Tue’s CPI To Decide If Non-Commercials Will Cover Short Bets On Large-And Small-Caps

After three straight down weeks, both large- and small-caps rallied strong last week. More could follow should non-commercial futures traders, who remain heavily net short S&P 500 e-mini and Russell 2000 mini-index contracts, are forced to cover.

Last week began where the prior three left off – down. But Tuesday’s low of 3887 was bought. This was essentially a defense of dual support – one a rising trendline from June when the S&P 500 bottomed at 3637 and the other a horizontal support going back several months around 3900.

After remaining under the average for seven consecutive sessions, the 50-day was reclaimed on Friday. For the week, the large cap index was up 3.6 percent. Odds favor continued upward momentum ahead.

Nearest resistance lies at 4150s (Chart 1) and after that the 200-day at 4275.

Small-caps too rallied strong last week, with the Russell 2000 up four percent. As was the case with its large-cap cousin, it too was down in the prior three. As well, small-cap bulls had an opportunity to defend dual support around 1800 and they delivered.

On Tuesday, the small cap index ticked 1787, which again occurred in the next session. Around there lied trendline support from last November when the Russell 2000 peaked at 2459 as well as lateral support going back to May (Chart 2).

By the end of the week, the index had rallied strong to end at 1887, just under potentially crucial 1900.

The selloff that began last November ended in June when the Russell 2000 printed 1641 on the 16th. It then went sideways for a month around 1700, which is where the index broke out of in November 2020. In essence, this was a successful breakout retest.

Bulls and bears have fought for control of 1900 since January. The level likely gets recaptured in the sessions ahead. If this occurs in a decisive manner, bulls in due course may begin to eye 2080s, which was lost mid-January. Before that, the Russell 2000 went back and forth between 2080s and 2350s for 10 months.

Interestingly, non-commercial futures traders have the potential to act as wildcards here, as they are loaded with net shorts in both large- and small-caps.

As of last Tuesday, they held 238,720 contracts in S&P 500 e-mini futures, down 0.4 percent week-over-week. In the week to August 16, they were net short 287,984 contracts, so they have been cutting back slightly (Chart 3). It is possible this continued in the last three sessions last week when the cash rallied furiously.

Longs’ hope is that last week’s upward momentum continues, forcing these traders to relinquish their short bets, which in the end turns into a self-fulfilling prophecy.

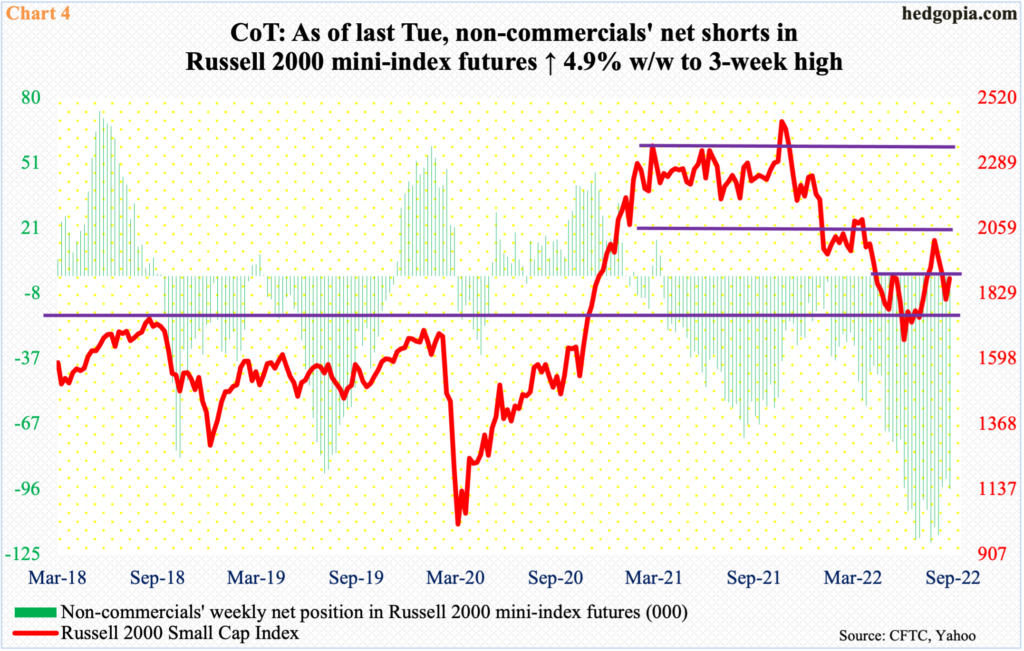

The dynamics are similar in small-caps.

