Thoughts For Thursday: The Vicissitudes Of Volatility

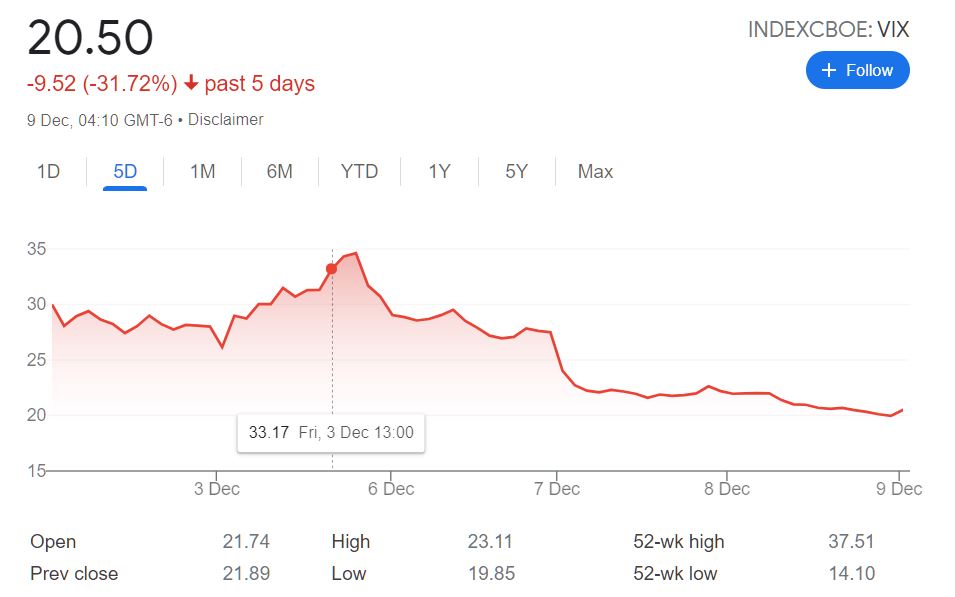

The markets continued to bathe in the balm of reduced Omicron fears on Wednesday, with all three major NY indices recording upward movement and the VIX appearing to be a sea of tranquility.

Chart: Google

Of course this could all change on Friday with the release of the November CPI data, of which there is some expectation of an increase in inflation over October's numbers.

Wednesday the S&P 500 closed at 4,701, up 14 points, the Dow closed at 35,755, up 35 points and the Nasdaq Composite closed at 15,787, up 100 points. Currently futures are trading in the red with S&P futures trading down 13 points, Dow futures trading down 101 points and Nasdaq 100 futures trading down 59 points.

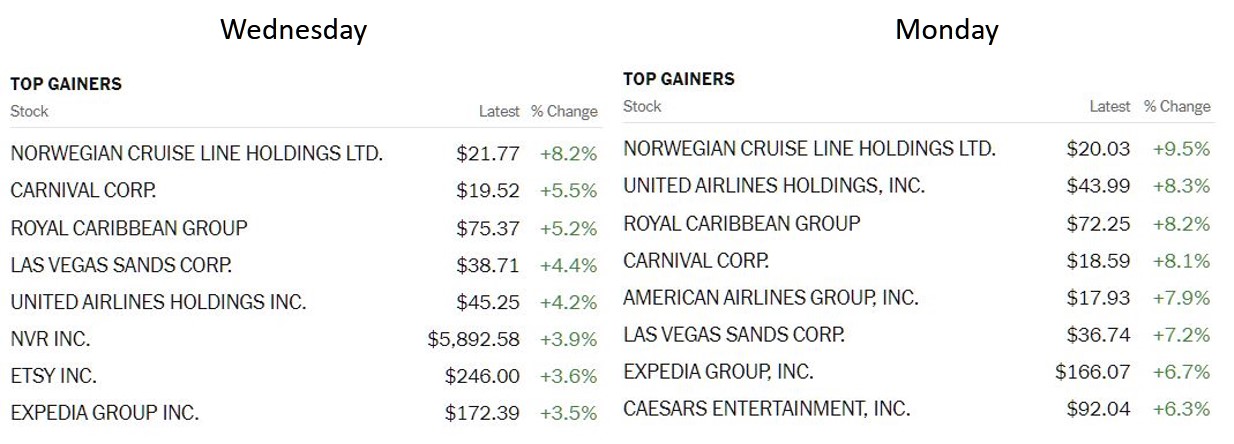

Yesterday's top gainers closely resembled Monday's list, with the leaders again comprised largely of travel and entertainment stocks with the exceptions of home builder NVR and online artisan marketplace provider Etsy.

