Tuesday Talk: Biden, Xi And Dollar Tree

The leaders of the United States and China held a 3.5 hour virtual summit yesterday to improve cooperation but it ended without any declaration of specific actions; similar to Monday's trading session which after 6.5 hours ended where it began, more or less.

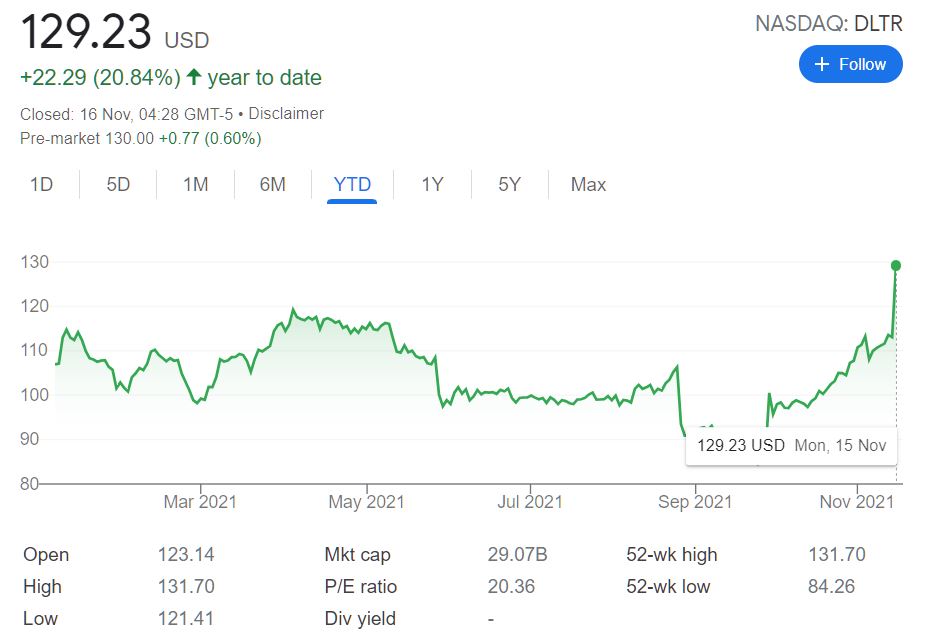

An exception was Dollar Tree (DLTR) which had an extraordinary day, adding $16.15 or 14.3%, to close at $129.23.

The S&P 500 closed at 4,683, down 0.05 points, the Dow closed at 36,087, down 13 points and the Nasdaq Composite closed at 15,854, down 7 points. Currently S&P futures are flat, Dow futures are trading up 50 points and Nasdaq 100 futures are trading down 3 points.

Yesterday's most actives were all big caps with Ford (F) heading the list.

With all the noise and tension that comes with a strong and hot market, TalkMarkets contributor Bob Lang writing in Trading Vs Investing: Which Offers A Better Return? helps sort this out for investors who may fear they bought too high or sold too low in recent days.

"An investor’s returns mirror that of the broader market: a slow and steady progression towards wealth. This strategy is proven over time to be a solid one. Look back at any indices historical chart, and you’ll see that the markets move up and to the right. "

"Traders tend to have a higher risk tolerance. They embrace the volatility of the markets and take advantage of short-term opportunities...He or she pays close attention to (technical and sentiment) indicators at all times, using them to read the charts and understand the next move. He or she may buy or sell constantly during bouts of volatility, never afraid to seek out and act on the next great trade."

"Because of these different approaches, a trader often beats the indices on returns, especially in a stock picker’s market. Both approaches can win over time. It’s up to you to determine the timeline and risk levels that work best for you."

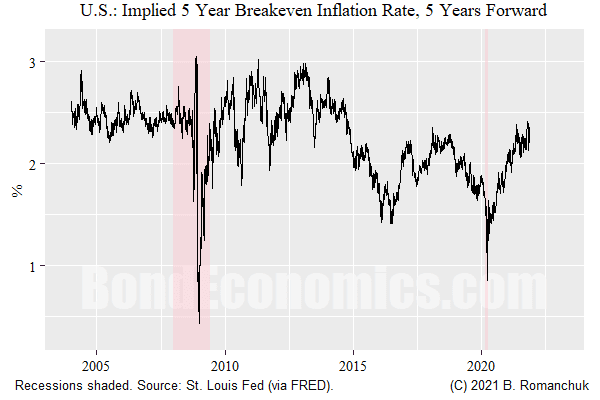

Inflation chatting is still all over the internet and elsewhere since last week's CPI data reveal. Contributor Brian Romanchuk takes a view similar to that of Secretary Yellen in his article The Great Inflation Scare Of 2021 (Or Not...). Below are some of his takes, both in chart form and in words.

"The first thing to note is that forward breakeven inflation rates (as calculated by the Federal Reserve) have risen since the pandemic lows — but are still not above the levels seen in the early 2010s."

