Tuesday Talk: Look Out For The Downdraft - Too Late!

Yes, balloons were deflating on Wall Street, Monday, but they are still in the sky and some of those balloons rose even higher.

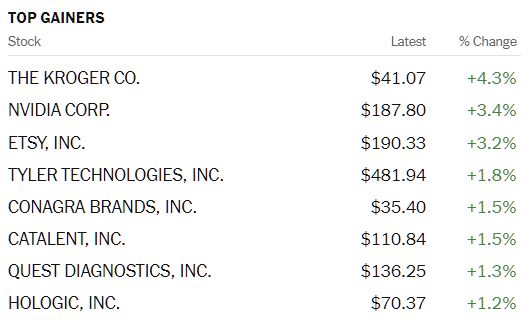

Still, that is not to understate the force of the downdraft. The S&P closed at 4,258, down 69 points or 1.6 percent, the Dow closed at 33,962, down 726 points or 2.09 percent and the Nasdaq Composite closed at 14,275, down 152 points or 1.06 percent. Currently market futures are trading higher. S&P futures are up 24 points, Dow futures are up 232 points and Nasdaq 100 futures are up 65 points. Yesterday's top gainers were across sectors. Leading the way was grocery chain Kroger's, who posted a gain of 4.3%.

Chart: The New York Times

Of course, TalkMarkets contributors have much to say about Monday's market action. Starting with a TM exclusive, contributor Stephen Innes asks Is The Summer Party Over?

"...Driving sentiment: growth concerns as delta infections rise globally. And adding to the toxic mix, oil prices fell 7.4% after OPEC's weekend decision to boost output.

Indeed, that OPEC decision was a monumental revision to its output deal. With the street now drawing comparison to the December 2014 change to market share priorities, OPEC may be starting to shed layers of supply discipline making it challenging to envision a world with oil +$80 bbl.

With equities going risk-off yet rates finishing off the extremes and stops going through, it does feel that the worse is behind us. But a Turnaround Tuesday? I do not think investors will be pretty eager out of the gates as there is still much dust to settle and numerous creases to iron out.

That said, despite the S&P Spot falling lower, there was only slight panic across options markets, almost as if the street expected the sell-off ."

"Still, while it is difficult to see what will change the direction of the long end, with core inflation, at 4% and the market pricing just two hikes by the end of 2023, there might be some more room to price sooner lift off in the front end of the curve...Markets look set to attempt a slight recovery early in European trade after yesterday's sharp meltdown in broader markets; it feels like we are trying to hash out a temporary bottom. While yesterday may not have been " the big sell-off," there appears to have been enough of a capitulation for now."

Innes notes that an important indicator for the markets will be what happens on the COVID/Delta Variant front: "The (pandemic) data point to watch - not just for the UK, but for all global assets - is the UK’s hospitalization rate. If the UK manages to make this strategy work, then risk markets will surge in mid-August. But if it doesn’t (and by the way, the medical profession is bracing itself), then a sub 1% 10-year yield is on the cards. Between now and then, the risk-off trade could remain the norm."

Writing in Post-Plunge Reflections contributor Tim Knight takes a sanguine view of yesterday's drop in the market. Here are some of his reflections:

"Days like today (Monday) are bittersweet. It’s great fun watching one’s account value roar higher, but at the same time, you know it’s going to be all over way too soon, and things will get dull and listless again. It takes a lot of patience to finally wallow around in a day like this. Now we have to deal with the stupid bounceback."

"The only asset gaining value today was bonds, and on huge volume. I have been pointing out the change in trend for many weeks, but I had no hope that we would absolutely pole-vault over the trendline. The 40-year bull market in bonds is clearly intact because The Fed Has No Alternative."

"With interest rates crumbling away, the banks have also completed a monstrous top. And I can’t think of any group on the planet more deserving of plunging stock prices than the banks."

"(Just to let readers know) I exited my short-term positions early Monday, but I am steadfast in all my others, bounce or no bounce."

See Knight's full article for additional quips as well as charts.

TalkMarkets contributor Peter Hanks gives this take on the Nasdaq 100 Forecast: Stock Rout Sees Index Seek Trendline Support.

