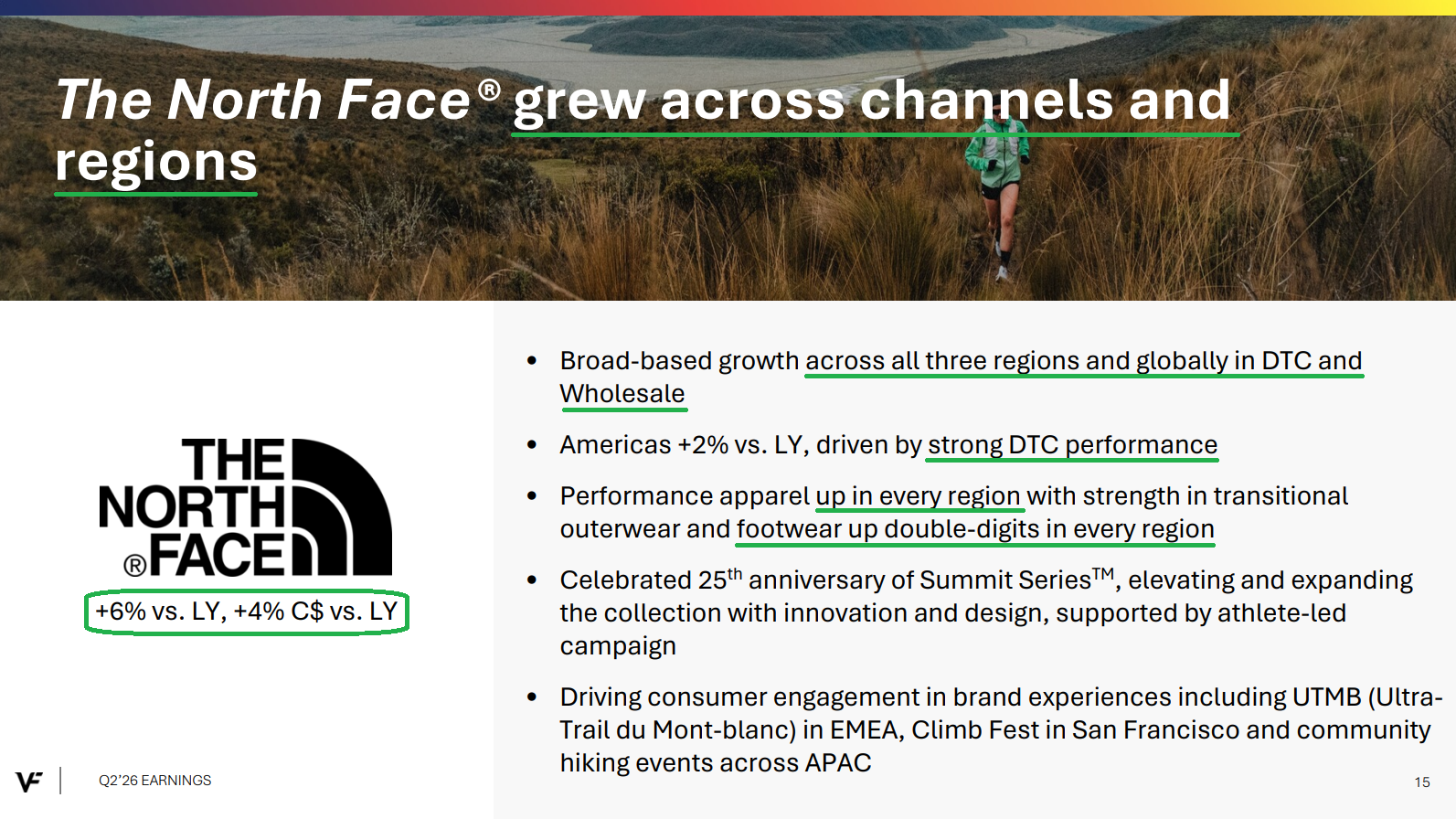

3) The North Face delivered top line growth across all three regions and across both DTC and Wholesale, with revenues up 6% or 4% C$. Footwear grew by double digits in every region as management executes on the long-term plan to triple the footwear business and double apparel and equipment, all while working to make TNF a true four-season brand.

