Thoughts For Thursday: Like A Spoiled Child

Yesterday the market seemed to behave like a spoiled child. After starting the day off on the right foot and spiking higher after an afternoon snack of milk and cookies which was the FOMC meeting, the market got upset upon being told to complete its homework which was the Powell press conference.

The FOMC policy statement noted that "The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent...The Federal Reserve's ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses." Just as the market was taking in the policy statement, Fed Chair Jerome Powell gave a press conference in which he declined to confirm that the size of rate increases would not be greater than 25 basis points and declined to forecast the number of rate hikes the Fed would make during the course of the year. These and other comments along similar lines cast doubt among traders and sent the market tumbling.

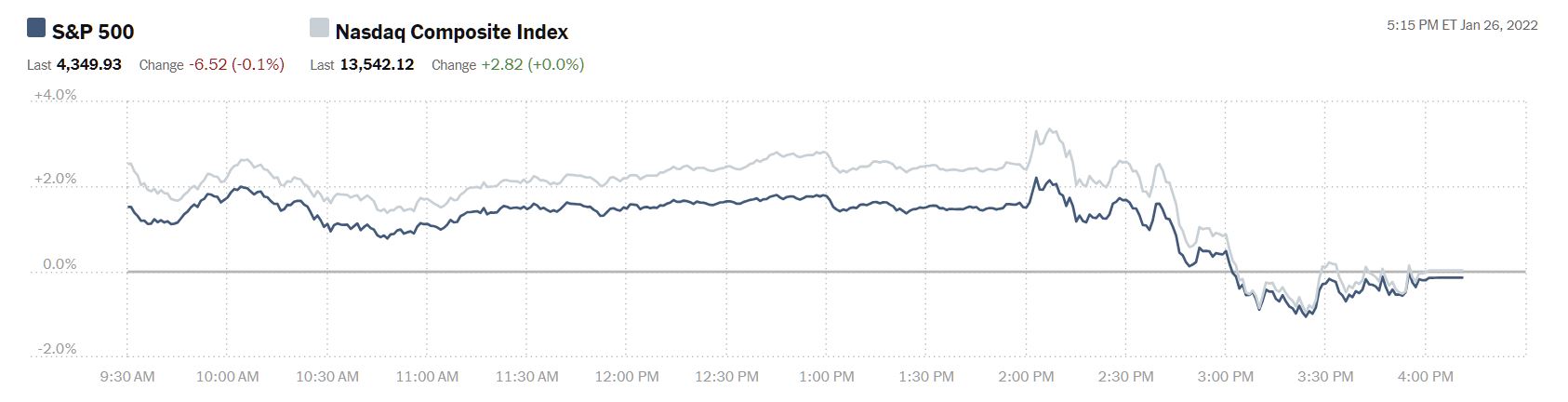

Chart: The New York Times

At the close the S&P 500 was down 6 points, closing at 4,350, the Dow Jones Average was down 130 points, closing at 34,168 and the Nasdaq Composite was up 3 points, closing at 13,542. Overnight the market has been working at digesting the full thrust of the Fed's new policy statement and in early morning action market futures are splashing amongst both red and green puddles. Currently, S&P futures are down 4 points, Dow futures are down 54 points and Nasdaq 100 futures are up 6 points.

Contributor Diego Colman notes the S&P 500 Falls As Fed Fails To Rule Out Steep Hiking Path, Growth & Tech Stocks At Risk and makes the following observations:

"Amid uncertainty about the tightening cycle and renewed fears that the process will not be gradual or measured due to red-hot inflation, volatility is likely to remain elevated in the near term, biasing stocks lower, particularly those in the technology and growth space, whose lofty valuations are supported by low rates. "

"...with the Fed in the rearview mirror, corporate results will command Wall Street’s undivided attention over the next couple of weeks. Companies that execute well and beat top- and bottom-line forecasts and issue constructive forward-looking guidance may be rewarded, while those that disappoint could come under pressure as investors continue to turn to firms with strong earnings power and solid cash flows in the face of rising rates, a headwind for valuations."

Expect more chop.

