Tie-Breaker

Another day, another set of political headlines dominating trading with the surprise result that ongoing US/China trade tensions hasn’t fully derailed yesterday’s gains. Oil consolidates, USD bid, but Copper leads commodity pain trade and adds to global slowdown fears. There is no doubt that its politics first, economics second so far. The key will be the tie-breaker of FOMC speeches and data. The analogy of Chess to the markets is worth considering today as Norway’s Carlsen battles to retain his championship title against American Caruana in a quickfire tie-breaker Wednesday after the 12th draw game in London yesterday. Everyone wants a winner. Consider the headlines:

- Trump likely to raise China tariffs again,

- Macron won’t cave to violent protests over higher diesel taxes;

- Ukraine imposes martial law on regions bordering Russia, fearing an invasion, while Turkey, Austria, Germany push for solution:

- Swiss/EU new trade deal pushed for 2019 as talks stall;

- UK Brexit deal passage hopes drop as Fallon (former defense minister) opposes it, and with PM May and Labour opposition Corbyn to have TV debate on plan;

- Italian Deputy PM Salvini says no new budget documents will be sent to the EU, but MNI reports ECB OMT could help if BTPs blow out.

The fact that the markets aren’t completely risk-off today, after these headlines, indicates something important, momentum to sell is slowing. The place where good and bad news seems to be ignored is the UK where politics and Brexit all lead to a dreadful game of Nine Men’s Morrisoutcomes with everyone losing. For the US today, the USD bid is more about Europe and UK weakness than US strength but the tie-breaker for momentum will rest on the Clarida speech and housing data ahead. Pay attention to GBP as its looking set to move much more aggressively.

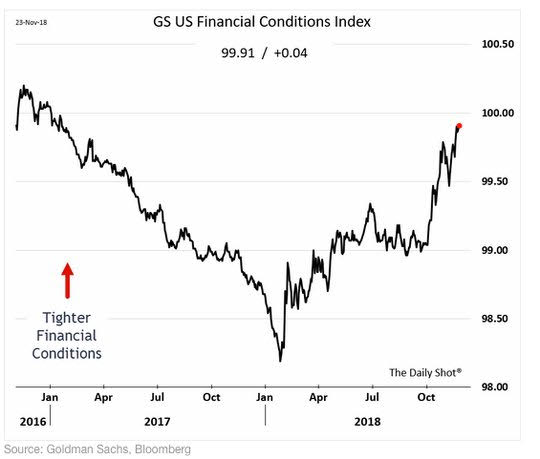

Question for the Day: Has the market already done the Fed’s work? The key speech today happens soon, from FOMC Vice Chair Clarida with the market listening to hear if there is hope for a pause in the hiking regime. The US market turmoil is showing up as a factor for many to predict less action from the FOMC in 2019. Clarida could clarify how the normalization to neutral plans can change according to market conditions and data. So far, the tightening of financial conditions hasn’t been as bad as the 4Q 2015 but we maybe are underestimating the next 6 weeks.

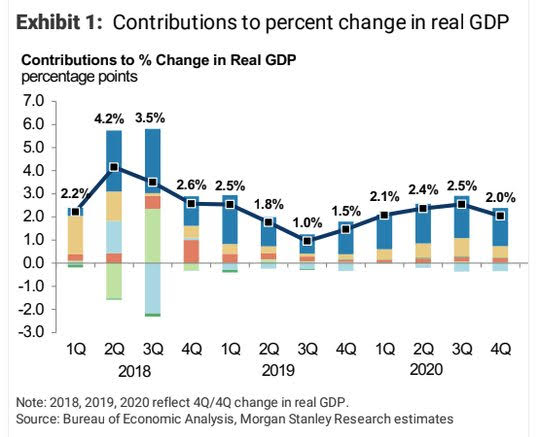

Tangential to the financial conditions is the forecasts for real growth in 2019 and beyond. The outlook from Morgan Stanley is worth highlighting into the FOMC minutes and speeches this week as they seem more bearish than others.

What Happened?

