“Lifting Off And Looking Good” Stock Market (And Sentiment Results)

Key Market Outlook(s) and Pick(s)

On Monday, I joined Stuart Varney on Fox Business “Varney & Co” to discuss markets, outlook for 2026, the Fed, the Santa trade, rotation, and more. Thanks to Stuart and Peyton Jennings for having me on:

Bank of America Fund Manager Survey Update

On Tuesday, we put out a summary of the monthly Bank of America “Global Fund Manager Survey.” This month they surveyed 238 institutional managers with ~$364B AUM:

Here were the 5 key points:

1) Fund manager sentiment, based on cash levels, equity allocation, and global growth expectations, rose to 7.4 from last month’s 6.4, the highest level since July 2021.

(Click on image to enlarge)

2) Global growth expectations are now the most optimistic since August 2021, rising to a net 18% expecting a strong global economy from last month’s net 3%. However, while economic expectations continue to catch up to stock prices, they are only slightly above neutral and remain well below prior periods of froth.

(Click on image to enlarge)

3) Fund managers’ average cash level fell to a record low of 3.3%, down from last month’s 3.7%. There have been 9 instances since 1998 when cash levels dropped below 3.6%, with global stocks falling an average of 2% in the following month.

4) Fund managers continue to neglect the energy sector, with allocation still a net 26% underweight and nearly 2 standard deviations below the average of the past 20 years, making it the most underweight equity sector. When the rubber band gets this stretched, mean reversion becomes inevitable.

(Click on image to enlarge)

5) Managers have also left Consumer Staples for dead, with allocation falling 4 percentage points to a net 20% underweight, making it the second most underweight sector. As volatility picks up in a midterm year presidential cycle and money comes off the sidelines in search of yield, we expect staples to move back into vogue in a hurry.

(Click on image to enlarge)

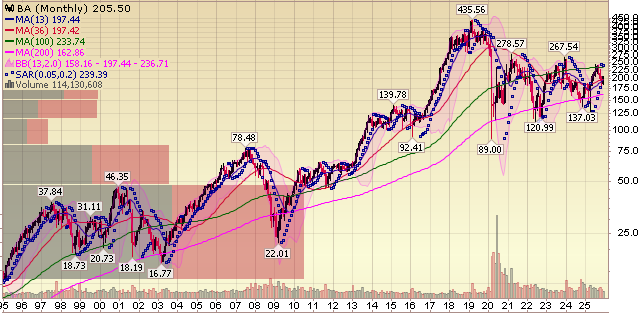

Boeing Update

Boeing (BA) has come a long way from earlier this year, when “uninvestible” was the consensus call and merely mentioning the stock earned double-takes.

It is remarkable what happens when you put a leader with a true, hands-on engineering background in charge of a company building some of the most complex machines on the planet.

And not just any engineer. Kelly Ortberg is a true one-of-one, with a long track record of turning an engineer-first culture into massive shareholder value. At Rockwell Collins, he doubled sales in six years and more than quadrupled shareholder value before selling the business at a nice premium to United Technologies in 2019. We have long flagged Ortberg as a true home-run hire and key catalyst in the Boeing turnaround, and so far he has proven to be the exact medicine the company needed.

The Boeing thesis has always been a simple one for us. This is a national champion and proxy for US manufacturing that operates in a growing duopoly, backed by a $636B backlog. A backstop like that provides a long and forgiving runway for management to fix self-inflicted wounds (plenty of those) and work its way back on track.

It certainly helps to have the world’s greatest salesman and ultimate closer in the White House, with a Boeing order increasingly serving as the price of admission in US trade negotiations. At this point, Boeing owes him a custom trophy (and if his pitch to sell beautiful Boeing planes has been impressive, just wait until Intel chip sales next).

Of course, while piling on blockbuster orders makes for great headlines, demand has never been Boeing’s problem. The entire story has always come down to production. Deliver more airplanes, generate more cash. It really is that simple. As Kelly Ortberg applies his playbook of operational excellence and whips Boeing back into shape, we expect that to translate to the long-awaited and coveted >$10B annual free cash flow target that the market still fails to appreciate.

The way we see it, turbulence is in the rearview, smooth skies ahead.

Ortberg joined CNBC post-earnings, giving a great high-level update on the state of the turnaround and how the administration’s deal-making is booking Boeing demand deep into the next decade.

Q3 Earnings Breakdown

10 Key Points

1) For the first time since Q4 2023, Boeing generated positive free cash flow, coming in at $238 million compared to a quarterly outflow of $1.96B last year. The improvement came from higher commercial deliveries and better working capital, both YoY and sequentially. Since the earnings call, management has updated full year guidance and now expects an outflow of ~$2B versus the prior ~$2.5B, as the $700M DOJ payment was pushed into 2026. Looking ahead, they expect to generate low positive single digit billions in 2026, a major YoY step forward, and still view the path to more than $10B over the next few years as very achievable.