Last week, as of Tuesday, non-commercials’ net shorts in Russell 2000 mini-index futures were up 4.9% w/w to 95,605 contracts. Holdings remain elevated, although they are slightly less than the 119,954 contracts posted in the week to August 2 (Chart 4), which was the highest since September 2008.

Whether or not a meaningful short-covering unfolds likely gets decided this Tuesday when the consumer price index is reported for the month of August.

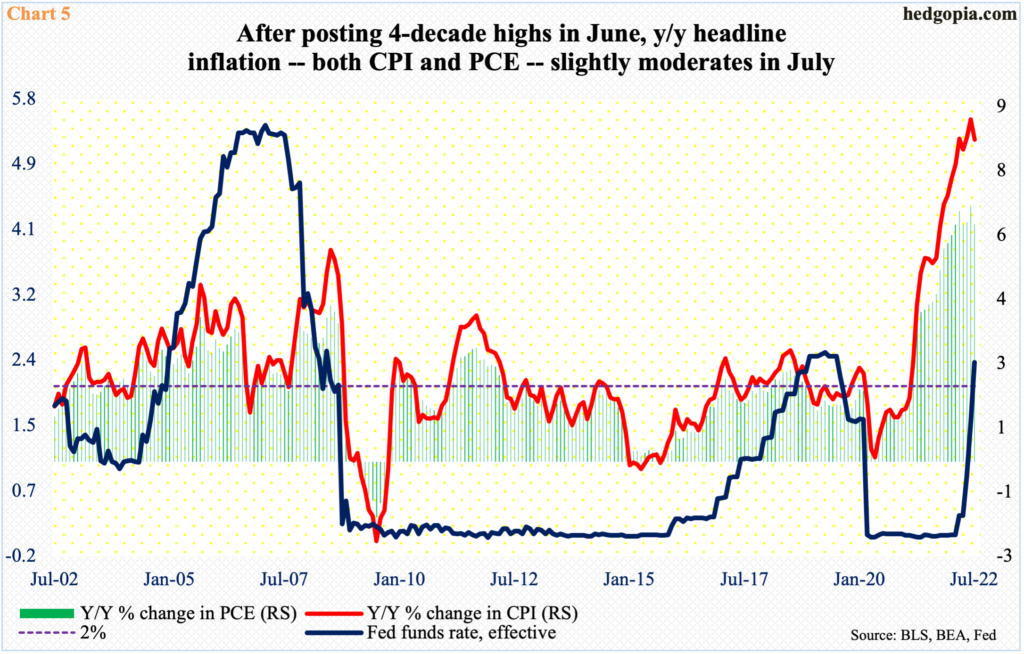

In the 12 months to July, both the CPI and the PCE (personal consumption expenditures) softened a bit to 8.5 percent and 6.3 percent; June’s 9.1 percent and 6.8 percent were the steepest year-over-year price increases since November 1981 and January 1982.

The Federal Reserve, which early on failed to see the incipient inflation saying it was transitory, is now on the case. Just last week, Chair Jerome Powell speaking at the Cato Institute, said “we need to act now, forthrightly, strongly, as we have been doing and we need to keep at it until the job is done.”

They have so far raised the fed funds rate four times – by a couple of 75-basis-point moves, one 50 and one 25 – to a range of 225 basis points to 250 basis points (Chart 5). In this month’s FOMC meeting (21-22), futures traders favor another 75 with 90-percent probability, followed by a 50 in November (1-2) and a 25 in December (13-14), ending 2022 at a range of 375 basis points and 400 basis points.

Once four percent, or thereabouts, is reached, the Fed likely pauses. The odds of this rise should more signs show up that inflation is on the way down. Hence the significance of Tuesday’s report. A softer print will not be in favor of non-commercials who are sitting on tons of bearish bets in both large- and small-caps.

Thanks for reading!

More By This Author:

CoT Report - Futures Positions of Non-Commercials

Volatility Index Itching To Go Lower

Revision Trend In ’23 Earnings - Estimates Down

The chart tells you that they wont, so stop asking. They have a better grasp of what the economy is actually doing. Oh, they just going to keep raising the hourly rate until your broke!