- New Zealand October Trade Deficit NZ$1.295bn after NZ$143mn - worse than NZ$850mn expected– biggest since Oct 2007. Imports surged 14% to NZ$6.2bn on NZ$ weakness and higher oil prices. Exports rose 6.6% to NZ$4.9bn. The China imports rose 41% up NZ$430mn to NZ$1.5bn on the month – biggest rise on record on anniversary of 10-year trade pact. EU imports fell 1.4% off NZ$14mn to NZ$959mn while US was off 27% due to aircraft to NZ$569mn. Australia up 15% to NZ$742mn and Japan up 6.2% to $400mn.

- Japan October Service PPI up 0.4% m/m, 1.3% y/y after 1.1% y/y – as expected. The core ex transport up 0.4% m/m, 1.2% y/y after 1.0%.

- China Jan-Oct industrial profits +13.6% y/y to CNY5.52trn off from +14.7% y/y for Jan-Sep. For the month profits rose CNY548bn.

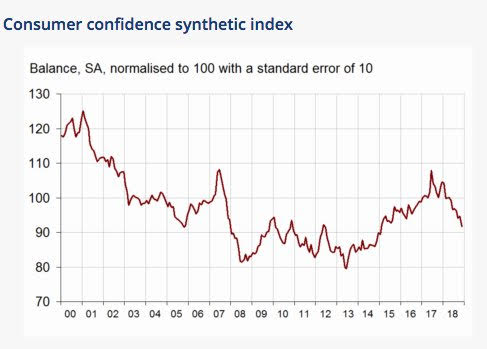

- French November consumer confidence drops to 92 from 95 – weaker than 94 expected. The unemployment fears rose to 27 from 6, prices outlook moderates to -14 from -13 but current prices higher -11 from -14 and personal financial outlook drops to -18 from -16.

- Italy November consumer confidence drops to 114.8 from 116.6 –worse than the 115.8 expected. Personal current economic conditions fell to 131.7 from 137.2, while future outlook also drops to 111.5 from 112.5. The business climate index fell to 101.1 from 102.5 with manufacturing 104.4 from 104.9 – slightly better than the 104 expected, while services fell to 101.8 from 103.6 and construction fell to 132.5 from 138.9.

- UK November CBI retail sales volume 19% from 5% - better than 10% expected. Outlook for December 22%. Volume of orders recovered to +15% with +15% expected for December. However, the outlook 3M for business is -9% and 12M forward investment plans -3% - basically flat to 3Q. Sales gains were driven by grocers up 48% and internet up 23% but volumes fell in clothing -15%, footwear -31%, furniture -25% and hardware -22%.

Market Recap:

Equities: US S&P500 futures are off 0.1% after a 1.55% gain yesterday. The Stoxx Europe 600 is off 0.2% with focus on materials while the MSCI Asia Pacific rose 0.6% catching up to US rally. The MSCI EM index rose 0.1% - best in a week.

- Japan Nikkei up 0.64% to 21,952.40

- Korea Kospi up 0.79% to 2,099.42

- Hong Kong Hang Seng off 0.17% to 26,331.96

- China Shanghai Composite off 0.04% to 2,574.68

- Australia ASX up 0.93% to 5,802.80

- India NSE50 up 0.54% to 10,685.60

- UK FTSE so far off 0.3% to 7,013

- German DAX so far off 0.3% to 11,323

- French CAC40 so far off 0.3% to 4,981

- Italian FTSE so far off 0.25% to 19,185

Fixed Income: Focus is on risk-mood, trade, UK and Italy stories – UK 10-year Gilt yields off 1.5bps to 1.39%, German Bunds off 0.5bps to 0.355%, French OATs off 0.5bps to 0.73% while periphery continues to rally with Italy off 1bps to 3.25%, Spain off 4bps to 1.52%, Portugal off 3bps to 1.845% and Greece off 2.5bps to 4.33%.

- Italy sold linkers with demand, meets target – Italy’s Tesoro sold E1bn of FY0.1% 2023 BTP linkers at 1.45% with 1.65 cover – previously 0.9% with 1.72 cover – also sold E2.5bn of 0% 2Y 2020 BTP at 0.995% with 1.56 cover.

- US Bonds are lower watching equities vs. FOMC and data– 2Y up 0.6bps to 2.831%, 5Y up 0.3bps to 2.888%, 10Y up 0.5bps to 3.059%, 30Y up 0.2bps to 3.313%.

