Thoughts For Thursday: Dust Off The Climbing Boots, The Fed Is Going On A Hike

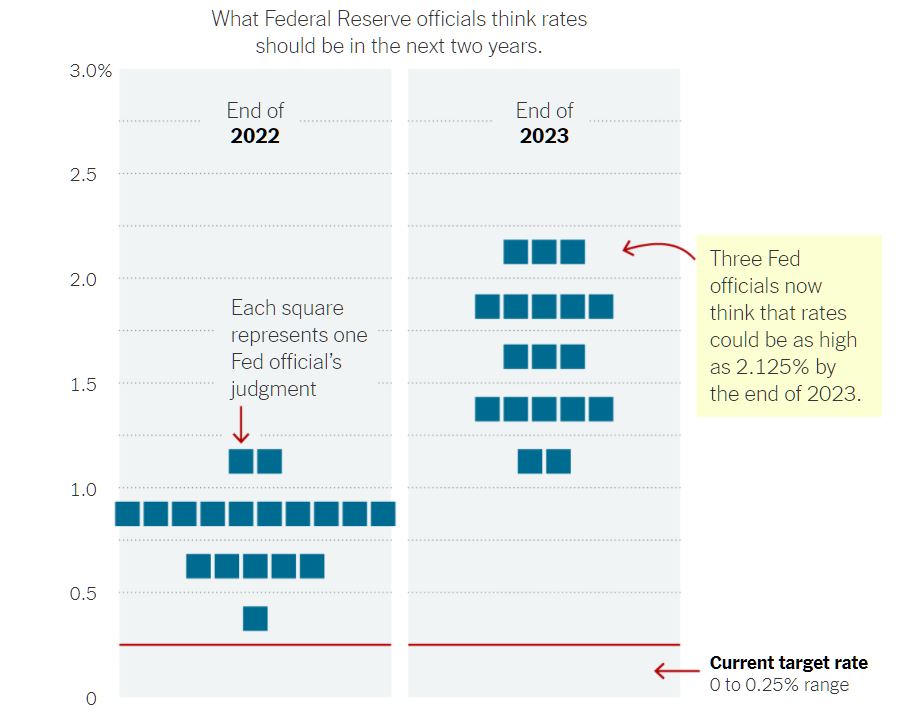

“Economic developments and changes in the outlook warrant this evolution...In my view we are making rapid progress toward maximum employment...To make that happen, we need to make sure we maintain price stability”. Fed Chair Jerome Powell, made these remarks yesterday as he announced moves to taper down by March 2022 as well as signal six rate hikes in the 2022-23 timeframe.

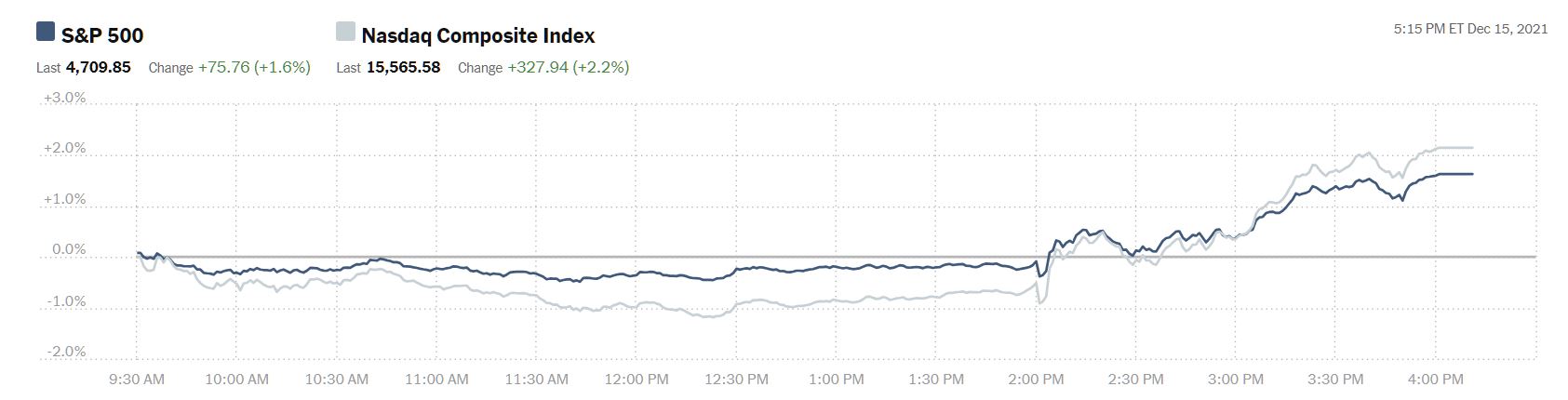

The markets welcomed Powell's remarks sprinting all the way to the finish line, after spending the earlier part of the day in negative territory.

Chart: The New York Times

The S&P 500 closed at 4,710, up 76 points or 1.63%, the Dow Jones Industrial Average closed at 35,927 up 383 points or 1.08%, while the Nasdaq Composite closed at 15,566, up 328 points or 2.15%. Currently market futures are trading in the green; S&P futures are up 38 points, Dow futures are up 237 points and Nasdaq 100 futures are up 139 points.

For readers looking for a map, the Fed December "dots" chart looks like this:

Chart: The New York Times

TalkMarkets contributor Mish Shedlock isn't having any of this and writes though The Fed Expects 6 Rate Hikes By End Of 2023 - I Don't And You Shouldn't Either.

"In today's clown act, five FOMC participants actually believe that in 2024 the Fed will hike all the way to 2.75% to 3.25%.

Such predictions are amazing in light of what they would do to interest on national debt.

I am unconvinced the Fed gets in any hikes in 2022 and certainly not 6 by the end of 2023.