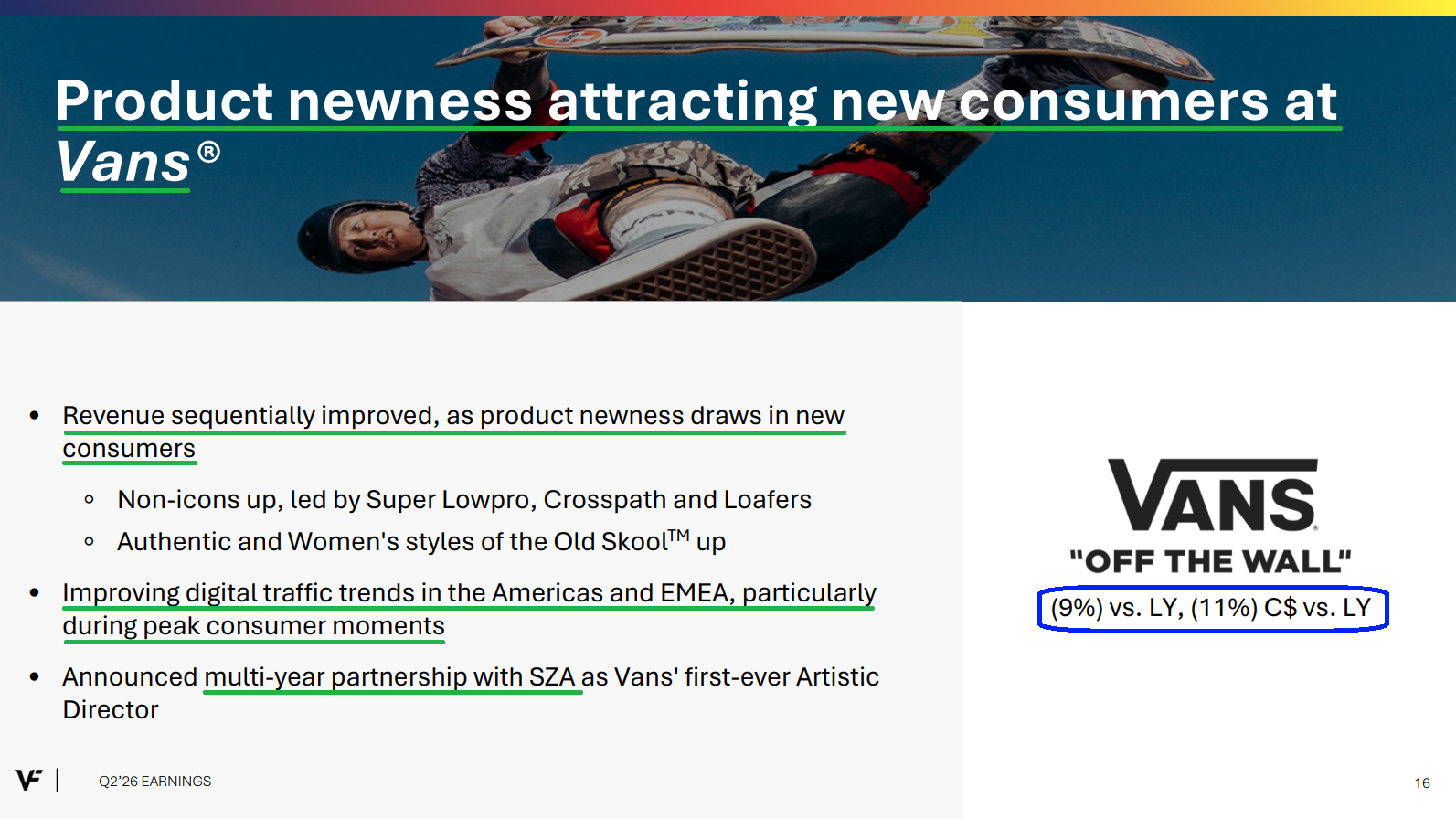

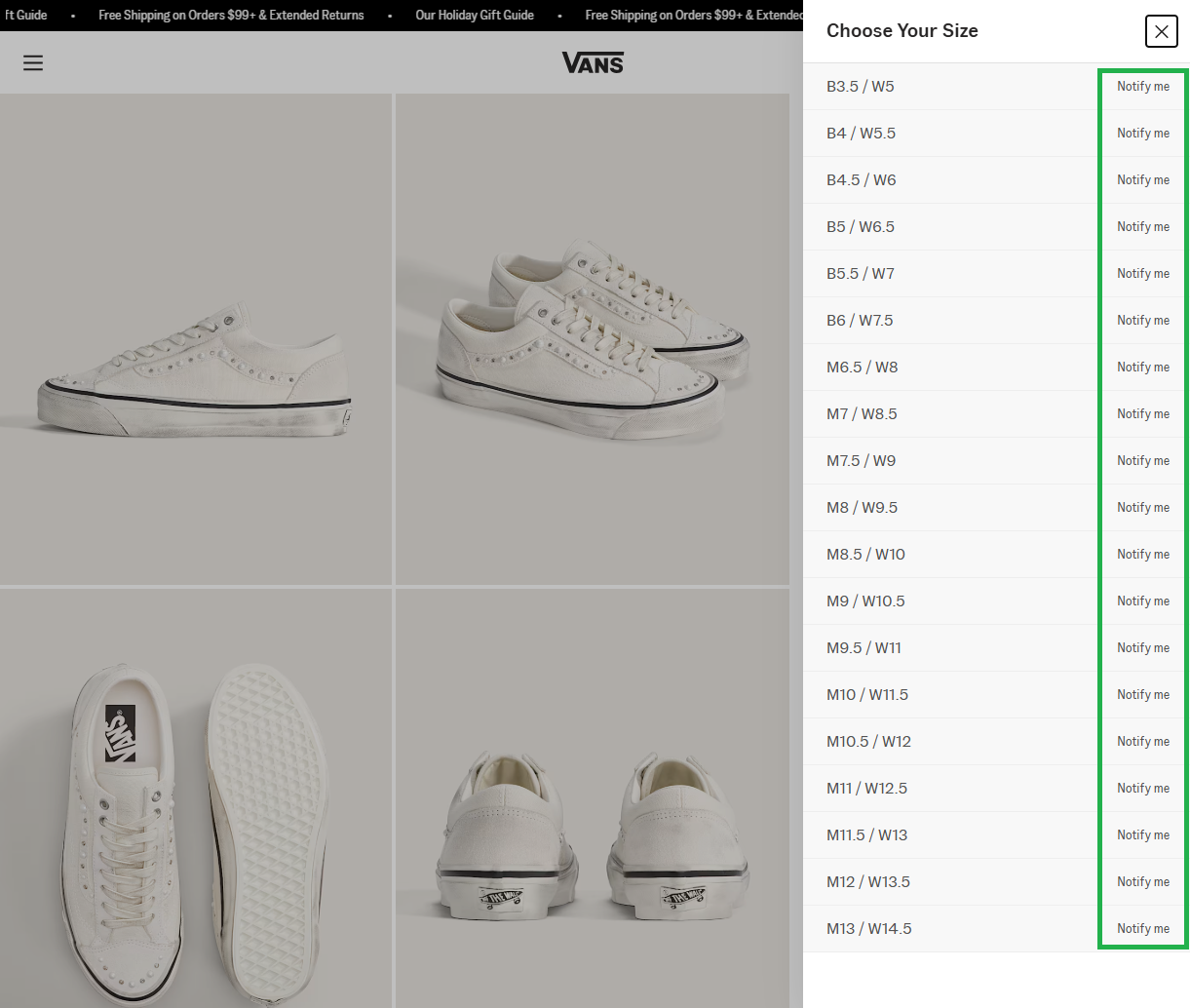

4) Vans revenues improved sequentially but still declined 9% or 11% C$, with more than 20% of the drop tied to intentional channel rationalization efforts that are expected to be fully lapped by Q4. Management noted the early influence of Vans president Sun Choe in the product pipeline, which first appeared during back to school and will ramp through the holiday season and into next year. Product newness is driving higher sell-through, with women’s Old Skool styles up more than 20%, an important focus for Vans as women’s revenue sits near an eight-year low. The Pearlized Old Skool shoe Bracken highlighted on the call is another early hit, launching online and in stores this past week and already selling out in both colors and all sizes. Management also expects the multiyear partnership with SZA to be a key catalyst and a major influence on upcoming products and the upgraded marketing push in the seasons ahead.

(Click on image to enlarge)

