The Decline Of Long-Term Investing

The Briefing

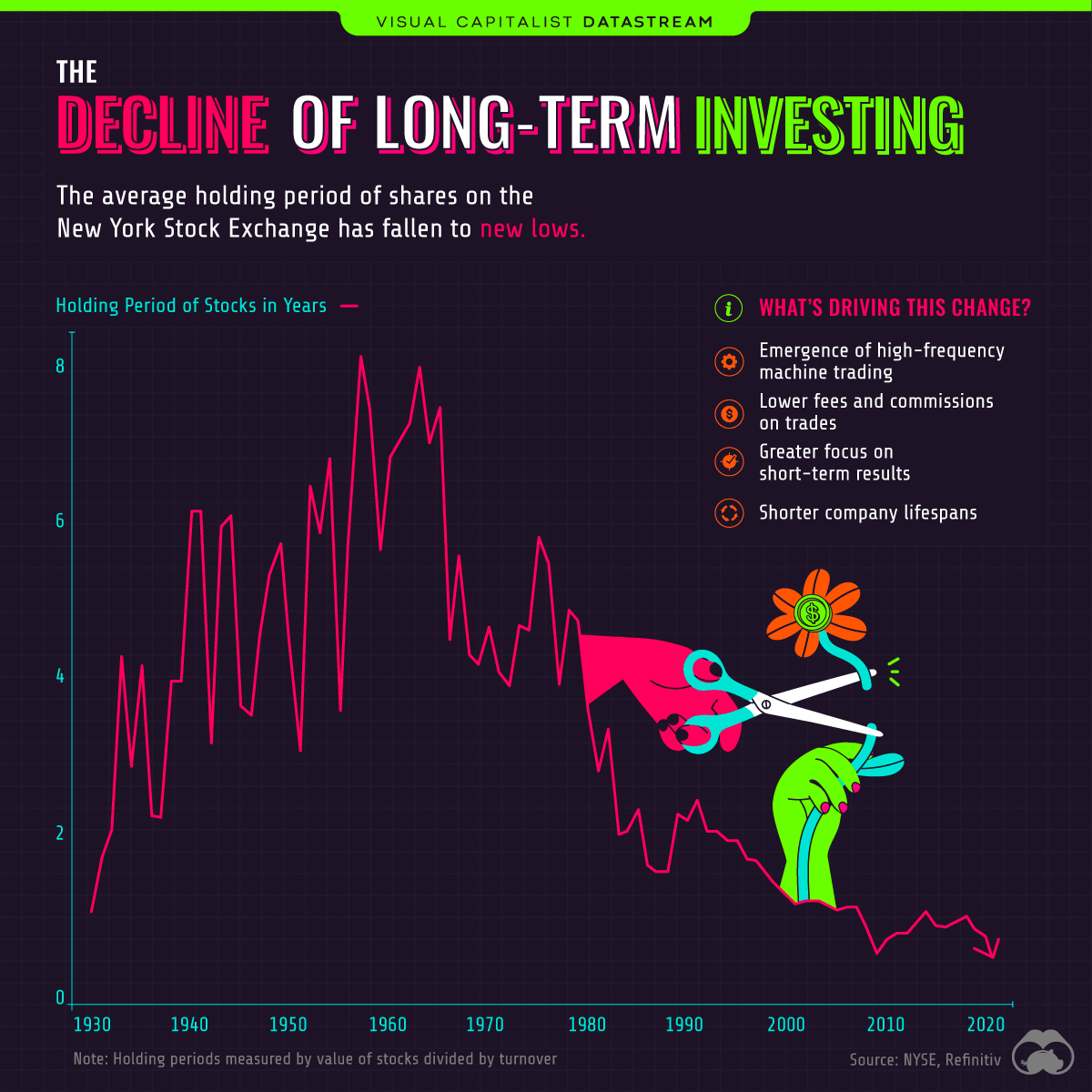

- The average holding period of shares on the New York Stock Exchange (NYSE) is now <1year

- Technological advancement is one of the biggest drivers of this change

The Decline of Long-Term Investing

“Our favorite holding period is forever.”

Those are words from famed investor Warren Buffett, an advocate of the buy and hold approach to investing. Buy and hold is a long-term strategy in which shares are gradually accumulated over time, regardless of short-term performance.

And while Buffett is undoubtedly a successful investor, data from the NYSE suggests that few are actually following his advice. As of June 2020, the average holding period of shares was just 5.5 months. That’s a massive decrease from the late 1950s peak of 8 years.

What’s Driving This Change?

The decline in holding periods appears to have been caused by a number of factors, with the most prominent one being technological advancement.

For example, in 1966, the NYSE switched to a fully automated trading system. This greatly increased the number of trades that could be processed each day and lowered the cost of transactions.

| YEAR | NYSE AVERAGE DAILY TRADING VOLUME* (NUMBER OF SHARES) |

|---|---|

| 1886 | 1M |

| 1982 | 100M |

| 1987 | 500M |

| 2020 | 1,000M |

*10 day moving average as of Dec. 15, 2020. Source: Nasdaq

Automated exchanges have led to the introduction of high-frequency trading (HFT), which uses computer algorithms to analyze markets and execute trades within seconds. HFT represents 50% of trading volume in U.S. equity markets, making it a significant contributor to the decline in holding periods.

Technology has enabled investors to become more active as well. Thanks to the internet and smartphones, new information is widely distributed and easy to access. With online trading platforms, investors also have the ability to act on this information immediately.

Social media is also playing a role. The recent r/wallstreetbets saga is an example of how the stock market can become sensational and fad-driven. After all, long-term investing has much less to offer in terms of excitement.

Corporate Longevity in Decline

Finally, companies themselves are also exhibiting shorter lifespans. This results in greater index turnover (companies being added or removed from stock indexes), and is likely a contributor to the decline in holding periods.

In 1970, companies that were included in the S&P 500 had an average tenure of 35 years. By 2018, average tenure was down to 20 years, and by 2030, it’s expected to fall below 15 years.

Altogether, these trends may be creating a greater incentive to pursue short-term results.

Where does this data come from?