Thoughts For Thursday: Inflation Moves Manchin

The stock market rallied yesterday on the anticipated 75 bp rate hiked announced by Fed Chair Powell yesterday, and should be further buoyed by Senator Manchin's change of heart.

The senator from West Virginia, has agreed to Senate legislation to pass a bill providing for climate and energy programs, tax increases to subsidize health care and lower the cost of prescription drugs.

One of the reason's for Manchin's about face was no doubt leadership agreement to put forward additional legislation to encourage domestic energy production which could ease the way for the Mountain Valley Pipeline, which would transport Appalachian shale gas from West Virginia to Virginia and no doubt is of interest to Senator Manchin and his constituency. Calling the proposed legislation the "Inflation Reduction Act of 2022" while proclaiming "Build Back Better" is dead seem to be additional pyrotechnics which assisted Manchin in executing his about face.

Additionally, in a rare move for the current Senate, a $280 billion dollar bill to shore up the U.S. semiconductor industry was passed with bi-partisan support with a vote of 64-33 in favor. Tech stocks were up on the news.

At the close of trading on Wednesday the S&P was up 103 points, or 2.6%, closing at 4,024, the Dow was up 436 points, or 1.4%, closing at 32,198, and the Nasdaq Composite closed at 12,032, up 470 points or 4%.

Most actives for the day all closed in the green and included many mega-cap technology issues.

Chart: The New York Times

In morning trading, market futures are currently trading in the red. S&P 500 market futures are down 10 points, Dow market futures are down 40 points and Nasdaq 100 market futures are down 75 points.

TalkMarkets contributor Jesse of Jesse's Cafe Americain is not buying into Fed Chair Powell's "not in a recession" remarks which came along with his 75 bp rate increase announcement. Writing in Stocks And Precious Metals Charts - Blue Skies - Forget 'Plastics' Wall Street Says 'Pivot', he sizes things up as follows:

"The market read between the lines of the FOMC decision and in particular Chairman Powell's remarks and assumed that the Fed is in a pivot to a less hawkish stance on interest rates.

And so gold and particularly silver rallied.

Stocks went stratospheric.

The Dollar dumped back to the 106 handle."

"Whether this interpretation of the Fed's intentions is valid or not remains to be seen.

Certainly, eyes will be on the data,

After hours the corporate earnings reports were a very mixed bag.

Tomorrow we will be getting an advance look at 2Q GDP.

Regardless of this backward look, history suggests that we are heading into a recession.

Unless this time is different."

Contributor Tim Knight, tongue firmly in cheek notes a Seismic Sentiment Shift.

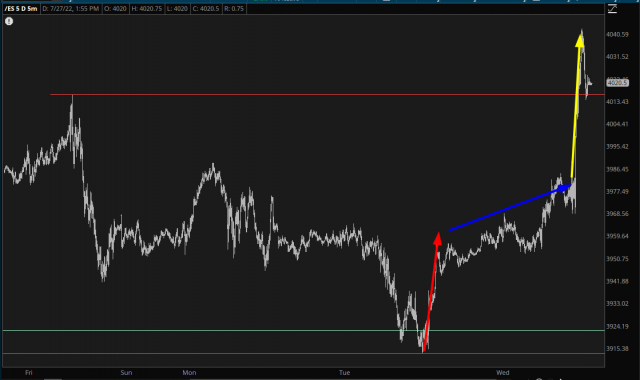

"Since the market bottomed on June 16th, the /ES (E-Mini S&P 500 Index Futures) has gone up hundreds of points (well over 300) and the Dow Industrials is up thousands. There has been an enormous change in sentiment, with the consensus being that the brief bear market (if you want to call it that) experienced during a tiny portion of this year was all the suffering that was required to clear out all the sins of the past quarter century...

If you look at what transpired over a mere twenty-two hours, it was extraordinary. On the /ES:

- The red arrow shows the Google/Microsoft relief rally;

- The blue arrow shows the growing optimism predicated upon the same rally;

- The yellow arrow indicates the absolute bull-gasm that was had upon hearing the silky sound of Powell’s voice. In the process, we blew right past last week’s peak."

"For the moment, however, we are (just barely) hanging on to well-constructed tops. You can see here on the S&P 500 index that we have spent the past 41 days doing a beautiful job sealing up the June 9th price gap and recapturing the Fibonacci retracement level."