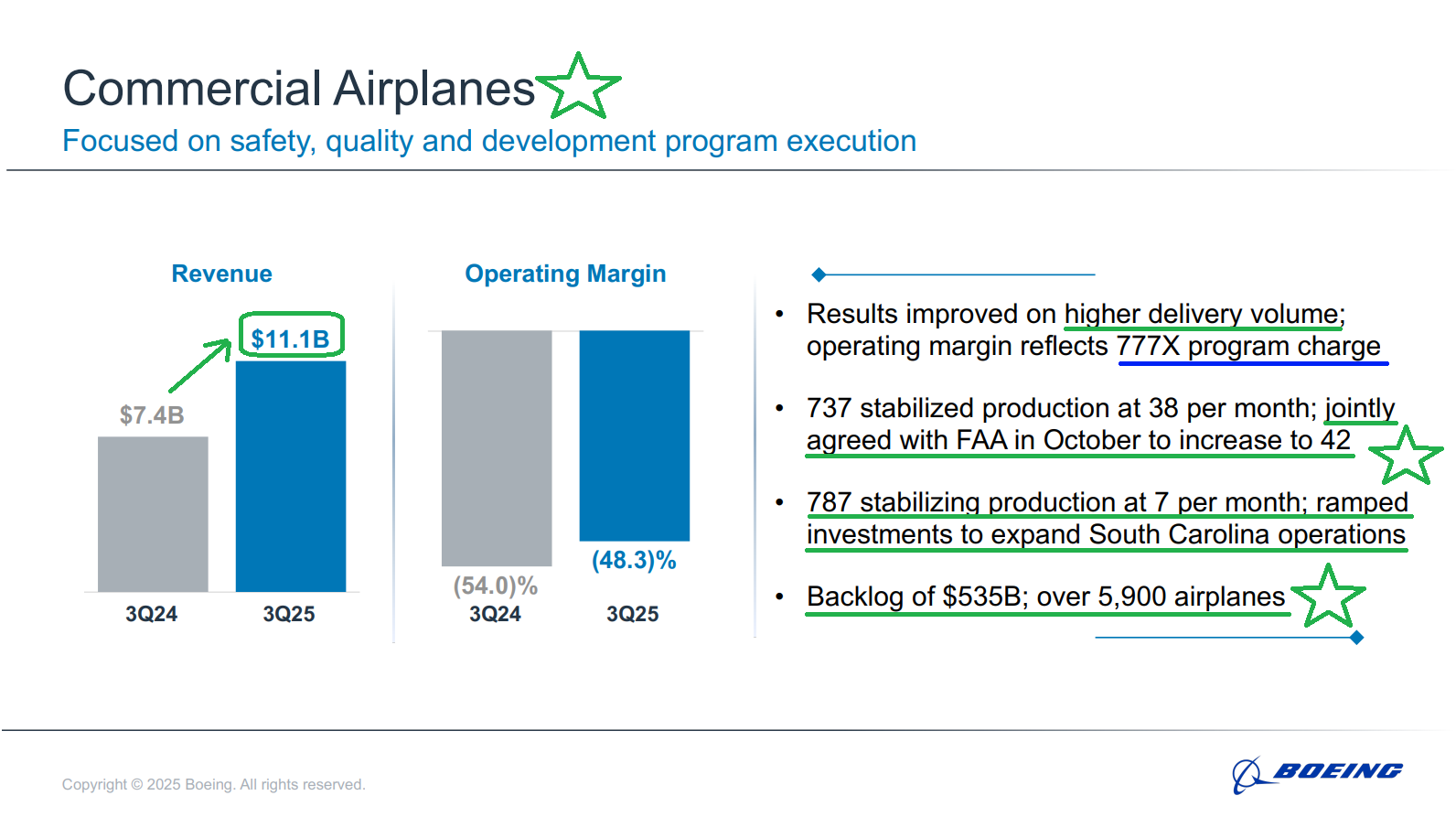

2) Commercial airplane deliveries reached 160 for the quarter, up 38% YoY and the highest quarterly total since 2018. By August of this year, Boeing had already surpassed last year’s full-year delivery count. Stronger deliveries lifted the commercial segment to $11.1B in revenue, up 49% YoY. The commercial backlog now stands at $535B and includes more than 5,900 airplanes, with both the 737 and 787 sold firm into the next decade.

3) After stabilizing production at 38 per month and meeting all required KPIs, Boeing jointly agreed with the FAA in October to increase 737 MAX output to 42 per month. Management expects to exit the year firmly at a 42-per-month rate and sees no supply chain constraints that would prevent further increases. Any production hikes beyond 42 per month will occur in increments of 5, no sooner than 6 months apart, and will use the exact same review process with the FAA.