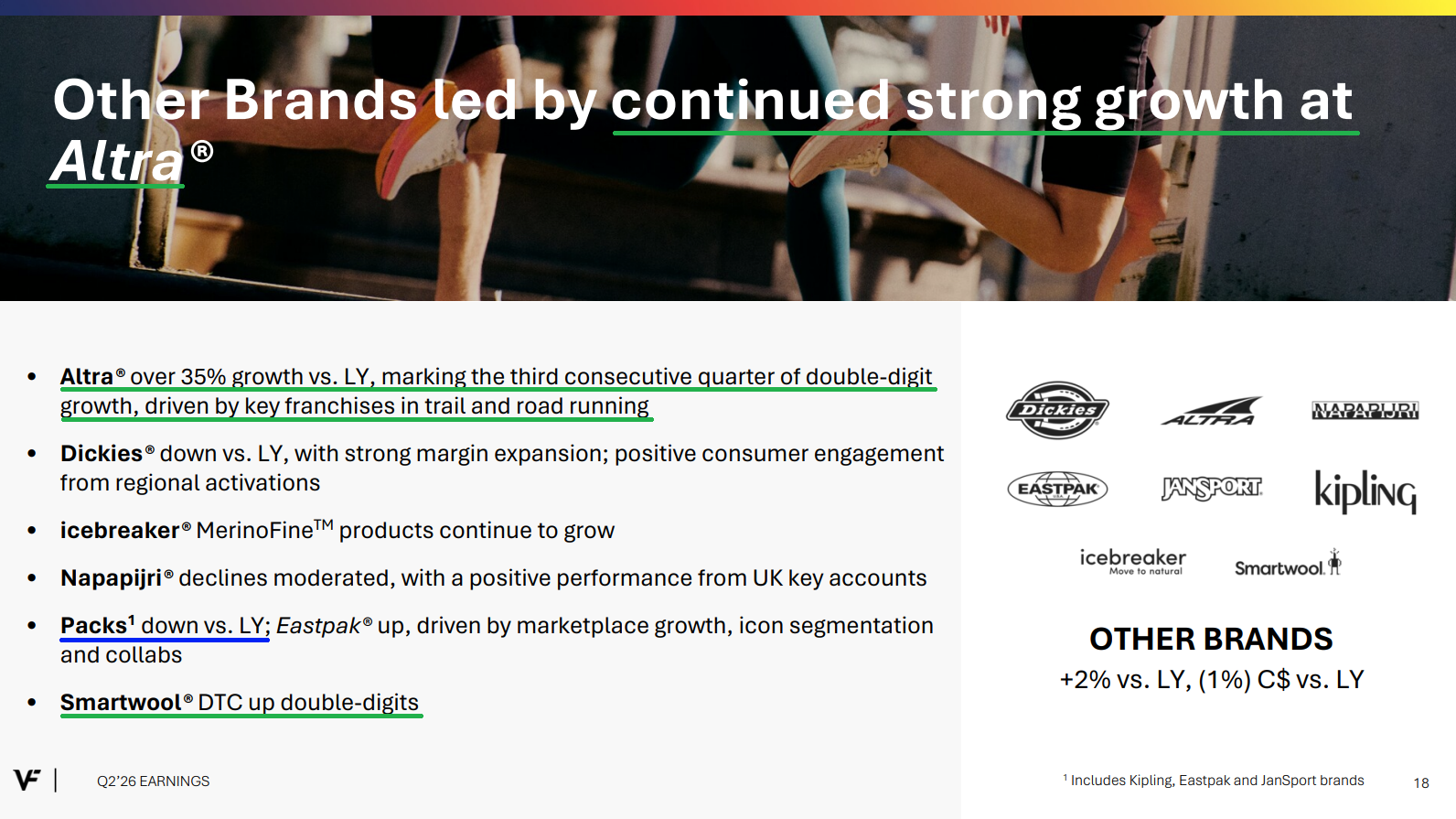

5) Altra continues to fire on all cylinders, delivering more than 35% growth and marking its third consecutive quarter of double-digit gains. The brand is now on track to exceed $250 million in revenue this year, compared to just ~$50 million at the time of its acquisition in early 2018, and is still operating with less than 10% brand awareness in the US and even lower levels internationally. Early, early days…

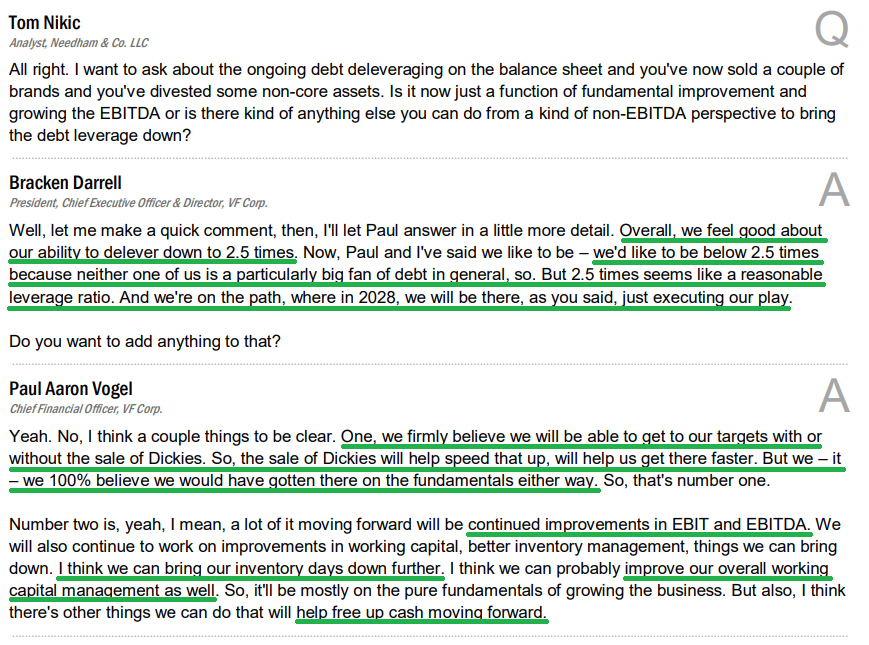

6) The Dickies sale, which closed last week, is expected to generate more than $600 million in overall cash benefit through reduced capex and lower net interest expenses. From a price standpoint, the deal was highly attractive, with management’s FY2026 estimates implying an EV/sales multiple of 1.2x and an EV/EBITDA multiple north of 20x. For a brand that had posted three straight years of double-digit revenue declines and was margin dilutive, this sale was a no brainer. Management plans to use all of the proceeds to pay down debt, which will accelerate the path toward the medium term target of net leverage below 2.5x.

7) Adjusted operating income of $330 million came in well above management’s prior guidance of $260 to $290 million. Adjusted operating margins, the key metric in the VF turnaround, reached 11.8%, up 40 bps YoY. Most importantly, management reiterated confidence in reaching the medium-term targets of 55% gross margins and 10% adjusted operating margins by FY2028, compared to 53.5% and 5.9% last fiscal year.

8) Management continues to make progress cleaning up the balance sheet, with net debt down $1.5 billion, a 21% reduction, and down 27% YoY when excluding lease liabilities. Net inventories excluding Dickies were down 4%, or $86 million YoY, as management continues to improve inventory quality, with further progress on inventory days expected ahead.

