Tuesday Talk: O(micron) - Pow(ell)!

As Wall St. investors await the market open Tuesday, futures dive on Omicron concerns as well as anticipation surrounding Fed Chair Powell and Treasury Secretary Yellen's Senate testimony later today.

Yesterday, the market did rebound from Friday's sell-off. The S&P 500 closed at 4,655, up 61 points, the Dow Jones Industrial Average closed at 35,135, up 237 points and the Nasdaq Composite closed at 15,783, up 291 points.

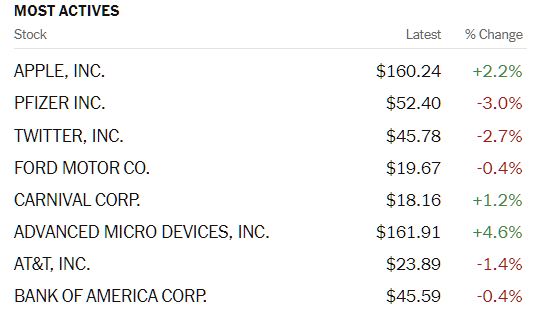

Most actives were large caps with Apple (AAPL), Pfizer (PFE), Twitter (TWTR) and Ford (F) at the top of the list.

Chart:The New York Times

In Asian markets the Nikkei is down over 450 points and the Hang Sang Index is down over 500 points. Currently market futures in New York are trading in the red, S&P futures are down 46 points, Dow futures are down 427 points and Nasdaq 100 futures are down 80 points.

To give readers some market perspective this morning, TM contributor Michael Kramer sums ups yesterday's S&P and Nasdaq activity, noting that Stocks Rise On November 29 On Predictable Volatility Crush .

"Stocks jumped on November 29 as volatility came down sharply. I noted this was highly likely on Sunday, but the S&P 500 wasn’t able to get up to 4700. Instead, it stalled at 4,675. The VIX jumped too much on Friday, and this snapback was obvious once we didn’t get a significant drop at the open."

"The IV crush pushed the S&P 500 (SPX) higher to 4675, which was a resistance level, and that is where it stopped rising. It was also the 61.8% retracement of what I believe was wave three down; therefore, today’s up move could be the completion of wave 4. Thus, we should start wave five tonight or tomorrow in the futures, resulting in that drop to support I have looked for at 4530. Let’s see what happens first before we think further out."

"There is a broadening wedge right now in the Nasdaq (QQQ), and these broadening wedges have been breaking in the direction of the previous move. The broadening wedge going into October was preceded by a rising trend, which led to a breakout. This wedge was proceeded by a down move and should result in a move down to around $383."

Kramer also gives his take on the iShares High Yield Corp Bond (HYG), SPDR S&P Biotech (XBI) and SPDR Utilities Select Sector (XLU) ETFs.

Moving from market activity to slightly more esoteric topics, economist and TM contributor Scott Sumner wants us to think about nominal spending rather than aggregate demand. He lays it out for readers in his piece, Nominal GDP --- Aggregate Demand. Here is some of what Sumner postulates:

"...from an AS/AD (Aggregate Supply/Aggregated Demand) perspective it looks like the US was hit by a negative supply shock (during the pandemic). But it’s equally true that the inflation is being driven by surge in demand for goods (as opposed to services.) You could say that the increased demand for goods has caused a supply shock, as our economy cannot suddenly turn on a dime and produce far more goods and far fewer services. You can see how terms like “supply” and “demand” don’t do justice to the complexity of the situation."

"...confusion could be eliminated if we changed the language of macroeconomics to something like a NS/RO model—nominal spending and real output. Nominal GDP and real GDP most certainly do not “share the same calculation”.

With that framing, the COVID economy is much easier to explain. Over the past two years, nominal spending (demand, yes) has grown at a normal rate, whereas real output (supply, yes) has been depressed by structural problems. Going forward, nominal spending over the next year is likely to be too high to maintain an average inflation rate of 2%. If I am correct, then by the end of 2022 we will have had a period of elevated inflation associated with both above normal nominal spending and structural problems in production."

Easier? Perhaps. Parsing economic theory is a fine art and Sumner is one of its dalliers. See the full article for more.

Staying in the realm of Economics (and Sociology) Timothy Taylor examines a couple of recent studies regarding Some Economics Of Place Effects. Whether you think the effects are obvious or something that you don't often consider, Taylor draws our attention to some interesting ideas.

"...In (more) concrete terms, those who end up living in a place with high-priced real estate and those who end up living in a place with low-priced real estate may well differ in a number of ways in their backgrounds, education levels, and job history, and it would be peculiar to say that the places in which people ended up living “caused” these differences. Instead, it often seems more plausible that the place where people end up living is caused by earlier mechanisms of social and economic sorting."

"As researchers began to think seriously about place effects, they sought out other situations in which people ended up moving out of low-income areas. For example, studies looked at situations where people had to move because public housing was demolished, or where Hurricane Katrina destroyed existing housing, in comparison to outcomes for a similar group that was not forced to move. There are also studies where one group of low-income households is offered information and counseling to help them match up with rental options in areas with higher average incomes...The overall finding from this line of research is that when lower-income household move to a higher-income neighborhood, it has substantial effects for younger children who grow up in the new neighborhood, smaller or even nil effects for those who are older teenagers at the time of relocation, and not much effect on the job or income outcomes for the adults in those households. Interestingly, the positive effects for younger children don’t seem to primarily be reflected in school test scores, but instead show up as a result of gains in noncognitive skills as reflected in measures like numbers of school absences or suspensions, and chances of repeating a grade."

Another issue being researched that Taylor brings to us for consideration is the impact of place with regard to access to healthcare (in particular Medicare).

"For example, one source of data is to look at the elderly, who are covered by Medicare insurance, who move between states. Patterns of medical practice vary across the US, so you can observe Medicare patients with similar earlier patterns of health care use who move to a place where Medicare recipients on average get more care, or where they get less care, or those who don’t move at all. One can also look at doctors who move between areas and, looking at doctors who had similar patterns of Medicare charges before their move, see if their pattern of Medicare charges tend to stay the same when they go to a different place."

Taylor cites the results of research that examined these questions, but as with the results of much research, the researchers found that "Although there are many plausible mechanisms through which these place effects may materialize, the question of what it is exactly that causes some places to be better for health than others has so far not been answered directly by any existing study."

Back to the earth moving beneath our feet (and video moving across our screens), Chuck Carnevale on the look out for investment opportunities suggests, IBM Is Growing Again: Buy Low.

"IBM is a company that has been in transition since 2014. Despite falling earnings-per-share over that timeframe, high-yielding IBM has continued to increase its dividend as it has for the past 26 years in a row. Therefore, investing in IBM has been about receiving a high current yield while exercising intelligent patience. According to Barron’s magazine, IBM is finally growing again...In addition to a high current dividend yield of 5.66%, the company also offers future growth potential with a margin of safety based on its low valuation."

As always, Caveat Emptor.

Have a good one. I'll see you in December.