Volatility Index Itching To Go Lower

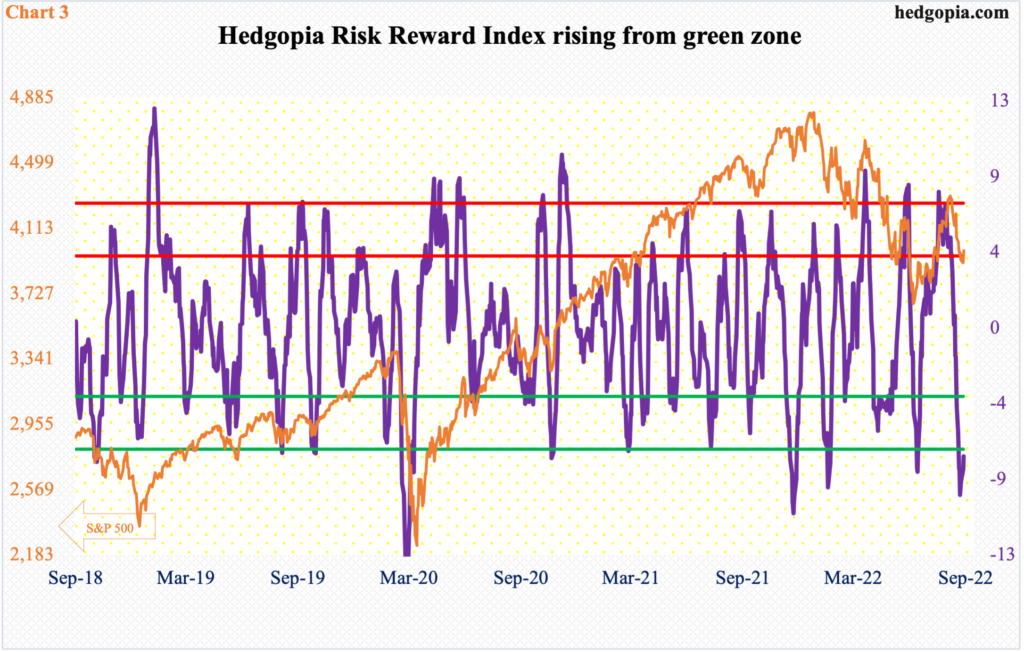

VIX took a dive on Wednesday after getting denied at 27.50s for several sessions. Concurrently, Investors Intelligence bulls plunged 15.4 percentage points over two weeks to sub-30 percent, and the Hedgopia Risk Reward Index is rising from oversold territory (VIX).

Equity bulls must be delighted how volatility behaved on Wednesday.

For the last several sessions, volatility bulls struggled at 27.50s. Rally attempts kept getting rejected there, including Wednesday when VIX touched 27.15 intraday but only to close at 24.64, slightly breaching mid-20s horizontal support (Chart 1).

The daily has tons of room to continue lower. Nearest support lies around 22, which is where a rising trend line from last November lies. This is followed by mid-20s lateral support, which rests just underneath.

Volatility is acting in this manner even as equity bulls have meaningfully pulled in their horns.

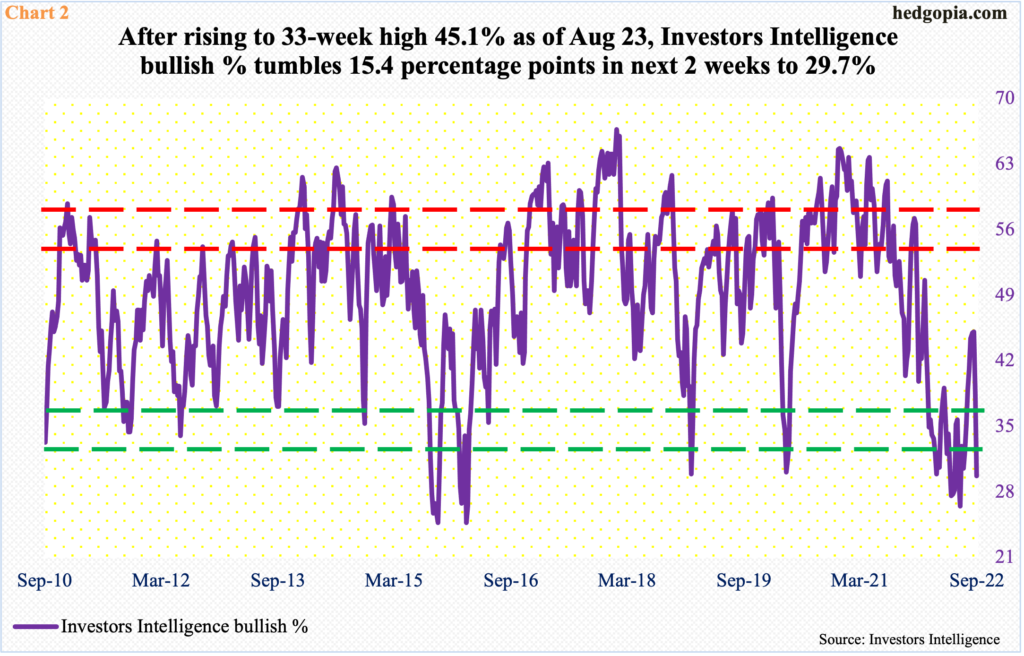

Investors Intelligence bullish percent this week dropped 8.7 percentage points week-over-week, to 29.7 percent, exactly matching the bears’ count. A couple of weeks ago, bulls were 45.1 percent, for a two-week tumble of 15.4 percentage points.

This week’s reading is the lowest since the metric bottomed at 26.5 percent in the week to June 21. The S&P 500 bottomed at 3637 on the 17th that month and went on to rally 18.9 percent in the next couple of months, before falling 10.1 percent through Tuesday’s (this week) low.

On Wednesday, the S&P 500 (SPX) jumped 1.8 percent and has room to continue higher. This week’s low in bullish sentiment is probably low enough to begin to unwind the oversold condition it is in (Chart 2).

Speaking of which our own Hedgopia Risk Reward Index is beginning to lift from oversold territory (Chart 3).

As is true with any other indicator, it is not perfect. Whiplashes do occur. But more often than not, when the index is this oversold, risk-reward odds heavily favor the longs.

Thanks for reading!

More By This Author:

Revision Trend In ’23 Earnings - Estimates DownCoT: Peek Into The Future, Hedge Fund Positions Etc.

10-Year T-Yield At Risk Of Forming Potentially Bearish Technical Pattern