"The Nasdaq 100 is on the backfoot alongside other risk assets to start the week as COVID Delta variant concerns and seasonal headwinds work to erode risk appetite across global markets. While traditionally more volatile than the S&P 500 and Dow Jones, the Nasdaq 100 has seemingly reclaimed its almost defensive-like status during bouts of COVID concern as losses in the other indices outpace that of the Nasdaq. Nevertheless, the Nasdaq 100 is more than 3.5% off its all-time high near 15,000 after breaking beneath trendline support (SPY, DIA, NDX, QQQ)...if prices continue to fall any upcoming attack on the (current) level will mark its first test. Should it fail, traders and investors might shift their focus to the more formidable rising channel near 13,000...That said, the Nasdaq 100 has climbed higher for weeks nearly devoid of interruption so losses at these levels may serve as healthy consolidation in the bigger picture as there is little to suggest the bull market will suddenly meet its end."

TalkMarkets contributor Forrest Crist-Ruiz says it might be time to take some defensive postures in light of the current market pullback. To wit he suggests Why It Might Be Time To Start Looking At Consumer Staples.

"Paired with rising inflation, many investors are searching for safer places to move money.

If uncertainty remains, we could see a rotation into consumer staples as they tend to outperform during inflationary times and stagnant market if the indices begin to trade sideways.

Consumer staples include foods and beverages, household goods, and hygiene products as well as alcohol and tobacco.

Some of the big names we are watching include Procter & Gamble Co. (PG), Coca-Cola Co. (KO), Pepsico (PEP), and General Mills Inc. (GIS).

We are also watching companies in agriculture - Bunge (BG), large discount stores such as Walmart (WMT) and Target (TGT), and supermarkets like Kroger (KR), and Costco (COST). The particularly interesting ones are GIS, BG, and PG."

Read the full article for further details.

In our "where to invest" segment this week contributor Zacks Equity Research suggests 3 'Strong Buy' Stocks To Add Amid Market Pullback.

"Investors might continue to pull profits until Wall Street bulls see their favorite stocks reach more attractive levels once again. But those with long-term horizons can hurt themselves by trying to time the market and they should also remember bond yields are poised to remain historically low even when the Fed starts to raise rates in the next couple of years, likely prolonging TINA (There Is No Alternative) investing.

With this in mind, we dive into three Zacks Rank #1 (Strong Buy) stocks that investors might want to consider amid the market pullback.

The first stock up is e-commerce pet store giant Chewy (CHWY) that has accumulated roughly 20 million active customers, with 70% of sales coming from loyal Autoship users. The stock popped nearly 7% during regular hours Monday as bullish investors prevented the stock from falling below a key technical threshold. Chewy also still trades roughly 25% below its February records and is poised to grow for years in an e-commerce world dominated by Amazon ( AMZN), Target, and Walmart.

Second, Tempur Sealy (TPX) has slipped around 10% from its early July highs, setting up a better possible entry point for the high-end mattress and bedding giant ready to keep growing amid strong consumer spending and the housing boom.

Last up is a stock that soared to records after it blew away Q4 FY21 estimates in late June. Nike (NKE) stock has cooled down since its initial post-release climb and the sportswear powerhouse is set to thrive as it expands its digital efforts and impacts fashion far beyond sports."

Caveat Emptor.

Rounding out the column with a nod to market innovators, contributor Carmen Ang racks up the current stand-outs in Ranked: The Most Innovative Companies In 2021.

"This year has been rife with pandemic-induced changes that have shifted corporate priorities—and yet, innovation has remained a top concern among corporations worldwide...While we often think of R&D and innovation as being synonymous, the former is just one innovation technique that’s helped companies earn a spot on the list. Other companies have innovated in different ways, like streamlining processes to increase efficiency...What’s holding (other) companies back from reaching their innovation potential? The most significant gap seems to be in innovation practices—things like project management or the ability to execute an idea that’s both efficient and consistent with an overarching strategy."

Go to the full article for a thorough look at the top 50 innovative companies for 2021 and the key metrics (according to the Boston Consulting Group) that make them so.

Have a good week.