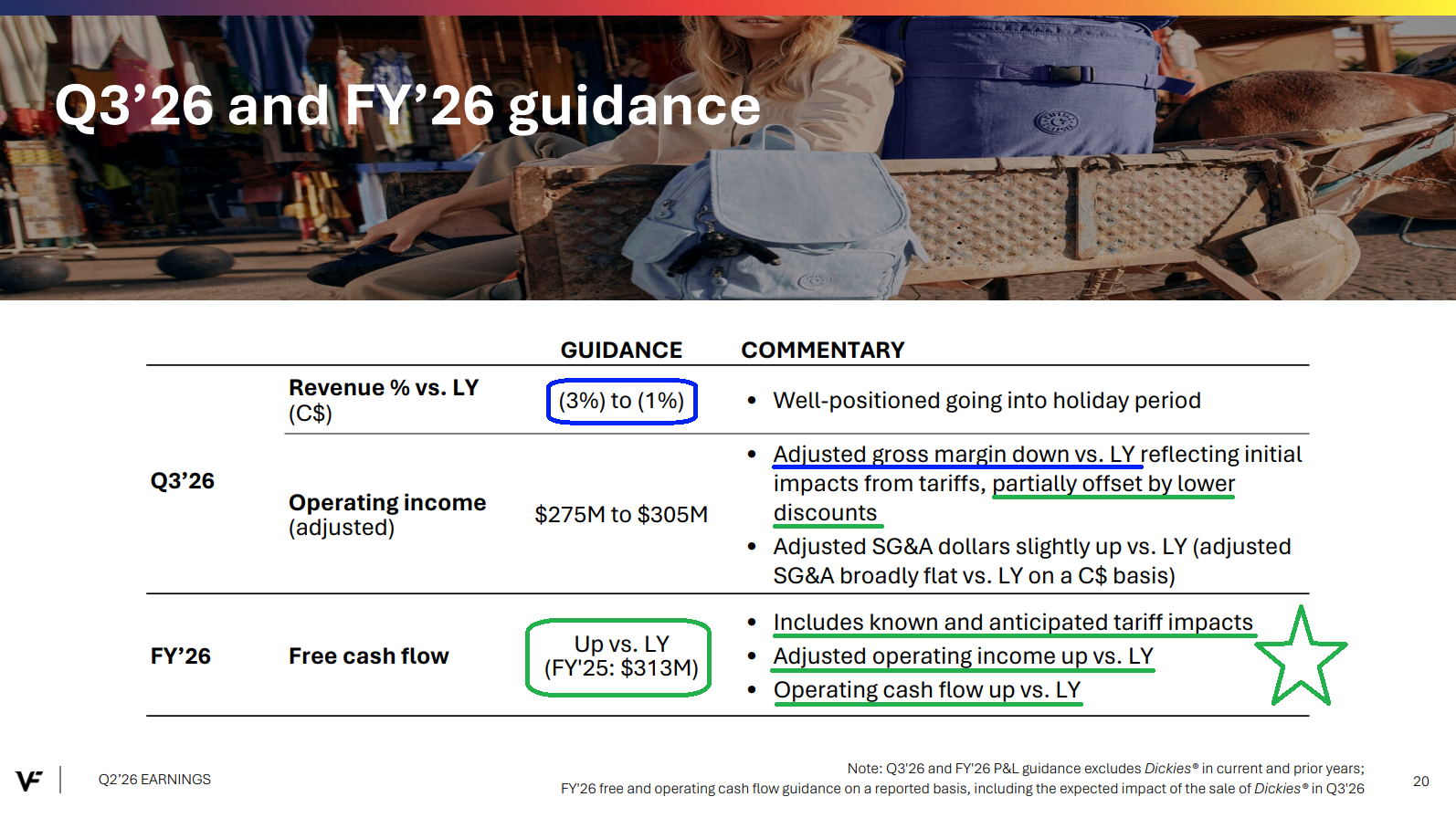

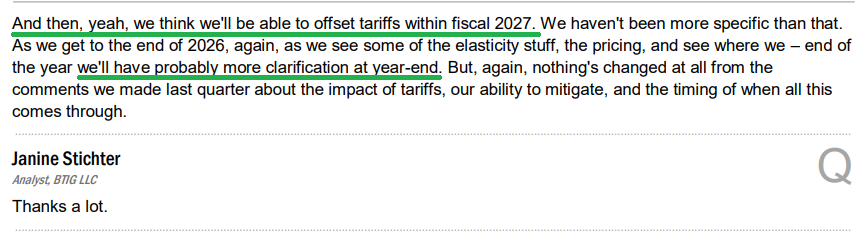

9) Management guided to a softer than expected Q3, with revenues projected to decline by 3% to 1% C$ and adjusted gross margins expected to be down YoY. The primary driver is tariff headwinds, with initial pricing actions underway but the majority not taking effect until Q4. Management continues to expect to fully offset the tariff impact within FY2027.

10) For the full year, management still expects to deliver a year over year improvement in free cash flow, which was $313 million in FY2025. Current free cash flow is an outflow of $453 million, which is in line with expectations and historical seasonality, since VFC typically starts generating free cash flow in Q3. This is even more impressive given that the year over year improvement includes the ~$60 million tariff expense headwind and the negative impact from the sale of Dickies, which is estimated to be ~$35 million. Management also expects adjusted operating income to be up year over year, compared to $556 million last year.

Earnings Call Highlights

Morningstar Analyst Note

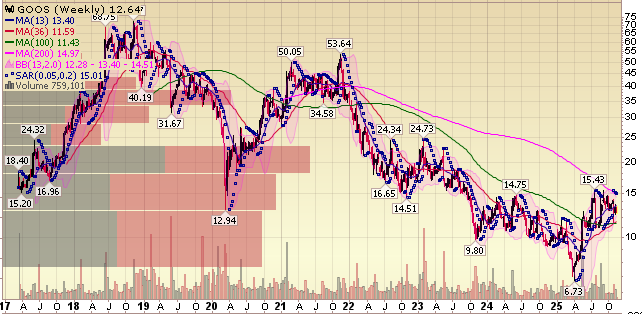

Canada Goose Update

(Click on image to enlarge)