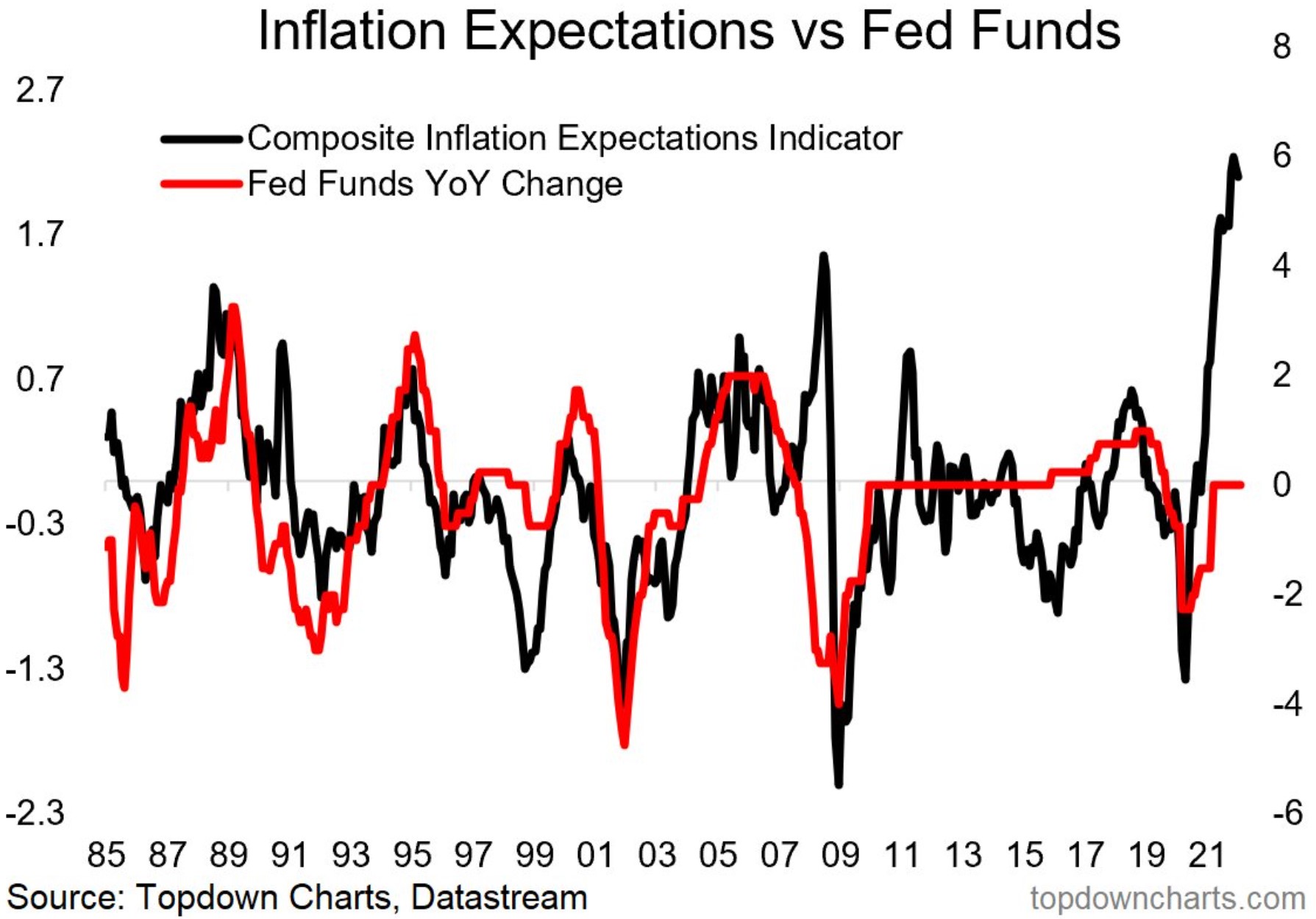

Contributor Ryan McMaken was clearly unimpressed with yesterday's FOMC policy statement (see above) and writes The Fed Has No Real Plan, And Will Likely Soon Chicken Out On Rate Hikes.

"The lesson here is that even when inflation is high and the labor market is supposedly strong, the Fed will still only proceed toward tapering and tightening in the slowest, most cautious manner possible...The Fed still refuses to acknowledge any connection between inflation and the incredibly large amounts of money creation and credit creation fostered by the Fed over the past decade, and especially over the past two years."

McMaken believes that the Fed's verbal hawkish turns are just so much window dressing and cites recent history to back up his belief:

"Indeed, it still looks like we’re looking at a repeat of 2016 when the Fed claimed it was going to implement four rate hikes that year. Only one rate hike actually occurred. Anticipated rate hikes based on Fed signals also failed to appear in 2019, when Fed watchers at Goldman and JP Morgan predicted four Fed hikes that year. What actually happened was one rate hike (from 2% to 2.25%) followed by rate cuts later in the year. That’s likely what Powell is referring to when he says the Fed must be adaptable and flexible. It must be prepared to become even more dovish at any given time."

"As a final sign of dovishness of the Fed's overall position, we can also note one especially good question from the gallery today. One of the journalists asked if the Fed would allow the inflation rate to fall below the target two-percent rate so as to achieve the much-touted "two-percent average."...Powell stated that no, the Fed has no plans to deliberately push inflation below two percent at any time. In other words, the two-percent average target only applies when it's an excuse to keep inflation above two percent."

