Tuesday Talk: Inflation And Impatience

After closing out the week at new highs the stock market is exhibiting impatience and jitters closing down on Monday with today's futures currently in the red.

The Nasdaq took the hardest hit yesterday closing at 13,403, down 350 points or 2.5%, The S&P closed at 4,188, down 44 points or 1.4%. The Dow Jones Industrial Average closed at 34,743, down 35 points or .10%. Currently, Nasdaq futures are trading down 1.57%, S&P futures down .89% and Dow futures down .52%.

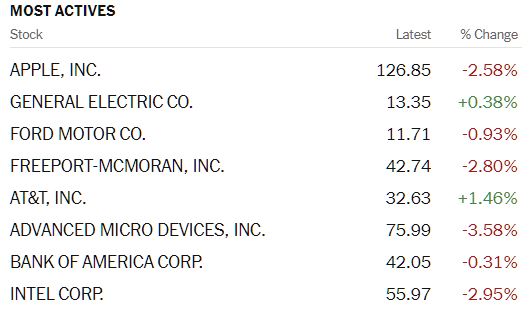

Source: The New York Times

Most actives as noted in the chart above were across sectors but top losers in the bunch were from the tech sector: Intel (INTC), Advanced Micro Devices (AMD) and Apple (AAPL); all three leaders were down sharply.

One of the fears running through the markets despite the solid recovery indicators is inflation. It is a word that seems to be on the minds of academics and pundits, alike. TalkMarkets contributor Brian Romanchuk in Cost Of Living Versus Inflation says that people tend to think that they are one in the same.

"Many people view inflation as a rising cost of living. There is a link between these two ideas, but they are not the same thing."

The article is a primer and a good resource for readers trying understand what exactly is meant by inflation. We have had little inflation for many years now, so it is may seem like a "new" concept for some. Romanchuk gives this (current) example:

"The COVID-19 pandemic that hit the world in 2020 disrupted the meat processing industry. When I go shopping, chicken and beef are considerably more expensive than they were before the pandemic, while the rise in pork prices was more moderate. The obvious reaction is to have more vegetarian meals and eat more pork. This then raises the question: how much did my “standard of living rise”?

- How much would it have cost if I kept my buying habits unchanged by the price rise?

- How much my spending actually rose, keeping in mind that I switched away from chicken and beef?

The people who want to complain about inflation will chose the first option – which implies the highest rate of inflation. But that is ignoring the story how capitalism is supposed to work: price changes can signal a shortage of goods, pushing consumers towards other products."

Contributor Michael Pento who is a portfolio strategist writes that both government stimulus and the current strong pace of economic growth will peak later in the year (and could turn into recession in 2021) and that investors need to be ready (fewer stocks, more bonds). Here are some of the key takeaways from his article, Peak Growth And Inflation, a current TalkMarkets Editor's Choice piece.

"The rates of growth and inflation are now surging in the U.S., but that shouldn't be a surprise to anyone. What else would you expect when the Federal government has sent $6 trillion dollars in helicopter money to state and local governments, businesses, and individuals over the past year...

The most salient factor that is set to implode the array of asset bubbles that are currently in existence is the monetary cliff. Fed-Head Jerome Powell should officially announce the plan to taper his asset purchase program this summer. In fact, Dallas Federal Reserve Bank President Robert Kaplan thinks the time to discuss tapering has already arrived. He said the following on April 30: "We are now at a point where I'm observing excesses and imbalances in financial markets," He especially highlighted stock valuations, tight credit spreads, and surging home prices as the real dangers. However, the truth is the unofficial tapering of asset purchases is already underway. The Fed's balance sheet increased by $3.2 trillion during all of 2020, but that figure should "only" increase by $1.5 trillion for this year. Turning off the monetary firehouse completely in 2022 will be far more destructive than the last time it occurred in the years following the Great Recession...

Asset prices have been driven higher precisely because of the near $5 trillion in newly minted money that was thrown at Wall Street over the past two years. However, sometime next year, we will learn what happens to these bubbles when the monetary speedometer goes from $5 trillion to $0.

What all this means is that the rates of growth and inflation are about to slow. This isn't a reason to panic…yet, but it does require a change in your investment allocations...Disinflation and slowing growth could morph into deflation and recession next year. Such macroeconomic conditions should prove devastating for these record asset bubbles.

(Investors need to) be able to determine when it is time to sprint for the emergency exit before the real chaos begins. That requires the ability to know when to raise cash, move into short-duration bonds, get the long the dollar, and allocate to a net-short position in equities."

Seems we should be on the lookout for more than just Pokemons.

In an exclusive for TalkMarkets contributor Vivian Lewis notes that Gold Up Four Days In A Row "...thanks to the risks of the US from slow growth, inflation, and higher yields." I'm not sure how big of a gold bug Lewis is, but check her article for a look at the latest in Commodity, Pharma, Telecom, Tech and Finance equities around the world. Lewis keeps tabs on companies, large, trending and obscure (GLD).

Michael Snyder writing in Yikes! Corn Prices Are Up Roughly 50% In 2021 As Americans Brace For Years Of Horrific Food Inflation is (IMHO) one of those pundits who likes to get our minds racing.

"Collectively, our leaders are literally committing economic malpractice, and if most Americans truly understood what was going on they would be out in the streets protesting against it. Already, a lot of people out there are becoming extremely alarmed that their food bills are so high. One of the things that is driving this is the price of corn (CORN). Most Americans don’t eat a lot of canned corn or corn on the cob, but corn has become a key ingredient in literally thousands of other products in our grocery stores."

Corn prices might be up, but it has more to do with the weather than Federal stimulus checks. Still, Snyder in his way is telling us not to be complacent and that the effects of cyberattacks on pipelines, disruptions in the supply chain, and cryptocurrency speculation affect all of us.

Don Kaufman in a video piece entitled Nasdaq Selling Strikes Fear Into The Heart Of Dip Buyers looks at Monday's market activity and tries to plot the rest of the trading week. There are three takeaways, one the Nasdaq (QQQ) is going through a rough patch (strong selling in an utterly weak market), two the financial sector in the S&P is what has been keeping the market up (a trend that may or may not continue) and three, this is not the time to buy the dip!

Caveat Emptor readers.

Have a good week, albeit a possibly rough one.

Inflation is that thing that drives down the purchasing power of my money. Plain and simple, and does not take a Masters degree to understand that. Inflation is caused by the government (the Federal Reserve Bank) putting too much money into circulation, usually in the wrong hands.

And I understand that inflation benefits those seeking to get rich in the stock market, and that is evidently as far as those in the fed care to look. The fact is that there exists a lot more in the world than wall street, and that most people are not involved in the financial industry. Most people are far closer to the real world, Unfortunately the damage is the result of a long string of very deliberate actions by those individuals running the Federal Reserve bank. So when all the bubbles burst and the times get really rough we will know the names of those responsible. And perhaps things can be changed so that it will not happen again. Certainly this is a radical prediction, and I wish that it would be wrong. But I don't think so.