Charts: The New York Times

TalkMarkets contributor Tim Knight writing in The Finest Financials thinks that financial issues could head lower in a hurry on Friday.

"The most important event this week (unless something extraordinary happens) is the pre-market time on Friday when the CPI number hits. That is probably the true “make or break” moment for the market for the rest of 2021. Just in case inflation continues to come in hot, financial stocks could flip lower in a big hurry. Below are ten charts I’ve plucked out for you in this sector that I think are worth a look."

Four of Knight's picks for a flight south are niche insurance provider Assurant, (AIZ), American Express (AXP), Capital One Financial Corp. (COF) and investment banker Morgan Stanley (MS). See the article for the other six.

Contributor Tim Plaehn has some simple advice for investors in his article How To Make Market Volatility Work For You. The advice is comprised of two words, dividend reinvestment. Here is some of what he has to say:

"A fundamental concept is that the share price of a quality dividend-paying investment will eventually recover from any downturn. There are exceptions, but very few income stocks don’t recover from a market decline.

Here are the factors in play with a dividend reinvestment plan:

- When reinvesting dividends, the number of shares you own and the size of the dividend payment go up with every dividend earned.

- If the share price is down, the reinvested dividend buys you more shares, resulting in a lower average cost per share and faster growth of your dividend income stream.

- When the share price is high, fewer shares are purchased.

- The cycle of buying more shares when the price is down and fewer shares when the price is high leads to a growing value of the stock position, even if the longer-term stock price trend is relatively flat.

- The dividend income stream grows with each dividend payment, providing compound growth to the income earned and the number of shares owned.

Let me illustrate possible results with a real-world example. I added Main Street Capital (MAIN) to my recommendations list in July 2014. MAIN pays monthly dividends and typically yields around 6%.

From July 1, 2014, until Dec. 2, 2021, MAIN posted a 94.77% total return, which corresponds to a compound annual growth rate of 9.39%. If you invested $10,000 in MAIN at the start, the shares plus cash from dividends would now total $19,471.

If you had your MAIN shares on automatic dividend reinvestment over the same period, the returns earned jump substantially. The total return would be 136.43%, giving an annual compound return of 12.29%. The $10,000 initial investment would now be worth $23,646.

In this case, reinvesting dividends increased the return on the $10,000 by 42% – a pretty amazing difference."

Make sense? There's more in Plaehn's piece, but this is the gist of it.

