Thoughts For Thursday: Pricing In A Ceasefire Nowhere On The Horizon

Despite a Fed rate hike and an illusive ceasefire in Ukraine the stock market recorded two days of consecutive gains at the close of trading on Wednesday.

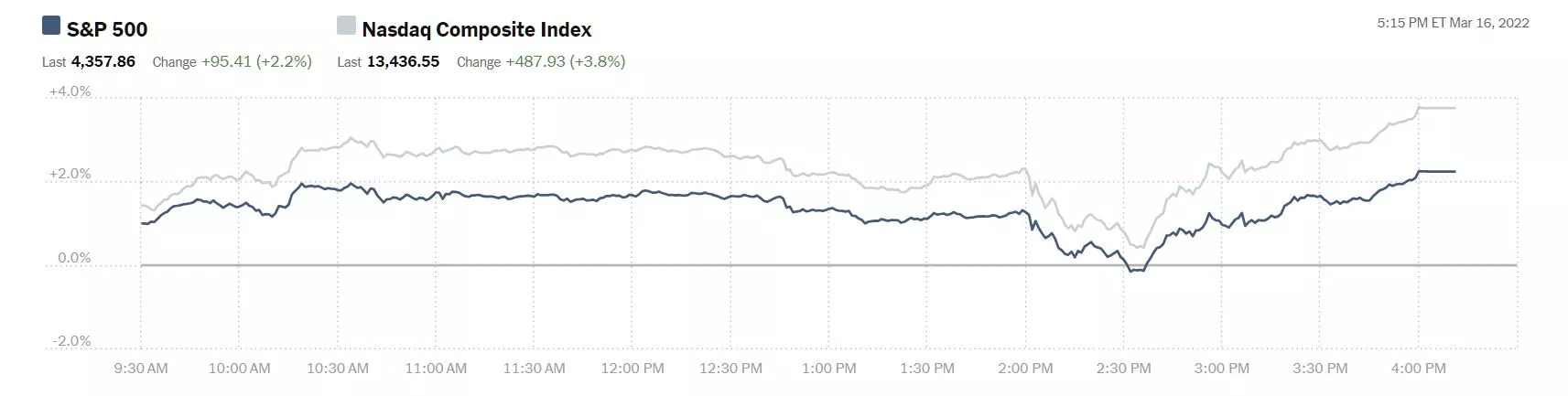

Yesterday the Fed increased the Federal Funds Target Rate by 0.25 percent and indicated plans for an additional six rate hikes in 2022. Fed Chair Jerome Powell said he believes the economy is strong enough to weather the Fed's efforts to slow the rate of inflation. The stock market gained 2.2% on the news of the rate hike, continuing to overlook the carnage in Ukraine and seemingly pricing in an end to hostilities. Yesterday the S&P 500 closed at 4,358, up 2.24% or 95 points, the Dow closed at 34,063, up 1.55% or 519 points, while the Nasdaq Composite closed at 13,437, up 3.77% or 488 points.

Chart: The New York Times

Early day traders perhaps feeling an overshoot have market futures trading in the red Thursday morning. Currently S&P 500 futures are trading down 14 points, Dow futures are trading down 105 points and Nasdaq 100 futures are trading down 52 points.

TalkMarkets contributors seem to be mixed to negative regarding the market despite the two day rally (so far) this week. Contributor Michael Kramer writing in The Fed Is Looking For Tighter Financial Conditions; Good Luck Stocks maintains his bear in the house stance which he also discussed on Tuesday.

"Stocks finished higher for the second day in a row, as traders looked to close puts into the final hour of trading, which led to a volatility melt. The options delta hedging action was positive, indicating traders were closing out SPX puts. The SPY and QQQ ETFs had negative delta hedging, suggesting that traders were buying puts and selling calls in those ETFs.

But really, the path of monetary policy the Fed laid out was for rates to be above the neutral rate in 2023 and 2024. That was more hawkish than even my hawkish expectations. From listening to Powell’s press conference, the Fed aims for tighter financial conditions, and those tighter conditions will lead to lower multiples and stock prices.