"We need to use forward inflation since everybody accepts that there will be a run of punchy inflation data over the coming months...the TIPS market indicates that the punchiness subsides within 5 years. Say what you want, that is not exactly a secular shift in inflation pricing...unless we are convinced the market is wrong — and it could be (you pays your money, you takes your chances) — the inflation story is just about the timing of “transitory.” Even without digging into data, it seems clear to me that we need to get the flurry of holiday spending out of the way before we can see what the underlying supply chain status looks like."

Romanchuk closes his piece with these thought provoking lines:

"The other angle is wage inflation. I think we have seen some unsustainable business models based on the availability of desperate workers, and/or hoodwinking people who were unable to account for depreciation into being “contractors” have finally hit the end of their sustainability. Such business are going to face higher wage costs. It remains to be seen whether this is a one-off shift, or sustains itself."

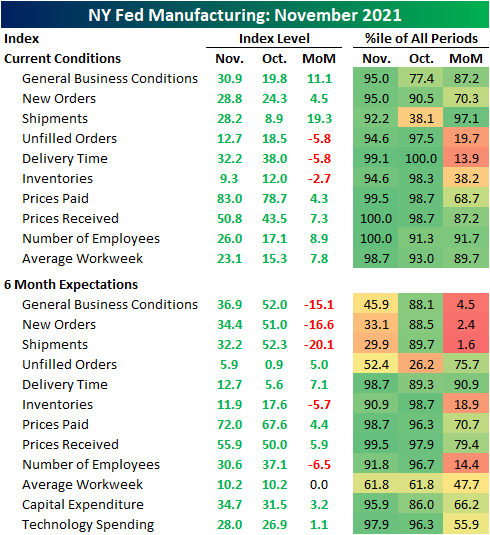

In addition to inflation woes we have also been hearing a great deal about the overall strength of the U.S. economy and the Staff at Bespoke Investments tallies up that strength by delving into yesterday's release of the latest Empire State Manufacturing Survey in their article NY Fed Current Conditions And Expectations Split.

"The New York Fed put out the first regional reading on manufacturing this morning with a big upside surprise. The Empire State Manufacturing Survey jumped from 19.8 to 30.9 in November versus a much smaller expected increase to only 22...Current condition indices and most other expectations indices remain strong with the vast majority sitting in the upper decile of their historical range; a couple (Prices Received and Number of Employees) even hit record highs."

In addition to the chart above there are several graphs which speak to many of the specific line items. The full article is worth a look. Below is the chart for technology spending and capital expenditures both of which are on a tear.

"...both CapEx and Tech Spending were higher this month with the former notching the strongest reading since January 2018. Before that, it was over a decade ago that Capital Expenditures was as elevated as it was this month."

The Staff at Lipper Alpha published their Q3 2021 U.S. Retail Scorecard – Update, yesterday. Below is their Same Store Sales and Earnings Estimates Chart for Q3 2021. See the article for the full scorecard.

Clearly, Macy's (M), Kohls (KSS) and The Children's Place (PLCE) are going to have good Q3 results.

TalkMarkets contributor Melanie Schaffer of Benzinga summarizes the action in Dollar Tree in her article Dollar Tree Stock Soars Into Blue Skies: What's Next?.

Photo: M.O. Stevens/Wikimedia

"On Monday, Dollar Tree’s volume indicates there is a high level of trader and investor interest in the stock. By midafternoon about 13 million shares of Dollar Tree had exchanged hands compared to the average 10-day volume of just 4.25 million. Monday’s volume is the highest bullish volume the stock has seen since Sept. 29."

"Dollar Tree, Inc shot up over 15% higher at one point on Monday to reach a new all-time high of $131.70. The discount retail store received a number of upgrades including R5 Capital analyst Scott Mushkin slapping a whopping $171 price target on the stock. Investment firm Mantle Ridge also said it had taken a 5.7% stake in the company valued at $1.8 billion."

"Eventually, Dollar Tree will have to fall lower or consolidate sideways for a period of time to drop its relative strength index (RSI). On Monday, Dollar Tree’s RSI was registering in at about 83%, which puts the stock square into overbought territory, which can be a sell signal for technical traders. When Dollar Tree’s RSI reached the same level on Nov. 3 the stock fell 11% the following day.

Dollar Tree is trading above the eight-day and 21-day exponential moving averages (EMAs), with the eight-day EMA trending above the 21-day, both of which are bullish indicators. The stock is also trading about 30% above the 50-day simple moving average, which indicates longer-term sentiment is bullish. Dollar Tree is extended from all three moving averages, which indicates consolidation may take place soon."

There are additional details in the full article.

As always, Caveat Emptor.

I will end today's column with this quote from historian Barbara Tuchman's book, Stilwell and the American Experience in China, 1911-45.

"...China was a problem for which there was no American solution. The American effort to sustain the status quo could not supply an outworn government with strength and stability or popular support. It could not hold up a husk nor long delay the cyclical passing of the mandate of heaven. In the end, China went her own way as if the Americans had never come."

Have a good week. I'll be back on Thursday.