4) The 787 program continued to stabilize production at 7 per month, with management expecting to finish the year at 8 per month and move to 10 next year. The South Carolina site expansion, which effectively doubles the manufacturing footprint, is aimed at supporting rates above 10, with current market demand allowing for rates in the teens. Management does expect some supply chain constraints, specifically around seat certifications, and noted that progress is being made with targeted actions underway with suppliers.

5) The Defense, Space, and Security segment generated $6.9B in revenue for the quarter, up 25% YoY from $5.54B. Boeing booked $9B in orders for the segment, bringing the backlog to a record $76B. Management continues to make progress de-risking development programs and improving profitability, with quarterly operating margins at 1.7% compared to -43.1% last year. There have been no charges so far in 2025 for the Defense business, a welcome change after more than $13B in charges over the past five years, and management remains confident the segment can return to historical performance levels.

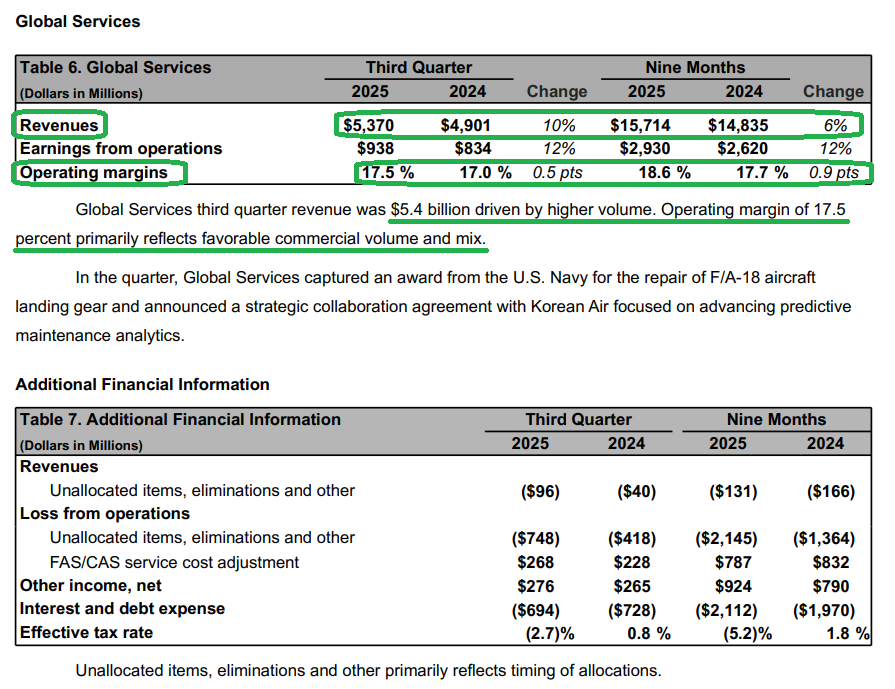

6) The Global Services segment delivered quarterly revenue of $5.4B, up 10% YoY from $4.9B. The segment booked $8B in orders during the quarter, bringing the YTD book to bill ratio to 1.2 and pushing backlog to about $25B. Profitability remains strong, with operating margins of 17.5%, up 50 bps YoY, and both the commercial and government businesses again delivering double digit margins.