Q2 Earnings Breakdown

10 Key Points

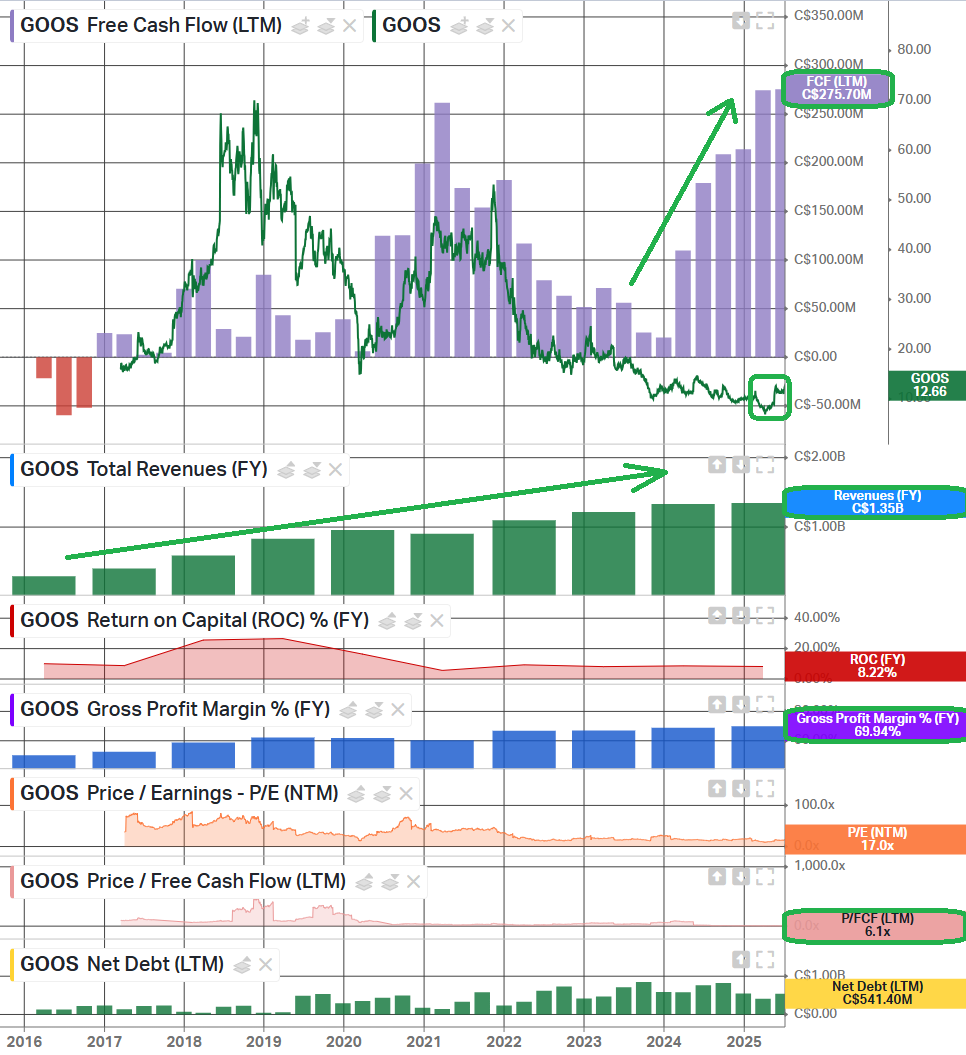

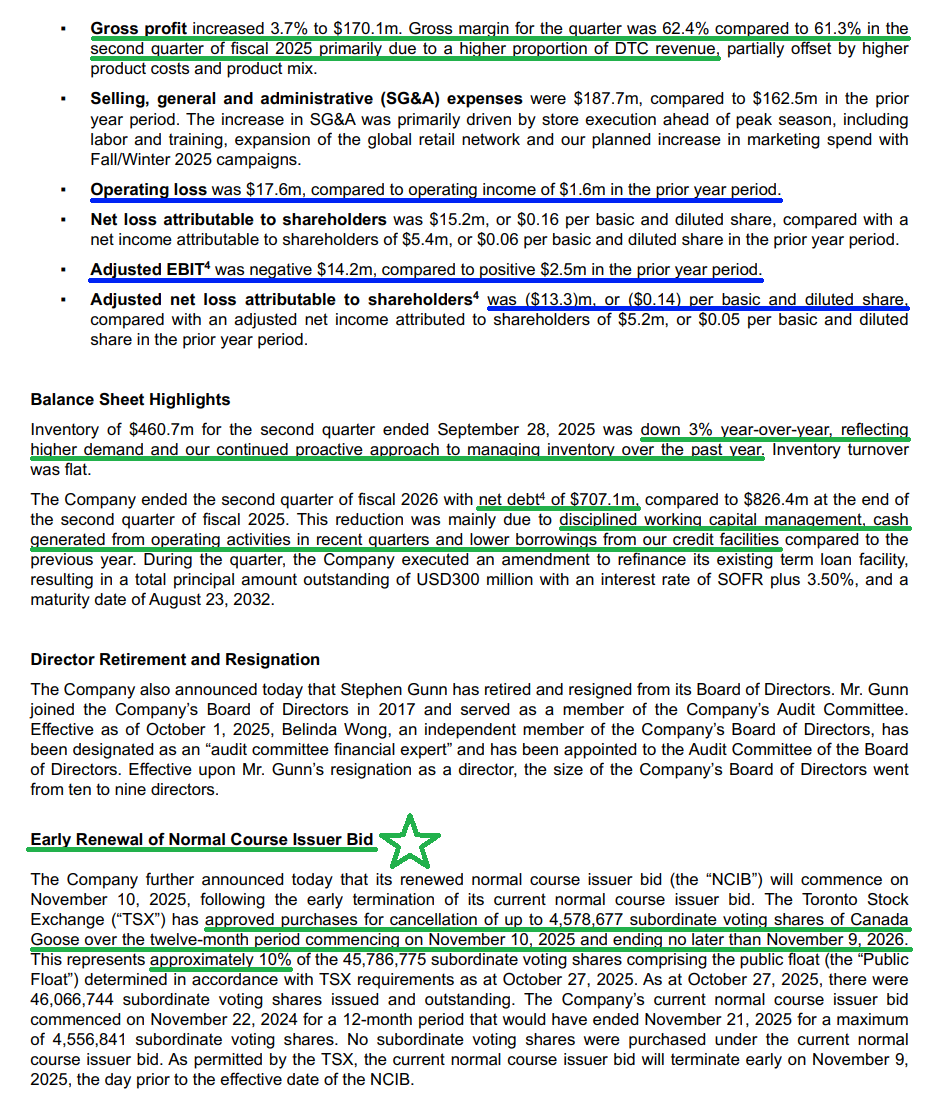

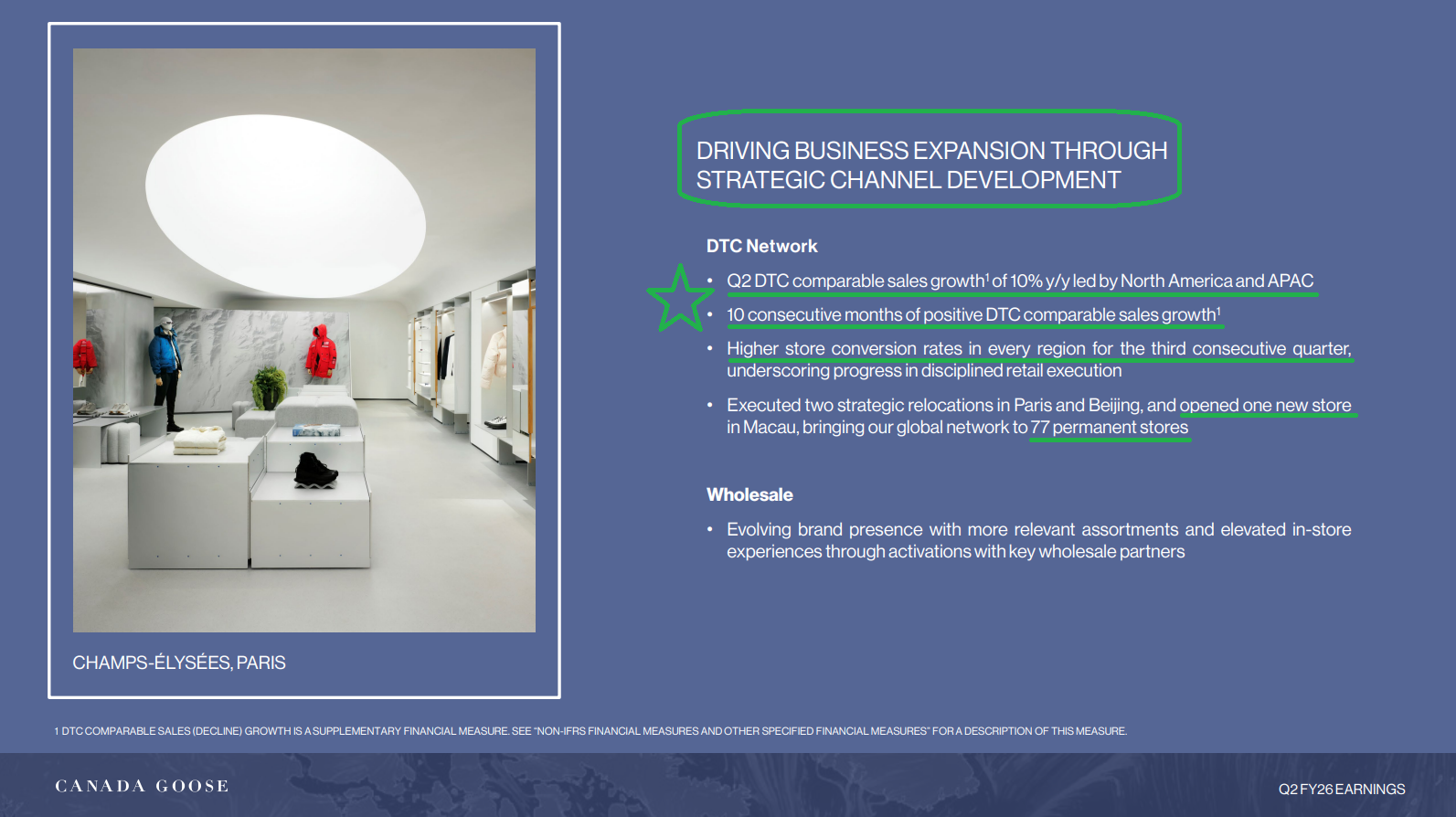

1) Q2 DTC revenues came in at $126.6 million, up 21.8% or 20.5% in constant currency, with comps up 10.2% on strong demand in North America and Mainland China. It was the third straight quarter and 10th month in a row of positive DTC comps, supported by better conversion across all regions. Management noted the momentum has continued into Q3 and has a high degree of confidence in strong top line performance as we head into the holiday season.

2) Wholesale revenues declined 1% or 4.8% in constant currency to $135.9 million, which was in line with management’s expectations as the mix continues