Thoughts For Thursday: Musking Twitter - Straight To The End

Stocks rallied on Wednesday and this morning's hot item is Elon Musk's offer to buy all of Twitter at $54.20 per share. Cowabunga dude!

Wednesday the S&P 500 closed up 49 points to close at 4,447, the Dow closed up 189 points at 34,565 and the Nasdaq Composite closed at 13,644 up 272 points. In morning trading the S&P 500 is down 16 points, the Dow is up 153 points and the Nasdaq is down 133 points. Talk about mixed!

Today's action will no doubt partly center around Elon Musk and his offer to purchase Twitter (TWTR). Many news outlets have created live update links. Whatever the outcome this should be a good show.

The Staff at TalkMarkets contributor Benzinga gives us a capsule look at Musk's offer in a short piece entitled Why Twitter Shares Are Ripping Higher Right Now.

"Twitter Inc. shares are trading 11.8% higher in the pre-market session on Thursday, according to data from Benzinga Pro.

The shares surged as Tesla Inc. (TSLA) CEO Elon Musk proposed acquiring all Twitter shares that he already doesn't own and said the company needed to be taken private so that necessary improvements could be made.

Musk offered to buy Twitter shares at $54.20 each, an upside of 18.2% over Wednesday's closing price.

"It's a high price and your shareholders will love it," the Tesla CEO told the Twitter board's chair, Bret Taylor. "If the deal doesn’t work, given that I don’t have confidence in management nor do I believe I can drive the necessary change in the public market, I would need to reconsider my position as a shareholder."

Twitter shares have been seeing volatility this month, with the disclosure of Musk's stake, his appointment to the board — and him later declining to join the board amid reported friction."

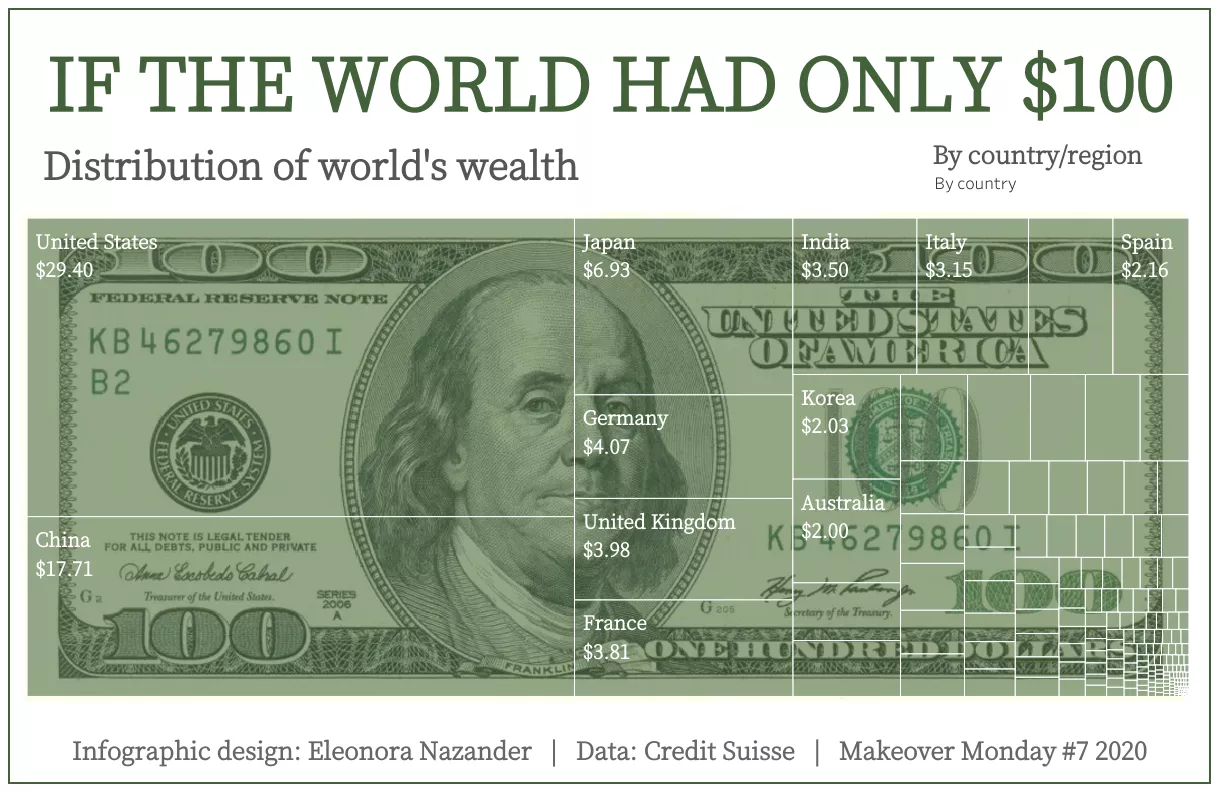

Looking at the macro for a moment, contributor Eleonora Nazander brings us a great interactive graphic in her article Visualizing The Distribution Of Household Wealth, By Country.