- Japan JGBs mixed with focus on good 40Y sale, equitiesbid– 2Y up 0.5bps to -0.147%, 5Y up 0.5bps to -0.11%, 10Y up 0.4bps to 0.081% and 30Y off 0.2bps to 0.801%. MOF sold Y399.3bn of 0.8% 40Y bonds at 0.94% with 3.85 cover

- Korea sold KRW801trn of 30Y 2.625% bonds at 2.005% with 2.723 cover – previously 2.11% with 2.794 cover.

- Australian bonds flat with eye on commodities, China– 3Y at 2.042%- 10Y flat at 2.63%.

- China PBOC skips open market operations for 23rdday, keeps liquidity neutral. 2Y bonds off 5bps to 2.725%, 5Y off 5bps to 3.12%, 10Y off 2bps to 3.37%.

Foreign Exchange: The US dollar index rose 0.1% to 97.15 with 96.97-97.28 range – focus is on 96.90 base building against 97.60. In EM – USD mixed – EMEA: ZAR up 0.65% to 13.815, TRY up 0.2% to 5.237, RUB up 0.5% to 66.82; ASIA: TWD flat at 30.89, KRW flat at 1129.3, INR up 0.1% to 70.787.

- EUR: 1.1320 off 0.1%.Range 1.1305-1.1344 with focus on 1.13 and 1.1250 again.

- JPY: 113.60 flat. Range 113.42-113.67 with EUR/JPY 128.65 flat – focus is on EUR not JPY with risk mood key

- GBP: 1.2755 off 0.55%.Range 1.2734-1.2830 with EUR/GBP .8875 up 0.4% - all about Brexit with 1.2550 target in play

- AUD: .7245 up 0.3%.Range .7214-.7269 with commodities and China negatives offset by carry trade and crosses with .7150-.7300 consolidation. NZD up 0.4% to .6800 despite trade deficit

- CAD: 1.3245 flat. Range 1.3236-1.3275 with oil helping – rates key. 1.32-1.33 keys

- CHF: .9985 flat.Range .9976-1.0004 with EUR/CHF 1.1305 – waiting game for risk moves.

- CNY: 6.9463 fixed 0.01% weaker from 6.9453, now off 0.1% to 6.9480 with 6.9404-6.9576 range.

Commodities: Oil up, Gold up, Copper off 1.05% to $2.7935 also Iron Ore off for 4thday,

- Oil: $51.76 up 0.25%.Range $50.70-$51.96 with equities, global growth negatives against OPEC and G20 – Brent up 0.4% to $60.73. Focus is on $60 pivot with $58-$62.50 consolidation.

- Gold: $1223.80 up 0.1%.Range $1221-$1224 – despite USD bid, gold holding with focus on Russia/Ukraine, equities. Sivler up 0.4% to $14.28 with consolidation $14.20-$14.50 ongoing. Platinum off 0.15% to $842.60 and Palladium up 0.1% to $1147.

Conclusions: Is the Fed going to kill the rally? The Fed tightening cycle is the play for 2019-2020 and many predict this is the end of the game. Markets are watching this story closely with the December hike all but priced in fully.

Economic Calendar:

- 0830 am Fed VC Clarida speech

- 0900 am US Sep FHA housing prices (m/m) 0.3%p 0.4%e

- 0900 am US Sep Case-Shiller house prices 5.5%p 5.3%e

- 1100 am ECB Mersch speech

- 0100 pm US $40bn 5Y note sale

- 0430 pm US weekly API oil inventory -1.545mb p +3.2mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.

The point of financial conditions is that they reflect the fear of higher Fed rates, the effect of lower S&P500 on wealth, the hit of house values. Cause and effect arguments about economics are always trouble - Does Trump get credit for a private economy? He can claim some for the tax reform, deregulation and take some blame for tariffs and the uncertainty that drives for global supply chains and prices. As for inflation - take a look at inflation expectations via 5Y 5Y forward. The market is telling you oil matters more than tariffs

The market hasn't slowed the economy, #Trump has. However, it may not encourage the Federal Reserve. If mass tariffs on autos and electronics is unveiled, it will not just slow the US economy, but it will cause inflation which will force the Federal Reserve to raise rates despite a slower economy. Trump is doing himself no favors if he wants the Federal Reserve to stop the rate hike. This scenario can point to higher rates and a slowing economy with inflation. Sadly, a businessman should know this.