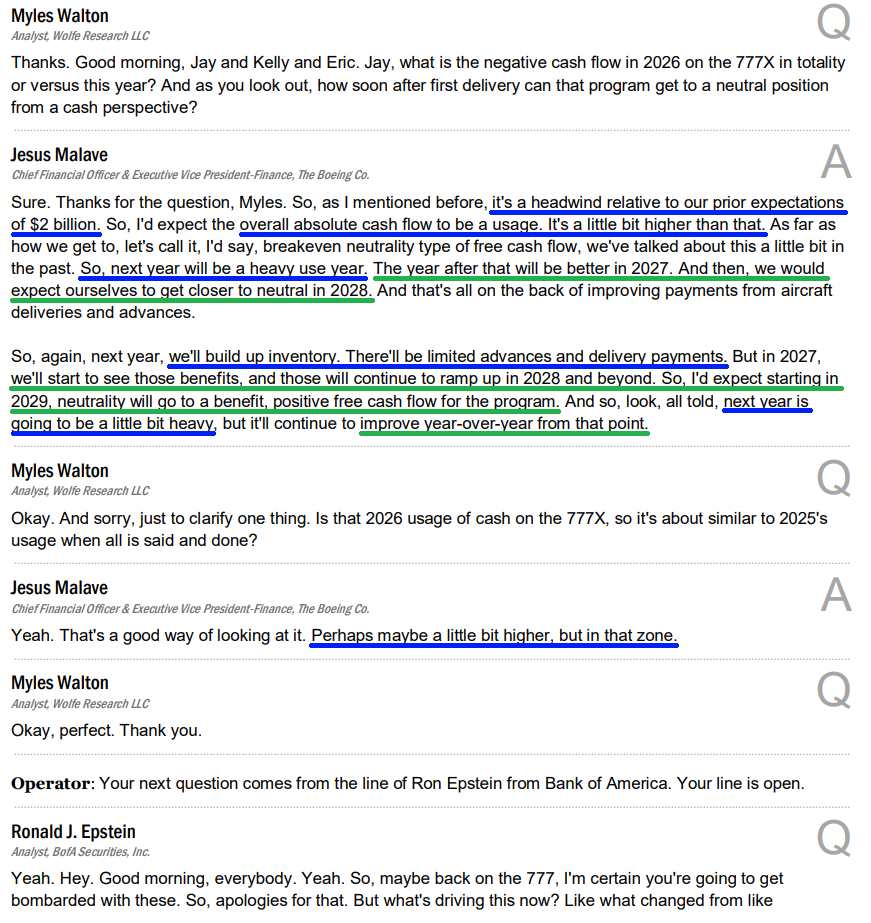

7) Management recorded a $4.9B charge tied to the updated 777X certification timeline, which increased quarterly loss per share by $6.45. While there are no major technical issues with the airplane or its engine, authorization to begin the next major phase of certification flight testing has been delayed, pushing the expected first delivery to 2027 instead of 2026. Management noted that demand for the aircraft remains strong and that they view the 777X as the company’s next flagship, with the charge serving as a conservative estimate that could allow them to beat the updated timeline. The program is expected to be a free cash flow headwind of about $2B in 2026, with improvements in 2027 and cash flow neutrality by 2028, followed by positive contributions thereafter.

8) Cash and investments in marketable securities stood at $23B at quarter end, which management expects to rise to about $28B now that both the Jeppesen and Spirit transactions have closed. Boeing also maintains access to $10B in undrawn credit facilities, with strengthening the balance sheet and supporting the investment grade rating a top priority against consolidated debt of $53.4B.

9) During the call, management had guided for the Jeppesen deal to close during Q4 and for the Spirit deal to close shortly afterward. Both transactions are now complete, with the $10.55B all cash Jeppesen deal closing in early November and the $8.3B Spirit acquisition closing in early December. Management noted that no other M&A is a focus at the moment.

10) After more than 3000 hours of lab testing and analysis, Boeing now has a final set of design changes to permanently address the engine anti ice issue for the 737-7 and 737-10. Both aircraft are expected to receive certification in 2026, with the process expected to be straightforward.