to shift toward higher-margin DTC. Wholesale still accounted for nearly half of total revenue in the quarter, with Q2 typically the seasonal high point for the channel. Sell-through at top wholesale partners was higher year over year across every region.

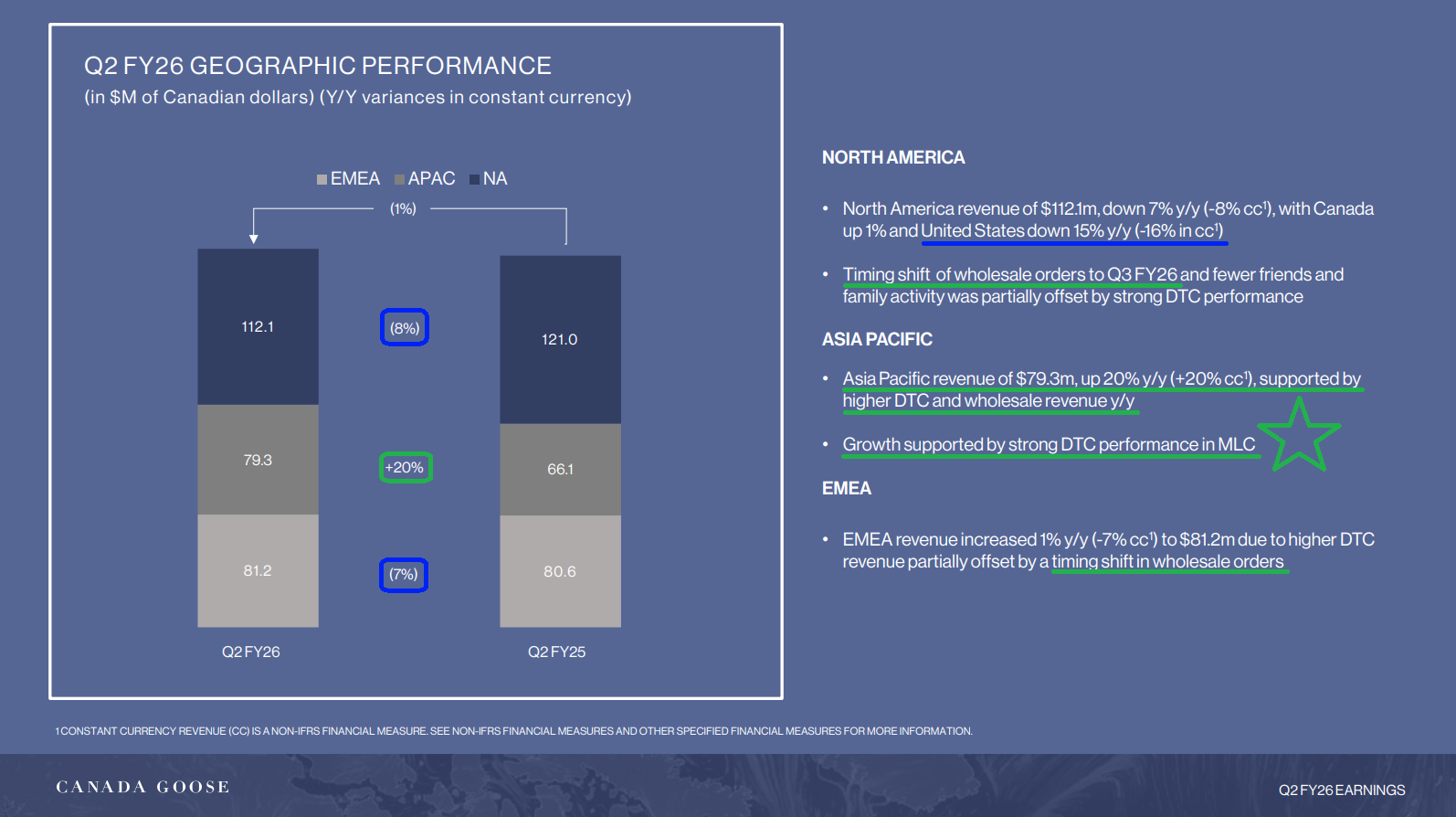

3) By region, North America posted revenues of $112.1 million, down 7% or 8% in constant currency, mainly due to a timing shift of wholesale orders into Q3. APAC revenue rose 20% YoY to $79.3 million, driven by stronger DTC and wholesale demand, with Mainland China leading the way. EMEA revenue increased 1% or declined 7% in constant currency to $81.2 million as results were affected by wholesale timing shifts and a tougher consumer backdrop in the UK.