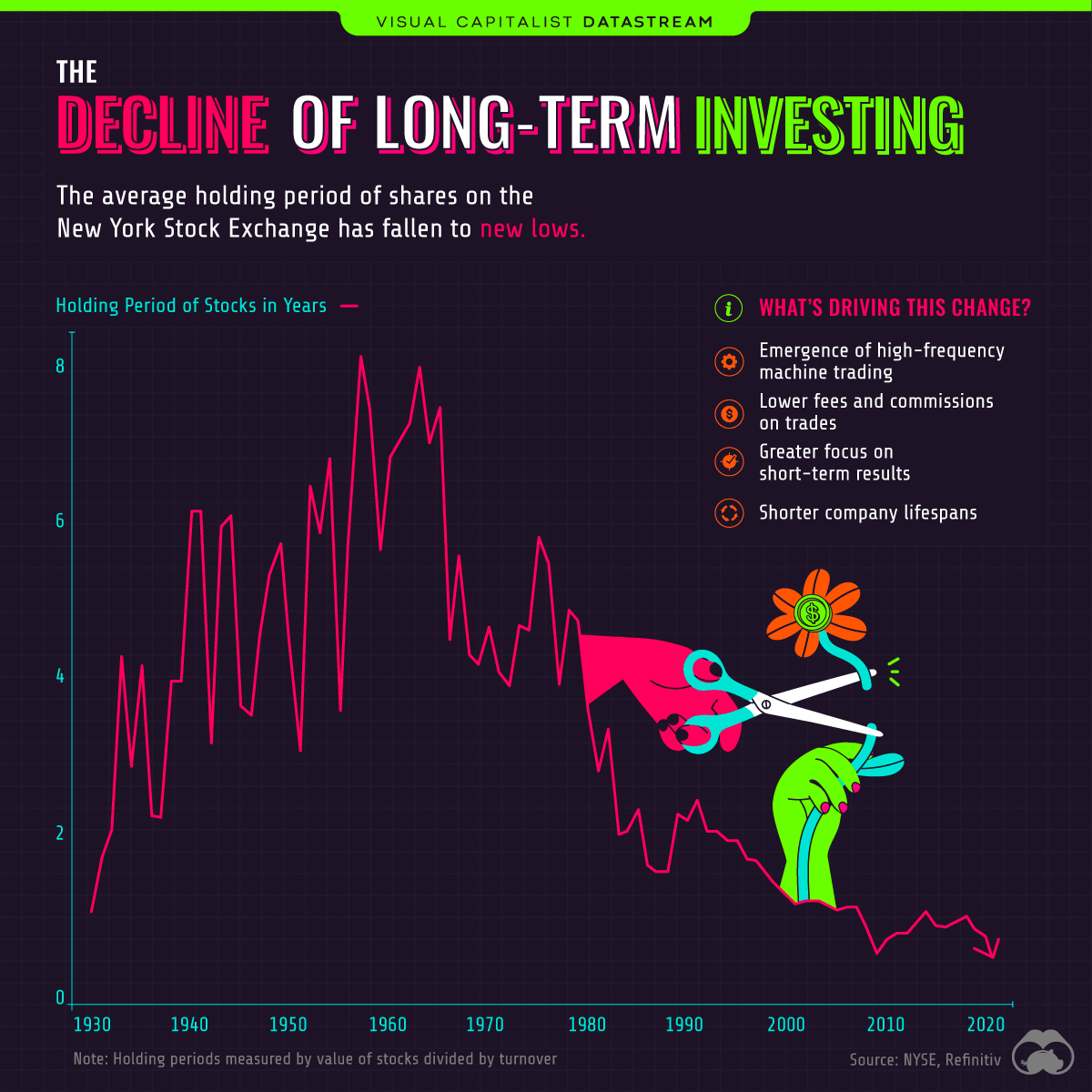

2021 has been the year of the retail investor and with platforms provided by new companies like Robinhood (HOOD) the pace of turnover in investor portfolios continues to quicken. Contributor Marcus Lu gives readers a vivid graphic representation of this trend in his piece The Decline Of Long-Term Investing.

Lu includes the following commentary as well:

"Those are words from famed investor Warren Buffett, an advocate of the buy and hold approach to investing. Buy and hold is a long-term strategy in which shares are gradually accumulated over time, regardless of short-term performance. And while Buffett is undoubtedly a successful investor, data from the NYSE suggests that few are actually following his advice. As of June 2020, the average holding period of shares was just 5.5 months. That’s a massive decrease from the late 1950s peak of 8 years."

"Technology has enabled investors to become more active...Social media is also playing a role. The recent r/wallstreetbets saga is an example of how the stock market can become sensational and fad-driven. After all, long-term investing has much less to offer in terms of excitement."

"...companies themselves are also exhibiting shorter lifespans. This results in greater index turnover (companies being added or removed from stock indexes), and is likely a contributor to the decline in holding periods. In 1970, companies that were included in the S&P 500 had an average tenure of 35 years. By 2018, average tenure was down to 20 years, and by 2030, it’s expected to fall below 15 years."