Earnings Call Highlights

Morningstar Analyst Note

Estee Lauder Update

Q1 Earnings Breakdown

10 Key Points

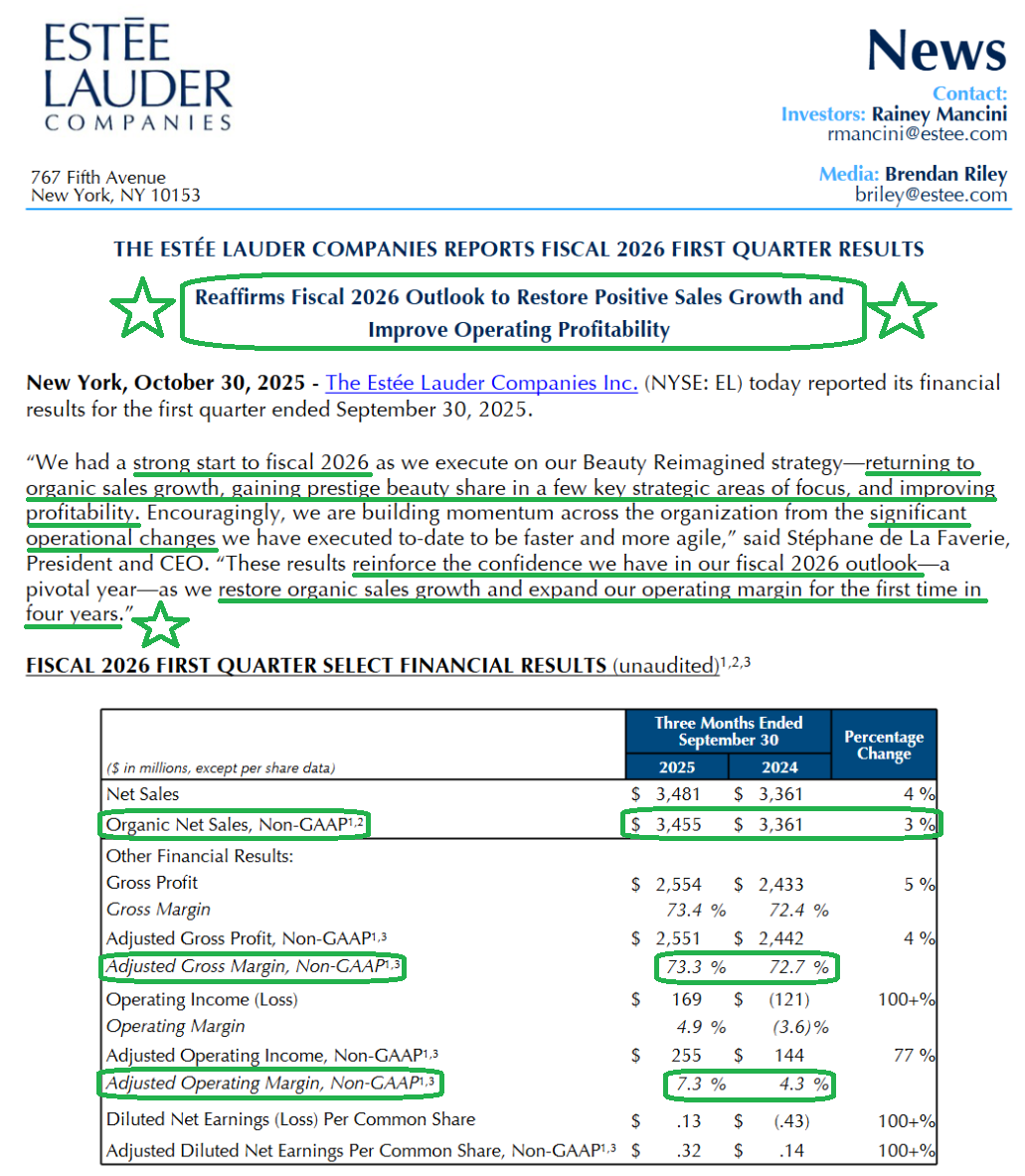

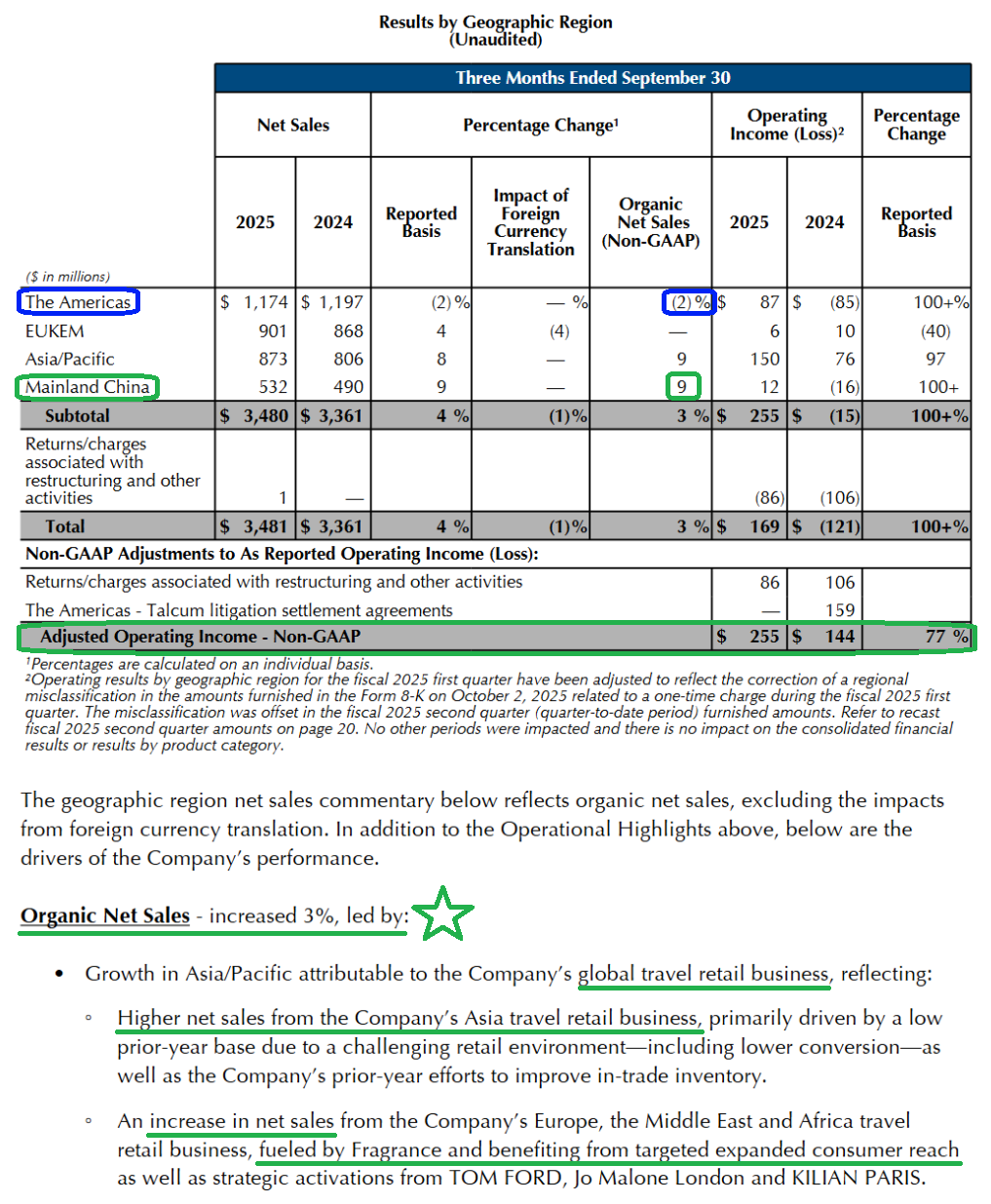

1) Estée Lauder (EL) reported Q1 revenue of $3.48B, up 4% YoY and ahead of consensus by ~$98.6M. Organic growth was 3%, a massive sequential acceleration from the 13% decline in Q4. Adjusted EPS of $0.32 also beat expectations by $0.14 and more than doubled versus the prior year period.

2) Mainland China surprised to the upside in Q1, with revenue up 9% to $532M as consumer sentiment continued to rebound. Estée Lauder significantly outperformed the prestige beauty market in China, with retail sales growing at a double digit pace versus high single digit growth for the industry. The company gained share across every category, marking five of the past six quarters of prestige beauty share gains, led by seven brands posting double digit growth and Le Labo delivering nearly triple digit growth.