4) Management’s effort to position Canada Goose as a true four-season brand continues to gain traction. Revenues from new styles more than doubled as a share of total sales, and in the DTC channel, newness now represents ~40% of sales versus ~10% last year. Apparel remains the fastest-growing category.

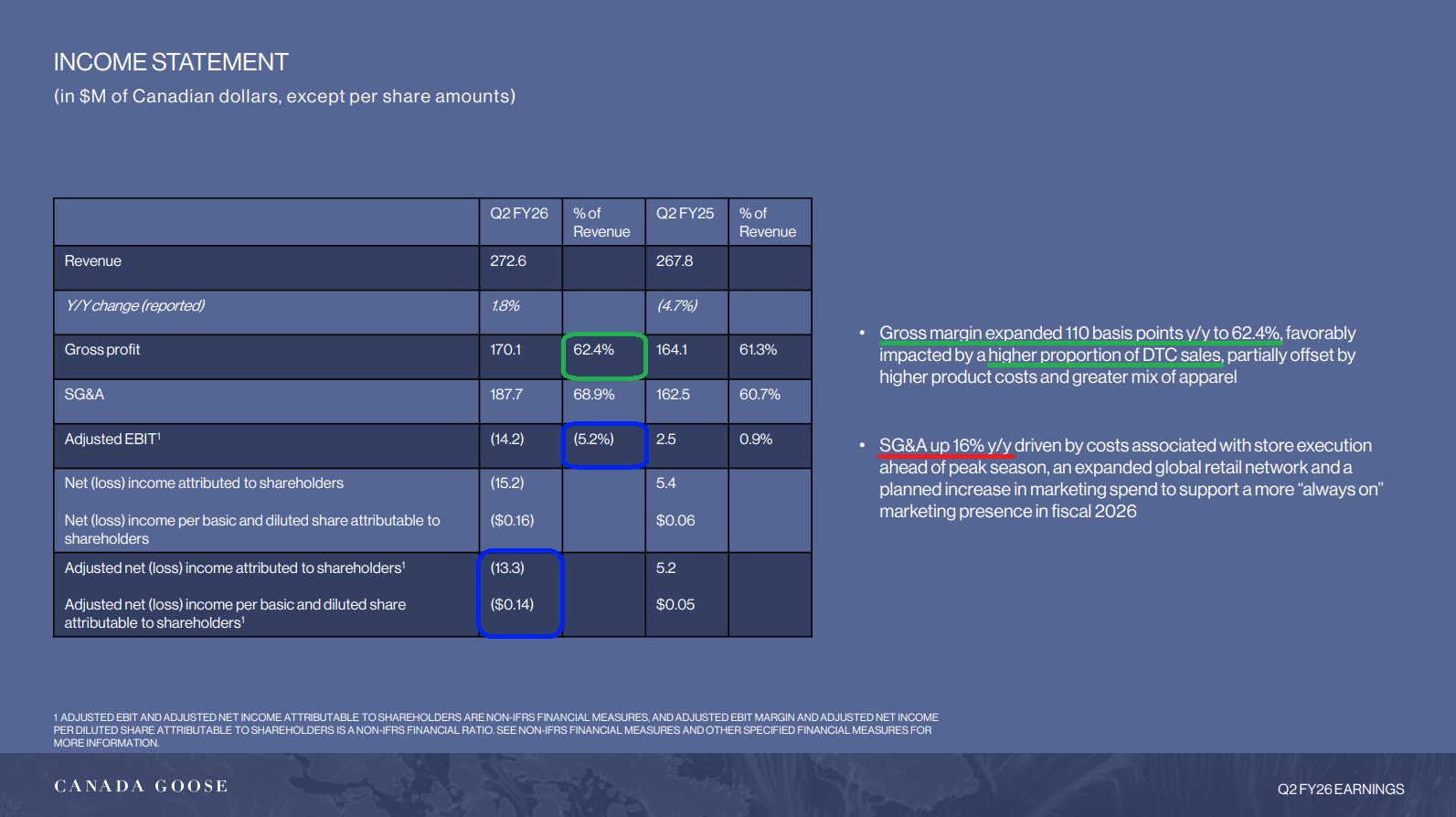

5) SG&A expenses rose 16% YoY to $187.7 million and increased 730 bps as a percentage of revenue to 67.6%. The higher expense base drove an adjusted operating loss of $14.2 million (-5.2% EBIT margin) versus operating income of $2.5 million last year. Management noted the step-up reflects a deliberate ramp in marketing and store investments that are expected to drive growth in the second half and beyond. Corporate expenses continue to grow at a much slower pace than overall revenues, and management remains confident in the medium- to long-term opportunity for margin expansion as operating leverage kicks in.

6) Gross profit rose 3.7% to $170.1 million, with gross margin expanding 110 bps YoY to 62.4% as GOOS continues to benefit from a higher mix of DTC sales.

7) Management announced the early renewal of the normal course issuer bid, allowing the company to repurchase ~10% of the public float over the next 12 months. Over the past five years, shares outstanding have been reduced by about 12%, increasing our slice of the pie without any additional capital.