"Overall, the impression one gets from watching the Fed today is that it's most certainly not in control of the situation and is hoping to muddle through. It's still unclear which way the Fed will go, however. Will it choose inflation or recession? Either way, a lot of people are likely in a lot of trouble."

TM contributor Mircea Vasiu taking the opposite view of McMaken found 4 Hawkish Twists During Yesterday’s Fed Presser.

"The US dollar ripped higher, gaining across the board, as the more Powell spoke, the more hawkish he was. Here are four hawkish twists delivered by Powell during yesterday’s press conference:

- Clear pivot to tightening

- Balance sheet runoff starts in May or June

- Room to raise rates without worrying about the labor market

- Strong faith in the economy and the labor market"

"The Fed delivered one of its most hawkish speeches in a while. Not only that it will start raising rates in March, but it will begin a full tightening cycle. In other words, the Fed will do the following three things, in this order. First, it will end the quantitative easing beginning of March. This way, it will have room to raise rates. Second, it will begin hiking rates in the same month. Third, it will initiate the balance sheet normalization. Hence, a clear pivot to full tightening as the Fed is behind the curve."

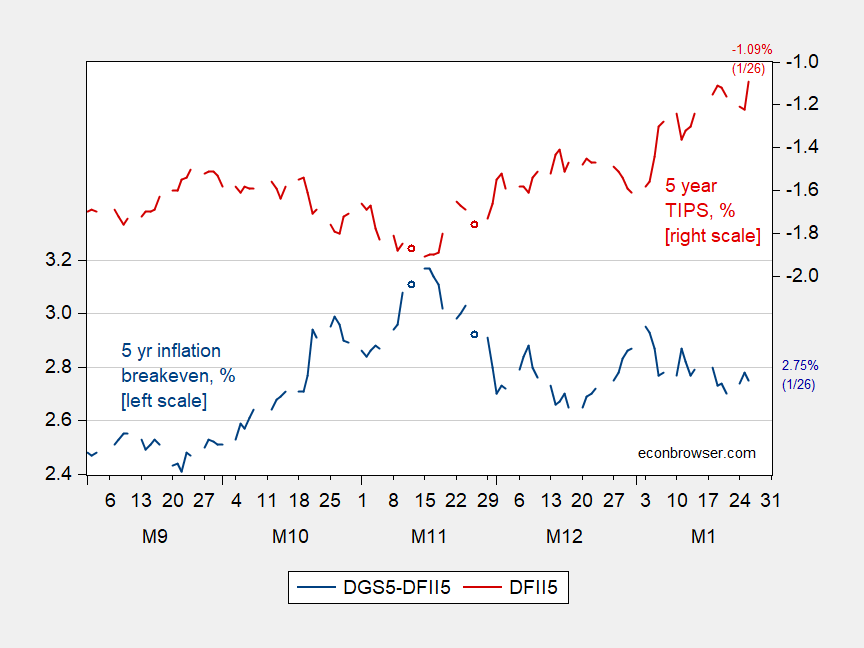

TalkMarkets contributor and economist Menzie Chinn in Breakeven And TIPS notes an increase in the 5-year TIPS rate as a result of the Fed's Quantitative Tightening policy.

"Given the indications of tightening in the Fed statement – both on rates and tapering – it’s surprising how little inflation breakeven moved. On the other hand, 5-year TIPS jumped 13 bps."

"Figure 1: Five year inflation breakeven calculated as 5 year Treasury minus 5 year TIPS (blue, left scale), and five year TIPS yield (red, right scale). Source: Federal Reserve via FRED, Treasury, author’s calculations."

Not that this will reduce the current volatility in the market, but by the end of the week market behavior should have returned to focusing on corporate earnings and weighing the risk of war in the Ukraine.

As such I'll closeout with contributor Chris Katje's look at Tesla Q4 Earnings Highlights: $17.7B Revenue Beats Estimates, Production & Delivery Totals And More.

Image: David Marshall

"Tesla reported fourth-quarter revenue of $17.7 billion, up 65% year-over-year. The total beat a consensus estimate of $16.4 billion...Tesla (TSLA) reported fourth-quarter earnings per share of $2.54, beating analyst estimates of $2.26 per share...The company produced 305,840 vehicles in the fourth quarter, up 70% year-over-year...For the full fiscal year, Tesla reported revenue of $53.8 billion, up 105% year-over-year. the company reported full-year production of 930,422 vehicles and 936,222 vehicles delivered, up 83% and 87%, respectively, year over year."

However..."Shares (were) down 1.8% to $920 in after-hours trading."

Till Tuesday...breathe deep, read and listen profusely and if you're buying the dip, caveat emptor.