3) The Americas saw net sales decline 2% to $1.17B, pressured by ongoing challenges in department stores and softness at certain retailers with elevated inventory levels. That said, Estée Lauder has maintained prestige beauty share year to date, with meaningful volume driven share gains in the US. This was led by the Estée Lauder brand, which gained share across skincare, makeup, and fragrance for the brand’s third consecutive quarter of overall share gains.

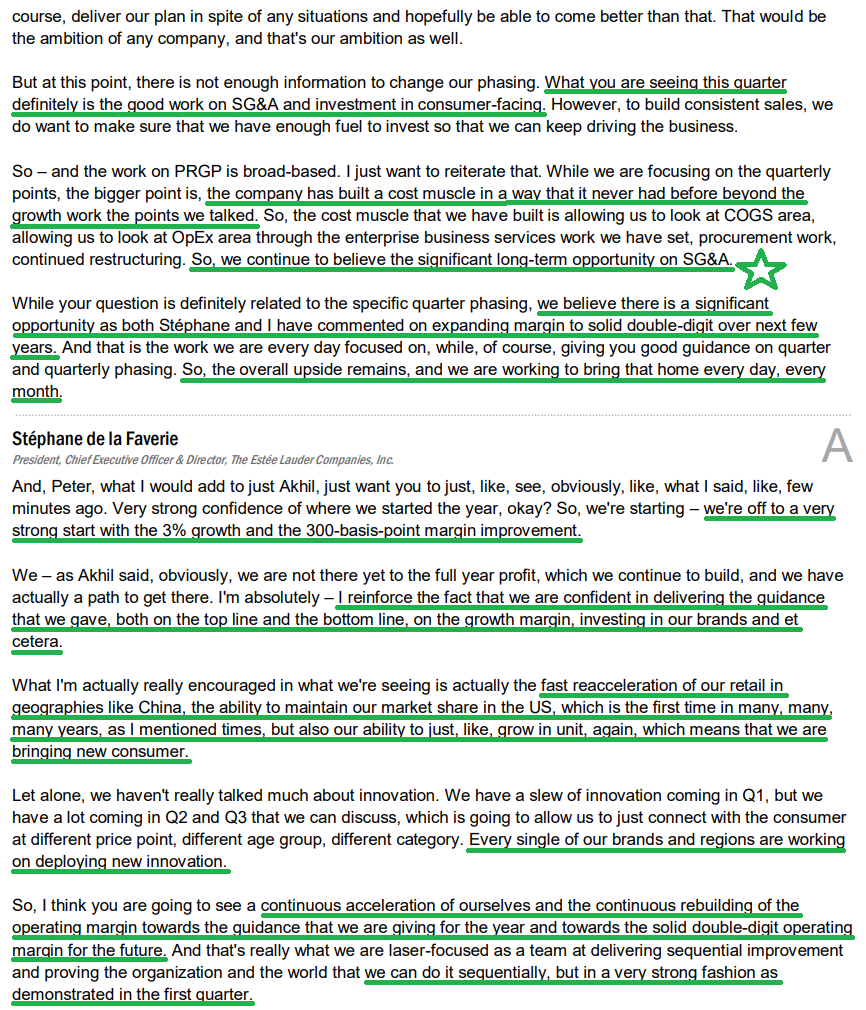

4) Profitability continued to improve, with adjusted gross margins of 73.3%, up 60 bps YoY from 72.7%. For the full year, management continues to expect gross margins to be flat to modestly positive versus 74% in FY2025, while noting meaningful upside potential remains. The most important metric in the Estée Lauder turnaround, adjusted operating margins, expanded by 300 bps in Q1 to 7.3%, ahead of expectations. Management expects operating margins to improve sequentially throughout the year, with full year guidance of 9.4–9.9% as the business works its way back toward solid double digit margins over time.

