The Weary Rubber Band

The past two days notwithstanding, I believe we are at the start of a lengthy bear market in equities. We certainly have not received “the big break” yet, but I offer these three charts.

First, is the Russell 2000 accompanied by the advance/decline summation. It’s quite plain that the market as a whole has been eroding for months.

(Click on image to enlarge)

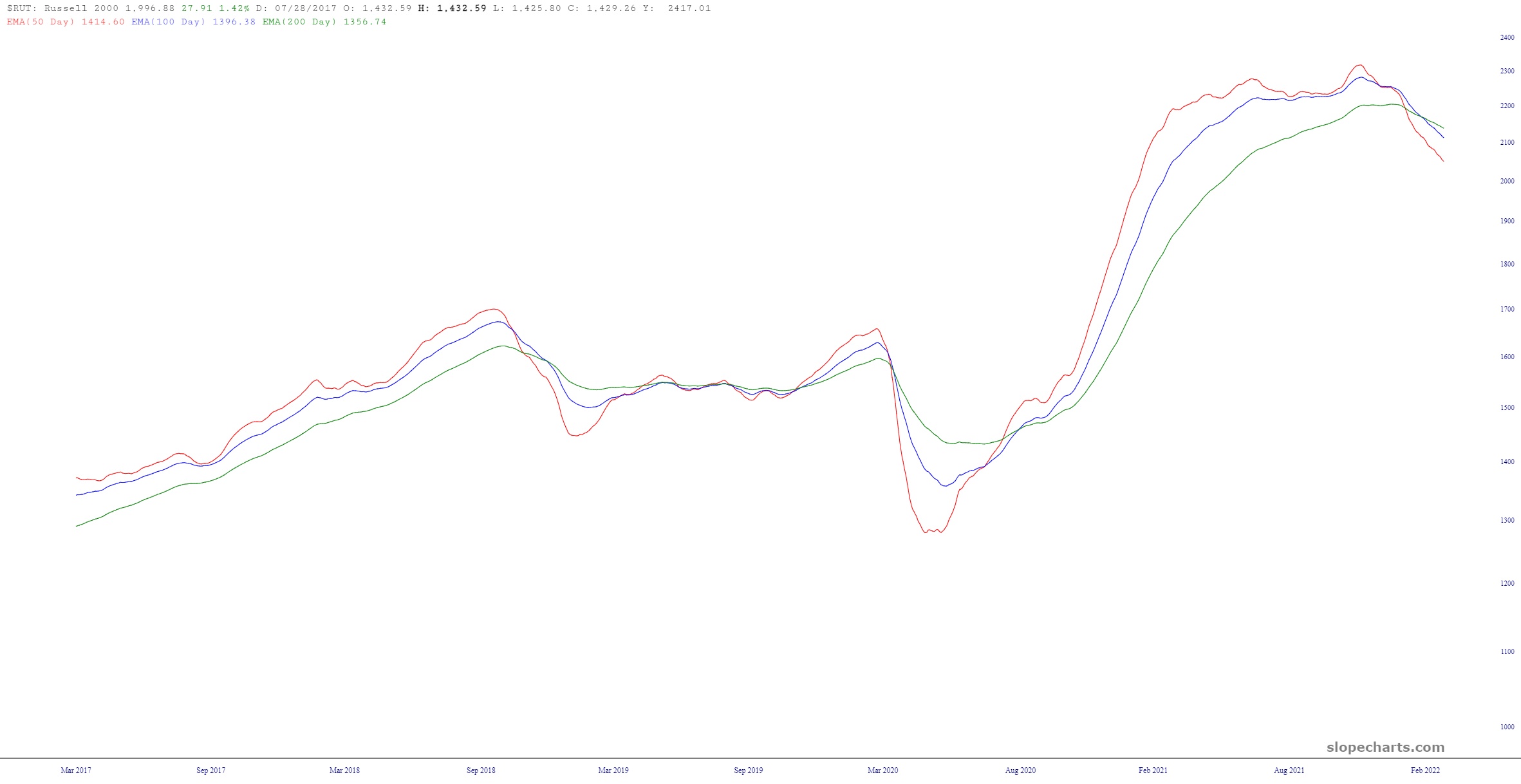

Strip away all the price bars and drawn objects, and replace it instead of the standard trio of exponential moving averages (50/100/200). It speaks for itself.