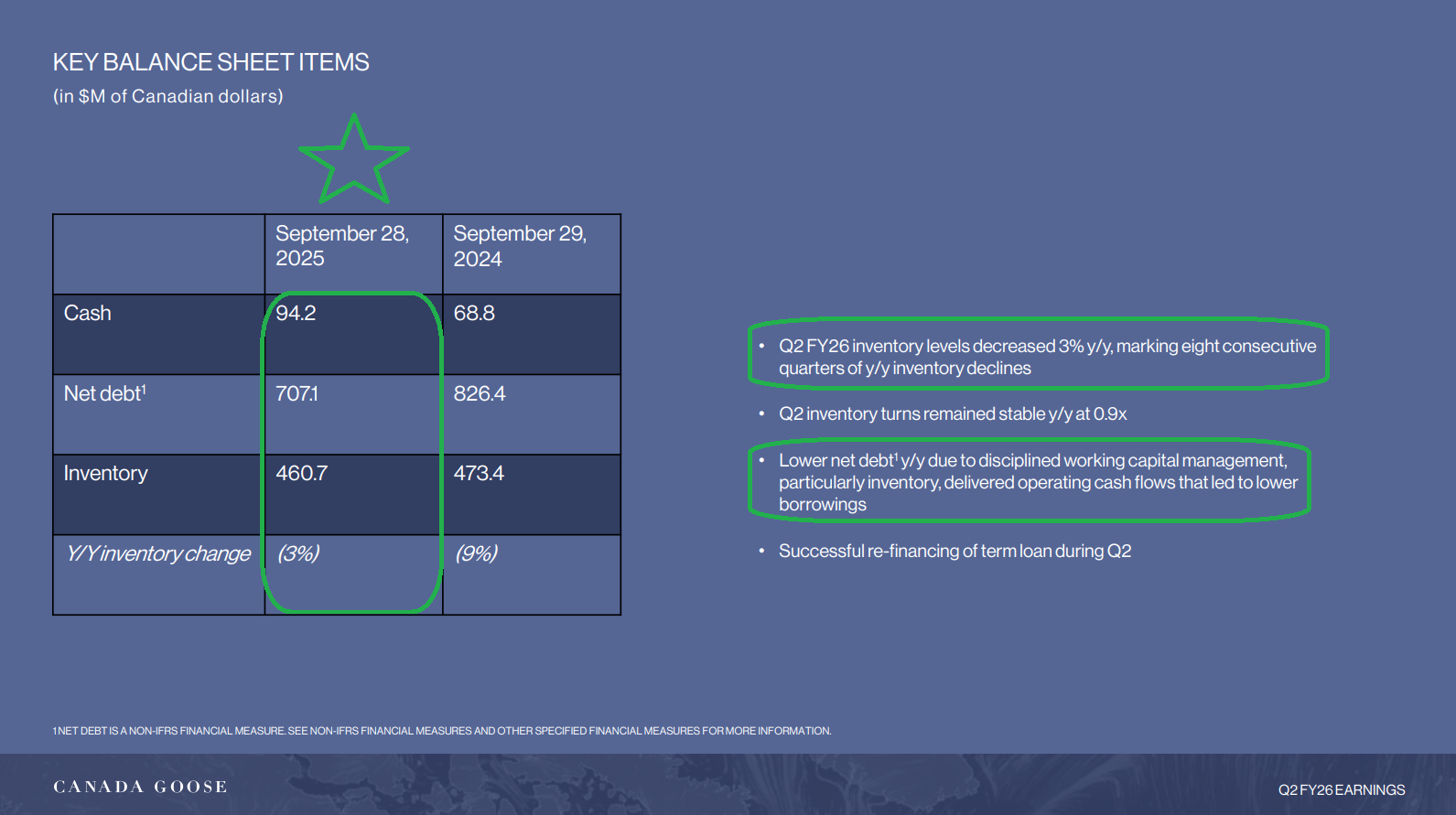

8) Management continues to clean up the inventory position, with inventory down 3% YoY to $460.7 million, marking the eighth straight quarter of declines. Inventory turns remained stable during the quarter at 0.9x.

9) Net debt fell to $707.1 million from $826.4 million a year ago, bringing net leverage down to 2.6x from 2.9x, driven by stronger operating cash flow and lower credit facility borrowings. Management also refinanced a term loan during the quarter, extending its maturity to 2032.

10) Canada Goose completed two strategic store relocations in Paris and Beijing and opened a new permanent store in Macau, which has been off to a strong start. The global network now stands at 77 permanent stores.

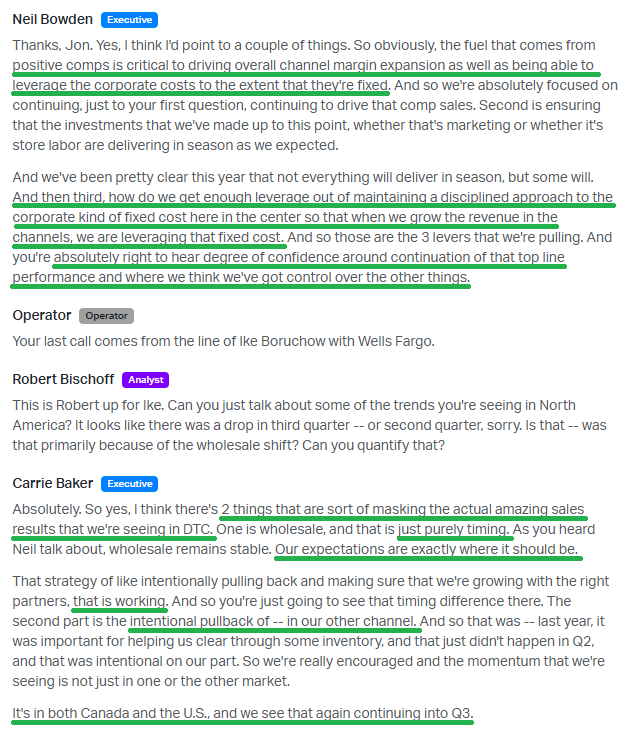

Earnings Call Highlights

General Market

The CNN “Fear and Greed Index” ticked down to 9 this week from 28 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

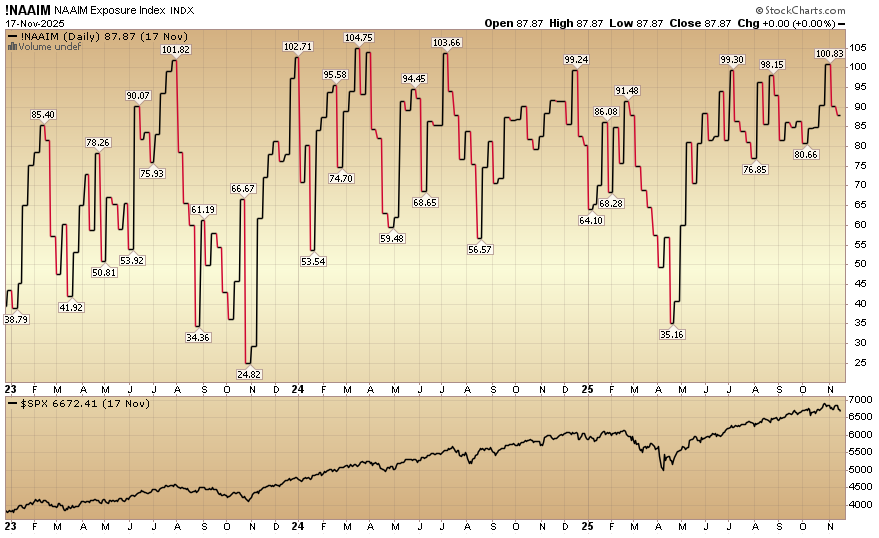

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 87.87% this week from 90.06% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Boring Never Looked So Good” Stock Market (And Sentiment Results)

“Turning The Corner” Stock Market (And Sentiment Results)

“Old Dogs, New Tricks” Stock Market (And Sentiment Results)…

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more