5) The Profit Recovery and Growth Plan continues to perform well, with management expecting it to be substantially completed in FY2027 and the majority of full run rate benefits realized in the same year. The program is expected to result in $1.2B–$1.6B of restructuring and related charges, with $697M incurred to date, and to deliver annual gross benefits of $0.8B–$1.0B. At this point, Estée Lauder has approved initiatives representing more than 70% of the expected gross benefits, over 50% of the anticipated charges, and nearly 60% of the projected net reduction in positions.

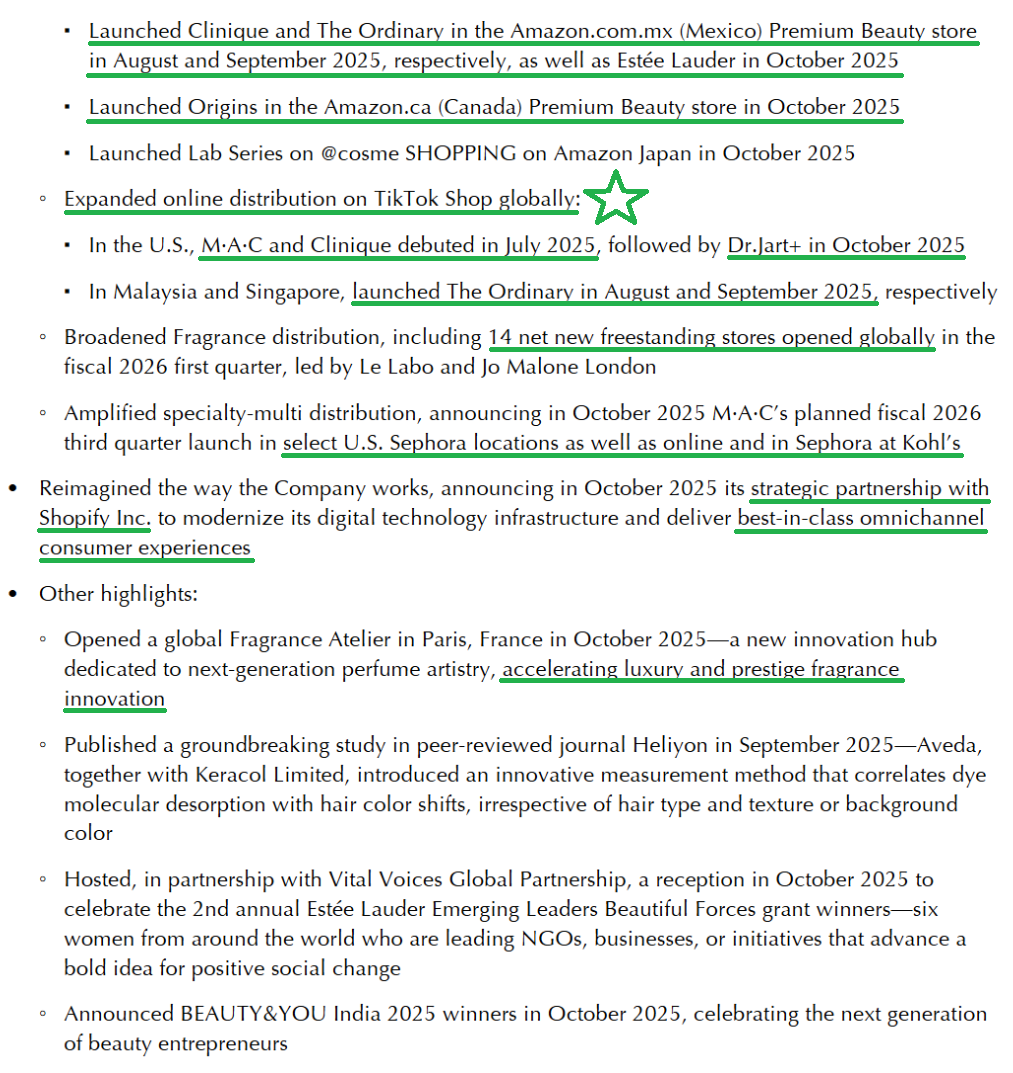

6) Management continues to lean into higher growth, higher margin digital channels, launching several brands on Amazon’s Premium Beauty store across the US, Canada, Japan, the UK, and Mexico. The company also expanded global distribution on TikTok Shop, with brands such as MAC, Clinique, and Dr. Jart+ debuting during the quarter, and announced a new partnership with Spotify aimed at modernizing and scaling the DTC business and building a best in class omnichannel platform. This accelerated push drove global online organic sales to double digit growth, up from mid single digits in Q4, outperforming the broader prestige beauty market in the online channel.