Ahead of tomorrow's release of new CPI data, the Bureau of Labor Statistics yesterday released the latest JOLTS (Job Openings and Labor Turnover Survey) results. TalkMarkets contributor Mish Shedlock takes a look at the numbers in Job Openings Surge To Near Record In October As Quits Rate Dips From September Record.

"On the last business day of October, the number of job openings increased to 11.0 million (+431,000).

The job openings rate was little changed at 6.9 percent. Job openings increased in several industries with the largest increases in accommodation and food services (+254,000); nondurable goods manufacturing (+45,000); and educational services (+42,000). Job openings decreased in state and local government, excluding education (-115,000)."

"Over the 12 months ending in October 2021, hires totaled 73.8 million and separations totaled 68.1 million, yielding a net employment gain of 5.7 million."

The continued high number of job openings (11M) points to the continued robustness of the recovery, but the high number of quits, 70% of all separations, illustrates a persistent and disturbing trend in the job market. See Mish's article for additional stats, it's worth the look to help understand what's going on in the economy.

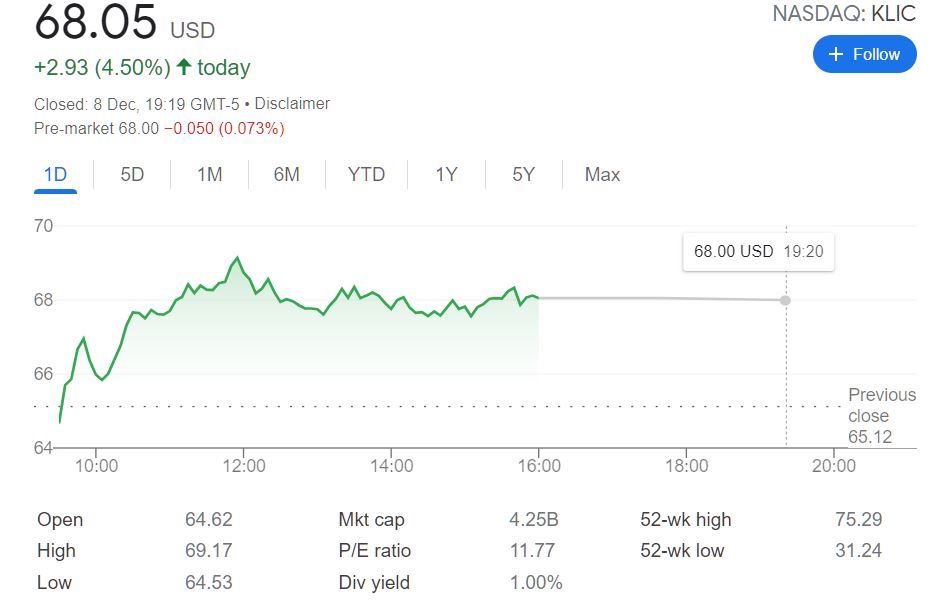

In the where to invest department TM contributor Steve Reitmeister discusses semiconductor equipment manufacturer (KLIC) and answers the question, Why Is Kulicke & Soffa My Top Stock For 2022?.

"The demand for semiconductors is soaring. This is not a surprise as our lives become more and more reliant on electronic devices. That’s at the very heart of the “Internet of Things” movement....what is the natural solution to a chip shortage? Build more chips. And in particular build out the capacity for manufacturing more semiconductors."

"The biggest winners will be semiconductor equipment companies, which is why I see nothing but upside for Kulicke & Soffa in the year ahead. Their most recent earnings announcement makes that point abundantly clear...Analysts were already high on KLIC before this report. Now they are downright effervescent."

"Right now the average stock is trading for 24X next years earnings. Whereas KLIC is not even at 12X next years earnings. This is why Wall Street analysts are pounding the table with an array of fair value target prices between $78 and $100."

Chart: Google

See the full article for the rest of Reitmeister's comments.

Caveat Emptor.

Poet Amanda Gorman's new volume of poetry Call Us What We Carry, was published on Tuesday. As we go about the work of economic recovery and post pandemic rebuilding, here are a few lines from her poem In This Place (An American Lyric):

Have a good one.

I'll see you on Tuesday.