(Click on image to enlarge)

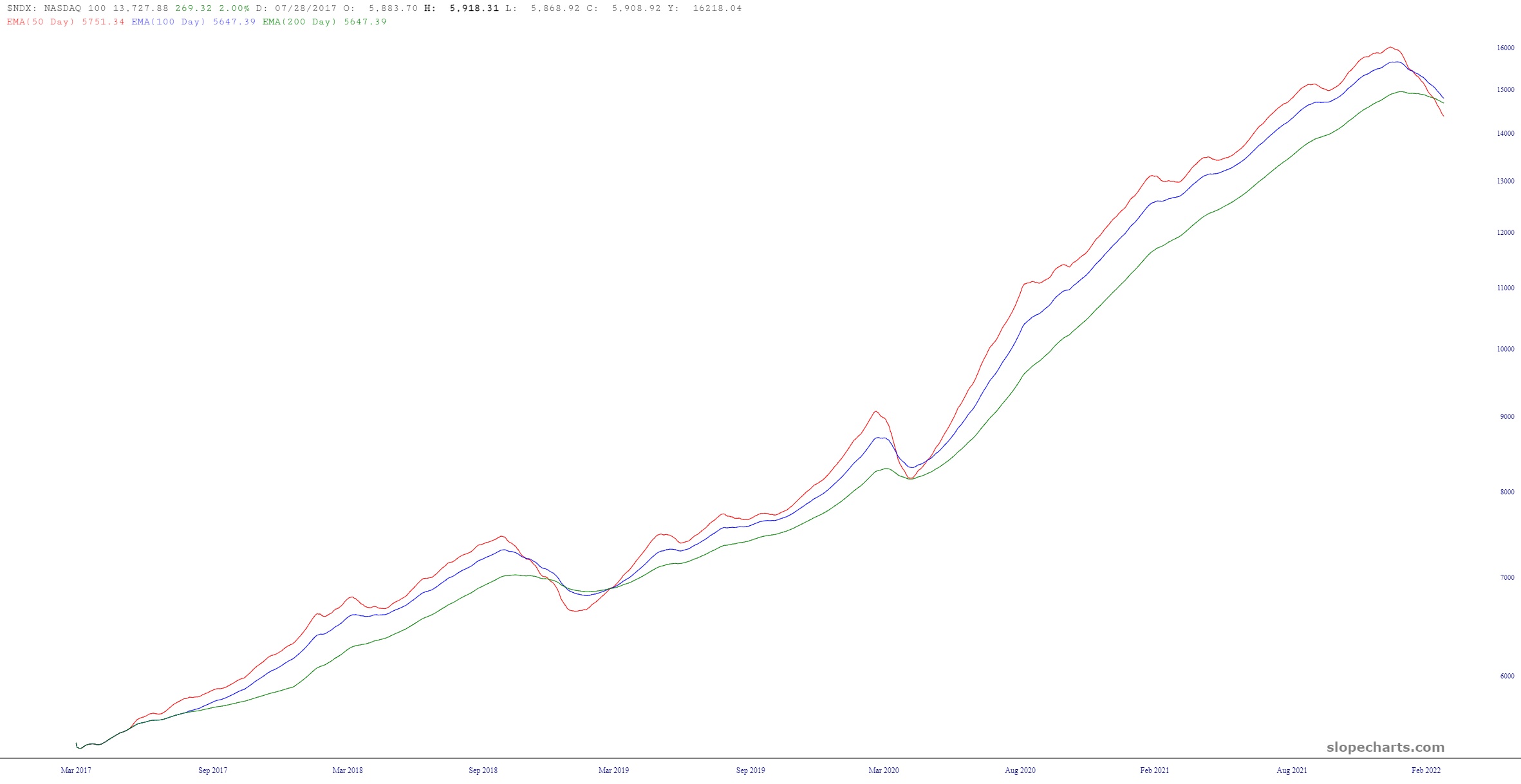

And over in Nasdaq-land, which was particularly strong lately, we likewise see the cross-undertaking place.

(Click on image to enlarge)

Obviously, I would have greatly preferred a bone-chilling washout on Fed day (Wednesday), but instead of exploded higher. I retain a 15% cash position and will be all too eager to deploy when the prices are right. Gold and Platinum members, keep in mind you can always see my positions by way of the shared watch list feature.

I would say also that my real estate fund IYR is my high conviction trade. This thing whipped around like mad today, but I’ve got nearly 100 days left on this, and it’s $8 in the money, so I’m not sweating it.

(Click on image to enlarge)

Oh, and just one more…

(Click on image to enlarge)