7) Travel Retail has begun to recover and show improving momentum, with air traffic in the key Hainan market up 14%, supporting strong demand and driving double digit growth during Golden Week. Importantly, inventory levels remain materially lower than a year ago, leaving the business far better right sized relative to retail demand. Management continues to expect global Travel Retail to return to modest growth for the full year and plans to double down on the segment in the West and the Americas, where exposure is lower, driven by distribution expansion and consumer facing investments.

8) Capex declined 32% YoY to $96M during the quarter as management continued to prioritize higher ROI investments, with full year capex expected to run at ~4% of projected sales. The focus remains on high ROI, consumer facing initiatives, with investment in this area up 4% during the quarter, including 14 net new freestanding stores, which management expects to drive a meaningful improvement in returns over time.

9) The full year tariff related headwind is expected to be about a $100M impact to profitability, with management continuing to leverage available trade programs and further optimize the regional manufacturing footprint to bring production closer to the consumer. These actions are expected to offset more than half of the anticipated tariff impact, while management continues to evaluate additional PRGP initiatives and potential pricing actions.

10) Management reaffirmed the FY2026 outlook, calling for net sales growth of 2–5% and organic growth of 0–3%, versus expected prestige beauty industry growth of 2–3%. Adjusted operating margins are set to expand for the first time in four years, driving full year adjusted EPS of $1.87–$2.07 versus $1.51 last year, representing 24–37% earnings growth.

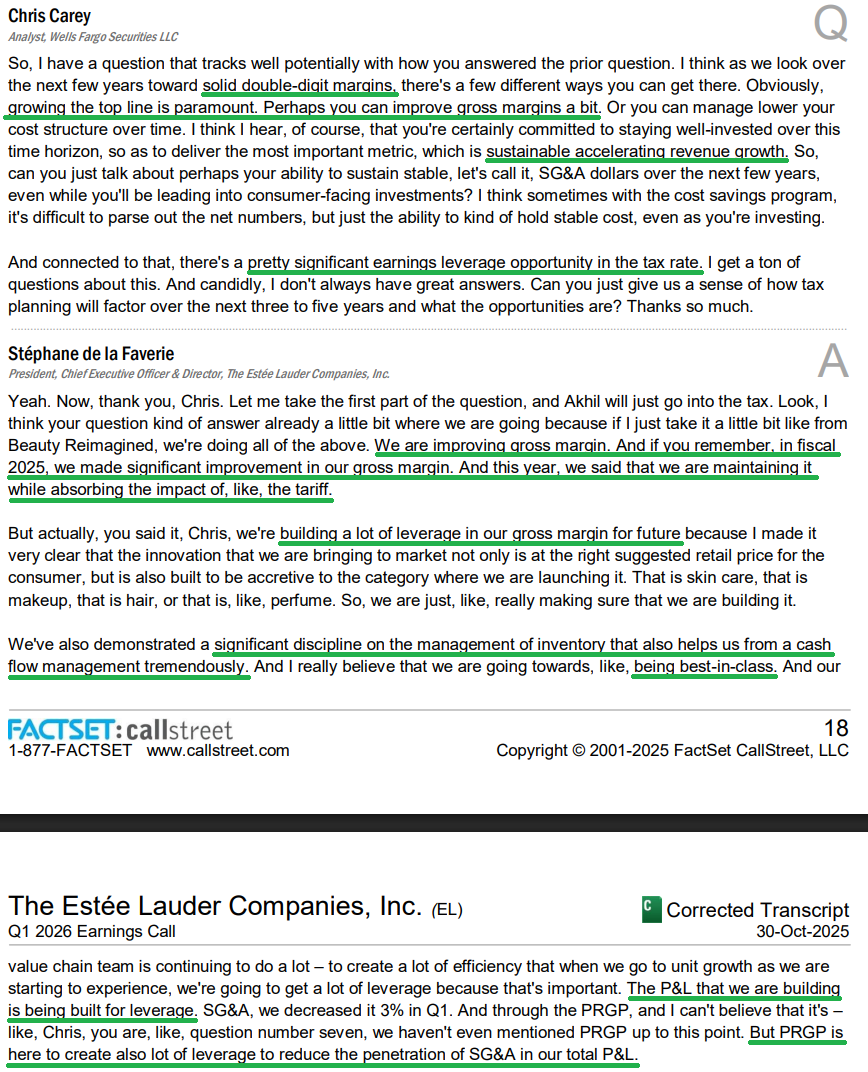

Earnings Call Highlights

Morningstar Analyst Note

General Market

The CNN “Fear and Greed Index” ticked up to 51 this week from 31 last week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

The NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked down to 97.13% this week from 98.57% equity exposure last week.

(Click on image to enlarge)

More By This Author:

“Holiday Carts And Auto Parts” Stock Market (And Sentiment Results)…

“The Housing Power Play” Stock Market (And Sentiment Results)

“Getting Their Groove Back” Stock Market (And Sentiment Results)

Long all mentioned tickers.

Disclaimer: Not investment advice. For educational purposes only: Learn more at more