See Knight's article for more sharp charts and jabs, it's worth a quick look.

Contributor Ironman gives us a strong reminder of just one of the reasons the Fed is working overtime to try and tame inflation; The Escalating Price Of Wheat.

"The price of bread in the U.S. is rising to all-time highs. One of the top contributing factors to its increase is the 2022's rising price of wheat.

The following chart shows the price per bushel of wheat grown in the U.S. from 1866 through 2021, with a preliminary average for 2022 based on available prices reported from January through May.

In 2022, the average monthly price of a bushel of wheat has ranged from a low of $7.45 in January to a high of $11.40 in May, with an overall average of $9.36 during those months. That's 25% higher than 2012's nominal record peak of $7.48 per bushel. It's also more than double the 2019 pre-pandemic low of $4.08 per bushel."

Interestingly enough, Ironman's second, inflation adjusted, chart shows that wheat prices today are still lower than those in 1865 (around $25 per bushel) and the 1917 all-time high (around $48 per bushel).

Contributor Ryan McMaken was not a bit soothed by Jerome Powell's words yesterday, he says in fact, The Fed Just Got Rid Of Forward Guidance Because It's Making It Up As It Goes.

"The Federal Reserve’s Federal Open Market Committee announced Wednesday it is raising its key policy rate—the federal funds rate—by 75 basis points to 2.5 percent...

There were not many surprises here. Most Fed watchers were predicting a 75-basis-point increase, and that’s what the Fed delivered.

This then leaves us with the question of “what now?” The Fed doesn’t know, and the weakness of the present economy will keep the Fed very cautious moving forward...

How the economy will react to the Fed’s changes remains a complete mystery to the Fed, however, as has long been clear. It only took six weeks, after all, for the Fed to go from a stance of “economic activity appears to have picked up” (at the June meeting) to July’s report of how “recent indicators of spending and production have softened.”

The Fact the Fed has no idea how things will go in response to Fed policy is emphasized by Powell’s admission that the Fed isn’t planning to offer any more forward guidance this year, which frees up the Fed to make more last-minute decisions and more aggressively make things up as it goes. Specifically, Powell said that moving forward "we think it's time to just go to a meeting by meeting basis, and not provide the kind of clear guidance that we did on the way to neutral."

Translation: “things might go even more off the rails at any time, so let’s just play it by ear.”...

The question now is how long it will take the Fed to throw in the towel and “pivot” to a loosening stance due to fears over a new recession...

What the Fed should be doing is stepping way back from monetary policy and stop “setting” the interest rate altogether. The Fed’s open market operations should be ceased, allowing the marketplace to discover what the real market interest rates actually are. That, unfortunately, is not on the Fed’s list of options."

Strong stuff.

Closing out the column for today TM contributor Mish Shedlock writes, Based On Analysis Of The Final Q2 GDPNow, A Recession Started In May.

" The important number is Real Final Sales (RFS). It's the true bottom line number for the economy. The GDPNow RFS estimate is 1.1 percent. If accurate, that would rule out a recession starting in the first quarter. But it does not rule out a recession starting in May, my preferred starting month...

Starting in May, retail sales floundered and housing fell though the floor. The RFS component of GDP fell from 3.7 percent to 1.1 percent. That means -2.6 percent on RFS in May and June. That's a pretty steep contraction. Strength in April negates a recession starting in the first quarter regardless of two quarters of negative GDP...

My May recession date depends on a couple of things: A GDP report from the Commerce Department's Bureau of Economic Affairs tomorrow that confirms GDPNow, and continued housing and retail sales weakness that I expect.

Jobs are very lagging and unlike others, I expect relative strength compared to most recessions.

From a jobs standpoint, I expect a Long But Shallow Recession With Minimal Job Losses.

From a stock market perspective, I expect things will be brutal."

Yesterday's rally aside, things could get choppy today.

Elsewhere, despite Russian-US discussions about a possible prisoner swap there has been no de-escalation in the Ukraine war in the past week.

Help is needed.

Have a good one.

More By This Author:

TalkMarkets Image Library

Tuesday Talk: Wonder Rates

Thoughts For Thursday: Rallies To Nowhere?

Glad to see Manchin finally got on board. Sometimes I think he forgets which party he belongs to.