"A majority of the world’s wealth is concentrated in just a few countries. In fact, almost a third of household wealth is held by Americans, while China’s population accounts for nearly a fifth...the graphic shows how much household wealth each country would have if the world only had $100. The top 10 wealthiest countries would hold an estimated $77, or 77% of global household wealth.

Here’s a breakdown of what their cut of $100 would be:

The U.S. comes in first place, holding $29.40, or almost a third of total wealth, while China comes in second, accounting for $17.71."

Go to the article to play with the interactive graphic to see how little other countries have of the pie.

TM contributor Jill Mislinski reports Retail Sales Up 0.5% In March.

"The Census Bureau's Advance Retail Sales Report for March was released this morning. Headline sales came in at 0.350% month-over-month to two decimals and was below the Investing.com forecast of 0.60%. Core sales (ex Autos) came in at 1.13% MoM

...March headline and core saw increases, but were slightly below forecasts while control saw a slight decrease and was below forescast.

“Control” Purchases

The next two charts illustrate retail sales “Control” purchases, which is an even more “Core” view of retail sales. This series excludes Motor Vehicles & Parts, Gasoline, Building Materials as well as Food Services & Drinking Places. The popular financial press typically ignores this series, but it's a more consistent and reliable reading of the economy.

Here is the same series year-over-year."

See Mislinski's article for additional details and charts.

Contributor Benjamin Rains in an 18 minute podcast episode entitled Buy This Tech Stock Down 50% Before Earnings For Huge Upside? takes a closer look at Netflix (NFLX) ahead of it's Q1 earnings release next week. Worth taking a look at that amidst the talk about its new old rival Warner Brothers - Discovery (WBD).

In the currency market contributor Kevin Beckman finds that the Dollar Capitalizes On Euro Weakness.

"After a short-lived profit-taking, the dollar regained the upside momentum to get back above the 100.00 figure ahead of the opening bell on Wall Street. Earlier in the day, the greenback derived support around 99.57 and trimmed yesterday’s losses amid a bounce.

The buck was helped by both solid economic data out of the United States and the ECB meeting outcome that sent the euro lower across the market. The central bank left its benchmark rate unchanged and reiterated its guidance that QE should end in the third quarter. As traders expected the bank to announce a more hawkish message, euro bulls were disappointed even as Lagarde highlighted that inflation has increased significantly and will remain high over the coming months.

Image Source: Pixabay

In the US, retail sales rose by 0.5% month-over-month in March, a bit less than the expected rate of 0.6%. However, the core retail sales figure came in stronger than expected, suggesting consumer spending remain solid despite the elevated inflation. In turn, strong figures imply that the Fed doesn’t need to take a more measured approach towards tightening.

Against this backdrop, EURUSD plunged back below the 1.0900 level to register intraday lows around 1.0820. Should the pair hold above this intermediate support in the near term, the 1.0800 key hurdle for USD bulls will stay intact so far. Still, the overall fundamental and the technical picture suggests the path of least resistance for the common currency remains to the downside."

In an Editor's Choice column for TalkMarkets contributor Michael Lebowitz takes another detailed look at the Fed's inflation taming actions in Inflation And The Fed. A New Dance Partner To Contend With. Here is some of what he has to say:

"The Federal Reserve, bond markets, and economic cycles have been dancing in a well-choreographed fashion for the last 30 years. This age-old dancing trio, the Fed, yield curve, and economy have a new dance partner. After patiently watching from the sidelines, inflation is flashing her moves. The once predictable partners are falling out of rhythm. With inflation running at four times the Fed’s 2% objective, the Fed is anxious to reign it in. However, the bond market and economy warn the Fed to be careful."

"CPI inflation is running at 8.5%, and the Fed’s preferred inflation measure, PCE Price Index, sits at 6.4%. Both figures are well above the Fed’s 2% target. The Fed will likely continue to hike rates while the yield curve warns of recession and slowing economic growth. The Atlanta Fed GDP Now forecast forecasts a meager 0.9% growth rate for Q2. The Wall Street consensus forecast has eroded from nearly 4% to 2% over the last few months. Both estimates pale compared to +12.2%, +4.9%, and +5.6%, the annualized rates from the prior three quarters."

"The Fed’s newfound desire to squash inflation is forcing them to ignore the warnings of their old dance partners, the economy, and the yield curve."

"Higher interest rates will create a further drag on the economy. This comes as yields have already risen significantly for mortgages, corporate loans, and most other forms of debt. In fact, some of the reasons recent economic data has been weakening are in part because of higher interest rates. The effect of higher interest rates often lags by six to nine months, so more weakness is expected."

"As a rule of thumb, the more the Fed decides to dance with inflation and ignore the bond market and economy, the more we should expect stock prices to fall. Such is an unfamiliar dance and one in which investors are woefully unprepared...As they say, don’t fight the Fed. That is a bullish mantra when the Fed is running an easy policy. It becomes a bearish mantra in times when they remove liquidity, like today."

That's a wrap for today. I'll see you on Tuesday, in the meantime, check your Twitter feed!