When financial conditions tighten, stocks go down. Financial conditions are already tighter today than in 2018; as they go higher, stocks will decline in value. So if you think the Fed said nothing today, you are entirely wrong. They indicated they wanted to raise rates to 2.8% for 2023 and 2024, which is above the neutral rate. They are telling us that they want financial conditions to tighten. Remember, do not fight the Fed; it works both ways."

Contributor Tim Knight, a chartist, titles his take on the rally as The Weary Rubber Band.

"The past two days notwithstanding, I believe we are at the start of a lengthy bear market in equities. We certainly have not received “the big break” yet, but I offer (these) three charts (Russell 2000 IWM, The Nasdaq 100 NDX, and iShares US Real Estate IYR).

First (above), is the Russell 2000 accompanied by the advance/decline summation. It’s quite plain that the market as a whole has been eroding for months."

See Knight's article for the other charts.

Contributor Mish Shedlock, no fan of the Fed writes that we should Beware Of A Very Aggressive Steepening Of The Yield Curve By The Fed. In a piece where he engages with his colleagues Joseph Wang and Harvey Bassman (interesting conversation worth clicking to) he comes away with the following:

"What if Wang is Correct?

We are all guessing. I am sure we will see points of view tomorrow in every direction.

But opinions, mine included are cheap. However, I want to add an important idea.

IF Wang is correct then Bassman will be correct on this: "Right now the biggest thing to worry about is higher rates, not inflation, and lower stock prices because then what you have is risk parity people taken out in a stretcher and there will be forced deleveraging."

Stocks and bonds will both get hammered. That especially applied to the FANG stocks that act like long-duration bonds.

Most People Have No Idea How Much Stocks are Likely to Crash

Repeating myself one more time, Most People Have No Idea How Much Stocks are Likely to Crash

Wang is of the view whatever it takes to cool inflation. And that take to me means demand destruction caused by higher mortgage rates and a collapsing stock market.

If so, today's stock market rally will quickly unwind, perhaps by the end of the day tomorrow.

Regardless, a crash will soon resume if Wang is correct. A 60-40 portfolio will not be a place to hide."

In a TalkMarket's Editor's Choice column, economist and contributor Scott Sumner takes the Fed to task for being both hypocritical and offering too, little to late. His piece is entitled, The Fed Abandons Average Inflation Targeting. It's a short piece, but the below chart of Fed economic projections and Sumner's closing remarks get to the heart of what's on his mind.

"St Louis Fed President James Bullard is right; the Fed should have raised rates by 0.5%. But the bigger mistakes were made late last year when the Fed allowed excessive NGDP growth and refused to commit to pushing inflation below 2% after a period of above 2% inflation.

Just as in late 2008, this is a mistake happening in broad daylight. There is no excuse."

In the "Where To Invest Department", TM contributor Phil Hall found 5 Stocks To Watch - Thursday, March 17, amidst all the noise.

"Wall Street expects Dollar General Corporation (DG) to report quarterly earnings at $2.57 per share on revenue of $8.70 billion before the opening bell. Dollar General shares rose 0.5% to $213.52 in after-hours trading.

Guess?, Inc. (GES) reported weaker-than-expected results for its fourth quarter and announced plans to enter into $175 million accelerated buyback plan. The company also named Dennis Secor as CFO. Guess shares gained 4.9% to $20.29 in the after-hours trading session.

Analysts are expecting FedEx Corporation (FDX) to have earned $4.64 per share on revenue of $23.44 billion for the latest quarter. The company will release earnings after the markets close. FedEx shares rose 0.5% to $227.05 in pre-market trading.

Williams-Sonoma, Inc. (WSM) reported better-than-expected earnings for its fourth quarter and announced a $1.5 billion stock buyback. The company also raised its quarterly dividend. Williams-Sonoma shares surged 7.6% to $164.00 in the after-hours trading session.

Analysts expect Accenture plc (ACN) to post quarterly earnings at $2.20 per share on revenue of $13.44 billion before the opening bell. Accenture shares rose 1.8% to $330.90 in after-hours trading."

Caveat Emptor, as always.

Stay well, stay vaccinated and Contribute to Ukrainian Relief.

I'll be back on Tuesday.