These ridiculous predictions assume there will not be another recession in "the longer run".

I am confident there will be another recession by 2024.

Admittedly, I am typically early in my recession calls. But these clowns never see them and Ben Bernanke denied a major one we were already in.

The only faith anyone should have in these Dot Plots is they will be amazingly wrong."

As well as his interpretation of yesterday's Fed "dot" chart above, Shedlock includes several Fed "dot" charts from prior years, (also, annotated with biting comments) in his article to prove his point. While Shedlock's sarcasm may be entertaining, his conclusion is not.

"...it's far too late for a wakeup call, The bubbles have already been blown. When bubbles burst guess what's next: Recession!"

Economist and TM contributor Scott Sumner is also an unhappy camper. A Disappointing Fed Inflation Forecast is his takeaway from the last FOMC meeting of the year.

"The Fed’s new long-run forecasts for PCE inflation have been raised significantly since the previous set of forecasts, three months earlier. That’s not how a sound central bank operates. You don’t raise the inflation forecast, you adjust policy so that the average inflation rate over the 2020s remains at 2%.

Here’s the data (and change from the previous forecast):

2020: 1.3%

2021: 5.3% (+1.1%)

2022: 2.6% (+0.4%)

2023 2.2% (+0.1%)

2024: 2.1% (unchanged)

2025-29: 2.0% (unchanged)"

"... Even worse, I suspect that inflation will end up being even higher than the Fed is currently forecasting. This is a very disappointing forecast."

The Fed isn't the only one sending messages to the market as contributor Jesse Felder notes in his article, Small Businesses’ Big Message For The Markets. Below is part of what Felder found:

"...small businesses are (also) very good leading indicators of corporate profits margins in the broadest sense. The chart below (hat tip to the brilliant minds at Nordea) plots the 12-month change in S&P 500 profit margins alongside small business optimism less compensation plans (set forward 1-year). Clearly, what small businesses see in terms of inflation trends going forward has them very concerned about their bottom lines over the next year. This sends a very loud message regarding the trend in corporate profits in a much wider sense."

"...the majority of investors are still betting on a transitory outcome, there could be some fireworks in the asset markets should they eventually be forced into an inflationary epiphany...what may exacerbate those fireworks, particularly in the stock market, is an earnings recession amid the most extreme valuations in history."

See Felder's full article for a further look.

The U.S. housing market has been on a tear all year and as the year winds down contributor Jill Mislinski checks in with the latest reading in NAHB Housing Market Index: "Home Builder Sentiment Strong At Year’s End".

"The National Association of Home Builders (NAHB) Housing Market Index (HMI) is a gauge of builder opinion on the relative level of current and future single-family home sales...a reading above 50 indicates a favorable outlook on home sales; below 50 indicates a negative outlook..."

Below is Mislinski's graph of the HMI since 1985. In her article she also charts the HMI against Michigan Consumer Sentiment Index and Conference Board Consumer Confidence readings.

In today's, where to invest department, contributor Chris Katje brings TalkMarkets readers the 5 Highest Yielding Dow Jones Stocks.

"At the time of writing, 27 of the 30 holdings pay dividends. Boeing Inc BA and The Walt Disney Company DIS suspended dividend payouts due to the COVID-19 pandemic. Salesforce.com CRM does not pay a dividend. The average dividend yield is 2.4% of the 30 stocks in the index.

Here is a look at the five highest-yielding components of the Dow Jones Industrial Average.

International Business Machines Corp IBM

- Stock Price: $123.48

- 52-Week Range: $114.56 to $152.84

- Dividend Yield: 5.4%

- Dow Inclusion: 1979

- Performance: YTD +3%, 5-Year -23%

...IBM beat analyst estimates in two of the three quarters reported in the current fiscal year. IBM will report fourth-quarter financial results in January, which is its largest revenue-generating quarter. IBM has consistently been raising its dividend each year.

Dow Inc DOW

- Stock Price: $53.18

- 52-Week Range: $51.33 to $71.38

- Dividend Yield: 5.2%

- Dow Inclusion: 2019

- Performance: YTD -3%, 5-Year N/A

Dow has beat Street estimates for revenue in each of the last eight quarters. Earnings per share estimates from the Street have been beaten in the last six straight quarters.

Verizon Communications VZ

- Stock Price: $50.83

- 52-Week Range: $49.69 to $61.06

- Dividend Yield: 5.1%

- Dow Inclusion: 2004

- Performance: YTD -14%, 5-Year -2%

...Verizon missed third-quarter estimates from the Street for revenue after two straight beats. The company raised its full-year fiscal revenue estimates for revenue growth and earnings per share. Verizon has increased its dividend for 15 consecutive years.

Chevron CVX

- Stock Price: $114.24

- 52-Week Range: $83.53 to $119.26

- Dividend Yield: 4.6%

- Dow Inclusion: 2008

- Performance: YTD +38%, 5-Year +0.2%

Energy company Chevron has had a strong year with its shares up 38% year-to-date...Chevron has been raising its dividend consistently every year. A rebound for the company along with the high yield could make Chevron one of the best in the energy sector.

Walgreens Boots Alliance WBA

- Stock Price: $49.07

- 52-Week Range: $39.03 to $57.05

- Dividend Yield: 3.9%

- Dow Inclusion: 2018

- Performance: YTD +24%, 5-Year -42%

With over 21,000 stores in 50 states and 11 countries, Walgreens Boots Alliance is one of the world’s largest pharmacy companies...Walgreens has been raising its dividend consistently each year going from quarterly payouts of $0.44, $0.4575, $0.4675 and $0.4775 over the last four years."

Read the full article for more details.

Caveat Emptor.

Whether it'll be six rate hikes or none, as the song goes "I'm Happy When I'm Hiking".

I'll see you on Tuesday. Till then, safe trails.